It seems that recession is imminent, according to some accounts (60% in 10/14 Bloomberg panel, 63% in the WSJ October survey, 100% in the Wong/Winger model). WaPo “As recession fears rise, Washington begins to weigh how to respond”. What do some models say about recession and growth?

For recession:

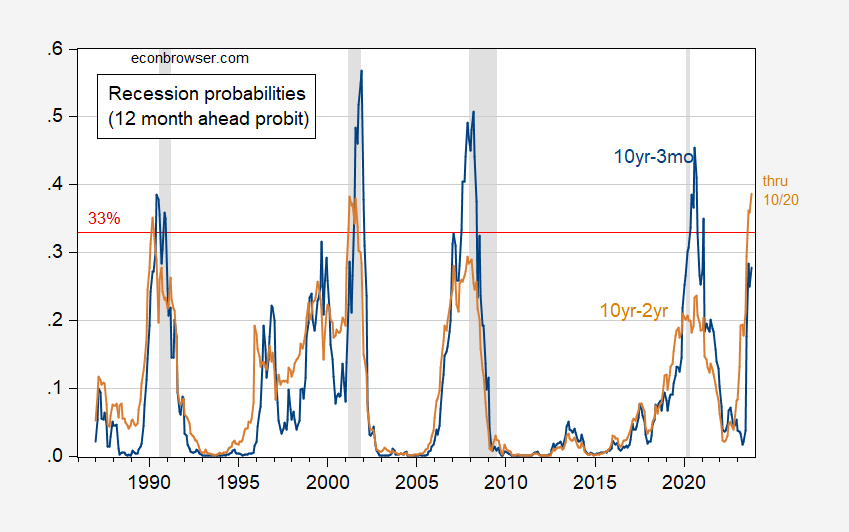

Figure 1: Probability of recession from 10yr-3mo Treasury spread (blue), from 10yr-2yr spread (tan), based on probit model 12-month-ahead. 33% threshold in red. NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations, NBER.

The 33% threshold implies no missed positives for the 10yr-3mo spread, but the 10yr-2yr would’ve missed the two most recent recessions. Only the 10yr-2yr spread implies a recession 12 months hence.

These probablities are based upon term spreads (October spread for data up to 10/20):

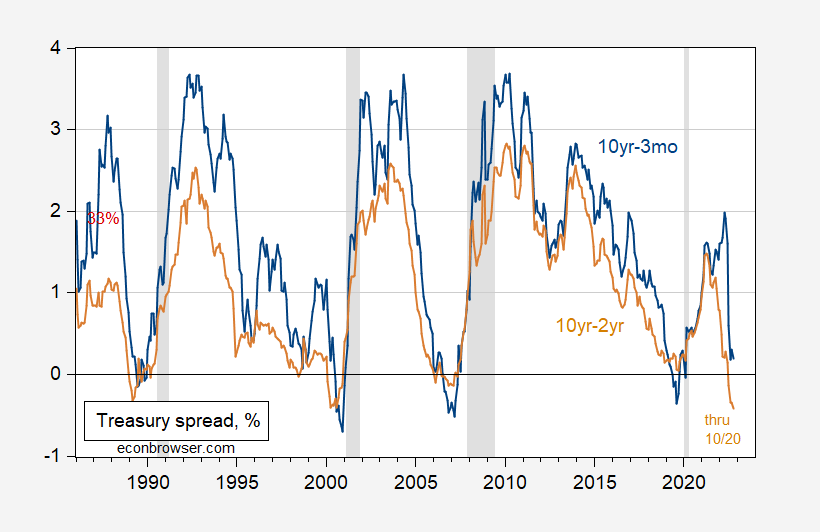

Figure 2: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (tan), both in %. October observation pertains to data through 10/20. NBER defined peak-to-trough recession dates shaded gray. Source: US Treasury, NBER.

The probit models, estimated over the “Great Moderation” period, yield McFadden R2 of 27 and 18% for 10yr-3mo and 10yr-2yr spreads, respectively.

Aside from recession, one can also look to see how economic growth is predicted. Now, negative industrial production growth is not necessarily the same as recession (see discussion of how recession differs from negative output movement here), but they are related.

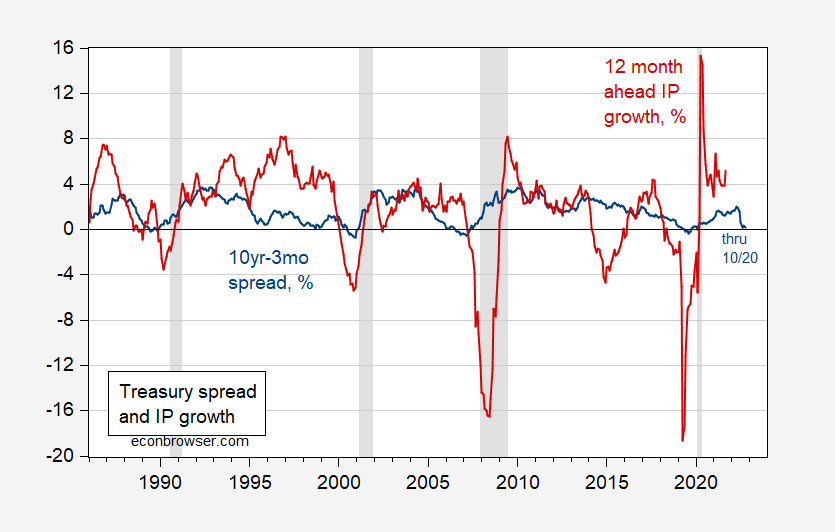

Chinn-Kucko (2015) estimate that each one percentage point increase in the 10yr-3mo spread is associated with a 1.13% acceleration in industrial production growth, over the 1998-2013 period.

In a recent paper, Arthur Stalla-Bourdillon, Nicolas Chatelais and I estimate the relationship between the term spread, dividend yield, and lagged growth rate for the 12 month ahead growth rate, as compared to a sectorally disaggregated divdend yield factor, and find that our preferred disaggregated factor outperforms the competitors, in terms of out-of-sample RMSFE comparisons. (Although the outperformance vis a vis the term spread is not statistically significant).

Here’s a picture of the current 10yr-3mo term spread and 12 month IP growth, lead one year:

Figure 3: 10yr-3mo Treasury term spread, % (blue), and 12 month IP growth rate, lead by one year , % (red). October observation is for data through 10/20. NBER defined peak-to-trough recession dates shaded gray. Source: Treasury, Federal Reserve via FRED, NBER.

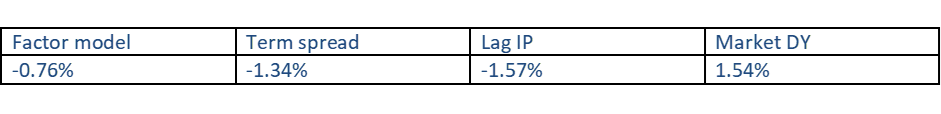

Using the models described in Chatelais, Stalla-Bourdillon and Chinn (2022), we obtain the following estimates for IP growth up to September 2023.

Source: Calculations based on model of Chatelais, Stalla-Bourdillon, Chinn (2022).

Our factor model predicts (as does the term spread and lagged IP model) a modest decline in industrial production over the course of the next year. Our model does particularly well vis a vis the competitors during periods of negative output growth. The positive view from the aggregate dividend yield is somewhat surprising, but then, our model should outperform when investor discount rates (composed of the risk free rate and the equity risk premium) move around a lot, which has arguably been the case.

So, recession probabilities are on the rise (other models will imply higher likelihoods), but our model predicts a modest decline in output (as measured by industrial production).

https://www.msn.com/en-us/news/politics/i-m-genuinely-afraid-gop-pollster-frank-luntz-fears-trump-s-lies-will-spark-post-midterm-civil-war/ar-AA13elnr?ocid=msedgdhp&pc=U531&cvid=d193ff033a934fdca44314bf801bcb68

‘I’m genuinely afraid’: GOP pollster Frank Luntz fears Trump’s lies will spark post-midterm ‘civil war’

I agree with the message but coming from this messager? Frank Luntz spent his life acting like Kelly Anne Conway before there even was a Kelly Anne Conway. Hey Frankie – try apologizing for your past garbage before preaching to the rest of us.

Amid intensifying forecasts of a U.S. recession, Washington policymakers are beginning to confront their limited options for easing the effects of a slowdown accompanied by high inflation – a confounding set of economic conditions that would present starkly different challenges from recent downturns. Officials at the White House and the Federal Reserve say that they continue to believe a recession can be avoided and that they remain focused on fighting inflation, which is rising at rates not seen in four decades. But with Wall Street trembling, and many private forecasters warning that recession is likely, preliminary talks about policy options are underway around town.

It is as if we woke up from a Rip van Winkle nap and it’s 1981 all over again. Maybe policy should be backing off the tight monetary policy more than planning for its disasterous effects.

Most of the current price issues are due to shortages – oil, grain, semiconducters… (there’s a war on, you know). Rising rates make investment more expensive and so do nothing to increase production – as if the Fed had any control over Russian oil or Ukrainian grain or US drought conditions anyway. That leaves the Fed with only one option: to wreck demand in those areas where they actually can do so. They have effectively already done that in the case of housing and record numbers of new units coming online this fall and early next year in the face of high borrowings costs should totally crash that market. Beyond that, causing a recession is about their only real power. Can you wreck demand without also crashing production and reinvestment? I doubt it, but the Fed seems determined to find out. They don’t have precision tools, only a very blunt club.

Exactly – they are trying to reduce inflation by reducing demand. However the current inflation is almost exclusively driven by supply issues, and higher rates will make it more difficult to make investments to increase supply. Sure they can eventually beat down inflation by crashing the housing sector and drag us into a recession. But is 8% inflation for another year such a serious issue that they should do that?

reducing the # of fiat chasing short goods is a way to reduce demand

What?

Sure that is what they say in Econ101 – and most people never get further than that.

However, for economists the question should be: (in the current situation) is it the best way?, the most efficient way?, what are the collateral damages?, how fast can you stop/reverse without causing even worse damage?, does the current minimal inflation levels warrant this kind of risk?

That is what they discuss at the adult table.

pgl,

Weren’t you the one who reported a vastly improved index of supply chain issues? Or was that somebody else? I confess that seemed a bit pollyannish to me, whoever reported it here, but I think there is such an index reporting improved conditions, even if it is exaggerating how improved they are.

Anyway, this has become a much murkier business than it was before. Just shouting about supply side problems is becoming increasingly out of date. Heck, oil prices have been pretty stable and nowhere near previous highs. Right egg and turkey prices are way up and lots of other stuff too, but those do not seem to be obvious “supply side problems” aside from some more specific micro issues in those markets. More is going on here, not so easy to deal with.

Higher egg & turkey (& other poultry products) prices are a legacy of the avian influenza outbreak earlier this year, so I would argue that they are indeed a “supply side problem” though they are not due to supply chain issues. It seems most people have forgotten about the avian flu but its effects are still with us. Millions of birds, entire flocks, were destroyed across a wide area of the US. I see the aftereffects every day.

True. There are multiple real effects driving the prices of various goods. Now I buy a dozen eggs a week and my local price has doubled. I still make my eggs in the morning just hoping prices will later come down.

Barkley – like you I have tried to follow shipping issues over time but I have lost track of what’s going on just as I have lost track of where COVID stands even in NYC.

https://www.msn.com/en-us/news/politics/mar-a-lago-classified-papers-held-us-secrets-about-iran-and-china/ar-AA13ehW0

Some of the classified documents recovered by the FBI from Donald Trump’s Mar-a-Lago home and private club included highly sensitive intelligence regarding Iran and China, according to people familiar with the matter. If shared with others, the people said, such information could expose intelligence-gathering methods that the United States wants to keep hidden from the world.

And I thought Trump was working for Putin. It seems he is an employee of Xi.

As long as you have a copy machine I guess you can sell the same document to more than one customer.

Whomever pays.

“And I thought Trump was working for Putin. It seems he is an employee of Xi.”

Por que no los dos?

https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/#deficit-by-year

Eek! The Federal deficit was $1.38 trillion in the last fiscal year. Biden is a SOCIALIST! Oh wait under the leadership of DONALD JOHN TRUMP, it was $3.13 trillion for 2020.

OK – the deficit has fallen a lot over the past two years. I seem to recall Princeton Steve lamenting that this decrease in the Federal deficit was some massive fiscal restraint. Yea – this arrogant fool never read the 1954 AER paper by E. Cary Brown.

https://www.msn.com/en-us/money/markets/dow-jumps-more-than-600-points-as-bond-yields-fall-after-reports-fed-may-shift-to-smaller-rate-hikes-after-november/ar-AA13dB6J

U.S. stocks were trading sharply higher Friday as investors weighed a story from the Wall Street Journal and comments from Federal Reserve officials suggesting that the central bank might shift to smaller interest-rate rises after its November meeting.

Good news – the FED may be listening to us!

Well Hershel’s own son says Hershel needs these:

https://www.msn.com/en-us/news/politics/comedian-trolls-herschel-walker-with-gift-of-condoms-at-senate-campaign-event/ar-AA13crFT?ocid=msedgdhp&pc=U531&cvid=21a5bba41da94a7884b69d0da08e24e3

Georgia Republican Senate contender Herschel Walker was offered extra protection on Thursday. During a campaign event in Macon, Georgia, The Good Liars comedian Jason Selvig walked up close to the former football star while he was shaking hands with supporters and offered him a roll of condoms — a knock over an abortion scandal that recently hit Walker’s campaign. “We tried to give Herschel Walker condoms today (for obvious reasons),” The Good Liars said in a tweet.

https://news.cgtn.com/news/2022-10-19/Saudi-Arabia-unveils-national-strategy-to-be-leading-industrial-power-1egftZNCXJK/index.html

October 19, 2022

Saudi Arabia unveils national strategy to become leading industrial power

Saudi Arabian Crown Prince Mohammed bin Salman bin Abdulaziz Al Saud on Tuesday launched the National Industry Strategy that aims to turn the kingdom into a leading industrial power.

The strategy covers 12 sub-sectors, with more than 800 investment opportunities worth 1 trillion Saudi riyals ($226 billion), the Saudi Press Agency (SPA) reported.

The investments are expected to contribute to the sector’s sustainable development and increase economic revenues, including doubling industrial GDP and boosting industrial exports to 557 billion Saudi riyals, the report said.

Crown Prince Mohammed highlighted the kingdom’s potential to build a competitive and sustainable industrial economy, including its talented youth, geographic location, natural resources and national pioneer companies.

He said that through the strategy and partnerships with the private sector, the kingdom will become a leading industrial power.

The previous years’ efforts to promote the sector, including the launch of the National Industry Development Program, have increased the number of factories from 7,206 to 10,640, the SPA reported.

The strategy aims to increase the number of factories to 36,000 by 2035, it added.

https://fred.stlouisfed.org/graph/?g=TPuq

August 4, 2014

Real per capita Gross Domestic Product for China and Saudi Arabia, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=TPuJ

August 4, 2014

Real per capita Gross Domestic Product for China and Saudi Arabia, 1977-2021

(Indexed to 1977)

[ Notice that for all the oil wealth gained, per capita GDP has declined by about 50% since 1977. The intent now is for a dramatic change in development strategy. ]

ltr,

Oh dear, please, do not start the sort of relationship you have with the CCP and its organs with those of the Kingdom of Saudi Arabia, about which I know far more than I do about China (well, I know more about China than I do about KSA, but there is way more to know about China than KSA).

Sorry, but this is just a joke. The Saudis have been trying to diversify their economy off oil for a good half century, and they have failed. Heck, 40 years ago the long run planners of the Soviet economy were trying to diversify it off oil, and even today Russia is still stuck on oil as is Saudi Arabia, and Russia had much more else going for it than the poor Saudis, who only had the Hajj and dates besides oil.

This post is a joke. Sorry.

This post is a joke. Sorry.

[ No; thinking through the nature of development and why so many countries have lagged in development, especially a range of countries that have had preferred resource allocations, is important. The United Nations has just had a push by a range of countries to make development a “right.” What does this mean in concept and technically? ]

ltr,

Get real.

See my comment below on “Dutch disease.” This is not a general problem of development, although indeed there are quite a few nations that suffer to some degree from this problem, nations whose main exports are some sort of natural resource, made worse if it is a nonrenewable depletable one like oil , unlike agriculture. Again, for reasons I do not get, you have suddenly decided to put the effing Kingdom of Saudi Arabia forward as some sort of poor developing nation we should all feel sorry for. Sorry, those effing bastards have personal friends of mine still locked up for no good reason. MbS is a murderer and utterly disgusting. Biden was right to call him a “pariah,” and made a fool of himself running over there to do a fist bump with this nauseating excuse for a human being.

I fear, ltr, that maybe what some here charge may be true, that you are being paid. It is one thing to be paid by the CPC, to be politically correct with you. It is quite another to be paid by the murderous MbS. This is actually personal with me. He should be taken out and dismembered live as he had done to Jamal Khashoggi.

The Saudis? I suppose that might work… as long as you can become an industrial power using “guest workers” to do everything.

W

The places that have gone further than the Saudis are the smaller higher income Golf manarchies, such as UAE, Qatar, and Kuwait. They have very high per csapita incomes, Qatar tops in the world. This is based on oil and gas exports. They have developed some non-petroleum sectors, perhaps most notably Dubai, one of the emirates in the UAE. But much of this is service activities and tourism. There has been almost no industrial development in any of these.

https://fred.stlouisfed.org/graph/?g=V9AN

August 4, 2014

Real per capita Gross Domestic Product for Saudi Arabia, Bahrain and Norway, 1981-2021

(Indexed to 1981)

https://fred.stlouisfed.org/graph/?g=V9Az

August 4, 2014

Real per capita Gross Domestic Product for Saudi Arabia, Bahrain and Norway, 1981-2021

(Percent change)

[ There is no inherent reason that a resource rich country, cannot turn the wealth to a program of industrialization, and there is every long run reason to attempt to do so. ]

https://fred.stlouisfed.org/graph/?g=UmcE

August 4, 2014

Real per capita Gross Domestic Product for China and Botswana, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=UmcI

August 4, 2014

Real per capita Gross Domestic Product for China and Botswana, 1977-2021

(Indexed to 1977)

[ There is no inherent reason that a resource rich country, cannot turn the wealth to a program of industrialization, and there is every long run reason to attempt to do so. ]

ltr,

The reason is the resource curse, or “Dutch disease.” Selling all that oil tends to push the value of the currency up, which makes it hard for other sectors of any sort to be internationally competitive. Saudis have been subsidizing other sectors, both agricultural and industrial, for many decades, with not all that much to show for it.

Sure, they have a high per capita income. But then, they are the world’s largest oil exporter.

“The reason is the resource curse…”

Thank you so much, but rather than a general resource-currency curse I prefer to think through specific compensating policy and look to a Botswana:

https://fred.stlouisfed.org/graph/?g=TBkW

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa and Botswana, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=TBl2

August 4, 2014

Real per capita Gross Domestic Product for China, South Africa and Botswana, 1977-2021

(Indexed to 1977)

[ Where Saudi Arabian per capita GDP decreased by 50% since 1977, Botswanan per capita GDP increased by 377%. ]

ltr,

Botswana has done very well. In the latest edition of my comparative systems textbook with my wife we added a chapter on South Africa, a most fascinating, complicated, and important case. In the end we posed that it faces two alternative paths. The bad one is Zimbabwe, the good one is Botswana.

https://fred.stlouisfed.org/graph/?g=SPb6

August 4, 2014

Real per capita Gross Domestic Product for China, Turkey, Egypt and Saudi Arabia, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=SPba

August 4, 2014

Real per capita Gross Domestic Product for China, Turkey, Egypt and Saudi Arabia, 1977-2021

(Indexed to 1977)

https://www.globaltimes.cn/page/202210/1277652.shtml

October 21, 2022

Chinese ‘artificial sun’ marks new breakthrough

By Cao Siqi and Fan Wei

A new breakthrough has been made in the scientific research of the new generation of “artificial sun” in China with its HL-2M plasma current exceeding 1 million amperes, creating a new record for the operation of controllable nuclear fusion device in the country, the Global Times learned from Southwestern Institute of Physics under the state-owned China National Nuclear Corporation (CNNC) on Thursday.

Scientists said it marks an important step forward in nuclear fusion research and development and fusion ignition in China.

Zhong Wulyu, deputy director of the Center of Fusion Science under the Southwestern Institute of Physics, told the Global Times that a new generation of “artificial sun” is the largest scale and highest capability parameters of magnetic confinement fusion experiment device in China, which uses the advanced structure and control mode that could increase the plasma current capacity to more than 2.5 million amps, increase plasma ion temperature to 150 million degrees.

“The core components of the device are designed and manufactured in China. It is an important device to realize the leapfrog development of nuclear fusion energy development in China. It is also an indispensable platform for China to digest and absorb the international thermonuclear experimental reactor (ITER) technology, one of the largest international cooperation projects,” Zhong said.

The latest breakthrough means that the device can be routinely operated under a plasma current of more than 1 million amperes in the future, carrying out cutting-edge scientific research, which is of great significance for China’s participation in the ITER experiment and independent design and operation of fusion reactor.

In 2006, China, the European Union, the US, Russia, Japan, South Korea and India signed an agreement on the launch of the ITER project….

This whole impending recession thing is starting to effect Lara Logan’s mental health:

https://www.thedailybeast.com/lara-logan-goes-full-qanon-spews-blood-libel-on-newsmax?ref=home

And after the whole flouting another country’s culture/religion thing in Cairo, I thought her career held so much promise /sarc. Maybe she’ll see the error of her ways in a few days:

https://www.thedailybeast.com/fox-nation-host-lara-logan-digs-in-boosts-attacks-on-auschwitz-museum

Or not……..

Well, if we want to avoid recessions, they just keep increasing government spending well beyond tax revenues, right? The more government spending, the more growth in GDP. The Fed can just print more money and GDP will keep growing. No one need fear a recession. Keep those multi-trillion dollar spending programs coming. We can all be millionaires. What could possibly be the downside?

https://fred.stlouisfed.org/graph/?g=sQDb

January 15, 2018

Gross Federal Debt as percent of Gross Domestic Product and Federal Interest Payments as percent of Gross Domestic Product, 1980-2022

https://fred.stlouisfed.org/graph/?g=sQCH

January 15, 2018

Gross Federal Debt as percent of Gross Domestic Product and Federal Interest Payments as percent of Gross Domestic Product, 1968-2022

“Well, if we want to avoid recessions, they just keep increasing government spending well beyond tax revenues, right?”

Hey troll – that is what Trump did. And your Republicans want to keep doing exactly that. Or have you not noticed that Biden did raise taxes on the rich and McCarthy wants to undo that in 2023.

Look Bruce – we get your day job is spewing MAGA propaganda but try to keep up with the facts.

larry summers says that $1.9 trillion of the deficit in 2021 was inflationary…..

trump did it in for the lock downs in 2020; biden over did it in 2021….

now usa has too much fiat and valuing ‘assets’ is risky!

shorter: that 3 year chart going around the ill-informing media about how good biden is for deficits begs context!

Anonymous: Do you remember the fiscal and inflationary implications of the Tax Cuts and Jobs Act of 2017, implemented at full employment?

Menzie, “inflationary implications:? Trump ” 2018 2.1 2.2 2.4 2.5 2.8 2.9 2.9 2.7 2.3 2.5 2.2 1.9 2.4

versus actual inflation history Biden’s : ” 2021 1.4 1.7 2.6 4.2 5.0 5.4 5.4 5.3 5.4 6.2 6.8 7.0 4.7

2022 7.5 7.9 8.5 8.3 8.6 9.1 8.5 8.3 8.2″

https://www.usinflationcalculator.com/inflation/historical-inflation-rates/

Maybe the WILLFULLY IGNORANT here will believe and accept your perceptions, but what will the US voters believe, a perception or their ACTUAL experience?

CoRev: Two things. You should look at y/y inflation from 2017M11 to 2018M07. You should also consider what the “Taylor rule” is. Gee, wonder what the Fed did in response to a bunch of stimulus being dumped into the economy at near full employment.

prof.

to answer [below] about fed response to 2017 tax cut, from jan 2018 to jul 2018 there was a period of modest qt, which the trumpers blame for damping the trump boom…..

since 2018 seems a life time past

Menzie, why did you did you give Econned another opportunity by changing the subject and cherry picking dates? I guess Biden’s policies had no economic impact it was all the Fed’s fault for ” inflationary implications”?

Biden has shown his economic incompetence. Those who support his policies ….?

Speaking of the willfully ignorant, CoRev, (and, of course, Anonymous) OMB data shows these deficits:

2017 (final Obama FY budget). $665.446 Billion

2018. $779.137 Billion

2019. $984.185 Billion

2020. $1.083, 419 Trillion (pre-pandemic)

That’s close to $3Trillion, give or take a few billion.

And you doubted Trump when he proudly claimed he was “King of Debt”

Noneconomist, why did you also ignore inflation as the issue? I guess that subject is just too embarrassing, because Presidential policies are obviously the cause. Those are the same policies you folks vociferously approve. Now that’s an example of willful ignorance.

Inflation? Deficits (no mention from you)? To simplify, CoRev,

Using the inflation calculator you linked to, inflation averaged 1.875% during Trump’s four years. Not bad, but it takes second to Obama’s second term during which inflation averaged 1. 125%.

Well, at the same time you’re giving Trump accolades for inflation, you and the equally clueless Anonymous are either silent or, yes, willfully ignorant on deficits during the same period.

From 2017 to 2018, that 17.1% increase in the deficit far outpaced the rate of inflation. The following year is even worse: a 26,3% jump and that’s pre pandemic. Under Trump’s “conservative “ fiscal watch, the government in his first two years spent $320 Billion more than it collected from various sources.

As ProPublica noted “Donald Trump Built a National Debt So Big (EVEN BEFORE THE PANDEMIC) That It’ll Weigh Down the Economy for Years”

The price of willful ignorance, indeed.

Noneconomist, I see you continue to discuss my point, inflation. If there was an argument that supported Biden’s/your policy preferences , we would see it discussed. Not doing so shows the embarrassment. Sigh.

Anonymous: see size of the Trump pre pandemic deficits and report back.

CoRev,

So, if inflation is the big issue, what will the GOP support if they take control of one or more houses of Congress? Near as I can tell, aside from pushing some more domestic fossil fuel production, the only thing they will try to pass is a tax cut for the rich. Right?

Let me note to you, since you obviously have not put this together, you being the stupidest commentator here, this was the main thing Liz Truss proposed in UK, although she was aggravating it with a massive subsidy for energy consumers as well. What happened?

Well, I think even idiot you knows: a massive financial crash that made threw her out of power.

So, idiot, just what else are you GOps proposing to do about inflation? Oh, I know: surrender to Putin.

Barkley, in your willful ignorance you stumbled on both the cause and solution for the inflation problem: “…pushing some more domestic fossil fuel production…” Golly, gee, whiz, an economist who can not see the impacts of limiting production growth for a FUNDAMENTAL and CORE component of every PRODUCT in an economy affects the overall economy.

With a real world case study playing out in Europe, the willfully ignorant can look in their respective mirrors smiling at the ?successes? at saving the world from global warming. But, never, ever ask then to calculate how much their efforts have changed the temperature, even if you show them that the world temperatures have paused their rise. Even they are aware that the pause is due to ENSO, 3 consecutive years of la Ninas, a relatively infrequent event.

I guess Brucie boy was not told by dear Kelly Anne Conway that the 2020 deficit under Trump was $3.13 trillion but the 2022 deficit under Biden was only $1.38 trillion. Yea – Bruce Hall is the most clueless troll ever devised by God.

missing context.

what Larry summers said about 2021 deficits.

I know what Larry said. It was 10,000 times smarter than the drivel from Bruce Hall.

Bruce thought Trump was just joking when he referred to himself as “King of Debt” That was about, oh, $8 Trillion ago.

Bruce Hall Where do you get this garbage? Instead of just assuming that deficits are increasing because Democrats control Congress and the WH, why not actually look at…you know…some real data? The fact is that deficits went up every year during Trump’s reign of terror and misadventures while going down in both FY2021 and FY2022. And in case you forgot, it was Trump and the GOP who cut taxes and increased spending. Meanwhile GOP critters are all over the airwaves bemoaning the fact that Biden and the Dems are increasing the number of IRS agents in order to go after tax cheats like your Republican friends.

https://fiscaldata.treasury.gov/americas-finance-guide/national-deficit/#deficit-by-year

h/t Kevin Drum

2slugbaits: Bruce Hall will not look at data, because it disproves his arguments.

Actually did Bruce have an actual argument? That comment struck me more as a rant driven by a fit of sheer anger.

https://tradingeconomics.com/united-states/government-spending

An interesting chart showing how much government spending rose under Trump and how government spending has declined since Biden took office.

Of course you are correct – Brucie is not allowed to look at actual real world data. It would make Kelly Anne Conway angry that he did.

Remember when St. Reagan decried “tax&tax and spend&spend”. He changed all of that to “spend&spend and borrow&borrow”.

Most comical in retrospect was Reagan’s ranting and raving over big spender Jimmy Carter’s awful deficits. Didn’t take long for Reagan to define awful at a new, much higher level.

that treasury chart….

context: inflation yoy 2020 to 2021 was roughly 5% (aug prints) and 2021 to 2022 8.4%. Cumulative that is 13.6%, roughly.

now you could argue that deficits were exceptional in 2020 bc we convinced trump to lock down the economy down. but then how egregious were deficits in ’21 and ’22 when there were no lock downs????

the jump between 19 and both 21 and 22 should be pondered!

let’s pay off a half trillion in student loans…..

Mary Daly told a panel at Berkeley “We might find ourselves, and the markets have certainly priced this in, with another 75-basis-point increase” at the November FOMC meeting. “But I would really recommend people don’t take that away and think, well it’s 75 forever.”

“We have to make sure we are doing everything in our power not to overtighten, and we can’t pull up too fast, and say we are done…” Further on ending rate hikes, Daly said “it’s really challenging to step down right now … We are not there yet…’ but “the time is now to start talking about stepping down. The time is now to start planning for stepping down.”

James Bullard told Reuters that front loading rate hikes is appropriate because of recent inflation data, which suggests he favors another 75 basis point hike in November, but that it’s “too early to prejudge” the rate decision at the December meeting. So not necessarily 75 bps in December, nor perhaps even 50. Beyond this year:

“I do think 2023 should be a data-dependent sort of year. It’s two-sided risk. It is very possible that the data would come in a way that forces the Committee higher on the policy rate. But it’s also possible that you get a good disinflationary dynamic going, and in that situation the committee could keep the policy rate and hold it steady,”

It’s a start.

I remember when inflation fears were derided here. 😉 How’d that work out?

Maybe you remember reading another blog. Most of us live in the real world even though you never do.

Inflation at 8% and falling is to be feared ?????

But why – its paying down our national debt without needing to increase taxes.

A.,

It was not just here. For the first part of 2021 the vast majority of the economics profession thought the inflation would be short-lived. Then two unexpected things happened that upended that: the appearance of the Beta variant of Covid that re-exacerbated supply chain problems, and then Putin’s invasion of Ukraine earlier this year that really goosed. Yeah, most of us did not see either of those coming. Wow.

Did you, Anonmous? Or do you want to blame the inflation solely on Biden’s fiscal stimulus last year, now largely ended? If that was the main source, why do we see even higher inflation in many other nations?

It should go without saying that predictions cannot take into account things that were not predictable. So not only do predictions come with a statistical uncertainty – they also come from a foundation of presumptions of “normality”. When that foundation crumbles the prediction crumble. However, that doesn’t mean the predictor or model is forever wrong. One of the things I respect very much about Krugman is that when he gets it wrong he doesn’t try to find excuses, he try to find out why he got it wrong. A true scientist in a profession that have more hookers and pimps than scientists.

draining the spr is not cutting gasoline prices, and worse the opec+ won’t flood the world with crude.

did any of us shout that biden would attempt ww iii?

and whoodadunk that xi would ball up the supply chain with zero civid?

chm xi purposely making biden’s immense 2021 stimmie go non transitory inflation!

zero covid in the prc is ongoing since feb 2020!

A.,

Actually, Biden’s spr policy probably has played a role in lowering gasoline prices. i can appreciate a claim that this is not a good long term policy. But it probably has had the effect he wanted it to have, which has helped him and his party politically somewhat. If gasoline prices were still over $5 per gallon nationally, the upcoming midterms would probably be a major GOP wipe over the Dems. As it is things are much closer and Dems might even still hang onto at least the Senate.

Now, what is this scheiss about “biden would attempt ww III”? Is this how you characterize Biden organizing military aaid and support for Ukraine after V.V. Putin invaded their nation without at shred of justification? Is this you playing putin troll again here, “Anonymous”? Truly nauseating. Go to hell, immoral scumbag.

from March 2022 usa export of finished petrol has exceeded any period in the eia ex-I’m time series.

rough eia balance sheet usa net exporter since same date, with crude net importer.

spr release coincident with export boom

export restrictions would harm eu who sanction Russian finished product

my hypothesis on decline in gas price discounts crude supply increases and tends to ‘demand destruction’

A.,

A bit more on this crazy “biden would attempt ww III” crack. Do please keep in mind that not only is it Putin who has invaded Ukraine, he is the one and only one leader who is threatening to use nuclear weapons. Do you think that is just fine by him and the fault of Biden somehow? Just how deeply ttollish have you become? Do you want to be even worse than JohH on this stuff?

you have a skewed view of WW iii scheiss

not time to go deep

us providing the kill chain to make its gifts effective is not military aid it is combat support.

how russia responds to such aggression by nations with no legal role…..

the moral line about the not so innocent kiev actions is scheiss

A.,

You really are an utterly wothless tankie beneath contempt. Providing arms to a nation defending itself against a genocidal and unjustified invasion amounts to “aggression by nations with no legal role”? What? Does Russia have a legal role in this, having already violated the Budapest Accords of 1994 with its aggressions in 2014? Frankly, the US would have been legally justified in taking out the Black Sea fleet back then, but, no, the US did not fulfill its international legal responsibllity to do so. Which has led us to Putin now engaging in massive ongoing war crimes.

Which you are justifying, you immoral nauseating tankie who will burn in hell.

Anonymous,

Please justify to us Putin killing tens of thousands, I repeat, tens of thousands of Russian speaking people in his utter destruction of the city of Mariupol when he conquered it. This is a massive war crime the world has not even yet begun to deal with.

How do you defend it? Because the US has had the awful nerve to supply weapons to Ukraine to oppose this awful slaughter?

Just how sick and disgusting are you? How do you sleep at night supporting this sort of unjustified mass slaughter?

Yes isn’t that amazing a competent President release oil from reserves we didn’t need in the first place and gasoline prices fall from over $5 to around $3.80. Even the OPEC reduction of 2 million barrels per day could not reverse the trend (oil still in the $80-100 range and falling). So much better to have a competent President than the Orange disaster. Both Xi’s stupid continuation of zero-Covid and Putin’s insane invasion of Ukraine were unpredictable but have been turned into something positive – as Biden is home-shoring manufacturing of strategic products (with some stick and some carrot) – and pushing the West away from funding Putin with our carbohydrate $ (switching a record speed into using renewable). A brilliant President surrounding himself with the best people – and understanding that the best are not identified as those kissing his ass. Amazing what competent leadership can accomplish.

Ivan,

Well, there is this unfortunate problem. What we really need in the long run is higher carbon and thus gasoline prices. But it is clear that pushing those up leads to those doing so being voted out of power in a democracy. Ugh.

Barkley, no! We do not need more virtue signalling: “What we really need in the long run is higher carbon and thus gasoline prices.”, because voters realize that it affects inflation.

https://newseu.cgtn.com/news/2022-10-22/Smoothing-the-wheels-of-commerce-Poland-China-trade-at-record-levels-1ejuYKVuCfC/index.html

October 22, 2022

Smoothing the wheels of commerce: Poland-China trade at record levels

By Aljoša Milenković

CGTN traveled from the Polish capital of Warsaw to the southern town of Katowice on a train. The ride was fast and smooth, and it was the company we were going to visit that can take the credit for that.

RAFAMET is a medium-sized company with a world reputation in the railway business. It produces lathes that make train wheels perfectly round, so train wagons have a smooth and comfortable ride.

The company is based in Kuznia Raciborska, a small town in the country’s south, close to Katowice. It is also a significant contributor to the expanding trade volume between Poland and China, where much of its output is headed.

The trade between the two countries hit a record high in 2021, with more than $42 billion worth of goods and services exchanged between them, a 35 percent increase over the previous year.

We saw some evidence of that increase in RAFAMET’s final assembly and delivery hall, where several heavy machines were ready to be shipped to China. We saw RAFAMET workers load the final parts of a huge wheel lathe onto a truck destined for Türkiye, just one of dozens of similar machines that the company sells every year to customers around the world.

In China, trains equipped with RAFAMET-finished wheels can reach a speed of 350 kilometers an hour. But RAFAMET’s President and CEO Emanuel Longin Wons told us they can do even better.

“We are proud that our first and foremost partner in China is China Railways Corporation. And we are the ones supplying machine tools for Chinese high-speed trains. But let me tell you something more: with our partners from Qingdao, we are working on the possibility of increasing the speed of Chinese railways to 450 kilometers an hour.”

RAFAMET is one of only a handful of companies worldwide that make these massive state-of-the-art lathes for railways. It has a huge impact on the community of a small town in the south of Poland, like Kuźnia Raciborska.

Most visitors would never guess that this city of 5,300 people hosts one of the world’s leaders in railway machinery production. It is a matter of huge pride for the town’s mayor, Pawel Mucha. The town and the company have been intertwined for decades, especially since hundreds of RAFAMET’s highly skilled workers are locals, as Pawel Macha, the town’s mayor, told us:

“RAFAMET is the reason for this city. Let’s say that the growing of this factory is fully connected with the situation in this city. It is the biggest taxpayer, from all other investors.”

China is the company’s largest client, accounting for approximately 85 percent of its output. By setting the pace of progress in its industry, RAFAMET hopes to keep its most important client happy for years to come.

ltr,

So, I read that it is not being reported in PRC that Hu Jintao was rather unceremoniously removed from the final session of the Party Congress while he was trying to speak to Xi, this after some of his allies were removed from the Central Committee. Xi really going all out on being Great Helmsman, although in danger of becoming degenerate autocrat making bad decisions nobody can say no to.

ltr,

So indeed I gather Hu’s rather peculiar and sudden removal during the final session of the Party Congress has been reported in the PRC. Apparently the claim is that he was “not feeling well” and needed to leave, although most reports not out of official PRC sources have him resisting being removed. However, I suspect the part about him not feeling well is probably accurate, although that may have gotten worse after his removal compared to before it.

It is possible he had a positive Covid test. Not sure how their testing protocols are implemented. But this does make the point that when information is controlled and “locked down” the speculations takes over and all kinds of things ends up as real possibilities. I mean did they drag him out in the back and shoot him? – we don’t know.

Ivan,

No. They are claiming he has various health problems, including incipient Alzheimers. But even that does not seem to justify or explain him being forcibly removed when he was, which the video shows was what happened.

https://www.msn.com/en-us/news/world/first-army-of-looters-vladimir-putin-s-troops-spotted-stealing-washing-machine-from-ukrainian-home/ar-AA13fgs5?ocid=msedgntp&cvid=1d891cbf90734ffea1a08db9130606ba

Vladimir Putin’s troops were spotted ransacking and stealing a washing machine from a Ukrainian home this week, RadarOnline.com has learned. Aerial footage of the incident, which was captured by a Ukrainian drone, showed at least two Russian soldiers entering a damaged home before exiting with a washing machine.

That does sound petty but hey these Russians want clean uniforms and it seems Putin’s war machine is so incredibly incompetent that the front line troops had no other options,

https://www.msn.com/en-us/money/markets/tsmc-said-to-suspend-work-for-chinese-chip-startup-amid-us-curbs/ar-AA13gkJB?ocid=msedgdhp&pc=U531&cvid=7ac5490163804cf791982af2373f075f

Taiwan Semiconductor Manufacturing Co. has suspended production of advanced silicon for Chinese startup Biren Technology to ensure compliance with US regulations, according to a person familiar with the matter.

Biden’s resolve did this to the mighty TSMC? For all his bluster and stupid tariffs – wimp Donald Trump never had this much clout.

So, I read that it is not being reported in…

So, I read that it is not being reported in…

So, I read that it is not being reported in…

[ Addressing such nonsense is never worth even a brief while. ]

ltr,

Well, it is not clear what has been reported about this in the PRC. You claiming this is not worth discussing has zero credibility.

According to CNN, the latest is that in fact there has been no reports about Hu’s removal from the session in Chinese language sources, while this claim that he left due to health reasons appreared on an English language tweet from an official Chinese source. Frankly, I do not know which of these is true.

I have also now seen the video of Hu’s removal. It is clear that these two men were pulling on his clothing to get him to go. He resisted. What is being said about this in China, ltr, if anything at all? Or are you just going to pretend this did not happen and is thus not worthy of commenting on? Is this video made up?

— really going all out on being —– ——–, although in danger of becoming degenerate autocrat making bad decisions nobody can say no to.

[ Beyond nonsense, an evident need to be offensive: *

https://en.wikipedia.org/wiki/Orientalism ]

Sorry, ltr, but Xi Jinping looks to be imitating V.V. Putin on the road to being a degenerate autorcrat. Putin is not an Asian, so this is not “Orientalism,” do not try to lie to us and push that piece of nonsense.

The alternative is Taiwan: absolutely and utterly superior to the PRC on all and every per capita measure.

Please provide a single per capita measure the PRC is superior to Taiwan on. It is better on some large scale things it can support such as its space program and some scientific research activities. But anything that actually matters to people in their lives such as income equality and level and life expectancy, not to mention freedom and democracy? No, sorry, PRC loses and is heading into a degenerate autocracy, sympbolized by Xi’s humiliation of Hu Jintao in the Party Congress, an utterly shameful display.