The gap between household expectations and economists forecasts is widening [updated 3:30pm]

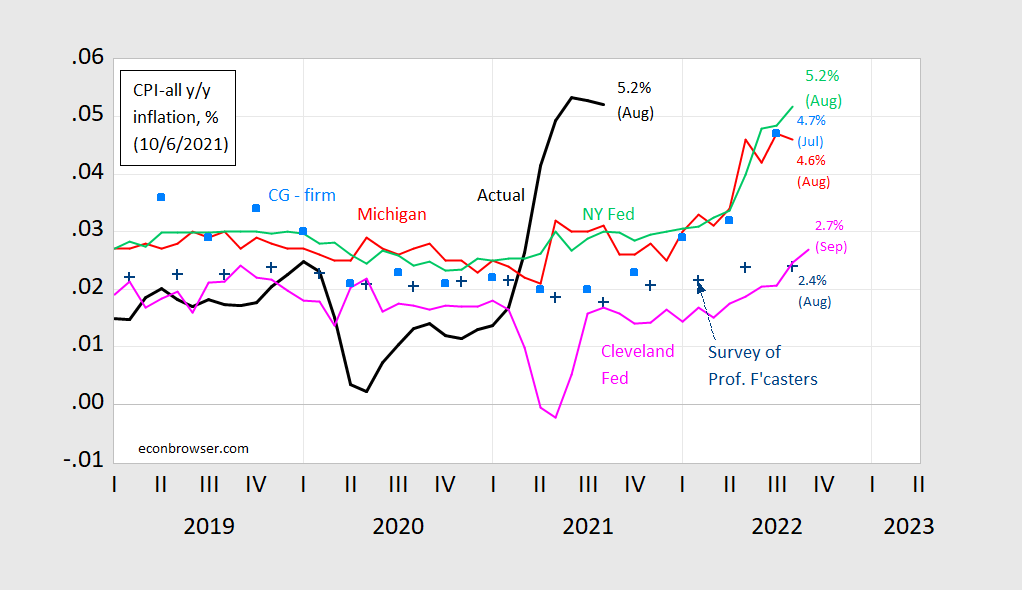

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko [updated 3:30pm].

All available measures of expected inflation rose in August (and September for the Cleveland Fed measure). This continues the pattern exhibited remarked upon back in July. What is perhaps more interesting is the fact that the gap between household expectations and professional forecaster measures has widened (again). In November 2019, the gap between the Michigan Survey of Consumers and the Survey of Professional Forecasters measures was 0.7 percentage points. As of August, the gap was 2.2 percentage points. Another way of illustrating the difference in views is to note that 1 year ahead inflation has risen by 2.1 percentage points for the Michigan survey, and only by 0.3 percentage points for the Survey of Professional Forecasters (SPF). F

Interestingly, survey based expectations (using CEO views) have diverged over the available sample (mid-2018 onward), but have converged to the household survey values (Michigan and NY Fed) as of July. On the other hand, the increase in expected inflation was smaller — for the period October 2019 to July 2021, the firm level mean forecast rose from 3.4 to 4.7 percentage points. More discussion of these firm based expectations are in this post, and described further in this paper [added 3:30pm].

Now, which one is more accurate? Over the period shown above, the Michigan survey exhibits an upward bias of 1.1 percentage points, statistically significantly different from zero. In comparison, the SPF is 0.2 percentage points upwardly bias, with the bias not significantly different from zero. (Using 2010-2019 data doesn’t change the pattern. The figures are the same after rounding.)

Since the firm survey data starts only in 2018M04, it’s not possible to compare the errors to those of the SPF or Michigan. Over a comparable period, the firm level mean survey exhibits a mean error of about 0.4 percentage points, versus 0.2 points for SPF, and 0.6 for Michigan – none of which are statistically significantly different from zero [added 3:30pm].

Rudd’s recent working paper (not an official Fed publication) has sparked a controversy over the role — both theoretical and empirical — of expectations in actual inflation behavior. Many of the arguments make sense to me, but I still think expectations still matter. The question (I think he’d agree) is how much. On the other hand Coibion et al. (2017) suggest that using household expectations (such as the Michigan survey) make estimates of the Phillips curve more stable, than using professional forecasts (e.g., SPF), and definitely than using full-information rational expectations (FIRE). (I’d like to add in firm expectations, e.g., as in the one compiled by Candia, Coibion, and Gorodnichenko, but those aren’t available online.)

As an aside, as noted in the Rudd working paper, most of the policy debates center on long-term inflation expectations (i.e., anchoring of expectations) whereas this discussion has focused on short term expectations).

Detail of Figure 1, below:

Figure 2, detail of Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

“What is perhaps more interesting is the fact that the gap between household expectations and professional forecaster measures has widened”

Of course household measures of expected inflation are becoming increasingly upward biased. The lies from Republicans and Faux News have become more shrill.

Do you mean outrageous lies such as, [Seen on FOXBUSINESS] US national debt is approximately $229,000 per taxpayer and $87,000 per American?

Or, consider that time after Reagan took office when he described (as I recall) the debt approaching $1Trillion as unimaginable. Remember how terrible that big ol big spender, Jimmy Carter had been!

Of course, eight years later, the debt was approaching $3 Trillion, ( $2.7 T+). a figure no longer unimaginable, just pure Reagan reality, presided over by that fiscal conservative budget balancing guy out of central casting.

In today’s dollars that $2.7T would be at least $6T+, right? Hard to imagine, no?

“Of course, eight years later, the debt was approaching $3 Trillion”

I remember a lecture on this from the great James Tobin some 30 years ago where he was trying to get across nominal v. real. He quipped that this charge that Reagan tripled the national debt was a bit misleading because inflation adjusted the debt only doubled. Tobin gave his usual smile as the audience laughed!

BTW even Milton Friedman had to admit back in 1981 that the real value of the debt fell under Jimmy Carter.

Senator Whitehouse says Senator Mcconnell has folded on debt-limit brinkmanship.

https://youtu.be/Bo5HckTXFf4

there should be no debt-limit brinkmanship to begin with. as i was taught growing up, what you charge to the credit card needs to be paid back, even if you have buyers remorse.

A 4.3% loss in the S&P since the beginning of September may help explain why Mcconnell is reportedly giving up the debt ceiling battle. His rich masters called him on the carpet.

I’m thinking of a film scene, with character Admiral Ackbar, who exclaims a memorable line.

And I was, for just a moment, happy.

I mean, it’s actually debatable, but I would say when the debt limit pops right back up again in December (will we get two breaths in between now and then??) that you’re playing right into Republicans’ hands because it enters into the “news cycle” for multiple weeks again and reinforces “John Q Homer Simpson’s” view that these things are always created by Democrats. Of course the woman some people on this blog (one of my few disagreements with Menzie) have told me over and over is a “musical genius” never thinks to try this same stunt when she’s holding the cards~~to hold Republicans hostage on the topic, and write the bill or set the debt limit number where it pops up 3 months later for donald trump to wrangle with. That one is just too much of a conceptual challenge for our Baltimore woman born with the silver spoon up her keister.

It is ever ‘The Moral Equivalent of War.’

I tremble at the thought of not adding another $5+ trillion to the national debt – after adding $8 trillion in the past 18 months – . . .

T.Shaw: Unlike the bills passed during the Trump administration, there are revenue enhancements in the Biden proposals. See e.g., Furman.

Jason notes that revenues will rise from 17.5% of GDP to 18% of GDP. This is Mitch McConnell’s socialist world? The case should be made for even higher taxes given these figures.

By “revenue enhancements” do you mean tax increases?

I do not tweet.

If so, why the dire need to raise the debt ceiling?

T.Shaw: Are deliberately trying to be obtuse? The debt ceiling is being broached because of previous decisions regarding taxation and spending; the pending legislation pertains to future spending and revenue plans.

Stop trolling.

Menzie notes: “The debt ceiling is being broached because of previous decisions regarding taxation and spending; the pending legislation pertains to future spending and revenue plans.” and roll over of existing debt.

It, annual debt increases, continues until we get spending and taxing balanced to stop the continuous roll over of existing debt.

Menzie notes: “The debt ceiling is being broached because of previous decisions regarding taxation and spending; the pending legislation pertains to future spending and revenue plans.” and roll over of existing debt.

It, annual debt increases, continues until we get spending and taxing balanced to stop the rising of the debt ceiling.

CoRev

October 8, 2021 at 6:05 am

Gee – you have company. CoRev is doing his best to articulate the Mitch McConnell BS. And yet even he comes across as some muttering clown. Between the two of you – it seems you cannot even form one coherent sentence!

Yes his rich masters refused to allow a default game. This time the markets actually feared the GOP was crazy enough to do default – and it responded in a frightful way. The further we moved towards October 18’th the more humiliating the surrender and the worse the damage to the rich.

If Schumer had gotten a budget together, he could roll it in with the debt ceiling. Then Mcconnell would not even have time to drag out and politicize the reconciliation process.

After reading much of Claudia Sahm’s comments regarding the Rudd paper, I’m not so certain of your assertion that Rudd would agree expectations matter but to what degree. It seems likely the degree may be negligible. Via Twitter Sahm has stated “ Jeremy’s paper is one of the best piece I have EVER read about inflation expectations. I have read many and written a few. I was point at the Board on the Michigan Survey and consumer expectations in general, I have written many notes and internal memos on them… for over a decade I have seen Jeremy and the entire inflation team some of who like me left the Board argue the same point. before staff, before the FOMC.” and “ I said FOR YEARS inflation expectations are the biggest pile of horseshit. Jeremy said it better. read every goddamn footnote in his paper.”

See this thread https://twitter.com/Claudia_Sahm/status/1442113980768694273?s=20

In a recent substack: “Rudd’s saying, don’t lean on inflation expectations. And stop talking about them.” https://stayathomemacro.substack.com/p/what-to-expect-when-youre-expecting

An interesting and appreciated rebuke by Rudd nonetheless.

Econned, for once you actually have a substantive comment here.

That said, this is not impressive. Rudd is a big deal because he argued with Bullard over 1.75% versus 2% Excuse me, but where is the nearest vomitourium?

Yeah, when massive exogenous shocks hit, like a pandemic, inflation expectations are wrong and not driving much. But they do influence peoples’ behavior, and in periods of stable inflation like we long had, they reinforce it.

Barkley, your comment is largely without substance.

That said, no. Rudd is a “big deal” to some because of his decades of research at the Board on this very topic (please do a quick search before such silly posting). Not that I’m necessarily in favor or not in favor of the position made by Rudd/Sahm but I’m certainly taking their expertise over yours. Your assertion “ they do influence peoples’ behavior, and in periods of stable inflation like we long had, they reinforce it” which is just a(nother) regurgitation of the conventional wisdom.

Jason Furman has also recently tweeted that expectations are merely a residual term that make models work but that he also feels it doesn’t necessarily make expectations completely irrelevant. He seems to be a fan of Rudd’s paper overall. Jon Steinsson wasn’t a fan of Rudd’s paper based on replies to Furman.

“Econned

October 7, 2021 at 4:29 am

Barkley, your comment is largely without substance.”

Oh gee – I thought this was going to be an informative discussion but the troll in you just had to come out. If you wish to discuss actual economics – please do. But if you just want pretend you are the only smart person in the room, find another blog to pollute.

Wrong.

I’m replying to “ Econned, for once you actually have a substantive comment here. That said, this is not impressive.”

If you can’t see that as trolling and uncalled for, there’s little hope. Try and put your biases aside.

“Econned

October 7, 2021 at 11:41 am”

Read Barkley’s ENTIRE comment and not just the intro this troll cherry picked. It seems our arrogant troll has a very thin skin.

pgl, and Read my ENTIRE comment and not just the intro this troll cherry picked. It seems our arrogant tragic clown has a very flawed logic.

Barkley’s comment was unprovoked and uncalled for. Calling Barkley out for such isn’t being thin-skinned – it’s calling a spade a spade. Also, it’s not PaGLiacci’s place to police comments. As such, if you want to discuss the topic, please do so. But you’re unable. Again. Go take a trip in your clown car. Honkhonkhonkhonk

Con Man,

‘

Excuse me, but what is this bs you spout that if somebody comments on a post you make without you specifically inviting them to do so, this constitutes”trolling”? Total bs. The troll here is you, one of the worst on this site.

BTW, reading CS’s tweets on all this have further reduced my respect for her. She has done some good work and been right about some other matters, such as sexism at the Fed and in the econ profession. But she has also been wrong about some other things, such as not admitting that Dudley beat her to the punch on “her” rule. And her claims that Rudd and associates are the world’s leading experts on inflation are pretty much completely off the wall. Gag.

Barf-ly Rooster,

You’re excused because you’ve misread/misunderstood. It’s your comment “ for once you actually have a substantive comment here.” it’s childish and uncalled for trolling.

Also, comments like this “But she has also been wrong about some other things, such as not admitting that Dudley beat her to the punch on “her” rule. And her claims that Rudd and associates are the world’s leading experts on inflation are pretty much completely off the wall. Gag.” Are the real “gag”.

Con Man,

What it really is that I actually started out by saying that for once you were at least dealing with a substantive issue, even if I did not completely agree with your post. But somehow you were back with your absurd claim that I was being trollish by daring to say anything at all in response to your out-of-the blue comment without your permission or invitation to say anything at all about it.

Why is it that you are the only person here, or for that matter on any blog I have ever seen, who somehow thinks you have this authority or right to have nobody comment on anything you post unless you have invited them to do so? It really is the ultimate manifestation of your supremely arrogant trollishness that you do this.

I’m not taking sides here, only asking an earnest question. If Dudley was the first person with the idea on the Sahm Rule, where is the evidence it was Dudley’s idea before hers?? Something about a GS investment letter?? Surely this isn’t a proprietary letter at this late stage in the game, can someone link the GS letter or said proof it was Dudley’s idea??

Apparently even William Dudley has ceded this point:

In an email to CBS MoneyWatch, Dudley said he believes Sahm deserves FULL CREDIT for the Sahm Rule, which he called “insightful and noteworthy.” He also said that in an earlier email to Sahm he never suggested she shouldn’t get credit, but was simply pointing out that “economists at Goldman Sachs had identified one empirical regularity that plays an important role in the Sahm Rule earlier.” Dudley was one of those Goldman Sachs economists. He said he wanted her to be “aware” of this and did not intend to “upset” her.

https://www.cbsnews.com/news/claudia-sahm-former-federal-reserve-economist-field-racist-elitist-sexist/

Barf-ly Rooster,

You’re wrong. Again. My issue wasn’t as you assert below…

“But somehow you were back with your absurd claim that I was being trollish by daring to say anything at all in response to your out-of-the blue comment without your permission or invitation to say anything at all about it.

Why is it that you are the only person here, or for that matter on any blog I have ever seen, who somehow thinks you have this authority or right to have nobody comment on anything you post unless you have invited them to do so? It really is the ultimate manifestation of your supremely arrogant trollishness that you do this.”

I’ve been clear to anyone who can read that it was your very first sentence that was trollish. Your inability to read and comprehend is embarrassing given your background. It’s either you’re ignorant or you’re a troll – I’m giving you the benefit of the doubt here.

“If you can’t see that as trolling and uncalled for, there’s little hope. Try and put your biases aside.”

econned, that is not trolling. he is disagreeing with you. sorry if you got your feelings hurt, snowflake. but people are allowed to disagree with you. you simply used that as an excuse to attack belligerently. that is your mode of operation on this site.

you share a lot of similarities with ltr. both of you provide provocative commentary, and then cry foul if somebody has the nerve to disagree.

baffling,

You really don’t think it’s trolling to comment “for once you actually have a substantive comment here”??? That’s a childish and unprovoked troll.

econned, no i do not. rude? insensitive? maybe. but he conveys the point that somebody does not believe you usually provide value to a conversation on this site. i would agree with barkley completely.

now one may think your response is because you are thin skinned. i have my doubts. you want to pick a fight. you just try to provide cover for your sophomoric responses. trump does the same thing.

Yes, Claudia Sahm wrote her rule independently of the earlier work by Dudley. He did not propose a rule per se, although he and his team identified the key empirical regularity behind it. Also, their work appeared in an intra-corporate newsletter, so Sahm did not know about it. However, she has been reluctant to admit his prior work on the matter.

Claudia Sahm documented that exchange between Rudd and Bullard quite well.

“Econned

October 7, 2021 at 1:38 pm”

I was quite willing to discuss this paper from the beginning. Of course the preK bully name Econned is more of the mood to hurl insults at Barkley and then me. Nothing new – it is what this troll always does.

PaGLiacci….

Your selective timing is ill fitted for engaging you in serious commentary (not that you’re ever interested in “serious” commentary as is). If you can’t see my reply was a response to childish and uncalled for comments, you’re blind. Please remove your oversized clown nose and maybe your vision will improve. HonkHonkHonk

Con Man,

Regarding my opening comment, you clearly took it was an insult to imply that pretty much everything else you have ever posted here beside this mostly substantial comment was a pile of totally worthless garbage. But indeed that is indeed exactly what I meant. Almost everything you have ever posted here has been utter and totally worthless garbage, and I have been fairly clear previously that this has been my view. You may think that is trolling, but it is true.

And it remains that one of the more consistently present pieces of garbage you have indulged ij, doing it again here blatantly, has been your ridiculous propensity to label anybody questioning you ar all a troll. It is the leading piece of evidence that you are one of the worst trolls in this place.

Barf-ley Rooster,

It was either trolling or immature. At least you’re now owning up to it. You’re 70, is this really how you want to spend your final years/decades? You’re using your real name and it’s quite embarrassing to witness.

Also, you’re wrong in stating that I label people trolls for disagreeing. Moreover, I don’t deny trolling at times but your specific evidence here is completely without merit.

“Moreover, I don’t deny trolling at times ”

and that is why people call you a troll, econned. stop denying what you readily admit.

baffling, congratulations for the most nonsensical comment on this post. It’s a true accomplishment.

econned, let’s be clear about something. you complain because somebody calls you a troll. and then YOU admit that YOU are a troll. you want it both ways. you want to be able to complain when called a troll, but you want the freedom to act like a troll when it is convenient for you. you display the maturity level of a young child at times.

EConned: Well, feel free to disagree. My reading of the paper is that expectations don’t matter when inflation is off of the consumer’s radar (e.g., when inflation is low and stable); they might be influential when they are “on the radar” (i.e., inflation is so high that it makes people change jobs, etc.). See page 13 of the paper. Well, this is consistent with some type of bounded rationality, so I don’t think it’s heresy, but it’s also outside of textbook.

My view: Better to read the underlying papers if you are going to debate the role of something as central as expectations in macro.

Menzie…

My view: you’re out of your mind if you think Rudd hasn’t read these papers. Alternatively, if you think I haven’t read these papers, remember three things

1)you’re wrong

2) you’re barking up the wrong tree

3) you should go understand Rudd’s stance and comments beyond this single paper and citations. Hell, Rudd is even quoted in FOMC transcripts as questioning if the general public even has a clue what PCE is. Have you read Rudd’s coauthored memo for the committee’s Jan 2014 meeting?

EConned: You misunderstand me. When I write “should read the underlying papers”, I am referring to you, since you are referring to blogposts and tweets. OK, so you’ve read the papers. I’m not sure you understand that in the context of my writings on this blog, I don’t find Rudd’s worldview that earth-shattering.

On this blog, I’ve discussed (1) how nominal rigidities can limit the role of expectations (as measured) in the Phillips curve formulation, (2) noted how there are different measures of inflation expectations — household/consumer, profession, statistical/econometric, FIRE, and firm, (3) noted how in low inflation environments one can get inverse directions for Phillips curve (a la my teacher George Akerlof for instance), (4) the fact that household/consumer expectations over-react to individual component prices, and seem to exhibit upward bias, (5) and noted (maybe not for inflation, but certainly for exchange rates) the possibility of bounded rationality.

So, if you want to think I am really shocked by Rudd’s views, you should revise your views. It is a little out of the ordinary for someone to be so outspoken in his views, but the Fed is a large place, and if you talk to enough people there (I have been a visiting scholar at the Board four times, and presented there multiple times more), you know there’s a diversity of views on everything.

How did I misunderstand when I *clearly* stated *me* as an option? Can you read?

When did I assert Rudd’s views were “earth-shattering”? Can you read?

Why do you think that I think you are “really shocked by Rudd’s views”? Can you read?

Rudd’s views have been noteworthy because this is his area of expertise and he isn’t merely a visiting scholar (you’re kidding yourself if you think your position as a visiting scholar researching unrelated areas is comparable to a respected Fed staff who has spent decades at the Fed Reade arching this specific issue). If you were considered an expert on this specific area of the macroeconomy, maybe your views would be considered as of value. But, seriously – can you read?

EConned: I was responding to your very first sentence, verbatim quote: “My view: you’re out of your mind if you think Rudd hasn’t read these papers.”

Menzie, I’m replying to your second sentence. Verbatim quote…

“When I write “should read the underlying papers”, I am referring to you, since you are referring to blogposts and tweets.”. I ask you again. Can. You. Read.

EConned: Well, my second sentence addressed your statement: “Alternatively, if you think I haven’t read these papers, remember three things 1)you’re wrong.” I don’t really believe your assertion. So: yes, I can read.

Menzie, why on earth can’t you read beyond the first sentence? You state unequivocally that you were responding to my first sentence.

If, as you now state that you were responding to my “very first sentence”, we are back to my original statements.

It’s honestly baffling how bad you are at staying in the context of the conversation. In any case, I couldn’t care less if you “believe me” or not because my points still remain and your beliefs have zero bearing on refuting the evidence from your own replies that support the evidence of your illiteracy. You’re seriously among the worst commentators I’ve come across in the econblogosphere. But you ignoring point three – which is back to the true topic of conversation – is exactly as I would expect from a third-rate blogger such as yourself.

Con Man,

Wow. Not only are you a nauseating troll, you have got to be the most unjustifiably arrogant commenter I have ever seen here. Ooooh, Menzie is supposed to “remember” that you have read all the papers cited by Rudd? When did you tell us that you had done so? Have you? Frankly I doubt it. I suspect you are just a liar. You make so many ridiculous statements that even if you have read all of them, you do not provide much evidence of it.

After all, as I noted above, in your initial comment above, you cited a ludicrous twitter feed by Claudia Sahm where she made herself look like she is completely out of her mind. This has nothing to do with the Dudley matter. It is her bald assertion that Rudd is one of the three leading experts on inflation in the world, the other two being people she also worked with at the Fed. Do you buy into this utter foolishness because maybe you also work at the Fed maybe? Gosh, maybe you worked with her and Rudd and those others. Maybe you are one of those others, one of the world’s leading experts on inflation according to Claudia Sahm!

So you dare to claim that somehow Rudd (and presumably Sahm as well) know more about inflation than Menzie because, gosh, Rudd has worked at the Board of Governors for a long time, while Menzie is just a mere Visiting Scholar like no-count George Akerlof was. I mean, wow, Rudd has been quoted in FOMC minutes! Nobody else has ever had that happen! That clearly shows Rudd knows more about inflation than mere visitor Menzie, although the Fed is full of lots of staffers who are permanent and who have also managed to get quoted in Fed minutes over the years.

Well, I did some checking. Rudd is a respected Fed staff economist, but while he has some respectable publications, none of them have more than about 400 google scholar citations, and he does not have all that many. Menzie has well into the thousands. He has way more than Rudd does. In fact this interesting paper, which both Menzie and I mostly agree with, is his writing that has gotten way more attention than anything else he has ever written, even if he has managed to get himself quoted on occasion in FOMC minutes. Menzie is the far more influential and respected macroeconomist than Rudd is, even if Claudia Sahm further damages her reputation by making the unsupportable comment she did in that silly twitter feed you linked to..

As it is, your denunciations of Menzie are just completely out of line and unsupportable. He is one of the top econobloggers there is right now. You label him “third rate.” Oh really? Well who then is first or second rate?

Which brings us to the problem of who the heck are you to be even making these judgments? I hold to my view previously stared here that almost nothing you have posted here has been of any worthy substance, even if you think that anybody who dares to disagree with you is clearly a troll.. Who the heck are you besides a foolish nobody who is egregiously pompous and arrogant?

Yes, it is conventional here for people to go against Menzie’s expressed wish that people use their real names, but when you hide behind such a stupid moniker as “Econned” you are in no position to pose yourself as some supreme expert on economics or econoblogs. Do you run an econoblog? Do you have a PhD? Do you hold a professional position as an economist, or did, either in academia, government, or the private sector? Do you have any publications? Heck, do you have any google scholar citations? Frankly, it looks like I have more of those than does Rudd, for all the insight in this recent paper of his, and Menzie certainly does, way more than Rudd does. And even if you actually have some, which I doubt, I am sure he has way more than you do too.

Frankly, your remarks in this thread have become over-the-line offensive and beneath contempt. I doubt there is a single person who is willing to support you on this garbage. And that is not because Menzie might ban them. He has made it clear what are the grounds for people being banned, and sharply criticizing his views or comments are not on that list. He will tolerate this blithering rant from you.

Oh, I suppose I should give you some credit: at least you have not accused him of being a troll, even though he dared to disagree with you without you having asked him to comment on what you said or even asking your permission to do so. Very tolerant of you. Wow.

Barf-ley Rooster,

So we will add you to the list of those who cannot read.

Lies/misunderstandings in your 1st paragraph:

1) you erroneously assume the word “remember” has a single definition (what is it with commenters here not understating this). See, e.g., the dusty dictionary in your bookcase.

2) I couldn’t care less if you think I’m a liar

3) you can’t name a “ridiculous statement” that I’ve made

4) it was you who began the trolling

Lies/misunderstandings in your 2nd paragraph:

Rudd’s area of expertise is inflation. Period. There’s nothing foolish about that. You write and debate like a middle schooler – this entire paragraph is complete gibberish from a senile septuagenarian.

Lies/misunderstandings in your 3rd paragraph:

1) “So you dare to claim that somehow Rudd (and presumably Sahm as well) know more about inflation than Menzie because, gosh, Rudd has worked at the Board of Governors for a long time, while Menzie is just a mere Visiting Scholar like no-count George Akerlof was.” This is completely false. if you knew Rudd’s work you would know how incompetent you sound.

2) “I mean, wow, Rudd has been quoted in FOMC minutes! Nobody else has ever had that happen!” Another non-sequitur. Anyone who isn’t senile knows that the committee typically allow staff to speak on their areas of expertise.

3) “That clearly shows Rudd knows more about inflation than mere visitor Menzie, although the Fed is full of lots of staffers who are permanent and who have also managed to get quoted in Fed minutes over the years.” See above and stop using logic like a school-aged child.

4) a lot of Fed staff work isn’t for publication. Many staffers actually do REAL work. Meaningful work that actually directly impacts policy on a regular basis. You’re glib.

Lies/misunderstandings in your 4th paragraph:

You’re attempting to compare Rudd’s area of expertise with Menzie’s areas of expertise. Your lack of logic is appalling given your background. I see your comment was late at night so I’ll attribute this to sun-downer syndrome and/or alcohol. Seriously you should attempt to do better considering your name is attached to your comments. It’s very sad.

Lies/misunderstandings in your 5th paragraph:

First rate is Jim Hamilton. Second rate is Scott Sumner. Third rate is Menzie Chinn. Fourth rate is Freakonomics blog . Fifth rate is Econospeak.

Lies/misunderstandings in your 6th paragraph:

1) I don’t call people who disagree with me trolls – at your advanced age you have clearly forgotten that correlation does not imply causation.

2) It does however seem that you have multiple fishhooks in your mouth rendering this paragraph largely indecipherable. You also have a large mirror that is talking back to you.

3) Please go take your meds.

Lies/misunderstandings in your 7th paragraph:

This is the internet. I understand you’re still getting acclimated but maybe go Ask Jeeves why on earth you think this paragraph is in any way meaningful. I would be embarrassed to know you after reading your comments on this and other blogs. Nothing you’ve said here is relevant because you keep redirecting the discussion to citations not related to the topic at hand. Apparently the telegraph to your ivory tower hasn’t functioned properly in decades.

Lies/misunderstandings in your 7th paragraph:

1) I’ve cited others who have supported Rudd on “this garbage”. I couldn’t care less about people on this blog supporting Rudd.

2) menzie’s ban rules are aren’t enforced. If they were, half of his followers would be banned. I’ve called them out many times.

Lies/misunderstandings in your 8th paragraph:

1) I definitely have accused Menzie of being a troll in the past but Barf-ley Rooster should worry about Barf-ley Rooster

2) I don’t accuse people of trolling if they “dared to disagree” again, you’re senile and can’t read or you missed the part of intro stats that correlation dne causation.

3) I’ve never accused people of trolling if they comment without me having asked them to comment on what I’ve said or even asking my permission to do so. Again, you’re senile and can’t read or you missed the part of intro stats that correlation dne causation.

i find it rather odd that econned has such a low of prof chinn, this blog site and its commenters, and yet repeatedly comes back to the site to read and comment.

i sense a bit of jealousy from econned. perhaps because prof chinn has accomplished quite a bit in his career, and poor econned feels he is a superior economist and yet for some reason simply lacks any professional credibility that allows him to get ahead in life. so he spends his extra hours trying to tear other people down. apparently nobody is interested in reading a blog created by econned. i wonder why?

Econned,

There is a long list of lies in your latest comment here, too long to go through in detail, although you are beginning to resemble Moses Herzog in some of your misrepresentations, although your claim that you do not accuse people of being trolls for not being invited to comment on your posts is a screaming lie as you have done this many times here. There is just so much more..

I shall simply focus on the main point that you srarted with, although i already. You popped in by supporting Rudd by providing links to Claudia Sahm. She made the incredible statement that Rudd and two of his coworkers and implicitly she herself who worked with them are the leading experts on inflation n the world. I said she lost her mind when she put that out there, and you lost yours when you linked to such incredibly stupid dreck. Just embarrassingly bad on her and your parts.

As it is, I never questioned that he knows about inflation. He is indeed a respected longstanding staffer on the Board of Governors who has studied it. You do basically accept that his broader record as measured by publications and citations is not all that earth shaking, certainly not remotely justifying this claim of him being the world’s leading expert on inflation, along with maybe a few of his cowlrkers. Your reply is that he has done a lot of unpublished work that matters. Yeah, so do the hundreds of other staffers who work at the Fed and also get quoted from time to time in FOMC minutes. And, again, both Menzie and I mostly agree with this paper by Rudd. It is clearly the most important work he has done. I pretty much agree with Mrnzie’s position, which involves disputing relatively minor points in it. But this sent you off the farm dragging in an outright off-the-wall twitter feed by Claudia Sahm.

I also note that all of the Fed district banks have research staffs. As it is, some of those staffs have higher reputations than the one at the Board of Governors. Rudd is a smart and well-informed guy, and this paper is well done and worthy of attention, which Menzie has given it by posting about it. But his caveats on it are reasonable, and I happen to agree with them.

In the meantime, you need to stop lying. You have really gone far beyond the pail on it with this latest comment, troll.

Barf-ley Rooster,

Again your comprehension of written word is awful. It is you who is lying.

1) you state “you claim that you do not accuse people of being trolls for not being invited to comment on your posts is a screaming lie as you have done this many times here.” This is a complete lie or misrepresentation of my comments. You should be ashamed. But you’re not and we know you’re a senile septuagenarian.

2) It is untrue in your assertion “ lost yours when you linked to such incredibly stupid dreck. Just embarrassingly bad on her and your parts.” Again, the senile septuagenarian who is off their meds has come out. No support. No logic. Nothing from you. Again.

3) you state “But this sent you off the farm dragging in an outright off-the-wall twitter feed by Claudia Sahm.” Again, you’re getting overly emotional and sensationalizing to an extreme degree. You’re uncomfortable with thinking outside your little box. Go take your meds.

4) you comment “also note that all of the Fed district banks have research staffs. As it is, some of those staffs have higher reputations than the one at the Board of Governors. Rudd is a smart and well-informed guy, and this paper is well done and worthy of attention, which Menzie has given it by posting about it. But his caveats on it are reasonable, and I happen to agree with them.” This is pointless. Nothing you’ve said is worth stating. I know it pains you to. It have anything of substance to say but it’s best you keep quiet until your senile brain has something to offer. I’d suggest you wait until morning when your sun-downers isn’t as pronounced.

5) you comment “In the meantime, you need to stop lying. You have really gone far beyond the pail on it with this latest comment, troll.” But didn’t point to any meaningful support of my supposed lying. You don’t agree with my comments and you associate that with lying. You’re a joke. A troll. And a pitiful commenter. Try harder next time. Or at the minute just try. All that typing and no logic. I wonder if you are still taken seriously in your department or just viewed as the senile old guy who won’t [edited MDC] and retire to greener pastures but is tolerated due to likely antiquated contributions from decades gone by.

EConned: Point of information, since you are disparaging an individual’s contributions as likely antiquated. I note that Dr. Rosser has 2112 google citations since 2016.

Menzie,

Thanks for the comment. I probably should not waste my time, but given his over the top insults of you and the fact that he is now tripling down on worse and worse lies, I am going to comment a bit more. Oh, and btw, my two most cited works are not listed in google scholar list, so the numbers are higher, both recent and total.

Econned.

You claim I am lying that regularly when somebody comments on a post of yours you accuse them of trolling and even declare that they should not be posting because you did not invite them to. Everybody here who follows things here knows you are the one lying. You have done it many times to many people. Such comments by you are a non-trivial portion of your posts here. Wow.

You are outraged that I dare criticize the twitter feed that you linked to by Sahm, where she outright says that Rudd is one of the three leading experts on inflation in the word, along with Lebow and Peneva. Do you deny that is right up front in the twitter feed? If you recognize it is, how on earth can you support such a ridiculous claim? I just checked the Wikipedia entry on inflation. It has 81 footnotes. Not a single one of these people is mentioned even once anywhere in the entire entry. My comment about other Fed bank research staffs is related to that without getting into too many details. There are other serious inflation experts in the system.

As for me being out of it and not respected? Well, my college is up for reaccreditation. In their formal report out this fall, I was highlighted as the outstanding professor in the whole college. They do not seem to be too ashamed of me or out to push me out the door.

Also, while Rudd and associates do not seem to be the world’s leading experts on inflation, I may be the world’s leading expert on the more admittedly more obscure and less important complexity economics. I had no input to it, but I am mentioned more than any other person in the Wikipedia entry on Complexity Economics. I am willing to grant that some others mentioned there are certainly at least as important as I am, with some probably even more. One of those is Steve Durlauf, whom I succeeded to become the Senior Coeditor of the New Palgrave Dictionary of Economics, widely regarded as a highly prestigious position from which i make judgments about what is important and what is not in the entire economics profession. Steve moved on to become the editor of the Journal of Economic Literature.

Oh, and I note you never did reply to any of my questions about you. You present yourself as someone more expert on economics than even Menzie, much less me, and I understand you will continue to hide your true identity. But could you not even lie to claim that you hold or have held some kind of respectable position in the economics profession. Or maybe that you have publications or citations? Not only am I still getting a lot of citations as Menzie noted, but I am still publishing, and in some serious outlets. You? Look like a big lying loudmouth.

A very rare moment of likability, from our favorite guy still hiding in the closet:

https://twitter.com/ABC/status/1445547364547055621

Perhaps someday Graham will recall in his memoirs this early October day in 2021 and tell us what fried okra tastes like when seasoned with sodium amytal.

BTW, one can be near flaming homosexual and still be electable and better than 90% of the other legislators out there. Barney Frank proved that. Although admittedly it would be a much tougher task with South Carolinian constituents than out of Massachusetts. He did it back around 1987. Roughly 1/3 of a century ago.

Could we finally put Chuck Grassley out to a retirement home?

https://www.huffpost.com/entry/chuck-grassley-korean-american-people-lucy-koh_n_615ddc73e4b0896dd1ac1137?voh

He wanted to congratulate Judge Lucy Koh on her career but statements like “your people” and strong work ethic is in its own way insulting to all Asian Americans.

When it comes to actual inflation, higher inflation brings with it greater volatility. It is not a big stretch to expect that it would also lead to greater dispersion in expectations. So no surprise there is greater dispersion now.

Ruud’s paper is lucid and well argued. As he states, the weaknesses of the whole expectations argument have been known for some time, for anybody who cared to look.

Assuming the formation of inflation expectations is backward-looking, the idea that expectations anchor actual inflation in a limited way but are not otherwise powerful in determining inflation trends makes sense. Inflation regime change (to borrow a label) cannot be the result of a backward-looking process. Covid, in changing inflation expectations, has done what the Fed could not do.

Whether inflation expectations are powerful or just a residual is a fine discussion to have, but there is a simpler question when it comes to the Fed’s policy regime – Does the average John Q. have any understanding of Fed policy? The answer is “no”, which means a policy regime based on signaling policy intentions to the public is misguided.

Doing something that doesn’t work – manipulating inflation expectations – is fine as long as it doesn’t get in the way of doing something that does work. The risk is that the Fed will be focused on influencing expectations at the expense of doing something else which would work better. One more constraint on policy that already has limited tools.

I kinda think the Lucas critique is under fire here – well and good. It has been fetishized long enough.

There is a lot of gray area here and a relatively wide margin for varying arguments. However from my view, I’ll take Bernanke’s transparency over Greenspan-speak. From what I could tell, in her unjustly abbreviated/robbed time at the Fed, Yellen was a believer in transparency.

Is signaling different than transparency?? Signaling (as terminology) to me implies something a little more aggressive than transparency. But there’s no doubt that the market (both equities and credit markets) pay attention to Fed signaling. What does the public/”John Q” think of signaling when guys like Robert Kaplan are trading their own stocks and investment accounts?? For me, it takes a lot of weight and respect out of what they have to say about anything.

What I am wondering here, after only reading the first few pages of the Rudd paper, is if commenter “JohnH” has gotten around to reading Ascari & Sbordone 2014. Some old proverb “just enough knowledge to be dangerous”?? The Joe Six Pack asked.

I agree that transparency is good for public institution. My point about signaling is that the Fed is relying on signaling its policy to the public as a way of making that policy more effective when there is little evidence the public is aware of the signal. The signal is something like “we are going to keep putting upward (downward) preswure on inflation until average inflation over time is equal to 2%” with the expectation that the public will hear, begin to expect higher (lower) inflation and help make it so. There is no real evidence the general public hears. The Fed may be relying on a non-existent mechanism to transmit policy.

It’s like putting the wrong address on a love letter – all those fancy words wasted.

I think we pretty much agree. I have sometimes wondered if a medium ground between Greenspan and Bernanke would be the magical “sweet spot” for policy effectiveness. That is, when the Fed is “continually” signaling, that signaling gets “diluted”. If that makes any sense. This topic is less likely to get me angry like some other topics, as I think there’s a lot of gray area on what is best. It actually reminds me some of the topic of inflation expectations, because it’s kind of an abstract thing that’s very difficult to quantify,

Now if we could replace the waste of time known as the Tucker Carlson show (or Hannity etc) with coverage of these Federal Reserve meetings.

For the record, even though I have defended the importance of inflation expectations in inflation, indeed mostly for reinforcing an existing rate, I do not support efforts to “manipulate” expectations of the -public, which strikes me as pretty much a lost cause anyway, for various reasons, some of them already stated here by various people.

I generally support transparency, although it is easy to forget that not too long ago the FOMC was totally opaque, only publishing minutes a month later. indeed the ratex people argued the only way the Fed could actually influence economic behavior was by fooling people, doing something unexpected, which was clearly easier to do back in the days of secrecy. But I am not for returning to those days.

https://newsaf.cgtn.com/news/2021-10-08/Nigerian-central-bank-to-launch-digital-currency-within-days-governor-14aTldyPY3K/index.html

October 8, 2021

Nigerian central bank to launch digital currency within days: governor

The Central Bank of Nigeria (CBN) will launch the eNaira, its digital currency, in a couple of days from now, Governor Godwin Emefiele told a conference on Thursday.

He said this would make Nigeria “one of the first countries in Africa, and indeed the globe, to adopt the digitization of its national currency”.

The CBN had announced plans to launch its own digital currency this year after Nigeria barred banks and financial institutions from dealing in or facilitating transactions in cryptocurrencies in February.

Emefiele had previously said the eNaira would operate as a wallet against which customers could hold existing funds in their bank accounts, and that this would accelerate financial inclusion and enable cheaper and faster remittance inflows.

The CBN had named Barbados-based Bitt Inc as its technical partner in developing the eNaira.

“The CBN had named Barbados-based Bitt Inc as its technical partner in developing the eNaira.”

More opportunities to funnel the potential tax base from Africa to offshore tax havens. This strikes me as a rather foolish idea.

https://www.reuters.com/article/us-caribbean-digitalcurrency/eastern-caribbean-blazes-a-trail-as-first-currency-union-to-launch-central-bank-digital-cash-idUSKBN2BO5VF

April 1, 2021

Eastern Caribbean blazes a trail as first currency union to launch central bank digital cash

By Sarah Marsh – Reuters

HAVANA – The Eastern Caribbean on Thursday became the first currency union central bank to issue digital cash, a move that comes as bigger monetary authorities such as the European Central Bank look at issuing their own electronic cash.

Official digital currencies are more “risk-free” than private electronic payment systems as they are backed by the central bank. They also cut out the middle man, reducing the cost of transactions, and make e-payments possible for those without bank accounts.

The so-called DCash is being initially rolled out in four of the eight member countries of the Eastern Caribbean Currency Union, according to Bitt, the Barbados-based firm that led its development. The pilot includes Antigua and Barbuda, Grenada, Saint Kitts and Nevis, and Saint Lucia.

Large central banks across the world are stepping up efforts to develop digital currencies to modernize financial systems, speed up payments and counter a possible threat from cryptocurrencies….

Someone screamed at me that Uber will be reporting profits for the 3rd quarter of this year which stunned me until I realized Uber is talking about something they call Adjusted EBITDA, which they define as:

“We define Adjusted EBITDA as net income (loss), excluding (i) income (loss) from discontinued operations, net of income taxes, (ii) net income (loss) attributable to non-controlling interests, net of tax, (iii) provision for (benefit from) income taxes, (iv) income (loss) from equity method investments, (v) interest expense, (vi) other income (expense), net, (vii) depreciation and amortization, (viii) stock-based compensation expense, (ix) certain legal, tax, and regulatory reserve changes and settlements, (x) goodwill and asset impairments/loss on sale of assets, (xi) acquisition and financing related expenses, (xii) restructuring and related charges and (xiii) other items not indicative of our ongoing operating performance, including COVID-19 response initiatives related payments for financial assistance to Drivers personally impacted by COVID-19, the cost of personal protective equipment distributed to Drivers, Driver reimbursement for their cost of purchasing personal protective equipment, the costs related to free rides and food deliveries to healthcare workers, seniors, and others in need as well as charitable donations.”

Well yea but with this kind of accounting, Donald Trump can declare the Federal government ran a surplus each year of his Presidency!