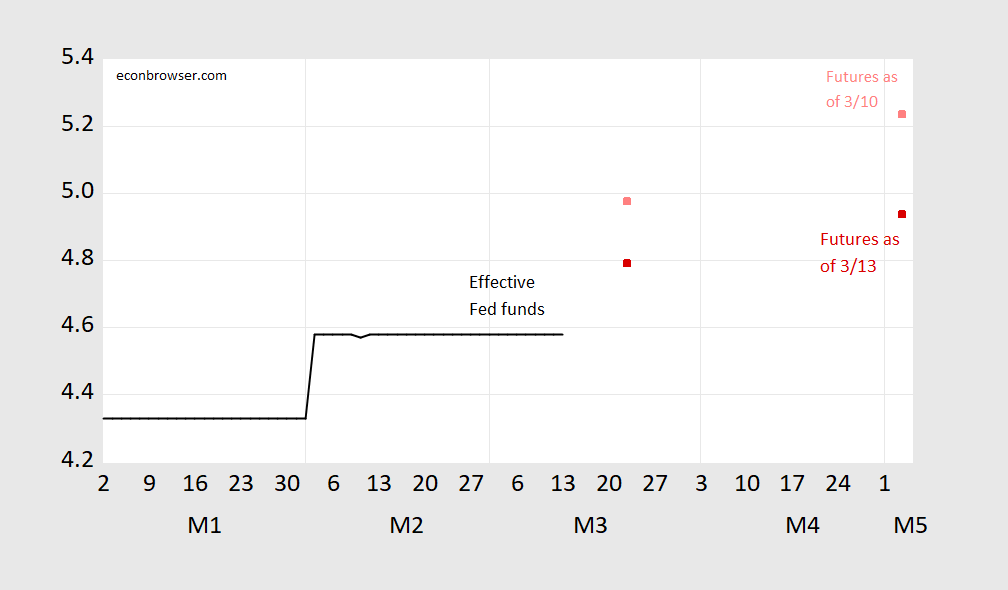

Comparing CME implied Fed funds for the March 22 and May 3 meetings shows a downshift, which seems attributable to developments surrounding SVB.

Figure 1: Effective Fed funds (black), CME futures implied as of 3/13 12:20CT (red square), as of 3/10 (pink square). Source: CME Fedwatch, accessed 3/13.

It is hard to imagine anything more breathtakingly mule-headed than simultaneously paying to make up losses at the same time they are actively undercutting the value of bank assets.

Well, don’t give out 100+billion to crypto crap, you wouldn’t have a problem. Stop with the Fed stuff.

Here are a couple of TIPS-based inflation expectation measures, not adjusted for liquidity:

https://fred.stlouisfed.org/graph/?g=118Ex

TIPS yields use CPI, not the PCE deflator, so subtract a couple of tenths. Inflation expectations are at the Fed target.

Is inflation headed up or down? Well, if one uses the Fed’s “preferred” inflation rate, the core PCE deflàtor, inflation is headed down. If you go looking for a narrower measure which is heavily weighted toward housing and utilities, the PCE services deflator, inflation is headed up:

https://fred.stlouisfed.org/graph/?g=118Fy

So if you want to hike rates, but the metrics the Fed has long relied don’t show hikes are necessary, pick the services deflator. And ignore the lagged effects of very aggressive rate hikes already in place. And ignore the expected direction of housing prices. And employ demand management tools to address supply-side poblems. And hand money to banks to make up for taking money from banks.

By the way, the largest banks are under more stringent balance sheet rules than other banks. During the Trump years, the threshold for more stringent rules was raised from $250 billion in assets to (if memory serves) $700 billion in assets. Silicon Valey Bank held $209 billion prior to the crunch, so would have dodged coverage under the old rules, despite being the 16th largest bank in the country. If a bank that held fewer assets than the older, lower limit can threaten the stability of the financial system, maybe we should edge that threshold back down again.

Gosh…… Is cowardly Jerome throwing the whole “It’s our mandate!!!” thing out the window?? I feel so letdown…….. All it took this whole time to shrug our shoulders on price gauging and supply chain created inflation was someone like Peter Thiel to lose his pants on a stupid investment.

Georgetown JD Jerome says: ” Joe Q Public loses jobs in the hundreds of thousands?? Ah, hahahahaha, F*ck him!!!! Let’s all have ice cream cones. Peter Thiel made a clusterf*ck decision that costs him money?!?!?!?!?! Oh God!!!! Oh God!!!! Oh God!!! The humanity…… !!!!!! Let’s lower rates 200bps tomorrow or the foundation of humanity will crater soon!!!! Oh God!!!!! Forgive me I have sinned against the “Masters of the Universe”!!!! Oh God!!! Oh God!!!! Save me from 1% hellfire!!!!! Why did my mother birth me!?!?!?! Waaaaaaaaaaaaaahh!!!!!”

Let’s get it straight on the Jerome Powells of this world. He is NO “technocrat”. He is an emotionally insecure child, looking to save his do nothing but flap my jaws job, at any cost.

Moses Herzog: I’ll just note that just because the market expects something does not mean it will come to pass. Moreover, Powell is Chair of the FOMC; you have to ask not only what he would want to do, but what the other voting members on the FOMC want to do in response to financial stress.

Now, if you want to argue the Fed overweights financial market interests relative to unemployment and/or inflation (or even over-weights inflation relative to unemployment), that seems like a more reasonable debate.

It was hard enough to have faith in them when Brainard was there, now that she’s gone to the WH…… Even though I am against raising rates here, and have been for awhile, if the FOMC (seven Board of Govs, whatever) were to decide not to raise rates at the exact juncture of the SVB failure, vacant of another (aside from SVB) clearly stated reason why not raising rates, it makes the drastic policy change a strong appearance that they have no idea what they are doing.

Which I suspect is the case anyway when FOMC is playing with demand levers to solve a supply/monopsony problem.

Sorry Uncle Moses, but you need to put the bottle down and put your thinking cap on.

The reason The Feds and the government have no choice but to stop a financial instability dead in its track is not to save Peter Thiel or other rich people. It is because a full blown financial crisis hurt everybody, including the million of workers who’s paycheck bounces and who’s mortgages, therefore, go unpaid.

If this was simply a case of letting a few rich bastards experience the consequences of their greed and risk taking I actually don’t think much would have been done. After all those rich bastards who hold stocks and bonds in those banks, right now are taking it on the chin with no Fed or government intervention.

The thing we hopefully will (but probably won’t) learn is that the Wall street masters and company CEO’s are more interested in the short term profits than the long term survival of a company. So companies that are essential for the function of society must be brutally regulated and controlled to avoid them doing harm to us. What the Fed and others should be blamed for is not the bailout but the lose control and regulation that allowed the banks to get into trouble in the first place.

Senator Elizabeth Warren knows banking:

https://www.nytimes.com/2023/03/13/opinion/elizabeth-warren-silicon-valley-bank.html

“No one should be mistaken about what unfolded over the past few days in the U.S. banking system: These recent bank failures are the direct result of leaders in Washington weakening the financial rules.

In the aftermath of the 2008 financial crisis, Congress passed the Dodd-Frank Act to protect consumers and ensure that big banks could never again take down the economy and destroy millions of lives. Wall Street chief executives and their armies of lawyers and lobbyists hated this law. They spent millions trying to defeat it, and, when they lost, spent millions more trying to weaken it.

Greg Becker, the chief executive of Silicon Valley Bank, was one of the many high-powered executives who lobbied Congress to weaken the law. In 2018, the big banks won. With support from both parties, President Donald Trump signed a law to roll back critical parts of Dodd-Frank. Regulators, including the Federal Reserve chair Jerome Powell, then made a bad situation worse, letting financial institutions load up on risk.

Banks like S.V.B. — which had become the 16th largest bank in the country before regulators shut it down on Friday — got relief from stringent requirements, basing their claim on the laughable assertion that banks like them weren’t actually “big” and therefore didn’t need strong oversight.”

The rest of this oped is a must read.

Yes.

Here’s the good news, after the horse is out of the barn. Stock options held by execs at risky banks just imploded. I assume many of these banks will have to raise capital, which is one reason their shares have tanked. Issuing share is “dilutive”, as they say in the business. This is where Mr. Shakespeare comes in so handy:

https://clickandtreat.com/wordpress/wp-content/uploads/2018/09/petard.jpg