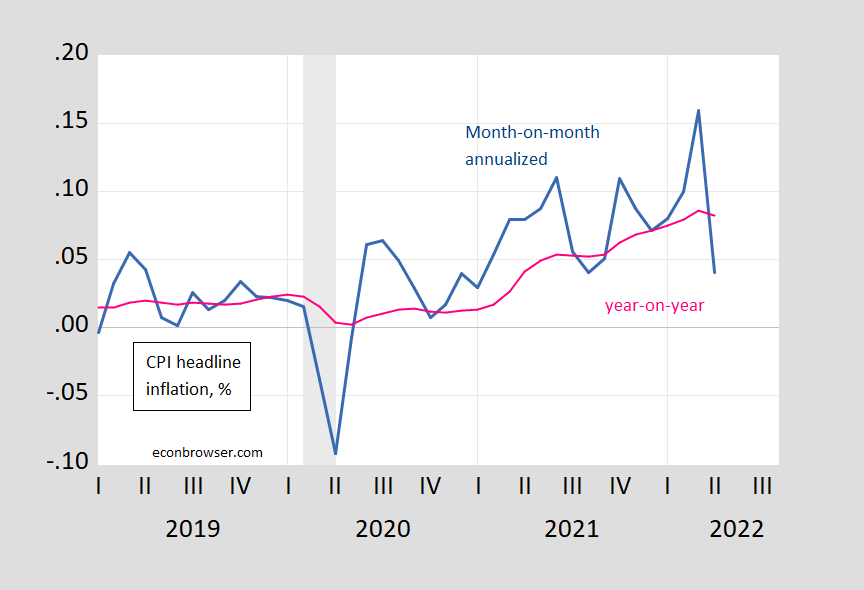

Dramatic plunge in headline CPI m/m inflation, but both headline and core surprise on upside.

Figure 1: CPI month-on-month inflation rate, annualized (blue), 12 month or year-on-year inflation rate (pink), in decimal form (i.e., 0.05 means 5%). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

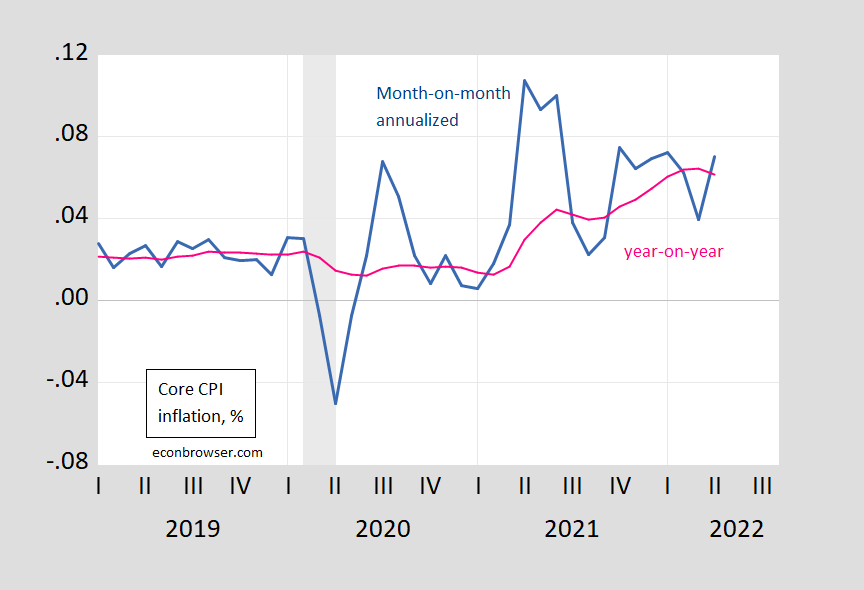

“Base effects” will help going forward, but services inflation (and housing costs) are likely to continue to put upward pressure on headline as well as core.

Figure 2: CPI month-on-month core inflation rate, annualized (blue), 12 month or year-on-year inflation rate (pink), in decimal form (i.e., 0.05 means 5%). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

If both year-on-year inflation continue to go down, we might be in a period of disinflation (as discussed here on Marketplace, this differs from deflation, which is a general decline in the price level).

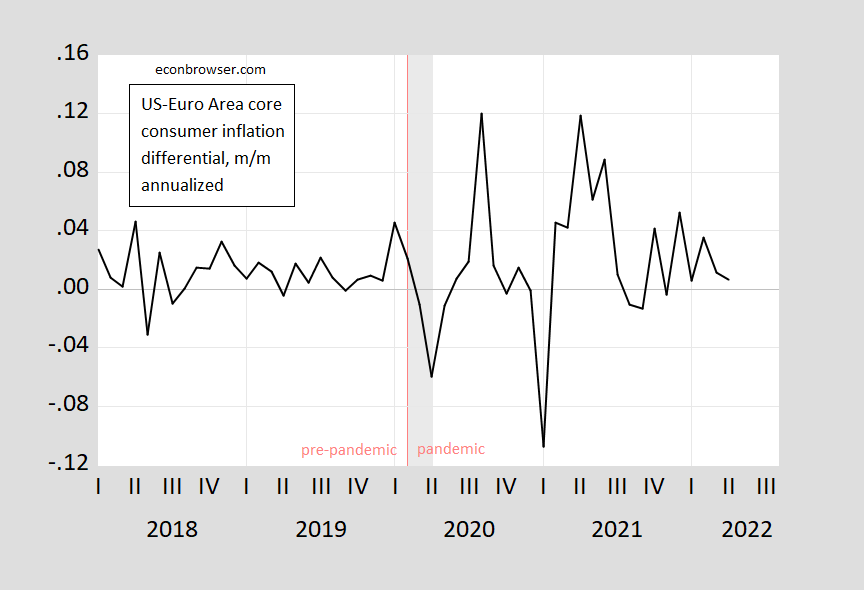

Finally, we can update the picture on core inflation developments in the US vs. Euro area. In April m/m annualized core inflation was 0.7 ppts higher in the US than in the Euro area, 2.4 ppts on a year-on-year basis. The fact that the m/m differential was smaller than the year-on-year is consistent with a shrinking of the inflation gap, as shown in Figure 3.

Figure 3: Month-on-month annualized core inflation differential for US=Euro Area (blue), calculated using log differences. Euro Area core HICP seasonally adjusted by author using geometric Census X-12. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, Eurostat via FRED, NBER, and author’s calculations.

Real average hourly earnings in 1982-84 dollars right back to where they were in February, 2020.

April, 2020: $11.03

February, 2020: $11.02

https://www.bls.gov/news.release/realer.nr0.htm

https://www.bls.gov/opub/ted/2021/real-average-hourly-earnings-down-1-9-percent-from-november-2020-to-november-2021.htm (Look for data under second “chart data” tab)

Not exactly a rosy picture. And reality is probably worse, since the plutocratic CPI was used as the deflator

is inflation a world wide phenomenon or just a US one? answer seems to be, its world wide with just one exception, and only because they have price controls

Thorough discussion – thanks!

CPI month-on-month inflation rate, annualized (blue) is one noisy series of late. Let’s hope this stays below 5% for a while.

https://fred.stlouisfed.org/graph/?g=FmWS

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MMHi

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=MN2G

January 15, 2018

Consumer Price Index for Food and Energy, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=MN3g

January 15, 2018

Consumer Price Index for Food and Energy, 2017-2022

(Indexed to 2017)

https://english.news.cn/20220511/85d696c9c2124d28b011dcdb977d5a02/c.html

May 11, 2022

China’s consumer prices see mild uptick, factory inflation narrows

BEIJING — China’s inflation has remained at an overall moderate and controllable level, with consumer prices seeing a mild uptick in April and factory prices facing cost pressure, official data showed on Wednesday.

The consumer price index (CPI), the main gauge of inflation, rose 2.1 percent year on year in April, and went up 0.4 percent from the previous month, according to the National Bureau of Statistics (NBS).

The rise was partly due to the domestic resurgence of COVID-19 and the continuous rise of bulk commodity prices across the globe, noted Dong Lijuan, a senior statistician with the NBS.

Food prices went up 0.9 percent from the previous month, driving up the monthly consumer inflation by about 0.17 percentage points.

Specifically, the price of pork, a staple meat in China, increased 1.5 percent month-on-month in April, compared with a 9.3 percent decrease in March. Hog production has gradually tempered and stockpiling of pork to replenish state reserves is in progress, Dong said.

Pork prices still registered a year-on-year drop of 33.3 percent, narrowing by 8.1 percentage points from the previous month.

Non-food prices rose 2.2 percent from a year earlier, the same growth recorded the previous month. The prices of gasoline, diesel and liquified petroleum gas went up by 29 percent, 31.7 percent and 26.9 percent year on year, respectively.

The core CPI, which excludes food and energy prices, gained 0.9 percent year on year in April, down 0.2 percentage points from the previous month….

China’s consumer price index:

https://news.cgtn.com/news/2022-05-11/China-s-consumer-price-index-rises-2-1-in-April-19Wp6imCfsc/img/a3224024031d4cefa9abbc2f96301fc2/a3224024031d4cefa9abbc2f96301fc2.jpeg

China’s producer price index:

https://news.cgtn.com/news/2022-05-11/China-s-consumer-price-index-rises-2-1-in-April-19Wp6imCfsc/img/edbd21f94d854d6aa44f4609dc7c527c/edbd21f94d854d6aa44f4609dc7c527c.jpeg

Dateline — Beijing. Things in China are great!

“If both year-on-year inflation continue to go down, we might be in a period of disinflation (as discussed here on Marketplace, this differs from deflation, which is a general decline in the price level).”

Hope you’re right!

Prof. Chinn, care to comment on Macroduck’s suggestion that the Fed might slow its hike plans given recent data?

AG,

Dudley certainly disagrees with me:

https://www.bloomberg.com/news/articles/2022-05-11/dudley-says-fed-should-hike-to-5-or-higher-to-curb-inflation

If a nation has serious supply chain problems, what level of interest rate fixes the supply shortage??

CPI for U.S. City Average:

Monthly, Seasonally Adjusted

All items:

Jan 2021 = 262.200

Apr 2022 = 288.663

Change = 10.1%

Food at home:

Jan 2021 = 252.270

Apr 2022 = 281.653

Change = 11.6%

Gasoline:

Jan 2021 = 215.529

Apr 2022 = 357.377

Change = 65.8%

While the rate of inflation increases may be decreasing, the perception of inflation is still very strong.

Interestingly, the CPI for gasoline did decline in the April data, but that will probably be temporary, even with any seasonal adjustment which is not a concept with which most purchasers will be familiar.

Regular grade gasoline:

Month Ago Avg. $4.114

Current Avg. $4.404

Change = 7.0%

https://gasprices.aaa.com

Just as Trump took the blame for COVID cases and deaths despite rushing new vaccines through development and distribution in less than a year, Biden is going to be blamed for high gasoline prices despite begging Iran, Venezuela, and Saudi Arabia to pump more oil. Neither situation was fair to the incumbent, but the “buck stops there.” Trump couldn’t do anything about states reacting badly to the infected elderly by putting them back in nursing homes to infect more elderly who then comprised 80% of COVID deaths (think New York and Michigan); Biden couldn’t stop the Russians from invading Ukraine. They simply got run over by “externalities”.

Jan 2021 = 262.200

Apr 2022 = 288.663

Now that is the perfect example of cherry picking the data. Bruce – everyone knows you lie 24/7 for the MAGA crowd so maybe you should not make it so damn obvious.

Oh wait – the change in the price level over a 15 month period is just over 10%. Annualize this and you get an inflation rate of only 8%.

My God – we all knew Bruce Hall sucked at basic arithmetic but this spin is beyond embarrassing. Come on Bruce – your preK teacher is not going to be happy with your latest incredible stupidity.

A professional liar who cannot even keep up with the 4 year olds at the basics!

You’ll see my reasoning when Menzie gets around to posting it.

“Just as Trump took the blame for COVID cases and deaths despite rushing new vaccines through development and distribution in less than a year,”

Trump never took the blame even though he should have. And Moderna gets the credit for doing their research over the past decade.

Bruce – you whine like a little baby when people note your blatantly lie 24/7 but you continue to lie like a rug. Grow up little baby. Damn! m

The reason Trump was blamed for Covid deaths were all the things he could reasonably have done to mitigate the disaster – but didn’t. In contrast, Biden has indeed done all he could to keep gasoline prices from increasing further.

Bruce Hall is on the record. No mask mandates. Forget social distancing. Take bleach etc.

You should have taken my advice, Lucy.

Sure, Ivan. Trump could have gone full blown China like Shanghi, eh? Or he could have gone full blown Sweden and let the chips fall where they may. Or he could have demanded that elderly people not be allowed to return to nursing homes when they were infected (as in New York and Michigan). Or he could have let the FDA take their usual 7 years to test a vaccine for approval. Or he could have … well, what could he have done without the benefit of hindsight?

After all, you love the vaccines and boosters. Trump was the one who directed the rapid development and distribution of those. The economy was virtually shut down in 2020. Should he have set off nuclear bombs to incinerate the virus? Trump was castigated for shutting down air travel with foreign countries. Well, he could have had the Air Force shoot down incoming airliners, right? He had Dr. Faucistein right by his side. Wrong Dr.?

Yeah, what could he have done without the benefit of hindsight? Do what Europe did? Oh, wait, their numbers were about the same as the US. Maybe he should have stopped all illegal immigrants who came in untested and unvaccinated. No, that would be racist.

‘It’s going to disappear’: A timeline of Trump’s claims that Covid-19 will vanish

https://www.cnn.com/interactive/2020/10/politics/covid-disappearing-trump-comment-tracker/

“Trump has stuck to the refrain no matter what has been happening with the pandemic. Since February, the President has declared at least 38 times that Covid-19 is either going to disappear or is currently disappearing.”

Trump Predicted ‘Covid, Covid, Covid’ Would End After The Election.

https://www.forbes.com/sites/tommybeer/2020/11/11/trump-predicted-covid-covid-covid-would-end-after-the-election-its-worse-than-ever/?sh=4669e4a76512

“In the days and weeks leading up to Election Day, President Donald Trump claimed that the ‘fake news media’ chose to focus on Covid-19 to damage his campaign, predicting that once November 4th arrived, Americans would not hear about the virus anymore, however, in the seven days since that date, infections and hospitalizations have spiked to unseen levels, shattering previous records.”

See the full video and transcript of Trump suggesting disinfectant might be injected as a coronavirus cure (BI)

https://www.businessinsider.com/trump-suggests-infecting-disinfectant-video-transcript-2020-4

You’re full of crap, Bruce.

Biden and his CDC director said get the vaccinations so that you will not catch COVID and won’t spread it. Oooo, you neglected that in your FOC remarks, Andrew.

Oh and:

Trump urges all Americans to get COVID vaccine: ‘It’s a safe vaccine’ and it ‘works’ (March 16, 2021)

The former president and first lady Melania Trump received their vaccines privately in January at the White House

https://www.foxnews.com/media/trump-urges-all-americans-to-get-covid-vaccine-its-a-safe-vaccine

Trump waited *two months* to tell the world he got the vaccine.

Covid vaccine hesitancy has been MAGA-dominated since Day 1 (unlike hesitancy regarding other vaccines):

How American conservatives turned against the vaccine | Vox

https://www.youtube.com/watch?v=sv0dQfRRrEQ&t=671s

Some people didn’t want to take the vaccine injections. So what? Now we know that you can still catch and spread the virus even when vaccinated and boosted.

https://www.walgreens.com/businesssolutions/covid-19-index.jsp Page three, positivity rate and proportion of tests… if you are smart enough to find that part.

gosh which one is much more volatile!

Trimmed mean is the best one to look at and it is running at 6.2%. way too high. Fed, like all central banks has been far too slsow getting back to a neutral rate.

“but services inflation (and housing costs) are likely to continue to put upward pressure on headline as well as core“

Furman has been pointing out the continued rise in core services as something that’s worrying for the USandA. His Twitter is always a must-read for quick, yet meaningful analyses, of these data.

Not CPI… PPI. Services ~ no change; Goods ~ 1.3% M/M Perhaps the costs will be absorbed, but probably passed through.

https://www.bls.gov/pPI/