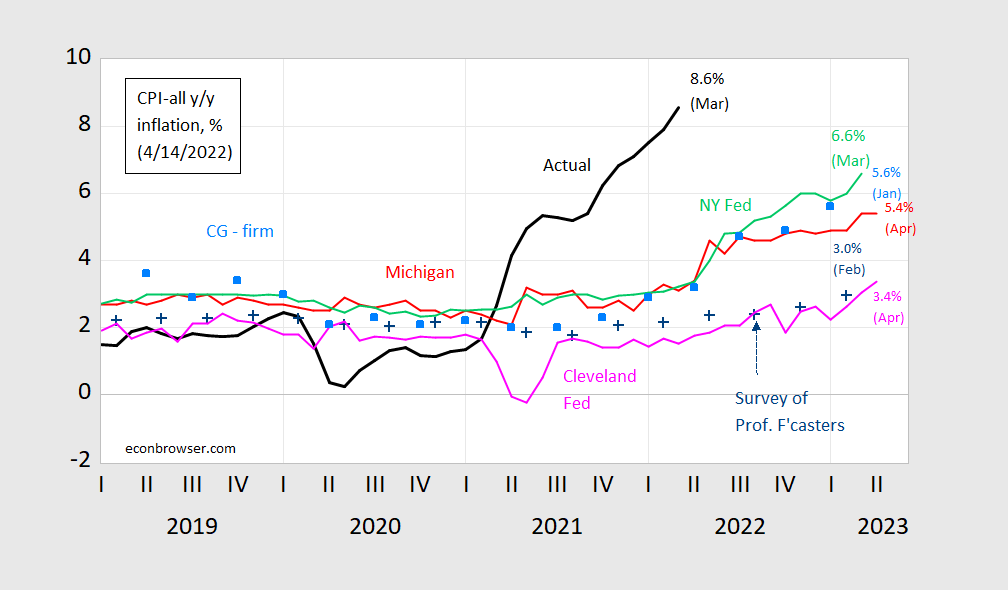

Figure 1: CPI inflation year-on-year (black), median expected from Survey of Professional Forecasters (blue +), median expected (preliminary) from Michigan Survey of Consumers (red), median from NY Fed Survey of Consumer Expectations (light green), forecast from Cleveland Fed (pink), mean from Coibion-Gorodnichenko firm expectations survey [light blue squares]. Source: BLS, University of Michigan via FRED and Investing.com, Reuters, Philadelphia Fed Survey of Professional Forecasters, NY Fed, Cleveland Fed and Coibion and Gorodnichenko.

In terms of accuracy and bias, a new study by Bennett and Owyang (forthcoming) is very relevant.

So, can we be 90% confident that inflation will be somewhere between 0 and ten percent?

Since at least 2000, Fed policy has been more responsive to economic slack than to short-term (or, in fact, any-term) inflation expectations:

https://fred.stlouisfed.org/graph/?g=OfAI

Now, of course, both inflation and slack are consistent with a policy stance far tighter than the current stance.

That doesn’t make the Fed’s job easy. Two big real-side shocks have induced a sharp rise of inflation. Does that mean the underlying disinflationary regime has shifted to a more inflationary regime? To soon to tell, I should think. For all the academic focus on expectations, real economic forces seem to have played a very large part in disinflation. There is a good bit of speculation that those real-side disinflationary forces have themselves been weakened by the big shocks – the whole “globalization is dead” thing.

The “opportunitistic disinflation” approach to monetary policy took the Fed off the hook (in theory) for causing recession. The dual mandate allows a much less draconian balancing act if policy makers believe that taking the foot off the gas is all that’s ever needed. Opportunistic disinflation means never having to step on the breaks.

If the world remains, underneath it all, disinflationary, the Fed can be far less aggressive in tightening than otherwise. Debtor nations, commercial and residential MBS, junk-financed buy-backs and buy-outs, private equity pirates, asset valuations and credit-financed wealth generation in general, face a very hard future if central banks go back to balancing inflation risk against growth on a more or less full-time basis.

Probably should have written that Fed policy is more responsive to slack than inflation expectations since around 1990. Rough guess, either way.

It would be very interesting to know the assumptions behind each forecast. For example, what will be the Fed funds rate during that period (how aggressive will the Fed be raising interest rates?). Will energy costs be up, down, pretty much as they are now? How about food costs? It would seem that the focus now is on energy costs, but a lot of voices being raised about food shortages later this year. How about all of the supply chain issues? When do they get resolved in the forecasts? Will housing prices go down because of higher mortgage rates or stay high because of lack of inventory?

And, of course, is there a recession somewhere in those forecasts dampening general demand?

One would like to believe that current models from the Fed would have assumptions about those issues/variables whereas consumer expectation surveys would be the least informed and most likely to extend current conditions into the future. So why are the Cleveland and NY Fed projections so far apart?

Bruce Hall: SPF, Michigan, NY are surveys of individuals, with different conditioning assumptions – the latter two of households. Coibion and Gorodnichenko’s survey is of company CFOs. Cleveland is a hybrid survey/financial market data forecast.

If you wanted to know what the assumptions were, then a relevant forecast to apply that to would be to a specific model forecast. But to my knowledge, none of the forecasts that are often mentioned churned out of one single econometric model (for instance Fed Board relies on a ensemble of models).

Now, if you were to ask “what is Moody’s model assuming in their forecast?”, that would be a well-defined question.

“One would like to believe that current models from the Fed would have assumptions about those issues/variables whereas consumer expectation surveys would be the least informed and most likely to extend current conditions into the future. So why are the Cleveland and NY Fed projections so far apart?”

I have to give up when I read such nonsensical queries. Of course both modelers consider relevant considerations including expectations of market players. But Bruce Hall has to emphasize that somewhat irrelevant Michigan consumer expectation survey just before he could not understand why two different models might have different forecasts? Does he bother to understand anything here? It seems the answer is no,

Lucy,

I used to work in conjunction with Ford’s economics office way back in the 1970s when I programmed multivariate models in a relatively new language (for business) called Fortran, so I know the difference between real econometric models and opinion surveys. But “real” models are not just averages of models (Menzie: “for instance Fed Board relies on a ensemble of models”). Hell, the IPCC for quite awhile relied on many models for its climate change projections and they all (except a couple, including one from Russia… wait for the screech) have overshot observations. https://www.cfact.org/2021/04/29/climate-models-hotter-than-reality/

My model in 1978 predicted the automotive crash of 1979 and saved us millions in inventory costs, but only because the inputs were pretty damned accurate. And even then, the VP to whom I presented the projection that went against the grain of every other forecast being presented decided to go with a worse sales number for planning purposes… and his intuition was better than the model and completely opposite what he was being presented by other parts of the organization. So, yeah, I understand computer models and their weaknesses. They can be great at hindcasting and really crappy at forecasting unless your input assumptions are good, and that’s the really hard part. So when I asked Menzie what was considered and why the two Fed branches came up with such different results, I had a pretty good idea that the assumptions in whatever methodology they chose didn’t align.

That just reinforces my perception that the mathematics in economics modeling is strongly reliant on craftsmanship and awareness more than rigid relationships of what has happened in the past. Sure, statistical relationships can explain what happened, but it’s the economist with the finely tuned eye for where the myriad of inputs are headed that comes out with a “model” that does a decent job projecting using those relationships. Otherwise, you’d just take the current information, choose the leading indicators, and crank out the answer (which may be exactly what is being done for all I know – oops, another screech coming). Of course, you get what you got in the graph above.

Oh, but you knew all that.

Fortran is for dinosaurs. But you worked for Ford? I guess you where the one who came up with those STUPID WIN buttons. Yes – Bruce Hall gave us the 1975 recession which led to Jimmy Carter being President. Brucie – I would not brag about being a low level economic advisor to Gerald Ford. But wow – this experience!

‘My model in 1978 predicted the automotive crash of 1979 and saved us millions in inventory costs’

High interest rates leading to a reduction in durable goods demand. Not exactly a new idea even back then. But you want to talk to us about inventories given you thought Just In Time Inventory management was the right thing to do for automobile companies in the last couple of years. Yes – Bruce Hall goes from giving us the 1975 recession to the current semiconductor shortage.

Any more damage you wish to take credit for?

“so I know the difference between real econometric models and opinion surveys. But “real” models are not just averages of models”

I learned Fortran back in the day. Dude if you think real models are averages of model (whatever that means) your ability with something logical as Fortran must really suck. Seriously dude – did you flunk preK reading or what? Your pathetic writing skills are getting worse by the day.

“I used to work in conjunction with Ford’s economics office way back in the 1970s when I programmed multivariate models in a relatively new language (for business) called Fortran”

Are you really this ignorant of this history of Fortran progamming? I had to review my notes but the first version of Fortran came out in 1953. Yea Fortran IV came out in 1962 so by the time you used it – it was quite old.

Hey – I have some news for you. Blackberry came out with a relatively new form of the flip phone. Check it out!

“Fortran is for dinosaurs.”

I would disagree with that. if you are doing numerical work, you really can’t get anything faster or better than fortran. and I mean large scale numerical work, not just something on a pc. it might be old, but its tough to beat in certain situations. but yeah, unfortunately it is a disappearing breed.

Lucy,

That’s the best snide remark you can make? You’re slip slidin’ away. Have you actually accomplished anything in your brief existence? I’m guessing that you learned how to use a computer playing Tetris on your daddy’s Macintosh when you should have been learning to read.

But you want to talk to us about inventories given you thought Just In Time Inventory management was the right thing to do for automobile companies in the last couple of years. Hah! You can absolutely misread anything and come up with the exact opposite of what was written. I’d like to try a little of what you are on full time. You know, just for a recreational buzz.

And, BTW, interest rates were not part of the model… not necessary or relevant. But I guess they would be to a day trader.

Hmmmm..

Well, I was programming in Fortran back in the 60s. But baffling is right that it is still being used by some fairly high powered people.

That said, it looks like if Bruce’s model for the Ford Motor Co., probably not the Ford admin, accurately forecast the 1979 slump in auto sales, it did so for the wrong reasons if it did not have the interest rate in it. Ex post most observers think that the main reason for the general economic decline in 1979, which included auto sales, was the tight monetary policy put in place by Volcker in 79, which involved a sharp increase in interest rates..

Bruce Hall

April 15, 2022 at 12:48 pm

First you denied that you said Just in Time Inventory was the only right approach. Yea you do say a lot of STUPID things that you later deny. Followed by the unbelievably dumb claim that interest rates do not matter to the optimal holding of inventory. Gee Bruce – that is the dumbest statement ever on the internet. Ever heard of William Baumol and his 1952 classis? Didn’t think so.

@ Bruce Hall

So the rumors of you being the original engineer and senior clay modeler of the Ford Pinto are false??

Speaking of the University of Michigan…

WASHINGTON — President Joe Biden said Friday he plans to nominate Michael Barr, the dean of the University of Michigan’s public policy school, to be the Federal Reserve’s vice chairman of supervision.

…

Barr would be joining the Fed at an especially challenging and high-risk period for the central bank and the economy.

The Fed is set to raise interest rates aggressively in the coming months to try to reduce persistently high inflation. Yet it will be extraordinarily difficult for Fed Chair Jerome Powell — who is awaiting Senate confirmation for a second term — to slow inflation by raising borrowing costs without also weakening the economy and perhaps even causing a recession.

“This is about landing a very complicated plane on the runway smoothly,” Dworkin said. “It’s very hard to do.”

https://www.freep.com/story/news/local/michigan/2022/04/15/michael-barr-federal-reserve-joe-biden/7330060001/

Couple of weeks ago, resistance groups in Myanmar were telling the world that Myanmar’s military regime intensed to engage in what amounts to chevauchée in the countryside. Well, $#!+, here’s what Reuters reports today:

https://www.reuters.com/world/asia-pacific/troops-burn-villages-myanmar-heartland-seek-crush-resistance-2022-04-14/

I’d be interested to know if macroduck ever commented on US droning of wedding parties and funeral processions in Afghanistan.

I suspect is “deep concern” for human rights magically disappears when “our side” commits the atrocities…

JohnH has a new job – supporting another group of brutal killers! You have found your life’s calling!

You have mistaken your own ethics for mine. Not surprised. You seem to think everyone else is as bad as you are. Perhaps cognitive dissonance rearing it’s head as a result of selling out?

Nice try with what-about-ism, by the way.

its not that there is no concern. I am not happy about those accidents. but those are accidents, and they happen rarely. what is happening in Ukraine is intentional and daily. John, you are trying to make the actions of two countries equivalent. they are not even close. John, why can’t you bring yourself to declare Putin is a war criminal, without trying to argue equivalence?

“why can’t you bring yourself to declare Putin is a war criminal”

You do know Putin only feeds his poodles when they obey. If JohnH decided to say the right thing just once – he would die of starvation inside the Kremlin,

JohnH, do you ever talk about atrocities without couching your comments in the derision of hypocrites? Because it seems like for you, bringing up atrocities is just a means of badmouthing hypocrites. It’s almost like the atrocities themselves aren’t what bother you.

He has repeatedly shown ZERO concern for the citizens of Ukraine. I guess he thinks his consistency here is a virtue.

He has repeatedly shown ZERO concern for the citizens of Afghanistan too. He doesn’t care about them. They’re just puppets for his morality play that blames hypocrites for all the world’s problems, or at least his own. It’s all about him.

He’s a teenager.

Bennett and Owyang stated that professional forecasters were not as accurate as models. This might have been in the back of their minds.

https://ei.marketwatch.com/Multimedia/2017/06/23/Photos/NS/MW-FP104_deutsc_20170623130002_NS.png?uuid=65f5d4d6-5835-11e7-b3f5-9c8e992d421e

That blind squirrel occasionally finds the acorn..

“Bennett and Owyang stated that professional forecasters were not as accurate as models.”

Ah your chart does not show the forecast errors as whatever model you were alluding to. I would trust a blind squirrel over someone like you who just makes BS up.

Lucy,

Can you provide me a link to whatever random word generator you use to write your comments? Thanks in advance.

Just ask Kelly Anne how she writes your gibberish. BTW – your failure to understand basic economics makes you think any sane statement must be a random word generator. Now we would ask you to learn basic economics but we all get that you are too dumb to do so.

No, Brucey. They had inflation forecasts in the front of their minds. Says so right in the title of their paper.

Macro,

From the B&O paper: First, professional forecasters are generally better than consumers and simple models at predicting inflation.

The issue then is what are “simple models”. Looking at Menzie’s chart, the Survey of Profession Forecasters (+) didn’t do the greatest job since Q2:2021. Still, I can appreciate that these professional forecasters should have their finger on the pulse of the economy in both a mathematical and intuitive way (much the way that the Ford VP in my previous comment reacted to the model output I had provided) assuming they could rely on years of experience.

Models that rely only on long term historical relationships and cannot adjust for recent disruptions (simple models?) are apt to miss quick turns. Models are only as good as the thinking behind them.

Bruce Hall: Perusal (i.e., reading the paper), one would find the “simple models” are AO (random walk), and VAR.

When professional forecasters use macroeconometric (structural, Cowles Commmision) type models, they typically include “add factors”, which are what you call “judgment”. By professional, I mean economists who sell their forecasts (bank research departments, consulting firms).

Bruce thinks this was all some random word generator. So to expect him to understand what they wrote is asking way too much.

“Models are only as good as the thinking behind them.”

Like your Ford model that pretended that Volcker’s high interest rates would not affect durable goods sales!

Brucey! You got some reading to do!

Your chart was to an interest rate chart. Your assertion was that authors of an inflation forecastin model had interst rates in mind. I pointed that out. Your rebuttal is non-responsive. Learn to read.

What if Congress changed Section 2A of the Federal Reserve act to mandate an inflation-adjusted basic income and maintaining real purchasing power rather than trying to control arbitrary, fickle nominal prices?

Wouldn’t we all be better off than with the gross uncertainties that the current mandates have repeatedly resulted in?

Still hiding behind questions? Poor, sad rsm.

you almost seem to be arguing for a socialist, communist government? am I reading you correctly?

Have you heard of this Crypto Dating App scam? I bet rsm is the one trying to pull this high tech theft off!

https://knowtechie.com/cryptocurrency-scams-are-infiltrating-dating-sites/#:~:text=A%20new%20kind%20of%20cryptocurrency%20scam%2C%20called%20%E2%80%9C,conning%20them%20into%20investing%20in%20phony%20cryptocurrency%20exchanges.

It’s almost as if money and prices have an effect on the real economy.

Yesterday there seems to have been some confusion over my assertion that real average hourly earnings are now back to where they were before the pandemic, even after I linked to my sources, which required looking for the data under “chart data.”

I stand by that assertion and provide two links that substantiate it:

1) The March 11, 2020 Real Earnings News Release shows real average hourly earnings for all employeesat $11.01 in February, 2020. The seems to have been revised to $11.02 subsequently.

https://www.bls.gov/news.release/archives/realer_03112020.htm

2) The April 12, 2022 Real Earnings News Release for all employees shows real average hourly earnings at $11.03.

https://www.bls.gov/news.release/realer.t01.htm

People are obviously free to generate their own “real” earnings numbers using preferred data sets and alternate deflators. However, a the fact remains that major BLS statistic clearly shows that real wages are back to where they were before the recovery. It should call into question the assertion that workers have been prospering lately. It should also help answer those who simply can’t understand the widespread discontent by workers in the current economy.

February 2020 is the period of the recovery? WTF? OK, real wages by your preferred measure are only slightly higher than they were 25 months ago before the PANDEMIC. Learn to write. BTW – I used a 24 month period as in 2 years. I guess you think a 2 year time frame is “moving the goal posts” as 25 months is always the right metric. Whatever.

Now had you bothered to state all of this in the first damn place, it would have saved you from writing 300 really dumb comments. Again – learn to write.

Johnny, Johnny, Johnny,

You must have serious doubts about your own intellect. Creating straw men to shore up your argument suggests you don’t have much confidence in the argument itself.

Now, this is one point on which you and I are in agreement; I don’t have much confidence in your intellect, either. But pretending to be able to read others’ thoughts, as you very often do, is a clear recognition of your own weakness. If your argument is solid, you should be able to stack it up against other people’s arguments in good faith. Instead, you pretend that the other guy secretly holds some view (“can’t understand the widespread discontent…”, etc) when there’s no evidence the other guy holds that view.

In resorting to transparent trickery, you compound your basic weakness. You begin with intellectual weakness and then add the moral weakness of being dishonest in your arguments.

Johnny, Johnny, Johnny…

Johnny boy wants us to believe that those “serious” economist are not addressing the fact that of late wage inflation has not kept pace with price inflation. Now on April 13, this dude at Brookings did so in detail with some excellent analysis that of course Johnny boy has not read (and would not get if he did):

https://www.brookings.edu/research/tight-labor-markets-and-wage-growth-in-the-current-economy/

Krugman, April 12: “ Rising wages are a good thing, but right now they’re rising at an unsustainable pace… This excess wage growth probably won’t recede until the demand for workers falls back into line with the available supply, which probably — I hate to say this — means that we need to see unemployment tick up at least a bit.”

https://www.nytimes.com/2022/04/12/opinion/inflation-consumer-prices.html

Yeah, Krugman thinks workers are doing great. But pgl and macroduck deride the fact that some economists think that. Straw man? Nope! Apparently macroduck and pgl are totally ignorant of what prominent economists are writing these days!

Since real wages are actually falling, and have been for some time, it appears that Krugman is advocating for wages to drop more. And since they are already back to February, 2020 levels, that would mean wage levels of the 2010s. How far back? A 7% decline takes us back to the Obama era.

In any case, I expect the Fed do the dirty work in short order.

“Krugman thinks workers are doing great.”

A complete misrepresentation of what he wrote. If you do not know why your misrepresented what he wrote – then you are indeed the dumbest troll ever. Now maybe you got what he was saying. Then you are a lying scum.

The title of this oped was Inflation is About to Come Down. Krugman noted why he expects that. Now Johnny boy – either you are too dumb to read even a title or you are hoping we have higher inflation. Which is it johnny boy – are you dumb as a rock or a total lying hypocrit? There are only two choices so pick one or just take your worthless rants somewhere else.

Yesterday there seems to have been some confusion over my assertion that real average hourly earnings are now back to where they were before the pandemic, even after I linked to my sources, which required looking for the data under “chart data.”

I stand by that assertion and provide two links that substantiate it:

1) The March 11, 2020 Real Earnings News Release shows real average hourly earnings for all employeesat $11.01 in February, 2020. The seems to have been revised to $11.02 subsequently.

https://www.bls.gov/news.release/archives/realer_03112020.htm

2) The April 12, 2022 Real Earnings News Release for all employees shows real average hourly earnings at $11.03.

https://www.bls.gov/news.release/realer.t01.htm

People are obviously free to generate their own “real” earnings numbers using preferred data sets and alternate deflators. However, a the fact remains that major BLS statistic clearly shows that real wages are back to where they were before the pandemic, despite the recovery. It should call into question the assertion that workers have been prospering lately. It should also help answer those who simply can’t understand the widespread discontent by workers in the current economy.

“It should call into question the assertion that workers have been prospering lately.”

Who has said this? Most economists I know recognize the fact that price inflation has exceeded wage inflation in the past few months. Oh wait – you have the secretive list of those “serious economists” who must be really dumb even if you are incapable of providing even a single name.

“Yesterday there seems to have been some confusion”.

There was a lot of confusion – generated by YOU. I would suggest you take a little responsibility but we all know – you are not that kind of person.

The opening line in this April 13 paper from an economist at Brookings:

Labor markets in the US are currently tight, and are generating substantial growth in nominal wages – i.e., those measured in current dollars (not adjusted for inflation). On the other hand, wage growth does not appear to be keeping up with inflation right now, regardless of how the latter is measured.

So when you write BS like this “It should call into question the assertion that workers have been prospering lately.” It only shows what a lying little twit you really are.

This is a great discussion. READ IT troll and ST$FU.

I get the fact that Feinstein is 88 years old. And I am well aware she is not liked by certain people on the far right as well as on the far left. But come on – there are a lot of male Senators who are not only really old but also certified ding bats:

https://www.nbcnews.com/politics/congress/sen-dianne-feinstein-pushes-back-reports-mentally-unfit-serve-rcna24547

pgl,

I have heard from inside sources for some time that Feinstein is by far more out of it than any other senator. This is not a new situation. It has just become worse and more public. It is an unfortunate travesty that she ran for reelection.

The question has been raised whether those sources are saying this because she is a woman. I have no real inside information but I wish her well. But maybe the governor should do a little planning – just in case. And for Nov. 2024 – California Democrats should groom a strong replacement.

My most inside source is female,. That is not it, pgl. She should have retired, but now we are stuck with her for a long time. This is a bad situation that is getting worse. Yeah, there are others, but apparently it is really bad with her and has been for several years.

No names? Marjorie Taylor Greene is female and I would not trust a word out of her racist pathetic mouth.

pgl,

No name, but very inside, way more knowledgeable than some freshly arrive nut like Greene.. Someone who is publicly known but that I know very well personally. Come on, pgl, do you want to act like Moses Herzog here? I am not going to say the name, but I think you actually do know that I actually do know the people I say I know.

Why on earth do you think people are lying about Feinstein? This has been in fact known for several years now. It has just gotten really out of control bad recently. There are limits to how long this sort of thing can remain semi-covered up.

@ Barkley Junior

Wait, what?!?!?!?!?! I feel deeply hurt in the soft spot of my heart right now. After I sent the 74 chocolate bunnies to your home residence today and this is how you treat me?!?!?!? I have always given you credit as the one and only American with true “inside sources” in Russia. Witnessed by one of my favorite comments of yours:

February 16th, Barkley Junior said:

“Do keep in mind I am the one here with access to Russian media. That has now been blaring for several days that the troops will go home after the exercises are done, and exercises are exactly what they are doing now. This has more recently been reinforced by statements from Putin in press conferences, such as the one just held after the visit of German Chancellor Scholze.

There is not going to be an invasion, even if some of the details of what Zelensky and Ukraine may agree to are not fully settled, and Victoria Nuland has been shooting her mouth off too much, somebody I wish was not part of this administration.”

If anyone ever questions your insider connections to Russia’s inner-workings Barkley, you send them to my house, I’ll put on my Everlast boxing gloves and set them straight. I tell you it gets me riled to think someone would question your personal credibility as a Russian insider. I don’t care if it’s Masha Gessen, I will punch her lights out. They’re all lightweights next to you Barkley. Your thoughts on Kharkiv on February 23rd proved very clairvoyant:

“According to a long story in today’s WaPo, people there are pretty calm, although according to you they should be running around freaking out. It may be that they are all a bunch of fools. But in fact I suspect another element of this is that because the city is dominated by ethnic Russians, they figure that life will go back to normal if they get conquered. But all accounts they do not support Putin or an invasion. But if it happens, they will move on.”

And those American embassy diplomats you labeled cowards for heading to Western Ukraine “early” in the game, are you kidding me!?!?!?! Who gave you a hard time over that the same day you said it?? WHO!?!?!!? I’ll tear that man to shreds Barkley, the man who would question YOU. I won’t let the naysayers doubt your Russian insider connections Professor Rosser. There are always those who will take your prior statements on Russia and requote them in bold print. Not me brother.

BTW, Does anyone out there know if this beats Barkley Rosser’s old world record for using the personal pronoun “I” in a single sentence??

“I am not going to say the name, but I think you actually do know that I actually do know the people I say I know.”

We need to phone Guinness World Records if this beats Barkley’s personal best.

Moses,

Oh, you are at it again, questioning the judgment of Ukrainian President Zelenskyy? Congratulations.

As for this business, you have repeatedly denounced Nancy Pelosi as allegedly “senile,” including me and Joe Biden in that more than once as well. You were especially incensed to the point of utter ludicrosity over her ice cream episode, which you denounced so many times I quite lost count. Needless to say, not a single person out there has agreed with your claim about her intellect, even as many agree the ice cream matter was mildly embarrassing, if not all that big of a deal in the end.

But now we have a San Francisco Chronicle story detailing reports from many insiders reporting on the unfortunately worsening mental incapacity of Sen. Feinstein, Pelosi’s fellow and older San Franciscan. I noted that I have heard these reports for a long time from a Senate insider I would prefer not to name, and you proceed to have c complete fit about it. As it is, I heard these accounts before she ran for reelection and was unhappy to see she did not step down then. California is a big state with many capable younger politicians who should have replaced her. So this has been known to me for some time.

So, you who was so down on Pelosi for her ice cream episode, do you want to defend Feinstein because I piled on? I am aware that you are so sick with your idiotic vendetta against me that you actually change your views of public figures based on what I say, often going in the opposite direction. So, now Feinstein can join some others as being Women Moses Defends, although I suspect your enthusiasm will be somewhat restrained as her temperature level is not quite high enough to get you really enthusiastic. But, hey, any minute you may be telling us how she should get the Nobel Prize for her ongoing brllliance and acuity. Go for it, Moses!

But, sorry, no, not telling name of insider aside from being female and not a right wing enemy of Feinstein. It really is the case that I know a lot of people, including a lot in Washington.

https://kawsachunnews.com/mexico-to-nationalize-its-lithium

April 14, 2022

Mexico to Nationalize its Lithium

The President of Mexico, Andrés Manuel López Obrador, stated today that he has already prepared a reform to the country’s Mining Law that would make Mexico’s lithium officially the property of the nation. This reform will be introduced if the ‘electrical reform’ is blocked by the opposition next Sunday.

President López Obrador said in his daily press conference,

“They are not going to put us against a wall. Lithium, which is coveted by both corporations and foreign governments, will belong to Mexico”, affirmed President López Obrador.

“Lithium is white gold and that’s why they are against reforming the Constitution”, he emphasized, adding; “this morning, I have just signed the initiative to reform the mining law, which doesn’t require two thirds. It’s a simple majority, so that lithium remains the property of the nation.”

The electrical reform is about taking back control of Mexico’s energy resources and distribution under the state-owned Federal Electricity Commission. The move has angered the US government as well as the EU because corporations from Spain are set to lose their dominant share in the market….

At a time when the international price of fertilizer materials have risen dramatically and dangerously for developing countries, the only fertilizer producer in Latin America is a state company in Bolivia. The Bolivian company was closed by a coup government representing wealthy interests, but opened immediately after the coup government was dismissed in a national election. The contest over control of resources in Bolivia extends to the campaign for water rights by indigenous Bolivians which resulted in the presidency of Evo Morales, the first indigenous president in the country’s history.

https://fred.stlouisfed.org/graph/?g=OhWK

August 4, 2014

Real per capita Gross Domestic Product for Mexico, Ecuador and Bolivia, 1992-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=OhWN

August 4, 2014

Real per capita Gross Domestic Product for Mexico, Ecuador and Bolivia, 1992-2020

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=OhXu

November 1, 2014

Total Factor Productivity at Constant National Prices for Mexico, Ecuador and Bolivia, 1992-2019

(Indexed to 2019)

https://fred.stlouisfed.org/graph/?g=OhXB

November 1, 2014

Total Factor Productivity at Constant National Prices for Mexico, Ecuador and Bolivia, 1992-2019

(Indexed to 1992)

Interesting. Of course they could raise the royalties charged to the foreign firms and enforce their transfer pricing rules.

https://tradingeconomics.com/commodity/lithium

Lithium prices have increased by a factor of four in the last couple of years. Can you say economic rents?

Touché: “ The fact that profits are entirely missing from the mainstream story about inflation reveals a fundamental problem within mainstream economic theories. On one hand, in their macroeconomics, wages and not profits are always the culprit. That’s because they only have a labor market, and not a capital market (much less a profit rate or, for that matter, a rate of surplus-value), when they analyze fluctuations in prices and output. It’s as if corporate profits are only a residual—what is left over in the difference between wages and wage-driven prices. On the other hand, in their microeconomics, profits represent the return to capital, and thus a key component of commodity prices as well as the driver of economic growth.

Such “capital fetishism” means that profits as the return to a thing, capital, play an important role in the mainstream theory of value but then disappear entirely in the macroeconomic story about inflation.” David Ruccio

https://rwer.wordpress.com/2022/04/15/inflation-and-the-case-of-the-missing-profits/#more-42505

“The amazing thing about Krugman’s story, and that of most mainstream economists, is there’s not a single word about profits. Corporate profits are entirely missing from their story. Inflation is only caused by workers’ wages, not the surplus raked in by U.S. corporations. Which is pretty amazing, given the numbers.”

Congrats – you have found someone as dishonest as you. Krugman never talks about rising profits? Lord – you are either the dumbest troll ever or the most dishonest.

Johnny, Johnny, Johnny,

Just because you can find someone who has said something, that doesn’t mean it’s true. You are, yourself, proof of that. You say things that aren’t true all the time.

David Ruccio has an ax to grind. He is often guilty of one of your favorite intellectual errors, that of assuming a famous member (Krugman) of a group (mainstream economists) speaks for the entire group. So, here are three examples of economists more mainstream than Ruccio, who have said very clearly that firms are taking advantage of inflation news to stack up profits:

Josh Bivens

https://www.epi.org/blog/profits-wages-and-inflation-whats-really-going-on/

Isabella Weber

https://www.npr.org/2022/02/13/1080494838/economist-explains-record-corporate-profits-despite-rising-inflation

Raken Mabud

https://groundworkcollaborative.org/news/new-research-from-groundwork-collaborative-shows-link-between-price-hikes-monopoly-and-corporate-greed

What makes Ruccio’s and, let’s face it, your assertion that nobody is talking about corporate profits as a source of inflation even more ridiculous, is that the business press is all over it:

https://fortune.com/2022/03/31/us-companies-record-profits-2021-price-hikes-inflation/

https://www.businessinsider.com/big-companies-keep-bragging-to-investors-about-price-hikes-2021-11

https://www.bloomberg.com/news/articles/2021-11-30/fattest-profits-since-1950-debunk-inflation-story-spun-by-ceos

Robert Shiller doesn’t want us to talk about it, for reasons which seem to me a bit muddled. There are some high-profile “wage-price spiral hand-wringer. But it is simply not true that mainstream economists ignore profits. Still, you keep sayin it. Which means you are either too ignorant or too dishonest to be listened to.

By the way, it took only five minutes to find those links. So if Johnny cared to know whether his latest “Wah, wah, wah! Economists are mean!” Schtick were true, he could easily have checked.

Wow! Macroduck knows how to provide links. Who knew?

JohnH: Typically, my recollection is that typically in your first comment on any given subject, you do not provide links that are clear to follow that substantiate your point (Note: There are two (2) conditions in this assertion). I am still waiting for your explanation why it took you several days and several comments from me to accede to the point that BLS provides easy access to median income data/median wage data (and was not “hidden” at the Social Security website).

Man, you have not one shred of self-reflection, do you?

You should learn to do the same – troll.

macroduck: Thanks for something actually useful, for a change.

Josh Bivens: “ For example, some well-known economists have mocked the idea that inflation is related to corporate profiteering. Yet some of the world’s most influential policymakers have expressed concern that inflation could spark an outbreak of excessive wage growth. One of these policymakers essentially pled with workers to moderate their wage demands in coming months in the name of slowing inflation. Finally, a Nobel Prize-winning economist claimed not only that inflation has nothing to do with the distributional conflict between labor and capital, but that even raising the specter of this will make it harder for policymakers to tamp inflation back down.”

https://www.epi.org/blog/profits-wages-and-inflation-whats-really-going-on/

Exactly my concerns. But funny, I’ve never seen macroduck or pgl articulate these sentiments.

“But funny, I’ve never seen macroduck or pgl articulate these sentiments.”

I have and macroduck has too. Come on Johnny – when you have to blatantly LIE to “make a point”, you have no point.

Josh did link to a Lawrence Summers tweet which did say:

The emerging claim that antitrust can combat inflation reflects “science denial”. There are many areas like transitory inflation where serious economists differ. Antitrust as an anti-inflation strategy is not one of them.

First of all Paul Krugman does not always agree with Summers. Secondly Dr. Chinn did bother to explain specifically to you what why Summers wrote is not all that crazy. I guess once again you failed to READ what our host provided.

“David Ruccio has an ax to grind.”

I started reading this dude’s blog. You are so right about this clown. It may be the worse non-rightwing economic blog I have ever seen. Such a waste of internet space.

BTW – JohnH is not telling us who this David Ruccio even is. It would have been nice if he had told us that this dude taught Marxist economics at Notre Dame for many years but then decided to start a blog where he can continue to preach Marxism. Of course he will take cheap and dishonest shots at people like Paul Krugman.

Of course I am not saying JohnH is a Marxist as his rants tend to be more akin to a gold bug.

“And profits? Well, they’ve been growing at astounding rates, magnitudes more than wages. Corporate profits (the light green line) rose during 2021 at an average rate of 40 percent, and the profits of nonfinancial corporations (the dark green line) expanded by even more: 69 percent”

Of course they have been lots of economists who have noticed this. For this Marxist and Johnh to suggest they are ignoring this fact is beyond dishonest.

Your guru is a little less than honest about corporate profits:

https://fred.stlouisfed.org/series/CP/

Yea they have increased a lot since they bottomed out during the pandemic. But as the FRED graph notes, they have risen in nominal terms by only 30% since late 2019. And you accuse others of moving the goal posts? You and your guru should write for the National Review where this dishonesty is welcomed.

Let’s see…corporate profits rose 30% in nominal terms since 2019…twice the rate of inflation.

Now how much have real wages grown?

But who’s making that comparison…besides David Ruccio?

As always, pgl the faux progressive growth liberal.

Are you really this damn stupid? Your source claimed nominal profits rose by almost 70%. And now you tell me what I said was correct? OK – troll. You win – I got it right and your dude lied.

30% is “twice the rate of inflation”? Johnny – could you stop writing gibberish here as your preK teacher needs you to do with arithmetic homework.

https://www.nytimes.com/interactive/2022/04/12/well/family/covid-deaths-parents-grandparents.html

April 12, 2022

As Families Grieve, Grandparents Step Up

As many as 200,000 U.S. children have lost a parent to Covid. Their grandparents are taking them in and helping them heal, while coping with their own grief.

By Paula Span

Photographs by Todd Heisler

This is not what Ida Adams thought life would be like at 62.

She had planned to continue working as a housekeeper at Johns Hopkins Hospital in Baltimore until she turned 65. After retiring, she and her husband, Andre, also 62, thought they might travel a little — “get up and go whenever we felt like it.”

She didn’t expect to be hustling a seventh-grader off to school each weekday. But in January 2021, Ms. Adams’s daughter, Kimya Lomax, died of Covid-19 at 43 after three weeks alone in a hospital with no visitors permitted. She left behind a young daughter….

In 2020, candidate Biden said he had a plan to save America from COVID.

In 2022, we have well over a million dead and 200,000 orphans.

I imagine he’ll tell you when he’s running in 2024 he has a plan . . .

I knew he was lying in 2020.

“I knew he was lying in 2020.”

Lying about what?

The guy you voted for twice said we were turning a corner on Covid, like, a dozen times, when he was in office. And then he suggested we ingest Lysol, prompting the company that makes Lysol to make a public statement. And then he said Covid would disappear after Biden won the election.

You’re paranoid about the wrong orange politician.

Pure political.speech. Get a real argument. Have a real thought.

TQuAShaw: : This from Pew Research,3/3/22.

“During the third wave—which continued into early 2021–the coronavirus death rate among the 20% of Americans living in the counties that supported Trump by the highest margins in 2020 was about 170% of the death rate of the one in five Americans that supportedBiden by the largest margin.

As vaccines became more readily available, this discrepancy between “blue” and “red” counties became even larger as the virulent delta strain spread across the country during the summer and fall of 2021 even as the total number of deaths fell somewhat from its third wave peak.

During the fourth wave, death rates in the most pro-Trump counties were about FOUR TIMES what they were in the most pro Biden counties.”

If you have a way to lead unvaccinated nitwits to clinics where such a plan might work, please elucidate. You can lead a reluctant horse to water, but you can’t lead an unvaccinated pro Trump know nothing to a clinic that might mitigate COVID caused damage or death.

But of course. Biden’s plan failed. If only more horse paste had been available….

The IMF has had this same problem with less developed nations, providing and bringing the Covid-19 vaccines to them, only to see they refuse to take the vaccine. This tells you a lot about the level of public education in states controlled by a Republican legislature. Driving it into the ground and worse by the day.

He saved me and 99.9% of those who followed the plan (taking the recommended precautions and getting vaccinated). The other idiots are on their own, because that is what they chose. Who would expect Biden to cure those who refuse to take the medicine? In contrast to the orange clown, Biden didn’t peddle anything dangerous or inefficient.

T.S.,

He had a plan, and it almost certainly reduced the severity of the three rounds of new variants we have experienced since he got in. So he did not lie. He did a lot better than we would have seen if his opponent were still in the WH.

Did his plan succeed in preventing the new variants from appearing? No. Did he claim he could prevent new variants from appearing? No. Is there any plan anybody could come up with, especially D.J. Trump, that would or could prevent new variants from appearing? No.

So your remark is really worthless partisan garbage.

《That’s because they only have a labor market, and not a capital market (much less a profit rate or, for that matter, a rate of surplus-value), when they analyze fluctuations in prices and output.》

Despite Loosey’s screeching, doesn’t this passage fairly describe our blogger Mensa?

What are the implications of inflation for brick-and-mortar instittutions? I’m hoping to open up a small local goods store this summer. Been diving into category management http://www.retailsmart.com/planogram-service as part of my planning and it doesn’t look to good for IRL shopping. Any thoughts?