Today we are pleased to host a guest contribution written by Jan P.A.M. Jacobs of the University of Groningen, Samad Sarferaz and Jan-Egbert Sturm of the Swiss Economic Institute, and Simon van Norden of HEC Montreal.

Many analysts consider two consecutive quarters of decline in real GDP to be a recession. But the latest GDP numbers give conflicting signals.

Recessions are all about economic contractions – a fall in the rate of economic activity. Partly because of that, the single most popular indicator of recession is a fall in real GDP for at least two quarters in a row. On that basis, the latest numbers from the BEA may seem to indicate that the US economy has been in a recession all year: “headline” GDP shrank at an annual rate of 1.6% in 2022Q1 and 0.6% in Q2.

However, other indicators seem to tell a different story. Over the same period, inflation stayed high, the unemployment rate stayed low, while employment , personal consumption and corporate profits continued to grow. These conflicting signals complicate the Fed’s task of engineering a “soft landing” while reducing inflation, and in turn clouds the interest rate outlook for borrowers and investors. How could they make better sense of how the economy has been growing?

Part of the answer may be to look more carefully at the GDP figures. It’s understood that initial GDP figures are revised as more complete data arrives. For example, the -0.6% figure mentioned above for Q2 was revised from an initial estimate of -0.9%. Further revisions aren’t usually large enough to turn that into a positive value.[1] Another type of measurement error in the GDP figures is larger, however, and receives much less attention; the difference between expenditure and income measures.

The basic principles of double-entry bookkeeping apply to GDP just as they do to a firm’s or a household’s Income Statements; every source of income is either spent or saved. That gives two different ways of measuring GDP: based on Expenditures or based on Income. “Headline” GDP is based on expenditures; it calculates GDP as the sum of expenditures on Personal Consumption, Private Investment, Net Exports and Government Spending (the Y = C+ I + G + NX from your first economics textbook.) But the BEA also estimates GDI (Gross Domestic Income), which includes Wages and Salaries, Corporate Profits, Investment Income, as well as some net transfers and taxes. If both GDI and GDP were correctly measured, they would give the same results. They are often close; for example, in 2019 GDI was estimated to be only 0.3% higher than GDP. Lately, however, the differences between the two have been larger, with GDI growing faster than GDP.[2] The latest figures put 2022Q2 GDI 3.9% above GDP. As a result, while GDP shrank at an annual rate of 1.6% in 2022Q1 and 0.6% in Q2, GDI grew 1.8% in Q1 and 1.4% in Q2.[3]

So has the economy been growing or contracting? Which set of estimates should we believe? Part of the reason that “headline” GDP is based on the expenditure estimates is that the BEA (like most other national statistical agencies) has better measures of expenditures than of income.[4] That doesn’t mean that the GDI estimates should be ignored, however. Since early work by Fixler and Nalewaik (2007) on the usefulness of GDI, several studies have tried to determine how much weight to assign to each of these two measures to best estimate “true” GDP growth. Aruoba et al. (2016) suggested that slightly more weight be put on GDI, leading the Federal Reserve Bank of Philadelphia to publish a combined estimate they call GDPplus. That estimate has stayed positive since 2020Q3 and is at 1.8% in 2022Q2 (i.e. higher than even GDI.) The BEA has taken to publishing growth rate of the simple average of their GDP and GDI estimates, which eked out 0.1% and 0.4% growth in Q1 and Q2.[5]

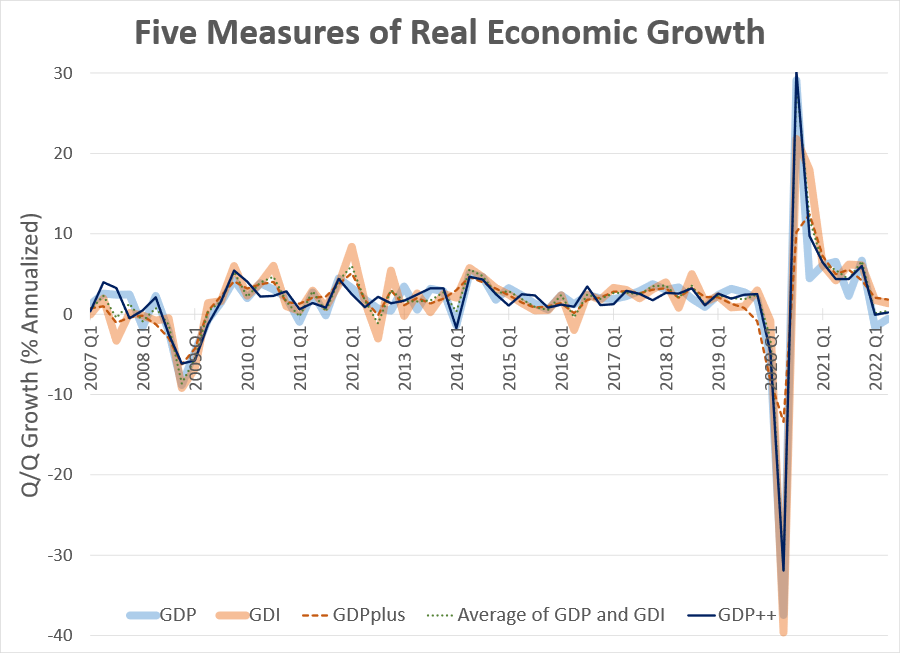

In a recent paper, we show how we can use the revisions in both GDP and GDI over time to help assess how informative each release of these series is and how we should weigh them accordingly. The resulting measure, which we call GDP++, tends to follow GDP growth a bit more closely than GDPplus. It also lets us put error bands around our estimates. The above graph compares these various growth measures. It shows that while they are all highly correlated, discrepancies of the size that we’ve seen in recent quarters tend to arise from time to time. The extreme movements during 2020 also highlight a distinctive feature of GDPplus; it produces a more persistent measure of growth and tends to smooth the COVID shock more than the other measures.[6]

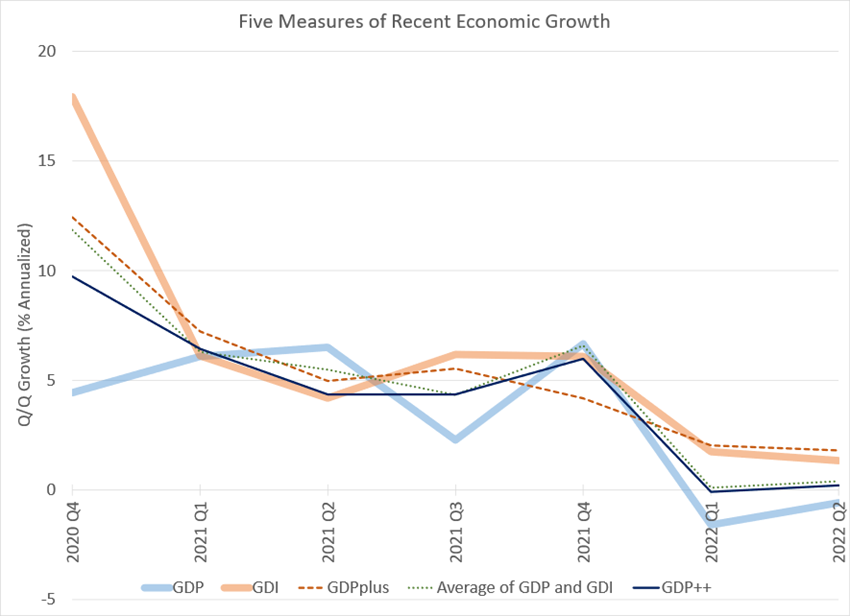

The second graph shows the same series since 2020Q4. While the differences between the GDP and GDI estimates have grown since the end of 2021, they are still small when compared to the gap in 2020Q4. Until the start of 2022, GDPplus, GDP++ and the average of GDP & GDI gave very similar estimates, but now GDPplus is quite a bit higher than the others. GDP++ is estimated to be -0.1% in 2022Q1 and 0.2% in Q2, mirroring the estimates of nearly zero growth from the BEA’s average measure. Perhaps as important, however, is the statistical uncertainty around GDP++, with 90% error bands from -0.9 to 0.7% in Q1 and -0.6 to 0.9% in Q2. Put another way, while “headline” GDP would seem to indicate a (mild?) recession has begun, a closer look at its statistical uncertainty suggests that the data are also compatible with simply two quarters of weak but continuing growth.

[1] For a deep dive into revisions in GDP, GDI and their components, see Fixler, de Francisco and Kanal (2021).

[2] See here, Table 7, line 20.

[3] See here, Table 1, lines 1 and 27.

[4] Aonther reason is that GDI estimates become available only one to two months after the preliminary release of GDP.

[5] See here, Table 1, line 28.

[6] This may also account for it estimating growth in 2022Q2 to be higher than either the GDI or GDP estimates.

When is a Recession not a Recession?

[ What a nice paper. ]

One of the talking points for Democrats going after Republicans criticizing the student debt relief efforts of President Biden goes like this:

https://www.msn.com/en-us/news/politics/democrats-keep-ripping-republicans-criticizing-biden-s-student-debt-jubilee-the-new-talking-point-college-cost-many-gopers-just-300-a-year/ar-AA118QGi?ocid=msedgdhp&pc=U531&cvid=71c2f149ac66f784dcddcb18d89cbfe4

“Senator McConnell graduated from a school that cost $330 a year” Sen. Elizabeth Warren wrote on Twitter Thursday. “McConnell has done nothing to fix” skyrocketing college tuition, she said, “and is irate that the President is stepping up to help millions of working Americans drowning in debt.” McConnell graduated from the University of Louisville in 1964. His tuition back then was $330, as Warren pointed out. The cost of tuition now is a little more than $12,000, according to the university’s website….To say a few: Sen. Chuck Grassley’s tuition was $159 in 1955, Sen. Richard Shelby’s was $190 in 1957, former Sen. Johnny Isakson’s was $333 in 1966, and Sen. John Boozman’s was $400 in 1973.

Wait a second. CPI has increased by a factor of 10 since the late 1950’s. Inflation adjusted old man Grassley and Shelby paid almost $2000. Now $12,000 is still 6 times the inflation adjusted figure but let’s not make the kind of dumb mistakes people like Bruce Hall routinely make.

I think a much more telling response is to note the complete lack of any outrage over the cacellation of the PPP business debts, which includes some pretty large payouts to various GOP members of Congress who are criticizing this student debt forgiveness, with lots of the hypocritical GOp Congresspeople getting far more than $10,000.

BTW, i do think there is and has been for a long time a problem of college tuitions going up faster than inflation, the only sector to compete with health care for price increases. I know a lot of it is due to expansion of administrators and staff, not particularly faculty salaries or numbers, with increasing numbers of poorly paid adjuncts getting hired. But why this is happening is a bit mysterious to me. As with health care, if one goes back about 40 years or so, both were not much more than what was being charged in some European nations, but now we are way more expensive.

It’s not a mystery. The more MBA’s there are in any administrative structure the more the focus is on adding more administrators supporting the MBA’s continually rising salaries for overseeing minions they’ve hired and bonus points for increasing the CEO’s administrative structure. Meanwhile MD’s can’t hire the staff they need to run practices and are chided when they complain about 15 minute “return” visits for complex patients in need of meaningful care whilst receiving all sorts of printouts on how “inefficient” they are just because patients need meaningful care and not just platitudes.

At many public schools tuition is rising at higher rates because state funding of higher ed is slowing or dropping. Tuition then must increase to compensate for the loss of public funding. If state funding were to rise with inflation, tuition increases would be smaller. At private schools, full tuition is not paid by most and is used to subsidize lower income students. It probably should not be compared to inflation.

“Tuition then must increase to compensate for the loss of public funding.”

A very important point. We need more public funding for education PAID for by increasing the corporate tax rate and enforcing things like the transfer pricing rules.

Semi-off topic –

I’ve been trying to find a reliable non-Bloomberg source for Bloomberg’s China Credit aImpulse Index, and I think I’ve found one:

https://en.macromicro.me/charts/35559/china-credit-impulse-index

The Impulse Index is a one-indicator way of tracking how credit is likely to effect economic activity – a financial leading indicator. Macromicro’s chart includes housing prices and the CSI 300, as well as the Impulse Index. The Impulse Index is used as a leading indicator for Asian equities in general, the CSI 300 in particular. You’ll note that the Impulse index also seems to lead housing prices, most of the time.

So, the good news is that the Impulse Index has stopped falling. I have no prediction to make about the future performance of the index – that would require forecasts of both credit growth and GDP, and I’m not that arrogant.

Couple of tidbits –

The spike in the CSI 300 in 2015 is the result of naive retail investors being given the opportunity to hand their hard-earned money to market pros. Roughly 30 million new investors entered the market in response to a regulatory change. The bubble then burst; nothing to do with the provision of credit to equities.

There is a dip and bouce in housing prices in mid-2017 to mid-2019 that appears to be unrelated to credit provision. My guess is that “houses are for living in, not speculation” and the imposition or U.S. tariffs on Chinese goods may have something to do with that.

Anyhow, I think this chart is regularly updated, for those interested in what the Credit Impulse Index can tell us.

When is a recession not a recession? Only when economists declare it’s not a recession?

Only problem is: “ According to an NBC News poll released (August 21), 68% of individuals believe the economy is currently in a recession while only 27% believe it is not.” https://news.yahoo.com/most-voters-believe-us-economy-191151059.html

But since when do voters’ experience count in a democracy? There are some numbers…that liberal economists choose to ignore…that would justify voters’ views.

1) Low wage employment is way down. High wage is also done somewhat. And middle wage employment is barely up.

https://tracktherecovery.org/

2) Usual weekly earnings of wage and salary workers are below what they were two years ago, before the start of th

https://www.bls.gov/news.release/pdf/wkyeng.pdf

This is what one would call a media inspired recession. A simple look at unemployment rate tells you this is not a recession. Only certain parts of media and policheks are pushing that angle. So the fed is raising rates a record amounts in the middle of a recession?

Do not bother JohnH with actual facts as he gets all of his cherry picked “facts” from his new BFF Princeton Steve. I look forward to the two of them appearing on Fox and Friends this week.

“ Unemployment is a lagging indicator. Once people start to lose their jobs, the economy has already begun declining. The last thing employers want to do is let people go. Unemployment will also continue to rise even after the economy has started to improve. Companies wait until they believe the economy has recovered before they start hiring again.” https://www.thebalance.com/lagging-economic-indicators-list-index-and-top-3-3305860

The “fact checker” is a dude who is described as

Has worked as a fact checker for The Balance, Investopedia, and Treehugger since 2019

Treehugger? Sorry but I may end up the rest of the day laughing at your latest stupidity!

“Unemployment is a lagging indicator. ”

ok john. lets assume this is true. we are now nearing the 9th month since the start of the first quarter and our “recession”. just how long of a lag are we going to assume john? every month that goes by makes these first and second quarter recession calls look foolish. we have one hell of a lagging indicator by john.

When is a recession not a recession? Never. A recession is a recession. Let’s go over this one more time:

When the NBER declares there has been a recession, that’s a recession.

When you declare there has been a recession, that’s Putin telling you to distract us from Russia’s war in Ukraine.

See the difference?

Hey, a few days ago you were all “I don’t care if the economy is expanding a little bit or contracting a little bit” and now you’re back to “recession, recession, recession”.

When is a recession bet not a recession bet? When johnny doesn’t have the stones to take the bet.

So, dear casual readers, let’s review. Ahead of the 2016 election, Russia engaged in an online effort to stir up racial divisions in the U.S. Trump was running for president after engaging in race-baiting against the first black U.S. president, making racial division a target of opportunity for Russian propaganda. Trump, as president, was notoriously chummy with Putin and antagonistic toward NATO. Funny yow that worked out.

Now, the big political issue is the economy, and Republicans political hacks dearly want a recession. That makes the economy a target of convenience for Russian propaganda. Here’s Johnny, relentlessly cheering for recession, talking endlessly about how bad economic sanctions are for the U.S. while claiming Russia is doing just fine, ignoring Russia’s role in Russia’s invasion of Ukraine.

If Johnny isn’t a Russian fifth column goon, stirring up political divisions ahead of the mid-term elections, he’s doing a heck of a good impression.

68% believe the economy is currently is in a recession while only 27% believe it is not..

98% of Econbrowser readers believe JohnH is an economics illiterate as well as an egocentric narcissist.

https://fred.stlouisfed.org/graph/?g=oarn

January 15, 2018

Consumer Price Index for tuition, school fees & childcare and Consumer Price Index for all items, 1980–2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=oarp

January 15, 2018

Consumer Price Index for tuition, school fees & childcare and Consumer Price Index for all items, 1980–2022

(Indexed to 1980)

https://fred.stlouisfed.org/graph/?g=TbpY

January 15, 2018

Median Family Income and Consumer Price Index for tuition, school fees & childcare, 1979-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=Tbqy

January 15, 2018

Median Family Income and Consumer Price Index for tuition, school fees & childcare, 1979-2021

(Indexed to 1979)

https://news.cgtn.com/news/2022-08-28/ECB-policymakers-make-the-case-for-a-big-rate-hike-1cRueXvrR3W/index.html

August 28, 2022

ECB policymakers make the case for a big rate hike

European Central Bank (ECB) policymakers made the case on Saturday for a large interest rate hike next month as inflation remains uncomfortably high and the public may be losing trust in the bank’s inflation-fighting credentials.

The ECB raised rates by 50 basis points to zero last month and a similar or even bigger move is now expected on September 8, partly due to sky-high inflation and partly because the U.S. Federal Reserve (Fed) is also moving in exceptionally large steps.

Speaking at the Fed’s annual Jackson Hole Economic Symposium, ECB board member Isabel Schnabel, French Central Bank chief Francois Villeroy de Galhau and Latvian central bank Governor Martins Kazaks all argued for forceful or significant policy action.

“Both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high,” Schnabel said. “In this environment, central banks need to act forcefully.”

Markets were betting on a 50 basis point move on September 8 until just days ago but a host of policymakers, speaking on and off the record, now argue that a 75 basis point move should also be considered.

“Frontloading rate hikes is a reasonable policy choice,” Kazaks told Reuters. “We should be open to discussing both 50 and 75 basis points as possible moves. From the current perspective, it should at least be 50.”

Rate hikes should then continue, the policymakers argued.

With rates at zero, the ECB is stimulating the economy and remains far from the neutral rate, which economists estimate to be around 1.5 percent….

There is no entrenched inflation. The pain these morons will feel by the 4th quarter will completely undermine them and bring central bank reform to the forefront.