Term spreads rising slightly, yields (nominal, real) down, and risk measures up.

One nominal rates have dived; real rates as well, suggesting the bulk of the movement is movement in perceived future economic activity.

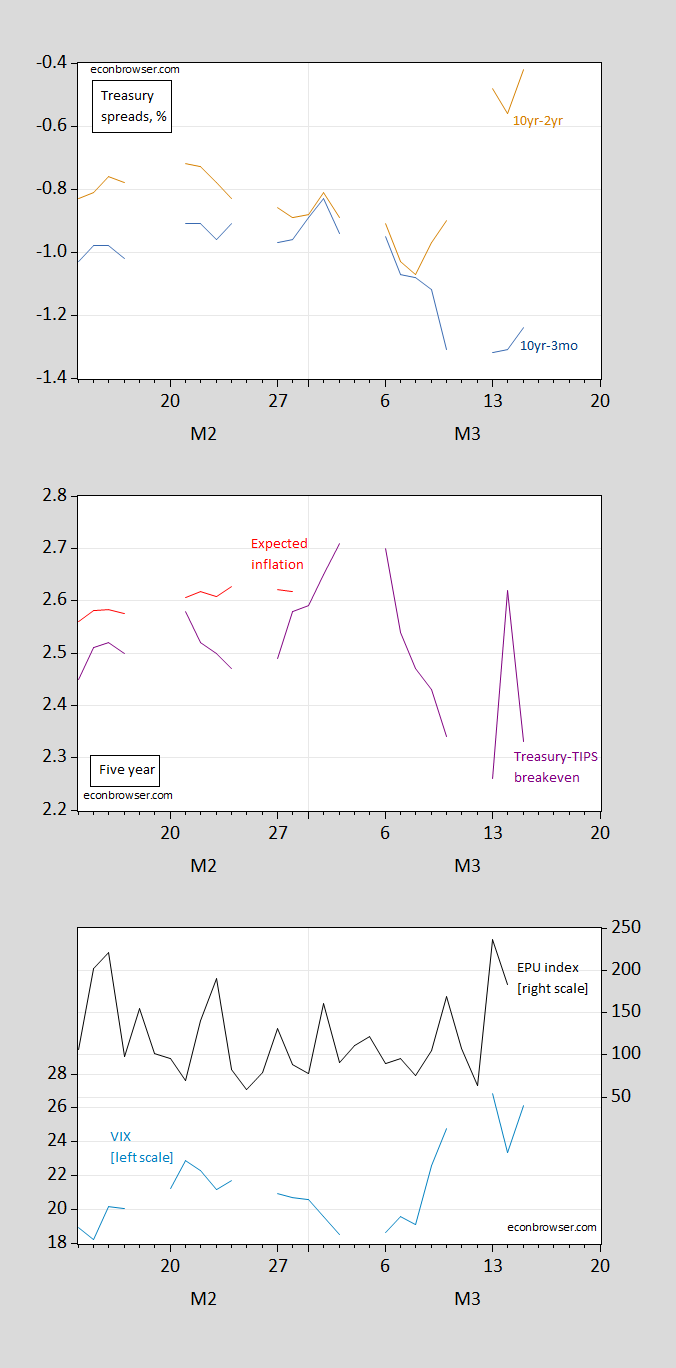

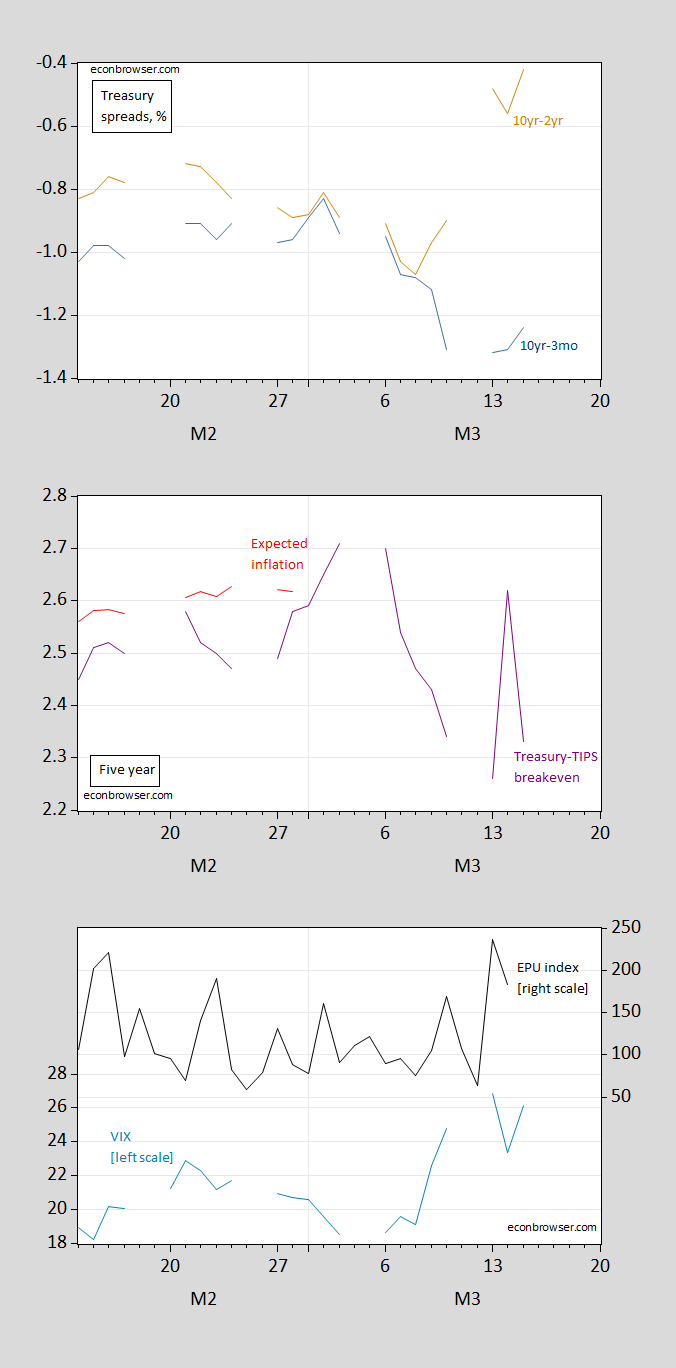

Figure 1: Top panel: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (tan), both in %; Middle panel: 5 year Treasury-TIPS spread (purple), 5 year spread adjusted for liquidity and risk premia (red); Bottom panel: VIX (sky blue, left scale), EPU (black, right scale). Source: Treasury via FRED, KWW following D’amico, Kim and Wei (DKW), CBOE via FRED, policyuncertainty.com.

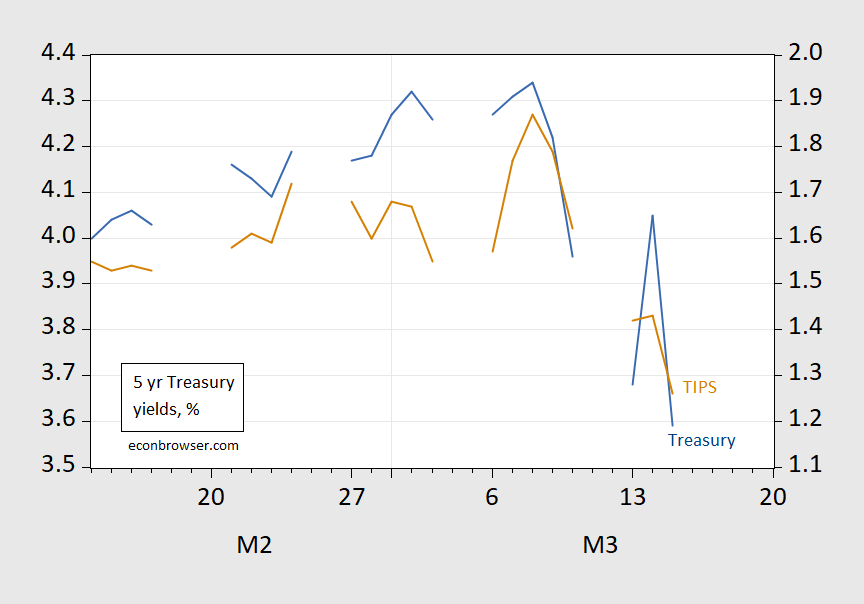

The five year yield dropped 46 bps today, while the two year dropped 27 bps. Real or nominal effects? Here’re the corresponding 5 year nominal and real rates.

Figure 2: Five year Treasury yield (blue), TIPS (tan), both in %. Source: Treasury via FRED.

Over the last week, nominal 5 year rate has fallen 75 bps, while the TIPS yield has fallen 61 bps. This is suggestive of a real decline — which of course could be driven by the outlook for the real economy, or by expectations of Fed policy tightness (see the previous post on the implied path of the Fed funds rate).

Or it means nothing. Investors have been out of touch for a year now. Too much Fed pumping and not enough real economy watching. Yeah, the sports media and high tech garbage is dying off……..so what. A lost investor base which’s long run elitist bubble has popped????? Things are changing menzie. The dollar standard is ending, globalization is over. The U.S. with enough Nat gas plants and building infrastructure for EV’s will give divorce papers to the middle east. East Asia will become hostile in full. No wonder Republicans are panicking. Their economic dream since 1979 is ending.

From early February till SVB’s crack-up hit the news, two year yields had risen by about 80 basis points, tens by about 60 bps. That was in response to a month’s worth of (probably distorted) data and a hawkish Fed chatter in response to those data.

Since the bank wobbles began, twos have shed about 100 bps, tens about 60 bps. One wonders if much of the wobble could have been avoided if Fed folk had said “We typically do not change our outlook on the basis of a single month’s data. More information is needed.”