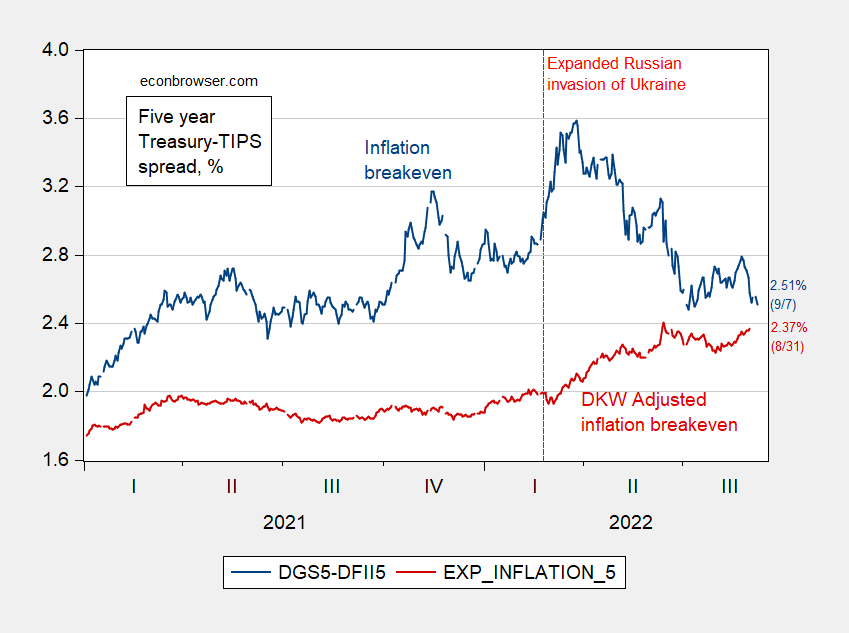

It might be misleading to rely to heavily on simple inflation break even calculations, which show inflation over the next five years lower today than they were on the even of the expanded Russian invasion of Ukraine.

Figure 1: Five year inflation breakeven calculated as five year Treasury yield minus five year TIPS yield (blue), five year breakeven adjusted by inflation risk premium and liquidity premium per DKW (red), both in %. Source: FRB via FRED, Treasury, NBER, KWW following D’amico, Kim and Wei (DKW) accessed 9/7, and author’s calculations.

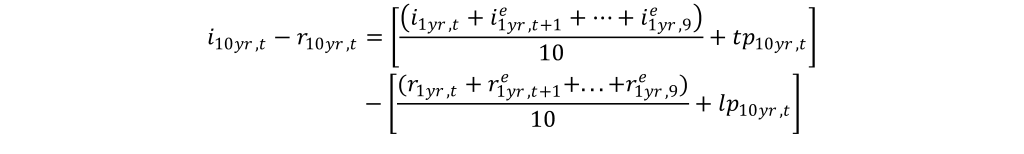

Two series are plotted. Why is this distinction important? Consider the case for the 10 year inflation break even calculation. If the 10 year TIPS depends on expected future one year real rates and a liquidity premium (lp), then:

The liquidity premium is defined as the premium that arises because of the lower liquidity of the TIPS market; from Andreasen, Christensen and Riddell (2020): “Despite the large size of the TIPS market, an overwhelming amount of research suggests that TIPS are less liquid than Treasury securities without inflation indexation

Hence the simple break even calculation is:

If the term premium on nominal bonds and liquidity premium on TIPS were zero (or each moved in lockstep), then the gap between 10 year Treasurys and 10 year TIPS could be imputed to expected inflation over the next ten years. However, that is not likely to be true, so the commonly calculated breakeven is probably measured with error, which is likely to vary systematically over the business cycle. The same applies for the five year spread.

Note that the adjusted series — contrary to the unadjusted series — indicates no jump up and then decline. Rather there is a gradual rise from about 2% to 2.4%. Hence, the adjusted series implies higher inflation than pre-invasion, but never as high as implied by the unadjusted series in March.

Since the CPI runs about 0.5 percentage points higher than the PCE deflator, this suggests the five year inflation rate for the PCE is about at the 2% number that was the Fed’s target.

If expected PCE inflation is around 2% and if expectations are reasonably accurate, then the Fed has – intentionally but inadvertently – gotten a bit closer to its long-term goal of inflation averaging 2%. And the period of above-target inflation has – intentionally but inadvertently – corrected the earlier inflation undershoot that was seen as likely to undermine the credibility of the Fed’s symmetrical target.

Mission inadvertently accomplished?

Now there’s just the trivial matter of getting the balance of the dual mandate right.

Princeton Steve’s cheerleading for a RECESSION (or was that a hard reset) involves all sorts of fishing for any statistic he can manipulate (excuse me report) including this series:

https://fred.stlouisfed.org/series/ICSA

Stevie took a short lived and modest increase in initial jobless claim and went beserk claiming this meant we were already in a deep recession. Of course Stevie has been silent lately and this may explain why:

https://www.barrons.com/articles/jobless-claims-fall-51662641926

The number of Americans filing for first-time unemployment dipped to its lowest level since May in the first week of September, pointing to a labor market that refuses to loosen up despite the Federal Reserve’s best efforts. Initial jobless claims dropped by 6,000 to 222,000 in the week ended Sept. 3, below estimates for 237,500, according to FactSet. The four-week average also declined to 233,000, down 7,500 from the previous week’s revised average. That’s not inherently a bad thing—low unemployment claims point to a strong labor market. But a strong labor market may be the last thing the economy needs right now, as it will do nothing to discourage the Fed from staying the course on its monetary tightening policy.

Oh well the RECESSION cheerleaders will switch tune and start babbling about HYPERINFLATION.

Under another comment CoRev drags out one paper from Richard Tol as the definitive study on the issue of climate change. There are two problems with this both noted in this exchange:

https://www.lse.ac.uk/granthaminstitute/news/the-economic-impacts-of-climate-change-richard-tol/

First up was Tol in his own words noting:

;climate change is a problem but not the biggest problem in the world;.

So Tol himself rejects CoRev’s barking. Second up was Bob Ward who is one of the many climate change economists who note Tol may be seriously underestimating the damage from fossil fuels.

Whenever CoRev pulls out a single paper from a climate change denier, know he is being less than honest about the totality of the research.

pg13,

So Richard Tol is a climate change denier? Better let Professor Nemet at Wisconsin know. After all, Menzie invited him to give a lecture on climate policy in one of his classes and in Nemet’s presentation he presents estimates from none other than Tol.

How can it be that Nemet is presenting estimates from a climate change denier? He’s not of course. Anyone with basic familiarity with climate analysis knows that Tol is a standard reference. CoRev knows that, which is why he cited Tol.

You apparently don’t know that Tol is standard. So we need to add climate policy to the long list of things you don’t understand—freshman calculus, British cheese, law, Bitcoin, economics, etc, etc.

You say you got a PhD at Vandermeer University. Are you sure they award a PhD? Just because they have an admission process and academics doesn’t mean they award a PhD. Maybe you got confused. Someone may have told you got P.H. Dee, but they meant the coach they assigned to you was Paul Dee.

So, should we all buy I-series Treasury bonds now because they currently pay 9%?

yes. we have about $60k put into I bonds since they began to rise a little over a year and a half ago. probably will put another round in come January. take them out after a year if you like, if we push inflation lower. otherwise continue past go and collect $200. savings bonds have been the best investment around for the past couple of years. would be nice if their fixed component increase some. will keep people holding onto them longer.