Industrial production and manufacturing production both came under Bloomberg consensus (-0.2% m/m vs. +0.1, -0.5% vs. +0.1, respectively). With these data, we have this picture of some key indicators followed by the NBER BCDC.

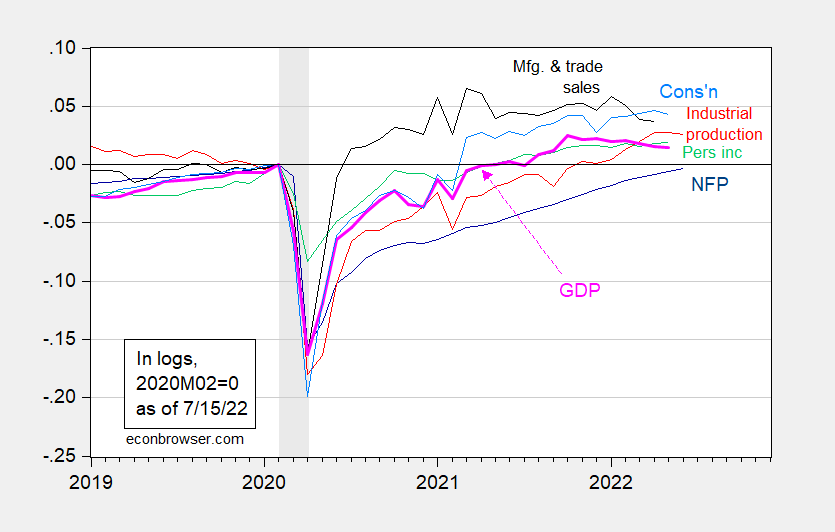

Figure 1: Nonfarm payroll employment (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2020M02=0. NBER defined recession dates, peak-to-trough, shaded gray. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (7/1/2022 release), NBER, and author’s calculations.

Given the rapid bounceback in all of these series, it’s getting a little difficult to see how things are evolving as we consider whether we are moving back into recession. Here I plot the last year’s worth of the data.

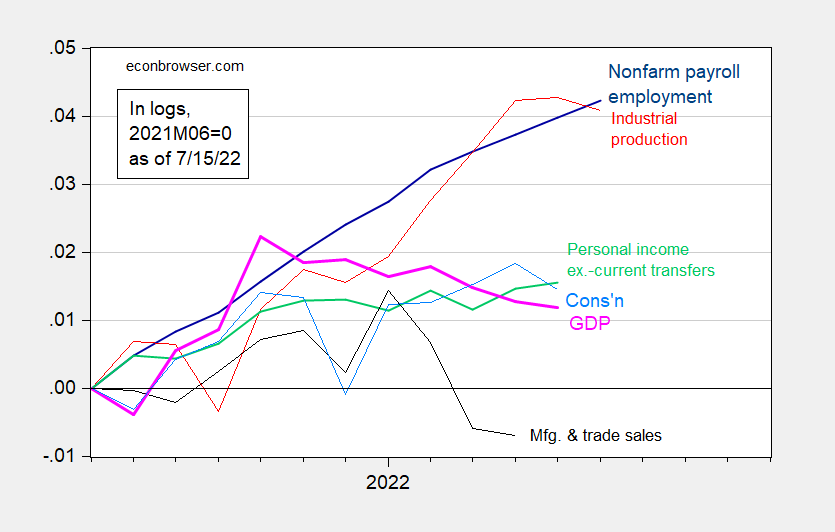

Figure 2: Nonfarm payroll employment (dark blue), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), all log normalized to 2021M06=0. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (7/1/2022 release), NBER, and author’s calculations.

While some series look like they might have peaked in the past (manufacturing and trade industry sales, monthly GDP), others are clearly still rising (nonfarm payroll employment, NFP). NBER BCDC notes that of these series, a greater weight is put on NFP and personal income excluding current transfers. Both of these continue to rise, with NFP over 4% higher over the past year (in log terms). Industrial production has also risen over 4% over the past year, even if it has registered a decline over the past two months of data.

In other news, retail sales exceeded consensus (1% vs 0.8%, versus -0.1% previous, m/m).

As of today, GDPNow for Q2 is -1.5%, IHS Markit is -1.9%, Goldman Sachs tracking is +0.7. Today’s Wells Fargo forecast, +0.2, Deutsche Bank forecast as of today is -0.6%.

Until the government finds missing exports/inventory, GDP is pretty useless indicator. Its pretty clear that GDP slowed down so far this year, but contracting, probably not. More like 1.2-1.8%ish range. NFP is going to be bloated due to pandemic lags into recovered businesses, though I figure revisions will backlog a lot of jobs into 2021 as the BEA goes through payroll data. July CPI is going crash though. I think the surge in gas prices and now its slow mo collapse is going to take some time to work through the system, but man it will alter alot of this data by fall. I usually use exgas retail sales, wages with mean trimmed CPI fwiw. Its gold.

There are also signs credit expansion is heating back up after the blip earlier this year as well(partially a reaction to the Russian war). Supports stronger growth and probably rising nonbank loan growth in housing through the rest of the year. I could see nonbanks controlling controlling 75% of all housing loan creation, which is crazy. You can thank Obama for that as he pushed these entities in the 2010’s with FHA support. Partially as a way to get back at the big banks.

June retail sales were boosted by gasoline prices. July retail sales face a drag from gasoline prices. The income effect from lower gasoline prices in July means real retail sales have more room for expansion.

Of course, CoRev will insist that thinking about how the economy works amounts to desperation, while running around squawking “Recession! Recession! The sky is falling on Biden!” is fact-based analysis.

MD & Readers,

Below is a link to retail sales categories, showing effect of gasoline sales, which will most likely decline in July as mentioned by MD. The effect on RSAFS could be about -0.5% due to price changes and perhaps lower volume (seasonally adjusted).

Forecasting overall retails sales, FRED series, RSAFS, July could see much lower m/m change. Interestingly, the biggest contribution to RSAFS is, Motor Vehicle and Parts Dealers (RSMVPD), which represent 18% of RSAFS. I find it very difficult to forecast RSAFS, however, since it is fun to try, I show a 0.2% increase for July. Since there are 13 sales categories to forecast to sum to RSAFS, I have not done so yet. The single RSAFS model I used for June showed 0.6% vs. 1.0% reported change.

https://fred.stlouisfed.org/release/tables?rid=9&eid=201241#snid=20124

The is what the comments section of an economics blog should look like. Once again, thanks, AS.

Any news from those brilliant Western economists predicting doomsday for the Russian economy? Does their silence suggest they have slunk back into their dark crack?

https://markets.businessinsider.com/news/currencies/russia-economy-better-than-expected-gdp-forecast-jpmorgan-sanctions-oil-2022-7

Or have they learned that it’s best making forecasts only for countries they know something about?

BTW the Russian unemployment rate was only 3.9% vs. The US’ 3.6%.

Why can’t Johnny learn economics?

So, Russia’s own statistical agency say Russian GDP was down from a year earlier in April:

https://docs.google.com/spreadsheets/d/e/2PACX-1vTNPCPFWMaFJdbJL-4E2wGAe1yuWKYT8ONj9E2lzvC3dRCJDNprsJ-pzg_HyQoohK9ALw2VYpN5xGCo/pubchart?oid=610488988&format=interactive

Whereas U.S.and Eurozone GDP see still up from year ago in Q1:

https://fred.stlouisfed.org/graph/?g=RPJX

But Johnny would rather talk about forecasts, because actual performance data show that Russia’s economy sucks under sanctions.

Russian inflation? It stood at 15.8% y/y n June:

https://tradingeconomics.com/russia/inflation-cpi

U.S. and Eurozone inflation are much lower:

https://fred.stlouisfed.org/graph/?g=RPLm

Comparing unemployment rates between countries is a rookie mistake. Different cultures and different data systems make unemployment rates comparisons misleading. Why bother pointing out that Russia’s jobless rate is higher than that in the U.S., making Russia seem to suck, when hose rates aren’t really comparable?

By the way, it might be the case (and I suspect it is) that Russia is substituting labor for other inputs because sanctions have made other inputs scarce. Meanwhile, falling real wages (there’s hat inflation, again) have forced workers into jobs they might not other have taken. And conscription is reducing the civilian labor pool – not a happy situation for young male workers.

Russian has been cut off from most Western technology, which means production of final manufactured goods is going to be difficult. Russian is reliant on a narrow range of exports and a narrow set of trading partners, not a healthy combination. One of those partners is China, which just reported very slow growth in Q2. Congratulations!

Not that any of this matter to Johnny. And that’s why Johnny can’t learn economics.

Well said but Johnny boy cannot bother to be honest about those forecasts:

The bank said gross domestic product would shrink just 3.5% in 2022, compared to a Wall Street consensus of 9.6%.

However, JPMorgan said a fall in commodities exports would hurt the economy and it’s too early to gauge the full impact of sanctions.

The consensus view has the economy falling by 9.6% rather than JPM’s 3.5 and even JPM is unsure of its less bleak forecast.

But what do you expect from a Putin poodle who celebrates the death of innocent Ukrainians?

Ah, yes. Macroduck prefers to change the subject away from GDP to other measures, ignoring terrible forecasts (propaganda) from some often cited forecasts: “ Robin Brooks, the chief economist at the Institute of International Finance trade group, tweeted on Sunday that his organization is predicting Russia’s GDP will collapse by 30% by the end of 2022.” https://wallstreetrebel.com/wsr/articles/russias_economy_imploding_exports_collapse_triggering_depression/2022-05-24-14-27-15.html

Brooks was one of many economists predicting doomsday, totally in synch with politicians’ wishful thinking in promoting economic warfare. “The ruble will be rubble” But rather than admitting that they were wrong in their faith-based economic forecasts, they change the subject.

Inflation? Has MacroDuck noticed US inflation, which is trending upwards, towards Russia’s? A year ago many economists were forecasting US inflation to be transitory. More faith based economics? Or just wishful thinking? And they claim to understand the US, even if they don’t understand Russia’s, though that doesn’t stop them from forecasting!

JohnH: Well, Robin Brooks is also forecasting *global recession*, and I’d say those two are not uncorrelated forecasts.

I linked to U.S. inflation data, you dolt. And I linked to GDP data. I changed the subject to the very subject you raised!

Your squawking has to do with forecasts which you pretend are wrong, without evidence. I insist in reality while you pretend to having enough knowledge to criticize forecasts which don’t suit your agenda.

Grow up, kid.

Still can’t admit that mainstream, establishment economists (propagandists) got their analysis of US economic warfare measures against Russia wrong, extremely wrong, can you?

Typical herd mentality in the promotional phase of a pointless and futile war…before reality sets in. If we have learned anything in the past decades, it is that establishment figures always rush to join the bandwagon, making war look great. Afterwards, disillusioned Americans are left to wonder: what were they thinking?

The sad thing is that The American public falls for the nonsense every time.

JohnH,

I think that you are the most morally sisgusting and egregious Putin troll on this site, on top of being a total economic idiot. I fully agree that we should denounce the “promotional phase of this pointless war.” But that could easily be done at any time by the war criminal who started this war for no good reason, V.V. Putin, whom you somehow think is just wonderful, the fascist who claims to be on a “de-Nazifying” campaign. Apparently you would have supported Hitler and Mussolini as well, near as I can tell.

On the matter of Russia’s economy, about which I do know more than you do, I avoided making any predictions myself about it collapsing. As it was, I commented here on how the very capable Russian Central Bank President, Elvira Naibullina, was able to stabilize the ruble by various capital controls and other measures. I note, in case you did not catch it, that Russia has just formally defaulted on foreign debts for the first time since the Lenin government defaulted on tsarist bonds.

As it is, if people are debating the apparently contradictory US economy with its competing data (GDP or GDI? Inflation or unemployment?), I think the problem for data our of Russia on its economy is much worse. I simply do not believe most of the published data. A particular item is oil revenues. Prices are up and they continue to sell a lot of oil and natural gas. But lots of that is at major discounts. It has just come out they are doing this with the Saudis, as well as the Indians and some others. Do the officially published data take into account those discounts? I do not know, but am rather skeptical.

It is clear that in fact while some things are not doing as badly as some indeed did forecast, most notably the value of the ruble, some other things are doing very badly. But Putin is able to get away with this for now by appealing to this lie that this is WW II revisited, so good patriotic Russians must put up with shortages and various other hardships as they did in the past.

In the meantime, how many Ukrainian civilians do you support killing for no good reason?

https://www.msn.com/en-us/news/world/borrell-says-sanctions-against-russia-over-ukraine-invasion-%c2%abare-having-an-effect%c2%bb/ar-AAZE1mJ

The High Representative for Foreign Policy and Common Security of the European Union, Josep Borrell, has assured this Saturday that international sanctions against Russia for invading Ukraine are “taking effect” and has called for “strategic patience” on the resulting energy crisis because “it is the price to pay to defend democracy”.

But what does he know? After all JohnH has this thing called Google which he uses to find almost any turd who crawls from under a rock to praise Putin’s war crimes.

So, Barkley, your position is that it’s criminal when Putin goes to war and kills people. How dare he? That’s the US’ job…as shown repeatedly in Korea, Vietnam, Panama, Iraq, Afghanistan and elsewhere.

Get real, Barkley. The US has no moral standing when it comes to criticising others’ behaviour. And the herd of elite propagandists, including many economists, who supported US military interventions but criticize Putin’s on humanitarian grounds, have zero moral authority. Most of the world except the West has come to recognise US hypocrisy

JohbH,

Talk about propaganda, are you getting paid or do you just listen to Tucker Carlson or RT too much?

The Korean War was started by the North Koreans invading South Korea. That is to be blamed on the US? Which potched history are you reading on that one? Does sound like something out of Putin’s shop.

I opposed both the Vietnam War and the Iraq invasion under Bush II. The former of course kind of crept up gradually, not a definite decision at a point in time the way Putin’s invasion of Ukraine is, and it was also arguably defensive. You have some claim on Iraq, but that ended some time ago.

Panama did not amount to much. How many civilians killed in that one>II just checked: 214, not great, but nowhere near the thousands killed by Putin and still being killed. Again, this one is over, as is Iraq.

Afghanistan is more complicated. My view was it was justified to go in and take out bin Laden but then get out right away. Obviously that did not happen and it turned into a mess. But we are out now, messily as it seems. But that one is also over.

So, sorry, Putin cannot excuse his war criminal behavior on past bad behavior by the US. Again, since you think he is not to be criticized, how many civilians is it OK for him to kill in Ukraine in your humble opinion?

“Ah, yes. Macroduck prefers to change the subject away from GDP to other measures”

He noted actual real GDP is down and you accuse him of changing the subject? BTW you are also less than honest about what your own link said.

There was the fellow named JohnH who would decry anyone relying on JPMorgan as an evil agent of the big banks. But this JohnH thinks JPMorgan are the most reliable forecasters for the Russian economy? Of course even JPMorgan has concerns that the fall in real GDP may be even worse then their little forecast.

Of course I could go on but Macroduck has already schooled you on your Putin cheerleading. But it is good to know how utterly two faced you can be as you cheer on the deaths of Ukrainian citizens.

Barkley went off at JohnH’s disgusting defense of Putin’s war crimes. This story notes why Barkley was right to do so:

https://madison.com/lifestyles/health-med-fit/robbed-of-the-most-precious-thing-missile-kills-liza-4/article_a01bba82-482e-544b-8653-5f5f9052d8ce.html

VINNYTSIA, Ukraine (AP) — Liza, a 4-year-old girl with Down syndrome, was en route to see a speech therapist with her mother in central Ukraine when a Russian missile rained down from the sky. She never made it to the appointment. Now the images that tell the story of her life and its end are touching hearts worldwide. Wearing a blue denim jacket with flowers, Liza was among 23 people killed, including boys aged 7 and 8, in Thursday’s missile strike in Vinnytsia. Her mother, Iryna Dmytrieva, was among the scores injured. After the explosion, the mother and daughter went in different directions. Iryna, 33, went into a hospital’s intensive care unit while Liza went to a morgue. “She remembered that she was reaching for her daughter, and Liza was already dead,” Iryna’s aunt, Tetiana Dmytrysyna, told The Associated Press on Friday. “The mother was robbed of the most precious thing she had.” Shortly before the explosion, Dmytrieva had posted a video on social media showing her daughter straining to reach the handlebars to push her own stroller, happily walking through Vinnytsia, wearing the denim jacket and white pants, her hair decorated with a barrette. Another video on social media showed the little girl twirling in a lavender dress in a field of lavender. Shortly before the explosion, Dmytrieva had posted a video on social media showing her daughter straining to reach the handlebars to push her own stroller, happily walking through Vinnytsia, wearing the denim jacket and white pants, her hair decorated with a barrette. Another video on social media showed the little girl twirling in a lavender dress in a field of lavender. After the Russian missile strike, Ukraine’s emergency services shared photos showing her lifeless body on the ground next to her blood-stained stroller. The videos and photos have gone viral, the latest images and stories from the brutal war in Ukraine to horrify the world. Ukrainian President Volodymyr Zelenskyy’s wife posted that she had met this “wonderful girl” while filming a Christmas video with a group of children who were given oversized ornaments to paint. “The little mischievous girl then managed in a half an hour to paint not only herself, her holiday dress, but also all the other children, me, the cameramen and the director … Look at her alive, please,” Olena Zelenska wrote in a note accompanying the video. After the Russian missile strike, Ukraine’s emergency services shared photos showing her lifeless body on the ground next to her blood-stained stroller. The videos and photos have gone viral, the latest images and stories from the brutal war in Ukraine to horrify the world. Ukrainian President Volodymyr Zelenskyy’s wife posted that she had met this “wonderful girl” while filming a Christmas video with a group of children who were given oversized ornaments to paint. “The little mischievous girl then managed in a half an hour to paint not only herself, her holiday dress, but also all the other children, me, the cameramen and the director … Look at her alive, please,” Olena Zelenska wrote in a note accompanying the video.

I challenge JohnH to watch this video. Of course he is likely too much of a coward to do so but no one with a soul could watch this and not realize how much of a pig Putin is. And if JohnH decides to say this is fake – let me assure you this is real. Putin is a horrific war criminal and anyone would defends this evil has no place making the standard stupid comment we see routinely from JohnH.

Wait…isn’t JPM western? You’ve told us western economists aren’t qualified to comment on Russia’s economy, and then you insist that a forecast which suits your agenda is the right one, even though it’s from one of those worthless western banks.

You little hypocrite.

Lee Zeldin wants to be the next governor of NY but something tells me he has zero chance:

https://www.newsweek.com/new-york-representative-lee-zeldin-accused-ballot-petition-fraud-independence-party-line-1725131

Representative Lee Zeldin, the Republican nominee to be New York’s governor, has been accused of ballot petition fraud and may not be able to have his name appear on the Independence Party line on the November ballot. Following the 2020 election, Zeldin supported former President Donald Trump’s claims that the 2020 election was fraudulent although no evidence has emerged corroborating the allegations. The GOP congressman voted against the certification of President Joe Biden’s electoral votes in Arizona and Pennsylvania on January 6. “This debate is necessary because rogue election officials, secretaries of state and courts circumvented state election laws,” Zeldin argued at the time. Now, the New York State Board of Elections has invalidated nearly 13,000 signatures on petitions for Zeldin to appear on the Independence Party line on the ballot, the Times Union reported. That decision came after it was alleged by Andrew Kolstee, secretary of the state’s Libertarian Party, that some 11,000 of Zeldin’s signatures were merely copies of other pages.

Look voter fraud does exist but the culprits are the MAGA hat wearing Republicans.

I know many of you have asked yourselves “How does Macroduck see things the rest of us miss? What makes Macroduck so wise?” There is a simple explanation; I have a close relative with only one year of higher education, but 92 years of experience in this world. When she speaks, I listen. Regularly, over the Covid period, and more frequently in recent months, she will look up from her reading and say “How is anyone going to afford insurance?” She has seen the value of financial assets plunge while risks to insure property increase. She has seen unrest and civil disobedience on the rise. All bad news for insurance cost and availability.

Well, what do you know, Alliance Global has caught up with my wise relative:

https://www.agcs.allianz.com/news-and-insights/expert-risk-articles/civil-unrest.html

Alliance recommends buying more insurance. Who’d have guessed?

Off topic, but on topic for the prior two posts –

Power grid problems come in several flavors: solar flares, broken parts, China stumbling into something while just snooping around, lack of connection to the wider grid (Texas), demand surges, hurricanes and blizzards.

Turns out, on of those risks has been greatly increased by changing technology and lack of foresight. Smart thermostats switch from day to night and night to day pretty much all at once within regions. Kinda like everybody on Earth running in the same direction and then stopping at the same moment. In a way, this is good news, since a few million service calls could fix the problem. Unless solar and wind power cause Texas to fall into a giant sinkhole, or whatever that stupid story was.

https://www.theregister.com/2022/07/13/smart_thermostat_strain/

MD, that stupid story was about solar electricity’s inability to meet peak demand. Your reference compounds the problem by re-defining peak periods: “Those hundreds and thousands of smart thermostats, typically configured to switch to day mode around 6am, “can cause load synchronization during recovery from nightly setpoint setbacks, increasing the daily peak heating electrical demand,” the paper said. ” AT 6AM there is little solar electricity being generated.

But any story questioning renewable electricity sources ability to match demand is stupid? Unless of course its presented by your superior research capabilities. Hypothetically then, when we go to EVs where do we get the needed added electricity? At what costs? Who pays? How much land will be lost to agricultural use? How much food can city balcony gardens grow? When will the liberal deep thinkers realize they should thank farmers 3 times a day, instead of curtail their production with stupid green regulations? (Just some random thoughts.)

Sheesh, the ignorance it burns.

CoVid, you ignorant shut. (Apologies to those who don’t know the work of Dan Aykroyd and Jane Curtin.)

Your stupid story was that alternative energy sources didn’t provide power during peak demand, which they do. My story, while in the same ballpark, is not the story you have pretended it to be. That’s not a surprise, as that is a standard trick on your part. It just park to the “junk science” bag of tricks.

Allow me to simplify, since you are willfully misunderstanding the smart thermostat problem. Smart thermostats manufacture sudden changes in demand. The timing of that manufactured change is somewhat arbitrary and can be remedied by varying the time at which various thermostats switch from one cycle to another takes place.

Really, CoVid, I don’t think your ideological bosses should pay you for this weak stuff.

Ouch! Auto-correct got me again. That’s “CoVid, you ignorant slut.”

https://www.youtube.com/watch?v=c91XUyg9iWM

Let’s go to the tape to see how he said it!

MD, Menzie quoted me and it NEVER mentioned renewables, only solar. You then claim: “Your stupid story was that alternative energy sources didn’t provide power during peak demand…” NOPE. Not today and not yesterday either. Changing the subject of a quote or issue then arguing on that change is a standard trick on your par, and Menzie has done it twice in the recent past for articles regarding my comments.

Why did you not catch Menzie’s common trick? The difference was in the title and the quote with just a couple of lines separating them.

Better still why have you not shown us how we get solar energy coverage to fulfill peak demand? Even in Menzie’s example, a very good solar day, the amount of solar energy generated at peak demand is ~2.5% of the overall generated total. On a bad solar day of which there are many, it is 0%.

So show us your superior knowledge and intellect convert 0 to 2.5% of total generated to 100% of peak demand.

I’ll wait.

“MD, Menzie quoted me and it NEVER mentioned renewables, only solar.”

Your ability to cherry pick and misrepresent is beyond amazing. Alas this is all you know how to do beyond chasing your own tail.

CoRev: Actually, if you look at the post, the word “renewables” shows up twice.

Menzie, elucidate me with: “CoRev: Actually, if you look at the post, the word “renewables” shows up twice.”,but not related to my point re: solar generated electricity and peak demand.

Why quote me then change the subject or ignore the quote?

https://news.cgtn.com/news/2022-07-16/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bHTL172DN6/index.html

July 16, 2022

Chinese mainland records 129 new confirmed COVID-19 cases

The Chinese mainland recorded 129 confirmed COVID-19 cases on Friday, with 75 attributed to local transmissions and 54 from overseas, data from the National Health Commission showed on Saturday.

A total of 418 asymptomatic cases were also recorded on Friday, and 3,457 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 227,272, with the death toll from COVID-19 standing at 5,226.

https://news.cgtn.com/news/2022-07-16/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bHTL172DN6/img/86492efaa1204eac8f8704aabc6e9b2d/86492efaa1204eac8f8704aabc6e9b2d.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-07-16/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bHTL172DN6/img/50b597b6ea294729969147f92084dda5/50b597b6ea294729969147f92084dda5.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-07-16/Chinese-mainland-records-129-new-confirmed-COVID-19-cases-1bHTL172DN6/img/7988cae991c44937985d8de600384a5c/7988cae991c44937985d8de600384a5c.jpeg

https://www.worldometers.info/coronavirus/

July 15, 2022

Coronavirus

United States

Cases ( 91,170,571)

Deaths ( 1,048,693)

Deaths per million ( 3,155)

China

Cases ( 227,143)

Deaths ( 5,226)

Deaths per million ( 4)