…although it helps.

I never thought an advanced economy government could pursue stupider policies than that implemented under the Trump administration. Consider me corrected on this point – case in point, the United Kingdom in 2022.

From Reuters yesterday:

“We are closely monitoring recent economic developments in the UK and are engaged with the authorities,” an IMF spokesperson said, in response to a query from Reuters after the British pound hit an all-time low amid spiking market concerns.

“Given elevated inflation pressures in many countries, including the UK, we do not recommend large and untargeted fiscal packages at this juncture, as it is important that fiscal policy does not work at cross purposes to monetary policy,” the spokesperson said in the IMF’s first public reaction.

I do see a lot of comparison of the UK to an emerging market economy. For many reasons, this is not an apt comparison.

- The UK government largely borrows in its own currency

- The currency floats, so is not susceptible to a “run” in the conventional sense

- The ability of the government to get the tax revenue it wants is not in question (unlike some countries where the ability to tax is less developed). So it’s a question of will, rather than wherewithal.

On the other hand, there is no doubt that lack of confidence in the ability of the government to stabilize the economy and hence the debt-to-GDP ratio raises premia on government debt, and reduces the desirability of pound assets.

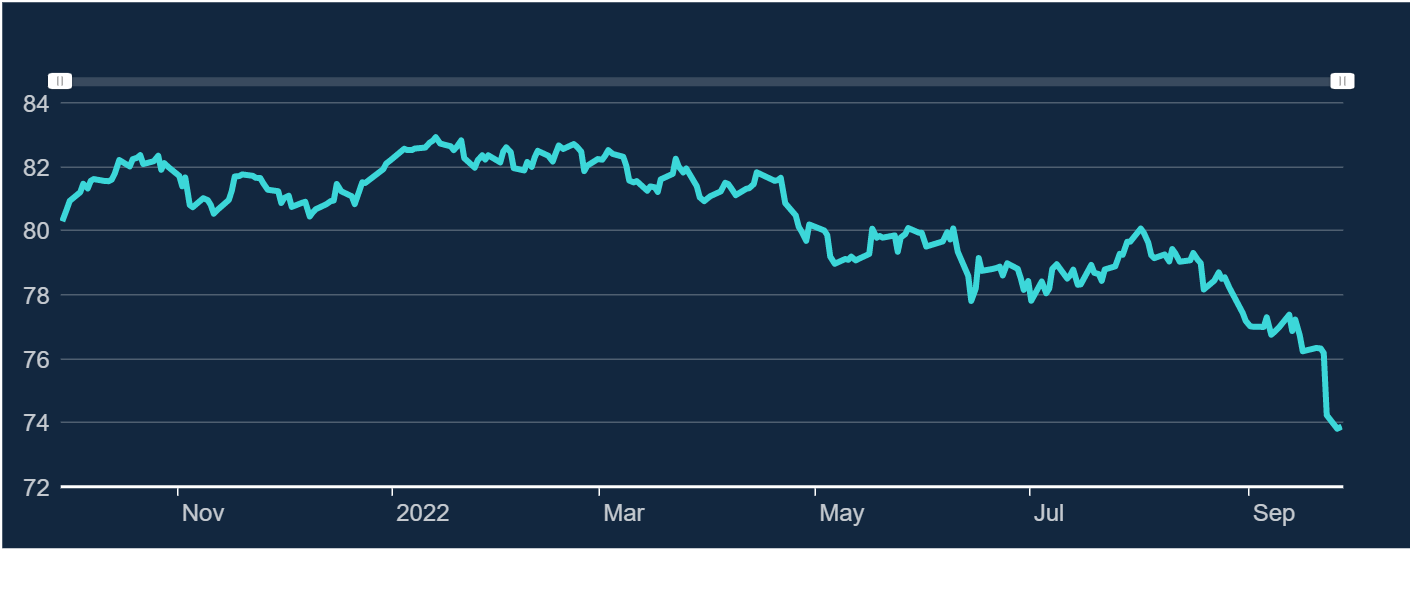

Furthermore, a sharp depreciation in the currency will lead to inflationary pressures. Here, the trade weighted value of the pound is more relevant than the USD/GBP rate.

Source: Bank of England, Broad Pound Index, accessed 9/28/2022.

The trade-weighted drop over the past week is about 3% (compared to 4.3% on USD/GBP). On the other hand, even on this trade weighted basis, the pound has dropped 8% since July 7th, when Boris Johnson announced his resignation. Given exchange rate pass through to CPI of about 0.13 (from Forbes, et al. JIE 2018), we get a cumulative bump up in the level of the CPI of 1%.

Adam Posen, head of Peterson IIE, comments here.

More on the macro environment, pre-crisis, see this post. OECD had already downgraded the UK outlook for 2022 even before these events (the release of the September Interim Outlook on 26 September incorporates forecasts locked down weeks before). From the June release, 2022 y/y growth was shaved by 0.2 ppts, while 2023 projected growth remained set at 0%.

Addendum, 4:16pm Pacific:

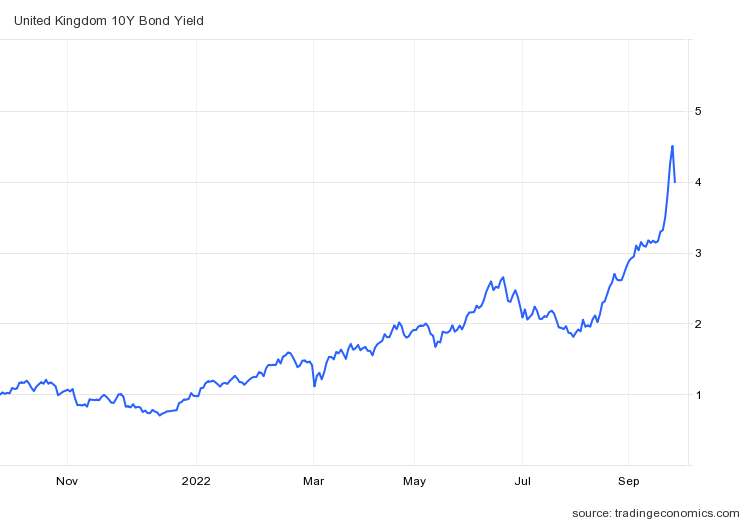

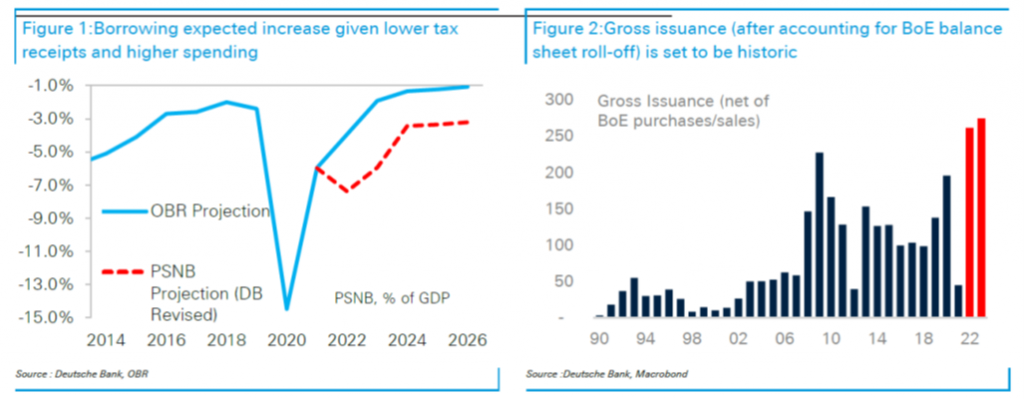

Deutsche Bank provides some graphical insights into why the Chancellor’s “mini-budget” was anything but “mini” in impact.

Source: Raja, “Mini Budget in numbers and charts,” UKBlog (Deutsche Bank, September 27, 2022).

Debt to GDP rises relative to OBR projection by about 7 percentage points of GDP, according to DB. If the economy tanks, then revenue falls relative to projection, etc., etc., and debt to GDP might do something else.

I think I’ve seen this story (“supply side miracle”, etc.) before. Oh, yes, I think I wrote about it in my first undergrad econ term paper…

The critical factor here is not DM or EM, reserves ccy or not with a noticeable exception of USD, a country’s cumulative large current account deficits and how it can be financed

So current account deduct if 8% gdp and 8.6% budget deficits from energy cap and tax cuts make the financing challenge without a substantial increase in Gov bond yields and a depreciating pound. If foreigners refuse to finance the double 8% deficits the a dramatic shrinking of domestic demand therefore deep recession inevitable

Yep. One thing, though. There is often talk of foreigners “refusing” to fund a deficit. For a country that prints its own currency, the reality is generally that foreign (and domestic) accounts simply demand higher interest rates. As they are doing.

Why does inflation matter when you can buy your own bonds and index?

It matters a tremendous amount. Why do you ask?

at some point your currency is shunned in foreign exchange….

which happened notoriously in the 1930’s great depression

https://fred.stlouisfed.org/graph/?g=B3UX

January 15, 2018

United States and United Kingdom Employment-Population Ratios, * 2007-2022

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=Uf2v

January 15, 2018

United States and United Kingdom Employment-Population Ratios for Men, * 2007-2022

* Employment age 25-54

https://fred.stlouisfed.org/graph/?g=Uf2l

January 15, 2018

United States and United Kingdom Employment-Population Ratios for Women, * 2007-2022

* Employment age 25-54

[ What has protected the Conservative government from David Cameron and on since 2010, has been the remarkably high British employment level. ]

https://stumblingandmumbling.typepad.com/stumbling_and_mumbling/

September 27, 2022

The full employment question

“Never mind the public finances. Look after the economy and the deficit will look after itself.” For years, critics of George Osborne such as me echoed Keynes’ old line. At last, the Tories are, by their own lights, heeding this call. And financial markets hate it. Does this mean the Keynesian advice was wrong all along?

No. There’s a big difference between the 2010s and now.

This difference is not that Kwasi Kwarteng * is mistaken to think that tax cuts will stimulate long-term productivity growth. He probably is, but this isn’t the main problem. Even if he had announced the best supply-side policies imaginable, these would not have a significant impact on the economy in the next few months simply because it takes time for capital and labour to learn of new and better opportunities and move to them. As Banerjee and Duflo showed in Good Economics for Hard Times, economies are sticky and slow to adjust to change.

Instead, we are closer to full employment now than we were ten years ago. And full employment changes how macro policy should be conducted. When there is unemployment any fiscal policy that boosts aggregate demand will lead to the greater utilization of unemployed assets (capital and labour) and hence to increased real output. At full employment, however, this cannot happen and so we get inflation instead. Tax cuts might have boosted growth ten years ago when there were idle resources, but now we are nearer to full employment they are more likely to lead to higher inflation.

Which is what financial markets expect. Their fear of higher inflation has driven five-year gilt yields up to 4.4%, compared to only 1.4% as recently as May.

This raises three issues.

One is: how much will this fiscal stimulus add to demand? …

A second issue is: how close are we actually to full employment? …

Thirdly, even if we are at full employment, is this inflationary? …

* Chancellor of the Exchequer

— Chris Dillow

Note: George Osborne was Chancellor of the Exchequer under David Cameron.

Posen did not hold back. Given the Reaganite reckless fiscal stimulus, the BofE unfortunately has to go full Volcker.

https://www.nytimes.com/2022/09/28/business/economy/uk-pound-history.html

September 28, 2022

In an Echo of History, the British Pound Has Lost Its Dominance

The Bank of England had to step in Wednesday after markets deemed a new government economic plan as unwise, but the pound has been on a longer slide.

By Patricia Cohen

Britain’s pound coin — rimmed in nickel and brass with an embossed image of Queen Elizabeth II at the center — could always be counted on to be significantly more valuable than the dollar.

Such boasting rights effectively came to an end this week when the value of the pound sank to its lowest recorded level: £1 = $1.03 after falling more than 20 percent this year.

The nearly one-to-one parity between the currencies sounded the close of a chapter in Britain’s history nearly as much as the metronomic footfalls of the procession that carried the Queen’s funeral bier up the pavement to Windsor Castle.

“The Queen’s death for many people brought to an end a long era of which the soft power in the United Kingdom” was paramount, said Ian Goldin, professor of globalization and development at the University of Oxford. “The pound’s demise to its lowest level is sort of indicative of this broader decline in multiple dimensions.”

The immediate cause of the pound’s alarming fall on Monday was the announcement of a spending and tax plan by Britain’s new conservative government, which promised steep tax cuts that primarily benefited the wealthiest individuals along with expensive measures to help blunt the painful rise in energy prices on consumers and businesses.

The sense of crisis ramped up Wednesday when the Bank of England intervened, in a rare move, and warned of “material risk to U.K. financial stability” from the government’s plan. The central bank said it would start buying British government bonds “at any scale necessary” to stem a sell-off in U.K. debt.

The Bank of England’s emergency action seemed at odds with its efforts that began months ago to try to slow the nearly 10 percent annual inflation rate, which has seen the price of essentials like petrol and food jump to painful levels….

https://fred.stlouisfed.org/graph/?g=Ugyh

January 15, 2018

Real Narrow Effective Exchange Rate for United States and United Kingdom, 1964-2022

(Indexed to 1964)

Menzie says: “I never thought an advanced economy government could pursue stupider policies than that implemented under the Trump administration. ” Really?!? Have you not noticed the Biden economy? Or is this what you consider sound economic policy?

Dude – this is a serious issue. We do not need your childish little stupid rants. Bugger off troll.

A few facts that the dumbest troll ever (CoRev) seems to have missed:

(1) The dollar has gotten stronger while the pound is devaluing;

(2) US labor markets are booming whereas the UK may have already entered a recession;

(3) The massive Trump government deficit has declined considerably since Biden took office; and

(4) While US interest rates have risen, they are still below UK interest rates.

Of course a dumb dog barking all day chasing its own tail cannot be bothered with facts.

CoRev prefers the Reagan years when mortgages hit the high teens before settling back to above 9% by 1989. He hates all thatBiden borrowing and would prefer returning to the glorious days when Reagan promised an end to the policies of big spender Jimmy Carter.

Unlike the rest of us, he can see clearly now. Those were the days. He wished they’d never end. If we couldn’t have a man like Herbert Hoover, at least we had budget balancer Ronald Reagan.

pgl,

Now now now, out brilliant CoRev knows that Biden has really disappointed the American people by passing a large infrastructure bill. He knows that when Eisenhower imitated the Nazi German autobahnen by passing an act to build the interstate highway system, this was a disastrously unpopular decision that led to a complete collapse of US economy and society. Biden has made such a terrible decision.

Obviously what people really wanted are promises of infrastructure investment, not actual infrastructure investment. So, President Trump had it figured out. What people want are repeated “Infrastructure Weeks” rather than actual infrastructure. These shows make people happy. Actual infrastructure is not what any sane person wants. Reasonable people want shows claiming there will be infrastructure. CoRev is very wise to understand this deep reality, :-).

Yes. Biden’s policies have led to strong employment growth and complete recovery from the covid recession in many sectors of the economy. Your unwillingness to recognize that success is what identifies you as a dishonest, partisan troll.

Inflation is a global phenomenon, so more or less by definition, mostly not the result of U.S. policy. The weaknes of GBP is a signal of bad policy in the UK. The dollar, by contrast, is strong. The U.S. budget deficit has narrowed since Biden took office. So, yeah, we’ve noticed the Biden economy.

MD claims: “Yes. Biden’s policies have led to strong employment growth and complete recovery from the covid recession in many sectors of the economy. Your unwillingness to recognize that success is what identifies you as a dishonest, partisan troll.”

How many times must i ask for a list of SUCCESSFUL BIDEN POLICIES? Claiming they are Biden’s instead of admitting they are continuations of Trumps is DENIAL of the obvious policy issues that the voters clearly understand. That understanding will be proven in November.

well, trump simply continued the successful policies of the Obama administration.

covid, you know your constant harping on the November election indicates you do not understand history. by default when the president and his party control congress during a midterm, the odds are very high that the other party will gain control of congress. this is a historical occurrence. if republicans do not obtain strong control of both chambers, then the election will indicate they did very poorly. and recent polling suggests that may very well be what happens.

but considering the landslide election against republicans during the past election, you talk an awful lot. trump and the republicans got beat worse than any president and party in modern history. covid, I think you, like trump, are still in denial from the severe beating you took in the last election. you lost the White House, the House and the Senate. it was a bloody beating.

You do know CoRev submitted his paper to the AER on how Trump’s trade war solved the problem of rising soybean prices. OK – the editors of the AER have gotten side aches laughing at the dumbest submission in the history of their journal.

Baffled, list the Obama policies Trump continued. The one I think is the best example is the illegal immigrant children kept in cages.

CoRev

September 29, 2022 at 1:00 pm

Baffled, list the Obama policies Trump continued. The one I think is the best example is the illegal immigrant children kept in cages.

Immigrants are not illegals. They are not animals. And Obama did not treat that way. But of course a racist liar like you celebrated such inhumanity when Trump the racist did it.

“How many times must i ask for a list of SUCCESSFUL BIDEN POLICIES?”

Answered MANY TIMES. Better question – how many times will you be a lying pointless little jerk? Trillions by now. ,

Ole bark bark claims: “Answered MANY TIMES. ” Really, show the list of BIDEN”S SUCCESSFUL POLICIES. What we have seen is claims of legislation, and hypothetical results, but never any actual policy statements. OTH, there is a complete list of failed Biden policies. Ofcourse the best example is a comparison of Trump vs Biden economies.

“Ofcourse the best example is a comparison of Trump vs Biden economies.”

you must be kidding me. trump presided over one of the most dramatic drops in economic activity in modern history. and if it weren’t for other elements of the government forcing king trump to reluctantly go along, the economic outcome would have been devastating. the best thing trump did was grudgingly let somebody else lead the nation. covid, there is a reason trump lost his reelection campaign by a landslide to an even older man. you are trying to be a revisionist of history. the trump years were terrible for most of the nation. it will take a generation to overcome the trump effect on this nation.

CoRev

September 29, 2022 at 12:57 pm

I’m surprised one of your neighbors have not put you down. You are one retarded puppy.

what do you against 8.9% y on y inflation

and peaked gdp?

well that inflation continues to drop. so you continue to let it drop. do you recommend changing that approach? would you rather inflation was increasing?

i am on ss, i will get a 8.7 or so raise in dec check! nah i’d rather we not inflate, but i’d wait a while to declare victory.

the “drop” was mixed in pce index last month: w/ food and gas -.1

w/o food and gas +.1

w/o food and gas is core and may be “sticky”.

pce index y on y was not pleasing to jpow it seems.

it will be a while b4 the monthly ticks can be called the ‘2d derivative of a trending function’.

why jpow says “data”.

the price of eggs went up ~10% since saturday in my supermarket, idk why i looked?

If ss is your only income, you’re likely on Rick Scott’s list because you’re not paying income tax. Even worse, you’re in that 47% of all American adults who pay no income tax. Mitt Romney also called out the 47% on that.To his regret.

once again, let me repeat. inflation has been dropping. is that not what you want?

There is a strong linkage between asset values and FX rates. Textbooks link interest rates and FX, which is pretty true in something like equilibrium. The adjustment to a new increment of fiscal irresponsibility in interest rate markets is a rise in rates. In some new equilibrium, that’s dandy, but on the way to the new equilibrium, bonds (gilts) lose value. In the period of adjustment, asset price is a huge concern. The smart play is to sell bonds before they adjust, then buy them back after. If there is more than one smart account in the world, the reality is that you sell as fast as you can during adjustment.

The second step in the sale of bonds is moving to a market not in turmoil, which involves selling the currency. Selling the currency compounds the loss on the bond, creating even more losses and even more reason to sell.

When it comes to falling out of a tree, it’s not the fall that gets you – it’s the landing. In international asset markets, the landing is the easy part – it’s the fall that kills you.

Now, imagine that you are an international portfolio manager who is going through the worst portfolio-wide losses of your career, because fixed income and equities have sunk sharply in tandem. How fast would you move to get away from UK assets?

Dornbusch and Krugman wrote a good bit about this, moving from a focus on real economy adjustment to overshoot.

Putin plays the tough guy for the press but he truly is a coward:

https://www.msn.com/en-us/news/world/putin-has-escaped-to-a-secret-palace-in-a-forest-amid-anti-draft-protests-in-russian-cities-report-says/ar-AA12dz38?ocid=msedgdhp&pc=U531&cvid=058040ccb0c14e5f884d121cffe4a449

Vladimir Putin has escaped to a secret palace amid anti-draft protests in Russia, per a report.

OVD-Info said 724 people were detained across 32 different cities on Saturday.

Putin intends to stay at the palace until at least Thursday, a journalist said, citing three sources.

Russian President Vladimir Putin escaped to his secret palatial complex near Lake Valdai, halfway between Moscow and St Petersburg, amid anti-draft protests in Russia, MailOnline was first to report.

According to independent journalist Farida Rusamova, who cited three sources familiar with Putin’s schedule, the Russian president traveled to his vacation home on Wednesday.

He has been resting his “body and soul” at the luxury complex, which is situated within a forest, Rusamova said in a Telegram post.

MailOnline reports that it boasts a three-story spa building, complete with a float pool and mud bath, and a personal beauty parlor.

The yuan is also experiencing significant devaluation,

https://www.msn.com/en-us/money/markets/china-s-yuan-slides-to-14-year-low-after-us-rate-hikes/ar-AA12kSH2?ocid=msedgdhp&pc=U531&cvid=4f35e58abdc04346b94e7e470509c537

pgl,

But supposedly Russia is becoming “yuanified” according to various sources.

A currency union among the two former Communist states! Will Cuba join?

Lou Dobbs sued for defamation!

https://www.msn.com/en-us/news/politics/judge-green-lights-defamation-lawsuit-against-fox-lou-dobbs/ar-AA12kqBS?ocid=msedgdhp&pc=U531&cvid=cd2c22990ac54930b6f95656ef5b0a50

A defamation lawsuit against Fox Corp., Fox News Network and Lou Dobbs can proceed toward trial, a judge ruled Monday after concluding that a Venezuelan businessman had made sufficient claims of being unfairly accused of trying to corrupt the 2020 U.S. presidential election to be permitted to gather more evidence. The lawsuit filed last year alleged that businessman Majed Khalil was defamed by Dobbs on “Lou Dobbs Tonight” and in tweets. It said the former Fox personality joined with attorney Sidney Powell on a December 2020 show to claim that Khalil and three others designed and developed programs and machines to corrupt the presidential election. Lawyers for Fox and Dobbs had tried to convince U.S. District Judge Louis L. Stanton in Manhattan to toss out the lawsuit before evidence such as depositions and emails could be reviewed, but the judge said Khalil had sufficiently claimed that his reputation was harmed by false accusations. The judge said Khalil may be able to argue to a jury that actual malice occurred because the defendants “repeatedly maintained their claims about Khalil long after Powell’s election fraud theories were challenged.”

He wrote that numerous reports declaring the falsity of claims against voting machine manufacturers Smartmatic Corp. and Dominion Voting Systems and rejecting Powell as a source of accurate information gave the defendants “reasons to doubt Powell’s veracity and the accuracy of her reports.” Stanton said Khalil had sufficiently alleged that “the defendants purposefully avoided the truth, given the amount of public information regarding the lack of fraud in the election.” He rejected arguments by lawyers for Fox that it cannot be held liable for statements made by Dobbs and Powell. The judge noted that Fox controlled Twitter accounts from which many of the statements were first made. He said the network’s executives were also on notice that allegations regarding election rigging by Dominion and Smartmatic were false because they had received several emails from the companies and had conversations with Dominion.

eia report for 23 sep 2022:

weekly draw on the reserve (spr) 4.6 million barrels, y on y 196 million, authorized now to election day.

net crude imports are down 4.5% y on y

domestic crude production is up 8.4% y on y

gasoline and distillate product inventory very slightly down y on y

net exports were 2.69 million barrels per day of which 1.8 million bbl per day crude imported while finished product was net export 4.5 million per day.

net export of finished product remains historically high

this suggests to me that gasoline and distillate demand is depressed due to a combination of gasoline price and the price of food and core items.

inflation factors and slowing economic activity likely more effective than the spr in allowing huge exports at declining pump prices!