Is core CPI inflation in a new regime? Results using a Markov switching model (pioneered by James Hamilton).

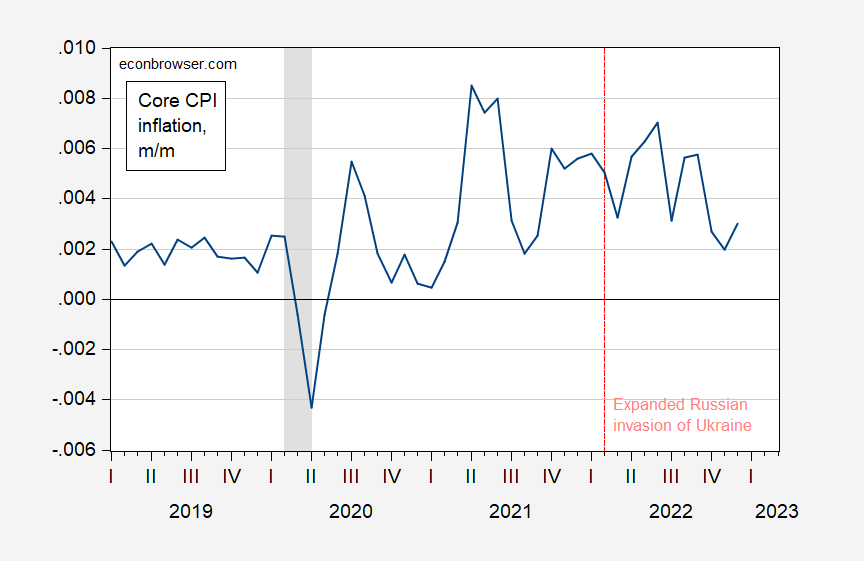

Figure 1: Core CPI inflation m/m in log differences (blue). NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NBER, and author’s calculations.

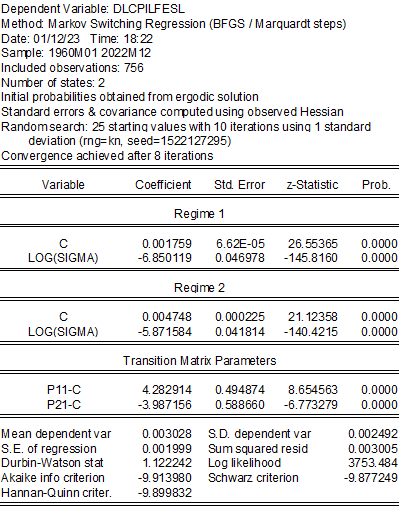

Applying a simple Markov switching 2-regime estimation method (implemented in EViews, using default settings, allowing for different variances) over the 1960-2022 period yields the followin estimate.

This estimate yields the following estimates of regimes (filtered, smoothed):

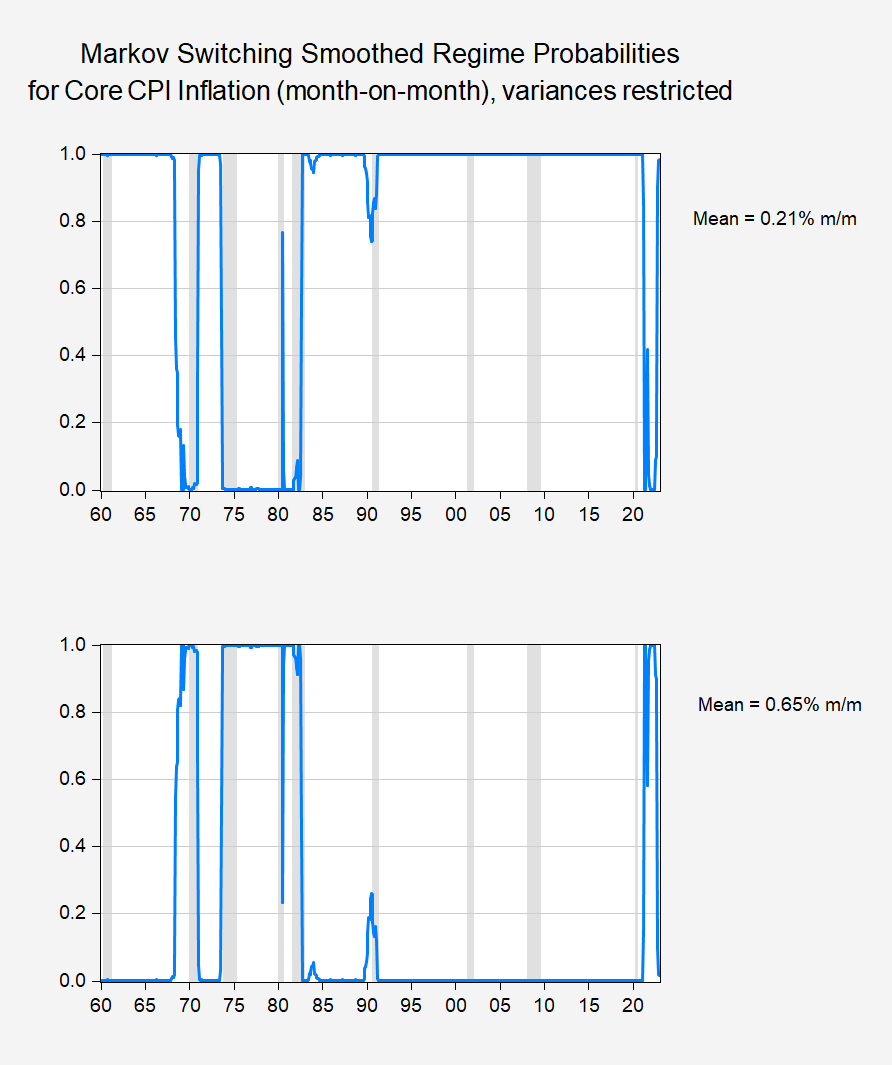

The estimates indicate a 30% probability of being in the low inflation regime. The results are somewhat sensitive to assumptions regarding the variances in the two regimes. Imposing a restriction of common variances leads to the following estimated probabilities of being in the two regimes.

Imposing the restriction of common variances, the indications are much stronger for a switch to the low inflation regime.

Professor Chinn,

Thanks for posting the models. Always something to learn.

After reading the EViews forum, I have a question on regime volatility. Is the LOG(SIGMA) the estimate of the log of the square root of the error variance for a regime, as stated in the EViews forum? If I have interpreted the regime volatility correctly, what is your opinion on same or different variances for your models?

Model 1 Regime 1, LOG(SIGMA) -6.8501

Model 1 Regime 1, exp[LOG(SIGMA)] 0.0011

Model 1 Regime 2, LOG(SIGMA) -5.8716

Model 1 Regime 2, exp[LOG(SIGMA)] 0.0028

Model 2 Regime 1, LOG(SIGMA) -6.3333

Model 2 Regime 1, exp[LOG(SIGMA)] 0.0018

Model 2 Regime 2, LOG(SIGMA) -6.3333

Model 2 Regime 1, exp[LOG(SIGMA)] 0.0018

https://forums.eviews.com/viewtopic.php?t=9614

Professor Chinn,

If the correct interpretation of the volatility of regimes is LOG(std Error) which seems more likely than LOG(Coefficient) the standard errors look close to me unless statistical test says different.

Or for those who don’t have access to EViews, Hamilton’s Two Regime Markov Switching Model can be implemented in R:

https://www.r-bloggers.com/2022/02/understanding-hamilton-regime-switching-model-using-r-package/

I have always been interested in “R” program. though mostly too lazy to follow through on it. The “R” link is appreciated anyway. My standby excuse is I am apparently too stupid to get my R Studio and R to jive on the versions. But whatever, I still appreciate when people put “R” program info/links up. I’d even be interested in learning Python but my sense is it is even harder and more laborious than “R” which makes it a no zone in my case.

I’m going to go out on a limb here and say that pgl’s mention of the 6-month average pace of inflation in the prior comments section was in response to your mention of regime switching. I certainly took it that way.

Responses from one of our anonymous commenters and from Bruce Hall seem either to have wilfully ignored your point about regime switching or to have failed to understand it.

This question is among the most important for the inflation outlook and for the policy rate outlook.

And, by the way, money markets are pricing in over 90% odds of just a 25 basis point rate hike this month. A week ago, 25 bps was only priced at about 2/3 odds, with the other 1/3 for 50 bps. A month ago, the odd-on pricing was for 50 bps.

Pricing for the December 2023 FOMC meeting centers on 425-450 bps, same as today. A month ago, December 2023 was priced 25 bps higher. Market participants seem to think we are undergoing an inflation regime change. Those focused on inflation in the December 2020 to June 2022 period will have missed the very thing that market participants have noticed.

The adjustment in expectations regarding Fed rates has induced a drop in ten-year Treasury yields, which has caused the 10-year/3-month inversion to deepen. The simple read on a deeper inversion is that recession has become more likely, though that is counter-intuitive.

I’m pretty satisfied with that little explanation, so I’m going to attempt another one. I will now explain why members of the troll choir are so fixated on inflation in the December 2020 to June 2021 period. Ready?

The troll choir insisted that the U.S. had suffered a recession in H1 of 2022 so they could blame President Biden for a recession prior to the 2022 election. Sadly for them, recession talk failed to gain a hold on the median voter’s imagination. The median voter was also not impressed with the notion that job gains had stalled in March. The median voter was, however, annoyed as heck about inflation. So, says the troll choir to itself, let’s blame Biden for this inflation thing.

Now, inflation is cooling. That’s good for the median voter, so good for Biden’s re-election odds. That’s bad for the troll choir. The troll choir can’t manufacture inflation any more than it could manufacture a recession, so it has to sing dirges about past inflation and hope the median voter listens.

QED

https://fred.stlouisfed.org/graph/?g=YGCr

Fed doesn’t matter with long term rates. Once oversupply and issues relating to Putin’s stuff began to resolve itself, prices dropped and so did market forces. The 10 year dropped because inflation fears dropped.

Nonsense. Funding costs matter.

“Responses from one of our anonymous commenters and from Bruce Hall seem either to have wilfully ignored your point about regime switching or to have failed to understand it.”

I posted a link to Alan Blinder’s excellent discussion of this issue. Bruce Hall had to place one of his usual retarded comments as a response – a comment that showed Brucie never bothered to read Blinder’s discussion. I mean come on – if one is going to comment on something can’t we expect that person to have first READ it?

Off topic, productivity –

The issue of interrupted productivity gains during the Covid pandemic has been raised, and misconstrued, in comments here. Anyone who knows how labor productivity is calculated will understand that rapid increases in employment hours will, all else equal, tend to slow or even reverse productivity gains. Anyone who understands that some jobs produce more than others will understand how the composition of employment will affect changes in overall measured productivity. Those issues have been discussed in comments here in the past.

There is another factor which has both direct and indirect influence on actual and measured productivity which, as far as a I know, has not been much discussed. That factor is absence from work due to illness. Here is the BLS page which tracks worker absence due to illness:

https://data.bls.gov/timeseries/LNU02006735

Note the increase in absences in the Covid period. The Washington Post reports the increase in lost days, but not the likely effect on productivity:

https://www.washingtonpost.com/politics/2023/01/10/coronavirus-employees-health-missed-work/

In the short term, in individual jobs, absences can either increase or decrease output per hour. If Jane and Bob do the same job and Bob calls in sick, Jane may end up doing Bob’s work as well as her own – an increase in productivity. If, on the other hand, Jane uses Bob’s output as her input, then Jane’s productivity falls when Bob is out sick.

In the longer term, lost work due to illness is almost certainly a drag on productivity. That, or managers are doing a really bad job.

Here’s one look at illness and productivity, based on flu rather than Covid:

https://pubmed.ncbi.nlm.nih.gov/36515814/

Morning Joe has dragged out Steve “charts” Rattner to discuss the latest news from BLS on inflation. I guess this pretend economist has not read this post or Alan Blinder’s most recent discussion. Rattner kept telling us inflation was 6.5% as his worthless charts were showing yr/yr changes. And to top it all off, Mr. Charts told us we needed to “lower wages” when he was really trying to say wage GROWTH likely needs to get down to 3% to have sustained inflation = 2%.

Morning Joe needs to have someone better than Bruce Hall as their morning economist. Geesh!

Can anyone tell me why Powell cut interest rates in the face of GOP/Trump tax cuts that just dumped a bunch of rich people speculative money into digital currency fantasies/bubbles https://www.washingtonpost.com/news/powerpost/paloma/the-finance-202/2019/10/31/the-finance-202-fed-s-decision-to-cut-rates-is-a-sign-trump-s-tax-cuts-have-fallen-short/5dba0575602ff10cf14f988f/ But now that the transitory inflation from a worldwide disruption from a pandemic is subsiding – the 90% of the population will just have to endure more “pain” https://ritholtz.com/2023/01/inflation-comes-down-despite-the-fed/

IMO – we are just starting to see the impact of interest rate hikes on housing and consumer credit. And, Fed Chair Powell – do remember – you do have a dual mandate.

Your first question is a good one. We all know Trump threw a tantrum whenever the FED increased interest rates. But then there is this from your first link:

The Republican architects of Trump’s tax cut said a big boost in business investment would prove the effort succeeded. That bump in corporate spending has failed to materialize nearly two years after the cuts passed into law and a new government report found it dropped 3 percent last quarter.

I do not think any credible economist thought this tax cut for rich people would lead to an investment boom. We were told that during the Reagan 1981 tax cut and it did not happen. We were told that during the Bush43 tax cuts and it did not happen. Supply side silliness is not real economics.

Trump’s Tax Cut Slashed US Corporate Effective Tax Rate to 9%

Large corporations saw a sharp drop in their tax burden in the first year of former President Donald Trump’s tax-cut law, according to a federal watchdog.

US companies with at least $10 million in assets paid an average of 8.9% in taxes to the Internal Revenue Service in 2018, a new study from the Government Accountability Office showed. That’s down from the effective rate of about 14.6% the year before.

To get the effective tax rate below 10% requires a lot of transfer pricing manipulation. Odd – we were told the 2017 tax cut for rich people would end this garbage. Oh well – Bruce Hall tells us we do not need more IRS enforcement to address this scandal. Go figure!

If it makes you feel any better I think there are a few orthodox/mainstream economists who would agree with you on this. But I am afraid at this moment they are in the minority. I saw a Youtube video yesterday (I know this is a small singular data point, and seen as “anecdotal evidence”) of a guy who does food reviews. He said he regularly gets an Asian beef dish at his local Winn-Dixie grocers. For at least the last year he has paid $5.99 for this same dish, and in “one fell swoop” they increased the price to $13.99. He is very mild tempered in general, and was nearly enraged in the YT video upload. I don’t blame him, and no one is going to tell me Winn-Dixie isn’t enacting price gouging on the American consumer pulling that stunt, based on a mythos propounded by American media and yes, mainstream economists that we are undergoing “demand side” inflation. It’s crap. Now Menzie or “PhD X” can sit here and tell me “that is demand side inflation”, and “if not for Georgetown Juris Doctor Jerome” that Winn-Dixie beef dish would be $20.99 instead of $13.99. My reply to that is, I feel sorry for anyone that dumb to believe that. And I encourage such a hypothetical person to continue on playing “super genius” with graphs in the economics department basement (preferably on a computer not connected to the internet) if that’s the best commentary on prices they can do.

There were signs of finance stress and an inversion of the yield curve in 2019:

https://fred.stlouisfed.org/graph/?g=YHDI

Scared the pants off the Fed guys – looked like it was their fault.

The regime change Menzie discusses here is going to bring rate hkes to an end. Probably soon, but probably too late to avoid recession. Bernanke would probably have avoided the mistake Powell appears to be making. Yellen might have avoided it, too, though she is very much a Phillips curve thinker.

The babbling heads on the TV keep saying the FED will limit the next rate increase to 0.25%. Me? I would have the FED to start lowering interest rates. Declare victory and go home!

Inversion is irrelevant. The main thing in 2019 was the excessive debt in subprime commercial banking.

Really? ‘Cause the guys at the NY Fed that I talked to said financial stress and inversion were critical in the decision.

Who’d you ask?

They are just trying and be politically revelant. The natural rate of interest in the post industrial revolution investment decline means nominal interest rates are down. The idle rich are investing less and stashing more.

@Gregory Bott

So how do you celebrate something in a political way?? That’s the best I could do for the “word” revelant in the urban dictionary, but to be honest with you, I’m not sure even teenagers use that “word”.

This is one of many things I’m talking about when I say I had mainland Chinese students and colleagues who spoke the English language better than natives.

contemplate what the fed did in 2018 and 2019, looks like a bit of qt.

Maybe, but it’s impact was pretty irrelevant. The huge surge in subprime commercial banking debt was a risk. The primary dealers however had not spent much in the decade since the financial crisis. There was no real investment boom outside mining(which was in its second downturn of the decade) and it was too small. Then there was the China/Trump trade war grift they hatched up. Something over time which would fade away. There was no financial stress in the Federal Reserve system. Period. It was all subprime and if busted was a mild recession.

The Fed needs to be exposed for its grift. They don’t control consumer finance at all. All they have is increased interest payments banks must give out and boy, that can spur leverage into increased loan volume.

“There was no financial stress in the Federal Reserve system.”

That sentence is just wierd. I am stuck between thinkng you don’t know what you’re talkng about or that you have no idea how to say what you mean. Either way, I’ll take the direct statements of Fed officials and the evidence of market pricing over your personal beliefs, every time.

https://jabberwocking.com/breaking-stunning-republican-budget-plan-revealed/

Kevin Drum and others have seen the House Republican plan to balance the budget in 10 years. They will not say it explicitly but the arithmetic shows they intend to slash your Medicare and Social Security benefits massively. Gee – they did not run on this in 2022. Republicans are liars? Stop the presses.

Professor Chinn,

I computed Markov models for core commodities (FRED series, CUSR0000SACL1E and core services (FRED series, CUSR0000SASLE), using different variances. I used data from 1967m01 to 2022m12.

The results show that there is a probability of about 76% that core commodities are in the low regime and about zero percent that core services are in the low regime. Using same variances, both probability charts look strange.

I ask as a learning experience not as a challenge, if there is some significance in the above results compared to the Markov model using CPILFESL.

Thanks

If you thought Hershel Walker was bad, check this dude out:

https://www.msn.com/en-us/news/politics/national-embarrassment-gop-lawmaker-faces-furious-backlash-after-comparing-women-s-reproductive-systems-to-cattle/ar-AA16jTRC?ocid=msedgdhp&pc=U531&cvid=878d3a7d71934708a76b3ef2ea6c6031

A joke made by Idaho state Rep. Jack Nelsen (R) this Tuesday when he was introducing himself to the House Agriculture Committee didn’t go over too well, since many interpreted the remarks as him comparing women to livestock. “I’ve milked a few cows, spent most of my time walking behind lines of cows, so if you want some ideas on repro and the women’s health thing, I have some definite opinions,” Nelsen said.

An op-ed from the Idaho Statesman’s editorial board said it would be nice if “men like Nelsen would demonstrate a bit of humility and decency, and not paint themselves as experts in women’s health care—which they certainly are not.” “It would also be nice if they kept their mouths shut a little more, didn’t insult women and saved Idaho from national embarrassment,” the op-ed stated.

Paul Gosar has some explaining to do:

https://www.rollingstone.com/politics/politics-news/ali-alexander-warned-paul-gosar-violence-jan-6-1234660239/

THE FOUNDER OF “Stop the Steal” delivered an early warning about the violence soon to overwhelm the U.S. Capitol on Jan. 6 in a text to the chief of staff of Rep. Paul Gosar, according to a deposition released by the Jan. 6 Committee.

Ali Alexander is a far-right agitator who was one of the key mobilizers of the protest that morphed into the insurgency of Jan. 6, 2021. After making an early exit from the Ellipse rally he’d helped organize — at which Donald Trump demanded his backers march on the Capitol — Alexander became an eyewitness to the chaos unfolding as insurrectionists breached the Capitol perimeter.

“People were scaling the wall like Spiderman,” Alexander testified to the Jan. 6 committee. “I’ve never seen anything like that.” But Alexander didn’t just stop and gawk. He took time to sound the alarm to Gosar, one of his top House allies. “I think you and your staff should maybe leave,” Alexander texted Gosar’s chief of staff, Thomas Van Flein. “This is hell out here.”

Off topic, Russia’s war in Ukraine-

Dara Massicot (RAND, former DOD) is all over the press, commenting on the recent shuffle at the Kremlin, putting Russia’s top general in charge of operations in Ukraine. Much of what she has to say is less sensational than this, from the NYT:

“They have taken someone who is competent and replaced him with someone who is incompetent, but who has been there a long time and who has shown that he is loyal,” said Dara Massicot, senior policy researcher at the RAND Corporation in Washington. “Whatever is happening in Moscow, it is out of touch with what is happening on the ground in Ukraine.”

Her view is that the change is Kremlin politics, not performance-based (obviously) and that Gerasimov isn’t going to say “no” to desperate ideas, since he no longer has underlings to blame.

Escalation? Tactical nukes? More widespread civilian slaughter? Sure, why not?

http://www.nytimes.com/2023/01/11/briefing/russia-ukraine-war-gerasimov.amp.html

you might consider:

https://covertactionmagazine.com/2023/01/13/kyiv-shows-signs-of-desperation/

the author is a not blonde or thirty something!

i do not see the massive russian attack, nor that general winter is that much a factor…..

in my sac days our motto, living and working in the blast zone around the alert facility: ‘the living will envy the dead’ which we presumed would be us in a nuke exchange.

never mind the iodine pills, radiation poisoning beats cannibalism!

@ Anon

It appears, judging from your Russian state propaganda links, you are currently suffering from radiation-induced brain injury.

Lots of jokes popping into my head now related to people who quote Russian intelligence like it’s life truth straight out of the Talmud, but seems to fall under the inappropriate “Too soon??” category.

On a side note, Does anyone know the exact time mark Katie Halper started taking payola from friends of the Kremlin?? Was it before or after she did YT live streams sloppy drunk?? Asking for a friend.

https://covertactionmagazine.com/pushback-against-empire-covertaction-magazine-holiday-party-and-fundraiser-december-1-2022-at-the-peoples-forum/

mose,

if you have ever been in an ‘igloo’ which had at one time or other stored ‘special weapons’ managed by doe you won’t forget the background odor…..

unlikely I had a large dose of rem…..

Whether being exposed to high doses of radiation or being assigned to suffer through horrific odors, whatever government you work for, I feel they chose the exact right person for either of those tasks.

If it makes you feel any better I would have assigned you to cleaning all base latrines.

UW’s own Alfred McCoy has some thoughts on the US position in the world;

“Dream on, as they say. In this century, with its disastrous wars, Washington has already lost much of its influence in both the Greater Middle East and Central Asia, as once-close allies (Afghanistan, Egypt, Iraq, Saudi Arabia, and Turkey) go their own ways. Meanwhile, China has gained significant control over Central Asia, while its recent ad-hoc alliance with an ever-more-battered Russia only fortifies its growing geopolitical power on the Eurasian continent.

Although the Ukraine war has momentarily strengthened the NATO alliance, the unilateral U.S. retreat from Afghanistan in 2021, ending a disastrous 20-year war, forced European leaders for the first time in half a century to consider what life and NATO might be like on a changing planet. They are only now beginning to imagine what taking charge of their own defense would mean perhaps a decade from now, with most U.S. military forces withdrawn from Europe. For the first time in memory, in other words, we could truly find ourselves on another planet.”

https://tomdispatch.com/an-american-new-deal-for-an-entire-continent/

McCoy has some thoughts on a new, constructive place in the world…focusing on this hemisphere.

“By taking the necessary steps beyond CAFTA, NAFTA, and NORAD, Washington could help lead its North American neighbors, roiled by the ravages of climate change, toward a more perfect union. In the process, this entire hemisphere would ultimately become a far safer haven for its share of humanity in the troubled decades to come.”

We already have a rough idea (“rough idea” read as “we know exactly”) what ALL of Europe would look like without NATO:

https://www.rferl.org/a/ukraine-dnipro-russia-missile-strike-apartment-block/32223544.html <<—Dnipro, East Ukraine, January 14

Personally, the Europe I'm more interested in seeing 10 years from now is a Europe which purchases ZERO energy resources from the terrorist state of Russia. And what Putin’s offices look like 10 years from now after the Kremlin has turned Putin into a cold cadaver. With apologies to John Lennon, let’s all “Imagine” what that latter scenario looks like.

Jonny boy probably counted on us not reading his link. Please do so as a lot of the criticism of recent American policy is leveled at the pro-Putin anti-NATO stances of one Donald Trump. Biden is trying to reverse this damage and yet Jonny boy wants to condemn Biden’s foreign policy stance.

Yeah, Moses…we already know how Iraq, Afghanistan, Libya, Somalia, Yemen and Syria look under US hegemony…but as long as it wasn’t Putin doing the damage, all is forgiven and forgotten!

Jeffrey Sachs: “We are no longer in a US-led world, nor even a world divided between the US and its rival China. We have already entered a multipolar world, in which each region has its own issues and role in global politics. No country and no single region can any longer determine the fate of others. This is a complex and noisy environment – with no country, region, or alliance in charge of the rest.”

https://www.jeffsachs.org/newspaper-articles/febj7gnedfemn5b2wh46pbwarye53f

World’s policeman, RIP. Unfortunately, this situation represents an ideal situation for bigger “defense” budgets and more pointless and futile wars as the foreign policy blob tries to cling to its former status as the “indispensable nation.”

@ JohnH

There’s a very large difference between the American government’s accidental missile strikes on Mid-East citizenry happening in a relatively infrequent manner and Putin’s intentionally bombing residential areas packed with non-military families or citizens in hiding. Not to mention Russia’s bombing of Ukraine’s utilities for regular citizenry during extreme winter cold. The two behaviors are not equivalent. And everyone but you and Sergey Lavrov can understand the difference very easily.

And for the record, Russia has done much more damage to Syria and Afghanistan than America has. Russia basically did the heavy lifting on intentional killing of citizens in Syria.

https://www.washingtonpost.com/world/2022/07/21/syria-russia-double-tap-airstrikes-report-war-crimes/

Then we can get into the estimates running from 500,000 and 2,000,000 murdered Afghans during the Soviet-Afghan War. Was that humanitarian work there by Russia?? You really need to read more.

https://sites.tufts.edu/atrocityendings/2015/08/07/afghanistan-soviet-invasion-civil-war/

OK, I’ve considered it. Having done so, I’m amused you thought I should. John Helmers? Every word he has written about Russia’s war in Ukraine has favored Russia. “Lived in Russia since 1989” is not evidence of unbiasedness.

I’ve also considered “not blond or thirty something!” Strong, fact-based argument you’ve got there. What you “see” happening next in Ukraine – based on assessment of hair color? – doesn’t matter one bit.

Uh, Oh! Here’s another blond trying to explain stuff to the menfolk:

https://carnegieendowment.org/politika/88753

Fortunately, she’s in her forties. A Russian political analyst’s look at Russian political developments in 2023.

I do have to quibble with her assertion that Russian elites have put their faith in Putin. At least some of them have simply developed a pragmatic faith in the effects of gravity when one falls out of a window.

The depth that Anonymous and JohnH go to defend Putin’s war crimes reminds me of the depths Republicans have gone to defend the mob boss Donald Trump. Then again – both Stalin and Hitler had their own fan boys.

Wow! pgl really has unleashed his inner Joe McCarthy. Neocons and liberal interventionists couldn’t happier! And the merchants of death—Raytheon, General Dynamics, etc.—who fund neocon think tanks like ISW must be happy with his smear campaign. Bigger “defense” contracts and Endless War, Go, Go, Go!

JohnH

January 15, 2023 at 6:28 pm

Wow! pgl really has unleashed his inner Joe McCarthy.

This is so utterly stupid and retarded that Bruce Hall and Princeton Steve need to be worried that they are trailing in the 2023 Troll of the Year award. Hey Jonny boy – an attempt to smear someone with something this dishonest and childish is almost as much of a failure as you are at basic economics.

Interesting. Thanks for the share.

Infla-dating?

https://www.msn.com/en-us/lifestyle/relationships/infla-dating-is-on-the-rise-and-experts-want-to-flip-the-script-on-the-new-trend/ar-AA16kgll?ocid=msedgdhp&pc=U531&cvid=f54d9426980342a7acf45fa96d994a23

‘First thing’s first: what is infla-dating?

Infla-dating is opting for less-expensive outings with a romantic partner during these uncertain economic times. According to research from Plenty of Fish, a whopping 48% of millennial and Gen Z singles are embracing the trend.’

In my youth – this was called the guy being just keep. Now I get why one does not want to spend $200 on the first date but this is never going to work with the gals on Manhattan’s Uppity East Side. Just saying.

I don’t agree with blanket statements like that. If that’s true, and I doubt it is, I would say it’s more a function of geography than gender. I would wager there’s girls there born into lower socio-economic class that are now there in East Manhattan and that’s not the sum-total of their value judgement on the person they are dating.

Well – it is true that a few of the gals there are decent people but yea – there was more gold digging there than I have seen anywhere else. Then again – when one has to pay $3000 a month for a studio.

I finally got around to reading that Alan Blinder WSJ commentary. I should thank you because I had missed that, and have always been a huge Alan Blinder fan. My Micro and Macro texts in college was “Baumol and Blinder” and I may have even been aware of him before then but certainly from then onward I was a fan of Blinder’s. The Micro book cover was a dark background with a globe lit up in a yellow light. The Macro book (a more recent set) wasn’t near as interesting visually, but still a good book. I hope he’s not reading this because I’m afraid Mr. Blinder would take it the wrong way, but when I saw him on TV or YT videos I even found his facial tics charming on some level. Like Einstein’s crazy hair, I mean who doesn’t like Einstein’s crazy hair?? I just always found the facial tics charming. Such a sharp guy, and fighting for the little guy when he was at the Fed.

“when I saw him on TV or YT videos I even found his facial tics charming on some level.”

I noticed that too when I had the great honor of having a conversation with the utterly brilliant Alan Blinder. James Tobin stuttered a lot but we tolerated both because whenever listening to either man – the sheer brilliance of their words was worth the occassional tic or stutter. And of course their vast writings were true joys to read.

The 45th President of the United States basically conceded he is a serial rapist:

https://www.businessinsider.com/trump-cant-think-of-any-complaints-that-he-forcibly-kissed-woman-2023-1

Donald Trump was asked by a lawyer for rape accuser E. Jean Carroll if he’d ever forcibly kissed a woman, according to newly unsealed court documents. The former president said he was unaware of any “complaints,” according to newly-released excerpts from his deposition in Carroll’s ongoing defamation lawsuit. The answer was surprising because at least 26 women have accused Trump of sexually assaulting him in alleged attacks going back to the 1970s.

I see – if the victim does not complain, rape is OK? Trump is one disgusting piece of garbage.

Kevin Drum is watching the House Republicans on the debt ceiling issue making total fools out of themselves:

https://jabberwocking.com/republicans-are-developing-a-clever-plan-to-shoot-themselves-in-the-foot/

Republicans are developing a clever plan to shoot themselves in the foot

I must be missing something here. The Washington Post reports that Republicans are getting ready to pass a bill that mandates precisely how the Treasury Department handles a breach of the debt ceiling. In particular, it would specify which bills have to be paid and which can be blown off. The must-pay bills are likely to be these:

Social Security

Medicare

Military

Veterans

Interest on the national debt

The curious thing about this is not the choice of which bills to pay. It’s a pretty conventional list. The curious thing is why MAGA Republicans are so hot to put this down on paper. It’s purely symbolic since it will never become law, and it opens up Republicans to pretty obvious attacks:

“Any plan to pay bondholders but not fund school lunches or the FAA or food safety or XYZ is just target practice for us,” a senior Democratic aide said, speaking on the condition of anonymity to discuss a proposal that hasn’t yet been released publicly.

Yes, exactly. I mean, this is roughly what Democrats are going to do anyway, but you might as well make them work for it. Why go to the trouble of opening the door to the shooting range yourself instead of making them kick it down on their own?

The Producer Price Index will be reported on Wednesday, Jan. 18.

It looks like Producer Price Inflation may give some very encouraging inflation results for December and I assume for January CPI due to lags.

Bloomberg consensus is -0.1% change for PPI All and 0.1% for PPI Core.

Briefing.com consensus is -0.1% change for PPI All and 0.1% for PPI Core

I noticed that PPI All seems to be sensitive to the price of gasoline, FRED series, GASREGW and PPI Core seems to be sensitive to the WEI weekly index.

Models using GASREGW and WEI produced the same forecasts as shown above.

Before ltr clutters up the post with more fake data. China just announced 60,000 covid deaths in the past month. Very contradictory to the numbers and propaganda ltr has been posting from the ccp over the last couple of years. Waiting for your apology in attempting to mislead folks on this blog ltr.

“ The minutes also showed officials urging hospitals to only label deaths as Covid-related if no other underlying diseases were present. ”

Leaked minutes from the ccp national health commission. Seems they take an approach similar to kopits and hurricane related deaths. Preexisting conditions exclude one from pandemic or natural disaster death counts.

i am pretty old, i know a fair # of people admitted. everyone i know entering a hospital is covid positive during the stay…. all went in for something else.

in us a foia is needed to get at cdc safety signal data

if they have ‘clean’ data!

ccp version has less ‘integrity’

The old saying is “you have to be in good health to survive a hospital stay”.

I guess we are down to betting who is going to blow up the economy first Jay Powell or Kevin McCarthy.

Powell was a pretty sensible person about supporting high employment pre-pandemic. And then he suddenly went crazy, obsessed about “two jobs openings for every unemployed worker.” Hey, you know, workers having choices is a good thing. But it’s like Powell suffered some inflation psychic trauma that flipped a switch like those previously reasonable people who became raving war hawks after 9/11.

Maybe Kevin McCarthy will blow up the economy with his debt limit hostage situation first and Powell won’t get the blame he deserves.

Yep.

I am hearing a bit of “informed opinion” that the debt limit will be addressed before default can happen, however bad things may look along the way, because that’s what always happens. I hear the calming sound of whistling near my local graveyard.

John Boehner and Paul Ryan both learned the cost of making decisions for the benefit of the country, or perhaps just for mainstream Republican House members. Kevin McCarthy has already had a big taste of what is likely to happen to him if he doesn’t pay more ransom to the Tea Party/Freedom Caucus/Children of the Trump than Boehner or Ryan did, and McCarthy response was to give ’em everything they asked for, except his cherished gavel. He’s the guy who’s going to save us from the barbarians?

Meanwhile, Democrats have faced nihilistic threats from the GOP for a generation, and seem to have learned that compromise doesn’t work. They’ve joined the crew of the Black Pearl – “Take what you can. Give nothing back!”

Fingers crossed, it’ll work out with nothing worse than another credit downgrade.

The good thing is that legislation has to first come from the house – then the Senate and President can block it. But the house has to show what it want to do about spending and taxes. My guess is that they will deliver a lot of unpopular “solutions” but none will become law. However, those “solutions” will become part of the campaign adds from democrats in 2024. A lot of people don’t understand that their pensions will be destroyed in a default scenario; maybe they need a little scare to be reminded about that. Perhaps Biden may have to mint that $1 trillion coin or declare that its illegal to default on US government debt – and let the the courts decide over the next 3-5 years if he was right and indeed allowed to just print up new treasuries to replace old ones. Trump did a lot of stuff that he knew would not hold up in court but at least it would not be stopped until years later.

“I guess we are down to betting who is going to blow up the economy first Jay Powell or Kevin McCarthy.”

Yep – we are seeing insanity from all sides. But of course we know McCarthy will blame Biden for the damage McCarthy creates. The Republican way!