How did the Fed get this so wrong?

Monetary stimulus can result in lower unemployment (which voters usually want) but higher inflation (which voters usually don’t want). One view of this tradeoff is that monetary policy should try to keep aggregate output near its long-run potential value. According to this view, as long as GDP is below potential, more stimulus may help lower unemployment with little cost in terms of inflation. But if GDP is above potential, more stimulus will do little for unemployment and mostly will result in higher inflation.

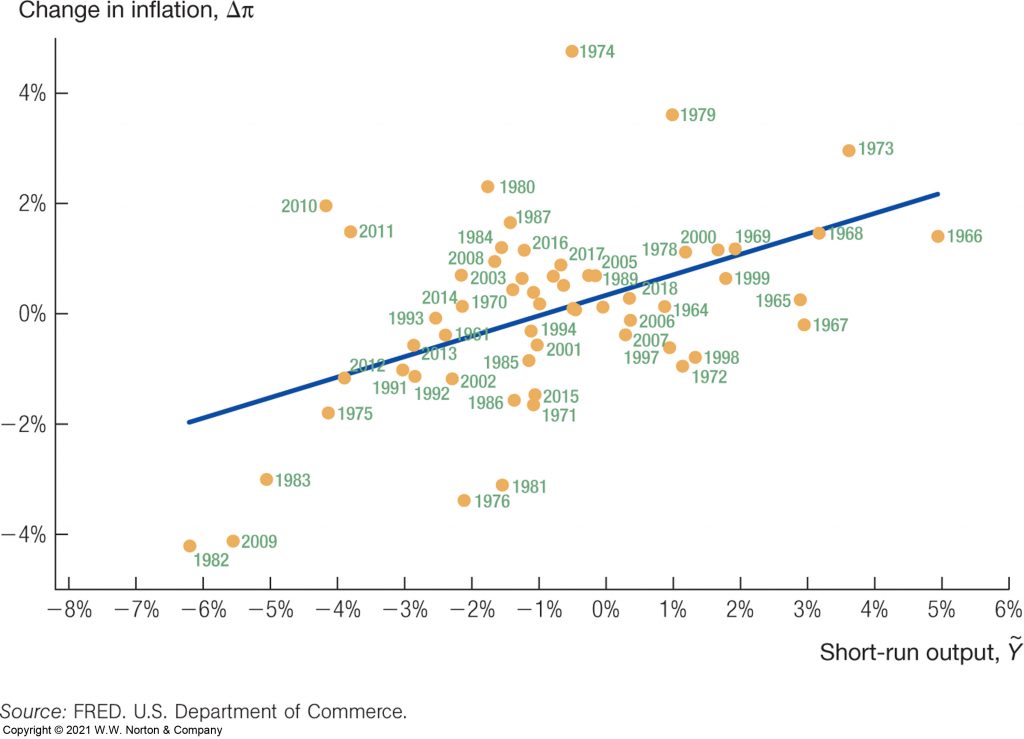

The diagram below, taken from a leading undergraduate macroeconomics textbook, summarizes some of the empirical evidence that is sometimes used to support this view. Each year between 1964 and 2018 is represented by a circle. The horizontal axis summarizes whether real GDP for that year was above or below the CBO estimate of potential GDP, and by how much. The vertical axis summarizes whether inflation for that year was higher or lower than the year before, and by how much. Years in which inflation did not change relative to the year before (zero on the vertical axis) tended to be years when output was equal to potential (zero on the horizontal axis). Years with big increases in inflation were often years when output was significantly above potential.

Source: Charles I. Jones, Macroeconomics, Fifth Edition, Figure 9.7, W.W. Norton & Co., Inc., 2021.

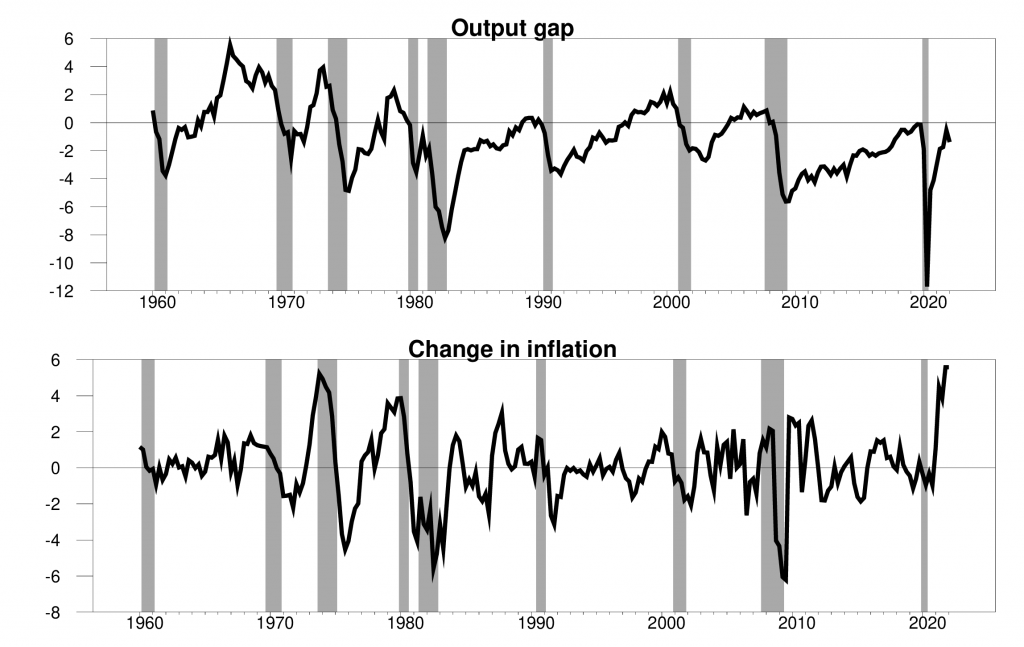

The figure below plots these data another way. The top panel plots the gap between actual and potential GDP for each quarter from 1960:Q1 to 2022:Q1. This gap remains negative up through the most recent data. A policy maker who was guided by the previous figure and the most recent CBO estimates of potential GDP would conclude that we could have continued with economic stimulus in 2021 and 2022 without worrying about a rise in inflation.

Top panel: 100 times the logarithmic difference between real GDP and potential GDP, 1960:Q1-2022:Q1. Bottom panel: Change between year-over-year inflation rate in quarter t (as measured by the CPI) and year-over-year inflation rate in quarter t-4.

Oops! The bottom panel shows this wasn’t the outcome, as everyone now knows only too well. Inflation has been on a tear upward. When Professor Jones updates his textbook, the first figure will show some pretty impressive outliers in 2021 and 2022.

But these may not be quite as impressive outliers as one might have guessed from the data plotted, if history is any judge. The reason I say this is that I’m guessing that the CBO in retrospect will decide that it probably overestimated potential GDP in 2021 and 2022, given what we now know happened to inflation. If CBO later decides that potential GDP in 2021 was lower than they are currently reporting that it was, it will make the output gap positive rather than negative in 2021, and make the data seem to predict at least some increase in inflation in 2021 and 2022. One of the reasons that the first figure seems to fit the data as well as it does (and honestly, the fit is not that great) is because the variable on the horizontal axis has been adjusted after the fact so as to better correspond to what turned out to happen to the variable on the vertical axis.

My view is that this traditional understanding of the limits to stimulus is not the right way to think about what happened over the last two years, and in fact never has been. I argue in a recent paper that the key feature that makes modern economies productive is specialization of labor, capital, and production networks. These are designed to be very efficient at accomplishing very particular tasks. In such a world, how much the economy can produce depends not just on the size and quality of our workforce and factories, but also on the match between the goods and services that producers set up in advance to be able to provide and the particular demands for those items by potential buyers. If demand for a particular good falls relative to the resources that were committed in advance to produce that item, the result will be a fall in the output of that good. Since we can’t change our specialties instantaneously, the result is idle resources and a drop in total GDP.

Our current problems have to be understood at the micro level of imbalances between productive capacity and specific demands rather than conventional summaries of the amount of water sloshing around in a big macroeconomic bathtub. We’re not producing more oil because the specialized drilling rigs aren’t in the fields. Cars aren’t being produced because chips are unavailable. Airline flights are being canceled because pilots who quit haven’t come back. A shortage of baby formula is not a problem that the Federal Reserve can solve.

I assume that most of us can agree that that such micro imbalances are a key component of the current situation. But I argue in the paper that the same issues are involved in most historic economic downturns, if people don’t want to buy the kinds of cars that Detroit is set up to produce, or construction workers are idle because no one wants to buy new homes. The latter is of course a problem the Fed can do something about. But I still think it’s better to view the construction market in terms of a mismatch between specialized factors of production and demands for the particular products (namely new houses) that they are set up to produce.

Where’s that leave us now? Well, for example, to get more baby formula on the shelves we could relax restrictions on imports and minimize regulatory shutdowns of producing plants. But monetary and fiscal stimulus is the wrong lever to push if the goal is to increase this particular component of GDP.

Very well thought out and articulated. But emphasizing the reality of microeconomic shocks sort of takes me back to those old fashion Real Business Cycle (RBC) types. Then again had the RBC crowd allowed for some role of aggregate demand rather being so utterly dogmatic – maybe RBC concepts would have been more accepted among the rest of macroeconomists.

Jim,

Well done paper.

My question is about how to figure out in a real economy the degree of these difficulties arising from specialization that will generate macro problems. 2slugbaits suggests worrying about elasticities of substitution, and that may be the underlying matter. But I am thinking more in terms of the Fed looking at the economy and trying to figure out how much inflation is due to these micro disequilibria. Should they be looking at sectoral inventory changes or something else to get some index of the degree of this specialization macro friction”

I agree that allowiing more imports is an obvious way to deal with particularly acute specific shortages.

Since the 1st draft of your paper came out over a one year I should have remembered its abstract was:

This paper develops a unified model of economic fluctuations and growth characterized by long-run equilibrium unemployment and sustained monopoly power. The level of demand is a key factor in deviations from the steady-state growth path with a Keynesian-type spending multiplier despite the absence of any nominal rigidities. The key friction in the model is the technological requirement that production of certain goods requires a dedicated team of workers that takes time to assemble and train

In other words more than just my suggestion to combine Keynes and RBC as you also note the reality that the micro foundations should include monopoly power. Can I have a small request from the peanut gallery? Go read the paper again before launching some partisan sillieness.

What a terrific analysis.

My takeaway is that economists should focus more on BEA’s Input/Output tables for commodities and industries.

Calculating the elasticity of substitution in a two commodity world is easy. Calculating the Allen-Uzawa elasticities of substitution in a multi-commodity world isn’t hard, but it has plenty of well known problems. Calculating the Morishima elasticities of substitution across a macro economy is downright daunting, but that seems to be the direction you’re heading.

Interesting thoughts – with some very specific areas to explore. Now on another note, we have an economic know nothing trying to introduce a whole new vocabulary which adds nothing to the discussion as in the latest from Princeton Steve:

Definition: Suppression is an event exogenous to the economic system which influences economic activity at a magnitude measurable using aggregate indicators like GDP and unemployment rates.

A lot of factors would be exogenous and material as in things like government purchases. I would not define a large decrease in government purchases to be “suppression” even though it might be considered exogenous and material. Now of course this economic know nothing is trying to tell us that since the actual government deficit has fallen, there must have been a large decrease in government purchases. Of course the actual deficit is not an exogenous variable but hey!

That’s misinterpreting what I am saying.

The stimulus is not suppression. The suppression is the economic shock. The stimulus is the response to the economic fallout of suppression.

In the case of the suppression, the event is fundamentally non-economic. A virus or pandemic or even a lockdown is not really an economic event like, say, the government raising taxes or borrowing money to fund purchases. I think of a suppression like an outage, say, a power outage. You’d don’t remove your electric stove or sell your TV or go chop down a tree during an outage. You sit in the dark and wait for the power company to turn the lights back on and then life goes on as though the outage never happened. It has the characteristics of being short term and reversible. Of course, if it drags on, it may turn into a recession as, say, businesses run out of money and have to shut down.

In any event, we’re discussing the topic, and that’s something.

https://www.researchgate.net/publication/46532886_The_AllenUzawa_Elasticity_of_Substitution_as_a_Measure_of_Gross_input_Substitutability

Another paper on the must read list!

Got to add the fight-vs-flight dimension. It’s a three way substitution with decreased savings / increased debt in the middle. Elasticities are different depending on whether you are in flight or fight mode, at least in the short term. That’s the difference between, say, 2007/2008 and 2011-2014 wrt to oil consumption. In 2008, advanced country consumers were willing to get into a bidding contest with China, and oil went to $147. Under similar circumstances after 2011, oil prices never went much past $115 or so. Advanced country consumers just yielded their consumption. Before mid-2008, advanced economy consumers were willing to fight, afterwards, they just yielded consumption. If you’re not willing to fight, you’re probably going to be depressed.

el Erian suggests the US fed should have choked the monetary stimulus long ago

my jaundiced view has seen “potential” gdp as overstated, wrt to labor participation.

‘if we cannot entice a few percent of ‘prime work’ age to work then our idea of potential may push a wage spiral….”

el Erian has been saying “I want to see labor part rise…”

harder lesson to learn, a year late!

I think most economists got potential GDP right a year ago back in July. Maybe everyone has forgotten but there was terrific optimism. They had finally gotten through the bottlenecks in vaccine supplies so that anyone could get vaccinated with no waiting in lines. Soon everyone would be back at work and production would resume.

But that isn’t what happened. Who could have imagined, certainly not me, that 100 million Americans would refuse a miraculous new treatment that would prevent disease and death. That Americans would sue the government to eliminate vaccinations. That Americans would sue the government to remove their masks. That Americans would plot to assassinate a governor over masks. That Americans would shoot shopkeepers over masks. It was astonishing to witness.

Then Delta and Omicron came on top of an under vaccinated, maskless population. And then toss in a war with oil and food shortages. And a pandemic that still won’t quit.

The economists were right about potential GDP back in July. But then the facts changed in a unexpected way. A recalcitrant and obstinate population is performing way below their potential.

So what do we do now? The problem is supply, not demand. Wages are not driving inflation. Trying to raise unemployment to make people poorer works on the wrong problem.

“ The problem is supply, not demand.” I’m not sure the profession agrees with this assertion. See, e.g., https://www.project-syndicate.org/commentary/inflation-demand-driven-persistent-by-jason-furman-2022-04?barrier=accesspaylog

Jason Fruman may be a very good macroeconomist but to say he is the profession is absurd even for you.

For what it’s worth, as productivity-killing mismatch fits the data:

https://fred.stlouisfed.org/graph/?g=QIMV

Menzie, you’ve gone from article-length to blog-post-length. May I humbly suggest you take the next step and distill the idea to paragraph-length? Two reasons:

1) That’s the length that can stick in non-specialists’ heads.

B) Writing your own paragraph correctly will go some way in preventing others from writing a paragraph-length description which leaves important stuff out or simply gets your idea wrong.

This is a very convincing idea. For it to grow legs, it will need a paragraph-length statement.

On to policy…

What can government do to foster adjustment? Recession seems unlikely to foster restructuring.

Well, recessions are exactly how the economy restructures. Some segments release labor, and these are gradually reabsorbed into rising businesses.

But you don’t need to restructure in a suppression! Because the force is exogenous, it can take an economy with no imbalances otherwise and just trash it. If you take away the suppression, the economy should bounce right back without the need for restructuring. I think this largely describes the case.

“Well, recessions are exactly how the economy restructures.”

Now you have entered into Hayek land. Gee – you have been digging up the most nonsensical ideas from economic history. It is sort of like the doctor who practices blood leaching.

Steven,

Yet more evidence of how your suppression idea is not so useful. An exogenous shock on an economy may well reveal problems in the structure or nature of the system, such as for example that it is too reliant on fossil fuels, which becomes obvious when it is hit by a fossil fuel shock. A pandemic shock that manages to reveal problems with ports or transportation systems may show need to work on restructuring to repair those.

So it gets back to yo trying to call “exogenous shocks” this “suppression,” but the latter tells us nothing and certainly does not tell us that the economy will just readjust back to where it was prior to the shock. We are back to a point I have emphasized with you repeatedly: it all depends on the nature of the exogenous supply shock what the appropriate policy response should be. Labeling it “suppression” does not answer or clarify any of this in any way.

This is a Hamilton post. Don’t worry I’ve made this mistake at least twice in the past. I don’t think Prof Hamilton worries too much about the lower level groups catching on comprehension wise. And that’s understandable.

So sorry. Should have addressed my comments to Professor Hamilton.

Professor Hamilton,

A few questions about your article regarding the quotation below.

“In this model, a stable unemployment rate in the face of long-term economic growth is an equilibrium implication of the fact that the opportunity cost and potential benefits of being unemployed along with the tax base that finances compensation paid to the unemployed all grow with the overall level of productivity.” Page2.

1. The above statement seems to say that the unemployed are less likely to seek employment due to unemployment benefits thanks to increased burden on taxpayers. Are unemployment benefits too generous?

2. Would this group of unemployed add much to the skilled employee group or are they unemployed due to lack of ability of most to join the skilled labor group?

3. How much math is needed to follow the math in your article? I find that three semesters of calculus, a semester of linear algebra, and several courses in operations research are inadequate as seems to be the case with most journal articles.

AS:

Thanks for looking at the paper carefully and asking some thoughtful questions.

The statement about the effects of unemployment compensation on the number of people who are unemployed was simply a summary of the implications of the model. How much unemployment would go up if one increased unemployment compensation depends on the parameter values. I make no pretense in the paper of offering policy prescriptions about unemployment compensation based on the properties of this simple model. Note also that in my model, people are unemployed because they are trying to develop a new skill, which if they are successful, will end up benefiting everybody.

It’s a general equilibrium model, in which all incentives matter for all decisions, so one could not say these people are unemployed because of compensation and those people are unemployed because of other factors. However, if in the model you set unemployment compensation to zero, there would be zero unemployment. That’s because in the model, if you’re unemployed and don’t get compensation you would starve. So nobody would ever be unemployed in the model; they’d always stick with whatever they’re doing no matter how bad the pay. And that would mean nobody ever develops new products or acquires new skills.

The Fed got it wrong because leadership was technically weak.

The output gap analysis is fine, but this was not a close call.

Consider: Larry Summers, in the Washington Post, Feb. 4, 2021

https://www.washingtonpost.com/opinions/2021/02/04/larry-summers-biden-covid-stimulus/

The proposed stimulus will total in the neighborhood of $150 billion a month, even before consideration of any follow-on measures. That is at least three times the size of the output shortfall.

[T]here is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation, with consequences for the value of the dollar and financial stability. This will be manageable if monetary and fiscal policy can be rapidly adjusted to address the problem. But given the commitments the Fed has made, administration officials’ dismissal of even the possibility of inflation, and the difficulties in mobilizing congressional support for tax increases or spending cuts, there is the risk of inflation expectations rising sharply.

What part of Summers argument is hard to understand? Why is there a need for a linear regression? This was not a close call. Three times the output gap? Are you kidding me? The macroeconomics community should have been all over it.

But was it? Larry Summers pretty much stood alone on the topic. Okay, there were another couple of economists in this camp. But the rest of the mainstream macroeconomists? Where were they? Where was Jim? Where was Menzie? Were was the rest of the blogosphere raising the alarm on blowout inflation?

Absolutely nowhere. And it’s still absolutely nowhere.

And why is that? Well, first, it’s because it’s orthodoxy over mathematics (not true for Jim, to be clear). I have asked Menzie multiple times to work through the contractionary effects of a roll off of a massive stimulus. This matters, because it can generate a technical recession a la 1945 without being a business cycle recession. If that’s the case, for God’s sake, you want to be careful with the interest rate increases.

The second issue is that the profession is simply behind the curve in being able to distinguish between a recession, a depression and a suppression. If Jimmy can’t come out of his room, it could only be one thing: He has the flu! It’s not possible he has cancer or was grounded by the folks. It never even enters the mind of the economics community that downturns could be different things at different times.

So, we don’t need regression analysis. We need the economics community to go through the same Come-to-Jesus process that CNN is facing, that is, that the proper loyalty of the economics community is to economics, and not to any administration left or right.

Second, I think we need a generational change. The business is now dominated by Old Dogs who are really struggling to learn new tricks. Meanwhile, the younger generation — like its generation more generally — has contented itself with smaller topics, miniature still-life applications and econometrics like “Is there really a ‘hot hand’ in basketball?”. That kind of thing. Why are economists wasting their time on this sort of topic? Is it because the profession has become trivialized?

As a result, theory has been elevated to the altar as Theory, some religious object which must enjoy the respect of the congregation. Forget it. Times have changed. We live in a different reality where the rules of thumb of the 1980s no longer apply, or not in the same way.

So, the issue is not analysis. It is orthodoxy, fear, age and diminished expectations. Kudos to Larry Summers for standing up and expressing an opinion. As for the rest of the profession, well, Larry Summers shows you what you should be.

Summers and Furman may be saying the same thing but when Econned calls them the profession – that is misleading. For you to think this was all one simple case of excess aggregate demand shows me that you have not bothered to read Dr. Hamilton’s paper.

You think you can put in a stimulus three times the size of the output gap and not blow up the economy? You’re kidding, right?

i’ve been following opec+ deliberations on oil output since the panic-over-the-virus.

the constant theme has been a jaundiced* view to first world recovery!

how could they out do cbo?

or did cbo expect a glut of oil based on their projections?

A glut is exactly what the EIA was forecasting. It still is, actually. If you ask me to, I will put up the graph for you.

EIA implied excess petroleum inventory outlook, here.

http://www.prienga.com/blog/2022/6/19/eia-implied-excess-petroleum-inventories

So, having re-read your comment, it is remarkably mild, as though you might have agreed with some of what I said.

But here’s the thing, as I see it: We have three things going on at the same time: 1) a massive fiscal stimulus, which is rolling off; 2) a massive monetary stimulus, which is now being aggressively reversed; and 3) an oil shock whose provenance is not entirely clear, that is, maybe its part war, part fiscal stimulus, part monetary stimulus.

If inflation of the CPI variety is due to the fiscal stimulus, then we should see prices levels shoot up, but then reverse as purchasing power reverts to mean. In that case, it seems to me, we just eat the inflation and wait for markets to stabilize. We see some evidence of this, in avocados, lumber prices and the surely inevitable discounting at the big box stores as they try to clear inventories. If that’s the case, then you want to go easy on the interest rate hikes, because the inflation is self-correcting. Note that this is entirely different than the 1970s, for example, when the inflation arose from easy monetary policy, not fiscal policy. There was no stimulus of 7% of GDP making its way through the system at the time. So this time is different and therefore you don’t want to use Volcker’s anti-inflationary policies, necessarily.

If, however, inflation is due to loose monetary policy principally, then we’re in an entirely different policy world, and then Volcker is the model to use.

And then there’s the oil bit, which also merits attention. For the moment, however, we need a nice, clean, clear analysis of the impacts and dynamics of the pandemic fiscal v monetary stimulus. I haven’t seen it yet, and Jim, at least in this post, is not addressing that issue.

“But here’s the thing, as I see it: We have three things going on at the same time: 1) a massive fiscal stimulus, which is rolling off; 2) a massive monetary stimulus, which is now being aggressively reversed; and 3) an oil shock whose provenance is not entirely clear,”

Wait, wait – I thought you believed only oil matters. OK, a wee bit of progress. BTW most economists get the idea that temporary reductions in net taxes will be partly saved which mutes the fiscal stimulus. But then getting that requires some understanding of macroeconomics, which you totally lack.

Just for the record, you said that, not me.

“Note that this is entirely different than the 1970s, for example, when the inflation arose from easy monetary policy, not fiscal policy. There was no stimulus of 7% of GDP making its way through the system at the time.”

Your 7% of GDP strikes me as grossly overestimating recent fiscal impact. But if you really think we had no fiscal stimulus back in the days, I should remind everyone of a December 1965 meeting between LBJ and his CEA where his economists warned about the triple whammy of the 1964 tax cuts, the Vietnam War buildup, and the Great Society.

Oh gee – Princeton Steve once again proves his utter ignorance of our economic history.

BTW the sin of monetary policy was less its stimulus but its stop/go approach in the 1970’s. I guess Stevie pooh does not know Nixon had the FED tighten in 1969 only to reverse course before the 1972 election. Maybe someone should remind Stevie pooh of those Ford WIN buttons. Stevie – please stop writing about periods where you have ZERO understanding.

“…If, however, inflation is due to loose monetary policy principally …”

Unfortunately Steve, the inflation will not be self-correcting.

And the Volcker model will be the only way to go.

The crash will come.

Please reread my comment in a years time …

And let me add one more point.

These two graphs need explaining.

M2 Velocity https://fred.stlouisfed.org/series/M2V

M2 https://fred.stlouisfed.org/series/WM2NS#

In the last two years, M2 is up 42% compared to Q4 2019. If the money supply is up sharply, we might expect prices up sharply (less GDP growth). So, net of GDP growth, M2 is up maybe 35%. Which is a lot.

This has not translated, or fully translated, into inflation so far, because M2 velocity has collapsed. On the other hand, velocity has been creeping up in the last two quarters, and inflation with it.

So what is the outlook for M2 and velocity? Would we expect velocity to gradually creep back to normal? If so, do we have another, say 25% inflation to eat in the meanwhile? Or will velocity remain permanently low? Why or why not? If it remains low, presumably M2 is then invested in assets like housing or securities? Is that right? What are the implications of that?

And who owns M2 anyway? The definition suggests that it is held by the private sector. Here’s the St. Louis Fed’s definition:

M2 is a measure of the U.S. money stock that includes M1 (currency and coins held by the non-bank public, checkable deposits, and travelers’ checks) plus savings deposits (including money market deposit accounts), small time deposits under $100,000, and shares in retail money market mutual funds.

That sounds like it is money and equivalents held by the public, not by the US government or banks. Is that right?

Can the Fed reduce M2? How would that work? Since 1959, there has never been a nominal reduction in M2, and in fact, growth of M2 correlates pretty well to period inflation. https://fred.stlouisfed.org/series/MYAGM2USM052S

So what does that mean now, and what is the relation to QT?

I would be more than grateful if Jim or Menzie explained this topic in much greater detail to help us better understand the potential path of inflation.

Do you read ANYTHING Dr. Chinn posts. This quantity theory (M times V = GDP) was totally discredited generations ago. That drop in V is just another nail in the coffin. You finally came up with something in some old macroeconomic books but you have not noticed that this concept is more worthless than an old type writer.

“I would be more than grateful if Jim or Menzie explained this topic in much greater detail to help us better understand the potential path of inflation.”

Dr, Chinn has – many times. Stop bloviating and learn to READ.

MV = Y in nominal terms is a mathematical relationship, if I understand it correctly. If you divide Y / M, the you get V. But perhaps I misunderstand this. That’s what appears to be on the FRED spreadsheet on the topic.

If we assume V is constant, the change in M must lead to change in Y at its nominal value. So if M is up 42%, then Y in nominal terms must also be up 42%. That relationship holds pretty well historically.

Unless V decreases, which it has. And then the question is why, and moreover, the plausible trajectory of V. In the last two quarters, V has been rising and inflation is really high.

I’m not an expert on this, so I am looking for some insight on the matter.

“Steven Kopits

June 19, 2022 at 11:16 am

MV = Y in nominal terms is a mathematical relationship,”

Actually is a stupid definition of a worthless concept (velocity). The idea one could predict nominal GDP growth by simply look at the growth rate of the money supply was abandoned by most economists generations ago.

And if you stop bloviating BS maybe you could go back to Dr. Chinn’s past posts on this topic; m

“If we assume V is constant, the change in M must lead to change in Y at its nominal value. So if M is up 42%, then Y in nominal terms must also be up 42%. That relationship holds pretty well historically.”

That has to be the dumbest thing you have ever said. It has not held up jhistorically at all. Now if I assume that NYC is going to get 24 inches of snow on the first day of summer! Dude – GDP/Money is not a constant. It is not even an economic behavorial equation.

And also, where did the growth in M2 come from? Part of it has to be the stimulus. Where did the rest come from?

see federal reserve balance sheet.

do they teach “money and banking”?

We do teach money and banking – another basic course that Princeton clearly never took!

Steven,

Since you keep ignoring this point in your gushing praise of Summers, I shall repeat it: he only turned out to be right about inflation because of things happening that he did not foresee, further new Covid variants and Russia invading Ukraine. This means it was not due to his estimates of what potential GDP was back then, which you are touting.

It was entirely foreseeable, Barkley. You did not foresee it. I did. But are you kidding me? The Fed increases M2 by 42% and you think that’s not going to show up in inflation? You have to have some real guts forecasting MV, or some astounding confidence in unwinding the Fed’s balance sheet. Do we have anything, I mean, anything in the historical record to give us any confidence at all in these two assumptions?

You used the discredited Quantity Theory of Money to forecast inflation? Seriously? Had you done so, you would have forecasted hyperinflation. And every economist on the planet would be mocking your abuse of what turns out to be junk science.

You did not forecast the variants or the war. I would be more impressed if you had. It is pretty clearly not money supply increases that are the main player here, although they are not completely irrelevant. We have been having M increases way beyond what monetarists would allow for a long time without any pickup of inflation. Even Milton Friedman abandoned his strict monetarism before he died. The people now crowing about how it is M increasing that did it seriously lack credibility.

Try for more general supply and demand stories, and we see elements on both sides, with probably fhe fiscal stimulus more important on the demands side, as Summers was huffing so much about last year while he downplayed the supply side aspects, which kicked in big time for reasons neither he nor you forecast (and none of the rest of us did either, which was why we underforecast inflation).

I am not gushing in praise of Summers. He made a reasonable call and got it right. But it’s not exactly finesse to say that a stimulus three times the output gap is going to cause problems, notably a surging trade deficit, bottlenecking and inflation. It’s like having a pickup rated for 2,000 lbs and putting 6,000 lbs in the cargo bed and watching the axle break. I mean, even if the actual capacity of the vehicle were 3,000 lbs — 50% higher than rated — you’re still going to crack it in half. You don’t have to run regressions to know you’re going to trash the truck.

So the claim that such a heavy load will break the axle isn’t exactly rocket science. It’s pretty obvious. It’s not that Summers said it, it’s that he’s almost the only one who said it.

“But it’s not exactly finesse to say that a stimulus three times the output gap is going to cause problems”

Now you are lying. The stimulus was not 3 times the output gap – even if you wrote such an incredibly bogus statement. Stop repeating such utter BS.

Actually, the increase in debt held by the public, which is a kind of measure of stimulus (ie, it including govt outlays beyond just transfer payments) was running about 16 times the output gap in last 2021, per the spreadsheet I’m looking at.

Steven,

Except that if the Covid-19 variants that appeared in 2021 and the invasion of Urkraine that happened in 2022 had not happened, Quite likely inflation in the US would have subsideded somewhar.

This is speculation, not analysis, Barkley.

Maybe, Steven, but your “analysis” is based on a questionable claim about what potential GDP was, with how to determine that the main issue here,. The low inflation rate had been deeply entrenched for years so that expectations of it were deeply entrenched. It was obvious that that the economy had been knocked aside by the pandemic, which deeply affected both supply and demand. But with vaccines coming in, it was quite reasonable to think that the pandemic was over, which clearly lots of people did. That turned out not to be the case.

Again, for the ujmpteenth time, the delta variant in particular was more virulent than the initial alpha round, and it definitely reaggravated the supply side problems that had arisen earlier, what you want everybody to follow you in calling “suppression.” You accuse others of speculation, but you are in the position of also speculating. You are effectively claiming inflation would have stayed high even if there had been no more of your “suppression,” which pretty much makes your suppression argument into a vacuous joke. Did you not notice that?

Effectively none of us know what inflation would be right now if there had been no more new variants that were so pernicious, much less if Putin had been more rational and not engaged in his full-scale invasion of Ukraine He had only just begun his troop buildup, something he had done previously, and it was not until July that he came out with his weird essay denying the existence of Ukraine, which made quite a few of us sit up and start worrying that he might in fact be capable of doing something irrational (Moses H. likes to forget that I was warning about his isolation here before anybody else here, even if for about three days in February I said he would not invade).

Maybe inflation would not have gone all the way back to where it was before by the end of the year, but there really were no grounds for Summers’s claim that it was going to accelerate, which you agreed with if none of those exogenous shocks happened, which neither of you were forecasting. So, you guys got it right out of luck, not anlysis, and you should admit it. Claiming otherwise simply renders your grea t”suppression” theory utterly useless, as you seem to be failing to understand.

Actually, Steven, I think I was one of the few who worried about the possibility of there being problems arising due to the pandemic or trouble with Putin. Going back to 2020, you were the one who made a definite prediction that crude oil was going to $100 per barrel by the end of the year, which did not happen. I was the one who earlier in the year had pointed out the wide variance possible in what would happen, agreeing with you that it might hit $100, much to ridicule from both pgl and execrable Moses, while also noting that especially if a really bad variant of Covid hit that much more deeply collapsed aggregate demand, crude oil could go below $40. That did not happen, fortunately, but it could have and I was more willing to entertain such a possibility, with indeed nasty variants appearing later.

I believe I l was still mentioned this wide variance of possibly oil price outcomes a couple of times at the beginning of 2021, especially prior to the passage of the Biden fiscal stimulus package. But I am not going to play Moses Herzog and go dredging through old comment sections here to dredge those remarks by me up. As it was, there were only two other people here who recognized that I might have a point on noting the wide possible range of oil price outcomes that might happen, with one of those actually being Menzie Chinn a bit. Curiously, although I have mocked him more recently, I think it was Anonymous noted that official 95% confidence intervals for future oil prices are regularly issued that covered a range pretty similar to what I had been emphasizing to much ridicule from many.

Oooops, on the matter of forecasts, that should have read about 2021, not 2020.

BTW, Steven, one more oddity in your arguments is that you are now warning that the ending of last year’s fiscal stimulus is a reason why we might be getting into the recession you have been declaring we are already in. But I would point out that one of the reasons so many of us thought that the inflation last year would be transitory was precisely because of the temporary nature of that fiscal stimulus. Clearly there were various inflationary pressures happening early last year, continuing supply side ones still hanging on from the pandemic, as well as the highly stimulative fiscal and monetary policies pushing on the demans side. But there was hope the pandemic-induced supply side issues would subside, which they did not, and it was known the fiscal stimulus was temporary.

Anyway, you need to get your story atraight about last year’s fiscsal stimulus. If its current disappearance is helping to lead us into recession, how is it that it was the key to our having a higher inflation rate now than early last year when you and Summers were making such a big fuss about it?

BTW, the issue raised in Jim’s paper is relevant here, that increased specialization may have increased micro friction issues, which in turn effectively reduce potential output relative to when these issues are not there. But, I do not think Summers was making that point.

Steven Kopits Larry Summers pretty much stood alone on the topic.

Let’s be clear; Larry Summers did not predict inflation. What Larry Summers actually said was that there were equal chances of (1) inflation, (2) recession, or (3) everything working out just fine. I don’t call that a prediction. It’s like “predicting” that the next time a pitcher throws the ball it will be either inside the strike zone or outside the strike zone.

What we’re facing today is something of a sui generis case. Most macro tools treat the economy’s potential supply curve as a given that is largely immune to exogenous shocks. So macro policy is organized around maintaining aggregate demand within some narrow range around that potential supply curve. But COVID shocked the supply side across the global economy. And COVID is still shocking the economy as we deal with the effects of “long COVID” on worker productivity, both here and abroad. COVID also shifted demand away from services (which dominated US GDP) and towards goods. Over the last few decades advancements in inventory and production theory have allowed companies to eliminate excess capacity and operate near the optimal production frontier. That’s great in a static world, but it doesn’t allow firms to expand to meet sudden shifts in demand. A case in point. Remember the toilet paper shortage? Well, it turns out that the real problem was a shift away from institutional toilet paper (e.g., what you’d find in airports and workplaces) and towards home consumer grades of toilet paper. The two types of toilet paper use different production techniques and have different supply chain relationships. That’s why you could find “institutional” paper in stores but not consumer paper. Micro efficiency can be a killer when the world changes. That’s also been a perennial problem within DoD. If you want to have an army that operates efficiently during peacetime, then you probably won’t have what you need when the balloon goes up. And if COVID wasn’t bad enough, we got a terrible war from Trump’s buddy Putin. And now we’re starting to see Mother Nature’s revenge thanks to CoRev and his gang of climate change deniers. All in all a perfect storm.

I would agree that a lot of economists are stuck in the old familiar macro of the business cycle. What we need is a new kind of supply side economics…not the fake stuff that Reagan peddled, but a serious approach that looked to make economies more nimble in the face of supply shocks.

Taking the good from the Real Business Cycle types but not paying any attention to their claims that aggregate demand does not affect real variables! BTW these economists never had to use a stupid term like suppression or invoke a silly Art Laffer cocktail napkin.

Slugs –

This is what Summers wrote:

The proposed stimulus…is at least three times the size of the output shortfall. [T]here is a chance that macroeconomic stimulus on a scale closer to World War II levels than normal recession levels will set off inflationary pressures of a kind we have not seen in a generation.

I think it normal for an economist to hedge their wording. I certainly do it, because we don’t always know the future. But the phrase inflationary pressures of a kind we have not seen in a generation? That’s fire alarm wording. And he was spot on.

2slug,

Good point to remind precisely what Summers said. He has been running around bragging about one of his one third possibilities coming true.

As it is I do not see any need for a “new supply side economics,” although I agree that it should not be the silly Reagan tax cut sort. Many economists have long been aware that the supply side matters, with most of that awareness clear during the oil shock 70s. But many have been aware that other things can impact the supply side as well. We just do not usually seem them doing so.. Now we have, with both multiple rounds of a varianst of a serious pandemic, as well as a war that implacting supplies of both energy and food. Given that, I do not think most economists need some “new” supply side economics to figure out the implicaations. The problem was foreseeing that these shocks would happen, which basically nobody was doing.

Barkley says: “But many have been aware that other things can impact the supply side as well. We just do not usually seem them doing so.. Now we have, with both multiple rounds of a varianst of a serious pandemic, as well as a war that implacting supplies of both energy and food. Given that, I do not think most economists need some “new” supply side economics to figure out the implicaations. The problem was foreseeing that these shocks would happen, which basically nobody was doing.”

At least Menzie admits that POLICY impacts the supply side of oil production. Why ignore policy as an inpactor?

I can give you a list of Biden’s crude oil production policy impacts. I have yet to see a list form the Bidenistas of his successful policies.

At least the market and his jaw boning are starting to reverse some of his earlier crude oil production policy impacts, but not inflation, yet.

CoRev,

You have bored us to tears with your list of Biden’s supposed awful oil production impacts. The problem is that it has been repeatedly shown that they did not have much impact, and most of them have been at least temporarily suspended since. Do we need to remind you again of all the permits oil companies had all along that they were not using, not to mention the evidence that they were being slow to pick production up because their financiers were unhappy about recent price volatility? And, of course your yapping about the keystone pipeline is just a joke, You really have very little out of that, for all your incessant listings here.

As I have noted, which you completely ignore along with most others here, is that the policy move he could have and should have made that Trumpistas like you did not call for was to reenter the JCPOA with Iran. This would have led to an increase in oil production far exceeding anything that would have happened even if Trump had remained in office and fallen all over himself to encourage domestic production. Are you actually unaware of this? There is the policy mistake Biden made, imitating dumb Trump policy on that too much like you probably supported, silly hypocrite that you are.

Barkley, than you for your single example of Biden’s policy failure. I’ll add it to my list.

But I asked for a list of his policy successes.

CoRev,

Oh, you want some Biden policy successes? Passing the infrastructure bill. Trump kept giving us infrastructure weeks, but somehow he never got around to even submitting a bill or proposals. We also happen to have the hottest job market that has practically ever been seen. People can get jobs, and lots of people have been able to move up from where they were working to better jobs. That is partly a result of the fiscal stimulus that also probably added to inflationary pressure, with us looking to be back in a Phillips Curve world, as I have noted. But the good job market is certainly a success, even if voters seem to take it for granted while whining about higher inflation.

He has also done much better on most foreign policy moves. I think he is handling the situation with Russia and Ukraine pretty well, organizing a solid European support for Ukraine. Trump certainly would not have done that, heading to take US out of NATO as he seemed to be doing. Opinion of Biden and the US is now much higher than it was under Trump in all but literally a handful of countries.

Barkley, thank you for the 2 policies you have listed. I think your 3rd reference, foreign policy, is conjecture and opinion.

Barkley, thank you for the list of policies. I accept your first 2 policies, but think policy 3, foreign policy, is conjecture and opinion.

I don’t understand why and how this was so difficult for the others

With all due respect to Professor Hamilton, I thought it interesting he didn’t mention changing the oligopolistic environment of baby formula producers in America as a potential answer. I imagine Professor Hamilton will say “more imports solve this issue”. Really?? Have imports in the U.S. automobile computer chips created better quality American cars?? Ones that for the last 40+ years you wonder why any American with a functioning brain would choose nearly any American car over a Honda, Subaru, or a Toyota??

As in, the profits are largely locked in when you have very few producers making the same product, and little reason to improve processes or worry you’re going to go out of business when entire plants are shut down. We wonder why guys like JohnH blather on on this blog. Yeah….. a lot of times there’s issues he’s missing. But I think there is some message there when economists think regulatory issues are the problem, when a very few amount of local producers can manage something as simple as putting a safe product for babies out, have shown zero concern for production shutdowns, and the top 3 issue an economist mentions is “minimizing regulatory shutdowns” for companies that produce food for babies?? What about sidestepping quality control?!?!?!?!, which if 3-4 domestic producers stopped sidestepping, they wouldn’t HAVE to worry about “regulatory shutdowns”. Gee, who in this crowd doesn’t have any infant relatives they personally have to shop for I wonder??

https://thehill.com/opinion/finance/3508940-in-baby-formula-shortage-poor-quality-control-is-to-blame/

https://www.wbur.org/onpoint/2022/05/19/the-corporate-monopolies-behind-americas-baby-formula-crisis

One answer which might be involved, but better than what we have now might be divesting the 5% of Abbot Labs that is baby formula into 2–3 separate companies. If you break off that 5% part of Abbot Labs into two separate entities (i.e two companies with a $5 billion value each) with their sole business being baby formula we might be surprised how quickly manufacturing issues get FIXED.

BTW, I’m copy/pasting this comment, and if it doesn’t go up I will attempt it in another thread. Blogs are at least in part for debate, if people don’t like that, maybe they should put their posts up eye level on their backyard tree. This isn’t meant to be contentious, just a statement of fact.

“this is a highly concentrated market with only four manufacturers — Abbott, Mead Johnson Nutrition, Nestle USA, and Perrigo — supplying 90 percent of the domestic baby formula market in the U.S. Abbott alone has a 40 percent share of the U.S. market, and the currently shuttered Michigan plant was responsible for 40 percent of the company’s U.S. production.”

Economists who specialize in market structure (aka industrial concentration) would find a Concention Ratio for the top 4 firms at 90% a clarion case for anti-trust actions. Of course the restrictions on imports from Europe made this monopoly power even worse. The call for freer trade is one part of the solution but yea – we need to break up the Big 4.

BTW – having a tax cheating pharma giant make baby formula strikes me as not a good thing. Quality control with food and quality control with drugs are two different things and we know Abbott sucks at food quality control.

Abbott knew that there were serious problems in that plant – with a leaking roof and babies getting sick from their formula. Finally the regulators had no other choice but to close down the plant. This was used to increase prices and also to attack regulators (for daring to prevent them from making toxic baby formula). This company should not be allowed to produce baby formula ever again. Break them up and sell them to someone else. But first give Abbott a big billion dollar fine. This was not incompetence it was malice.

You and Moses got me wondering what Abbott Labs said in their latest 10-Q filing on this baby formula disaster. I had to go to the bottom of page 20 to find the only 2 paragraphs:

International Pediatric Nutritional sales, excluding the effect of foreign exchange, decreased 5.4 percent. The decrease reflects lower sales due to challenging market dynamics in the infant category in Greater China partially offset by higher volumes sold in various countries in Southeast Asia, Latin America and the Middle East. International Adult Nutritional sales, excluding the effect of foreign exchange, increased 15.6 percent, and U.S. Adult Nutritional sales increased 3.7 percent, reflecting continued growth of the Ensure® and Glucerna® brands in several countries including the U.S.

In U.S. Pediatric Nutritionals, Abbott initiated a voluntary recall in February 2022 of certain infant powder formula products manufactured at one of its U.S. facilities and stopped production at the facility. The 33.6 percent decrease in U.S. Pediatric Nutritional sales reflects the impact of the recall and production stoppage partially offset by increased demand for Abbott’s Pedialyte® and PediaSure® products. U.S. sales of certain infant powder formulas were $59 million in the first quarter of 2022 and $288 million in the first quarter of 2021. Abbott is working with the U.S. Food and Drug Administration (FDA) on corrective actions and enhancements so that operations at the facility can be restarted. Abbott cannot predict when manufacturing at the facility will restart. Abbott is also working to bring infant powder formula to the U.S. from its FDA-regulated facility in Europe and to increase production at other U.S. manufacturing plants.

THAT’S IT. Oh my shareholders – we had only a temporary decline in US sales for this one segment but be of good cheer as overall sales and profits are still strong. And we will get back to producing our overpriced products soon so cheer up as we do not give a damn about those parents and their infants. Typical greedy corporation with too much market power,

https://www.nytimes.com/2021/10/01/business/stock-bond-real-estate-prices.html

October 1, 2021

Stock, Bond and Real Estate Prices Are All Uncomfortably High

An economist says the three major U.S. markets all show signs of severe overpricing.

By Robert J. Shiller

The prices of stocks, bonds and real estate, the three major asset classes in the United States, are all extremely high. In fact, the three have never been this overpriced simultaneously in modern history.

What we are experiencing isn’t caused by any single objective factor. It may be best explained as a result of a confluence of popular narratives that have together led to higher prices. Whether these markets will continue to rise over the short run is impossible to say.

Clearly, this is a time for investors to be cautious. Beyond that, it is largely beyond our powers to predict.

Consider this trifecta of high prices:

Stocks. Prices in the American market have been elevated for years, yet despite periodic interruptions, they have kept rising. A valuation measure that I helped create — the cyclically adjusted price earnings (CAPE) ratio — today is 37.1, the second highest it has been since my data begin in 1881. The average CAPE since 1881 is only 17.2. The ratio (defined as the real share price divided by the 10-year average of real earnings per share) peaked at 44.2 in December 1999, just before the collapse of the millennium stock market boom.

Bonds. The 10-year Treasury yield has been on a downtrend for 40 years, hitting a low of 0.52 percent in August 2020. Because bond prices and yields move in opposite directions, that implies a record high for bond prices as well. The yield is still low, and prices, on a historical basis, remain quite high.

Real estate. The S&P/CoreLogic/Case-Shiller National Home Price Index, which I helped develop, rose 17.7 percent, after correcting for inflation, in the year that ended in July. That’s the highest 12-month increase since these data begin in 1975. By this measure, real home prices nationally have gone up 71 percent since February 2012. Prices this high provide a strong incentive to build more houses — which could be expected eventually to bring prices down. The price-to-construction cost ratio (using the Engineering News Record Building Cost Index) is only slightly below the high reached at the peak of the housing bubble, just before the Great Recession of 2007-9….

Robert J. Shiller is Sterling Professor of Economics at Yale.

ltr,

For better or worse Shiller has been declaring the US stock market way overvalued for a long time based on his own favorite running average measure. He may be right, although it may also be that there has been a structural change to make the historical averages he cites not hold anymore.

As it is, despite the recent sharp decline of the US stock market, it is now only slightly below where it was when Biden took office and well above where it was at the time Biden was elected, at which point in time his opponent declared there would be a massive market crash that did not happen.

Maybe Shiller will now be proven right and we shall see a much larger downward adjustment of the market. Heck, maybe it will get back to where it was when Biden got elects, heeaven forfend.

“Real estate. The S&P/CoreLogic/Case-Shiller National Home Price Index, which I helped develop, rose 17.7 percent, after correcting for inflation, in the year that ended in July.”

At the time he wrote this – real rents were much higher than in the past while mortgage rates were at all time low. I trust people know why this matters for the fundamentals of asset valuation. If not – then that person needs to take Finance 101.

At the time [Shiller] wrote this – real rents were much higher than in the past…

[ This is incorrect. Shiller was correct:

https://www.nytimes.com/2021/10/01/business/stock-bond-real-estate-prices.html ]

https://fred.stlouisfed.org/graph/?g=oCkD

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2000-2022

(Indexed to 2000)

ttps://fred.stlouisfed.org/graph/?g=rdkG

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2007-2022

(Indexed to 2007)

Notice two years ago this was a mere 130 with the very modest increase being attributable to lower mortgage rates. In fact – this ratio probably should have been higher two years ago. Yea it did rise a lot since then but mortgage rates were very low.

Correcting FRED reference link:

https://fred.stlouisfed.org/graph/?g=rdkG

January 30, 2018

Case-Shiller Composite 20-City Home Price Index / Owners’ Equivalent Rent of residences, 2007-2022

(Indexed to 2007)

No – real rents were higher. You even provided the FRED data on this.

https://fred.stlouisfed.org/graph/?g=obKe

January 30, 2018

Case-Shiller Composite Home Price Index / Owners’ Equivalent Rent of residences, 1992-2022

(Indexed to 1992)

https://fred.stlouisfed.org/graph/?g=obKe

January 30, 2018

Case-Shiller Composite Home Price Index / Owners’ Equivalent Rent of residences, 2000-2022

(Indexed to 2000)

Correcting FRED reference link:

https://fred.stlouisfed.org/graph/?g=QKha

January 30, 2018

Case-Shiller Composite Home Price Index / Owners’ Equivalent Rent of residences, 2000-2022

(Indexed to 2000)

“If demand for a particular good falls relative to the resources that were committed in advance to produce that item, the result will be a fall in the output of that good.”

Why was FDR’s chief problem overproduction, because farmers produced more and more as prices declined?

rsm,

Always a waste of time to reply to your silly stuff, but farmers were not accurately forecasting how much demand was declining by. Heck, nobody foresaw how deep the Great Depression was going to be. So they produced in expectation of demand and prices being higher than they proved to be in light of the production they engaged in. That is well known, although pretty clearly not by you.

Farmers produced more and more, as they were persuaded by incentives to produce more and more, whatever the price.

Powell on Wednesday: “Wages are not principally responsible for the inflation we’re seeing.”

Nevertheless, the beatings will continue until morale improves.

That’s correct. Fiscal and monetary policy is responsible for the inflation. Wages are responding to objective conditions.

In your simpleton and discredited Quantity Theory world, nominal wages would be rising by more than 40% per year. Oh wait – they rose by only 4%. So much for your simpleton view of modern macroeconomics.

Lagging variable.

Funny guy, you must be.

Powell is a stooge of big money. There is a lot of money to make in a terrible sock market crash + recession + depression, we have not seen for a hundred years.

Why people in this comment section are so stupid and do not look what the hedge funds are doing, no one will ever know.

Johannes,

Does not look like a “terribel stock market crash” offhand. Has been going up laat couple of sessions and now about where it was when Biden came in, not to mention oil price falling, along with crypto. I think you are hyperventilating.

Yes, no aircon here. Man it’s hot.

But thank you for your reply, I think that’s a huge honor- as you are an econ VIP, and myself only a troll.