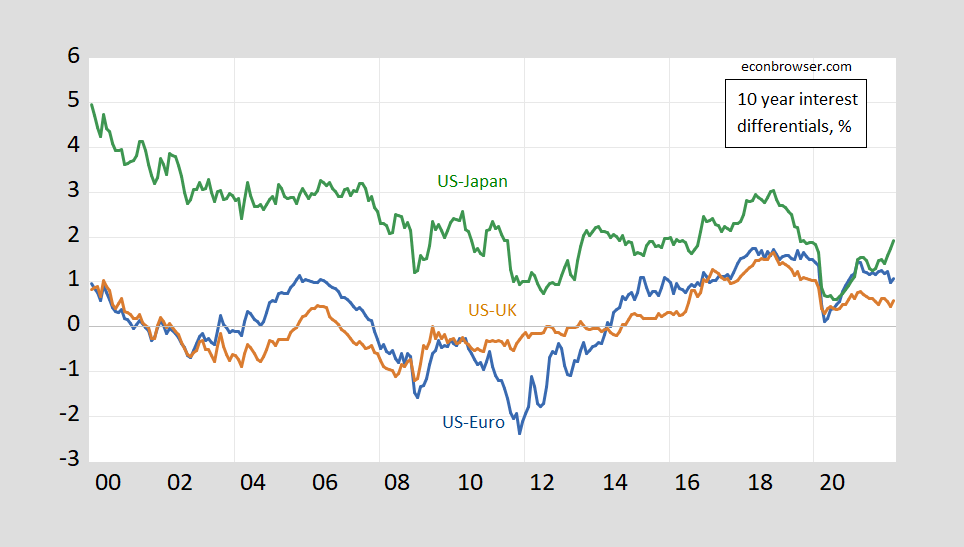

Some key interest differentials, through March:

Figure 1: Ten year government bond yield differential US-euro area (blue), US-UK (brown), US-Japan (green), in %. Source: OECD MEI via FRED, Treasury (for US), and author’s calculations.

As we move away from the zero lower bound (again) and we see more rapid inflation, I thought it interesting to see what linkages might exist between long term interest rates. In particular, will long term rates move in line with expected depreciation rates?

The answer to this question is not really knowable, since we don’t have direct observation on market expectations; and at the 10 year horizon, we don’t really have much survey based expectations data (which contrasts with short horizons like up to a year, as used in Bussiere et al. (2022)). However, we can observe how subsequent ex post exchange rates moved with interest differentials — up to 2012Q1. What does the past tell us about what to expect.

In Chinn and Meredith (1998), we documented that at longer horizons, interest differentials were positively associated with ex post depreciation. Panel regression coefficients had the following pattern:

Figure 2: Panel beta coefficients at different horizons. Notes: up to 12 months, panel estimates for 6 currencies against US$, euro deposit rates, 1980Q1-2000Q4; 3-year results are zero-coupon yields, 1976Q1-1999Q2; 5 and 10 years, constant yields to maturity, 1980Q1-2000Q4 and 1983Q1-2000Q4 (last observation corresponds to exchange rate data). Source: Chinn (2006).

I updated these results four years ago in this post (and yet earlier, in Chinn and Quayyum (2013). We can evaluate this relationship by using the Fama regression, viz. :

(1) st+k – st = α + β(itk-itk*) + εt+k

Where s is the log exchange rate defined as home currency units per foreign currency unit (e.g., USD per pound for Americans); itk is the interest rate of maturity remaining k, and * denotes foreign (e.g., UK); and ε is an error term.

The test that the coefficient β is not different from unity is a test for “unbiasedness” — the joint null hypothesis that uncovered interest parity holds and expectations are on average correct (or full information rational expectations hold).

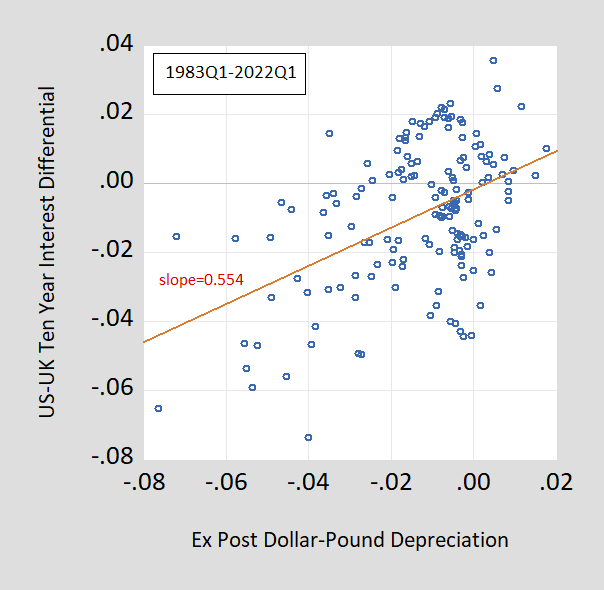

Running the regressions on quarterly data (end-of-period) for the US-UK, one gets:

st+k – st = -0.002 + 0.554(itk-itk*) + εt+k

Adj-R2=0.21, SER= 0.018, DW = 0.018, Nobs = 157, sample 1983Q1-2022Q1. Bold denotes significantly different from value of unity using HAC robust standard errors at the 5% msl.

In this case, with quarterly data, k=40. This regression result summarizes the relationship in this scatterplot:

Figure 3: Ten year dollar-pound ex post depreciation annualized against US-UK ten year interest differential lagged 10 years.

For the US-Euro Area:

st+k – st = 0.003 + 0.592(itk-itk*) + εt+k

Adj-R2=0.05, SER= 0.024, DW = 0.011, Nobs = 53, sample 2009Q1-2022Q1. Bold denotes significantly different from value of unity using HAC robust standard errors at the 5% msl.

For US-Japan:

st+k – st = 0.015 + 0.323(itk-itk*) + εt+k

Adj-R2=0.02, SER= 0.032, DW = 0.058, Nobs = 157, sample 1983Q1-2022Q1. Bold denotes significantly different from value of unity using HAC robust standard errors.

In previous studies, Japan has stood out as having a particularly low coefficient. One explanation would be the lack of capital account liberalization in the earlier part of the period. Starting to examine the interest rate data in 1982Q1 (and hence looking at 10 year exchange rate changes beginning in 1992Q1), one obtains:

st+k – st = -0.033 + 1.699(itk-itk*) + εt+k

Adj-R2=0.28, SER= 0.028, DW = 0.161, Nobs = 121, sample 1992Q1-2022Q1. Bold denotes significantly different from value of unity (for slope) or from zero (for constant) using HAC robust standard errors at the 5% msl.

So, the coefficients from a long horizon Fama regression are typically positive (still), and in several cases don’t reject the null of a unit slope coefficient. That being said, it’s not clear that this correlation is much of a guide to the strength of linkages given the adjusted R2‘s are so low.

A minor data source question. You write OECD MEI via FRED, which seems to be your source for Euro, Japan, and UK 10-year government bond rates. What is MEI?

I do know FRED gives us these long-term rates for Germany, Japan, and the UK. Are you using a different rate for these comparisons?

pgl: MEI is Main Economic Indicators. The FRED series are from OECD (at least the ones I pulled).

OK – I sort of answered my own questions. MEI = Main Economic Indicators and FRED does say in the notes for the German, Japan, and UK long-term interest rate reporters that their source is the OECD’s Main Economic Indicators. And this source along with FRED reporting does report a Euro Area interest rate, which is traditionally a bit higher than the German government bond rate.

Which raises another question. Since the Euro area rate is a blend of German, French, Italian, Greek, etc. government bond rates – is there some concern about using this cocktail of interest rates over the German bond rate? I know an age old question which I have never seen a compelling answer.

pgl: if i were to write a paper, I would likely drop euro area, or use German bond yields. The euro area is a weighted average of country sovereign bond yields. So answer to your question, yes, there is a problem doing the regression I did because there is substantial time-varying default risk for the euro area series, not (presumably) for US.

“The euro area is a weighted average of country sovereign bond yields.”

Thanks. I was playing around with FRED which provides data not only for German government bond rates but also for the French, Spain, Greece, Italy. etc. A comparison over time of each nation’s yields would be interesting and something tells me that ltr will do this for us.

Not to mention the possibility of issues with stationarity in these variables and autocorrelation in this “model”. Eeek. Hat journal would you submit to?

Econned: Do you really think long term interest rates are I(1)? (I might imagine they could be nonstationary in different ways). I admit there’s autocorrelation (under the null hypothesis of serially uncorrelated forecast errors, we should have moving average error of order k-1). That’s why we use HAC robust standard errors. So if you want to be a bit more precise about your criticisms, I’ll just conclude you have nothing useful to add.

“if you want to be a bit more precise about your criticisms”.

Asking for the impossible.

Not asking the impossible. Asking a person who is incapable of the task.

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/index.html

May 12, 2022

Chinese mainland records 237 new confirmed COVID-19 cases

The Chinese mainland recorded 237 new confirmed COVID-19 cases on Wednesday, with 222 linked to local transmissions and 15 from overseas, data from the National Health Commission showed on Thursday.

A total of 1,680 new asymptomatic cases were also recorded on Wednesday, and 75,532 asymptomatic patients remain under medical observation.

Confirmed cases on the Chinese mainland now number 220,958, with the total death toll from COVID-19 at 5,203.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/img/31c00adcee3842fbbaa4fe7a7f2c5dfe/31c00adcee3842fbbaa4fe7a7f2c5dfe.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/img/c75784c4cdfa4bbe83e286cf7eae2fc9/c75784c4cdfa4bbe83e286cf7eae2fc9.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/img/8516f262b0e9493caa19bce09a145d2b/8516f262b0e9493caa19bce09a145d2b.jpeg

https://www.worldometers.info/coronavirus/

May 11, 2022

Coronavirus

United States

Cases ( 83,953,371)

Deaths ( 1,025,764)

Deaths per million ( 3,066)

China

Cases ( 220,721)

Deaths ( 5,198)

Deaths per million ( 4)

1917 active cases of covid detected in china yesterday. and based on what I hear in a couple of large cities (Beijing and Shanghai), that number is low.

https://www.worldometers.info/coronavirus/

May 12, 2022

Coronavirus

United Kingdom

Cases ( 22,159,615)

Deaths ( 176,708)

Deaths per million ( 2,578)

China

Cases ( 220,958)

Deaths ( 5,203)

Deaths per million ( 4)

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/index.html

May 12, 2022

Chinese mainland records 237 new confirmed COVID-19 cases

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/img/31c00adcee3842fbbaa4fe7a7f2c5dfe/31c00adcee3842fbbaa4fe7a7f2c5dfe.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/img/c75784c4cdfa4bbe83e286cf7eae2fc9/c75784c4cdfa4bbe83e286cf7eae2fc9.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-05-12/Chinese-mainland-records-237-new-confirmed-COVID-19-cases-19Y1ggbXRV6/img/8516f262b0e9493caa19bce09a145d2b/8516f262b0e9493caa19bce09a145d2b.jpeg

https://fred.stlouisfed.org/graph/?g=PiKP

January 30, 2018

Interest Rates on 10-Year United States, United Kingdom, Euro Area and Japanese Government Bonds, 2007-2022

https://fred.stlouisfed.org/graph/?g=NQuj

January 30, 2018

Interest Rates on 10-Year United States, United Kingdom, Euro Area and Japanese Government Bonds, 2017-2022

https://fred.stlouisfed.org/graph/?g=PiMd

January 30, 2018

Interest Rates on 10-Year United States, United Kingdom, German and Japanese Government Bonds, 2007-2022

https://fred.stlouisfed.org/graph/?g=PiLN

January 30, 2018

Interest Rates on 10-Year United States, United Kingdom, German and Japanese Government Bonds, 2017-2022

These charts should be interesting to anyone who is involved in intercompany financing issues. There was a freak out period among the practitioners who are not that bright over negative arm’s length interest rates. Now consider the fact that most third party borrowers have to pay some sort of credit risk premium and you might conclude that an arm’s length rate could not be negative for any currency of denomination. But OK – Dr. Chinn and I might use the German government bond rate instead of the Euro area rate. But even then, the government bond rate never fell below negative 1% and if you think these not so bright practitioners are telling clients to accept really low credit premium – you are not following the utter confusion they inflict upon tax authorities.

Japan is currently experiencing a rapid depreciation of the yen, associated with a trade deficit, some of this driven apparently by high prices of imports, of all things. This is an unusual situation, and apparently the Japanese are unhappy about this situation, with them usually liking to have the yen down.

With allegations of extensive US military research in bio labs around the world, it’s perfectly understandable why China clamps down so hard on incipient outbreaks.

https://english.news.cn/20220319/9f91bddaf5794e1eba06726e9e66f224/c.html

COVID shows how vulnerable the US is, perhaps even to its own organisms.

https://www.usatoday.com/story/news/2015/05/28/biolabs-pathogens-location-incidents/26587505/

JohnH,

Oh gag. You are repeating a Chinese repetition of one of the most flagrant pieces of ongoing Putin propagandistic lies. You are a worthless liar, truluy nauseating,

Sorry, Rosser, but it is you who is the victim of Disinformatiin: “ US undersecretary of state acknowledges there are biological warfare labs in Ukraine.”

https://www.wsws.org/en/articles/2022/03/10/nula-m10.html

If these labs are for humanitarian purposes, why is there no transparency as to their existence, purpose, and research being conducted?

After millions of deaths in the US’ pointless and futile wars in Vietnam and Iraq, Rosser continues to believe that the US is a human rights champion and behaves like a choirboy. What a rube!

The Chinese are wise to be prepared for a biological weapons attack.

And you believe the stuff posted on this site? There are enough imprints on Putin’s buttocks in this article to outdo even those you’ve seen fit to post. Gee, who would ever believe a guy like Putin would stoop to poisoning his opponents? Only vicious American corporate war mongers, don’t you know!

What should we expect from a sad little egocentrist who pushes Kremlin propaganda, hook, line, and sinker? (The ALLEGED poisoning of Navalny? Really? Hey, alleged!)

Excuse me jacka$$ but we did not use biological weapons in Iraq. And we did not start the current war. Your boss – Putin – did.

You cite the title which grossly mispresented what she said. Her term was facilities not weapons. I guess you forget to read her actual testimony. The story also notes:

She went on, in a carefully orchestrated exchange with Rubio, to say that if there were a biological or chemical weapons attack inside Ukraine, it would “no doubt” be carried out by Russia.

Johnny boy – try reading your own links and not just some stupid title.

JohnH,

You have reached some new level of sub-human nauseating lying. We can read your link. It has Nuland referring to biological “RESEARCH” labs, not biological “WARFARE” labs. Why are you so blatantly lying here? You need to go to the vomitorium right now.

These labs in several former Soviet republics were biowarfare labs in the Soviet era, a fact the Russians know. What has been going on since is the US DOD has been funding non-military bio research in them to keep their researchers from going off elsewhere and returning to their former acrtivities. It has been an ongoing propoganda campaign by the Putin admin to lie about these labs and claim they are still doing weapons research. They are not, and your source does not say they are, even though you falsely claimed that.

Actually I think you should be sent to Ukraine to be shot at by Russian artillery,, your lies here have become so repulsive. Vomitorium too good for you.

Have you actually read the article at the link you provided? It’s pure insinuation.

“The recent revelation of the U.S. biological military activities in Ukraine has sparked widespread concerns, but it just disclosed the tip of the iceberg in the U.S. “biological military empire” across the world.”

So Putin gets the PRC to spread his lies for him and Putin’s pet poodle has to repeat these lies. This was popular among the MAGA crowd for a while but it still is a pathetic lie. Hey JohnH – Putin owes you a bone.

what you are hinting at is that the us stop bio research for infectious disease. history has shown that nature will occasionally strike with deadly, contagious diseases. shutting down those labs will not stop nature in the future. the us is MORE vulnerable to future outbreaks, rather than less vulnerable, if the labs are shut down. but john, it is nice that you use the propaganda mouthpiece of the ccp as a link for your argument. that is not a news outlet. it is the propaganda arm of the ccp. but you knew that already.

Off topic – another Chinese property developer defaults:

https://www.bloomberg.com/news/articles/2022-05-11/bondholders-of-major-chinese-developer-sunac-yet-to-get-coupon

Ya know, if Xi is handing control of economic policy to Li, maybe it’s so Li can go down in flames. Xi is, after all, a pretty good politician.

In market parlance, would Li be “catching a falling knife”??

Well, he has to hope it’s just market parlance.

So Xi is looking for a third term this fall. On the one hand, he’s got a Covid problem. On the other, he’s got the economic fall-out from dealing with ye Covid problem. In octopus fashion, on yet another hand he has problems in the real estate sector, which he is dealing with by encouraging lending to enterprises which are bad credit risks. And the U.S. is changing the picture on relative returns when China is facing intermittent capital flight. Ad Xi has health issues which make him look weak.

Putting Li’s face on economic policy, at the cost of surrendering a bit of power to Li and his faction, may be the price of securing another chunk of leader-for-life status.

Pretty astute look by you I would say. Nearly as astute as you can get from the outside looking in. I don’t even know how they make it work with those Beidaihe meetings and stuff. Maybe they should rename Beidaihe “Wasps’ nest”. I think Xi is kinda shooting himself in the foot with the Shanghai lockdown, but it’s a hard juggling act for sure.

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2022

(Indexed to 1994)

https://fred.stlouisfed.org/graph/?g=lv0w

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 2007-2022

(Indexed to 2007)

https://www.imf.org/en/Publications/WEO/weo-database/2022/April/weo-report?c=924,134,534,158,111,&s=BCA_NGDPD,&sy=2007&ey=2021&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2022

Current Account Balance as percent of Gross Domestic Product for China, Germany, India, Japan and United States, 2007-2021

2017

China ( 1.5)

Germany ( 7.8)

India ( – 1.8)

Japan ( 4.1)

United States ( – 1.9)

2020

China ( 1.7)

Germany ( 7.1)

India ( 0.9)

Japan ( 3.0)

United States ( – 2.9)

2021

China ( 1.8)

Germany ( 7.4)

India ( – 1.6)

Japan ( 2.9)

United States ( – 3.5)

Off topic, but commonly (and dishonestly) discussed in comments here, California has briefly produced enough solar and wind energy to meet 100% of its electrical grid demand:

https://www.npr.org/2022/05/07/1097376890/for-a-brief-moment-calif-fully-powered-itself-with-renewable-energy

But by all means, let’s keep insisting that intermittency is the only thing that matters.

MD, did you even read your own reference? If you claim you did, it confirms you still have a comprehension problem. From his own reference: “Even as the record was broken, natural gas power plants were still running in California.

Because despite the dramatic growth of renewable energy, turning off natural gas power still isn’t possible in California. The reason is due to a tricky time of day: when the sun sets and solar farms stop producing. (Often called intermittent production) California needs to replace that power quickly and seamlessly with other sources, like hydropower and natural gas.”

What is even more hilarious, his article says: “For about an hour on April 30th,…” and then graphically shows hows much electricity was being generated and by source for the day: https://apps.npr.org/dailygraphics/graphics/california-supply-demand-ai2html-20220512/img/_ai2html-graphic-wide.jpg For 1/2 the day the largest supplier of electricity was from gas to solve MD’s nonexistent INTERMITTENCY problem.

I won’t even bring up the cost comparison issue. Just remember the claim has been that renewables sources are less expensive than traditional sources. https://www.weforum.org/agenda/2021/07/renewables-cheapest-energy-source/ Renewables were the world’s cheapest source of energy in 2020, new report shows

Congratulations! I knew you would take the bait! I’m surprised anonymous has jumped in here, too.

Nowhere in my tiny little text did I say carbon dioxide producing plants weren’t running. Nowhere did I claim anything that wasn’t in the article itself. All I noted was tha renewables production was equal to demand within the borders of California. You desperately need me to have made an intellectual error that I dd not, in fact make. You even resorted to a canned critique: “didn’t read your own link” which relies on you pretending I said something I didn’t say.

Your deparation to treat every good-news story about renewables as wrong or trivial is getting ridiculous.

You took the part about renewables capacity rising rapidly in California, a state which has put real public policy resources into renewables, and used it as an excuse to repeat the intermittency whine. You keep pretending that people outside you little renewables-hating bubble don’t understand intermittency. You keep pretending that intermittency is somehow deadly to the effort to expand the use of renewables. That’s wildly dishonest, but you just keep doing it.

I understand how “big lie” propaganda works. You have to keep repeating the lie because you need to wear down the public’s resistance to it. Well, I’m happy to point out your lie every chance I get.

fusion generates too, for a tiny part of a nano second……

‘engineerss are a sad and embittered race of pronouns who are very much in demand in the real world, and who sink resentfully into obscurity in climate panic threads.’

‘intermittency’ is a tiny part of the problems “renewable” energy has to achieve ‘suitable’ performance.

i will propose a solution must be ‘effective’: satisfies a measurable need, as well as ‘suitable’: satisfies secondary attributes such as availability, generating reliability, cost etc.

and those two demands must be proven in unlimited real world situations.

the climate panic threaders do not care for engineers

and big carbon has a virtually unlimited future with the panickers not caring about engineers.

my suspicion is nuclear power is better than all other renewables…..

and could gut big oil is about 40 years.

Your third grade teacher would be sadly disappointed in your writing. I suppose coherence is not a major goal for writing if the ideas expressed aren’t coherent.

All you’ve written is a laundry list of conventional talking points, so your high school debate teacher wouldn’t be all that proud either.

Come on, stop with the canned talking points. Have a real discussion.

MD, your cognitive dissonance is blinding you. Does logic even co-exist with it? I responded to this claim: “But by all means, let’s keep insisting that intermittency is the only thing that matters.” (note the quotes)

You consistently misstate (lie about) positions and read more into them: ” You keep pretending that people outside you little renewables-hating bubble don’t understand intermittency. You keep pretending that intermittency is somehow deadly to the effort to expand the use of renewables. That’s wildly dishonest, but you just keep doing it.” (Again note the quote) I have been consistent in my contention that actual customer costs are ignored in the price comparisons. My claim with an example: “I won’t even bring up the cost comparison issue. Just remember the claim has been that renewables sources are less expensive than traditional sources. https://www.weforum.org/agenda/2021/07/renewables-cheapest-energy-source/ Renewables were the world’s cheapest source of energy in 2020, new report shows” Your own article showed this price comparison to be a woeful exaggeration.

“Just remember the claim has been that renewables sources are less expensive than traditional sources. https://www.weforum.org/agenda/2021/07/renewables-cheapest-energy-source/ Renewables were the world’s cheapest source of energy in 2020, new report shows,” (Again note the quotes) Even your referenced article shows the best we can get is a short period when INTERMITTENT renewables provide/support demand. Otherwise, total price for delivery to the customer ignores the actual costs.

“I understand how “big lie” propaganda works. You have to keep repeating the lie because you need to wear down the public’s resistance to it. Well, I’m happy to point out your lie every chance I get.” There is still no discussion of the pricing comparison big lie, because the policy impacts/effects are now evident. Inflation, possible recession, people dying as in Texas, environmental impacts, etc. all due, at least in part, to the ignorant focus on the big lie.

You are one of the big lie proponents here. Consistent claims that use of these INTERMITTENT renewables protects us from climate change, when you usually mean warming. We have >150 years history of that ole climate change/warming, and the planet and we are better off in that same period.

Your core policy beliefs are wrong. Their implementation are costly and detrimental. The US voters are experiencing these effects since the 2020 election. They will vote accordingly.

corev, you rambling is simply incoherent.

again, repeat after me. the winter texas blackout was caused by natural gas failure. the winter texas blackout was caused by natural gas failure.

Repeating the same message does not make it true. “the winter texas blackout was caused by natural gas failure.” That is NOT what the current FERC/Nerc Report said: “Both the 2011 and 2018 Reports identified certain equipment that more frequently contributed to generating unit outages, including frozen sensing lines, frozen transmitters, frozen valves, frozen water lines, and wind turbine icing.”

and

“Those components and systems (including wind turbine blades, transmitters, sensing lines and instrumentation) froze, caused trips, derates or failures to start, and, during the Event, were responsible for over 68,000 MW of generating unit outages in ERCOT, nearly 27,000 MW in SPP and over 21,000 MW in MISO South.”

These findings were confirmed by earlier 2011 2018 reports. The big lie keeps costing lives and money. 2011 and 2018 and now 2022? When will you fanatics learn?

wind turbines is not what contributed to the majority of the power loss. if was failure of the natural gas power plants. it even says so in the report.

“including frozen sensing lines, frozen transmitters, frozen valves, frozen water lines,”

why not highlight those items? they were the biggest cause of failure.

Anyone who knows weather knows that wind and solar often operate in synchronicity, as the Sun lowers so does wind. Also, those who follow the INTERMITTENT renewables issue, know that peal electricity usage occur with this synchronous drop in solar and wind. Is anyone surprised that “Texans asked to set thermostats to at least 78 degrees during 5-hour peak period Saturday, Sunday” https://abc13.com/ercot-texas-electricity-conservation-is-there-a-power-emergency-loss/11846502/

Remember INTERMITTENT renewables are cheaper than the required dispatchable sources which solve the intermittency problem. Cheaper? Except when they are not, which is ALWAYS.

And we thought Abbott had THE solution to providing reliable electricity. Thanks for reminding us that your rightwing hero has even less answers than you.

https://pv-magazine-usa.com/2022/05/13/climate-the-texas-grid-and-solar-batteries-to-the-rescue/

In 2021, winter storm Uri became a landmark example of the unpredictability of climate, and its harsh impact on the legally mandated core requirements of electric utility companies: to provide electricity reliably, and to furnish just and reasonable prices to customers. The electric grid’s functional collapse during the storm was an example of the Texas ERCOT grid’s failure of achieving those mandated goals. By some estimates, the storm caused $130 billion in near-term economic damages, and the long-term consequences have not yet been fully assessed.

CoRev would put the blame on the lack of reliability of solar energy but FERC disagrees:

The sudden spike in unplanned-for energy demand caused by extreme weather led to wholesale market spot prices skyrocketing up to $9,000/MW, and that price held for over three days. Historically, the price cap is only hit momentarily, and pressures are relieved quickly, but this storm was described as a “tail event” that caused unusual levels of strain on the grid. This was caused by a combination of nonfunctioning natural gas equipment, and congestion on the grid from intense localized energy demand, that caused substations to cut power to stabilize the grid. A study by the Federal Energy Regulatory Commission found 87% of the outages were caused by issues with natural gas supply as uninsulated stations failed to function.

Hey CoRev – do not let the facts get in your way.

Bierka, does research and what does he choose as a reliable and unbiased source, Photo Voltaic Magazine?

The PV article does reference a FERC, NERC etc. Report which in mult-part Recommendation 1 says this:

“Both the 2011 and 2018 Reports identified certain equipment that more frequently contributed to generating unit outages, including frozen sensing lines, frozen transmitters, frozen valves, frozen water lines, and wind turbine icing.”

and

“Those components and systems (including wind turbine blades, transmitters, sensing lines and instrumentation) froze, caused trips, derates or failures to start, and, during the Event, were responsible for over 68,000 MW of generating unit outages in ERCOT, nearly 27,000 MW in SPP and over 21,000 MW in MISO South.”

Now these failures were long term, multi-day, and amounted to ~80% of the total outages. Notice the failure to mention Gas?

Mentioning gas the Report makes this point ” … ERCOT did not anticipate that its use of firm load shedding to preserve system stability would contribute to power outages of natural gas production and processing facilities,…”So ERCOT was responsible for gas failing.

Clearly the priority is one fixing ” (including wind turbine blades, transmitters, sensing lines and instrumentation) froze,” s they are referenced in recommendation 1.

Good grief troll. He is not saying (in fact no one is saying) we rely exclusively on solar power. We can rely more on solar power with other sources supplementing them in spite of your nonstop stupid bloviating to the contrary.

BTW – how is Governor Abbott doing these days? I hear his vaunted Texas system of supplying electricity just failed because of a little summer heat.

At this time, intermittency is a non-problem which already has plenty of solutions waiting to be deployed after it actually becomes a problem. If one state at one short period of time produce more green electricity than it needs then it just send it somewhere else. When we get to the point where there is nowhere to send it, then we will store it. Lots of technologies to handle that, and they will be scaled up when they are needed. Interesting news on that front.

https://www.innovationnewsnetwork.com/cleanly-converting-solar-energy-storable-hydrogen-fuel/21047/

https://www.innovationnewsnetwork.com/dynelectro-explores-power-to-x-technology-denmark/21269/

You still need an infrastructure that can do this efficiently (which the US doesn’t have), and when you do have it, you may be more susceptible to Texas-style problems during common high demand. (There’s lower risk of this due to higher geographic distribution, but conditional on it happening, the risk of problems becomes higher. Just like any wide, low-friction market. The euro transmits financial crises across the euro area quickly, for example.)

Also, it’s not so much about today as going forward. We have plenty of baseline power now, and Denmark is awash in constant North Sea wind. Going into a future with higher renewables production and lower baseline production, places that are not awash in constant wind need more storage. I don’t see a large-scale commercial storage solution yet (though we should be hopeful given that there’s nothing technological holding us back).

Also, there should be a future in nuclear. It really is clean and safe, and is effective baseline power. It’s just expensive.

Agree, it’s just an issue of sufficient storage, locally. If each locality has stored 1-year of total electrical use – then all of the interruptions or intermittence issues are mute. At that point it doesn’t matter any longer what production is “baseline” or not. With enough storage the difference becomes semantic.

I don’t think nuclear will make it because the combination of renewable and storage will soon be costing less than nuclear. As an investor I would not want to put money into a 50-year project that would not be competitive by the time it had been build. As a society we should not subsidize it if it cannot provide something highly useful that has no alternatives.

Even the issue of whether the total system is optimal and sufficient becomes mute if the source is renewable. So we took some solar energy and it got “lost” as heat – that is where it would have ended anyway. From an environmental and societal point I am not worried if we overdo solar productions at a locality and can’t get it to someone else. I understand why the ones who put money into that project would be concerned – but I am not.

“As an investor I would not want to put money into a 50-year project that would not be competitive by the time it had been build”

Depends on the premium for regularity. If wind and solar are hugely variable, a low cost of installing and running those plants isn’t enough to make them feasible. But if they’re backed up by reliable baseline power and/or storage, then they’re the best thing since sliced bread.

Also, depends on the storage costs. Not sure what those would look like when they’re commercial, though. Since the technology isn’t rocket science (as far as I can tell), I’m not too worried. And I doubt there’s a business case for 1 year of backup power! It’s probably more like day-to-day or week-to-week, in which case the capacity needed wouldn’t be so huge.

Also I take back my comment about Texas being like the euro zone. I think the problem with Texas was pricing during a huge demand shock. The solution to that is probably just subsidies (for producers) and price caps (for customers) during those extreme events, and maybe some sort of good-times premium to help smooth prices (a rainy day fund). The Texas system was probably better prepared due to integration than a comparable low-integration system.

Yes it is indeed a question of cost all the way around. The investors don’t pay any attention to, or premium for, regularity or stability. As we have seen in Texas neither does the predatory capitalists that have been handed way too much control over a life saving system. It is in the nature of predatory capitalism to cut corners (cost) and not “waste” money on preparing for 10-year, or rarer, events. They harvest the money and get out of there in a shorter timeframe than that (leaving behind a degraded shells of a company). To the extend the public doesn’t want to accept regular “Texas disaster” style events, it may decide to overrule the “cult of profit” and fund/require actions that are not cost-effective in the traditional sense.

Please , please keep discussing costs and pricing Re: electricity generation.

It appears only after the voters decide will these issues reach the fore front.

electric utility landscape will change dramatically over the next few years. people will continue to buy electric vehicles. and they will continue to add solar panels to the rooftops. once you add in a power wall, you will get a distributed electric generation and storage utility built locally within each community. there is no reason that an electric car battery should not also serve as an emergency backup battery. this intermittency issue is very easily solvable. which is why nobody who understands the issue takes any of corevs arguments seriously. corev is presenting engineering challenges, not technology challenges. there are very few items corev has presented that do not already have engineering solutions.

“If wind and solar are hugely variable, a low cost of installing and running those plants isn’t enough to make them feasible.”

they are not as hugely variable as you may think. it is an issue that needs to be addressed. it is by no means insurmountable. long distance transmission lines and grid interoperability will resolve most of the issues of intermittency. well engineered systems have redundancy built into them. redundancy is standard in engineering curriculum today.

Baffled now claims: “they are not as hugely variable as you may think. it is an issue that needs to be addressed. it is by no means insurmountable. long distance transmission lines and grid interoperability will resolve most of the issues of intermittency. well engineered systems have redundancy built into them.”

And yet CA on a good day got a whole hour where the preferred electricity generation solution. https://apps.npr.org/dailygraphics/graphics/california-supply-demand-ai2html-20220512/img/_ai2html-graphic-wide.jpg See all that redundancy in the gray portions of the graph?

Texas on the other hand had an ~80 drop in production from wind, solar and grid components. Baffled still thinks that gas which continued to supply electricity at well above the average demand: https://upload.wikimedia.org/wikipedia/commons/7/75/ERCOT_generation_2021_power_crisis_US_Energy_Information_Administration.jpg

Since this doesn’t fit the narrative, it is ignored.

https://www.msn.com/en-us/news/us/texas-gov-greg-abbott-criticized-biden-after-a-gop-lawmaker-said-pallets-of-baby-formula-were-sent-to-migrant-holding-facilities-amid-national-shortage/ar-AAXdagq?ocid=UCPNC1&bncnt=BroadcastNews_TopStories&pc=U531&cvid=a2132893b65443049d733c18b705e762

Governor Gregory Abbott must really hate Hispanics as he is angry that their babies may actually get baby formula. Yea Greg – let these children just die.

I have yet to read that Alito draft opinion that will likely overturn Roe. I truly despise reading legalesse and therefore am no expert on such matters. Lisa Rubin did read it and exposes the legal logic behind Alito’s arrogant bloviating is incredibly flawed:

https://www.msnbc.com/rachel-maddow-show/maddowblog/the-leaked-draft-has-a-fatal-flaw-and-its-even-worse-than-you-think-rcna27416

Look – the Federalist Five do not care about the law. They do want to turn the clock back 175 years when women were mere property.

I have a lot of mixed feelings on the topic of adultery. However, I would submit that maybe anyone on Rachel Maddow wouldn’t be considered a neutral party on the topic, and that’s coming from a Rachel Maddow fan.

*”adultery” excuse me, I meant to type abortion. Don’t ask me how I managed that brain fart. Summer heat?? Anywayz…….

https://www.msn.com/en-us/news/world/senegal-sees-opportunity-and-hypocrisy-in-europe-s-search-for-gas/ar-AAXe7Yn?ocid=msedgntp&cvid=b0779ac2d0854aa8a138bb6b65cbfb36

As EU nations look for sources of natural gas other than Russia – it seems certain African nations may be the winners here.

I get that parents of newborns want a reliable source of baby formula but this entire dustup is striking me as something that could be readily solved. First of all – how did we get to a situation where basic food is being manufactured by only 4 domestic suppliers? Going forward we need more competition even if that is not going to address the current crisis. Some have called for Biden to invoke the Defense Production Act. What would that mean – beer manufacturers producing baby formula?

Oh wait – we could import baby formula from places like Europe!

https://www.msn.com/en-us/news/us/fda-to-announce-how-itll-increase-baby-formula-imports/ar-AAXcH27?ocid=uxbndlbing

The FDA has to approve this? Now I get parents want safe baby food but come on – German parents and American parents are not that different. If the Big Four have not only gotten an oligopoly strangle hold on domestic production of formula but also limited imports abusing the FDA, then shame on this sector.

Open the borders, approve more domestic producers, and that might just lower the price parents have to pay for their baby’s food going forward.

And while we at it – get rid of those stupid 2018 Trump tariffs on a host of other goods too.

BTW if Tucker Carlson tells his audience tonight about some home made solution, DO NOT follow this moron’s recipe as it will likely kill your precious infant.

My sentiments exactly. Baby formula isn’t medicine. It just needs to be food-grade, like any other powdered food-like substance. Dumb, overreacting regulations shouldn’t stop people from getting this sort of thing.

Two follow ups on my baby formula comments. My link notes:

The vast majority of baby formula — about 98% of what’s consumed — is produced domestically. The FDA has strict requirements about the vitamin content, formula packaging and labeling that raise high barriers to importing formula. And the U.S. also imposes 17.5% tariffs on imports of infant formula.

Yep – the domestic baby formula cartel has gotten the FDA to do its bidding in limiting foreign competition. That needs to stop. And as I noted we should have more domestic competition. It seems a new company in Pennsylvania called ByHeart is making baby formula. Its demand is quite strong.

pgl,

There is also the matter that Cato types resist having full inspections of production facilities. So it is not surprising that the biggest of them all, at Abbot Labs, ended up producing toxic formula and has had to be closed for awhile. But they would rather wail about immigrants and funding the Ukrainians than actually supporting anything that might lead to avoiding this sort of event in the future.

We must inspect the production facilities here. And I’m sure the EU governments are inspecting their facilities.

I mean, I’m all for more food factory inspections. What does that have to do with baby formula tariffs? This is the Irish Famine in miniature.

I generally avoid anything written by a member of CATO but this is what Google had up when I search for baby formula tariff and the discussion is actually not bad:

https://www.cato.org/blog/rock-bye-trade-restrictions-baby-formula

Back on May 6, AS wrote:

“Using the same model for May nonfarm employment as used for April, we may see an increase in employment of only about 185k. The same model forecasted 410k for April vs. actual report of 428k.”

Well, as of the week ended May 7, the 4-week moving average of new jobless claims was 192,750, up 4,250 from the previous week and up 15,250 from the survey week for the April jobs report.

I don’t think any forecasts for the May job count have been collected yet by the usual suspects, so it’s too early to know how he rest of the forecasting world sees he number. AS seems right in calling for a number below the recent average.

Just for fun, has anyone noticed what’s happening in the “stablecoin” market this week? Instability.

Stablecoins come in two varieties. One variety employs collateral to provide stability, the other relies on an algorithm. Both aim a a fixed value to some reference asset, like the U.S. dollar. Turns out, collateral works better. USDCoin and tether are collateralized cryptocurrencies. USDCoin has held its value at one to the dollar, while tether broke the buck this week but mostly recovered.

The algorithm-stabilized stablecoin TerraUSD has plunged in value, ending the week at 13 cents. Oops.

Stablecoins aren’t supposed to break the buck. It’s a contradiction of their very purpose. It is worse, though, to break the buck and fail to recover. Stodgy old notions like collateral work, though imperfectly. Algorithmic fantasies, not so much.

Lol I love this comment. Thank you.

The good news is, given the pace of change, it takes only a couple years for crypto market participants to learn a few centuries of the history of currency and monetary policy without actually reading any history. I call that a win.

https://fred.stlouisfed.org/graph/?g=PkXW

January 30, 2018

Life Expectancy at Birth for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2000-2020

https://fred.stlouisfed.org/graph/?g=MnBT

January 30, 2018

Infant Mortality Rate for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2000-2020

https://fred.stlouisfed.org/graph/?g=Pmd6

January 30, 2018

Life Expectancy at Birth for United States and European Union, 2000-2020

https://fred.stlouisfed.org/graph/?g=OQgq

January 30, 2018

Infant Mortality Rate for United States and European Union, 2000-2020

Let’s applaud Bruce Hall for finally bringing us an informative discussion of the economics of high gasoline prices ala the Dallas FED:

https://www.dallasfed.org/research/economics/2022/0510

Alas Bruce Hall posted this interesting discussion before he read it. You should read it as it completely undermines every piece of intellectual garbage Brucie has been putting forth here for weeks.

Yes Bruce Hall is so incredibly stupid that he cannot understand what his own links actually said! But you knew that already!

concerning increasing crude output, it is not that easy nor quick, as the dallas authors see.

e.g. if you shut a producing well there are risks to not ever restarting, and “set up and restart” schedule risks.

opec+ estimates world crude demand at 100.3 mbbl/day and last week missed their supply by a bit more than 2 million bbl/day.

note the commercial side built petroleum inventories during the spring 2020 pandemic response, while no crude was put in the spr when wti went negative!

the usa will buy 60 million barrels for spr at north of $100.

in the 6 may eia report: spr is down 89 million barrels year on year and usa net exports were 700k barrels per day.

jet fuel and distillate stocks remain historically low while gas drew down a bit more than recent weeks in the latest report.

Sorry for all the clutter, but…

The latest Fed loan officer survey shows that lending conditions are not tightening yet, on balance, but are not easing much, either.

https://fred.stlouisfed.org/graph/?g=PmoX

This is actually very interesting now. When things get shaky you can learn a lot more from credit markets than equities. At least, in how to say??~~ a granulized (or granular??) fashion. Credit markets will always tell you more in the crazy periods. But that one you gave presents a different angle than the bonds stuff and is very worthy observing.

The problem is when what we *don’t* know about credit markets is the thing actually causing a crisis. You can be slapped by the invisible hand as Gary Gorton would say.