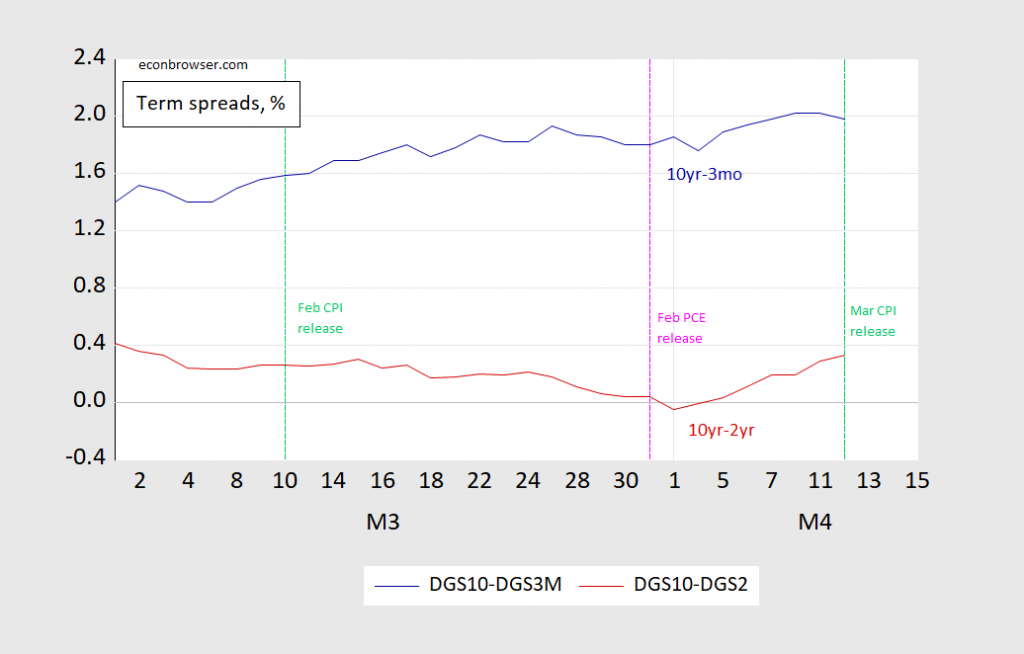

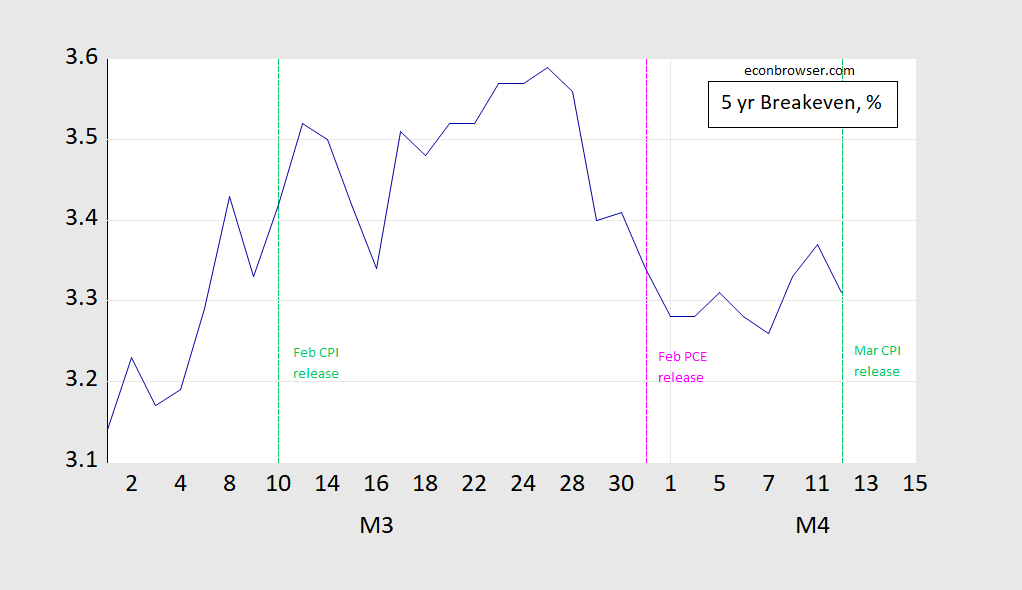

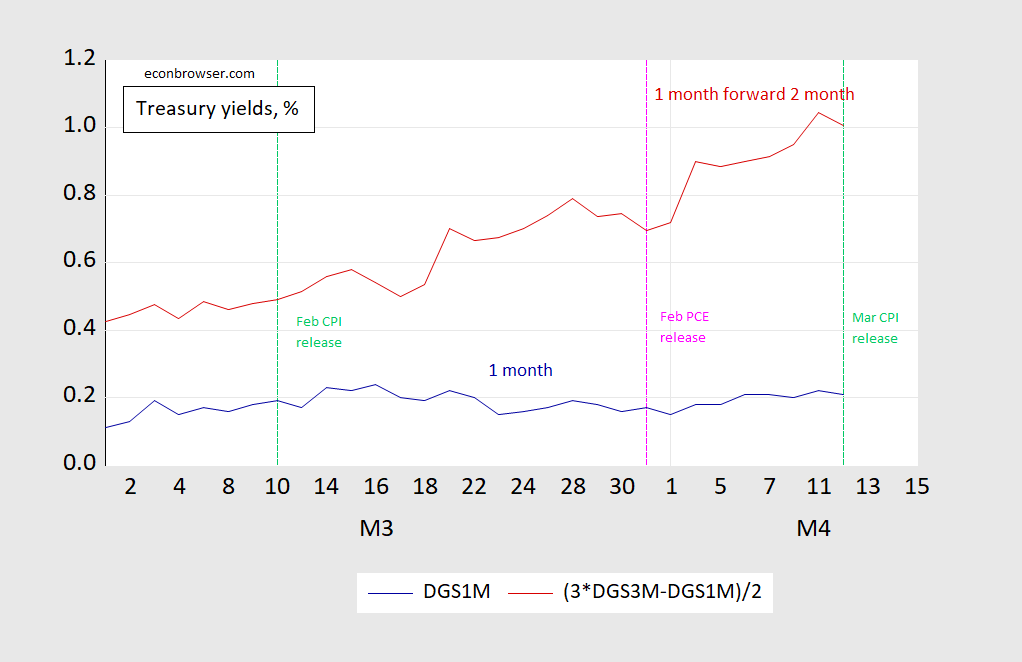

10yr-2yr spread continues to rise, 5 year inflation breakeven (unadjusted) shrinks, as does implied 2 month interest rate 1 month forward.

Figure 1: 10yr-3mo Treasury spread, % (blue), and 10yr-2yr spread (red). Source: Treasury via FRED.

Figure 2: Five year Treasury yield minus five year TIPS, % (blue). Source: Treasury via FRED, author’s calculations.

Figure 3: One month Treasury yield, % (blue), and one month forward 2 month implied Treasury yield, % (red). Source: Treasury via FRED, and author’s calculations.

No big movements, which is unsurprising given headline CPI inflation was at consensus (although Core was below).

Cooling core keeps capitalists calm.

You are a poet even if you do not know it!!!

Trimmed mean way too high and Fed way to slow. Why is monetary policy so expansionary????

Wouldn’t we all be a lot better off with a Fed CBDC account offer that paid inflation as interest, than with Messy’s trite reassurances based on cherry-picked noise that conveniently happen to support his political agenda?

Wouldn’t we all be better of if you had the courage to stop hiding behind questions?

Wouldn’t we all be a lot better off if you stopped writing this insulting gibberish.

“Messy”? Oh, so just what does “rsm” stand for? Rotten Silly Moron?

How about Rosser’s Scared of Me?

More pointless questions. I have one for you – are you a bot?

Ooooooh! I am terrified!!!!!!!

Actually, Rotten Silly Moron looks like it hits the spot right on it. I think we’ll stick with that.

nobody is scared of you. most of your commentary is either incomprehensible or just plain stoopid.

It seems pretty obvious that the drivers of current headline inflation are temporary.

Biden seem to be able to control the oil price at $80-100 which is exactly where it needs to be to encourage shift to alternative energy without to much pain on the economy. The high gasoline prices will encourage shifts to hybrid/electric without too much economic damage. He is putting pressure on the use of Russian hydrocarbons to make sure they are sold at a hefty discount, but not taken off the market. The chip shortage problem is being “chipped away at” and car production is recovering. That should stabilize the hot new/used car markets and normalize prices. Mortgage rates are going up which should stabilize housing prices.

The chicken littles in the press are as always screaming about doom (so people will pay attention to them). But the reality of it all is that most of the inflation bump is temporary. Even the part that is driven by permanent increased salaries for the low wage workers is a temporary driver of inflation. They will not be in the drivers seat forever. Their ability to move to a job that pays $2 more per hour is not going to last forever – and when it stops its effect on inflation goes away.

It looks like the markets realize that Biden has brilliantly engineered a soft landing for this slightly overheated economy. Competence in the white house matters.

“It looks like the markets realize that Biden has brilliantly engineered a soft landing for this slightly overheated economy. Competence in the white house matters.”

The White House doesn’t manage monetary policy. Nor should it, ever.

Also, the job market is clearly overheated. The Fed could have acted earlier and kept inflation over the past couple quarters down, but they didn’t.

But I agree with you that a soft landing is possible.

I agree that the white house should not declare monetary policy (as Trump tried) but they can and should influence policy indirectly by instituting policies that help the Fed with creating a soft landing. So if inflation shoots up based on oil prices, chip shortages and other supply chain problems – the administration should (and Biden’s has) try to intervene and solve those problems. That allows the Fed to fulfill its inflation mandate without hampering its employment mandate. It also make it easier to resist the GOP’s loud calls for sabotaging the Biden economy with an overreaction to a minor and temporary increase in inflation.

I also agree that the current economy, as well as the Trump economy before Covid, would be able to absorb a slow and deliberate reduction in Fed balance sheet and increased rates. It is worth noting that Trump and GOP back then recklessly called for the opposite. Although the minor overheating of labor markets are driving increased wages in the low end (a democratic policy goal) you would be hard pressed to find anybody in the Biden administration demanding the Fed change their current policy (let alone rumbling about getting a new Chair). Biden is competently driving policies that help the Fed fulfill its mandates and still support policies that are beneficial for the country (such as shifting away from hydrocarbon energy and increasing real salaries in low wage profession)

It’s too early to call “we have a winner”. There is a lot of volatility in crude prices because of the political uncertainty surrounding the Ukraine invasion and Western sanctions. Earlier in Iowa, Biden was grasping at straws trying to farmers to plant more corn so E15 gasoline could be sold through the summer because of an EPA waiver (global warming cancelled this year) while the Secretary of Agriculture was denying requests to open up the Conservation Reserve Program lands for planting such corn because it would adversely impact climate change and the environment (global warming crisis).

Crude Oil May 22 (CL=F)

NY Mercantile – NY Mercantile Delayed Price. Currency in USD

104.19+3.59 (+3.57%)

As of 03:28PM EDT. Market open.

Just can’t help yourself, can you? Start from politics and work backward to economics. How very honest of you.

A winner at what Brucie? Come on dude – stop writing such whiny fluff and actually make a substantive statement for a change. Assuming you know how.

“Earlier in Iowa, Biden was grasping at straws trying to farmers to plant more corn so E15 gasoline could be sold through the summer because of an EPA waiver (global warming cancelled this year) while the Secretary of Agriculture was denying requests to open up the Conservation Reserve Program lands for planting such corn because it would adversely impact climate change and the environment (global warming crisis).”

Gee boys and girls – Brucie forgot to tell what the Conservation Reserve Program even is so permit me:

https://www.huffpost.com/entry/biden-america-the-beautiful-challenge-30x30_n_625432dee4b06c2ea32105ec

Now he is making some off the wall claim without telling us WTF he got his bizarro story, But of course we all know he cuts and pastes emails from Kelly Anne Conway even if he has no idea what she wanted him to say.

Ivan, I responded a few minutes ago but neglected to include this link which you may find useful from Financial Times.

https://www.ft.com/content/048ea270-cdd8-4c77-a8d4-0c67e2f9b921?

https://news.cgtn.com/news/2022-04-11/Development-economics-goes-north-199ekuI3q6Y/index.html

April 11, 2022

Development economics goes north

By Dani Rodrik

At the heart of development economics lies the idea of “productive dualism.” The economists who founded the field of development economics, such as the Nobel laureate Caribbean economist W. Arthur Lewis, noted that poor countries’ economies are split between a narrow “modern” sector that uses advanced technologies and a much larger “traditional” sector characterized by extremely low productivity.

Dualism was long held to be the defining feature of developing countries, in contrast to developed countries, where frontier technologies and high productivity were assumed to prevail across the entire economy. This marked development economics as a distinct branch of the discipline, separate from conventional neoclassical economics.

Development policy, in turn, traditionally focused on overcoming the disparities in incomes, education, health, and life chances more broadly. Its task was to overcome productive dualism through new institutional arrangements that would alter how markets work and expand access to productive opportunities.

While this distinction may have made some sense in the 1950s and 1960s, it no longer appears to be very relevant. For one thing, the methods used to study developed and developing countries have essentially merged: Development economics today is essentially the application of standard frameworks of public finance, labor economics, industrial economics, or macroeconomics to low-income settings. But perhaps more importantly (and interestingly), productive dualism has become a critical and visible feature of advanced economies as well, requiring remedies that come straight out of the development policy toolbox.

In his 2017 book The Vanishing Middle Class, the MIT economic historian Peter Temin pointed out that the Lewis model of a dual economy had become increasingly relevant to conditions in the United States. A combination of forces – de-industrialization, globalization, new technologies that favored professionals and capitalists, and declining protections for labor – have indeed produced a widening gap between the winners and those who are left behind. Convergence between poor and rich parts of the economy was arrested, educational attainment increasingly polarized labor markets, and regional disparities widened.

In Europe, the increase in inequality was not as marked, owing to a stronger welfare state, but the same forces operated there, too. The gaps between leaders and laggards among firms and regions grew, and the middle class shrank.

As a result, policymakers in advanced economies are now grappling with the same questions that have long preoccupied developing economies: how to attract investment, create jobs, increase skills, spur entrepreneurship, and enhance access to credit and technology – in short, how to close the gap with the more advanced, more productive parts of the national economy.

The starting points may be different, but the problems of a region where good jobs have disappeared look distressingly familiar to a development economist….

https://voxeu.org/article/overheating-conditions-indicate-high-probability-us-recession

April 13, 2022

Overheating conditions indicate high probability of a US recession

By Alex Domash and Lawrence H. Summers

As inflation accelerates in the US, the Federal Reserve will raise interest rates in the hope of achieving a soft landing for the economy. This column uses historical data on unemployment and inflation to evaluate the likelihood that the Fed can lower inflation without causing a recession. The authors find that low levels of unemployment and high inflation are both strong predictors of future recessions, and that overheating indicators today suggest a very high probability of recession over the next two years. The likelihood of the Fed achieving a soft landing in the economy appears low….

Well that sucks.

https://fred.stlouisfed.org/graph/?g=tr30

January 30, 2018

Producer Commodities Price Index, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=zYmJ

January 30, 2018

Producer Commodities Price Index, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=MYMH

January 30, 2018

Producer Price Index for Fertilizer Materials and Mixed Fertilizers, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=OcWA

January 30, 2018

Producer Price Index for Fertilizer Materials and Mixed Fertilizers, 2017-2022

(Indexed to 2017)

The day after the chaos on the N train in the Sunset Park section of Brooklyn, law enforcement has concluded that it was Frank James who inflicted this horror. What motivated him?

https://www.nbcnews.com/news/us-news/frank-james-suspect-brooklyn-subway-shooting-discussed-violence-youtub-rcna24179

The big question of course is where is he so they can take him in custody.

They have him, now.

You can ride the subway, again.

Capitalism: Uber jacked up its fares while mass transit was shut down in the area.

did they “jack” it up, or was it supply and demand? please clarify.

US urban price changes (Jan-Mar YoY average):

Utility gas +25%

#2 Heating oil: +55.4%

Unleaded gasoline: +48.7%

Bacon: +23.3%

Beefsteak: +17.9%

Sirloin: +17.2%

Ground beef: +14.3%

Flour: -1.7%

Wholewheat bread: -4.6%

Spaghetti: -13.4%

Eggs: +27.6%

Whole milk: +13.7%

Coffee: +13.3%

Beer: +7.4%

Wine: +2.8%

Adjust your buying habits accordingly!

Source: https://fred.stlouisfed.org/

LOL! Italian dinners it is!

https://english.news.cn/20220413/7d0316d00ff7434e859928ace138dc08/c.html

April 13, 2022

China’s foreign trade sustains upward momentum despite mounting challenges

BEIJING — China’s foreign trade maintained its growth trajectory in the first quarter of 2022 despite increasingly complex internal and external challenges and risks.

The country’s total imports and exports expanded 10.7 percent year on year to 9.42 trillion yuan in the first three months, data from the General Administration of Customs (GAC) showed Wednesday.

In U.S. dollar terms, total foreign trade came in at 1.48 trillion U.S. dollars in the period, up 13 percent year on year, the data showed.

Exports surged 13.4 percent year on year to 5.23 trillion yuan, while imports rose 7.5 percent to 4.19 trillion yuan during the period, leading to a trade surplus of 1.04 trillion yuan, the data showed.

In terms of goods types, exports of mechanical and electrical products expanded by 9.8 percent to account for 58.4 percent of the total, while exports of labor-intensive products increased 10.9 percent in the first quarter, GAC data showed.

“China’s foreign trade has sustained growth momentum and posted positive year-on-year expansion for seven consecutive quarters, which shows its great resilience and potential,” Li Kuiwen, a spokesperson for GAC, said at a press conference.

China’s imports and exports with its major trading partners — ASEAN, the European Union and the United States — gained 8.4 percent, 10.2 percent and 9.9 percent from a year ago, respectively, in the first three months.

China’s trade with Belt and Road countries saw an impressive jump by 16.7 percent from a year ago to 2.93 trillion yuan in the January-March period….

Still with the Covid boat problem:

https://www.caixinglobal.com/2022-04-12/china-port-congestion-strands-ship-cargos-from-grains-to-metals-101868696.html

But weather and mortgage rates are bringing lumber prices down:

https://tradingeconomics.com/commodity/lumber

It won’t be a surprise if a remarkably fast rise in mortgage rates cools off housing-related stuff generally:

https://fred.stlouisfed.org/graph/?g=Ocp8

Most of the rants from the AEI are utter BS. Case in point – this criticism of Biden’s proposals to undo the damage from the 2017 tax cut for rich people:

https://mnetax.com/bidens-tax-reforms-could-leave-us-multinational-corporations-at-a-competitive-disadvantage-47209

As you read this rant – you might be wondering why is the US tax code so complex? Well it is and the Republicans made it that way so they can find new clever ways for multinationals to evade profit taxes. If I were Biden – I would be scrapping all these little loopholes entirely. But to AEI actually taxing corporate taxes at the low rate of 2! is going to reduce investment demand. Does it? It seems this AEI rant is all about assertions but there is not a shred of logic or evidence to support these claims.

I thought trump was going to reduce income tax filing to a postcard? guess he failed at that one as well.

https://www.bbc.com/news/world-europe-61036880?xtor=AL-72-%5Bpartner%5D-%5Bmicrosoft%5D-%5Blink%5D-%5Bnews%5D-%5Bbizdev%5D-%5Bisapi%5D

BBC notes the actions of Russian invaders tell us in various ways that committing war crimes is part of planned strategy. The Denial of Responsibility discussion is interesting as it seems JohnH is leading this portion of Putin’s plans.

Rare comments from a US official that runs counter to the 24/7 propaganda being aired on the infotainment media:

“It’s bad,” the DIA official says. “And I don’t want to say it’s not too bad. But I can’t help but stress that beyond the clamor, we are not seeing the war clearly. Where there has been intense ground fighting and a standoff between Ukrainian and Russian forces, the destruction is almost total. But in terms of actual damage in Kyiv or other cities outside the battle zone, and with regard to the number of civilian casualties overall, the evidence contradicts the dominant narrative.”

It is ugly,” a senior official with the Defense Intelligence Agency tells Newsweek. “But we forget that two peer competitors fought over Bucha for 36 days, and that the town was occupied, that Russian convoys and positions inside the town were attacked by the Ukrainians and vice versa, that ground combat was intense, that the town itself was literally fought over.”

The official, who has been conducting intelligence analysis of the Ukraine war and requested anonymity to discuss classified matters and share personal views, says the Bucha effect led to frozen negotiations and a skewed view of the war.

“I am not for a second excusing Russia’s war crimes, nor forgetting that Russia invaded the country,” says the DIA official. “But the number of actual deaths is hardly genocide. If Russia had that objective or was intentionally killing civilians, we’d see a lot more than less than .01 percent in places like Bucha.”

It is ugly,” a senior official with the Defense Intelligence Agency tells Newsweek. “But we forget that two peer competitors fought over Bucha for 36 days, and that the town was occupied, that Russian convoys and positions inside the town were attacked by the Ukrainians and vice versa, that ground combat was intense, that the town itself was literally fought over.”

The official, who has been conducting intelligence analysis of the Ukraine war and requested anonymity to discuss classified matters and share personal views, says the Bucha effect led to frozen negotiations and a skewed view of the war.

“I am not for a second excusing Russia’s war crimes, nor forgetting that Russia invaded the country,” says the DIA official. “But the number of actual deaths is hardly genocide. If Russia had that objective or was intentionally killing civilians, we’d see a lot more than less than .01 percent in places like Bucha.”

https://www.newsweek.com/how-us-intel-sees-russias-behavior-after-bucha-1697074

I wonder if Biden would characterize US destruction of Fallujah as genocide? Of course not…it’s fine when the US commits war crimes, but it’s not OK when others behave the same way…disgusting double standards.

You’re not smart enough to realize the hole you’ve been digging for yourself is getting deeper by the post.

You’ve now gone completely 5th grade by adopting the “they did it, so we can do it too” defense.

Keep digging. At this rate, there’s no way out for you, but lots of shoveling will make all that righteous indignation you spout seem worth it.

Or is that alleged righteous indignation?

Don’t insult 5th graders this way. They are WAY smarter than this troll and they also tend to care about people who are victims of war crimes.

JohnH,

Oh, back with Fallujah are we? 600 civilians were killed there out of 337,000, no reports of decapitations or child rapes before killings. In Bucha it was over 300 out of about 30,000, which some DIA guy was quoted as calling “0.1 oercenbt,” which is more like 1 percent. Much higher than Fallujah and indeed decapitations, disembowelings, rapes of children, and people shot in the back of the head with hands tied behind their backs. That is not just people getting killed because two sides were fighting over the place. Also, Fallujah was the home of a militia attacking neighbors. Bucha was a harmless town just minding its own business.

Sorry, JohnH, you are making yourself accomplice of war crimes far beyond anything US has pulled ever.

https://www.msn.com/en-us/news/politics/wisconsin-supreme-court-justices-question-ballot-drop-boxes/ar-AAW9RIq?ocid=msedgntp&cvid=cb4d129dbd6e4bb4a144b73879ba0aed

Wisconsin Republicans so desperately want to limit the right to vote – they bring up absurd arguments as to how to place one’s vote in a drop box. And it seems one conservative member of their Supreme Court are calling out these absurd attempts to deny the vote.

https://jabberwocking.com/chart-of-the-day-the-produce-price-index-vs-the-consumer-price-index-in-march/

Kevin Drum is telling us PPI inflation has exceeded CPI inflation since 2021. So does this mean retail prices have fallen relative to manufacturer prices, which seems to suggest that retailers are seeing their profit margins erode. If this is right – then another JohnH thesis bites the dust as he kept insisting retailers have yuuuge monopoly profits. His evidence? He don’t need no evidence!

Of course I have evidence. “ 56% of retail businesses say inflation has given them the ability to raise prices beyond what’s required to offset higher costs.”

https://digital.com/half-of-retail-businesses-using-inflation-to-price-gouge/

It’s economists who deny monopolistic price gouging who have no evidence…because strangely…they don’t bother to conduct surveys that ask the question!

You actually think this fluff is economic evidence? Yep – you are the dumbest troll ever.

If you don’t like my evidence, produce evidence you like. Good luck with that. The government and private companies produce data on all sorts of things, but…strangely…they almost never ask businesses how much they plan to increase prices…or whether they plan price increases in excess of inflation.

And there is absolutely no push among economists to have somebody collect the data, which would be very useful in forecasting inflation.

Those most responsible for rising prices are exactly the same executives who make the decision to raise prices, but…strangely…no one thinks to ask them…gigantic oversight or implicit coverup? We can’t make the rich and powerful uncomfortable with inconvenient questions, now can we?

Minus his humor—accompanied by any noticeable talents or ability to make coherent points—you’ve become Econbrowser’s version of Rodney Dangerfield.

You get no respect, and rightfully so. The last few weeks (months really) have been rough, and this week is no different.

RIP, Rodney. No disrespect or real comparison intended.

@Ivan.

Biden is not brilliant and he has not engineered anything other than taking measures targeted at restricting oil supply and distribution growth which is incredibly bullish for oil & gas producers and pipeline companies (as well as investors). Biden seems to be reacting to events and taking immediate measures in hopes of minimizing the devastation in the mid-term elections.

This myopic, populist president is not much different in some respects from the last populist president. Both Biden and Obama are big proponents of the US cheap energy entitlement.

Eric Poole,

Why are you making yourself look like a complete idiot by saying that “the last populist president” was Obama? Absolutely everybody other than you identifies Trump as the most blatant populist president we have had. Perhaps you have some special insight on this matter? Have you published these insights in peer reviewed academic journals and been heavily cited for doing so? Or are you simply parroting some also especially stupid Fox News bloviater?

You have in the past occasionally said semi-intelligent things. But indeed, this just makes you look like some propagandistic idiot. Pathetic.

https://www.msn.com/en-us/news/world/russia-duma-deputy-says-kremlin-fighting-fourth-reich-in-ukraine/ar-AAWaUaN?ocid=msedgdhp&pc=U531&cvid=3b996275d00d4bbc9467c8470699e442

Russia’s disinformation would be comical if this invasion of Ukraine were not so brutal. A Putin supporter is still trying to paint Ukrainians as Nazis? No dude – the Putin pigs are the Nazis.

pgl,

WaPo reports that since the withdrawal from the Kyiv region, there has been a consciously directed from above campaign in Russia to substantially escalate the propaganda campaign against Ukraine and Ukrainians, with the idea that they do not have a separate identity and any Ukrainian who dares to assert they do is a Nazi and should simply be eliminated. The rhetoric has gone fully genocidal.

https://www.msn.com/en-us/money/markets/china-s-biggest-offshore-oil-and-gas-producer-is-preparing-to-exit-operations-in-the-us-uk-and-canada-due-to-concerns-around-sanctions-a-report-says/ar-AAWb29T?ocid=msedgdhp&pc=U531&cvid=8f012c0ea68c4808a3238661b7f98d83

CNOOC, a Chinese state-owned offshore oil and gas producer, is preparing to exit its operations in the US, UK, and Canada because of sanctions concerns, regulations, and costs, industry sources told Reuters. A senior industry source told Reuters that CNOOC wanted to sell “marginal and hard to manage” assets in the three countries. They said that CNOOC’s top management found it “uncomfortable” to manage the Western assets because of regulations and high operating costs.

CNOOC had entered the three countries through a $15 billion acquisition of Canadian oil and gas giant Nexen that closed in 2013. The company had been listed on the New York Stock Exchange since 2001 but former President Donald Trump’s administration added CNOOC to a list of countries it claimed were owned or controlled by the Chinese military in December 2020. Following an executive order by Trump, CNOOC was delisted from the NYSE in October 2021, the company said.

It was removed from the blacklist by President Joe Biden’s administration in June 2021. “Assets like Gulf of Mexico deepwater are technologically challenging and CNOOC really needed to work with partners to learn, but company executives were not even allowed to visit the US offices,” the senior industry source told Reuters. “It had been a pain all along these years and the Trump administration’s blacklisting of CNOOC made it worse.”

《Kevin Drum is telling us PPI inflation has exceeded CPI inflation since 2021. So does this mean retail prices have fallen relative to manufacturer prices, which seems to suggest that retailers are seeing their profit margins erode.》

What if producers are making more in financial markets than from real economy sales?

What if they aren’t? Seriously, you really need to grow a spine and stop hiding behind disingenuous questions.

If producers are making more from finance than from from sales, it will show up in their quarterly reports. Go look it up. Prove it. Unpess, of course, you don’t know how.

It would just be meaningless noise like all other economic data is according to you, rsm.