I keep on hearing this refrain from people like former senator Toomey (on Bloomberg TV today) that the 2018 deregulation had nothing to do with SVB’s travails; rather its problems (presumably also Credit Suisse’s too) was due to monetary and fiscal profligacy. I thought it would be useful to recap the path of expected interest rates.

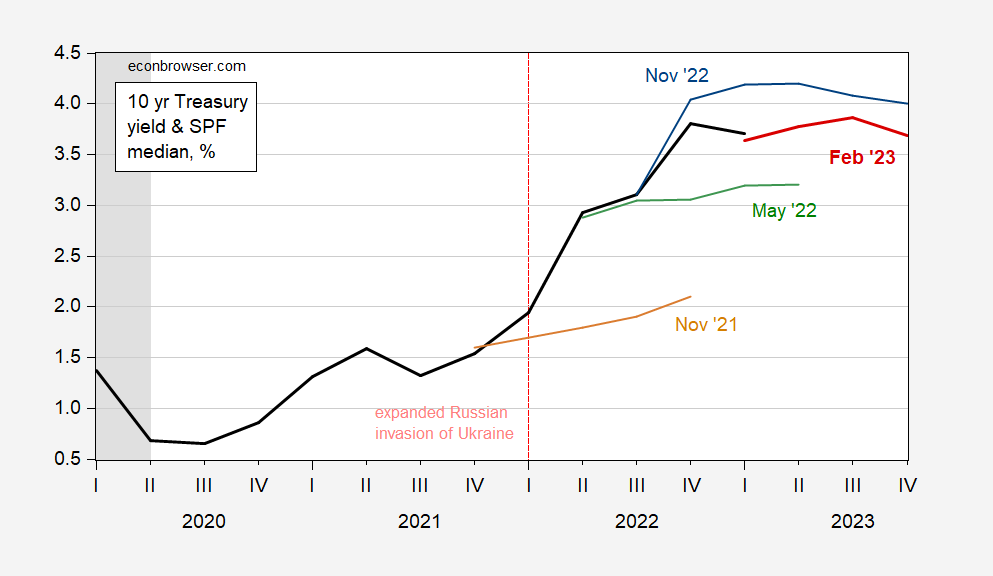

Figure 1: Ten year Treasury yield (black), and median forecast from February 2023 Survey of Professional Forecasters (red), from November 2022 (blue), May 2022 (green), and November 2021 (tan). 2023Q1 observation for data through March 15. Source: Treasury via FRED and Philadelphia Fed SPF (various), and author’s calculations.

While as of 2023Q1, the 10 year interest rate was 2.54 ppts above that forecasted in November 2021 – over a year ago – it is about half a percentage point below that forecasted in November of 2022.

In other words, even before the Russian invasion, banks should have expected a rise in long term bond yields. Certainly by May 2022, the forecast was such that the resulting surprise in Q1 was only half a percentage point.

Surely, had interest rates not risen so much over the past year, the SVB collapse might not have occurred so soon. But given the downturn in the tech sector, SVB (given not subject to annual stress tests, and liquidity requirements) would have probably encountered a run (Toomey’s assurances notwithstanding).

Toomey is rehashing the GOP play book. It is all Biden’s fault. Trump rules. Now one would hope Bloomberg TV would not have as its guest partisan morons but hey – Toomey and the other GOP spinmeisters are no worse than our usual trolls such as CoRev and JohnH. All politics – no economics.

Not working. SVB’s issues go back to 2019.

The risk must have been obvious to their (ex-)Chief Risk Officer, who stepped down in April 2022. Abandoning the ship before it hit the iceberg? What’s crazy is that the board did nothing to reduce the risk (by shortening their portfolio holdings) at any time in 2022.

It sounds like it was incompetence in top management (not listening to the Risk Officer) rather than incompetence in the risk management department. The good news is that such a level of incompetence is not likely to be a generalized phenomenon, even if it may still be found in other, currently solvent, banks.

Whether we like it or not the banking crisis created by the Fed has been solved by the Fed.

https://www.reuters.com/business/finance/feds-new-banking-backstop-could-slow-balance-sheet-drawdown-2023-03-15/

Banks can anonymously borrow money against their losing portfolio of long treasuries at par. No need to sell at a loss and reveal to investors and regulators that you are insolvent. Just kick the can a year down the road and hope the problem will be solved by then. I sure hope there are some harsh conditions restricting stock buybacks and executive bonuses, attached to that BTFP (Bailout To Fat Procrastinators) money.

I agree with the fed solution. I also agree with you, that banks who pursue this should have penalties to shareholders and management. it is not the fault of depositors.

What banking problem??? SVB was a short, pure and simple.

Boy do I have a bridge to sell to you!

Its really pretty 😉

You simply don’t get it. Wealthy concentration creates illusions

If you do not understand risk or hedging then this occurs. history tells us this does occur time after time.

Who knew investing in bonds was woke?

Interest rates are irrelevant. It’s the 100+ billion in debt Thiel used to finance crypto startups with management, is where the problem is at. Then he shorted a fake run by withdrawing 42 billion. In Ocelot metal gear solid explanation: “it was a nonexistent bank run, by a nonexistent crisis, Thiel engineered a loss by shorting the bank to make up for his crypto mess. You were all played….all made to believe.”

Interest rates are not relevant? Really??

When it comes to wealthy deposited monies into crypto, yup.

Yves Smith posted an interesting piece on how these bank failures are the result of having too many wealthy depositors…and how the Fed bailed the wealthy out. In 2008 it was the banksters, this time the wealthy…not that I’d expect anyone here to notice or be interested…

https://www.nakedcapitalism.com/2023/03/were-the-bank-bailouts-the-result-of-rising-wealth-concentration.html

When you have a cup filled up to the rime with 10 different liquids adding a drop of any of those liquids can be claimed to be “the reason” for the overflow – but is it?

If you have a favorite narrative, or grudge against one of those 10 liquids, you can always claim it is responsible – with enough evidence to convince yourself and ignorant minions – that’s how Faux “news” works. A multivariate model with 10 parameters may even be a little too much for the pros. So not surprising if there are so many people left swimming.

We may have to put “woke banking” into the model (as the 11’th parameter) but with an extremely low (say 0.001% ?) weight ?