The value of the ruble has returned to pre-invasion levels [1]. But what I am more concerned about is exchange market pressure. And there, we are at sea.

Exchange market pressure is variously measured, but is usually a weighted average of currency depreciation, reserves and (possibly) the policy rate, viz:

EMP = αΔs – βΔres + γΔi

Where α, β and γ are parameters that are typically the inverse of the variance of the associated variable, and res (foreign exchange reserves normalized by money base) and i might be relative to the core country (typically the US).

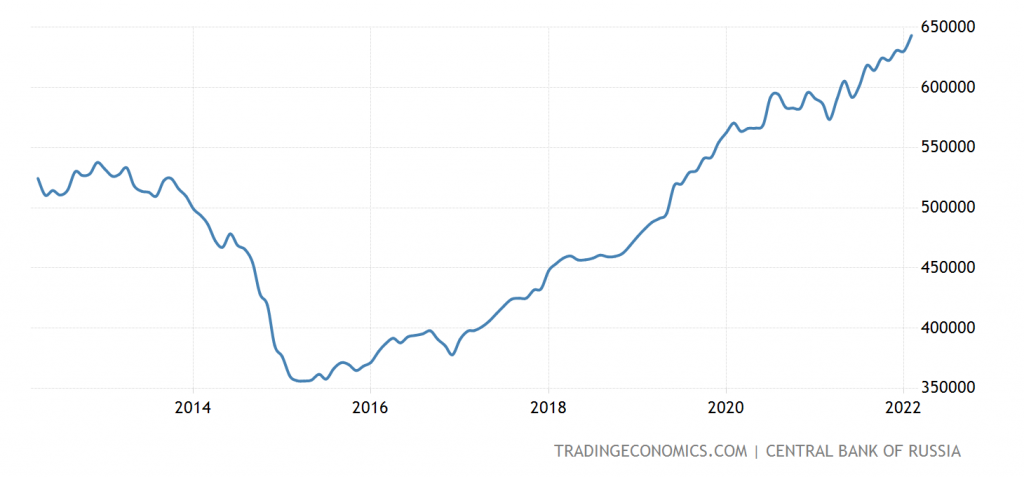

First the currency’s value, over the last ten years:

The policy rate we observe:

However, for reserves, the Central Bank of Russia yesterday announced on its website:

Disclosure of Russia’s international reserves

30 March 2022NewsTo mitigate the sanctions risks, the Bank of Russia has updated the disclosure format for international reserves of the Russian Federation and foreign exchange and gold asset management.

Starting from 31 March 2022, the Bank of Russia resumes publishing the total value of international reserves of the Russian Federation on a daily and weekly basis.

Information on the foreign exchange and gold asset management as of 1 January 2022 will be disclosed in the Bank of Russia’s 2021 Annual Report. The Bank of Russia suspends the publication of its foreign exchange and gold asset management reports for the period from 1 January 2022.

So, we only have data through February in the below graph (for international reserves):

In addition, part of the work in stemming the rise in the EMP has been done by stringent capital controls. From Reuters:

Russia also introduced restrictions on the movement of funds that could be transferred to unfriendly countries by a comparable amount,” the central bank said in its first detailed explanation of the reasoning behind its decisions.

These included capital flow restrictions, a ban on the sale of securities by foreign investors, a ban on withdrawal of their funds from the Russian financial system, and the need to obtain special state approval to make payments to debt holders from “unfriendly countries”.

So, it’s true the ruble is back to where it began. But we literally do not know where some other variables are now.

In other financial developments, as of today (WorldGovernmentBonds.com):

Last Update: 31 Mar 2022 20:15 GMT+0

The Russia 10Y Government Bond has a 11.105% yield.

10 Years vs 2 Years bond spread is -157 bp.

Yield Curve is inverted in Long-Term vs Short-Term Maturities.Central Bank Rate is 20.00% (last modification in February 2022).

The Russia credit rating is CC, according to Standard & Poor’s agency.

Current 5-Years Credit Default Swap quotation is 412.48 and implied probability of default is 6.87%.

However, the CDS quotation is dated February 28th…

OK – the ruble has gone back to its old level for now but these financial indicators are troubling:

Central Bank Rate is 20.00% (last modification in February 2022). The Russia credit rating CC, according to Standard & Poor’s agency. Current 5-Years Credit Default Swap quotation is 412.48 and implied probability of default is 6.87%.

Sounds like any business needed capital to expand is going to have a very hard time.

https://www.msn.com/en-xl/news/other/zelenskyy-targets-russian-diamonds-in-address-to-belgian-parliament/ar-AAVJ1st?ocid=uxbndlbing

I was wondering when Belgium’s massive diamond business would get called on its imports of diamonds from Russia (Russia is far from the major exporter of diamonds but this trade is still significant). I wrote a presentation a few years ago on the transfer pricing for Belgian marketing hubs which generally sold $40 billion a year on diamonds purchased from related party mining affiliates which includes Russian mines. The Belgium government got tired of the fact that its hubs received gross margins of only 1.7% since expenses were near 1.5% of sales so they demanded the gross margins be raised to 2.1%. The presentation went through the usual yada yada yada of why this made sense.

OK – the interesting part is how Zelensky is saying giving up the trade in these luxury products is a small price for hopefully ending Putin’s terrorism. Especially true since the Belgian profits are a mere 0.6% of sales which used to be $40 billion a year. Losing a mere $2.4 billion in one’s tax base is not exactly a deal breaker.

https://www.statista.com/statistics/1136257/russian-diamond-export-value/

Of course not all of Belgium’s $40 billion diamond business comes from Russian exports, which have been less than $5 billion a year. So pardon me and divide my little story by 10. Belgium can still trade diamonds purchased from African mines.

https://news.cgtn.com/news/2022-03-31/Chinese-mainland-records-1-839-new-confirmed-COVID-19-cases-18QiqpSlSW4/index.html

March 31, 2022

Chinese mainland reports 1,839 new COVID-19 cases

The Chinese mainland recorded 1,839 new confirmed COVID-19 cases on Wednesday with 1,803 linked to local transmissions and 36 from overseas, according to data from the National Health Commission on Thursday.

A total of 6,720 new asymptomatic cases were also recorded on Wednesday, and 54,911 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now total 149,276, with the death toll at 4,638.

https://news.cgtn.com/news/2022-03-31/Chinese-mainland-records-1-839-new-confirmed-COVID-19-cases-18QiqpSlSW4/img/19337c9b02e34215b94e22a59b5dcd09/19337c9b02e34215b94e22a59b5dcd09.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-03-31/Chinese-mainland-records-1-839-new-confirmed-COVID-19-cases-18QiqpSlSW4/img/c268273b4f1d4af5913a3d0e326f6403/c268273b4f1d4af5913a3d0e326f6403.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-03-31/Chinese-mainland-records-1-839-new-confirmed-COVID-19-cases-18QiqpSlSW4/img/c07bfa37d77d4b5abadada98cb8bd4ad/c07bfa37d77d4b5abadada98cb8bd4ad.jpeg

https://www.worldometers.info/coronavirus/

March 30, 2022

Coronavirus

United States

Cases ( 81,740,722)

Deaths ( 1,006,445)

Deaths per million ( 3,010)

China

Cases ( 147,437)

Deaths ( 4,638)

Deaths per million ( 3)

Yes China is indeed in serious trouble. Their lockdown policies are failing, with twice as many new cases per day as they had during the worst of their previous peak. The dike is leaking and there are not enough fingers to plug it. Their “half-of-Shanghai, then-the-other-half” approach is interesting, but unlikely to make a big difference. Companies and countries all over the world has already begun asking whether they really dare to be dependent on unreliable foreign supply chains and producers just to save a few bucks.

In a development perhaps worthy of inclusion at https://www.tylervigen.com/spurious-correlations, the BAA corporate spread has also jumped and the reversed:

https://fred.stlouisfed.org/graph/?g=NGt3

Or perhaps there is a causal link that is too whacked out for me to discover. Anybody? Well, anybody but anonymous, rsm, Johnny, Brucey or Econned.

Meanwhile morgage spreads as reported by Fannie Mae are widening. Perhaps that’s a data lag, since Fannie reprts weekly averages. Anyhow, fifteen year mortgage rates are up 1.4 percentage points from a year ago. The rule of thumb is that a 1 ppt rise is enough to stall housing demand. Interestingly, the increased spread since January between 15 year mortgages and 10 year Treasuries accounts for about 50 basis points of the rise in mortgage rates. So a risk premium is being built into mortgages, coincident with the Russian invasion of Ukraine and with the flattening of the 2/10 Treasury spread.

I find both the similar behavior of the Ruble and corporate spreads and the (apparent) dissimilarity corporate and mortgage spreads odd.

Note how high this spread spiked back in late March 2000. Oh yea – the start of the pandemic.

Maybe the weirdness in corporate spreads has to do with earlier massive selling – oversold conditions, as market monkeys like to say – leading to some bottom fishing. Investment grade corporate bond portfolios lost more va!ue in Q1 than at any time since Lehman fell:

https://www.bloomberg.com/news/articles/2022-03-30/corporate-bonds-lost-1-trillion-and-there-s-more-trouble-ahead

I guess this shows that economists who been gleefully forecasting doomsday for the Russian economy don’t know that much about it after all! Basically it’s just cheerleading and propaganda.

Maybe they should refocus their attention to something they ostensibly do know something about—the American economy and just how bad the fallout from the war will be in terms of inflation, supply chain disruptions, and financial impacts. Of course they basically dismissed the impact of supply chain disruptions for most of last year, so it’s hard to have much confidence that they have much worthwhile to say about this year’s.

Most wars begin with the government and infotainment industry joyously proclaiming imminent success and in denial about any likely downsides, including the impact on the economy. Economists with few exceptions seem to have bought into this psyops campaign, refusing to assess the real and likely downsides of the decision to wage economic war on a major commodities supplier. It seems like they are still in the “what could possibly go wrong phase?” Best to lull the American people into a compliant stupor.

“I guess this shows that economists who been gleefully forecasting doomsday for the Russian economy don’t know that much about it after all! Basically it’s just cheerleading and propaganda.”

No one is cheering except for you as you spread Putin’s really stupid propaganda. OK we get you do not care a lick about the Ukrainians who are displaced from their homes or worse yet killed by the war your boss (Putin) wages. But come on dude – stop insulting everyone’s intelligence with your disgusting drivel.

You’ve misused “ostensibly.” Big words are so tricky.

Don’t you love this line?

‘Of course they basically dismissed the impact of supply chain disruptions for most of last year, so it’s hard to have much confidence that they have much worthwhile to say about this year’s.’

I guess JohnH limits his attention to those “economists” on Fox and Friends. Supply side disruptions have been all the rage not only here on this blog but in other economic circles – places JohnH is too lazy to visit so in his little mind they do not exist.

From Merriam-Webster-Webster: Synonyms for ostensibly: apparently, evidently, ostensively, presumably, putatively, seemingly, supposedly.

I thought of saying ‘something [economists] claim to know.’

English is obvious not macroduck’s strong suit…and neither is the Russian economy!

Do you really have to embarrass your mother this way? Macroduck has nailed you again and your childish need to have the last word only proves what he and everyone else knows – you are just a dumb troll.

Oh horrors. Ukraine forces may have taken out a Russian oil depot:

https://www.msn.com/en-us/news/world/kremlin-accuses-ukraine-of-attacking-fuel-depot-in-russia-mariupol-dangerous-as-citizens-try-to-escape-live-updates/ar-AAVK88g?ocid=msedgdhphdr&cvid=4565b55bc22b4cef83553505210df4c1

Hey JohnH – get on Putin soap box and condemn Ukraine for this. After all – the Russian army is taking out hospitals with patients, pregnant ladies, and new born babies which according to Putin and you is just fine and dandy.

broader war,

“Basically it’s just cheerleading and propaganda.”

That’s nonsense. It takes a great deal of resources to prop up the currency like this when it’s under so much pressure. If anything is cheerleading and propaganda, it’s the Russian government rushing to keep the ruble at pre-war par. If anything, they’ve made the sanctions bite harder. This is the Russian equivalent of Trump obsessing over the stock market, but much worse.

Paul Krugman with some details: https://www.nytimes.com/2022/04/01/opinion/russia-ruble-economy.html

I can’t get past the NYTimes pay wall (cheapo me) but Google turned this interesting discussion up:

https://smartagain.org/2022/04/01/why-russia-is-defending-the-ruble/

Maybe it is the same essay. Either way – Krugman sensibly notes one can avoid currency devaluation by using very tight monetary policy. But that happened to be the Reagan-Volcker mess that led Martin Feldstein to hire Krugman and Larry Summers back in 1982 to clean up the mess.

Now one would think someone who reads an economic blog to get that the high Russian interest rates is likely to seriously hurt its economy. Alas – it seems JohnH is not that bright.

“I guess this shows that economists who been gleefully forecasting doomsday for the Russian economy don’t know that much about it after all! “

Well the russian economy is actually tanking, so those predictions were not off. Try again with the gaslighting.

Who is buying rubles? Maybe Sri Lanka?

And we thought you were the speculator. I guess who live in Sri Lanka.

Anyone purchasing Russian oil would be buying rubles right now as Russia has required all payment in rubles going forward in an attempt to bolster their currency.

have they been successful imposing that rule? I have not heard whether this is actually working for them. Germany said no, follow the contracts.

Japan has said no too.

“In other financial developments, as of today (WorldGovernmentBonds.com):”

Great source of government bond yields for other nations besides the US. FRED has great information for the US but limited information for other nations. Thanks for the heads up.

https://www.msn.com/en-us/news/world/first-thing-russians-flee-chernobyl-with-radiation-sickness-says-ukraine/ar-AAVKaIF?ocid=msedgdhphdr&cvid=13f8947441c3460ea364f94382a3bab7

So the Russian soldiers occupy Chernobyl and end up getting radiation sickness. Are these the most disorganized soldiers ever? Or is it that Putin really could care less about the soldiers he sent in to destroy Ukraine?

given the actions and controls Russia has imposed on the ruble, what confidence do you have in the current market price? is there really a market price? if the sanctions continue for a couple of more months, you will probably see a different result. the longer people stay away from the ruble, the harder it will be for Russia to control its value on paper. that 20% interest rate is going to become costly over time. any word on how the ruble is trading on the black markets?

“is there really a market price?” My understanding is that Russia has a managed floating exchange rate regime but our host should correct or qualify my limited understanding.

pgl: I think there’s a price for what remains of “the market”, but it is highly distorted. Just like there is a “black market” exchange rate on the streets of some countries, it’s just highly distorted.

Thanks. “Managed” can take on all sorts of form.

I have just checked and reported black market rates for the ruble range from 132 to 150 per dollar, so equal to or worse than what the official rate when it was at its bottom. Given the extreme controls on the ability of Russians to engage in official forex transactions the black market rate is the effective one.

When I first encountered the ruble black market nearly 40 years ago, it was about one sixth of the official rate, so a lot more different from the official rate than what is currently the case.

Of course the existence of this black market rate makes pretty much a joke of JohnH’s blather here about implication of the value of the ruble for Russian economic conditions, which are terrible in terms of both inflation and GDP growth, with the former soaring and the latter collapsing. But then he knows he knows more about the Russian economy than anybody who posts here.

Update on the black market straight from Moscow personal sources, not the internet. Rubble now at 200 per USD on the streets of Moscow.

Where do you check black market rates?

Rk,

You can find rates on internet by googling, but I have my more accurate private sources not available to you, which as maybe a newbie here you are unaware of.

Total nonfarm payroll employment rose by 431,000 in March, and the unemployment rate declined to 3.6 percent, the U.S. Bureau of Labor Statistics reported today. Notable job gains continued in leisure and hospitality, professional and business services, retail trade, and manufacturing.

https://www.bls.gov/news.release/empsit.nr0.htm

Labor force participation rose slightly and the employment to population ratio rose from 59.9% to 60.1%.

Meet the Butcher of Mariupol:

https://www.msn.com/en-us/news/world/russian-general-dubbed-butcher-of-mariupol-is-a-mystery-to-experts/ar-AAVLbZD?ocid=msedgdhp&pc=U531&cvid=1d348b47b5784e7ea926a64ab1ae7e78

Most of us will see this person as the monster he is but I bet Bruce Hall and JohnH will find someway to worship this war criminal.

if you can be led to believe the absurd you can be led to commit atrocities.

weed out the propaganda!

Anonymous,

Just what is “absurd” here? That this Colonel General was involved in the total destruction of Syrian cities? Do you deny that Russian forces participated in the total destruction of East Aleppo, formerly Syria’s largest city? Do you deny the widespread reports that now more than 90% of the city of Mariupol has been destroyed by relentless bombing and artillery attacks? I do not know if this particular colonel general was the main figure involved, but does that matter? Clearly it is Russian forces who are doing the destruction of Mariupol. That this is happening is not propaganda, Anonymous. Denying that it is happening is what is the lie.

Or do you want to spout what the Russian people are being told, that the destruction is being carried out by the Ukrainians themselves?

Anyone remember who destroyed Fallujah (twice)? Of course, that was all done in the name of freedom, democracy, and human rights! As someone said in Vietnam, they had to destroy a village to save it!

And did MSN ever rage against the atrocities? Of course not. The infotainment media was embedded with the military.

And you can bet that the same media will serve the interests of US propaganda, downplaying US atrocities and sensationalising enemy ones…but the commenters here are oblivious to how the world works.

Meanwhile Chris Hedges got expunged by YouTube…raising a gigantic red flag about censorship in America and the media’s role in enforcing it.

https://www.democracynow.org/2022/3/30/headlines/youtube_deletes_entire_archive_of_chris_hedgess_rt_show_on_contact

Anyone who thinks that Americans are being informed honestly about what is going on in the world is seriously delusional.

The 2003 invasion of Iraq was a mistake – every sane person knows this. But WTF does that have to do with Putin’s war crimes? Nothing but as Putin’s chief apologist, I guess you have to act like a jerk 24/7. You are disgusting. But hey – what’s new?

“The 2003 invasion of Iraq was a mistake” Hundreds of thousands of Iraqi died as a result of a “mistake” that the American public cheered on at the outset because of US government misrepresentations (propaganda.}

I doubt that Iraqis’ pain is assuaged by the fact that “every sane American” now thinks it was a mistake. And II don’t see any apologies coming from any American leaders who should have been tried and convicted for their little “mistake.” In fact, Hillary probably still thinks it was a great idea.

So, I guess if the standard for morality as set by the US is for Russians to say in a few years time, “Sorry, it was a mistake,” then all should be forgiven. No leaders tried for war crimes or illegal war or anything else, per the American example in Iraq. But we all know that that won’t happened. Others are judged by different standards.

Don’t you just love the hypocrisy of the American political class and their stenographers in the infotainment industry? And the American public can be counted on to faithfully follow along, brain dead as can be.

JohnH,

Sorry, no comparison. Fallujah was bad, but at its worst about half the structures in the city were damaged, not even fully destroyed. In Mariupol it is well over 90% and this is full destruction. This is at least an order of magnitude worse.

There is also a difference in that while the US should not have gone in at all, Fallujah was the base of a militant group that had been actively attacking people in other locations. Nobody in Mariupol has been attacking anybody. They were doing nothing and minding their own business only to be attacked by the Russian forces in one of the most destructive assaults ever seen in human history short of nuking the city like was done to Hiroshima. The latter might be more the comparison, if you want to start playing on US guilt trips, not the far less destructive attack on Fallujah.

Your Putin botting is really becoming quite bizarre, JohnH.

JohnH

April 2, 2022 at 5:27 pm

This is your response when I asked WTF does the 2003 invasion of Iraq have to do with Putin’s war crimes? Ducking questions is your forte.

Rosser thinks that destroying “only” half of Fallujah was relatively acceptable and should shield the US from criticism.

And if your standard for destroying a large city that was a base of a militant group, then it should occur to you than Mariupol was infested with the Nazi Azov battalion, not exactly choir boys. In fact, Democrats requested that they should be designated as a foreign terrorist organisation in 2019. But Barkley thinks that they were doing nothing, just minding their own business!

My point is not to defend Putin, but to point out that people who live in glass houses shouldn’t throw stones. A lot of people around the world think that the US rules based order is a sham, a PR gimmick. And the “rules” are situational. Under its “rules” the US can kill hundreds of thousands and then turn around and self righteously criticize others for doing what the US did.

JohnH,

Your efforts to whitewash Russian bombing and destruction of Mariupol are becoming increasingly nauseating. There really is no comparison to Fallujah.

Yes, we know for Putin propagandists the fact that the Azov battalion is based in Mariupol and has a Nazi-linked past supposedly justrifies genocide against the citizens of the city. But the Azov battalion had not been doing anything before Putin invaded. They were just sitting there minding their own business, besides having been tamed and put under control of the national Ukrainian military.

OTOH, for the record I always opposed the invasion of Iraq. But once in there a civil war erupted. Fallujah became the base of operations of people who were the leaders of a group that was actively attacking other groups in the country when the US military finally went in there. When the US conquered the city, peace largely arrived. There really is no comparison, quite aside from the fact that the US engaged in far less damage to both property and civilians than what the Russians are doing in Mariupol, which has no justification whatsoever.

JohnH,

I just checked. The estimate of the civilian dead in Fallujah id 600 that is about one tenth of the current estimate for Mariupol, with most saying the latter is an underestimate. And the killings are continuing, even though nobody in Mariupol was attacking anybody, in contrast to what was going on in Fallujah.

You are really out to lunch.

Oh, and does the presence of the Azov battalion in Mariupol justify bombing the maternity ward there? Go ahead. Tell us all about thiat. Yes, I did read that Russian media claimed there were “radicals” in that maternity ward, and, oh yeah, the Ukrainians did it theselves. At least you have not tried to sell anything quite that outrageous to us yet.

Johnh role is to introduce doubt and insecurity into the conversation. He wants to introduce a level of equivalencey between fallujah and mariupol, as an excuse for the russians. I thought he was a conservative in disguise, but it seems more logical that he is a russian asset. That would explain his criticism, at times, of both parties. And his consistent defense of russia over time as well. If i were the blog hosts, i would treat foreign assets differently than trolls. Their misinformation is more calculated and more dangerous.

Johnh, what do you say to the citizens outside kiev that were found bound and gagged with a bullet through the back of the head? You want to defend that as well, or call it for what it is. A war crime. Putin is a war criminal and will be held accountable.

barks

context?

“context”? What are you talking about Anonymous? You are the one who somehow made the absurd comment that it was absurd to talk about a Russian commander being “the Butcher of Mariupol.” Your comment was not merely absurd but fully demented.

About the economic crisis in Sri Lanka, the crisis developed after the government implemented a sudden turn to organic farming through the country. Organic farming at least in developing countries tends to be significantly less productive, and this was the case in Sri Lanka. Food costs began to rise and this came just as fertilizer costs began to rise significantly. Sri Lanka needs to import fertilizer, but foreign exchange reserves were quite limited and the Rupee quickly lost value:

https://fred.stlouisfed.org/graph/?g=nGdh

January 15, 2018

Price of an American Dollar in Sri Lankan Rupees, 1973-2022

Relatedly and importantly, the coup government of Bolivia closed down national fertilizer production after taking power but on being removed from power in a following election the elected government quickly began fertilizer production again. National fertilizer production in Bolivia is proving a remarkably beneficial decision. Bolivia is now exporting fertilizer through Latin America. (The president of Bolivia is an economist.)

While Russia may now be floating in its own oil due to sanctions even though China and India are buying significant amounts at a discount, Joe Biden wants to draw down the US Strategic Petroleum Reserve by 1 million barrels per day for 180 days to lessen the price pain at the gas pumps. That will leave the SPR at approximately 55% of its capacity in six months. Biden hopes that the additional oil will reduce gasoline prices in the US by $0.35 per gallon. Of course, due to the EPA summer blend gasoline requirements which are now causing refineries to produce more expensive blends combined with normally higher demand for gasoline during the warmer months, it might take a $0.60 actual reduction to show up as a $0.35 reduction at the pump.

https://www.gasbuddy.com/go/summer-blend-and-winter-blend-gasoline

The real questions are 1) is this a national emergency that requires draining the SPR to nearly half of its capacity and 2) if global oil supply remains constrained by sanctions, will the temporary psychological impact of 1 million gallons per day increase be maintained by the market.

There is, of course, the cost of replenishing the SPR which hopefully will be less than the current price per barrel so that the revenue over the next six months will end up as a net profit for the government. https://qz.com/2149146/where-does-the-us-stash-its-strategic-oil-reserves/?utm_source=YPL

Now a silly question: why does the federal government not contract to have oil extracted from federal lands and put directly into the SPR so that the costs are limited to extraction and transportation? It would seem the opportunity to be the contractor(s) to extract 300-400 million barrels of oil might be attractive to drillers. Wouldn’t that be a better deal for the federal government than selling oil leases (current royalty rate of 12.5%) and then buying the oil on the open market? No, I haven’t gotten the cost differentials which is why I’m asking the question.

Well, it’s preferable to handing out to everybody $300 monthly gasoline checks.

I’d spend mine on Yuengling Lager.

Answer to your last question, “Because Greta Thunberg with tears running from her dyslexic eyes would stomp her tiny, truant’s feet, and whine, “How dare you?!”

And, the SPR releases are plain and simple politics.

File under, “Don’t Say Gas.”

T.S.,

Actually, one of the emergencies the SPR is for is wartime, and this is war, even if the US has not specifically declared it. But then the US has not declared a war since WW II. And the shortage of oil is substantially aggravated by the war. We see all the Putin bots here going on about how the economic backlash will lead the US public to pressure its leaders to stop those meanie sanctions against innocent Russia who should be allowed to conquer Ukraine without any muss or fuss. So in fact the SPR releases aid the war effort by reducing that backlash. Ask JohnH. He can tell you.

similar to the november’s show release the impact on wti will fade is a few days, on price at the pump a tiny blip more due to ukraine not blowing up any worse than it is.

1) lots of sour oil in the reserve. i don’t know the recent input (tiny bc congress has not been generous with replenishing the releases) has lessened the quantity of sour/high sulphur oil in the reserve.

2) a million bbl per day when refinery inputs are 16 million and not a problem: total usa crude was down >6 million barrels week of 25 mar!!

3) commercial stocks dipping below 400 million barrels (410 M 25 mar report) is not historical low, prior to 2015 commercial stocks were below 400M for years.

4) reserves are already 70 million drawn year o year, *congress does not seem interested in refilling when prices go down.

5) *unlike comm’l stocks spr not filled up on cheap crude oil in spring 2020!

6) usa exports 2 to 3 mbbl each week.

7) opec+ had hinted an increase after usa release no increase, they do not trust usa to leave market alone!

as long as nato give ukraine weapons to kill russians oil will be high!

Anonymous,

On your last line, oil is high because most of the world is not buying Russian oil, which would hold even if NATO were not providing the Ukrainians with arms to defend themselves from Russians who have invaded their nation and are killing them, most recently shooting civilians dead who have their arms tied behind their backs, something utterly barbaric.

Not only shooting them dead, but raping them also, including children. This stuff really is becoming ever more gruesome full-=bore war crimes.

Kevin Drum charts inflation adjusted employment cost index (wages plus fringe benefits):

https://jabberwocking.com/raw-data-employers-are-paying-workers-less-and-less/

It jumped in 2020 but has been retreating since. Now two things would have made this presentation even more information: (1) taking it back to say 2000; and (2) showing real compensation by sector. But still a nice effort from someone who is not formally an economist.

https://www.msn.com/en-us/money/companies/amazon-workers-on-staten-island-vote-to-form-union-in-historic-upset/ar-AAVLs8Y?ocid=uxbndlbing

Staten Island’s Amazon just experienced a majority voting yes on unionizing. Labor rights moving forward one step at a time.

《In the paddy fields spread out below on the Dogo Plain, one no longer sees the

pastoral green of barley and the blossoms of rape and clover from another age.

Instead, desolate fields lie fallow, the crumbling bundles of straw portraying the

chaos of modern farming practices and the confusion in the hearts of farmers.

Only my field lies covered in the fresh green of winter grain*. This field has

not been plowed or turned in over thirty years. Nor have I applied chemical

fertilizers or prepared compost, or sprayed pesticides or other chemicals. I practice

what I call “do-nothing” farming here, yet each year I harvest close to 22 bushels

(1,300 pounds) of winter grain and 22 bushels of rice per quarter-acre. My goal is to

eventually take in 33 bushels per quarter-acre.》

Masanobu Fukuoka, “The Natural Way of Farming”

Has Sri Lanka been so corrupted by western materialist farming as to forget the tried-and-true ancient farming knowledge?

“Or perhaps there is a causal link that is too whacked out for me to discover. ”

Is Macrosmurf beginning to understand why supply chains are just payment chains in reverse?

Is it too much for Microknuck to discover that problems in payment (funding) chains develop for weird odd psychological groupthink erratic irrational arbitrary fickle human reasons, not any type of real world actual physical supply and demand variables?

Actually rsm, it is the supply chains that are what are real. Money is an illusion, and that is what playments are all about. So, no, you have it backwards. Payments are supply chains in reverse, not the way you put it. The supply chains are the fundamental reality.

In 2008, did runs on repo create real effects?

In 2020, did the Fed reverse real effects of another financial panic by supplying as much liquidity as necessary to keep payment chains functioning?

Why doesn’t the Fed see inflation as just another payments system problem, and fix it by supplying unlimited liquidity to individuals?

rsm,

You are off on your timing. The runs on the repo market came after several other markets crashed, which ultimately came from the crash of the massive US real estate bubble that had built up over a long period of time. I suggest you read either Neil Irwin’s or Adame Tooze’s book on what went down. You clearly do not know what you are talking about.