That’s the message from PCE deflators today.

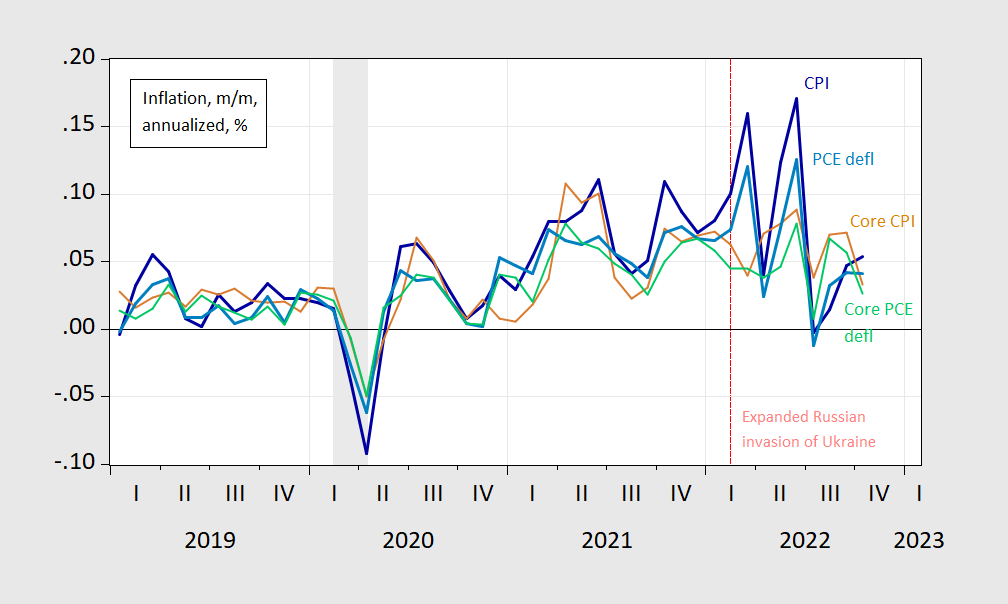

Figure 1: Month-on-month inflation annualized, for CPI (bold blue), core CPI (tan), PCE deflator (bold sky blue), and core PCE deflator (light green). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, BEA via FRED, NBER, and author’s calculations.

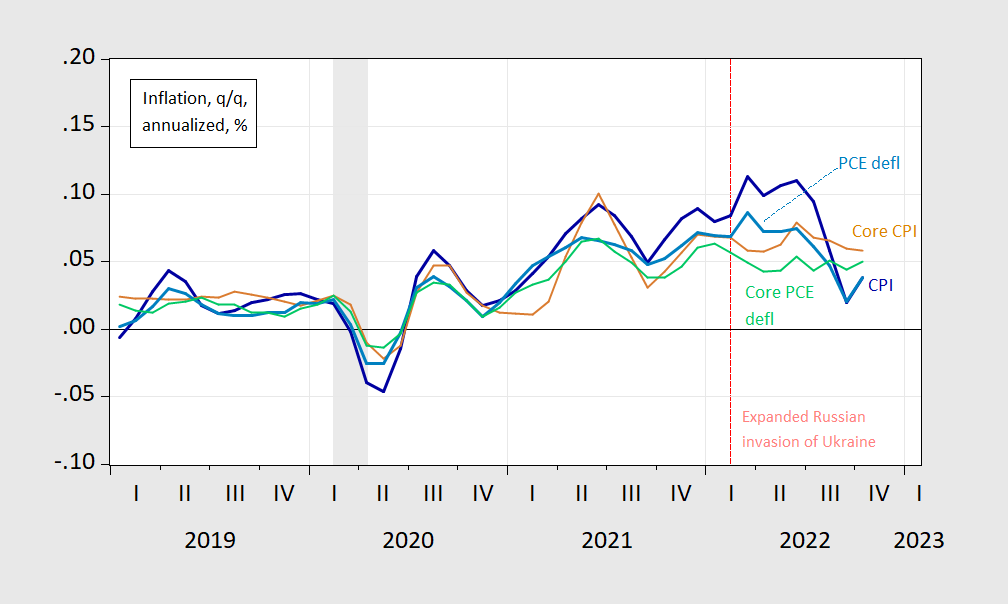

And the quarter-on-quarter basis, the deceleration seems apparent, except perhaps for core CPI.

Figure 2: Quarter-on-quarter inflation annualized, for CPI (bold blue), core CPI (tan), PCE deflator (bold sky blue), and core PCE deflator (light green). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, BEA via FRED, NBER, and author’s calculations.

While year-ahead Michigan household expectations of inflation are up slight in November (5.1% prel vs 5% in October), they are still down vs. March-April 2022 (5.4%).

https://fred.stlouisfed.org/graph/?g=RCja

January 30, 2020

Gross Domestic Product and Gross Domestic Income, 2020-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=RSSM

January 30, 2020

Gross Domestic Product and Gross Domestic Income, 2020-2022

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=IBTh

January 4, 2020

Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Percent change)

https://fred.stlouisfed.org/graph/?g=Qe7j

January 4, 2020

Real Average Hourly Earnings of All Private and Production & Nonsupervisory Workers, * 2020-2022

* Production and nonsupervisory workers accounting for approximately four-fifths of the total employment on private nonfarm payrolls

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=Vmy6

January 15, 2018

Employment Cost Index of Private Workers for Compensation, Wages & Salaries and Benefits, 2017-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=Vmyb

January 15, 2018

Employment Cost Index of Private Workers for Compensation, Wages & Salaries and Benefits, 2017-2022

(Indexed to 2017)

If a hobbyist is permitted to opine, I agree that it looks like inflation has peaked.

Core PPI Final Demand, Fred series, PPIFES showed zero change for October 2022

and looks like the November change to be reported on December 9, 2022 will be about 0.1%.

Eyeballing the actual curve, however, it looks like the M/M percent change could be lower than

the model forecasts.

I am also seeing for November a rear-view reading of about 5.8% for PPIFES on a Y/Y basis, compared to

6.7% Y/Y for October. However, as of today the Bloomberg forecast of PPIFES Y/Y percent change is 7.2%.

For PPI all items, FRED series, PPIFIS, I show a M/M increase of about 0.2% for November, the same as

for October.

The monthly change shows a Y/Y percent change of about 7.2% for November, down from 8.0%

for October.

@ AS

It specifically states in the Econbrowser bylaws, written by Prof Chinn and Prof Hamilton, “hobbyists are permitted and encouraged to opine”. Trust me, I saw it with my own eyes and would even bet Barkley’s next university paid travel excursion on that.

Russia’s attack on Ukraine induced a sharp rise in headline inflation. One interesting development in the quarterly inflation measures is that 3 of the 4 displayed in figure 2 are now running below their pre-war pace. We don’t know what would have happened to price trends if Russia had not screwed up the world’s food and energy markets, but it may be that inflation would have peaked in mid-2021, just based on figure 2.

Monetary policy takes 4 to 5 years to be fully expressed in inflation performance. There is plenty more disinflation already baked in the cake.

We don’t know what will happen to food and fuel prices over that period, but that’s a considerable period to adjust to shocks already experienced. Jay Powell has confirmed that the Fed won’t bequite so bloody-minded at the December FOMC meeting as at the prior four meetings, but he (the Committee) still seems to be more worries about the Fed’s reputation than about its dual mandate. He has indicated that the Fed will be feeling its way at future meetings, an acknowledgement that the job is mostly done. A pause wouldn’t change a thing over the medium term, but Powell suggests “feeling its way” means another 50, 100, 150 basis points? When additional disinflationary effects are on track for another 4 or 5 years?

One explanation is that Powell is unhappy at the low level of rates at the long end. If that’s the issue, Powell isn’t having much luck, what with the deepest curve inversion in four decades.

Powell also said he wants to see a modest rise in the unemployment rate, a soft landing. That has happened once, twice if you squint, since 1948; once in the early 1960s, maybe once in the mi-1970s. So nearly half a century, but more like over half a century, since a modest rise in the jobless rate was achieved, and that’s what Powell says he’s going to pull off? Sure he is.

But playing with demand side levers during a supply chain caused inflation sure has helped hasn’t it. The juris doctor Jerome saves us all by creating higher joblessness. No worries, Larry Summers applauds from the sideline of irrelevance.

My question is why did Hicks and company come up with IS-LM and AD-AS models when PhDs in economics and Juris Doctors are going to run in anf F— up everything anyway, in order to justify their own existence in the world??

Keep hiking Jerome, keep hiking. And the orthodoxy will keep applauding you, even though it beggars belief from economics’ most concrete postulates. But Georgetown Jerome, it gives you an excuse to take extended holiday from this city to that city to this city pretending you know what you’re doing. Congrats on sucking up oxygen from the world as you breathe. Congrats Georgetown Jerome.

consumer is hanging in, pci’s may have peaked, but what if plateaued…?

powell talking like he does is to see what effects he can have on strengthening the currencies of the other [nags in line for the glue factory] currencies…..??

between trillion dollar deficits, a $200b b-21 (looks too much like the 2 billion dollar (last century $$) per unit b-2), $58b added to the 2023 defense authorization bill, and green inflation powell has more to worry than biden embargoing russian oil and gas sales.

i think .75 in dec is possible.

Looked at over the longer term, isn’t a local peak in core inflation a pretty reliable sign of a cyclical peak?

https://fred.stlouisfed.org/graph/?g=X5db

https://www.nytimes.com/live/2022/12/02/business/jobs-report-november-economy

December 2, 2022

November Jobs ReportU.S. Hiring Continues at Robust Pace

The labor market showed resilience despite efforts by the Federal Reserve to cool the economy, stoking fears about higher inflation.

– U.S. employers added 263,000 jobs in November, the latest sign of the economy’s strength.

– Markets sink as investors digest a surprisingly strong report.

https://static01.nytimes.com/newsgraphics/2022-12-01-nov22-jobs/95bb6703b0e330b07345ad6144711bd5d2052225/_assets/monthly-change-600.png

America’s jobs engine kept churning in November, the Labor Department reported Friday, a show of continued demand for workers despite the Federal Reserve’s push to curb inflation by tamping down hiring.

Employers created 263,000 jobs, even as a wave of layoffs in the tech industry made headlines. The unemployment rate was steady at 3.7 percent.

The labor market has been surprisingly resilient in the face of successive interest rate increases by the Fed over the past year. Even sectors normally sensitive to borrowing costs, like construction and manufacturing, have been slow to back off the brisk pace of growth they posted coming out of the pandemic.

— Lydia DePillis

Nonfarm Employment

As in the past, using 17 categories of employment, my forecast for nonfarm employment for November was 264K, vs reported actual of 263K.

Must have been lucky, although my October forecast was for 277K. Revised actual shows 284K.

Looks like more impetus for the Fed to increase rates, even though inflation seems to be easing.

Strong jobs report this morning. The Fed is in a risky spot here… they could begin to be seen as anti-job rather than anti-inflation. Not a good optic.

It’s a report distorted by covid era diagrams. Not nearly that useful.

https://www.bls.gov/news.release/empsit.nr0.htm

Total nonfarm payroll employment increased by 263,000 in November, and the unemployment rate was unchanged at 3.7 percent, the U.S. Bureau of Labor Statistics reported today … Both the labor force participation rate, at 62.1 percent, and the employment-population

ratio, at 59.9 percent, were little changed in November and have shown little net change since early this year. These measures are each 1.3 percentage points below their values in February 2020, prior to the coronavirus (COVID-19) pandemic. (See table A-1.)

I did go to Table A-1. The employment-population was 60.1% in September and 60.0% in October. So the household survey is painting a different picture than the payroll survey.

As someone who cheered the play of Michael Vick from 2001 to 2007, I am happy to see this:

https://thesource.com/2022/12/01/michael-vick-to-produce-docuseries-on-the-evolution-of-black-nfl-quarterbacks/

We are in another age of Black quarterbacks in the NFL, with the likes of Patrick Mahomes, Lamar Jackson, Jalen Hurts, and Justin Fields ruling over the league. Focusing on them and the Black quarterbacks of the past, Michael Vick is planning to create a docuseries on the Evolution of Black NFL field generals. According to Variety, Vick’s Fubo Studios and SMAC Productions will co-produce an eight-part docuseries on the evolution of the Black Quarterback in America. The docuseries will feature Michael Vick speaking with Mahomes, Cam Newton, Tony Dungy, Andy Reid, and Doug Williams. Additionally, Vick will sit with celebrities, journalists, cultural figures, and more.

I don’t see anything that could drive up prices any more. Both food and hydrocarbon prices are stable or falling. Supply chains are recovering. China seem to have come to its senses on the zero Covid policy. Housing prices are slowly falling and labor markets don’t seem conductive for rapid wage increases.

God help America if feckless bureaucrats like Xi JInping start earnestly listening (and not by once every quarter century mob/crowd threat) to those youngsters attending China’s better universities. The sleeping monster (“sleeping monster” read as terrific human potential) will awake. Not going to happen though, and from a purely selfish standpoint, America should celebrate that fact. As that is the main thing keeping China forever spinning its wheels and not surpassing America in global power.

Moses,

I think “feckless bureaucrat” is not what Xi Jinping is now, although he may have been that earlier in his career. Now he is more like a neo-emperor, and indeed admires the powerful Qianlong emperor of the 1700s who expanded the territory under Chinese control to include Tibet and Xinjiang.