(not in 2018, but in 2002-03):

Lydia Cox. Working Paper. “The Long-Term Impact of Steel Tariffs on U.S. Manufacturing [Job Market Paper]”. From the abstract:

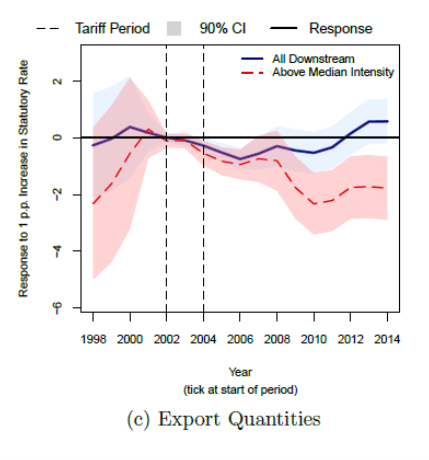

In this paper, I study the long-term effects that temporary upstream tariffs have on downstream industries. Even temporary tariffs can have cascading effects through production networks when placed on upstream products, but to date, little is known about the long-term behavior of these spillovers. Using a new method for mapping downstream industries to specific steel inputs, I estimate the effect of the steel tariffs enacted by President Bush in 2002 and 2003 on downstream industry outcomes. I find that upstream steel tariffs have highly persistent negative impacts on the competitiveness of U.S. downstream industry exports. Persistence in the response of exports is driven by a restructuring of global trade flows that does not revert once the tariffs are lifted. I use a dynamic model of trade to show that the presence of relationship-specific sunk costs of exporting can generate persistence of the magnitude that I find in the data. Finally, I show that taking both contemporaneous and persistent downstream impacts into account substantially alters the welfare implications of upstream tariffs.

Here’s one graph out of Cox’s Figure 7 that summarizes the impact on downstream industry’s exports. The red dashed line is the IRF for above median steel user intensity industry.

I find this paper very interesting, both in terms of methodology, and in terms of policy implications, but also because I still remember like yesterday the decision in 2001 to announce investigation in advance of implementing steel tariffs (as I was one of the two senior economists on international at CEA at the time).

More from Cox (with Russ) in this earlier post on the broader impacts of the Trump tariffs.

I find that upstream steel tariffs have highly persistent negative impacts on the competitiveness of U.S. downstream industry exports. Persistence in the response of exports is driven by a restructuring of global trade flows that does not revert once the tariffs are lifted….

Lydia Cox

[ A terrific paper; thoroughly convincing. ]

Conclusion

Using a case study of the steel tariffs levied by George W. Bush in 2002-2003 and a newly devised method for mapping detailed steel inputs to downstream users, I provide the first comprehensive estimates of the long-term effects that temporary upstream tariffs have on downstream industries. I find that temporary upstream tariffs have negative impacts on downstream industries, both in terms of their competitiveness in the export market and in terms of domestic outcomes like employment and production. Crucially, I find that these declines are highly persistent, particularly on the export margin and especially for steel-intensive industries. The global market share of U.S. downstream industries remained depressed long after the tariffs were removed as foreign buyers permanently shifted sourcing patterns toward other top producers. Using a dynamic model of trade, I show that the presence of relationship-specific sunk costs of exporting can generate a persistent response of downstream exports to a temporary input tariff that is consistent with the patterns I find in the data. Intuitively, because it is costly for countries to change sources of imports, if an input tariff induces a change in sourcing patterns, those patterns will not immediately revert when the tariffs are lifted. Overall, my results highlight the complex nature of tariff policy in a world with globally integrated production networks. Even temporary tariffs on a small subset of imports can 42 have persistent effects on a broad swath of the economy. Failing to take this persistence into account can lead to a substantial underestimate of the welfare implications of tariff policy.

Lydia Cox

“Using a new method for mapping downstream industries to specific steel inputs, I estimate the effect of the steel tariffs enacted by President Bush in 2002 and 2003 on downstream industry outcomes. I find that upstream steel tariffs have highly persistent negative impacts on the competitiveness of U.S. downstream industry exports. Persistence in the response of exports is driven by a restructuring of global trade flows that does not revert once the tariffs are lifted.”

How do the Trump steel tariffs compare to what Bush43 imposed? Could the damage from Trump’s stupid trade war be even worse than what is documented here from Bush’s little ploy?

“More from Cox (with Russ) in this earlier post on the broader impacts of the Trump tariffs.”

Which was posted here back in Sept. 2020. A post worth reading indeed!

Check the comments section where Bruce Hall tried to dismiss the longer term effect by misrepresenting what other economists and have as well as playing Steno Sue for Faux News.

This, what initially looks like a solid paper on Steel tariffs, brings to mind or reminds us of another question many of us had wondered on this blog before. That is–how much of America’s soybean exports business has been voluntarily and permanently abdicated by donald trump to Brazillian soybean farmers?? Have we seen any recent papers discussing the permanent loss there??

“We report three findings. First, we find that media exposure does affect economic perception. Frequent exposure to conservative media is associated with a 2.3% decrease in farmers’ expected income loss while frequent exposure to liberal media is weakly (p<10%) associated with a 2.4% decrease in farmers’ expected income loss. The implied gap in expected income loss is 4.7% between farmers who only list liberal versus those who only list conservative media in their top three sources. Given that farmers on average estimate a 14.4% expected income loss, the equivalent of $94,445, this gap of 4.7% is relatively large and economically significant ($30,810). Also, frequent exposure to conservative media is associated with a 14.3% increase in the probability of farmers perceiving MFP payments as helpful, while exposure to liberal media is associated with a 7.4% (statistically insignificant) decrease in the probability of farmers perceiving MFP payments as helpful. In other words, exclusive conservative media consumers are 21.7% more likely to find MFP payments helpful than exclusive liberal media consumers.”

* “MFP”= Market Facilitation Payments= U.S. Federal Government social welfare for farmers

Some of us, who have spent a lifetime listening to Republicans/”conservatives” rage, go into ugly facial contortions, and give lip-service to the “evils” of social welfare find the above research to be…….. typical of how Republicans’ “brains” work when it comes to social welfare funds provided by the U.S. federal government. Read as “good when I get it, bad when ‘they’ get it”

https://ageconsearch.umn.edu/record/312684/files/Abstracts_21_06_13_22_28_25_22__73_242_182_132_0.pdf

Two proverbs spring to mind “Oh, what a tangled web we weave” (Scott) and “a little learning is a dangerous thing” (Pope).

I’m enjoying the first part of the paper very much, but I get the feeling when I get to section 7 and Ms. Cox’s dynamic model is where the paper is going to start losing me, like a TV channel that comes in clear a few seconds, then goes to total static, then comes in clear, then goes to total static, and start cycle again.

Nice to see this so well documented. But it should come as no surprise that when you increase production cost for domestic producers they become less competitive and lose business (both on the domestic and international markets).

And people wonder why I say the GOPers are the protectionists … from Reagan’s attack on American consumers wanting to buy Japanese cars to Bush’s steel tariff and He Who Shall Not Be Named’s efforts to bankrupt the lower middle class by jacking up the price of everything they have to buy from China …

GOPers are bad for your health.

Well said. One could note Bush41 pushed for NAFTA. That, his willingness to raise income taxes, and his cap and trade were good policies but not ones supported by Republicans ever since.

I don’t know, I think my mind works weird sometimes. I read a semi-decent amount of these papers. One thing kind of semi-entertaining and wording new to me. She keeps say “setting” and “clean setting”, and I think I get what she means, but I don’t remember it ever being worded this way. Maybe it’s common to others but I sure don’t remember it being worded that way.