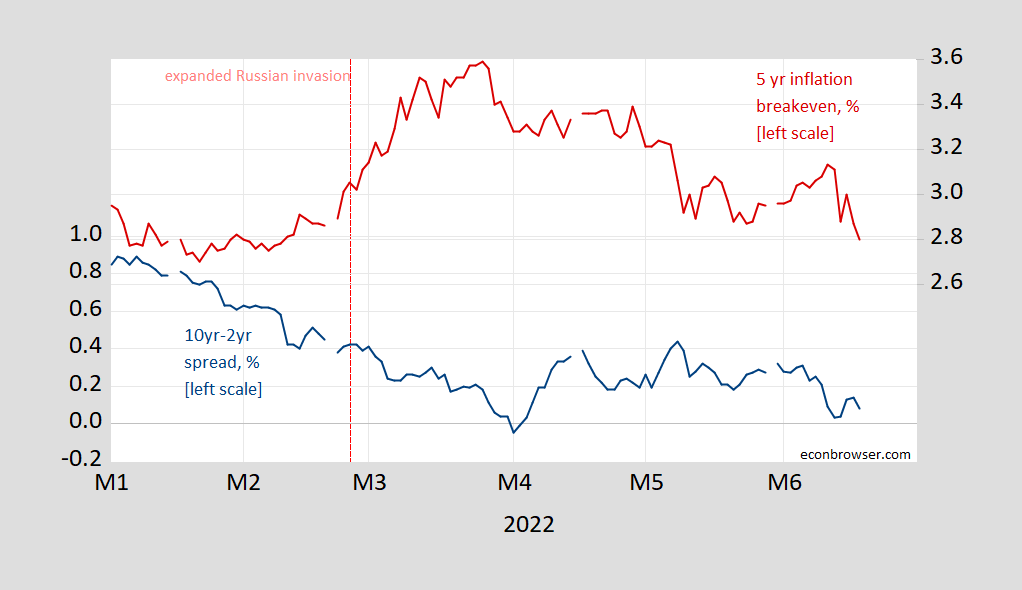

At February 10th levels, but 10yr-2yr term spread below.

Figure 1: 10yr-3mo Treasury spread (blue, left scale), and 5yr Treasury-TIPS spread (red, right scale), both in %. Source: Treasury via FRED, author’s calculations.

The lower term spread suggests inflation expectations are the same as in February, but growth expectations lower. On the other hand, the 10yr-3mo term spread is the same on Friday as on February 10.

Current commentary seems to envision recession as pretty much a foregone conclusion. Using a simple 10yr-2yr term spread probit model, the probability of recession in May 2023 is 18%; using 10yr-3mo, it’s 2%. Adding in the Fed funds rate does not change the results appreciably. However, as noted by Ahmed, including oil prices, financial conditions, and foreign term spreads can raise the probability to around 60% (where what drives the probabilities high is not the term spread, but the other factors).

For anyone whose memory is as poor as mine is (sometimes):

**Rashad Ahmed

https://econbrowser.com/archives/2022/05/guest-contribution-do-foreign-yield-curves-help-predict-u-s-recessions

I have some slight cynicism about the connection on foreign yield curves, but I think there’s enough evidence that Ahmed has found, it’s an avenue worth pursuing farther, and I’m glad he shared it with us.

2% +/- 58%?

What does anyone think about the NY Fed. staff model as presented in

“Federal Reserve Bank of New York Staff Reports What Predicts U.S. Recessions?”

Staff Report No. 691 September 2014

Weiling Liu Emanuel Moench

Using the model for the six-month horizon, which includes: GS10-tb3ms, the six-month lag in the difference and the Y/Y % change in the SP500, the calculation shows about a 5% probability of recession within six months of May 31, 2022.

https://www.newyorkfed.org/medialibrary/media/research/staff_reports/sr691.pdf

Off the cuff, 5% seems low. Since WWII, the U.S. has been in recession roughly 15% of the time ( you should check my math) and rather famously, even Fed policy sometimes can’t tell when the economy is in recession. So for my money, an estimate of recession odds six months out below 5% is always suspect. I realize the model’s value is not in precise odds, but we (in our role as pretend policy makers) should be aware that 5% is never realistic.

I haven’t done a thorough search, but a cursory search hasn’t turned up any subsequent verification of this 2014 paper. Or much attention to it. Maybe there is more out there than I’ve found, but lack of interest for nearly a decade may be a bad sign.

The paper strikes me as a data-mining exercise. The wide variety of indicators and timeframes makes it more likely we would get spurious results. Is there a strong theoretical reason to suspect that margin accounts would convey information not available in the yield curve? Research since Galbraith’s “Great Crash” has cast doubt on margin debt as a predictor of stock market performance. What are the odds margin accounts predict economic performance? Frankly, I’d be delighted to have a more reliable leading indicator of recession than the curve qlone, with or without a good theoretical foundation, but absent a theoretical foundation, I’m suspicious.

But this kind of research isn’t my strong suit, so what do I know?

The problem with models is that they by their nature only take into account the run of the mill often occurring drivers of process being modeled. The black swan events are not included – although when those events comes they often becomes the main drivers. Russias invasion of Ukraine and their use of hydrocarbons and food as blackmail to force the world to accept it, is not processes that are included in normal economic models. Some of the secondary effects of Russias acts (and the wests responses) may eventually show up in numbers that are used in the models, but even then they may not act in the same old predictable way. Modeling is hard, predicting is even worse.

Mentioned this before, and it’s pretty obvious, but the difference between 3-month/10-year spread and 2-year/10-year spreads when rate hikes are anticipated is that more of the expected hikes fall within the duration of the two-year note than the 3-month bill.

Probably because of inflation, markets have anticipated much more rapid rate hike this time than in recent cycles. The result is a divergence between the two term spreads. If current expectations of rate hikes are near correct, then there will be a flattening of the 3-month/10-year spread in coming quarters. It’s that “if current expectations are near correct ” part that matters.

Read this way, the curve suggests the risk of recession will rise with hikes in the funds rate. That seems pretty reasonable. Certainly, the current shape of the curve doesn’t suggest we are in recession now and doesn’t mean we will necessarily go into recession next year. It’s still a Ghost of Christmas Future kind of think. Not will be, but might be.

I think I forgot the picture of how much faster markets are expecting rate hikes to be this time than in recent cycles:

https://fred.stlouisfed.org/graph/?g=QLjI

Wide 3-month/2-year spread means rapid rate hikes.

Menzie,

This looks like things going from completely gonzo about two months ago to a “new normal” that seems to have held for about two months.

What is driving most of this is the war in Ukraine, which is having a terrible effect on the world economy, especially regarding food supplies in poorer nations around the world. A bottom line here for any of our local Putin fans is that he is personally responsible for the starvation deaths of many poor people in man nations around the world,

how dakota grain gets to lake superior ports

for the money spent on a couple of 463l pallets of stingers….

there are roads from ukraine to danzig and other baltic ports?

two sides to start a war

ask pope francis his recent observations?

A.,

Wow, you continue to be just about the least intelligent person commenting here, almost making CoRev look like he might get invited for that trip to shake hands with the King of Sweden.

So, duh, why does it matter how Dakota grain gets shipped out? The issue is that there are established transportation patterns that get established over time and it is not all that easy to make massive changes from those. So the problem is that the routes out of Ukraine through the Baltics and so on are very limited and have not been carrying such levels of grain out, while grain leaving the Dakotas is doing so in long established ways. You do not understand this? Just how effing stupid are you?

Ad for Pope Francis, I just checked and he has strongly denounced “using food as a weapon of war.” He has been cautious about coming down on Putin, but I think this is because he does not want Putin mistreating Roman Catholics in Russia. That is pretty obvious, but he is clearly appalled at what Russia is doing with this food situation, which is its fault, not Ukraine’s Just how out of it are you again?

Anonymous,

BTW, in case you did not catch top Russian propaganda chief, Margarita Simonyan, has just bragged about how the Russians are hoping for a famine to happen as a result of their actions, so as to bring about pressure for a victory for them. She was that blatant. They are to blame. Period.

Uh-oh, Baffling isn’t keeping us up-to-date on Texas’ goings on:

https://www.texastribune.org/2022/06/18/republican-party-texas-convention-cornyn/

“Meeting at their first in-person convention since 2018, Texas Republicans on Saturday acted on a raft of resolutions and proposed platform changes to move their party even further to the right. They approved measures declaring that President Joe Biden “was not legitimately elected” and rebuking Sen. John Cornyn for taking part in bipartisan gun talks. They also voted on a platform that declares homosexuality “an abnormal lifestyle choice” and calls for Texas schoolchildren “to learn about the humanity of the preborn child.”

Maybe this insanity explains why they hate red flag laws. These people are all incredibly insane and should never be allowed to hold a gun.

why do you despise dues: due diligence and due process?

I’m not sure what preborn means. I assume it means a premature birth, since you have to be born to be preborn. Unborn makes sense as not born yet. Texas is being Texas, I suppose. Oh, well.

As far as recession, it is hard for me to believe we are going into one. A period of slower growth, sure. We couldn’t keep growing like we were. But the usual things I see at the beginning of a recession aren’t happening yet. There’s no slowdown in construction, there’s no slowdown in the unsolicited offers to tear down our house from developers, no slowdown in people who want to lend me money. All of those things tend to fall off dramatically. The one thing that is fouling me up is that the usual sequence would be violated if we weren’t already in a recession. That’s people saying we aren’t in a recession just yet. That’s always been a giveaway that the recession has started. But I don’t see one yet and don’t expect one for a while.

Bring it n the crazy. It can only help:

https://poll.qu.edu/poll-release?releaseid=3849

https://jabberwocking.com/heres-a-walk-down-memory-lane-with-the-platform-of-the-texas-state-gop/

Kevin Drum reminding us that Texas Republicans have always been bat$hit insane.

In general, right now whether a model predicts a recession in the near term into 2023 depends on the extent to which it relies on the Treasury yield spread. Those models which rely heavily on the spread do not; those which rely primarily on other factors do.

The inverted yield curve is primarily a function of the active Fed since the late 1950s or 1960s. Before then, without Fed intervention, there were plenty of recessions.

The primary difference is that older models relied upon both short and long corporate bond rates, not for inversions, but for whether average rates were rising or falling. That is why, for example, Prof. Geoffrey Moore’s model relied on the Dow Jones Bond Average. Similar models, based on short term corporate paper, have a track record that goes all the way back to the 1850s.

Moore’s other 3 long leading indicators were real money supply, housing permits, and corporate profits deflated by labor costs. All but the last one are now negative.

Since ECRI relies on Moore’s model, once it turned I went looking to see if ECRI’s spokesman, Lakshman Achuthan, had given any interviews forecasting a recession next year. Sure enough, in the past month he has.

Here’s ECRI’s weekly leading index:

https://www.advisorperspectives.com/dshort/updates/2022/06/17/ecri-weekly-leading-index-update

It’s not encouraging.

Oh, see you need a wristband like I’m going to get soon. It’s the Larry Summers Principle: “Recessions are better than inflation”. Also “U.S. government stimulus causes war in Europe” and “U.S. government stimulus causes global supply chain problems”. OK?? Try to get this right. Just watch Summers on Bloomberg more and tune in for his soon to be published National Review column co-written with Larry Kudlow. Look for the title “Larry and Larry” or “Washed-up and His Friend Cokehead”. I make the same mistake that’s why I’m mail ordering my “Larry Summers Principle” wristband to help me not forget. These are principles Larry has made so that Biden knows what a huge mistake he made to tell Summers to catch up on his crochet hobby over at Bloomberg.

It’s not just Musk – techy CEO’s suck as bosses.

https://newsletters.theatlantic.com/galaxy-brain/62a7fbc951acba00209259f5/elon-musk-brian-armstrong-coinbase-crypto/

Not surprising. The reason a person gets drawn into computer and tech stuff is usually that they always sucked at the human interaction thing, so they love how easy it is to understand and control computer/tech stuff.

The smartest of them will understand how important the human stuff is in a successful company. If they don’t have a fragile ego they will admit their weaknesses, then hire and listen to a person who get the human stuff (while they continue doing brilliant things on the computer/tech side).

Unfortunately, fragile egos are abundant among them because of all the failures in their youth on that human stuff. So, they will insist they CAN do the human stuff (cause they ARE brilliant).

They treat humans as computers, that will do as programmed if the right commands are typed in by their owner. If those humans “malfunction” (=complain), they will throw them away and get a new one – never listening to the “malfunctioning” humans or questioning their own approaches to management.

The best company leadership teams have an innovator, an implementor, a business person and a human glue administrator. They all have to understand and respect what roles and strengths the others are bringing to the team. Unfortunately, most tech companies are born out of innovation and never manage to recruit the other 3 as equal players on the team.

BOA’s comments about the possibility of a recession:

https://news.yahoo.com/us-economy-grind-halt-second-123000232.html

In a note published on Friday — two days after the Federal Reserve hiked interest rates by 75 basis points — analysts said the Fed was too slow to aggressively tackle inflation, which is running at a 40-year high, and abruptly scrambling to get on top of it.

Now the bank sees GDP growth slowing to nearly zero by the second half of 2023 because of the influence of tighter financial conditions. While the risk of recession this year is low, Bank of America sees a 40% probability starting next year. And 2024 isn’t looking much better, as analysts see only “a modest rebound” by then.

The economy is acting like an old Hollywood actress wearing heavy makeup and a tight corset. Looks good on the surface. But labor shortages, diesel fuel shortages, tampon shortages, baby formula shortages, and even normal saline shortages among others are cracks showing through the makeup.

We already know that food shortages as farmers abandon growing crops due to the high cost of diesel fuel and fertilizer will hit many countries as it is already occurring in Sri Lanka which got rid of its “green” prime minister. Some European countries are scrambling to implement their “green” agenda while Germany is scrambling to implement its coal power resurrection. South America is on the verge of looking like the continent of Venezuela. Africa could see mass starvation in some countries.

Meanwhile, Russia is raking in oil revenues from China and India and the ruble has recovered to the strongest in years. https://www.xe.com/currencycharts/?from=USD&to=RUB&view=10Y

Now the world’s fifth most populous nation and a nuclear power is teetering on the brink of collapse. https://www.dawn.com/news/1694552

It is beginning to look as if those sanctions against Russian oil are resulting in a total economic disaster for nearly everyone except Russia… a consequence of APT – Act, Plan, Think. Apparently when sanctions are your only international hammer, everything becomes a nail.

“The economy is acting like an old Hollywood actress wearing heavy makeup and a tight corset. Looks good on the surface. But labor shortages,”

Old Hollywood actress – another woman who turned down your rude sexual advances we presume. We warned you Brucie but your wife is about to divorce you.

But BTW – when labor is in high demand as it is now, talking about a recession is short of contradictory. Then again – you and CoRev are both dogs chasing their own tails.

“We already know that food shortages as farmers abandon growing crops due to the high cost of diesel fuel and fertilizer”

The farmers that are abandoning growing crops are in Ukraine. I guess you do not know the difference between high prices versus Russian tanks. You are indeed that dumb!

“Pakistan Human Development Report published by the United Nations in 2021 found that the economic privileges accorded to Pakistan’s elite groups, including the corporate sector, feudal landlords, and the country’s powerful military, add up to an estimated $17.4bn, or roughly 6 per cent of the country’s economy. The biggest beneficiary of the privileges – in the form of tax breaks, cheap input prices, higher output prices or preferential access to capital, land and services – was found to be the country’s corporate sector, which accrued an estimated $4.7bn in privileges, the report said.”

Oh wait – to reform the economy of Pakistan would require taking away these privileges of the corrupt elite. Now this might be seen as the end of the world to a MAGA hat wearing Trump lackey like Bruce Hall.

“Now the world’s fifth most populous nation and a nuclear power is teetering on the brink of collapse.”

Are you so utterly dishonest that you cannot say this economy is Pakistan? Now the economy has serious issues but they are not due to our support of the brave Ukrainians who are resisting the war crimes of your boss (Putin):

https://www.thefridaytimes.com/2022/05/12/five-steps-pakistan-needs-to-take-to-resolve-its-grave-economic-crisis/#:~:text=Pakistan%2C%20a%20nuclear-armed%20country%20with%20the%20world%E2%80%99s%20fifth-largest,third-highest%20among%20the%20major%20economies%20of%20the%20world.

Come on Bruce. It is bad enough that you support the genocide of Putin. It is bad enough to lie 24/7. But this lie is so transparent that even your own dog is laughing at you.

That BofA story notes this:

Despite the Fed’s more hawkish stance, the bank doesn’t see inflation cooling enough to get down to the central bank’s 2% target. Instead, it will persist around 3%, it said. While supply problems and demand for goods will ease, inflation expectations are anchoring at higher levels and wage pressures will likely be tough to reverse.

OK – we end up with 3% inflation. This is the end of the world? Give me a break. Didn’t Lawrence Summers along with Brad DeLong a few years ago say we should target 5% inflation. Now Summers is jumping up and down with his hair on fire over the horrors of 3% inflation? WTF?

3% inflation sure doesn’t sound like much of a problem in light of where it was in the 1970s.