Steven Kopits writes:

We might expect a massive stimulus coupled with a major loss of jobs to lead to an explosion of the trade deficit, which it has.

…

In extremis, such a stimulus might even generate record levels of goods imports, which it has.

…

This record level of imports would result in record levels of shipping, which it has, with LA in-bound port traffic running about 15% above its prior peak. (Let me add here that US shale oil production has meant that the historical US trade deficit in oil has disappeared. Since oil is imported chiefly through Houston and a couple of other ports — but not LA — the increase in port traffic is showing up in merchandise, not oil, imports. That is, imports are going to cargo ports like Long Beach and LA.) Such ports may not be equipped to handle surges of cargo imports well above historical peaks.

…

At the same time, a loss of jobs accompanied by record stimulus might lead to weak exports, which it has.

Let’s just check to see if all this makes sense. First, “record” deficit? Sure in dollar terms – but in share-of-GDP terms, no.

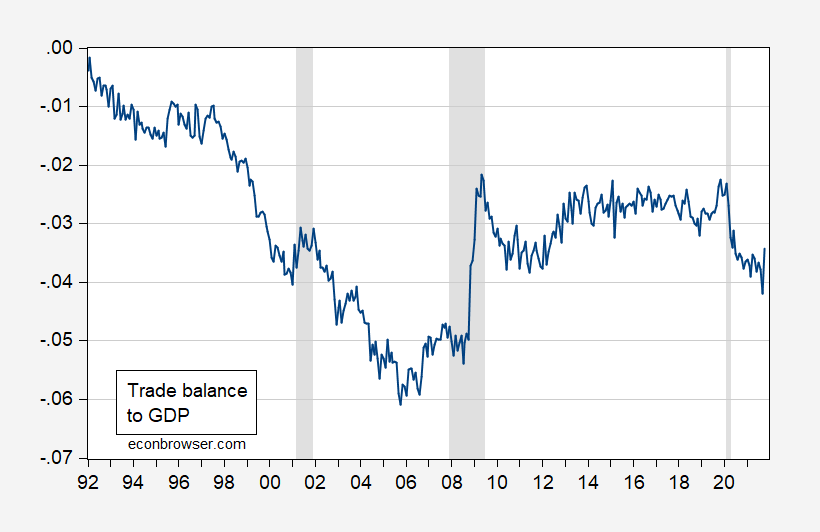

Figure 1: Trade balance – goods and services (in balance of payments terms) as a share of GDP (blue line). Monthly GDP interpolated from quarterly GDP and 2021Q4 SPF forecast. NBER recession dates peak-to-trough shaded gray. Source: BEA/Census, BEA, Survey of Professional Forecasters (November), NBER, and author’s calculations.

In fact, it’s not anywhere a record deficit in GDP normalized terms (which is what matters), and the balance has actually recovered quite sharply in October.

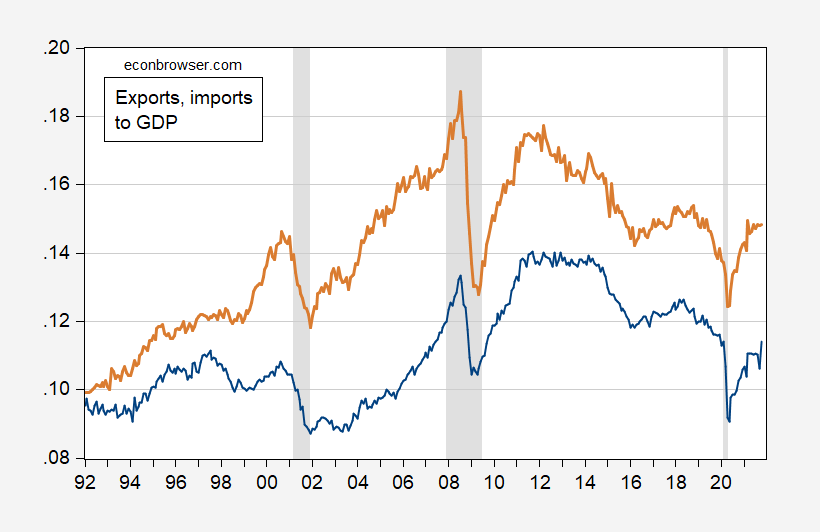

Collapse in exports? Well, they did fall, but are now rising sharply.

Figure 2: Exports of goods and services (in balance of payments terms) as a share of GDP (blue line), imports (tan line). Monthly GDP interpolated from quarterly GDP and 2021Q4 SPF forecast. NBER recession dates peak-to-trough shaded gray. Source: BEA/Census, BEA, Survey of Professional Forecasters (November), NBER, and author’s calculations.

As a share of nominal GDP, they’re at NBER peak levels, i.e., at 2020M02 share. Now, if one wanted to argue that stimulus pulled away goods and services to domestic use that would have otherwise been exported, sure that makes sense. However, the fact that imports fell at the same time detracts from that argument.

And what about the argument that the loss of jobs accompanied by stimulus might weaken exports? I would’ve thought that given continued growth in manufacturing employment, this would be a hard one to argue (employment in that sector is only 2% below NBER peak level). A more natural argument is that constrained demand for US exports limits actual exports – I’m not sure I’ve seen arguments that somehow the stimulus (or enhanced benefits) drew workers away from working in manufacturing and other exporting sectors.

In other words, when people talk “open economy macro”, they should probably learn a model or two that applies to open economy macro.

Update, 6pm Pacific:

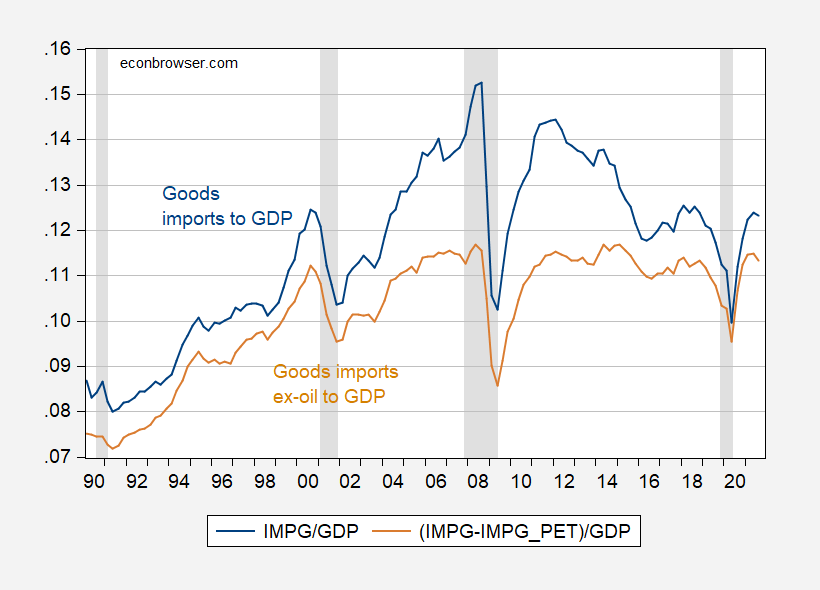

Mr. Kopits argues we should look at non-oil goods trade balance. I’m not sure why the trade balance is relevant to his point – a typical model of US trade aggregates has exports depend on RoW economic activity (and the real exchange rate) and imports depend on US economic activity (and the real exchange rate) (see this paper). So here is goods and non-oil goods imports as a share of US GDP:

Figure 3: Imports of goods and services (in balance of payments terms) as a share of GDP (blue line), goods imports ex-petroleum (tan line). NBER recession dates peak-to-trough shaded gray. Source: BEA, NBER, and author’s calculations.

Non-oil goods imports are now lower than they were 2018Q1, certainly lower than in 2015Q1.

For a guy whose bio says he’s got an economics degree and who tries to sell consulting services, this is an embarrassing show of ignorance. Flaming pantaloons of death embarrassing.

Just Wow.

For many of us, formal models are too much effort. We fall back instead on stylized facts, regularities and rules of thumb. These amount to informal models.

The thing is, relying on stylized facts which are not formally linked to each other still requires effort. You have to rub a bunch of them together before reaching any kind of a conclusion – a modicum of informal effort. Just trotting out one economic relationship (or bias – never confuse a bias with an economic relationship) without thinking of any others is the path to the flaming pantaloons.

Whenever you scale by GDP, shouldn’t you multiply the standard errors, which you don’t do, because you would get uncertainty so large you could support any story with your graph?

No, you shouldn’t. What ever gave you that idea?

I think you have missed the point of Menzie’s post. You need a framework of understanding to make sense of even fairly simple relationships. Your question reveals the lack of any framework of understanding.

This is simply a foolish comment. It makes no sense.

Is this your defense of Princeton “oil prices will top $100 a barrel by year end”? Run away with your worthless trolling.

Steven’s argument that stimulus spurs imports is reasonable. Where he really got in trouble was with this nonsense on the export side. What can lead to a decline in exports is a loss of jobs abroad leading to weakened demand for our exports. If demand is there for exports, those people who lost their jobs in the US will get hired back to produce them.

Stevie’s argument suggests people without jobs are more likely to import goods from China which makes no sense.

Stevie complains about fiscal aid for the poor but I never saw him go off on Trump’s tax cut for the rich. The latter would encourage people to shop on Rodeo Drive for things like apparel, which is more like to be imported from China than the food people purchased with the stimulus Stevie has decided to mock. But hey – complaining about tax cuts for the rich does not get one invited onto Fox and Friends.

We could also title this “What Happens When One Copies and Pastes Alternative Facts from Kelly Anne Conway Without Checking the Facts”.

Yes his babbling made no sense from an international macroeconomic perspective but Steve also had to misrepresent the data. And what really insulted me was his supposed reliance on Bill McBride. Read what Bill wrote as it was quite smart. Steve misrepresented what Bill wrote.

OK off topic but it is a big deal in sports world. The cheapest seat in Madison Square Garden for tonight’s3- game is $336. People want to see Steph Curry break Ray Allen’s 3-point goal record badly.

Allen averaged 2.28 3-pointers over his 1300 game career. In only 788 games, Steph has reached 2972 3-pointers averaging 3.75 goals per game. If he keeps this up for 1300 games, he will reach 4875 3-point goals. DAMN!

2.28 3-pointers per game.

read an interesting article on curry. historically, 80% of threes are assisted. curry hits a far greater number of unassisted three’s than anybody else. this is how he takes, and makes, more three’s than anybody in history.

His dribbling skills are off the charts. He can create open shots even when double or triple teamed. And he still bought Rolex’s for 3 of his long term team mates for their assistance over the years. What a decent guy!

“Let’s just check to see if all this makes sense. First, “record” deficit? Sure in dollar terms – but in share-of-GDP terms, no.”

So let’s look at that as the goods deficit ex-oil as a percent of GDP, because that’s what’s coming through the ports in LA. I am going to guess it’s a record.

Guess? You were spanked for getting facts wrong, and now your guessing about facts?

Is this how you treat your clients? Do you have any clients?

There are a lot of stupid people out there with money to burn. Steve’s kind of client.

Steven Kopits: Not sure why your argument hinges on the trade balance. For imports, total goods and ex-oil, see addendum and Figure 3.

You know – you should have apologized to both Bill McBride and the readers of this blog for your blatant lying before uttering another comment. But you won’t.

I did not know that the port of LA handles ‘deficits’. Come on Steve – you do know that the trade deficit is a definition not a commodity – right? And if you were honest about what Bill McBride recently wrote, he noted that exports have increased even more than imports.

You yourself argued that the Trump tax cuts would increase the trade deficit, and it did! The logic is no different here. If you reduce the workforce by 5 million and pump a few trillion of stimulus into the economy, then that purchasing power has to go somewhere, and clearly much of it will go into imports, hence the blowing out of the trade deficit. That should come as no surprise.

If the stimulus is big enough, and it was, then it will overload the system, which it looks like it did, unless you’re arguing that the LA ports had 15% idle capacity, and I am going to guess they did not.

But McBride’s latest post on this – the one you alerted me to with his Tweet – clearly talked about the trade deficit falling. It was the headline of the Tweet you linked to. Can you not READ? Or did you just LIE? Own up to this or STFU.

“If you reduce the workforce by 5 million”

So your macroeconomic model has people losing their jobs leading them to consume more goods from China. I get your writing skills suck – but HELLO?

so are you arguing against the covid stimulus of the past couple of years?

Too big, Baffs. And I think it has a nasty back end.

A nasty backend? Is that some new macroeconomic term? Or just a sickening peek into your bath room habits? Forget taking macroeconomics. Learn to write. DAMN!

a decade ago we saw how slow an economy recovers when you give too little of a stimulus during a crisis. steven, you seem to be advocating a response that would have kept millions out of work to favor lower inflation (or even deflation) rather than suffer through a few months of higher inflation but robust recovery. if you call some inflation a nasty back end, what do you call millions unemployed for years?

interesting!

i began wondering if any impact of narrowing (short time negative) net petroleum/oil imports.

https://www.eia.gov/dnav/pet/hist/LeafHandler.ashx?n=pet&s=mttntus2&f=m

i do not see much effect on trends in net imports.

big economy!

A lot of the facts Menzie noted in his correction of the nonsense from Princeton Steve were also noted by Bill McBride in this recent post:

https://www.calculatedriskblog.com/2021/12/trade-deficit-decreased-to-671-billion.html

Note Princeton Steve linked to Bill’s tweet that alerted any honest reader to this very post. Did Stevie read the actual post? If he did – he clearly LIED about what Bill recently wrote.

Really nice post…

https://fred.stlouisfed.org/graph/?g=niDR

January 30, 2018

Exports of Nonagricultural Goods minus Imports of Nonpetroleum Goods, 1992-2021

https://fred.stlouisfed.org/graph/?g=niDS

January 30, 2018

(Exports of Nonagricultural Goods minus Imports of Nonpetroleum Goods) as a share of Gross Domestic Product, 1992-2021

What I find striking about the graphs that Menzie so generously provided is the general ineptitude of Trump trade policies. Where was the MAGA? Compared to the heyday of the 2008 it seems like international trade lost its mojo for 15 years.

With respect to trade deficits, I want to have options, particularly when it comes to complicated equipment—like my Japanese/Canadian Toyota Corolla. Greg Mankiw noted that he’s been running a structural trade deficit with his local restaurants for decades.

my college room mate ken is a mathematician, we were in school all we had were slide rules.. and books of tables.

wondering why you graphed a ratio, with numerator that is component of the denominator……

i am getting old, i need to remember political economics is a social science

comments here are always ‘entertaining’.

paddy kivlin: For exports, we are interested in the share of domestic production that is being purchased by the rest of the world. For imports, we are interested in the share of expenditures falling on foreign goods.

That fiscal stimulus might worsen the balance of trade has a long history, culminating in the 1960’s with the Mundell-Fleming (MF) model. In that model, fiscal stimulus is rendered ineffective for a small open economy with perfect capital mobility and floating exchange rates. Briefly, lifting G moves the IS curve up raising domestic interest rates. The resultant capital inflow appreciates the currency worsening the trade balance, leaving GDP unchanged. The flip side is monetary stimulus – this shifts the LM curve down lowering domestic interest rates. The capital outflow depreciates the currency improving the trade balance and GDP. It is probably the influence of the MF model and variants that has shifted the focus to monetary stimulus in recent years.

Although the US is neither small nor particularly open, it is reasonable to argue that fiscal stimulus is less effective the more open is the US economy.

An insightful comment based on a classic international macro model. Which is to say your comment is WAY OVER Princeton Steve’ head.

I flatly disagree with your analysis, Menzie. Here are my numbers.

https://www.princetonpolicy.com/ppa-blog/2021/12/15/pandemic-stimulus-and-supply-chain-bottlenecks

Shamelessly promoting your worthless blog again. You have no shame!

One of Steve’s dishonest themes was a claim that we are importing a lot more from China. I mentioned earlier that Census reported a higher Oct. 2018 monthly level of imports from China than recent months. I should have included this FRED link:

https://fred.stlouisfed.org/series/IMPCH

Steve does spread a lot of disinformation which is easily shown to be BS if one uses the data readily available for free!

https://fred.stlouisfed.org/series/IMPGSC1

As far your 16% “surge” in imports from the “average” of 2019 to October, let’s consult with FRED on real imports of goods and services quarterly. It seems real imports as of 2021QIII were only 3.2% higher than they were as of 2019QII. But nice try in terms of conning your stupid readers.

gross imports do not apply to the issue that he brings up in his initial comment….he’s referring to a surge in container imports due to the stimulus…no one here seems to be addressing that data, including steve….BEA/Census divides goods imports into 6 end use categories…food & feeds do not apply, nor do industrial supplies, like oil….capital goods have a high dollar value, but occupy little container space…but you should be able to find import data and graphs for consumer goods, which is the metric you should all be using to test his thesis…this looks to be the FRED graph that covers that: https://fred.stlouisfed.org/series/A652RX1Q020SBEA

now, go figure…

He does mention the LA port a lot but could you please explain to this arrogant know nothing that the balance of trade includes exports and imports from all sorts of nations covering all sorts of goods.

Beside the COVID related fiscal aid likely went to poor people buying food while the Trump tax cuts went to shopping on Rodeo Drive for things like apparel. Which of these two are more likely to be imported from China?

Real imports of goods: Consumer goods, except food and automotive

OK I get your point and appreciate your doing this in real terms. These imports are up by $100 billion from pre-pandemic. And this likely includes imports from all sorts of nations.

Somehow none of what you suggested doing appears anywhere in Steve’s rants.

Steven,

At least you have not been touting your nonsenseical argument regarding exports again here.

Barkley –

I have shown exports on the second graph. I did not comment on them there.

I have shown exports for Long Beach on the third graph, where I state: “Exports were largely flat; however, they are down about 6% over the last six months compared to the 2019 average.” This is the simple read of the data on the graph, which you yourself can see and reproduce, if you so care.

As for exports, given a whopping positive demand shock and a substantial negative demand shock, I am surprised that exports have held up as well as they have. But you are correct, overall, the impact has been on the import, not export, side.

…negative supply shock…

“I did not comment on them there.”

Is that because exports have risen more than imports? McBride did not ignore this little pesky fact as the calculation of the change in the trade balance must include the change in both components. I guess that is why he correctly wrote in his recent post that the trade deficit FELL while you continue to incorrectly claim it rose.

Way to ignore a relevant inconvenient fact.

“I have shown exports for Long Beach on the third graph”

Wow – I did not know all exports go through Long Beach. Your cherry picking of the data is just incredible!

You started this post with this utter BS?

“The Trump and Biden stimulus packages, coupled with easy money from the Fed, led to a surge in demand even as the US economy was missing millions of workers.

Standard economic theory holds that such a difference might be met through surging imports and a swelling trade deficit, and indeed, both are visible in the statistics.”

First sentence is just more of your really AWFUL writing. Standard economic theory? Seriously dude – have you embarrassed your poor mother enough already?!

Check out his chart immediately following this sentence:

“This has resulted in surge of goods imports, up 16% in October compared to the 2019 average.”

Imports fell at the beginning of the recession but have recovered. But more to the point, exports have been rising faster than imports. And yet this troll is telling us this all means a surging trade deficit?

His little blog post are repeating the lies from his original comment.

ex all else, this much strikes me as true:

such a stimulus might even generate record levels of goods imports, which it has. … This record level of imports would result in record levels of shipping, which it has, with LA in-bound port traffic running about 15% above its prior peak. … cargo ports like Long Beach and LA… may not be equipped to handle surges of cargo imports well above historical peaks….

unless our transportation infrastructure can magically increase to meet that surge, we have a problem…

and that was still true a month ago:

According to data from the Marine Exchange, a total of 111 container ships are bobbing at sea around the ports of Los Angeles and Long Beach, waiting to dock and unload.

https://www.businessinsider.com/supply-chain-crisis-record-number-of-container-ships-ca-ports-2021-11

and also 4 days ago:

“The congestion of the nearly 110,000 empty containers spans up to 80 miles away from the port, filling nearby streets and yards and making it more difficult for supply-chain workers to move goods efficiently. ”

https://www.businessinsider.com/weather-backlog-california-ships-move-out-to-sea-2021-12

those are real world problems…

Steven Kopits

Keep doing what you are doing. You make your living on your analysis. You have to give account for it. Professors, not so much.

Steve Kopits vs Academic Economist Who ya got?