Today, we present a guest post written by David Papell and Ruxandra Prodan, Professor and Instructional Associate Professor of Economics at the University of Houston.

The Federal Open Market Committee (FOMC) raised the target range for the federal funds rate (FFR) by 25 basis points to between 4.5 and 4.75 percent in its January/February 2023 meeting and anticipated that ongoing increases would be appropriate. This followed rate increases totaling 4.25 percentage points between March and December 2022 preceded by two years at the Effective Lower Bound (ELB).

There is widespread agreement that the Fed fell “behind the curve” by not raising rates when inflation rose in 2021, forcing it to play “catch-up” in 2022. “Behind the curve,” however, is meaningless without a measure of “on the curve.” In the latest version of our paper, “Policy Rules and Forward Guidance Following the Covid-19 Recession,” we use data from the Summary of Economic Projections (SEP) from September 2020 to December 2022 to compare policy rule prescriptions with actual and FOMC projections of the FFR. This provides a precise definition of “behind the curve” as the difference between the FFR prescribed by the policy rule and the actual or projected FFR. We analyze four policy rules:

The Taylor (1993) rule with an unemployment gap is as follows,

where is the level of the short-term federal funds interest rate prescribed by the rule, is the inflation rate, is the 2 percent target level of inflation, is the 4 percent rate of unemployment in the longer run, is the current unemployment rate, and is the ½ percent neutral real interest rate from the current SEP.

Yellen (2012) analyzed the balanced approach rule where the coefficient on the inflation gap is 0.5 but the coefficient on the unemployment gap is raised to 2.0.

The balanced approach rule received considerable attention following the Great Recession and became the standard policy rule used by the Fed.

The FOMC adopted a far-reaching Revised Statement on Longer-Run Goals and Monetary Policy Strategy in August 2020. The framework contains two major changes from the original 2012 statement. First, policy decisions will attempt to mitigate shortfalls, rather than deviations, of employment from its maximum level. Second, the FOMC will implement Flexible Average Inflation Targeting (FAIT) where, “following periods when inflation has been running persistently below 2 percent, appropriate monetary policy will likely aim to achieve inflation moderately above 2 percent for some time.”

While most of the attention following the Revised Statement focused on FAIT, the large rise in inflation in 2021 and 2022 has made that part irrelevant. The balanced approach (shortfalls) rule was introduced in the February 2021 Monetary Policy Report (MPR). The rule mitigates employment shortfalls instead of deviations by having the FFR only respond to unemployment if it exceeds longer-run unemployment,

If unemployment exceeds longer-run unemployment, the FFR prescriptions are the same as with the balanced approach rule. If unemployment is below longer-run unemployment, the FOMC will not raise the FFR solely because of low unemployment. We also analyze a Taylor (shortfalls) rule,

These rules are non-inertial because the FFR fully adjusts whenever the target FFR changes. This is not in accord with FOMC practice to smooth rate increases when inflation rises. During 2021 and 2022, the non-inertial rules prescribe unrealistically large increases of the FFR.

We specify inertial versions of the rules based on Clarida, Gali, and Gertler (1999),

where is the degree of inertia and is the target level of the federal funds rate prescribed by Equation (3). We set as in Bernanke, Kiley, and Roberts (2019). equals the rate prescribed by the rule if it is positive and zero if the prescribed rate is negative.

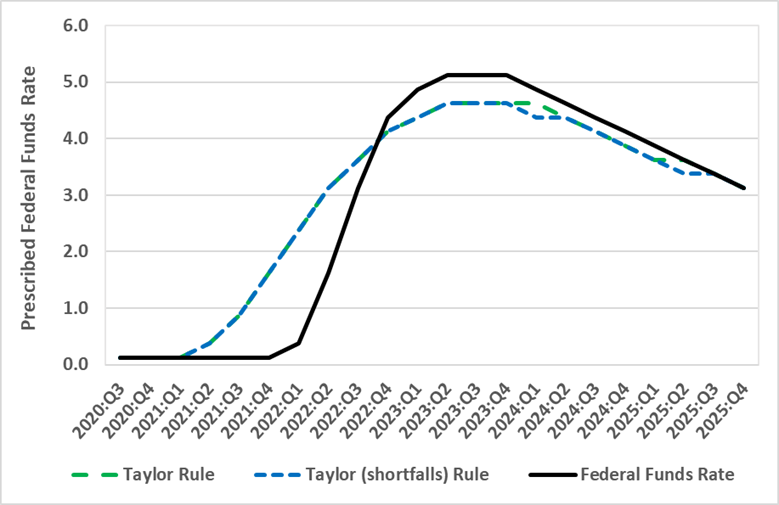

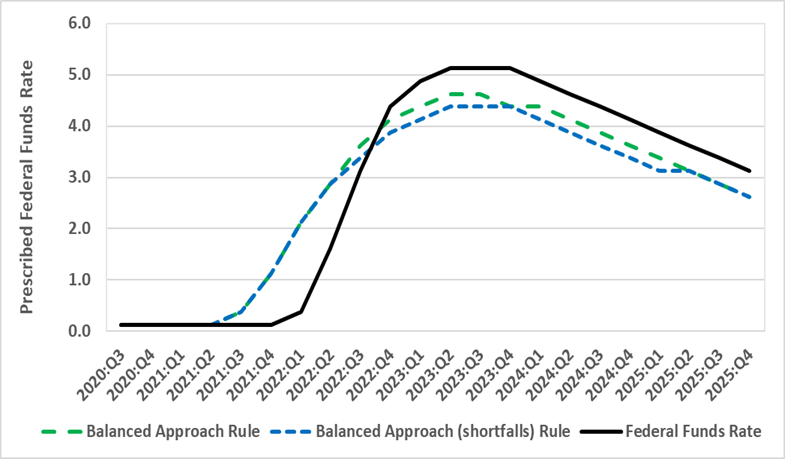

The figure depicts the midpoint for the target range of the FFR for September 2020 to December 2022 and the projected FFR for March 2023 to December 2025 from the December 2022 SEP. Following the exit from the ELB to 0.375 in March 2022, the FFR rose to 4.625 in February 2023 and is projected to rise to 5.125 in June 2023 before falling in 2024 and 2025.

Figure 1, Panel A: Inertial Policy Rules and the Federal Funds Rate – Taylor Rule

Policy rule prescriptions are reported in Panel A for the Taylor rules and Panel B for the balanced approach rules. Between September 2020 and December 2022, we use real-time inflation and unemployment data that was available at the time of the FOMC meetings. Between March 2023 and December 2025, we use inflation, unemployment, and real FFR in the longer-run projections from the December 2022 SEP.

Figure 1, Panel B: Inertial Policy Rules and the Federal Funds Rate – Balanced Approach Rules.

The FFR fell “behind the curve” when the prescribed FFR increased above the ELB in June 2021 for the Taylor rules and September 2021 for the balanced approach rules. The gap peaked at 200 basis points for the Taylor rules and 175 basis points for the balanced approach rules at the liftoff from the ELB in March 2022. As the FOMC aggressively raised the FFR, the gap narrowed to 25 basis points above the FFR in September 2022 for the balanced approach (shortfalls) rule and 50 basis points above the FFR for the other three rules.

We highlight two points illustrated in Figure 1. First, as described in more detail in the paper, the FOMC could have achieved the same increase in the FFR by September 2022 without resorting to 75 basis point rate increases by following any of the policy rules. Second, the balanced approach rules prescriptions are closer to the path of the FFR than the Taylor rules prescriptions.

The relation between the actual and prescribed FFR’s reversed in December 2022, as the FFR is 50 basis points above the prescribed FFR for the balanced approach (shortfalls) rule and 25 basis points above the FFR for the other three rules. For 2023 – 2025, the figure shows the FFR projected by the December 2022 SEP and the FFR prescribed by the policy rules using data projected from the December 2022 SEP. The gaps widen through December 2023 and then narrow as the FFR projections decrease.

The relation between the Taylor rule and balanced approach rule prescriptions also reverses with the December 2025 SEP, as the gaps between the FFR projections and the policy rule prescriptions are smaller for the Taylor rules than for the balanced approach rules. Starting in March 2024, the gaps for the Taylor rule narrow to 25 basis points and, between June and December of 2025, the Taylor rule prescriptions are equal to the FFR projections.

This post written by David Papell and Ruxandra Prodan.

By April, 2021, PCE Core was already above 3% after hitting the 2% target in March. Why the Fed did not start aggressively raising rates at that point is unexplained, but clearly it was a policy error that involved significant misjudgment. https://fred.stlouisfed.org/series/PCEPILFE#0

Follow mean trimmed pce.

Well, it was tacitly explained though flexible average inflation targeting:

https://www.stlouisfed.org/on-the-economy/2021/july/inflation-expectations-fed-new-monetary-framework

Under this framework, not only shouldthe Fed aim at running inflation above 2% for a period, but if inflation expectations are not elevated, it should be cautious in reacting to brief periods of above-target inflation. When Fed officials anticipated that inflation would be transitory, they were not alone.

Come back in June. Transition will be the rage. Because inflation will be called dead.

Could you share a link to YOUR public pronouncements at the time??

SNL does Trump’s visit to East Palestine, Ohio:

https://www.msn.com/en-us/news/politics/trump-makes-an-exhaustive-rant-for-the-ages-as-snl-spoofs-east-palestine-visit/ar-AA17WtGH?ocid=msedgdhp&pc=U531&cvid=e9881bece7a444d8b4adc4f6d7e4a0a9&ei=31

Worth the watch!

Rules are very useful (especially nonsense ones).

When “you” (i.e. current Fed Chair XYZ) are judged by two performance measures, but one performance measure is valued higher, as it effects the wealthy and TBTF banks more, a rule can become life’s manna. Because when you fail to perform on preventing inflation (because the levers you use are of zero use when inflation is caused by dysfunctional supply chain created shortages) you need something to point blame at so you don’t get blamed for failing in your job. The answer is “We used the standard policy rule, the Taylor rule (fill in orthodox economics policy prescription du jour of the month). You can’t be blamed for following “the rule” can you?? LFPR?? Doesn’t exist. LFPR is not to be discussed in polite company (see blog post above). They fell off the “actively hunting for shit job” list so they are no longer human. And inflation?? Well they “are behind the curve” and “if only they had acted faster” to F**k over people with higher rates they would have had supply shortages and American monopsonies solved way earlier.

That’s how orthodox economists can sell us all (notice I used the verb SELL, not tell) to “solve” supply chain dysfunction created by pandemic and long-standing American monopsonies~~~you take out your “magical rule” and raise rates!!! Problem solved!!!

I’m going to withhold other, more crude thoughts here. Related to the “taylor rule” and other “rules” effects on economists’ biology. Who knew ineffectual “rules” and equations could replace the blue pill?? Gives the rules one purpose outside of “publishing count”, so I guess that’s a positive.

Much obliged.

Off topic, Russian public’s view of Russia’s attack on Ukraine –

With China and Sachs both angling for locking in Russia’s territorial gains in Ukraine before Ukraine regains even more ground, it’s obviously time to assess some of the factors which make war sustainable for both sides. Russia is low on munitions, and China is testing the waters for supplying weapons. Ukraine is low on munitions, and so on.

Public support for the war, on both sides, is a factor in sustainability. The Center for Strategic and International Studies (CSIS) has taken a novel look at Russian public support for the war in Ukraine:

https://www.politico.com/news/magazine/2023/02/25/ai-russians-feel-war-putin-ukraine-00084145

This study looks at the persistence of effect of new rounds of pro-war propaganda in various regions of Russia. The authors note that polling is unreliable in authoritarian societies, so data from other sources is needed. Their finding is that new rounds of propaganda are losing their effectiveness, beginning around the start of mass conscription. Regions where conscription has been heaviest – regions with large ethnic minority populations far from population centers – are where propaganda is least effective.

The upshot is that public support for the war is waning, and waning fastest in less urban areas. What I don’t see in the article is any mention of the relative importance of urban vs rural support for the government. Anyone familiar with the basics of development economics, with ancient Rome bread provision, with France’s yellow vests, understands that urban unrest is more destabilizing than rural unrest. If Putin has arranged for the burden of was to fall most heavily on ethnic minorities and those far from urban centers, he has done so with an eye to his own survival.

My casual consumption of CSIS output leaves me with a question. I can’t tell whether they are balanced in their views, or all-in on punishing Russia. It is entirely possible that the best information and analysis leads to the view that the optimal policy is to devote big resources to weakening Russia now as a way of avoiding even greater cost later. I know CSIS is highly regarded for the quality of their work, and also that they claim to be devoted to maintaining the prominence of the U.S. So you can understand my curiosity in this particular case.

If anyone other than Johnny, ltr, the “anonymous” who is a Putin tool and others of their ilk have information on this question, I’d like to see what you’ve got.

I’ve never liked “CFR” which strikes me as a war-monger type outfit with douches like Richard Haas and David Rubenstein. Haas is always pounding the drums of war. But I don’t recall hearing anything particularly bad about CSIS. On the other hand, I have a great deal of respect for Brad Setser and he was connected to “CFR”. So I guess the answer is I really don’t know what the hell I’m talking about on this topic. You know, like usual.

“Haas is always pounding the drums of war.”

Almost every morning on Morning Joe. Every time they mention he wrote “The World A Short Introduction” I gag sort of like I gag whenever we have to endure some rant from Princeton Stevie boy. Hmm – I wonder if the two are related.

Speaking of “Our Man Friday”

https://www.cfr.org/blog/chinas-rising-holdings-us-agency-bonds

Whatever Setser was doing at the WH (personnel decisions??) it appears he is back at the place us blog maniacs most like him to be.

Thanks for the update. Setser is always a must read.

The great thing about Setzer is that he can write the scene-setting parts of an essay like that from memory. He has specialized in global flows since he was in 3rd grade. He know the history as well as anyone, and he mines data to educate himself and us – as he has done here. The man is priceless.

One obvious point which Setzer leaves out – and good for him – is the political environment. He doesn’t rub his chin over why China would be accumulating Agencies while shaking its fist at Washington. The simple answer is that China’s reserve policy is driven by economic policy, not foreign policy. As long as that’s the case, no need to fuss about the political environment unless some pundit breathlessly warns of China “selling all its Treasuries”.

As to Setser’s career moves, he was part of Biden’s transition team. I don’t know any details, but he, or they, may never have intended for him to stay.

Just wild speculation on my part, but I wouldn’t be surprised to see Setser invited back. Biden is beefing up his econ policy staff, reportedly with aneye toward dealing with economic fragility. Setser is an old hand. With international shocks and trade issues both high profile, he’d be a good hire.

Macroduck: Brad Setser was Counselor to USTR.

The reason why a globalist like Putin tried to take the Ukraine has little to do with the glory of Russia, but his band of globalists wanting control of Odessa to heighten their control of Europe. Putin’s problem is the flight of balto slavs is decimating his workforce up north. His manpower is less than what people think and his soldiers left outclassed. When Ukrainian soldiers move to the Crimean border, the end will be near.

Kosher Nationalism moved too slowly. Should have done it in 2018, but it was politically difficult.

The Fed followed the Taylor Rule before Taylor proposed it. See Henderson and McKibben.

Taylor said so, too. Thr rule was descriptive before it was prescriptive.

I bring our best-loved blog boob Bruce Hall a bulletin of bombastic blathering:

https://www.npr.org/2023/02/26/1159580425/newspapers-have-dropped-the-dilbert-comic-strip-after-a-racist-rant-by-its-creat

I imagine this “news” “shocks” Menzie as much as when poor Uncle Moses woke up and realized what a fruitcake Tulsi Gabbard was (Hey, I can’t help it if superficial hotness affects Uncle Moses’ character gauge sometimes). I’ll settle for a roughly .800 batting average.

Adams reacted to the new backlash on Twitter, saying he’d been canceled. Nearly 18 minutes into his YouTube show Saturday, he predicted, “Most of my income will be gone by next week … My reputation for the rest of my life is destroyed. You can’t come back from this, am I right? ”

Don’t you love it how this clown considers himself the victim? No Scott – you were the one who destroyed your “reputation”.

They like to walk that border. He probably even thought if he acted like a nutjob he’d have even more subscribers and followers. He sees Tucker Carlson and Megyn Kelly and the whole laundry list of fruitcakes, Tulsi Gabbard headed over to FOX. His problem is he’s not telegenic and newspaper cartoons are a dime a dozen, There’s people who can do “TV fruitcake” much better than him. His ending isn’t like Glen Beck’s where he’s got a safety net of illiterates. Bruce Hall probably barely gets 15% of the humor in the Dilbert. It leaves him with no audience,

The irony is, here’s a guy who made a living off of skewering corporate idiocy, and he doesn’t know kindergarten marketing “Know who your audience is” and until recently he had big crossover appeal.

As to Setser’s career moves, he was part of Biden’s transition team. I don’t know any details, but he, or they, may never have intended for him to stay.

Just wild speculation on my part, but I wouldn’t be surprised to see Setser invited back. Biden is beefing up his econ policy staff, reportedly with aneye toward dealing with economic fragility. Setser is an old hand. With international shocks and trade issues both high profile, he’d be a good hire.

How would the results differ if the Fed was freed of the employment mandate?

If the Fed was freed of the employment mandate, how would Fed policy have looked?

I see the employment mandate as a major source of instability, and I cannot help but thinking that the employment mandate is designed largely for the benefit of employers, not employees.