Some people think we’re in a recession now, some think it’s in the past (we’re currently in H2 2022). With some new incoming weekly, monthly and quarterly data, should we still think those views are plausible [follow up on this post]?

First, let’s look at what the quarterly (Q2 second release for GDP) and new monthly consumption and income data show:

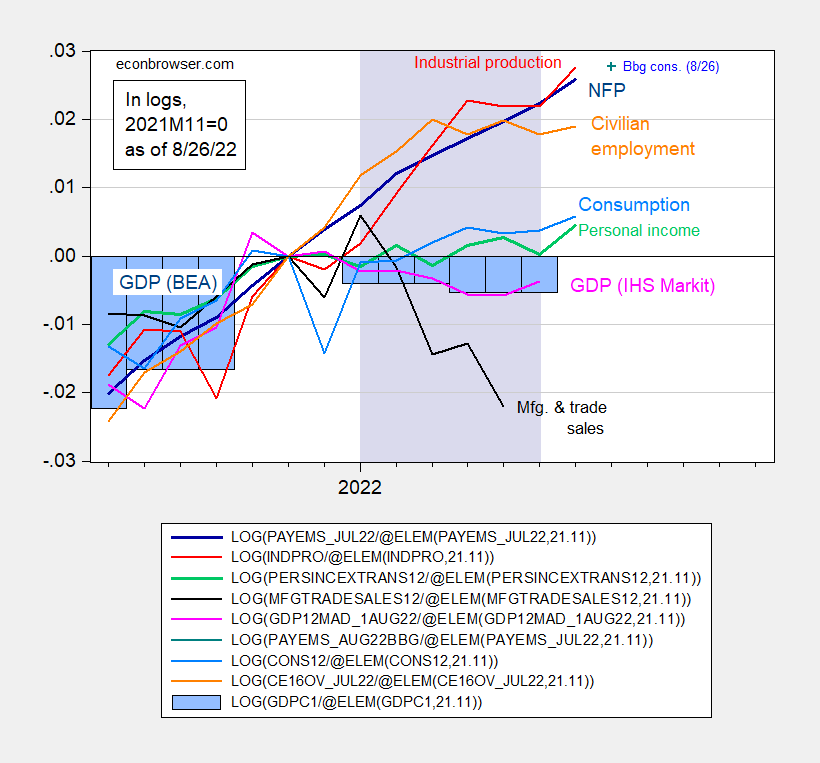

Figure 1: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 8/26 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official GDP (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (8/1/2022 release), and author’s calculations.

From these data, recalling that the NBER Business Cycle Dating Committee (BCDC) does not place great reliance on quarterly GDP (because of the numerous revisions which can either erase a recession, or create a recession, over time — see this post regarding 2001), it doesn’t look like a recession occurred in H1. (The NBER BCDC now places greatest weight on employment and income.) The only clearly downward trending indicator is manufacturing and trade industry sales, and that reflects in part the consumption shift away from goods and toward services.

Speaking of revisions, it’s important to note that Q2 GDP will get one more revision, before the annual benchmark revision at end of September. We know from previous work that GDP is better measured in real time using a combination of expenditure side data (GDP) and income side data (GDI). A 50-50 weighting yields what BEA reports as Gross Domestic Output (GDO), which is only available with the second GDP release.

We also know that establishment survey data, while more precisely measured than household survey data, gets revised, and the preliminary benchmark data for March 2022 implies stronger employment growth than previously thought. This point was discussed in yesterday’s post. Putting together our knowledge of GDO and employment, this is the corresponding figure to Figure 1.

Figure 2: Nonfarm payroll employment (dark blue), Bloomberg consensus as of 8/26 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2012$ (green), manufacturing and trade sales in Ch.2012$ (black), consumption in Ch.2012$ (light blue), and monthly GDP in Ch.2012$ (pink), official Gross Domestic Output (blue bars), all log normalized to 2021M11=0. Lilac shading denotes dates associated with a hypothetical recession in H1. Source: BLS, Federal Reserve, BEA, via FRED, IHS Markit (nee Macroeconomic Advisers) (8/1/2022 release), and author’s calculations.

Finally, the Lewis-Mertens-Stock Weekly Economic Index for the week ending 8/20 was released yesterday. With this release, we have the following high frequency picture of the economy.

Figure 3: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green) Source: NY Fed via FRED, OECD, WECI, and author’s calculations.

The WEI reading for the week ending 8/20 of 2.8 is interpretable as a y/y quarter growth of 2.8% if the 2.8 reading were to persist for an entire quarter. The OECD Weekly Tracker reading of 1.9 is interpretable as a y/y growth rate of 1.9% for year ending 8/6. The Baumeister et al. reading of 2.1% for the week ending 6/25 is interpreted as a 2.1% growth rate in excess of long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%.

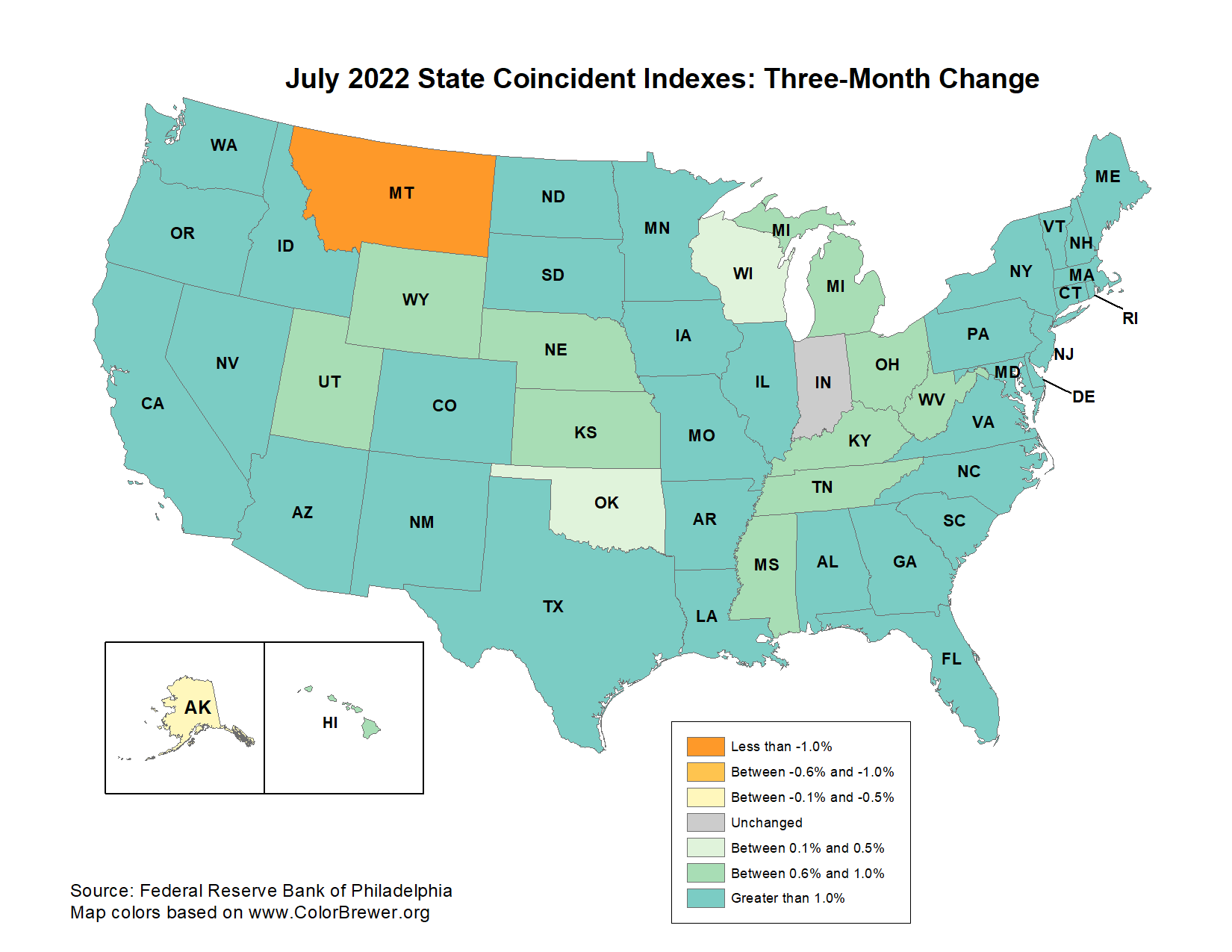

We also have a measure of the geographic dispersion of economic activity through July, using the Philadelphia Fed’s monthly coincident indexes, released the day before yesterday. The map looks like this:

Source: Philadelphia Fed.

This map, and the previous months’ of maps (see here), do not suggest a geographically broadly-based downturn.

The argument that we were in a recession in H1 further weakens with consideration of these data.

As usual, very clearly explained and presented. Thank you.

Looks like housing prices have started to come down, although right now some of that is seasonal. Housing investment (the thing about the housing market that drives GDP the most) looks like it started to slow down many months ago, and the slowdown continues now:

New Home Sales Decrease Sharply, Record Months of Unsold Inventory Under Construction | Calculated Risk | Aug 23, 2022

https://www.calculatedriskblog.com/2022/08/new-home-sales-decrease-sharply-record.html

“The next graph shows the months of supply by stage of construction. “Months of supply” is inventory at each stage, divided by the sales rate.

“Active InventoryThere are 1.06 months of completed supply (red line). This is about two-thirds of the normal level.

“The inventory of new homes under construction is at 7.33 months (blue line) – a new record and well above the normal level. This elevated level of homes under construction is due to supply chain constraints.

“And a record 107 thousand homes have not been started – about 2.51 months of supply (grey line) – more than double the normal level. *Homebuilders are probably waiting to start some homes until they have a firmer grasp on prices and demand.*

…

“This suggests we will see a sharp increase in completed inventory over the next several months – and that will put pressure on new home prices.”

He yeah, but that so called slowdown isn’t quite that impressive when you look at raw population growth. I mean, hedge funds aren’t going to buy properties when they are normal rate adjusted purchases.

Coherent thought much?

Here’s a look at the housng sector through two metrics which are closest to what NBER uses to time recessions:

https://fred.stlouisfed.org/graph/?g=T9mT

Employment and output from housing are trending upward, though output is down in the latest month. Construction spending and employment are notvthe most leading of indicators – McBride has leading indicators covered. What we see is that in terms of income generated and demand for inputs, housing is still not a drag on the economy.

Residential fixed investment as a share of GDP has flattened out so that in some recent quarters in has been a small drag, some quarters a small addition:

https://fred.stlouisfed.org/graph/?g=T9n9

Th big threat lies ahead. Rising rates and the completion of that overhang of unfinished homes will put a sizable dent in the housing sector.

Back by popular demand, GDP-based productivity (home-brew calculation) vs GDI-based productivity:

https://fred.stlouisfed.org/graph/?g=T8zJ

With the addition of Q2 real Gross Domestic Income data, the gap has widened, but that’s not the point of this picture. Using GDI, the productivity lump is no longer record-breaking.

While I’m at it, here’s Gross Domestic Output-based productivity:

https://fred.stlouisfed.org/graph/?g=T8AP

That’s a pretty steep drop, but still well above the pre-Covid trend. Labor productivity is still in good shape, despite slowed inventory accumulation.

Read the NY Times reports on Georgetown Jeromes’ latest comments. I see a VP job at one of the larger banks waiting for jerome at the revolving door. Slaughter the common man Jerome. Slaughter the common man to the ground 75bps hike Georgetown Jerome. Prove to us why trump chose you over Yellen, Jerome. but don’t come visit my street if anyone here was just cleaning guts out of catfish Jerome.

Corporate profits deflated by unit labor costs are a long leading indicator. In Q2 they made a record high.

Only one among an array of mainly negative long leading indicators, but they suggest that either (1) we will escape a recession after all, or (2) any such recession will be brief and perhaps shallow. Relying on memory here, but I don’t think they have *ever* made all-time highs *during* a recession.

Corporate profits usually tank during a recession. I just checked at FRED then lost the link like a dummy, but your instincts are right. Crazy-high profits are what you’d expect from an economy that is very hot, with high inflation, but just not hot enough to give us stagflation. Very high costs will make it hard for new entrants.

Something like this:

https://fred.stlouisfed.org/graph/?g=T9ve

So no, we aren’t getting a recession signal, but we are getting some flopping around. Same as with real GDP. “Flopping around” is sometimes noticed at turns, but is not part of the definition of recession.

By the way, look at that wage-price spiral…wait…um, never mind.

Fiddling with the dates to get rid of the period of rapid rise makes it easier to see the pattern prior to 2000.

Basically the size of inflation was bogus. Driven by panicking vendors and retailers who panicked during the port clog/shipping price surge. Now they are overloaded with stuff leading to price deflation. Auto is the next consumer durable to normalize. If the Iran deal is finalized by October, we are looking at deflation by 2023.

This will surge real wages yry

Basically the size of inflation was bogus. Driven by panicking vendors and retailers who panicked during the port clog/shipping price surge. Now they are overloaded with stuff leading to price deflation….

[ Understood belatedly, this has all been pretend. ]

“The implication would seem to be an emerging recessionary environment resulting from increased interest rates, with the 30 year at 5.72% — pretty stiff.” Some person (Stevie of course) wrote this on 8/23. Let’s see what FRED (Freddie Mac) at each of their Thursday weekly updates:

https://fred.stlouisfed.org/series/MORTGAGE30US/

On 8/18, the report was 5.13%. Yea higher rates were reported back in late June but they clearly fell over the next several weeks. The next day Stevie said this rate was rising and his new BFF JohnH kept saying Stevie was right and that I was somehow lying. Now on 8/25 I did report the rate had increased from 5.55% which is still below 5.72%.

Of course JohnH keeps claiming I got this all wrong and I was lying. I guess Johnny boy really wants to join Stevie on Fox and Friends so they can jointly cast racist hurls at immigrants or whatever. But no mortgage rates did not start at 5.72% and rose from there. They rose from 5.13% to 5.55%.

But one can understand why Stevie and JohnH are BFFs. They love to throw one lie after another on something as simple as what has been happening to a particular interest rate as they both think confusing easy things makes them look smart.

My response to pgl’s statement that “Princeton Steve first tells us 30 year mortgage rates are over 5.7% and then he comes back and declares that this interest rate is rising…Stevie is not alone with his lying to us about mortgage rates as JohnH is pulling the same cheap tricks.”

Mortgage News Daily daily survey (8/24) reports 30 year fixed mortgages at 5.84%, up 0.36% from a week earlier.

MBA weekly survey (8/24) is at 5.65%, up 0.18% from a week earlier.

FreddieMac (8/17) is at 5.13% (week old data); [the next day FreddieMac announced that rates had risen 0.42% to 5.55%]

https://www.mortgagenewsdaily.com/mortgage-rates/30-year-fixed

Of course pgl is notorious for claiming that he has the truth, the whole truth, and nothing but the truth…and anyone not agreeing with him is a rotten, no good liar!

Sad to say, pgl’s outdated data had been overtaken by events showing that mortgage rates were in fact rising, but as is SOP for pgl he called anyone not agreeing with his data a liar.

In all that pathetic babble of yours, the one thing correct was this:

FreddieMac (8/17) is at 5.13% (week old data); [the next day FreddieMac announced that rates had risen 0.42% to 5.55%]

On 8/17, Freddie Mac’s last reporting was 5.13%. I was the one who noted “the next day FreddieMac announced that rates had risen 0.42% to 5.55%”

So all of your pathetic babbling shows I told the truth all along.

Come Johnny boy – we all know you are beyond STUPID but do you have to keep proving it over and over again? DAMN!

https://www.youtube.com/watch?v=ULDGfjyVOW0

Jamie Foxx Gives His Best Donald Trump Impression

Only 1 minute long with nothing offensive. Funny.

“Cratering housing market. See CR.”

Of course Bill McBride never said that. Cratering must be some new technical term like hard reset of suppression. Or maybe it just another example of extreme hyperbole from the worst consultant ever.

https://fred.stlouisfed.org/series/DCOILWTICO/

Oil prices (WTI) have declined from over $120 a barrel in early June to less than $94 a barrel. Why isn’t Princeton Steve telling us the oil market is “cratering”. Oh wait – more affordable gasoline prices does not fit his doomsday scenario so admitting what is really happening might lead to Fox and Friends firing him as their chief economist. Time to find some other “data point” to spin!

pgl,

That $94 is up from mid 80s we were at over a week ago or so. Recent trend has been up somewhat unfortunately. Sure could use that nuclear deal with Iran, but it seems to have gotten gummed up by the Russian war in Ukraine and Iran buddying up with Russia on that.

Anyway, I note Krugman has noted the ongoing decline in gasoline prices may be about to end, and this resurge of crude oil , with Brent just over 100, is the obvious reason why, although hopefully we are about to see some food price declines as the declines in primary food products start to finally pass through to the retail level.

https://www.msn.com/en-us/news/us/moderna-sues-pfizer-and-biontech-over-covid-vaccine/ar-AA1189DR?ocid=msedgdhp&pc=U531&cvid=873d9966c2544aaea8d1959932708c11

“The vaccine manufacturer Moderna sued Pfizer and BioNTech on Friday, claiming that its rivals’ Covid-19 shot violates its patents protecting its groundbreaking technology.”

Oh gee – another attempt to limit competition. Hey – this is what biopharma does.

“Moderna said in a statement that Pfizer and BioNTech infringed on patents filed between 2010 and 2016 that covered its mRNA technology. Moderna, which is based in Cambridge, Mass., sued in U.S. District Court in Massachusetts and the Regional Court of Düsseldorf in Germany, where BioNTech is based. Christopher Ridley, a spokesman for Moderna, said the company did not have an estimate for the amount of damages it was seeking.”

Of course they do not have their estimate yet because their lawyers are still opinion shopping for an ‘expert’ to come up with some overinflated value.

But wait – the government funded much of Moderna’s R&D to get their COVID-19 ready for use. Whatever they extract from the Pfizer shareholders should be shared with the government. But I doubt Moderna’s lawyers will admit that.

https://www.cnbc.com/2022/08/26/powell-warns-of-some-pain-ahead-as-fed-fights-to-lower-inflation.html

Federal Reserve Chairman Jerome Powell delivered a stern commitment Friday to halting inflation, warning that he expects the central bank to continue raising interest rates in a way that will cause “some pain” to the U.S. economy.

In his much-anticipated annual policy speech at Jackson Hole, Wyoming, Powell affirmed that the Fed will “use our tools forcefully” to attack inflation that is still running near its highest level in more than 40 years.

That could be interpreted as the US is not in a recession… yet.

Meanwhile…

https://www.bloomberg.com/news/articles/2022-08-24/biden-s-student-loan-relief-adds-new-wrinkle-to-inflation-debate

But, hey, buying a more votes is worth a few extra points of inflation, eh? Besides, that will be wiped out by the “pain” to the general economy.

This from the troll who kept chirping how high inflation was the end of the world as we know it? Now you are complaining that the FED is trying to lower it. You are indeed one inconsistent clown.

pgl, you read many more things into links that aren’t there, yet you never actually contribute any serious information. That would be the definition of a troll.

Do you disagree with the CNBC article? If so, why?

Do you disagree with Bloomberg article? If so, why?

There, made it easy for you.

“you read many more things into links that aren’t there”

In most situations you do not even read your own links but I do and yea – I find things that ARE there but you are too dumb to have noticed.

But no in this case I am reminding everyone of what YOU said over and over again. Come on Brucie – at least hold yourself responsible for the intellectual garbage you have peddled here in the past.

‘Do you disagree with the CNBC article? If so, why?’

That is a stupid question. CNBC captured what Powell said at Jackson Hole. Nothing to do with their reporting. Do I think Powell is overreacting? Yea – I have said so. But I guess you are once again too stupid to have noticed.

‘Do you disagree with Bloomberg article? If so, why?’

Macroduck has already blown away what this article said in a comment directly to you. Another thing Bruce Hall is too stupid to have read.

But i guess those stimulus checks that trump forced his signature onto were not an attempt to buy votes? Hypocrite.

Or the billions in additional farm subsidies to stem losses from the tariffs and the pandemic. $30+ Billion in 2020 alone. Trump was on record as being hopeful farmers would remember at election time.

I have a suspicion that Powell’s especially hawkish tone was partly inspired by the student loan deal, which I am sympathetic to (maybe should have had a lower income cutoff for eligibility for it), even as I think the inflationary impact of that deal is being exaggerated by many.

Brucey? Haven’t you been paying attention? CoVid already tried to pretend student loan forgiveness is inflationary. Didn’t work. Or is the troll choir under orders to keep up this noise? Anyhow, this was my answer to CoVid, and it’ll do for you, as well:

Goldman and BoA, who are smarter than you, conclude student loan forgiveness is likely to be slightly disinflationary:

https://www.forbes.com/sites/jonathanponciano/2022/08/25/student-loan-forgiveness-plan-wont-make-inflation-worse-even-if-it-adds-400-billion-to-deficit-goldman-says/?sh=234c6ce12e77

More importantly, the analysis concludes that macroeconomic effects will be small – about 0.1% of GDP in the first year, less in subsequent years. CoVid (now Brucey) this is an economics blog; you want to explain how student loan forgiveness will have a big inflationary impact when the overall ecominc impact is small?

You may be tempted to crib from a crft report which argues that student debt forgiveness will prove inflationary, since this is apparently the source of much of the press coverage:

https://www.crfb.org/blogs/cancelling-student-debt-would-undermine-inflation-reduction-act

Problem is, some serious questions have been raised about the crft report:

https://rooseveltinstitute.org/2022/08/17/canceling-student-debt-would-increase-wealth-not-inflation/

Now, I don’t see a link on the crfb site to the math behind the report, but Mike Konczal and Alí Bustamante seem to have found it. They cite a few assumptions in the crfb analysis which seem quirky, to say the least. First, they assume the forgiven payments will be spent, not saved. Second, they use a budget convention to assume all of the repayment of debt would have take place in the first ten years (the CBO budgeting period) rather than the actual lifetime of debt repayment. Finally, they assume 90% of the impact of increased spending would be through inflation, 10% through real consumption. These three assumptions interact (you do understand how yes?, Or should I explain this, as well?) In sum, the big splash of ink in the press about the inflationary impact of debt forgiveness is based on assumption cnompounded by assumption. Change the assumptions, and the inflation disappears.

Brucey, if you can’t be bothered to make up new bogus accusations, it’s even easier for me to make you look silly.

Duckie,

I provided the links. You may not agree with the links and that is fine. However, there always seems to be significant disagreement among “experts” regarding the outcome of government programs. So I guess we’ll have to see 1) if the loan “forgiveness” passes the court tests and 2) if Congress is willing to fund it. We all know that an EO won’t be enough on this one.

No. Experts seem in general agreement that the economic impact of student loan forgiveness will be small. When you sad loan forgiveness would add “few extra points of inflation”, you were claiming that the inflationary impact would be larger than the entire projected economic impact. A “few extra points of inflation” is more than any forecast in any of the links you provided – to non-expert journalists, or that I provided.

By the way, nice use of the main tool of “fake science” – “Experts disagree!!!”

‘I provided the links. You may not agree with the links and that is fine.’

Since Bruce Hall always is too stupid to read his own links, I don’t understand why Macroduck expects Brucie to read informed discussions Macroduck provides. Bruce Hall is totally incapable of actually reading informed discussions.

Bruce,

The not much talked about item associated with the debt deal that pretty much removes most and maybe more than all its potentially inflationary effect is that as of December, people with student debts will have to resume making payments on them. The pandemic moratorium on those payments will be coming to an end, conveniently the month after the midterm elections, although nobody will have their debts actually concelled until after the elections either, noting this given that you often comment on how these things will affect those elections..

If you ever drove a semi truck, or loved any person who drove a semi truck, you know this song…….. Any truckers read this blog??? Former…one….. I love any truckers reading this blog. We love you guys with all of our hearts. Truckers keep this country running, We LOVE you. We LOVE you.

https://www.youtube.com/watch?v=q3LK1Mt3CZA

Ope!!!! Broke down on the south side of Texas, Love you truckers , good lord gonna “come along”, just wait……

Folks,

We must recognize that while indeed Moses has been a trucker, he is covering for being the most important secret expert on everything who posts here. The reason he does not say what he does is that he has more security clearances than everybody else here ever had put together He has ones whose existence are classified, indeed, ones that one can know about only if they already have one whose existence is classified. We must all understand that he is nearly overwhelmed by this burden of super secret responsibility when he gets up every morning.

It should be realized that he still likes to drive trucks. After all, truck stops are great places for dead drops and secret rendezvous. Those country music songs are great for hiding all kinds of codes in.

And his time in China supposedly “teaching English”? More like advanced study of cryptography and related matters. And for sure this is how he realized that “anne” of the old Economists View is really a man, who now goes by “ltr” here.

As for his constant campaign against me, well, it should not be surprising that it resembles the noble campaign of de-nazification being carried out in Ukraine by V.V. Putin, whom Moses knows far more about than I could ever hope or dream to know. In his case the noble campaign involves de-pompousification, with me being undoubtedly by far the most pompous individual posting here, even putting such pomposities as Econned, Steven Kopits, and Rick Styker to shame, not to mention the pathetic CoRev, whose efforts to be pompous cannot get off the ground as he is just a gaseous balloon full of leaks.

Of course, Moses nobly continues to highlight my numerous blunders and inaccuracies, which certainly do warn all of you to be careful about anything I post here, especially anything critical of him. None of that should be believed for even one second. But, like those naughty Ukrainians, it seems that it is hard to successfully complete my de-pompousification, even though Moses tries to bomb me as hard as Putin bombed the Azov battalion in Mariupol. But the grandiosity of my pomposity is truly stupendous, I am sorry to say, :-).

“Pomposities” – this hilariously comes from the entity who pointlessly name-drops without being prompted. Get outta here.

Hah, “MaybeEconned,” presumably standing in for the pomposity who is better known as “Econned,” is just jealous that he does not know as many well-known people as I do, so will just have to play second fiddle at best to me in the pomposity game. I am more pompous than thou, Econned, and no way you will ever be able to credibly match me, :-).

“Barkley Rosser”,

Indeed.

i still would like to know why econned uses different monikers on this site in order to defend his commentary. it is VERY troll like behavior. and i am not talking about the “maybeeconned” names. actual new names and then referencing posts by econned, such that it was simply a different commenter who was independently defending econned’s position. very juvenile behavior, imo.

A followup here. We must also realize that Moses makes James Bond look like a pathetic virgin as regards women. He has a woman in every bed, all of them hot, and some of them even brilliant economists. This explains why he is such an expert on women, able to tell which ones are admirable and which ones should be removed from office ASAP.