Official vs. effective, real vs. nominal, bilateral vs. multilateral.

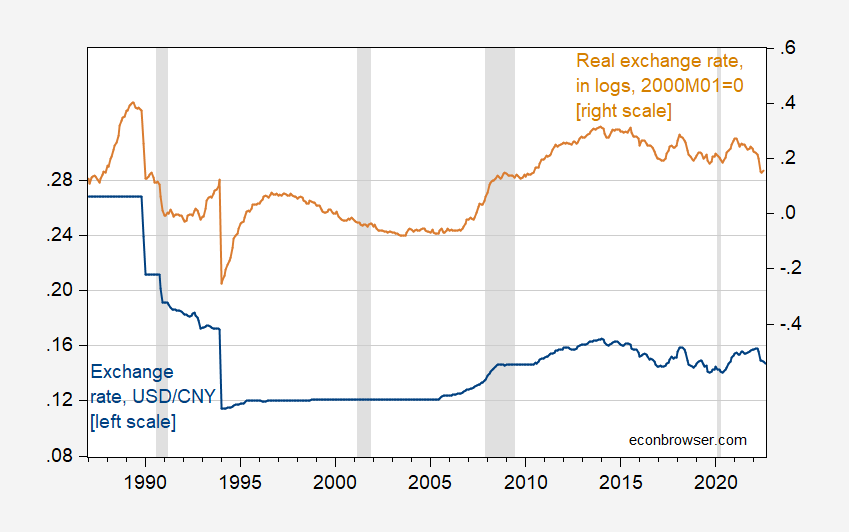

First, let’s the nominal as compared to the inflation adjusted.

Figure 1: Official bilateral nominal USD/CNY exchange rate, period average (blue, left scale), log bilateral real exchange rate (tan). NBER defined peak-to-trough recession dates shaded gray. “Down” is a CNY depreciation. Source: FRED, NBER, and author’s calculations.

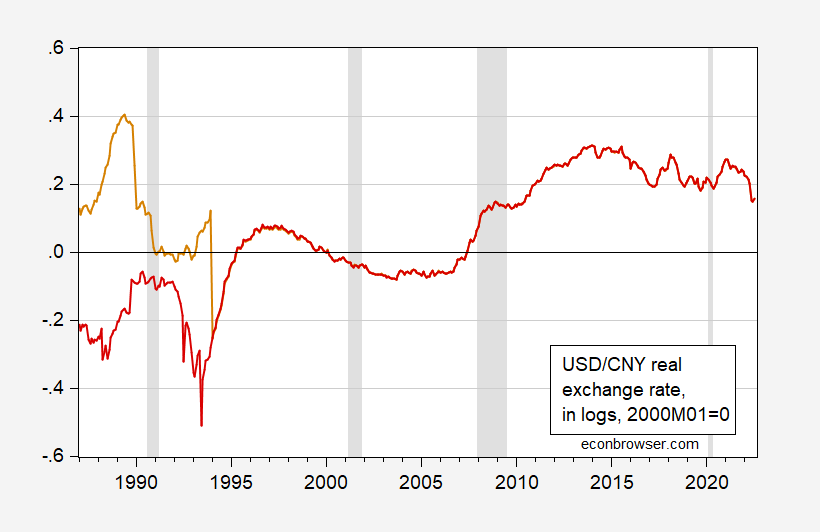

Second, let’s consider the difference between the official exchange rate, and the rate that transactions are conducted at. In advanced economies, they are typically the same; not so for many developing countries. In China this distinction becomes important insofar as the observed “mega-devaluation” in 1994 was in some ways an artifact of using the official exchange rate. Fernald, Edison and Loungani (1999) note that many transactions were conducted through swap centers. Using their series yields a less dramatic drop in 1994.

Figure 2: Official bilateral real USD/CNY exchange rate, period average (tan), and bilateral exchange rate adjusted for swap center rates used before 1994 (red). NBER defined peak-to-trough recession dates shaded gray. “Down” is a CNY depreciation. Source: FRED, Fernald, Edison, Loungani (JIMF, 1999), NBER, and author’s calculations.

Two aspects are of interest here. First, the trend CNY appreciation using the official rate is essentially zero. However, using the swap center adjusted rate, the CNY has been appreciating about 1% per annum over this period (estimated using first differences).

Second, the real exchange rate looks possibly trend stationary if one uses the official rate (rejects Elliott-Rothenberg-Stock unit root test at 10%, but also rejects Kwiatkowski-Phillips-Schmidt-Shin trend stationary test at 1%), but is pretty clearly I(1) using the adjusted rate (fail to reject ERS, and rejects KPSS).

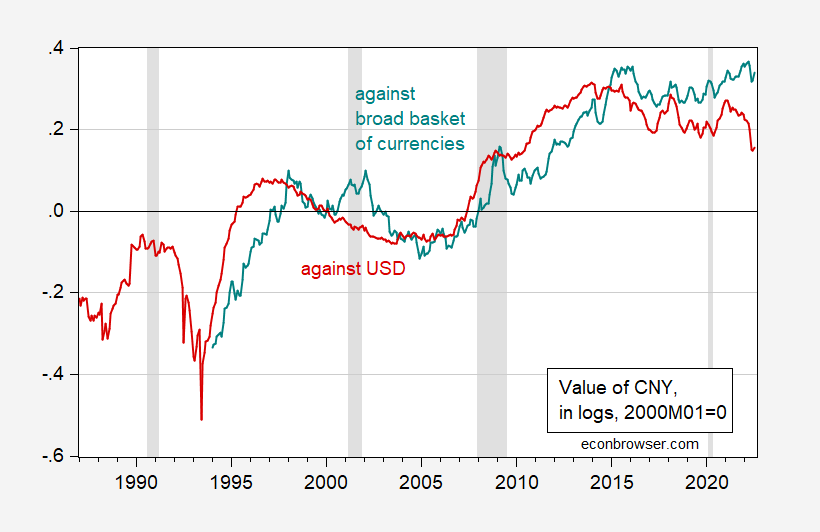

Third, and particularly relevant now (see Sobel, 2022), the bilateral and real exchange rates can differ substantially in terms of direction.

Figure 3: Bilateral exchange rate adjusted for swap center rates used before 1994 (red), and trade weighted value of CNY (teal), both in logs, 2000M01=0. Trade weighted CNY is against broad basket of currencies. NBER defined peak-to-trough recession dates shaded gray. “Down” is a CNY depreciation. Source: FRED, Fernald, Edison, Loungani (JIMF, 1999), BIS, NBER, and author’s calculations.

What becomes clear is that the recent depreciation of the CNY is really a depreciation against the dollar. Once one takes a trade-weighted view, the CNY is about at the same (inflation-adjusted) level it was in 2015.

Addendum, 9/9/22, 8AM:

As for whether the CNY is misaligned, there are numerous ways of answering this question. The most appropriate depends on the economic model used, the data being used, and the statistical characteristics of that data. For more, see Cheung, Chinn, and Fujii (JIMF, 2007). Using PPP and monetary models, Chinn (2000) evaluated exchange rates other than the Chinese on the eve of the 1997 currency crises.

Put in terms sometimes heard frm markety types, the pattern is not of yuan weakness, but of dollar strength.

In 2006, China began managing its exchange rate against a basket of currencies, rather than against the dollar alone. In figure 1, that change is perfectly clear. In other figures, it’s also clear, but kind of mushed together with the Great Financial Crisis. Wonder whether there is a difference in measurable trend performance before and after adoption of the basket.

https://english.news.cn/20220909/0123bf65b0a64d79a09224d995b25ab2/c.html

September 9, 2022

China’s CPI up 2.5 pct in August

BEIJING — China’s consumer price index (CPI), a main gauge of inflation, rose 2.5 percent year on year in August, the National Bureau of Statistics (NBS) said Friday.

On a monthly basis, August’s CPI remained stable, reversing the 0.5-percent rise in July to edge down 0.1 percent, thanks to efforts to contain COVID-19 and extreme weather impacts, as well as efforts to ensure sufficient supply and stable prices, noted Dong Lijuan, a senior statistician with the NBS.

Food prices went up 0.5 percent month on month, which raised the monthly consumer inflation by about 0.1 percentage points.

Specifically, the price of pork, a staple meat in China, inched up 0.4 percent in August, contracting 25.2 percentage points over the previous month, as hog slaughter activities returned to normal and consumer demand saw a seasonal weakening, Dong said.

Non-food prices rose 1.7 percent year on year, lifting the yearly consumer inflation by about 1.38 percentage points.

The prices of gasoline and diesel reported year-on-year growths of 20.2 percent and 21.9 percent, respectively.

The core CPI, which excludes food and energy prices, gained 0.8 percent year on year in August, staying flat from the growth pace logged in July.

Friday’s data also showed that China’s producer price index, which measures costs for goods at the factory gate, went up 2.3 percent year on year in August.

https://fred.stlouisfed.org/graph/?g=yeYT

January 15, 2018

Real Broad Effective Exchange Rate for China, United States, India, Japan and Germany, 1994-2022

(Indexed to 1994)

https://fred.stlouisfed.org/graph/?g=hEsX

January 15, 2018

Real Broad Effective Exchange Rate for China, India, Brazil, Mexico and South Africa, 1994-2022

(Indexed to 1994)

https://news.cgtn.com/news/2022-09-09/Chinese-mainland-records-301-new-confirmed-COVID-19-cases-1dbbMCCxB9C/index.html

September 9, 2022

Chinese mainland records 301 new confirmed COVID-19 cases

The Chinese mainland recorded 301 confirmed COVID-19 cases on Thursday, with 259 attributed to local transmissions and 42 from overseas, data from the National Health Commission showed on Friday.

A total of 1,103 asymptomatic cases were also recorded on Thursday, and 24,048 asymptomatic patients remain under medical observation.

The cumulative number of confirmed cases on the Chinese mainland is 246,328, with the death toll from COVID-19 standing at 5,226.

Chinese mainland new locally transmitted cases

https://news.cgtn.com/news/2022-09-09/Chinese-mainland-records-301-new-confirmed-COVID-19-cases-1dbbMCCxB9C/img/a64da144ee204f069cf89917234422c9/a64da144ee204f069cf89917234422c9.jpeg

Chinese mainland new imported cases

https://news.cgtn.com/news/2022-09-09/Chinese-mainland-records-301-new-confirmed-COVID-19-cases-1dbbMCCxB9C/img/fca089e2e3754e7a87f690cad566a296/fca089e2e3754e7a87f690cad566a296.jpeg

Chinese mainland new asymptomatic cases

https://news.cgtn.com/news/2022-09-09/Chinese-mainland-records-301-new-confirmed-COVID-19-cases-1dbbMCCxB9C/img/15358592ef024a79acf6437f6be11040/15358592ef024a79acf6437f6be11040.jpeg

https://www.worldometers.info/coronavirus/

September 8, 2022

Coronavirus

United States

Cases ( 96,959,165)

Deaths ( 1,074,787)

Deaths per million ( 3,233)

China

Cases ( 246,027)

Deaths ( 5,226)

Deaths per million ( 4)

And AT LEAST Three Nobel Prizes.

Excellent point. I knew a PhD once who had a hard time figuring that out.

The funny thing is that same PhD was always whining about those he thought should have gotten a Nobel and didn’t. You’d think that guy would recognize what an achievement that is operating inside of the mainland China system (which is very dysfunctional ). You might even argue those people are “handicapped” (put at a disadvantage) compared to American scholars. And therefor those three winners should be all the more admired and recognized for their achievement of winning a Nobel. The reality is many scholars get their Nobel “late”, and so it’s not surprising~~if the arbiters of the Nobel refuse to award it posthumously~~that some great scholars would be left out. And there’s many examples of people who got their Nobel, but got it “late”.

https://www.nobelprize.org/prizes/physics/1986/ruska/facts/

https://www.aap.org/en/pages/2019-novel-coronavirus-covid-19-infections/children-and-covid-19-state-level-data-report/

November 1, 2022

Cumulative Number of Child COVID-19 Cases

Over 14.5 million children are reported to have tested positive for COVID-19 since the onset of the pandemic according to available state reports; over 343,000 of these cases have been added in the past 4 weeks. Approximately 6.65 million reported cases have been added in 2022.

14,539,261 total child COVID-19 cases reported, and children represented 18.4% (14,539,261 / 78,948,024) of all cases

Overall rate: 19,317 cases per 100,000 children in the population

American Academy of Pediatrics

Children’s Hospital Association

https://news.cgtn.com/news/2022-09-07/China-s-foreign-trade-grows-10-from-Jan-to-Aug–1d86hznTvwI/index.html

September 7, 2022

China’s foreign trade grows 10% from Jan. to Aug.

China’s foreign trade maintained its upward momentum in the first eight months of this year, with exports and imports up 10.1 percent year on year, customs data showed Wednesday.

In the first eight months of this year, the country’s total imports and exports rose to 27.3 trillion yuan ($3.91 trillion), data from the General Administration of Customs (GAC) showed.

Exports grew 14.2 percent year on year to 15.48 trillion yuan and imports increased by 5.2 percent to 11.82 trillion yuan. Meanwhile, China’s trade surplus jumped 58.2 percent to 3.66 trillion yuan, official data showed.

In August alone, China’s total foreign trade expanded 8.6 percent over the last year to 3.71 trillion yuan.

China’s trade with all its major trade partners increased in the first eight months, according to the GAC. The Association of Southeast Asian Nations (ASEAN) remained China’s largest trading partner, followed by the EU and the U.S., official data revealed.

China’s trade value with ASEAN grew by 14 percent, with the EU by 9.5 percent and with the U.S. by 10.1 percent.

In the same period, China’s imports and exports with countries along the Belt and Road routes jumped 20.2 percent to 8.77 trillion yuan.

https://www.businessinsider.com/neil-gorsuch-report-will-come-on-supreme-court-leak-investigation-2022-9

Associate Supreme Court Justice Neil Gorsuch, who was part of the conservative majority that overturned Roe v. Wade in June, said he’s anticipating a report on the investigation into the leaked draft opinion on that abortion rights case. “The chief justice appointed an internal committee to oversee the investigation,” Gorsuch told the 10th Circuit Bench and Bar Conference in Colorado on Thursday, the Wall Street Journal reported. “That committee has been busy and we’re looking forward to their report, I hope soon.” … “I very much hope we get to the bottom of this sooner or later,” Gorsuch said. Gorsuch did not say whether the report will be made public.

Now why would they not make this report public? Oh yea – if it turned out that Ginni Thomas made a copy of her husband’s draft opinion and leaked it to the press, I guarantee that people lie Gorsuch would bury this report.

This headline made my day:

https://www.msn.com/en-us/news/politics/really-smart-legal-experts-praise-doj-move-in-mar-a-lago-investigation/ar-AA11CdsE

‘Really smart’: Legal experts praise DOJ move in Mar-a-Lago investigation

Of course the DOJ lawyers are really smart so why did this make my day? We all have seen how our favorite arrogant idiot – Rick Stryker – struts around acting like he is some brilliant legal mind as he criticizes DOJ. Never mind the fact that Rick is even more incompetent than you standard Trump lawyer. But he does very well parrot the parade of blatant lies from Team Trump.

The only problem is that DOJ has shredded everyone of these clever little lies. But do expect another tirade of arrogant and dishonest claims from Rick Perry Mason Stryker. It is what he do.

Seeing this handpicked Trump baby Judge and Trumps incompetent lawyers go up against the DOJ is like watching a bunch of toddlers play basketball against Michael Jordan.

When I was in China in 1989, was the official exchange rate a joke only paid by suckers while the rest of us got ten times more from street dealers?

Did Rick Stryker help Trump file this lawsuit?

https://www.msn.com/en-us/news/politics/judge-dismisses-trump-lawsuit-against-hillary-clinton-over-2016-election/ar-AA11Exls

A federal judge in Florida dismissed Donald Trump’s lawsuit against former secretary of state Hillary Clinton, saying there was no basis for the former president to claim that Clinton and her allies harmed him with an orchestrated plan to spread false information that Trump’s campaign colluded with Russia during the 2016 presidential race. Trump “is seeking to flaunt a two-hundred-page political manifesto outlining his grievances against those that have opposed him, and this Court is not the appropriate forum,” Judge Donald M. Middlebrooks of the Southern District of Florida wrote in a scathing 65-page ruling released Friday. The judge also wrote about “the audacity of Plaintiff’s legal theories and the manner in which they clearly contravene binding case law.” Middlebrooks also wrote there are “glaring structural deficiencies in the plaintiff’s argument” and that, “Such pleadings waste judicial resources and are an unacceptable form of establishing a claim for relief.”

Trump does waste the time of a lot of people that are so much smarter than Trump and his band of incompetent lawyers.

Kevin Drum summarized this judge’s take down brilliantly:

https://jabberwocking.com/here-are-the-five-best-lines-from-todays-dismissal-of-donald-trumps-latest-idiocy/

Huh – Rick Stryker’s reply? Crickets.

Rick Wilson and the Lincoln Project has really angered Donald Trump. Go figure – standing up to a mob boss is so “terribly unfair”. So Trump says he is going to sue the Lincoln Project. Rick Wilson says bring it on!

https://www.msn.com/en-us/news/other/go-for-it-i-can-t-wait-rick-wilson-profanely-taunts-trump-after-threat-to-sue-lincoln-project/ar-AA11BOZu?ocid=msedgdhp&pc=U531&cvid=ad762f8a219545318be4c8203f9980aa

It seems Larry Summers is on the Twitter being his usual inflation hawk self. OK – old news but check out how Kevin Drum takes Summers on:

https://jabberwocking.com/lets-analyze-larry-summers/

Kevin may not be a world renowned economist but he holds his own here.

Not a bad post, but “they should pull back a bit and let the economy lose steam on its own” is a strange way to put it. The economy is not losing steam on its own. It’s losing steam because the Fed is hawkish.

Hardly an expert here, but I don’t get Summers’ contention that core inflation is still “robust” so I’m with Drum on that.

Drum totally misunderstands the labor market data, though. The job market is still clearly hot (as of the last bits of data I’ve seen). “Close to full employment but not quite there” is also a strange way to put it. Same with his contention about potential GDP: That FRED graph looks extremely tight.