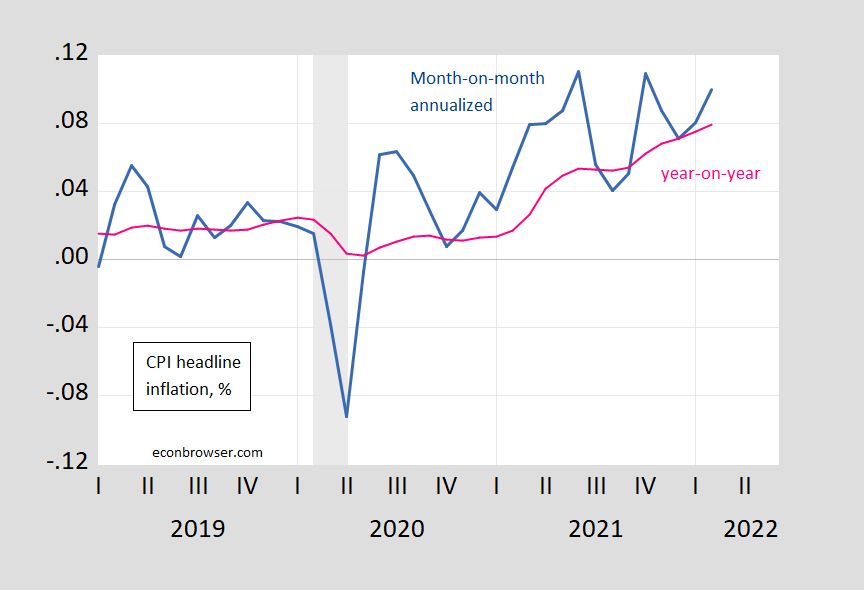

Oil prices were on the rise before the invasion, so gasoline prices were up. Headline m/m ticked up, core down. We are below peaks for month-on-month, even if you hear about 40 year highs (on year-on-year).

Figure 1: CPI month-on-month inflation rate, annualized (blue), 12 month or year-on-year inflation rate (pink), in decimal form (i.e., 0.05 means 5%). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

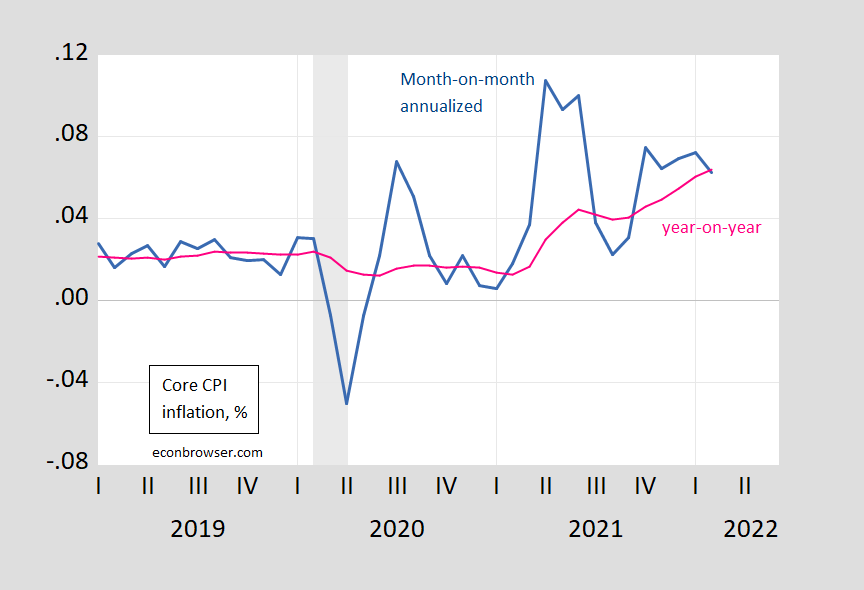

Figure 2: CPI core month-on-month inflation rate, annualized (blue), 12 month or year-on-year inflation rate (pink), in decimal form (i.e., 0.05 means 5%). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

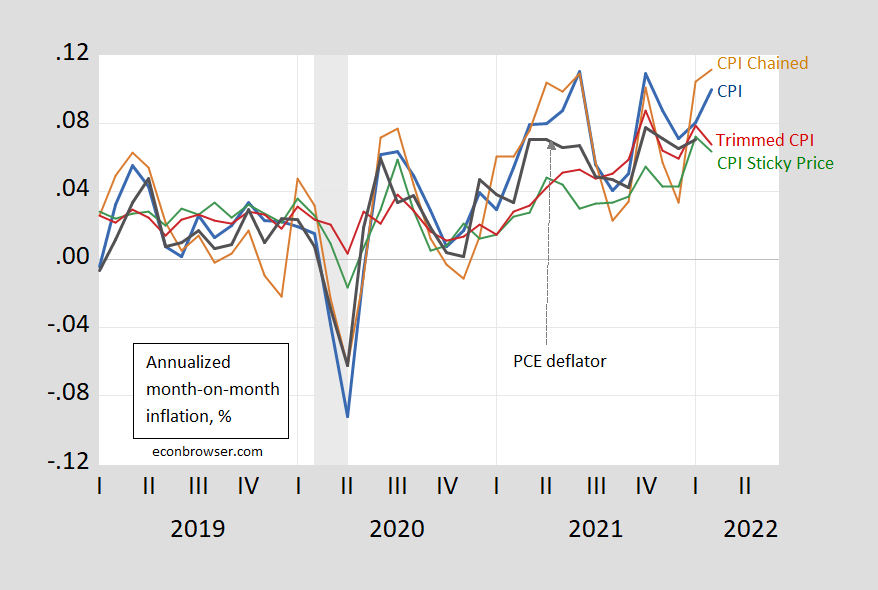

Month on month inflation rates indicate next month’s headline will remain elevated. For the various measures available (chained, trimmed, sticky price), we have the following picture.

Figure 3: Month-on-month inflation of CPI (blue), chained CPI (brown), 16% trimmed CPI inflation (red), sticky price CPI inflation (green), personal consumption expenditure deflator inflation (black), all in decimal form (i.e., 0.05 means 5%). Chained CPI seasonally adjusted using arithmetic deviations (brown). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, BEA, Atlanta Fed, NBER, and author’s calculations.

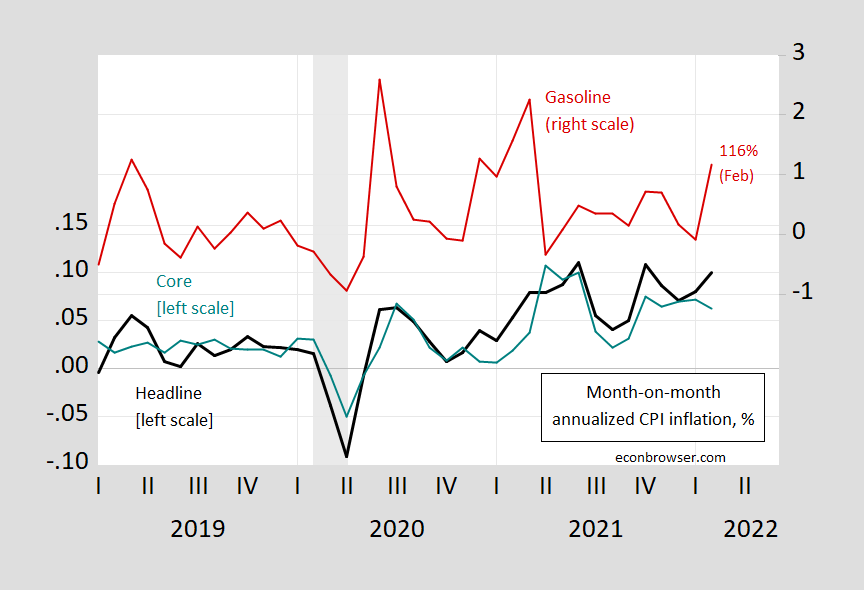

Sticky price inflation down suggests infrequently adjusted prices are being changed smaller amounts. Trimmed inflation down suggests that outliers are pushing up inflation (of which gasoline would be an obvious candidate). This is confirmed by re-examining headline vs. core vs. gasoline-CPI:

Figure 4: Month-on-month inflation of CPI (black), core CPI (teal), gasoline CPI component (red, right scale), all in decimal form (i.e., 0.05 means 5%). NBER defined recession dates (peak-to-trough) shaded gray. Source: BLS, NBER, and author’s calculations.

Month-on-month, annualized gasoline inflation was 116% in February (6.6%, not annualized). Clearly, if oil prices remain around $110 throughout March, then gasoline prices will rise further.

March will be bad, of course. Persistence of the Russia price shock is a big issue for subsequent months.

I remember hearing that we should pay attention to monthly-extrapoled, more than the yearly. But both were bad numbers. Annualized is 12 *0.8= 9.6% (ignoring any slight compounding).

Doesn’t fit the “getting better” trend that we heard about with the NOV and DEC monthlies. But then I really think there is quite a lot of month to month variation. No clear trend of 1H bad, 2H good, for instance. So I think the trailing twelve month is a nice metric. Yes, it’s not latest, greatest. But it smooths some of the sawtoothing.

Agreed that oil is a big short term driver here. For those who want to encourage transition (“let them drive Tesla”), this may be a feature, not a bug. Of course, the time to encourage, not discourage US production was before we had a geopolitical event. And Psaki is still saying renewables is the solution. No wonder that oil companies are more averse to investing in the US industry (higher hurdle for capex for new wells, more emphasis on returning cash from existing).

Anonymous: Back in November, I was conditioning on “no Russian invasion of Ukraine”, at least not a sweeping one that would make this the largest land conflict in Central Europe since WWII (interestingly, the Donbas is not far from Kursk). I was wrong on that count.

If you weren’t wrong you wouldn’t be wrong. Very enlightening, Menzie!

“No wonder that oil companies are more averse to investing in the US industry”

many of the big multinationals were already diversifying their work, before the Ukraine events occurred. they have been banging the drum on carbon sequestration (and trying to use their old wells as storage). and more recent emphasis has been on hydrogen. they are trying to get blue hydrogen into the workplace. the concern is that green hydrogen may get here faster and cheaper than many people realized. the big oil is not really averse to investing, but they are coming to the realization their way of making money over the past century is steadily disappearing. if they do not change, they will be out of business as well. that is simply how the world evolves. the fossil fuel businesses we know it is a relic and cannot compete in the electric world.

“the concern is that green hydrogen may get here faster and cheaper than many people realized. ”

And the other issue is of course that oil companies do not have special expertise in the field of green hydrogen.

Big oil should invest and pursue hydrogen while we are in the blue hydrogen era. They should use that to build out the hydrogen infrastructure, of which they will hold the expertise. And continue to invest in green hydrogen, through renewables such as wind and solar. There is still plenty that an energy company can offer in the future. Its just that energy will not be fossil. Companies can either evolve and grow, or become a relic. Bruce, corev and company want these companies to become relics. I would rather they evolve, successfully.

Gasoline prices seem to be the most obvious indicator of inflation to most people, especially when increase occur rapidly. The real economic hardship for most people is minimal and can be absorbed.

Emotionally, gasoline price increases are more significant than the economic impact.

• Oil companies are ripping us off!

• Politicians are in the pockets of oil companies!

• It’s just gasoline, not gold!

• Why doesn’t the government fix this?

These percentages have gone up 50-100% since this was published, but even if gasoline reached 1% of average US income, it’s not a big deal… except for someone earning much less than average income.

https://www.statista.com/statistics/1294118/cost-to-fill-a-vehicle-tank-as-share-of-income-by-country/

Republican senators took the opportunity of higher gasoline prices to condemn the Biden administration energy policies. Of course this is political rhetoric without merit.

https://www.facebook.com/robsmithbk/videos/420720606490796/

“Of course [sic] this is political rhetoric without merit.”

Last night, the lead on 11PM news ABC TV NYC [flagship] – “One Million New Yorkers [households] Cannot Afford Energy Bills.”

It’s not only gasoline.

You heartless, rich people need to stop Biden’s [let them drive $60,000 EVs] screwing the little people.