The Bureau of Economic Analysis announced today that seasonally adjusted U.S. real GDP fell at a 1.4% annual rate in the first quarter. What does this portend?

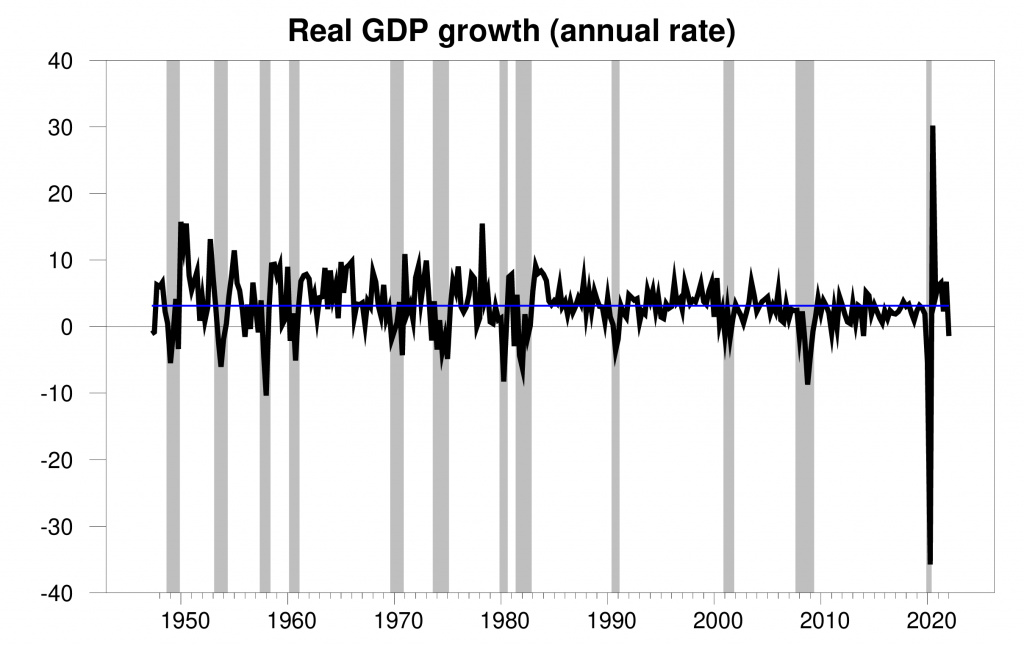

Real GDP growth at an annual rate, 1947:Q2-2022:Q1, with the historical average (3.1%) in blue. Calculated as 400 times the difference in the natural log of GDP from the previous quarter.

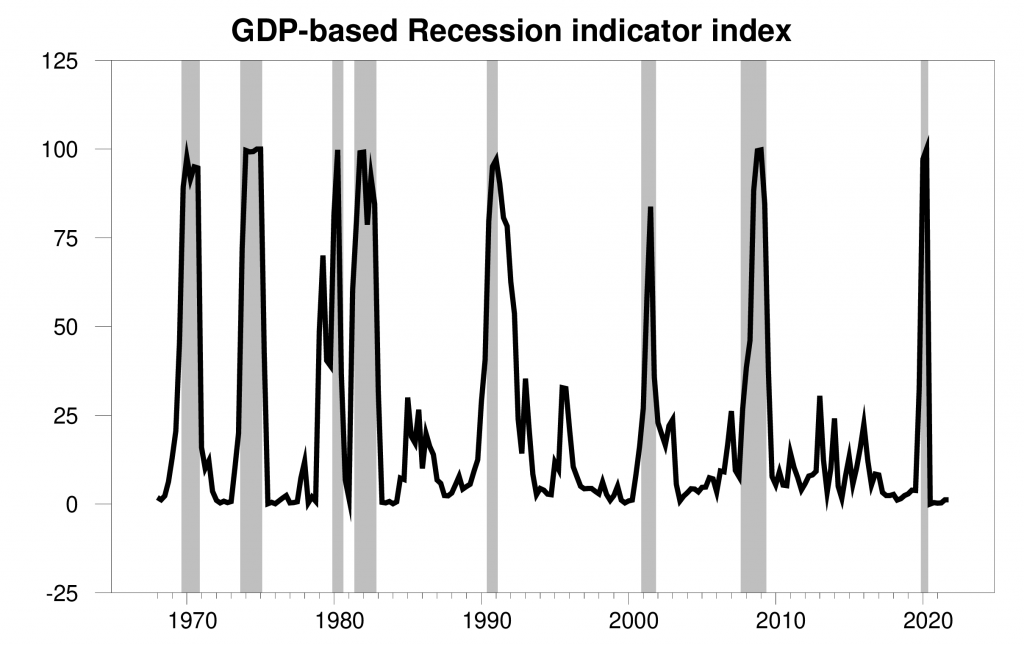

The new data left the Econbrowser recession indicator index at 1.2%, signaling very clearly that the economic expansion continued at least through the end of last year. This is not a predictive measure, but rather is an assessment of the situation of the economy in the previous quarter (namely 2021:Q4). We use the one-quarter lag to allow for data revisions (more on which below) and to gain better precision. This index provides the basis for an automatic procedure that we have been implementing for 15 years for assigning dates for the start and end points of economic recessions. We would declare a recession to have started if the index rises above 67%.

GDP-based recession indicator index. The plotted value for each date is based solely on the GDP numbers that were publicly available as of one quarter after the indicated date, with 2021:Q4 the last date shown on the graph. Shaded regions represent the NBER’s dates for recessions, which dates were not used in any way in constructing the index.

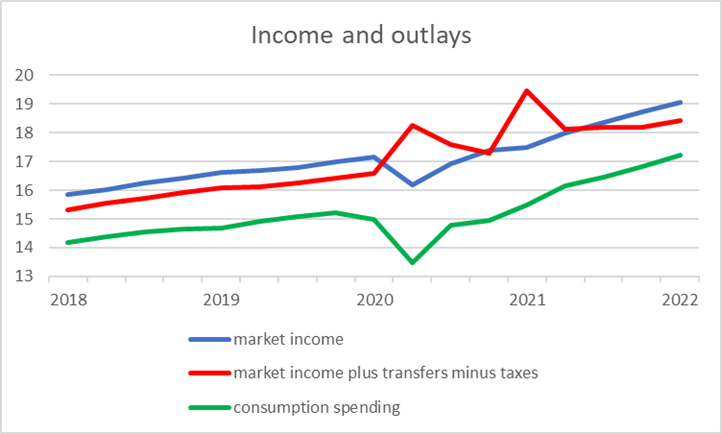

Some may wonder whether a withdrawal of fiscal stimulus could be a factor in the negative GDP growth. I’m skeptical of that possibility. The blue line in the graph below shows personal income excluding taxes and transfer payments, while the red adds transfer payments and subtracts taxes. The Coronavirus Aid, Relief, and Economic Security Act in March 2020 and the American Rescue Plan Act in March 2021 produced huge surges in disposable personal income, with total transfer payments exceeding personal taxes collected. Taxes net of transfers are now back near historical levels. It’s hard to look at this graph and conclude that the stimulus efforts associated with the red line have been the main driver of consumption spending in green. Indeed, the growth of U.S. consumption spending was stronger in 2022:Q1 than it had been in 2021:Q4.

Blue: personal income (PINCOME) plus contributions for government social insurance (A061RC1Q027SBEA) minus government social benefits to persons (A063RC1Q027SBEA). Red: personal income minus personal taxes (W055RC1Q027SBEA). Green: personal outlays (A068RC1Q027SBEA). All data quarterly in billions of dollars at seasonally adjusted annual rates, from FRED. For details see BEA Table 2.1.

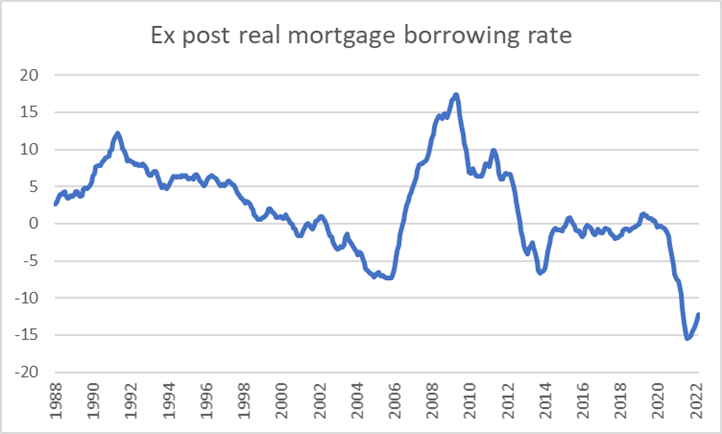

Others may worry about the Fed’s intended interest-rate hikes. We’ve only seen 25 basis points of these so far in the fed funds rate, but anticipation of more to come has already produced a 200-basis-point increase in 30-year mortgage rates since the start of the year. But if you borrow at the current 5% rate and see the price of your house go up 17%, as it did last year, it’s still hugely profitable to buy a home. Granted, it’s not clear how long those house price increases will extend into the future. But historically the series plotted below changes pretty slowly. To be sure, as the Fed continues its tightening cycle in an effort to control inflation, the cycle often ends in a recession. But we’re way too early in the cycle for that to be showing up now, and again, residential fixed investment was slightly stronger in Q1 than Q4.

Nominal interest rate on 30-year fixed mortgage (end-of-month value of MORTGAGE30US) minus the year-over-year percent change in the Case-Shiller national house price index (CSUSHPINSA) for the 12-month period ended two months earlier, from FRED.

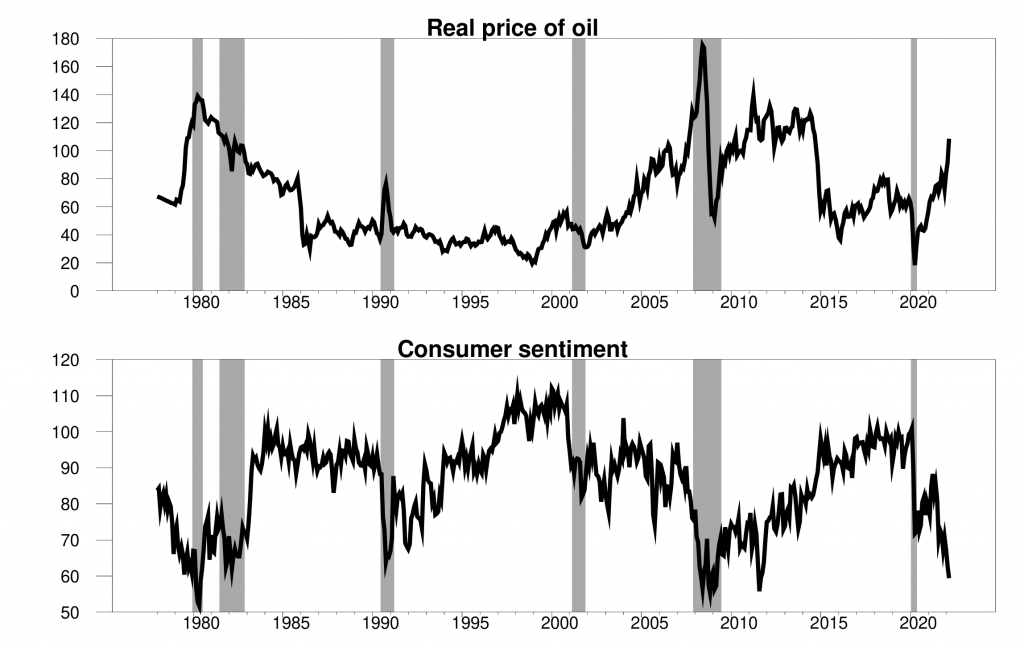

High oil prices are another headwind for the economy. These often send consumer sentiment falling, and the current episode is no exception. However, the current indications are that oil prices will end up lower and consumer sentiment higher in April than they were in March.

Top panel: real price of oil (WTI divided by CPI) in 2022 dollars. Bottom panel: University of Michigan survey of consumer sentiment. Monthly, 1978:M1 to 2022:M3.

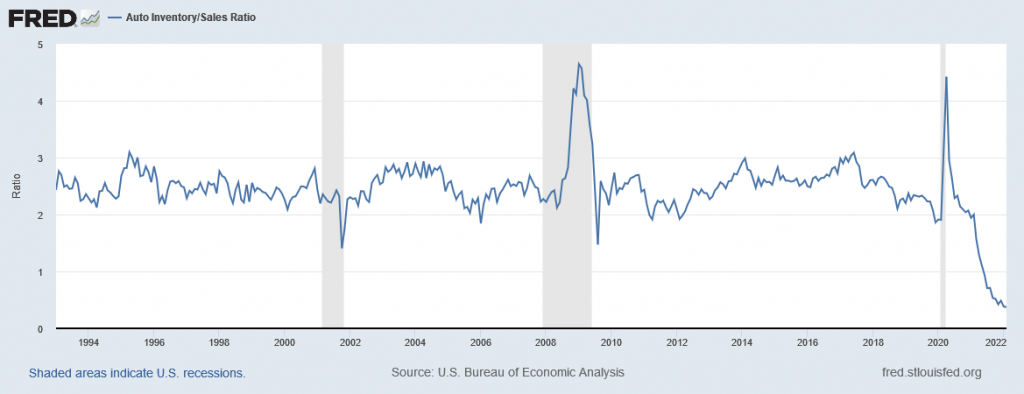

A key place that sinking sentiment would historically show up is in purchases of consumer durables, particularly autos. The quarter-over-quarter growth in these was actually stronger than that of GDP. Inventories of autos have been so low due to supply-chain problems that it seems unlikely that this will be a big source of quarter-over-quarter declines. Lots of room for production gains from restocking even if consumer purchases are anemic.

Source: FRED.

Nonresidential fixed investment is another component of spending where sentiment might show up. But this too has been holding its own.

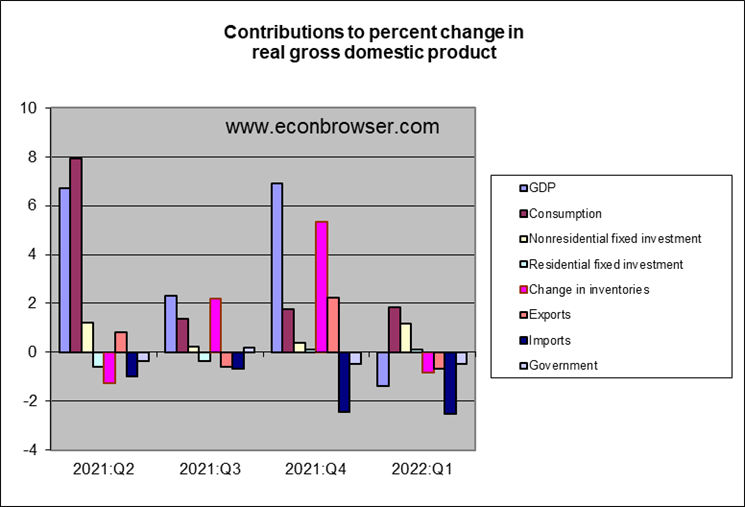

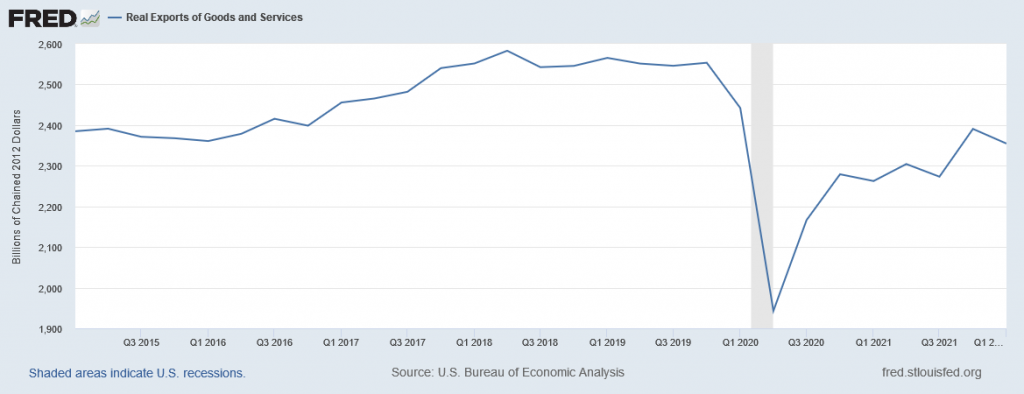

The one category that stands out most dramatically in the above graph is U.S. exports. Certainly there is no shortage of deeply troubling events around the world that likely contributed to the export decline. But it’s worth noting that the Q1 over Q4 comparison (which is the way the numbers enter for the graph above) looks bad in part because Q4 exports were so strong. In terms of levels of exports rather than quarter-over-quarter changes, Q1 still looks reasonably solid.

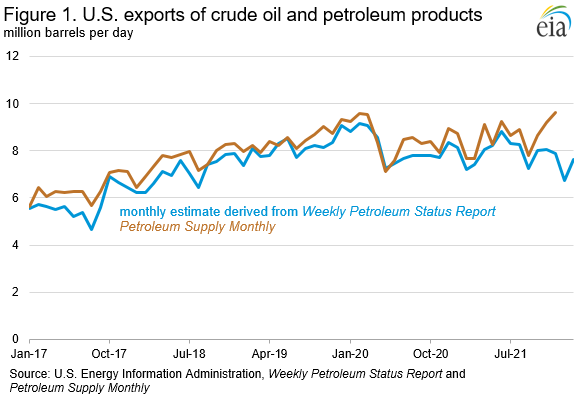

Looking at BEA Table 4.2.2, I was surprised to find that almost half of the decline in U.S. exports for Q1 relative to Q4 is claimed to have come from a decrease in U.S. exports of petroleum and petroleum products. The Energy Information Administration reports two estimates of this number that are collected from different sources. A monthly series, constructed from data from refiners and transporters of oil, shows exports still strong. A weekly series, constructed separately by U.S. Customs and Border Protection, shows weakness.

Here’s the EIA assessment of the discrepancy:

we likely underestimated export quantities for most products (including crude oil, finished motor gasoline, distillate fuel oil, propane/propylene, and other oils) in [our Weekly Petroleum Status Report] for November 2021 through the week ending February 18, 2022. We use information from the U.S. Customs and Border Protection (CBP) in our WPSR estimates and are consulting with them to determine the cause.

None of this is to deny that there are plenty of storm clouds to be concerned about, including another round of COVID-related shutdowns in Asia and the ongoing horrible tragedy in Europe. But it would be a mistake to conclude that these or other concerns have already led to the start of a recession in the United States.

Nice analysis. I use this simple model:

https://fred.stlouisfed.org/graph/?g=AuPx

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

https://fred.stlouisfed.org/graph/?g=AuPM

January 15, 2020

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=z21W

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2022

https://fred.stlouisfed.org/graph/?g=z21I

January 15, 2018

Shares of Gross Domestic Product for Private Fixed Nonresidential & Residential Investment Spending, Government Consumption & Gross Investment and Exports of Goods & Services, 2017-2022

(Indexed to 2017)

To me, the question is whether the housing market holds as the Federal Reserve raises rates and mortgage costs increase:

https://fred.stlouisfed.org/graph/?g=x2gN

January 30, 2018

Case-Shiller Composite 20-City Real Home Price Index, 2017-2022

(Indexed to 2017)

https://fred.stlouisfed.org/graph/?g=OEo3

January 15, 2018

Interest Rates on Baa Bond and 30-Year Mortgage, 2017-2022

The soaring housing markets are the outlier.

Note the carnage [declines in prices and aggregate market capitalizations – people’s 401ks, wealth] in the equities [after yesterday down 16% from February 2, 2022] and bond markets [your guess, a guy on TV said 14% – rates rise market prices drop]; and note the people’s bank deposits also lost about 8% due to inflation on top of zero rates.

And, the Fed only ONCE raised rates to 0.25% from ZERO.

The question remains: Why did real GDP decline?

Incredible amount of detail and excellent analysis. May I take just one sentence?

“But we’re way too early in the cycle for that to be showing up now, and again, residential fixed investment was slightly stronger in Q1 than Q4.”

Some have worried about a crash in residential investment but that has yet to materialize. Ditto for business investment. And consumption demand is strong albeit some of that went for imported goods. As you note export demand was weak. And the inventory issue has lots of possible interpretations.

James it was an annualised rate not an annual rate. I still have not gotten why you yanks like annualised figures when no other nation does. I won’t even go to ‘advance’ estimates which again no other nation uses.

I seem to strangely recall Professor Chinn giving you more than patronizing answer on this question once. Now, if you don’t like the answer that’s fine, but your query has been addressed at least once. I would tell you America just did it solely to annoy you if I thought that would shut your cake hole/

Chinny did that but it really did not make sense. Annualised figures are more volatile by definition and no other country uses them. When I read OECD, IMF or world Bank publication I do not see them.

Did not make sense to you. You have made it you goal not to understand, so you don’t understand.

With so much that is interesting on this blog, you choose to comment on a trivial difference in data presentation. Want the data presented differently? Go to FRED and do it yourself.

Great points, thank you. The autos, oil, and stimulus points are particularly interesting.

The FX value of the dollar is strengthening at what looks to be a pretty steady pace since the summer of last year, though gains may be accelerating now. FX rate changes affect trade flows with a lag, so trade may remain a drag on U.S. growth. There is also the possibility that easing of recent distortions in trade will overwhelm FX effects.

Mortgage rates affect housing with a lag. The huge overhang of unfinished houses will come on the market as building materials become available, which may coincide with the lagged impact of rising mortgage rates. That creates the possibility of a double whammy for new residential construction.

Both of those effects are issues for Q3/Q4 and beyond, if normal lags are in effect. If supply problems for autos clear up (something a couple of commenters insist has already happened), auto production could offset some of the drag from trade and residential construction.

So if the EIA indicates discrepancies in their two petroleum export series, where does the BEA get their data?

Since this BEA release is advance data, is there a likelihood of future revisions that might clear up the petroleum export conundrum?

The government doesn’t know what “real” GDP is and never has. More likely everything since 2020 is open to review. Nor was it likely GDP “contracted”? Not a chance. This just isn’t a BEA problem. But a BOX one as well.

Nice combination of trivial and wrong, as usual.

Honest question seeking understanding, not trolling:

“…anticipation of more to come has already produced a 200-basis-point increase in 30-year mortgage rates since the start of the year”

Why do you think mortgage rates have risen because of anticipation of Fed rate increases, as opposed to

observed increased inflationary expectations, or

observed increased 10 year Treasury rates?

Thanks for your help and for all the effort you put into this amazing blog!

Todd,

Evidence from financial market pricing suggests the reason for the rise in mortgage rates is “all of the above.”

Here is a picture of the difference in interest rates between morgages and Treasury notes:

https://fred.stlouisfed.org/graph/?g=OFCr

Here is a picture of what is called “term premium” for ten-year Treasuries (the return required for lending at longer term):

https://fred.stlouisfed.org/graph/?g=OFCJ

Term premium includes the risk premium investors require to cover the uncertainty of various costs, including uncertainty about inflation and uncertainty about the cost of overnight funds.

Here is a picture of on measure of inflation expectations:

https://fred.stlouisfed.org/graph/?g=OFD5

And finally, here is a picture of expectations for the fe funds target rate:

https://www.atlantafed.org/cenfis/market-probability-tracker

As you can see, all have risen recently. They interact, of course, but in theory, investors must be paid for all of them.

https://fred.stlouisfed.org/graph/?g=OnCR

January 15, 2020

Interest Rates on Baa Bond and 30-Year Mortgage, 2020-2022

It would be nice to also show the interest rate on long-term US government bonds. These two series tend to move with this government interest rate. Both have credit spreads of course which is around 1.5% of BBB corporate bonds normally (notice the temporary spike right after the pandemic). For conventional mortgages, this spread is generally near 1%.

https://fred.stlouisfed.org/series/DGS20

The 20-year US government bond rate over your period.

the one major part of inventories that i track on a weekly basis is that of oil & oil products…last week i summarized: SPR at a new 20 year low, total oil supplies at a 14 year low after record jump in oil exports; distillates supplies at a 14 year low, total oil + products exports at a record high; total oil + products inventories at an 8 year low

a lot of what’s going on with US oil inventories is withdrawals from the SPR to add to commercial inventories…i imagine that plays out in GDP as a reduction of government investment and an increase in private inventories, but i’m not sure..

rjs,

petroleum inv in usa been going down for many months, comm’l peaked spring 2020….

inv decline since mid march due to usa exporting to replace russian crude and product.

watch distillate fuel inv the coming weeks!!! not only in usa.

and gasoline prices in usa will go up as more crude exported.

spr release underpinning oil for europe.

yes, i agree, and i addressed that…here’s my relevant paragraph..

The depressed level of our distillate supplies has led to diesel fuel and heat oil prices that are often $1 per gallon more than the already elevated price of gasoline…supplies of diesel and pricing of it are also elevated in Europe and globally, leading to economic restrictions and power outages in countries that cant afford it, such as Sri Lanka, Pakistan, and now India…although those diesel shortages had developed over time, the loss of Russian oil has exacerbated the situation, because refineries get more diesel per barrel oil out of a heavy crude than they do from a light one, and most Russian oil exports are medium heavy sour crudes….that global shortage of diesel also explains the thinking behind the 1 million barrel per day SPR release better than the administration’s political messaging about gasoline prices…for US Gulf Coast and European refineries that were built to use a medium heavy crude like Russian Urals, they need to find an equivalent grade of crude to replace it, or do some expensive blending of other grades to match it…remember that the administration’s first frantic moves after the Russian oil ban were to try to get Venezuelan oil and even Iranian oil back on the market to replace it?…well, the US Strategic Petroleum Reserve is 60% heavier grades of crude, so it appears that they’re pulling it out to partially replace embargoed Russian oil globally…most oil we get from shale is light and sweet, typically more expensive, but worthless when one is trying to replace Russian oil losses…and those losses also explain our rising exports to Europe..

Speaking of GDP data, here is a recent reassessment of China’s output data and growth over the past 40 years:

https://voxeu.org/article/exploring-hidden-price-effect-china-s-official-gdp-estimates

The authors conclude that China grew on average 1.2% less per year than reported in official statistics. The problem is inappropriate use of price deflators. That suggests inflation has been higher than reported. That, in turn, suggests financial repression through caps on interest on savings has been more severe than we knew. Below-market rates on savings is a major driving force behind over-investment in residents real estate – Evergrand and the like. TINSTAAFL.

Observers of the Chinese economy have long argued that the country’s practices in price statistics are the major barrier to more reliable measurement of its real growth performance. This column proposes a national accounts approach to address some of the biases behind the gap between the underlying real growth rate and the ‘real growth rate’ reported by the statistical authorities. Compared to the official estimates, the authors’ method not only exposes more volatile movements and greater impacts of external shocks, but also slower growth.

Now that is an introduction! It makes one want to read the rest of their discussion!

The Wall Street Journal frets that businesses are paying 4.5% more for wage and fringe benefits but of course these corporate liars are looking at the nominal increase in the Employment Cost Index. Kevin Drum adjusts this for a higher price level and guess what happened to the real EPI:

https://jabberwocking.com/worker-pay-and-benefits-plummet-at-record-pace-yes-plummet/

The readers of the WSJ should demand a refund for whatever they paid for a subscription.

eci increase the dredded ‘wage price spiral’, which was the egg?

and todays not so high volume stock sell off!

we will see wednesday.

Jim,

I have a big question staring me in the face in light of this unexpected report: why have we seen such a strong labor market in the face of an outright decline of real GDP? I can see that maybe the decline in inventories might not connect solidly to job loss, but how does that sharp decline in exports, which is the main driver of this net negative outcome, not show up in a weaker labor market? Just about two weeks ago or so we had the lowest rate of layoffs in a half century, with job growth continuing positive and the unemployment rate continuing to fall. How can all this be reconciled?

If Jim does not answer (as he rarely does), anybody else got an explanation? I do not have it figured out, that is for sure, probably a sign that I am losing it and should retire so as not to further embarrass the taxpayers of Virginia, :-).

three-quarters of the trade hit to GDP was from higher imports….our real exports of goods and services shrunk at a 5.9% rate in the 1st quarter, after growing at a 22.4% rate in the 4th quarter of 2021, while our real imports grew at a 17.7% rate in the 1st quarter, after rising at a 17.9% rate in the 4th quarter…

so maybe the job losses you expect from lower exports were offset by job gains at the ports…

this week’s GDP report portends that next’s week’s trade deficit for March will beat the record trade deficits of January and February by more than 10%

rjs,

Yes, I think that is it. Looking at the figures again, I see that the really large negative number is the surge of imports. But those do not reduce jobs at all, per se. They can only do so to the extent they replace domestically produced consumption, but that was rising, so that was not happening. The actual decline of ecports is not all that great.

https://www.imf.org/en/Publications/WEO/weo-database/2022/April/weo-report?c=223,924,132,134,532,534,536,158,546,922,112,111,&s=PPPGDP,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2022

Gross Domestic Product based on purchasing-power-parity (PPP) valuation * for Brazil, China, France, Germany, Hong Kong, India, Indonesia, Japan, Macao, Russia, United Kingdom and United States, 2007-2021

2021

Brazil ( 3,436)

China ( 27,744)

France ( 3,362)

Germany ( 4,857)

India ( 10,219)

Indonesia ( 3,566)

Japan ( 5,615)

Russia ( 4,490)

United Kingdom ( 3,403)

United States ( 22,998)

* Data are expressed in US dollars adjusted for purchasing power parities (PPPs), which provide a means of comparing spending between countries on a common base. PPPs are the rates of currency conversion that equalise the cost of a given “basket” of goods and services in different countries.

https://fred.stlouisfed.org/graph/?g=HAKs

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1977-2020

(Percent change)

https://fred.stlouisfed.org/graph/?g=HAKv

August 4, 2014

Real per capita Gross Domestic Product for China, Germany, India, Japan and United States, 1977-2020

(Indexed to 1977)

“why have we seen such a strong labor market in the face of an outright decline of real GDP?”

The simple answer is that there isn’t an outright decline in real GDP in the items that matter. Consumption is up, business investment is up and residential investment are all up. Domestic demand is strong. Those are the components that really matter for labor.

And what are down? Inventories and exports. And as JDH explains, apparently half of the export decline is petroleum and petroleum products.

Which means GDP is calculated wrong. Exports/imports have too much weight. This is how you lose respect for this kind of data. I have doubts about their inflation data as well.

I’m sorry but that comment was just dumb.

the net of exports to imports is down!

and effective 11 march 2022 usa is a strong net exporter of crude oil and petro products to cover for loss of russian sources.

the spr releases are for europe not your suv.

https://www.msn.com/en-us/news/world/russian-territory-under-attack-as-ukraine-shells-border-checkpoint-official/ar-AAWJv6I?ocid=msedgdhp&pc=U531&cvid=28dffaf991d3447fadc2af03fa8c2939

It seems the Ukraine forces have struck locations inside Russia. Of course Putin’s pigs think this is SO unfair. Putin wants this war fought on his terms with the people he is killing having no weapons and both hands tied behind their backs. Awww – the real world don’t work that way. Poor little Putin. Boo hoo.

Because of the structure of Russias army they are very dependent on supply lines not being too long. If Ukraine can force them to not build up large depots right at the border (because they wouldn’t be safe there), that would have serious consequences for the Russians ability to fight deeper inside Ukraine. Ukraine has brilliant military leadership, whereas Russia seem to be run by amateurs (or should we say a guy whose training in intelligence services gives him no clue about how to fight a war). The small mobile units of Ukraines army could operate behind enemy lines on both sides of the border to shut down supply lines and starve the Russian forces. You don’t even need a missile to take out a supply truck – 3 soldiers with a big gun can do it. Ukraine may even be able to allow a battalion to go forward 20-30 miles, then cut off its supplies (in a pinch-the-pincher strategy). For the Russian troops in Ukraine “Victory Day” on May 9’th could bring a brutal humiliation.

The Biden administration has managed to use get into a proxy war with Russia that will degrade their military power and ability to intimidate other countries for decades to come. That with a literal gift basket of collateral benefits. Absolutely brilliant.

The USSR spent ten years in Afghanistan, then collapsed less than three years later. In that three-yearvperiod, there was a sharp decline in Soviet oil production following a sharp drop in world oil prices.

Putin is attempting to resurrect something of the old Union. Petroleum accounts for about half of Russia’s exports and 40% of government revenue. Cutting into those exports is a critical part of the strategy to defeat Russia in Ukraine and to weaken Russia’s ability to attack other countries. The lesson of the Soviet collapse has been remembered, and cutting into Russia’s oil production is also part of the current plan. Western firms contributed substantially to Russia’s ability to produce oil and have been pulling out of Russia. Time is not on Russia’s side when it comes to oil.

A ten-year war is a terrible prospect for Ukraine. Afghanistan did not come out of the ten-year war with the USSR into a period of peace. If Russia is allowed to adjust and adapt to sanctions, the war is likely to drag on longer. Any resolution which provides Russia advantages may encourage Putin toward further adventurism. Regular Russian losees on the battlefield combined with steady new shocks to Russia’s economy may do to Russian aggression what Afghanistan and faltering oil revenues did to the USSR. The quicker, the better.

Putins thinks the problem is that he is not emperor of a big enough state. The actual problem is that he is emperor of a failed state. Everything in Russia (including its military) is failing because of theft, graft, indifference, incompetence and nepotism. Extending his kleptocacy to cover more land and more people, is not going to fix that problem, it will just make it bigger.

You are absolutely right that Russia’s economy is dependent on its hydrocarbon revenue. Western sanctions can only do some damage to that revenue. We have a bit of a dilemma between wanting oil prices low to hurt Putin and wanting them high to save the planet. Supercharging efforts on energy efficiency and green energy production is the only way out of that. That would be a Win (hurt Putin) – Win (save the climate) – Win (reduce our dependency on nasty tinpot dictators) – Win (give us cleaner air to breathe) – Win (provide stable long-term jobs in our own country).

rjs: “three-quarters of the trade hit to GDP was from higher imports …”

This is misleading. Imports neither add nor subtract from GDP. Imports are simply not counted at all for GDP because — it’s right in the name– they are not “Domestic Products”.

Don’t confuse an accounting identity for causality, GDP = C + I + G + (X – M). The only reason we subtract imports at the end of the GDP equation is because we previously added imports into the sums at the beginning of the equation. For convenience, we don’t separate out Domestic Consumption and Imported Consumption, Domestic Investment from Imported Investment, etc. We just sum them all up, domestic and imported C + G +I, and then subtract imports at the end so that imports are zeroed out and irrelevant in GDP accounting.

What did contribute to the GDP decrease was not increasing imports but declining exports. Exports, which are domestic products, are counted in GDP. Imports, which are foreign products, are not.

rjs is unlikely to have confused anything that obvious. The question addressed in this post is an accounting question, so an accounting answer is appropriate.

“rjs is unlikely to have confused anything that obvious.”

But the statement is completely false. It is impossible for higher imports to decrease GDP in the accounting sense, as you say. Imports are not counted in GDP — they are zeroed out in the accounting sense. Imports can neither increase nor decrease GDP accounting.

It is inaccurate statements like this that lead even an economist like Peter Navarro to tell Trump that imports reduce GDP and tariffs are good.