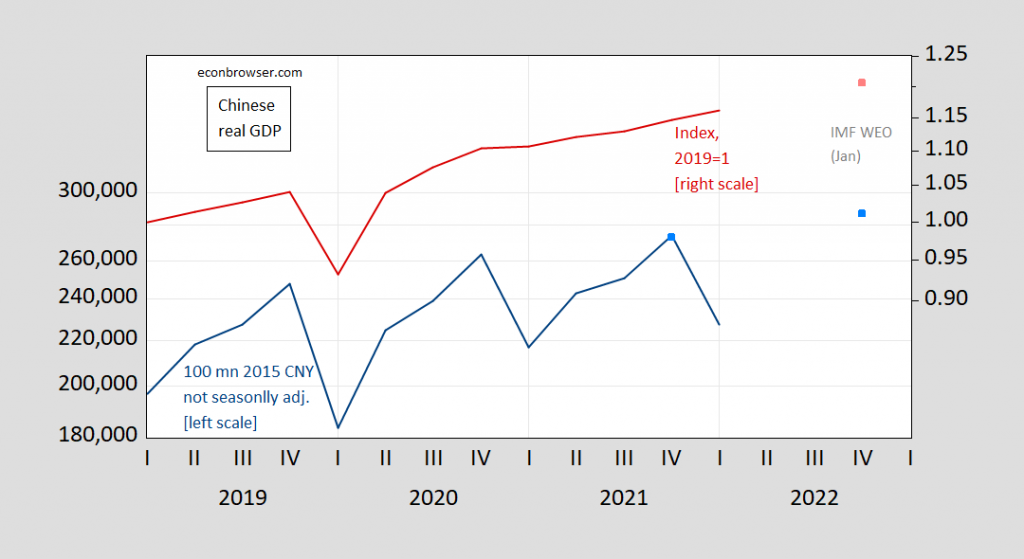

NBS released GDP numbers for Q1 yesterday, surprising on the upside (1.3% q/q vs. 0.6% Bloomberg consensus, not annualized; 4.8% y/y vs. 4.4%).

Figure 1: Real GDP, 100 mn 2015 CNY, not seasonally adjusted (blue, left log scale), and IMF forecast from January WEO (blue square), and index, 2019Q1=1 (red, right log scale), and forecast from January WEO (red square). Index cumulated from reported growth rates. Source: NBS, and IMF WEO (January 2022), and author’s calculations.

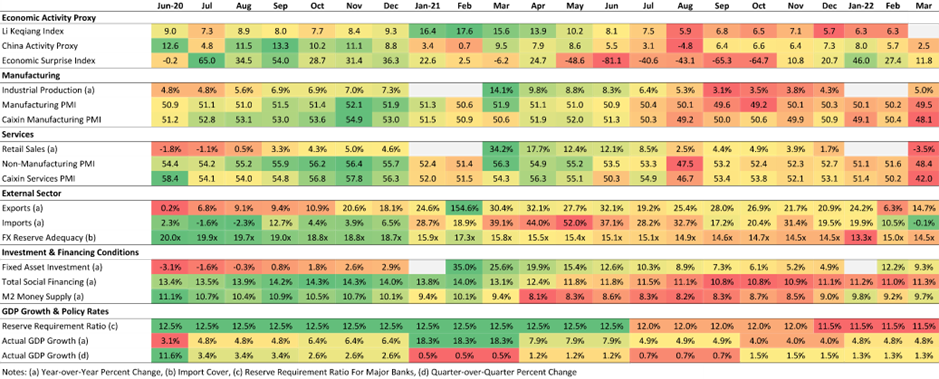

Chinese industrial production in March also surprised on the upside (5.0% y/y vs. 4.5% consensus) as did fixed asset investment (9.3% y/y vs 8.5% consensus). However, retail sales were down 3.5% y/y vs. down 1.65% consensus reflecting the latest Covid shutdown. (On the latter, see here on production impacts).

From Reuters:

Final consumption accounted for 69.4% of China’s first-quarter GDP growth, down from its 85.3% share in the fourth quarter of 2021, data from NBS showed.

“Even if the Q1 GDP growth is larger than the 4.0% growth in Q4, it’s still far away from China’s annual target of 5.5% growth. March’s growth is severely impacted by the anti-virus curbs, reflected by the greatly hit consumption in the service sector,” said Wang Jun, chief economist at Zhongyuan Bank.

“Second quarter this year will suffer greater pressure, and to what extent the economy loses steam will depend on whether China would make flexible adjustments to its anti-virus measures and offer greater support via its macro policy,” said Wang.

The real estate sector is still continuing to threaten overall growth.

Home sales by value in March slumped 26.17% year-on-year, the biggest drop since January-February 2020, according to Reuters calculations, pointing to a deepening downturn in the property market.

I’m setting aside questions about the accuracy of the official series, as discussed in this post (regarding Q3 numbers). You can see the Fernald, Hsu and Spiegel CCAT series up to 2021Q4 here (where the tracking indicates slightly less growth than the official 4 quarter growth rate).

The IMF will be presenting its April 2022 WEO forecasts tomorrow. Watch to see the revision!

Update, 1:30pm Pacific:

Brendan McKenna at Wells Fargo presents a heat map for the Chinese economy. Note the deterioration for March (recalling we’re midway through April) – lots of the recent Covid shutdowns are not reflected in these data.

“Home sales by value in March slumped 26.17% year-on-year”

So when is Princeton Steve going to take a victory lap? Oh wait – this is the Chinese housing market. The US market is still roaring.

China GDP “surprised to the upside”. This is a new venture for Menzie, providing comedy relief.

In next week’s sitcom episode China reports a negative economic number and Menzie faints into the arms of his dept Dean. Then the entire cast takes a trip to Hawaii. This is really must watch TV people, in the final climax episode commenter “ltr” arm wrestles Menzie to see if Chinese property companies get access to international bond markets.

https://news.cgtn.com/news/2022-04-18/China-s-GDP-expands-4-8-in-Q1-19k5jeviPm0/index.html

April 18, 2022

China’s GDP expands 4.8% in Q1 despite COVID-19 disruptions

China’s gross domestic product (GDP) expanded 4.8 percent year on year in the first quarter (Q1) of 2022, despite disruptions caused by the resurgence of COVID-19 cases and uncertainties in the international environment, the National Bureau of Statistics (NBS) said on Monday.

The figure beats the forecasts of 4.4 percent and 4.3 percent by Reuters and Bloomberg economists, respectively.

The quarterly result is supported by a strong January-February economic recovery. Retail sales grew by 6.7 percent, while fixed-asset investment rose by 12.2 percent during the period.

Quarterly growth slowed from 1.6 percent in Q4 of 2021 to 1.3 percent.

China’s per capita disposable income came in at 10,345 yuan ($1,623) in Q1, a nominal increase of 6.3 percent year on year, NBS data showed.

https://news.cgtn.com/news/2022-04-18/China-s-GDP-expands-4-8-in-Q1-19k5jeviPm0/img/9593c8e396e04c2f95b9f705713aa0d7/9593c8e396e04c2f95b9f705713aa0d7.jpeg

Retail sales slow

Retail sales slumped by 3.5 percent in March, weighing the Q1 retail sales growth down to 3.3 percent.

The retail sales of commodities increased 3.6 percent, and revenue from catering was up 0.5 percent year on year in Q1.

“The main drags of the economy were weak consumption and property investment,” said Wang Dan, a chief economist at Hang Seng Bank, pointing to the fast-growing e-commerce sector.

Online retail sales of physical goods rose 8.8 percent in Q1, accounting for 23.2 percent of the total retail sales, data showed.

Investment in real estate development edged up 0.7 percent in the first quarter. However, the pace slowed for the 12th consecutive month.

https://news.cgtn.com/news/2022-04-18/China-s-GDP-expands-4-8-in-Q1-19k5jeviPm0/img/040e158d7115404886439727ff5cc453/040e158d7115404886439727ff5cc453.jpeg

Manufacturing and investment

Industrial output went up 6.5 percent year on year in Q1. It rose 5 percent in March, compared with a 7.5-percent increase in the first two months of the year.

The official manufacturing Purchasing Managers’ Index (PMI) dropped to 49.5 in March.

China’s fixed-asset investment rose 9.3 percent year on year in the first three months of 2022, with manufacturing investment surging 15.6 percent, surpassing the pre-COVID-19 level.

Policies to strengthen supply chain security and tech innovation supported the strong performance in manufacturing investment, said Wang.

She expects manufacturing investment to maintain high growth throughout the year.

https://news.cgtn.com/news/2022-04-18/China-s-GDP-expands-4-8-in-Q1-19k5jeviPm0/img/5245bd2f153c4ef7be176ed0d92f4460/5245bd2f153c4ef7be176ed0d92f4460.jpeg

Labor market ….

https://news.cgtn.com/news/2022-04-18/China-leads-global-efforts-in-saving-forests-19kb90zBb4k/index.html

April 18, 2022

China leads global efforts in saving forests

By Alexander Ayertey Odonkor

According to the State of the World’s Forests 2020, a jointly published report from the Food and Agriculture Organization (FAO) and the United Nations Environment Program (UNEP), from 1990 to 2020, the world lost about 420 million hectares of forest.

Driven by the expansion of agriculture, frequent wildfire, increased exploitation of mineral resources and rapid infrastructure development, most of which are embedded in the fabric of human civilization, these incidents and activities have accelerated forest degradation and deforestation worldwide. This worrying trend has depleted global forest cover considerably.

As a matter of concern, the immensity of forest loss around the globe has prompted increased global efforts to address this challenge, a concerted action that has so far proved to be a step in the right direction. Between 2015 and 2020, the rate of forest deforestation was estimated to be 10 million hectares (100,000 square kilometers) per year, a decline from 16 million hectares per year. While this feat is obviously significant progress, it is worth knowing that this vital gain would not have seen the light of day without China’s consistent and monumental contribution.

The Chinese government’s commitment to bolstering forest cover has been exemplary and unparalleled in the last three decades. A 2021 FAO study found that among the 236 countries and territories covered by the FAO Global Forest Resources Assessment, China’s high and consistent increase in forest cover from 1990 to 2020 is unrivaled. Global planted forests increased from 170 million hectares in 1990 to 292.6 million hectares in 2020, and China accounted for nearly one-third of the growth….

Let’s not ignore India:

https://earthobservatory.nasa.gov/images/144540/china-and-india-lead-the-way-in-greening

One whould also consider the base from which countries start. China and India were and still are under-forested relative to South America, Noth America, Russia and Europe. China’s reforestation efforts are motivate less by good will to the world and more by a need to stem the spread of the Gobi Desert.

I think you may have just thrown “ltr” into a state of extreme shock. He was completely unaware the were other countries in East Asia. He thought they had all been annexed by Beijing already.

https://www.msn.com/en-us/news/world/bleak-assessments-of-russian-economy-contradict-putin-s-rosy-claims/ar-AAWkVqL?ocid=msedgntp&cvid=82b5f67894974bb9a02053ad1e2dc5b1

Putin tells Russians that their economy is fine even if it clearly is struggling. This is Trumpian level dishonesty so one has to wonder who Putin’s economic advisors might be. Perhaps the new Three Stooges – Larry Kudlow, Stevie Moore, and of course JohnH!

https://www.msn.com/en-us/news/world/seven-killed-in-russian-missile-strikes-on-ukraine-s-lviv-officials-say/ar-AAWjZOt?ocid=msedgdhp&pc=U531&cvid=1f7c5492127147649f58f4fdb54b970f

The Putin war crime machine launched 3 cruise missiles into Lviv this morning.

By making sure the US weapons deliveries were pushed up early, Biden forced Putin to begin his Donbas offensive before his military was ready. They still have about 10,000 troops locked up and fighting in Mariupol and have barely gotten another 10,000 added to the forces in Donbas. Maybe they can pull down another 10,000 from Karkhiv but that is still not enough for any decisive victory there. A lot of Russian military losses the next few weeks. That victory day parade may be less than planned.

I confess to being somewhat mystified by how well the PRC economy does given the lockdown approach that they use to combat Covid-19, although I guess the really severe recent lockdowns especially affecting Shanghai only got going at the end of the quarter, so not really affecting this data much.

https://www.msn.com/en-us/news/politics/lobbyists-loved-mike-pence-hitting-his-office-up-more-than-any-vp-ever-here-s-what-they-wanted/ar-AA

Lobbyists loved Vice President Mike Pence. That makes sense since Pence served in the most corrupt White House in history. Notice some of those seeking special treatment were pushing quack treatments for COVID-19. Bruce Hall probably got his own sweetheart deal.

Why do you trust figures handed down to you by government officials with no accountability? Is it too heterodox to point out you have a religious faith in state statisticians who have clear conflicts of interest?

why do you assume the worst in everybody around you? contrary to what you may see in the mirror, most people are not liars and thieves with an agenda.

Does anyone know when the IMF “Fiscal Monitor” will be uploaded?? I just DL’ed the other 2. These are so much fun to read, and I guess most people here already know that IMF has tons of “working papers” similar to VOX that can be had for the taking on nearly every topic under the sun (except maybe QAnon rumors). I mean this is a Godsend people, if you have the time, use it.