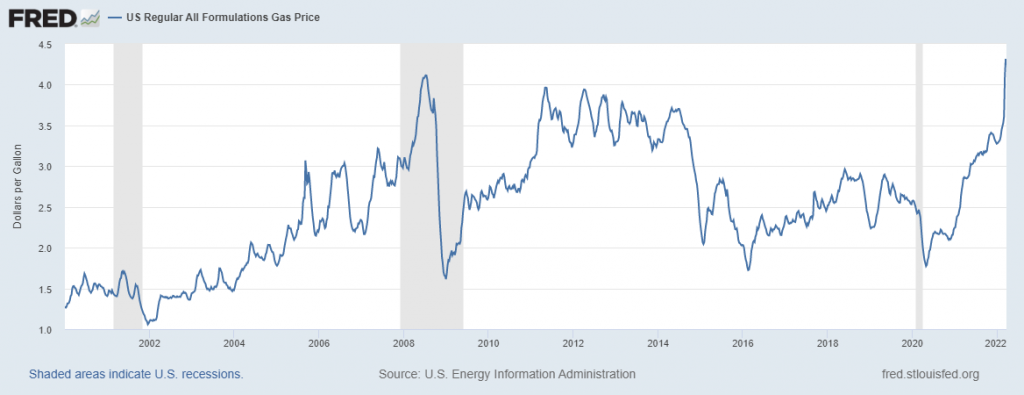

Gasoline prices have hit a new (nominal) high. The impact on the driving and the economy depends in part on the intensity of use of gasoline and diesel.

Source: EIA via FRED, accessed 2/24/2022.

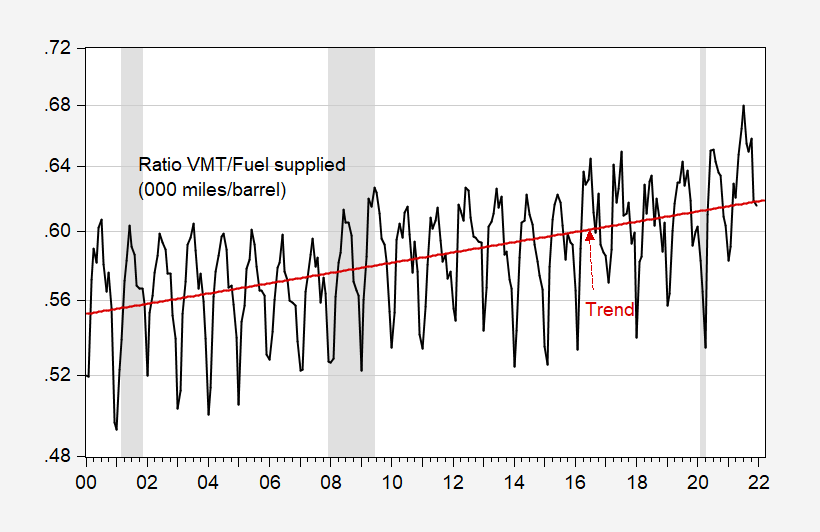

Fuel economy for conventional vehicles has been rising over time, as has the presence of electric vehicles. What does this imply for the ratio of vehicle miles traveled (VMT) and fuel used (actually, supplied)?

Figure 1: Vehicle miles traveled ratio to fuel use, 000’s miles/barrel (black). Fuel is barrel of gasoline plus 1.3xbarrel of diesel. Log linear trend (red), both on log scale. NBER defined recession dates peak-to-trough shaded gray. Source: DOT/FHA via FRED, EIA, NBER, and author’s calculations.

As of end-2021, the ratio of miles traveled to fuel use is about 6.5% higher than it was in January 2000. (Obviously, this number does not control of types of vehicles, and how intensively those different types of vehicles are used).

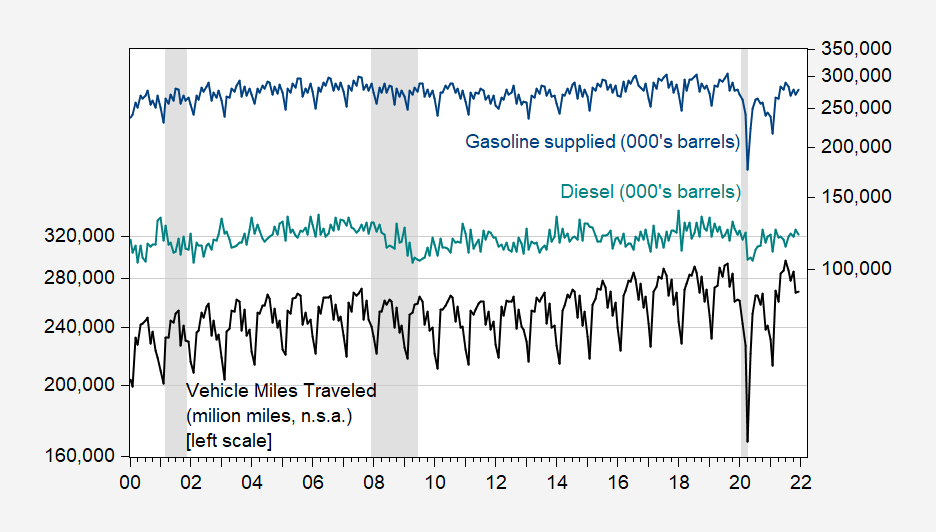

The underlying data series are shown below:

Figure 2: Vehicle miles traveled ratio to fuel use, millions of miles (black, left log scale). gasoline supplied, 000’s barrels (blue, right log scale), diesel supplied, 000’s barrels (teal, right log scale). NBER defined recession dates peak-to-trough shaded gray. Source: DOT/FHA via FRED, EIA, NBER.

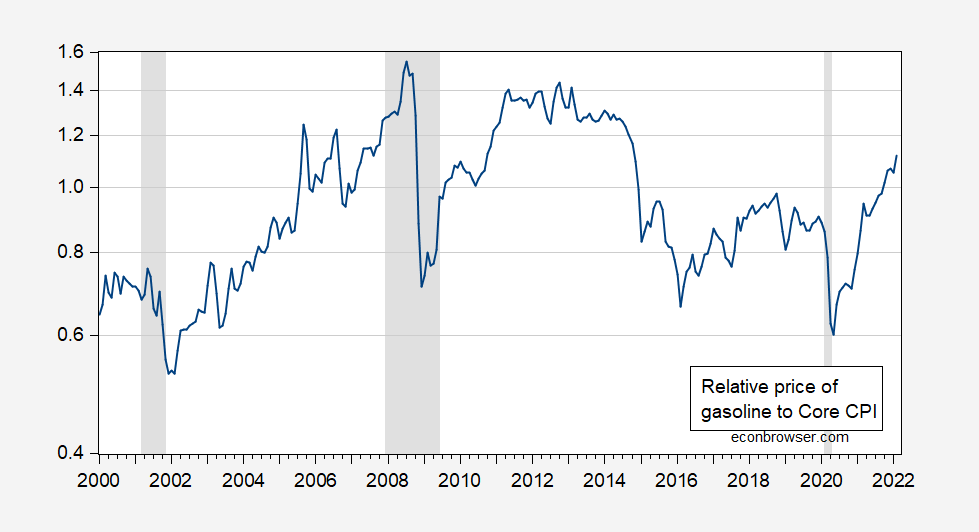

An aside: While the nominal gasoline price is at a record high, the real gasoline price component of the CPI is not.

Figure 3: Ratio of CPI gasoline component to Core CPI (blue, log scale). NBER defined recession dates peak-to-trough shaded gray. Source: BLS via FRED, NBER and author’s calculations.

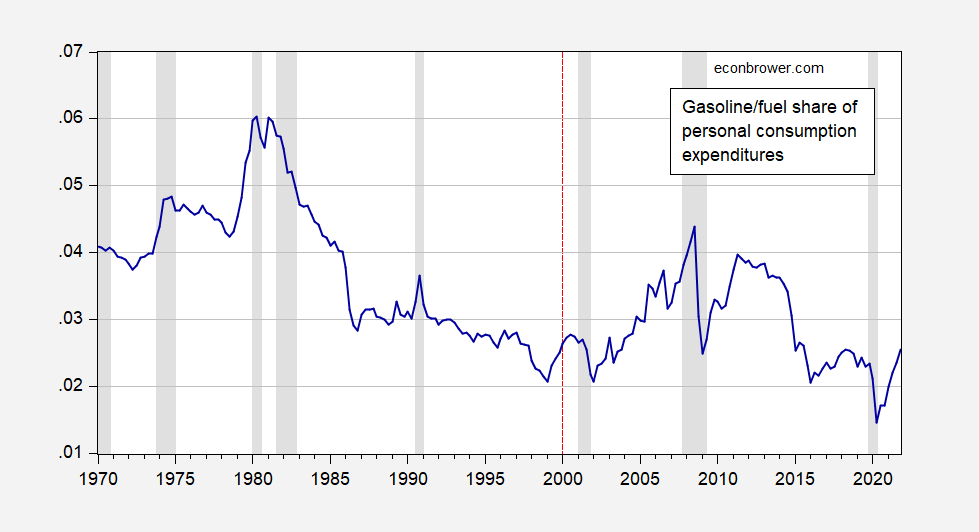

And the share of gasoline and other fuels in personal consumption expenditures is higher than in the recent past (graph below, through 2021Q4), but a lot lower than in 2012-13.

Figure 4: Share of personal consumption expenditures accounted for by gasoline and other energy goods (dark blue), ending 2021Q4. NBER defined recession dates peak-to-trough shaded gray. Red dashed line at 2000Q1 (sample beginning for Figures 1-3). Source: BEA, NBER and author’s calculations.

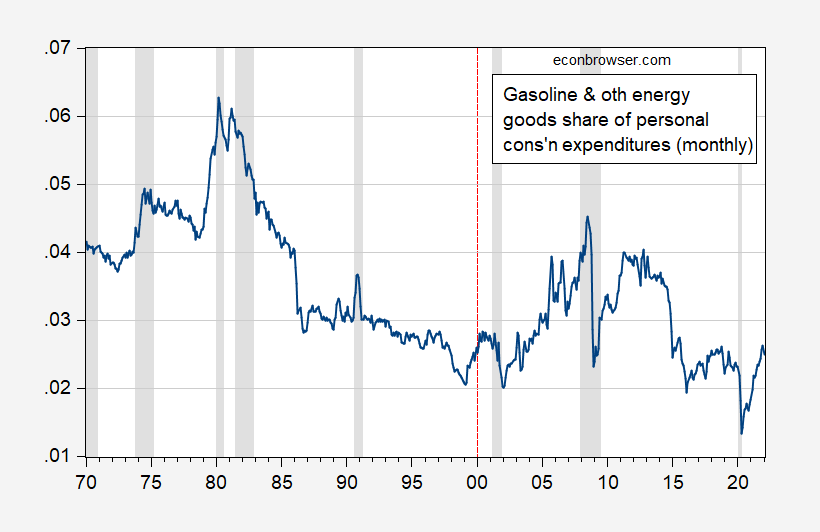

Update, 3/27 2:30pm Pacific:

Reader Steven Kopits points out there is a monthly series for personal consumption expenditures, which allows me to extend the sample by one month relative to Figure 4. Here is the corresponding graph.

Figure 4a: Share of personal consumption expenditures accounted for by gasoline and other energy goods (dark blue), using monthly data (ending January 2022). NBER defined recession dates peak-to-trough shaded gray. Red dashed line at 2000M01 (sample beginning for Figures 1-3). Source: BEA, NBER and author’s calculations.

https://www.msn.com/en-us/news/politics/mitch-mcconnell-says-he-opposes-ketanji-brown-jackson-s-nomination/ar-AAVsQda?ocid=msedgdhp&pc=U531

It is no surprise that Senator Turtle has decided not to support letting Ketanji Brown Jackson on the Supreme Court his speech saying why he will vote no was disgusting even for him.

File Under ‘Great Moments in US Senate SCOTUS Confirmation Hearings’:

Christine Blaisey Fraud = “Believe All Women.”

Amy Coney Barrett = “White Woman Lies.”

Ketanji Brown Jackson = “What’s A Woman?”

Christine Blaisey Fraud? So you endorse sexual abuse. Of course you do – you are a pig.

T.Shaw: Personally, I think the best line is “I still like beer!”

It’s comments like this where this blog is truly missing an upvote button or a thumbs up button. I’d say it deserves 5-stars but my fragile ego is afraid what conclusions about my personal habits people will draw from me saying that,

There were 3 separate accusations of sexual assault against Catholic frat boy Kavanaugh, from 3 different women. The sexual assault that only a bastard like Ted Cruz would call “high school dating”. Well, in Ted Cruz’s world, where you randomly post porn links on twitter and then blame it on your staff, sexual assault probably is just “a high school date”.

https://www.politico.com/news/2021/07/23/christine-blasey-ford-brett-kavanaugh-investigation-new-details-500652

Well, when Ted Cruz eats nose boogers on live TV (where else did it come from, minutes into the debate, his eyes?? Was he eating muffins when the camera went off him?? QAnon “mystery”) he’s the one to tell us all what the lines of classy behavior are. Everybody knows that.

Clarence Thomas talking about his beautiful bride and best friend might come back to haunt him. After all – he hit on Anita Hill hard back in the day. Plus Ginnie Thomas communications with Mark Meadow trying to overturn the election did mention her friend which some are taking to mean Justice Thomas was in on the scheme.

Ted Cruz = “donald trump insulted my wife multiple times. Don’t you just love that man?? I feel like he’s my lifetime soulmate. I wonder if I can get him to publicly insult my biological children?? #LifeGoals”

Hey Teddie – the Donald insulted each of his 3 wives with his serial adultery so pick a number and stand in line.

Nice analysis. The home run chart would plot

Vehicle miles traveled ratio to fuel use times the inflation adjusted price of gasoline.

I read somewhere that global supply delays are at a 17 month low. Surely this at least assists in lowering inflation pressures?? (lessening the increase if you prefer that wording)

Aren’t prices right now really about buying out futures low and selling them high as they become spot? Is the dollar volume traded in futures and options markets 10 times, or 100 times, the size of any supply and demand effect of the type economists myopically focus on? If you put prices on Mencius’s graphs, would they be essentially uncorrelated with those noisy, proxy measurements of supply and demand?

If the Fed wants to destroy demand to lower inflation, why not target advertising?

I actually think this is a terrific idea, but not for the reason you gave. I’ve been anti-marketing clear back to my teenage years. It’s one of my weird trains of thought that no one else seems to get.

“ Fertilizer prices just hit a record high sparking fears of global starvation and the worst food insecurity level since World War II.”

https://finance.yahoo.com/news/fertilizer-prices-just-hit-record-174439996.html

More blowback from sanctions, which most of the world outside the US, Canada, Europe, Australia and Japan never signed onto. But it will hurt them most.

More cheer leading for Putin. I’m sure he will give you an extra bone tonight.

That price index your story noted can be tracked here:

https://fertilizerpricing.com/priceindex/

Note this is a nominal series so a record nominal price may not mean inflation adjusted prices are higher than they were in the summer of 2008. It should also be noted that the general commodity boom was driving up prices even before Putin (your boy) invaded Ukraine.

Basic research is important even though we all know you loathe anyone who dares presents facts.

Yes, “ Basic research is important,” and it does not seem that it’s being done by US public policy mavens on anything but a couple indicators. Meanwhile Blowback is coming via a whole range of sanctioned items.

Of course, pgl is free to refute my assertion by providing links to experts who have done their homework by examining the impact of combined sanctions on items like wheat, fertilizer, etc. I have yet to see anyone besides Yves Smith, who does not have a PhD in economics, try to explain what could happen to the economy. It’s what happens when people whose job it is to do that go MIA.

I was clearly referring to to your incompetence. But hey lie your way out which is all you ever do

Johnny, Johnny, Johnny, you’ve done it again. You’ve made unsupported assertions and then assigned others the task of disproving your assertions.

If it’s OK for you to make unsupported assertions, it’s OK for others to doubt those assertions. You don’t get to assign homework. You haven’t done anything to earn it.

Now, I know there’s a reason you keep insisting that you get a free pass while others have to provide proof. You don’t understand what actual evidence looks like. You’ve proven that repeatedly. I guess you realize it, too, deep down, or you wouldn’t keep trying to dump all the evidence-gathering on others.

The rules of the game are not that Johnny gets to make unsupported claims and then declare “I win unless you prove I’m wrong.” That’s a rigged game and only you want to play. The rules of the game are that you have to support your own views with evidence. Otherwise, anybody who wants to can call bullpucky and you have to live with it.

I wish that I could find evidence of economists discussing blowback from economic sanctions on Russia. It kind of reminds me of the run up to the Iraq war when dissenting voices got cancelled from the infotainment media.

Oh, wait! I was wrong! Michael Hudson goes where others fear to tread. “ The American Empire self-destructs.” https://michael-hudson.com/2022/03/the-american-empire-self-destructs/

Of course his reply was totally devoid of substance

Wow Michael Hudson babbles Greek theater for several meaningless paragraphs but FINALLY tries to address economics with this:

‘American economic and financial power was expected to avert this fate. During the half-century since the United States went off gold in 1971, the world’s central banks have operated on the Dollar Standard, holding their international monetary reserves in the form of U.S. Treasury securities, U.S. bank deposits and U.S. stocks and bonds. The resulting Treasury-bill Standard has enabled America to finance its foreign military spending and investment takeover of other countries simply by creating dollar IOUs. U.S. balance-of-payments deficits end up in the central banks of payments-surplus countries as their reserves, while Global South debtors need dollars to pay their bondholders and conduct their foreign trade. This monetary privilege – dollar seignorage – has enabled U.S. diplomacy to impose neoliberal policies on the rest of the world, without having to use much military force of its own except to grab Near Eastern oil.’

This is beyond dumb. First of all the revenue from seignorage is a tiny percent of our GDP. But Hudson cannot say that. Did Johnny boy provide an estimate of how much we would get from this? Of course not as Johnny boy is too damn stupid to even try. And we would be able to pursue a whole variety of alternative policies with or without this puny amount of seignorage.

If JohnH thinks this is some bold endorsement of his latest yapping – then he is even dumber than we give him credit for.

Menzie, if you wanted to do something cheeky you could do a comparison graph between the price of gas and the price of milk. I used to think that gas at more than $4 a gallon was the sign that things were about to fall apart. Now, because my nominal spending baseline has been shifted by a year of inflation I’m feeling a bit indifferent when I fill up my Toyota. I suppose that $5 a gallon would be a more relevant psychological barrier—and have significant economic impacts (per Jim’s last few posts).

https://www.msn.com/en-us/news/politics/clarence-thomas-was-the-lone-dissent-in-the-supreme-courts-january-order-rejecting-donald-trumps-bid-to-withhold-documents-from-the-january-6-panel/ar-AAVsBMS?ocid=uxbndlbing

Follow up on the news that Virginia Thomas pleaded with Mark Meadows to overturn the results of the 2020 election. We know Trump asked the Supreme Court to bar release of key documents to the 1/6 committee but lost 8-1. The sole dissent was Clarence Thomas. I’m sorry but there is a serious conflict of interest here. Thomas should resign from the court NOW.

Here are a few interesting charts and a relevant article:

• https://afdc.energy.gov/data/10309 [average annual miles driven by type of vehicle]

• https://afdc.energy.gov/data/10310 [average fuel efficiency by type of vehicle]

• https://www.bts.gov/content/us-vehicle-miles [total miles driven by type of vehicle]

• https://www.energy.gov/eere/vehicles/articles/supertruck-team-achieves-115-freight-efficiency-improvement-class-8-long-haul

Class 8 trucks travel (per vehicle) about 6 times more miles per year than cars/light trucks

Light vehicles travel (cumulatively) about 10-11 times more miles than Class 8 trucks

Technology has the potential to more than double the fuel efficiency of Class 8 trucks (diesel powered)

UMich consumer confidence read 59.4 – lowest since depths of 1980 recession (56.5).

You have already been called on this little disinformation. But then you are a stupid bot.

@ T. Shaw

UMich’s is consumer sentiment. Consumer confidence comes from the Conference Board. Strange….. I see UMich’s number at 55.3 in November 2008. Are you learning disabled at reading footnotes and margins or something??

As much as it hurt right now there is a longer term benefit to increased prices on hydrocarbon energy. Interest in EVs is up. Europe is starting to figure out how to do without energy imports from Russia. We are setting up for sending a lot of LNG to Europe which will drastically reduce their need next winter for importing natural gas from Russia. What we really should help with is an accelerated program for hyper insulation of homes before next winter. Although we need to do both at this time, reducing energy use is a better way than just finding alternative suppliers. It reduces global warming and pollution. It reduces the flow of our money to a lot of bad actors (other than Russia). It reduce the political captivity of the west to those bad actors (maybe we can finally say the cutting the head of a journalist is unacceptable).

Some of the bad, bad things our local sanction-haters seem to hate are a shift in European energy demand away from Russia, price incentives to lower hydrocarbon consumption, a weakening of the economic base of Russia’s military, a strenghtening of cooperation within NATO and between NATO and non-NATO allies and a resuscitation of economic sanctions as an alternative to military intervention. Such ba bad things.

Yes, we are faced with some bad alternatives. Those alternatives were imposed on us by Russia’s invasion of Ukraine. Those choices are (repeating here, because Johnny wants to pretend bad outcomes can be avoided):

– Allow Russia to kill, starve, orphan and displace tens of thousands of Ukrainians (and Georgians and Moldovans…) unopposed

– Engage in direct military confrontation wih Russia, which has a nuclear arsenal sufficient to wipe out human life on earth many time over

– Impose economic sanctions on Russia

And if the point of economic sanctions is to discourage Russian aggression, those sanctions have to be harsh enough to do the job. Otherwise, they amount to nothing more than virtue signaling.

Ivan, my apologies for turning my response to you into a response to one of our local Putin-huggers, but…

Johnny, I long ago became suspicious that you are either a rightwing troll or a Russian apologist in progressive camouflage. I still can’t tell which, because Trump has made serving Russia’s political interests fashionable on the right.

So come on Johnny, tell us what your preferred choice is – war with Russia, economic sanctions against Russia, or allow Russia to attack other countries with no response. And no pretending there is some super-slick fourth option that’s all unicorns and rainbows.

Johnny might want to consult with his bedfellow Bruce Hall on cooking up that 4th option.

https://www.msn.com/en-us/news/world/uk-government-signals-mercenary-group-is-on-a-mission-to-kill-ukrainian-leader-zelenskyy/ar-AAVtjlX?ocid=msedgdhp&pc=U531

Putin has mired the Wagner Group (mercenaries) to murder Zelensky. Hey – we have certain mercenaries. Let’s have them take out Putin.

Great blog post Menzie. Thank you. Much appreciated.

As an active investor, I see two challenges before me.

1. When to pull the plug on upstream sector plays. According to this analysis, the high oil price party might last longer than initially believed.

2. Keep or scale back our large position in a multi-national roadside convenience store company. It can or at least should act as a hedge to oil price-weighted investment though both have been marching steadily up over the past couple of years.

Some are expecting/forecasting a robust summer driving season in the USA. Perhaps in light of this information, that expectation is more reasonable than I would have initially thought.

In passing, information technology has revolutionized ICE automobiles and made them much more safer, more fuel efficient as well as both environmentally and health-wise cleaner.

Many many many years ago, (in my late teens or early 20s, I forgot exactly) I made a small mint on Casey’s stock. They sold gasoline and were known as “Casey’s General Store” back then. That was before northeast China and alcohol incinerated all of the sensory neurons in my cranium.

[ Sigh…… good times…….. ]

https://abcnews.go.com/International/wireStory/document-china-boost-military-solomons-83662550

It seems Australia is worried about some formerly secret agreement between the Solomon Islands and the PRC. Now this was news to me so I’m not up on the strategic importance but something tells me we are about to have some more of Princeton Steve’s mansplaining.

https://www.nytimes.com/live/2022/03/25/world/ukraine-russia-war?auth=login-facebook

So now the Russian generals are saying that all they ever wanted was Eastern Donbas and taking Kyiv was never a priority. Seriously? I would quip these guys are a bunch of boobs but they have created some much misery over what turns out not to be an exactly set of articulate goals or no real plan how to accomplish them. Putin may be a war criminal but at the end of the day he will also been seen as a failure.

That is great news. Putin need to put his forked tail between the legs, run home and declare victory.

In the end Putin will likely get official annexation of Crimea and probably some (or all) of Donbas. A lot of people will be very upset about that (the bully “won”). However, the political, military and economic price he paid will be enormous. We will have defanged and boxed him in. The Europe he worked so hard to divide will be more united than ever. The idea that the west will fund him and his kleptocracy will be dead. His military will no longer be able to intimidate anywhere near what they used to.

https://www.cnn.com/2022/03/23/politics/us-russia-general-meeting/index.html

Putin poodle Bruce Hall the other day mansplained to us that the most important thing involving Putin’s war crimes against Ukranians has little to do with the victims and everything to do with the FEELINGS of the Russian leadership. I hate to break it to Putin’s little poodle but some of Putin’s generals are not so sure about Putin’s grand schemes. If Putin loses his generals, he might as well flee Moscow as his reign of terror is over.

https://www.msn.com/en-us/news/world/a-russian-commander-was-killed-by-his-own-troops-western-officials-have-revealed/ar-AAVuPVL?ocid=msedgdhp&pc=U531

Seven Russian generals have been killed. Some of these deaths were the result of Russian soldiers turning on their own commanders. One has to wonder how the Putin poodles will react to this turn of events.

https://econbrowser.com/archives/2022/03/the-times-we-live-in#comment-270918

March 22, 2022

You work for a brutal, racist regime. You don’t get to whine about prejudice.

It isn’t your heritage which makes you deplorable; it’s your behavior.

[ Precisely the way in which anti-Semitism has been and is expressed. Definitive prejudice, carefully meant to categorize and terrorize a people. ]

ltr, it is dishonest of you to compare anti-semitism, which is prejudice against a people, to opposition to China’s government or to your toadism in propagandizing for China’s racist, brutal regime.

It is dishonest of you to re-post your comment without re-posting my response, so I’ll repeat the gist of it: It is not prejudice to tell the truth. Your effort to smear those who criticize China’s government, your effort to praise Xi’s genocidal efforts against Chinese muslims while quoting civil rights activists is obscene. You are obscene.

@macroduck; agree. It’s an old rhetorical trick to say that “this bad thing that I don’t like, is equivalent to this horrible thing nobody likes”.

When I lived in China, this is how 99.999999999999999% of mainland people take criticism of the Chinese government. “You don’t like Chinese government = “you hate all Chinese”. Some Jews are like this if you point out some super bad policies of Israel’s government. At some point, other than my very closest of Chinese friends, like 12-15 college educated people who had access to internet outside China~~or a few who knew I wouldn’t consciously lie to them~~you just nod your head up and down in a totally robotic detached way and tell them “Yes, every single thing the Chinese government does is correct and wise. WOW!!! how did you know so much about world geopolitics!?!?!?!?!?” and life moves along so much smoother. Especially when talking to a potential mother-in-law who tells you “At least we felt good in the Mao years, because everyone felt together!!!!”. And then you reply breaking every personal code of truth you hold dear “WOW, yeah, how did Mao do that?!!?!?! What an AMAZING deity Mao was!!!!” and then 10 minutes later go to the bathroom and vomit out your dumplings.

https://www.msn.com/en-us/news/world/ukraine-has-actually-gained-tanks-during-war-while-russia-has-lost-hundreds/ar-AAVtUQf?ocid=uxbndlbing

Putin’s forces has seen almost 16 thousand soldiers die and have lost over 500 tanks. It seems Ukraine has MORE tanks than they did before the invasion as they have captured a lot of those Russian tanks.

Yea I get it. JohnH and Bruce Hall will find some way to turn this into good news for their boss – Putin.

This is not the most elegant analysis. First, you’re using the wrong data source. The EIA does track gasoline and diesel for road use on a monthly basis. You want to use this one: Table 3.7c Petroleum Consumption: Transportation and Electric Power Sectors

https://www.eia.gov/totalenergy/data/browser/index.php?tbl=T03.07C

Second, if Fig. 2, I have no idea why you would use a log scale for variables that really don’t vary that much. Moreover, why aren’t you using a 12 month moving average to present the data when the data clearly exhibits strong seasonality?

What is the ending date on Fig. 4?

This presentation does not really make any of the points intended very clearly.

Steven Kopits: I’m not sure why your variable is demonstrably better than mine since your measure uses PETROLEUM for both transportation AND ELECTRIC POWER sectors. I would think gasoline and diesel better accords with travel use alone.

Regarding Figure 4, data are quarterly, so one knows (unless one has a time machine) that data end at 2021Q4.

See col C and D

Steve’s graph is labeled – “Source: EIA, Table 3.7c Petroleum Consumption: Transportation and Electric Power Sectors, through 12/2021”

As you note “I’m not sure why your variable is demonstrably better than mine since your measure uses PETROLEUM for both transportation AND ELECTRIC POWER sectors. I would think gasoline and diesel better accords with travel use alone.”

And of course his graph only goes through the end of 2021 as well.

Come on Stevie – please read more carefully before launching these silly critiques.

You were not always this thick-headed. You could have checked the excel file yourself.

All of PCE, road fuel consumption and VMT are available on a monthly basis.

https://fred.stlouisfed.org/series/PCE

Steven Kopits: VMT only available through December. Yes, there is January PCE, so I’m missing a month (since my consumption graph goes through 2021Q4). Kind of immaterial for a trend.

I have added at the end of the post Figure 4b, which plots the monthly data corresponding to Figure 4.

For the life of me I’ll never understand why you humor him. But I guess you humor my occasional idiocy sometimes, so there’s that.

Menzie –

If I extrapolate to March data, the numbers look like this. PCE should be up about 3% over December; oil and distillate consumption is down about 1%; gasoline prices are up 30%. Therefore, the latest fuel expense / PCE estimate should be in the range of 3.1-3.2% of PCE, not the approximately 2.5% shown on the graph.

That’s a reasonably heavy burden for the consumer.

I have prepared the relevant graphs using the appropriate data sets.

https://www.princetonpolicy.com/ppa-blog/2022/3/26/us-fuel-efficiency-and-the-ukraine-war

Some excerpts:

Fuel efficiency is not much improved over the last thirty years. The first and second oil shocks of the 1970s and early 1980s led to a dramatic change in consumers’ choices of vehicles. After 1990, however, most of the low hanging fruit hang been plucked, and subsequent fuel efficiency improvements have proved modest.

From 1992 to to the onset of the pandemic, road fuel efficiency had improved by only 7%, equating to an observed improvement in fuel economy from 17.5 mpg in early 1992 to 19.1 mpg in February 2020, a not particularly compelling gain of 1.6 mpg in a bit less than three decades.

If we consider only the period of the pandemic, that is, from February 2020 to December 2021, the US shows a dramatic increase in fuel efficiency, a gain of 4% or 1 mpg in little more than one year. This is likely to prove a statistical artefact, a distortion induced by changed commuting and travel behaviors during the pandemic.

Perhaps the fuel efficiency gains will stick. Historically anomalous efficiency improvements suggests this is not the case, but we may need to wait for 2023 or even 2024 data to see whether recent gains are consolidated or prove transient.

Wow, all of the great improvements in fuel consumption ended in 1990, 32 years ago. Who knew?? Kopits, what model of car is your main choice for work travel and what is its mpg?? I’m gonna take a wild guess here and say it’s not a Honda Civic.

I think that’s the point. People tend to think that CAFE standards have vastly improved fuel economy. The data says differently. Having said that, there does seem to be some modest improvement over the last few years, from 18.3 mpg in 2014 to 19.0 in 2019. It’s not huge, about 0.1 mpg / year, but it is appreciable. It’s possible electric vehicles have something to do with that.

@ FormerlyOfStinkyJersey Kopits

Am I being overly redundant when I say, you have to be one of the dumbest adult males I have ever interacted with in my life??

“A slew of OEM sales tallies released this week suggests that 2020 marked the year crossovers and SUVs together commanded a 50 percent share of Americans’ auto buying, according to an IHS Markit analyst.”

“IHS Markit principal automotive analyst Stephanie Brinley said pickups should comprise another 20 percent of 2020 sales.”

“This looks to be the year when sales of utility vehicles reached 50% market share, across all size segments, compared with 48% in 2019,” Brinley said in a statement Tuesday. “Pickup truck sales remained strong over the course of the year, and are expected to end 2020 at about 20% share of total light vehicle sales, compared with 18.1% in 2019. There were also a number of new products contributing to the expansions. Though Jeep Gladiator and Ford Ranger joined the mid-size pick-up truck segment in 2019, 2020 saw impact of a full year of availability. As with pick-up trucks, share growth is in part on new entries and increased consumer choice. In 2020, Buick, Chevrolet, Kia, Genesis, Hyundai, and Toyota were among brands which added to the number of utility vehicles available in showrooms.”

Now as a “consultant” on oil etc. I want you to think real super hard here Kopits, I want you to concentrate your mind like you never have before, even more than the period of time in your life that you claim to have been a statistics TA. Think real super extra hard now Kopits. What do you think the consumer choices on cars would have done, to the mpg numbers you claim to be “representative of” increases in fuel efficiency technology since, 1990, 32 years ago?? Can you give the answer to this question?? After that Kopits, I’m gonna show you an internet image of a half full glass of water, and see if you can tell me if the water is in the top portion of the glass, or the bottom portion of the glass. Can you tell me if I give you 72 hours or so???

You realize you are now reaching “PeakTrader” level of asininity at this point, right?? You must realize that at this point.

Take your meds, Moses.

I am speaking of observed fuel economy. I have made no comment about the mix of vehicles. I think for purposes of policy, the question is whether consumers choose to 1) increase the efficiency of their vehicles or 2) drive less. In the 1970s, they chose more economical vehicles. After 2005, they chose to drive less, and during that period, we used the term ‘secular stagnation’ to describe the nature of the economy. Driving less is a sign of economic illness.

@ FormerlyOfStinkyJersey Kopits

YOU are the one who was muddying the waters by implying the fuel efficiency technology hasn’t changed in the last 32 years

“and subsequent fuel efficiency improvements have proved modest.”

“Perhaps the fuel efficiency gains will stick. Historically anomalous efficiency improvements suggests this is not the case,”

You cannot bitch about “fuel efficiency” and the “costs to consumers” when those same consumers are the ones choosing to purchase gas guzzling vehicles. You cannot have it both ways. Your wording and the way you disingenuously present your argument (as you disingenuously present nearly all your arguments here) implies that it is the technology that has gone nowhere in 32 years. It is a boldface LIE by you, you know it is a LIE

Americans driving less is largely a function of their own bad choices, not any “economic illness”. You still haven’t shared with us what model car the great “oil consultant” Kopits drives. I think everyone here knows why you don’t share that fact. Because you are just as dumb if not more so than every other American driving an SUV, “crossover”, or pick-up truck.

Markets in everything: Tank edition. $10,000 + Ukrainian citizenship for Russian tank and operator.

https://www.dailymail.co.uk/news/article-10656603/Russian-soldier-surrenders-TANK-return-7-500-Ukrainian-citizenship.html

Wow – you found a single person who accepted the monetary deal. That’s it? And if actually read the entire story, it sounds like he would have surrendered the tank even without getting $10,000.

Look doing this in pure self centered monetary terms could boomerang and be used to justify Putin hiring mercenaries. Now do you support that? If not, this markets in everything is your usual BS.