Month-on-month PCE inflation was 0.2% below consensus (core 0.1% below).

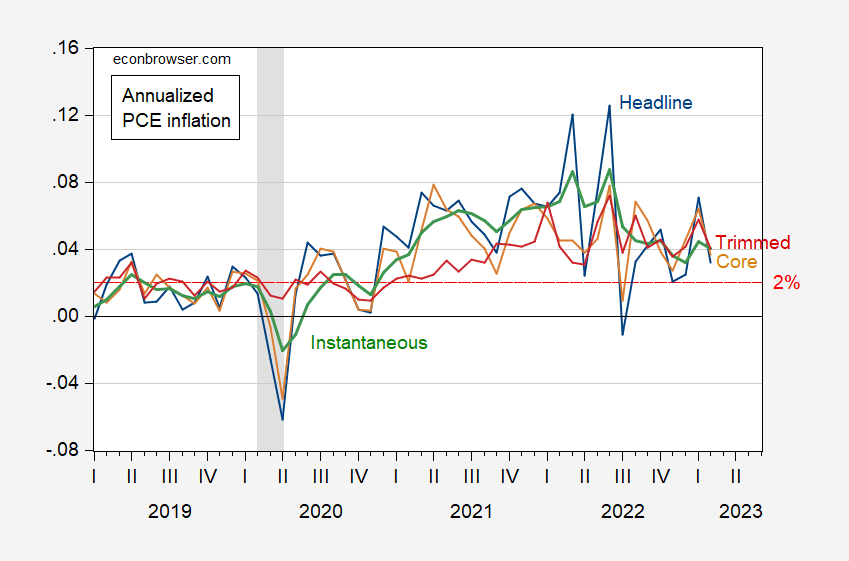

Figure 1: Month-on-month annualized PCE inflation (blue), core PCE (tan), trimmed PCE (red), and instantaneous PCE (T=12, a=4) (green). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, Dallas Fed via FRED, NBER, and author’s calculations.

Instantaneous and annualized trimmed PCE inflation at 4%; core at 3.7%.

Expected real rates positive. Actual real rates near zero!

Instantaneous and Trimmed met, back together, up in the treehouse. Do their parents know what is going on here??

expected real rates of inflation??

Sorry – real interest rates.

Yesterday was a long day as we had to argue with some Know Nothing who kept telling us that low interest rates were a horrible thing because if we pursued policies that would increase investment – then real wages would over the long-run. How does a rise in the capital to labor ratio lower real wages you ask? Uh – firms choosing capital intensive methods of production. Now guess who continues to confuse cause and effect?

Oh lest we forget – JohnH has this new theory that might explain why aggregate demand stays strong even with the higher interest rates from the FED. You see when Macroduck tried to tell JohnH that the cost of capital, JohnH rebutted that ‘hurdle rates’ for all companies are double digit – or something like that. Wow unless the FED doubles interest rates – we will all be fine. Good to know. And oh yea – that 1982 recession never happened.

Good one!

Stiglitz: “ First, low interest rates encourage firms to invest in more capital-intensive technologies, resulting in demand for labor falling in the longer term, even as unemployment declines in the short term. ” https://www8.gsb.columbia.edu/articles/chazen-global-insights/what-s-wrong-negative-rates

But true to his lying self, pgl attributes the quote to me. Apparently he’s afraid to confront Stiglitz and too lazy to take the subway and discuss it with him

You cherry picked and misrepresented what Dr. Stiglitz said. We have called out on this before so you know you are LYING. But it is worse than that – you are insulting Dr. Stiglitz by blatantly misrepresenting what he wrote for you retarded purposes. Yes – JohnH is the lowest and most disgusting scum ever.

Stiglitz: “ as real interest rates have fallen, business investment has stagnated. According to the OECD, the percentage of GDP invested in a category that is mostly plant and equipment has fallen in both Europe and the US in recent years. (In the US, it fell from 8.4 percent in 2000 to 6.8 percent in 2014; in the EU, it fell from 7.5 percent to 5.7 percent over the same period.) Other data provide a similar picture.

Clearly, the idea that large corporations precisely calculate the interest rate at which they are willing to undertake investment – and that they would be willing to undertake a large number of projects if only interest rates were lowered by another 25 basis points — is absurd”

This quote is entirely consistent with the other quote from Stiglitz. One of pgl’s usual tricks is to claim that someone misrepresented a quote…without bothering to elaborate on what the misrepresentation was.

Stiglitz point about large corporations’ investment plans being insensitive to changes in interest rates is entirely consistent with my own experience developing projects and new product proposals for a Fortune 200 company. It is also entirely consistent with the Fed paper I quoted below.

JohnH: I admire Stiglitz’s work (and contra you I suspect, I know the man and his research), and here I think he is allowing for collateral constraints to affect fixed plant and equipment investment as much as — or more — than the user cost of capital, which is dominated by the real interest rate. The problem with making a simple correlation of investment with interest rates is that they are affected by a joint (omitted) variable, that is the likely profitability of a unit of capital. More concretely, demand for credit is low typically when the profitability of investment is low, so that low investment shows up when there are low interest rates.

“he’s afraid to confront Stiglitz and too lazy to take the subway and discuss it with him”

No troll – I did notify Dr. Stiglitz of how you have utterly misrepresented his paper from 7 years ago. First of all he does not read this blog but he told me if he did – he would have to call you out for your disgusting misrepresentations of what he wrote.

Yea – we agreed that you are beyond stupid and dishonest. You are truly a disgusting worthless little boy.

The real concern of Stiglitz that our disgusting liar will not own up to:

The small and medium-size enterprises (SMEs) that are willing to borrow couldn’t get access to credit before the ECB went negative, and they can’t now. Simply put, most firms — and especially SMEs — can’t borrow easily at the T-bill rate. They don’t borrow on capital markets. They borrow from banks. And there is a large difference (spread) between the interest rates the banks set and the T-bill rate.

Now as Tbill rates rise and this spread persists, SMEs will find the credit they need to be even more expensive. But Jonny boy pretends his is the friend of the SMEs as he cheers for even higher interest rates?

Yea Jonny boy has so misrepresented what Stiglitz was saying it is beyond the pale. JohnH – serial lying and disgusting little scum who has forfeited any right to opine on what Stiglitz has really said.

SMEs’ lack of access to credit was only one of Stiglitz’ points.

Pgl is making his usual attempt at distraction and diversion from Stiglitz’ other point about large corporations’ investment plans being insensitive to changing interest rates. Talk about cherry picking!

Dr. Chinn notes his other point: “demand for credit is low typically when the profitability of investment is low, so that low investment shows up when there are low interest rates.”

Now if you are saying the economy is weak right now and profitability is low, then you are capturing what Stiglitz said. Oh wait – even you have noted profits are high which means you are blatantly misrepresenting his message. Like I said – you are a disgusting lying troll.

Stiglitz: “ First, low interest rates encourage firms to invest in more capital-intensive technologies, resulting in demand for labor falling in the longer term, even as unemployment declines in the short term. ” https://www8.gsb.columbia.edu/articles/chazen-global-insights/what-s-wrong-negative-rates

But true to his lying self, pgl attributes the quote to me. Apparently he’s afraid to confront Stiglitz and too lazy to take the subway and discuss it with him

Personally I’ll accept Stiglitz wisdom any time over pgl’s garbage.

But you turned this into a long-run proposition which I have already noted flunks growth theory 101 as in the Solow growth model. Look Jonny boy – it is OK that you are so incredibly dumb but damn to blatantly misrepresent a Nobel Prize winning economist’s writing this way? You have no soul. A bottomless pit of stupidity and dishonesty.

“I’ll accept Stiglitz wisdom”

But you haven’t. You took what he wrote in 2016 during a depressed economic situation and tried to bootstrap it to the current full employment situation. As dishonest as it gets and highly to Dr. Stiglitz. But yea – you are a lying scumbag.

“ A fundamental tenet of traditional theories of investment and monetary policy transmission is that interest rates are a critical determinant of business investment expenditures. Yet, a large body of empirical research offers mixed evidence, at best, for substantial interest-rate effects on investment. We examine the sensitivity of investment plans to interest rates based on surveys of CFOs during the recent economic recovery. We find that most firms claim their investment plans to be quite insensitive to decreases in interest rates, and only somewhat more responsive to interest rate increases. CFOs most frequently cited either ample cash or the low level of interest rates as reasons for lack of sensitivity. In the cross-section, we find that insensitivity to interest rate changes tends to be most pronounced among firms that do not indicate financial constraints as a top concern and firms with no near-term plans to borrow. Perhaps more surprisingly, investment is also less interest-rate sensitive at firms expecting higher year-ahead growth. These findings appear to be consistent with survey data on the “hurdle rates” firms report using to make new investments decisions: the average reported hurdle rate has hovered near15 percent for decades, despite the downward trend in market interest rates. Moreover, firms expecting to grow more tend to have higher hurdle rates, suggesting a possible connection between interest rate insensitivity and high hurdle rates.”

https://www.federalreserve.gov/econresdata/feds/2014/files/201402r.pdf

Faulty fundamental tenets of traditional theories of investment and monetary policy transmission sure do die hard, particularly when economists know nothing about how corporations decide on making investments.

But you can count on pgl will use any specious theory in order to justify lower interest rates to boost the value of his stock portfolio.

Hurdle rates of 15%? Do you even know how to estimate a hurdle rate? Didn’t think so since you can’t even be bothered with my challenge to you to estimate this for TSMC.

But surveys of CFOs? I thought you said they were not involved in these decisions. Oh yea – you as the janitor for your Fortune 200 company decided these things, which is why the company went bankrupt.

A hurdle rate is not calculated. It is a target. And, as the Fed paper notes, a 15% hurdle rate has been common for many years.

Pgl just shows his total ignorance of the corporate investment by claiming that hurdle rates are calculated and readjusted with any frequency.

“A hurdle rate is not calculated.”

A new candidate for the dumbest comment ever. I figured you’d duck my challenge and you did.

This idea that the “hurdle rate” is 15% for all companies for all time has to be the dumbest thing I have ever heard. I guess the risk premium rises when the risk-free rate falls in your stupid little world. Or the risk premium is greater than 10% regardless of the nature of the firm’s operations. Never mind the volumes of empirical work that has established the cost of capital for various industries. For example:

Companies that lease assets and companies that are regulated energy providers consistently have a risk premium of only 2%.

Now beer manufacturers face more systematic risk so their risk premia are generally seen as 4%.

Then we have semiconductor fabs such as TSMC which face a lot of systematic risk but even for them the risk premium is 6% not 10%.

But little Jonny tells us to forget all of that as he knows that the hurdle rate must be 15% regardless. How does he know? Oh yea – he served bagels one day when the CFO of his former Fortune 200 company was talking about the cost of capital for a firm that later went bankrupt because management was stupid.

CFOs are deeply involved in financing investments…once the product or project has been approved. Clearly they understand how the decision was made, even though they were not a part of the approval process itself, except at Board approval.. Finance managers at the division level are responsible for assuring that project and product proposals are sound financially and meet corporate hurdle rates. Corporate finance also establishes guidelines to assure consistency across divisions.

What pgl completely misses is the fact that many corporate investments are extremely time sensitive. Missing the market window for a new product can be devastating. Investments simply can not sit in a file cabinet waiting for a favorable rate environment.

This from the janitor of a former Fortune 500 company that went bankrupt. I guess you were in those meetings as someone had to serve the bagels.

I can only imagine how this worked at the former Fortune 200 company Jonny boy worked for. A bunch of know nothings like Jonny sitting around the table just randomly picking made up numbers which the CFO averaged. They finally get to a young guru who had done a careful analysis based on actual financial economists which indicated a cost of capital = 10%.

Jonny but pipes in how this guru is nothing more than an uncaring egghead and how Jonny boy likes the number 20%.

The CFO bored with these rantings by concluding the meeting by declaring the hurdle rate will be 15%.

And this is why Jonny’ former Fortune 200 company went bankrupt.

“Missing the market window for a new product can be devastating. Investments simply can not sit in a file cabinet waiting for a favorable rate environment.”

Little Jonny boy just made the case that higher interest rates may discourage investments today. But little Jonny boy is too stupid to grasp the implications of his own babbling. Go figure!

I have found the least convincing aspect of Modern Monetary Theory (MMT) the belief that investment is insensitive to interest rates – but the frb says maybe I am wrong.

That was a single paper by a couple of people who worked for the FED. It was not endorsed by the entire FED even if little Jonny boy says so. And yea MMT is rather junkie.

I am not always good at finding these things, graphed side by side. I assume FRED would be the place to look. But the obvious way to know is create/find a graph of consumption tied directly to investment levels, and create/find a graph of investment levels tied directly with interest rates, and see which one lines up better. I don’t think the answer is as clear as orthodox economists would have us believe. They might even start openly crying, as it messes up some of the assumptions they need for their equations.

I might add, when you look at how orthodox economics bought “hook line and sinker” Milton Friedman’s Monetarism, unlike Menzie would have us believe~~just because the vast majority of orthodox economists state something as “known fact” doesn’t mean it’s the case. And we can find examples of this in the history annals of hard science, much less social science.

https://artsonline.uwaterloo.ca/rneedham/sites/ca.rneedham/files/needhdata/documents/CollapseofMonetarismdelivered.pdf

[ I was going to see if I could annoy the hell out of Menzie and see if I could find some Jeffrey Frankel authored papers from the 1970s where he supported Friedman’s monetarism, but I couldn’t quite do it without feeling guilty. It’s like slapping your kindly grandpa in the face after he took you on a bunch of steam train rides. ]

pgl: “Actual real rates near zero!”

You are going to have to explain what you mean by “near zero.” Real rates for TIPS and I-bonds are positive right now.

“…particularly when economists know nothing about how corporations decide on making investments.”

Good thing economists know how corpordecisions are made.

More of Johnny’s trick of argument by assertion. By theway, Johnny, I’m still waiting for you to tellewhere I work. You claimed to know – let’s have it.

So Ducky, did you actually read the paper on large corporations investments being insensitive to changes in interest rates? Did you know that?

I tried to explain that to you on an earlier thread, because clearly you did not understand how corporations make investment decisions. But I’ll concede that perhaps there are good economists, like Stiglitz and those who wrote the paper at the Fed (cited here) who understand how corporations make project and product investment decisions.

BTW, why don’t you tell me where you work?

OK – which former Fortune 200 company did you work for and send into bankruptcy. No one calculates hurdle rates? Lord – you are STUPID.

You claimed to know where I work. You either know or you lied. So which is it?

And there you are, striking a pose – Johnny mansplains investment decisions. More dishonesty. You’ve repeatedly demonstrated that you rely on quotes you like – often without understanding them – rather than your own knowledge.

So come on, prove you’ve nailed me. Name my employer. You claimed to know that I work in the financial sector. Name the firm, you lying little weasel. Heck, I’ve had a long career – you should be able to name a handful of firms. No wiggling out of it.

You have an ethics problem, boy. You back Putin’s war in Ukraine. You lie all the time, about economists, about commenters here, about data when you bother with data at all. Your entire approach to argument is slime.

Jonny wants you to read a paper that surveyed a pack of CFOs who are likely as stupid as Jonny boy. After all – they just guess that the cost of capital is 15% when most financial economists would put at 10% or less. Then again – little Jonny boy never learned basic finance.