After last week’s financial turmoil, but before the CS/UBS deal, real rates and inflation breakevens were down, while risk and uncertainty indicators were up.

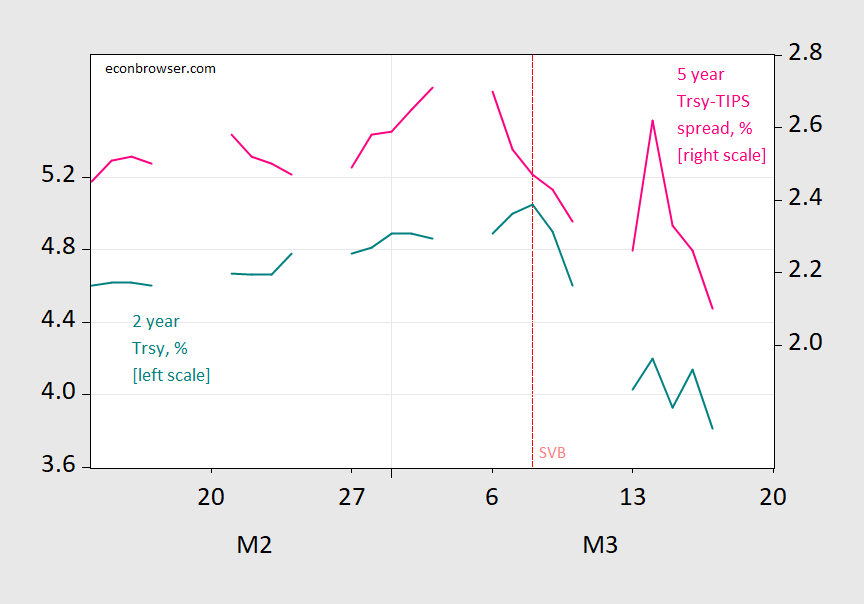

Figure 1: Two year Treasury yield (teal, left scale), and 5 year Treasury-TIPS breakeven (pink, right scale), both in %. Source: Treasury via FRED, and author’s calculations.

Note that the nominal Treasury yield has fallen as expected inflation (ignoring risk and liquidity premia). Note that five year TIPS have fallen about half a percentage point since the SVB drama unfolded.

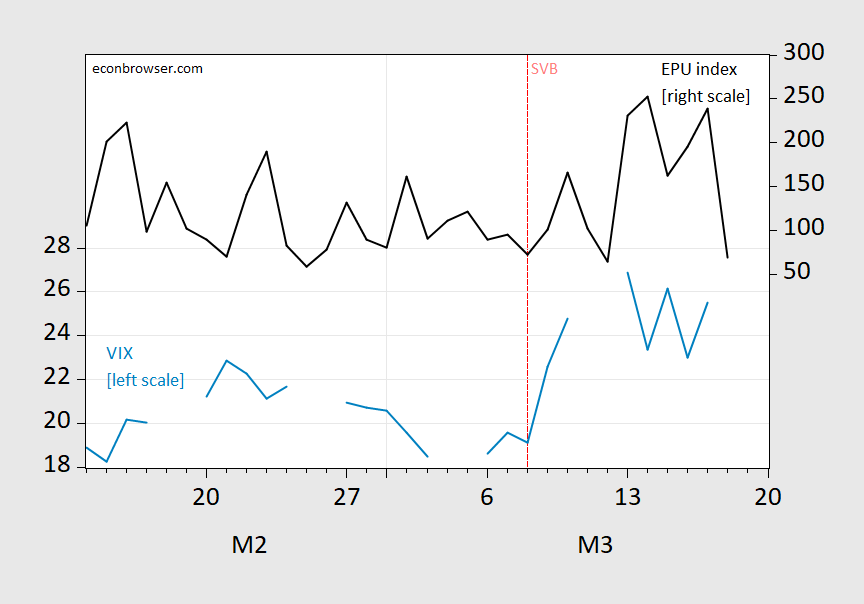

Figure 2: VIX (sky blue, left scale), and Economic Policy Index (black, right log scale). Source: CBOE via FRED, policyuncertainty.com.

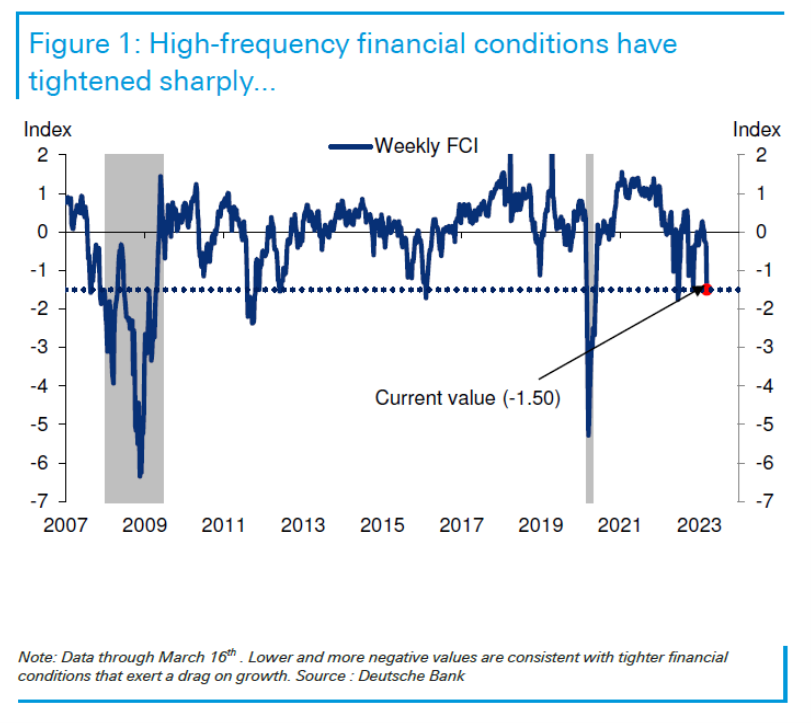

Financial conditions have tighted considerably, so much so that the market has delivered what the Fed might’ve through funds rate increases. From DB, Friday, for data through the 16th.

Source: DB, Where’s the stress? 17 March 2023.

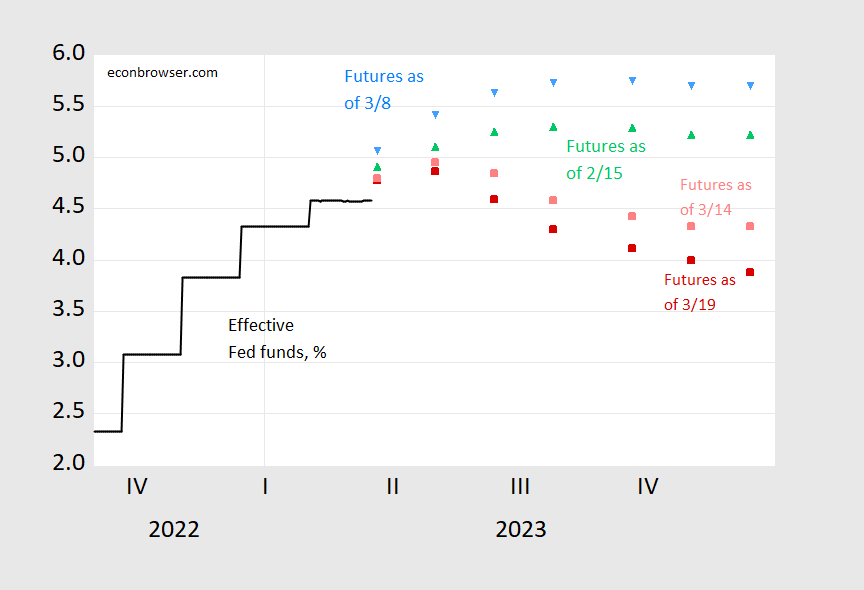

And indeed, the Fed funds path as perceived by the market is now downshifted.

Figure 3: Effective Fed funds (black), implied Fed funds as of March 19 4:30CT (red square), March 14, 1:30 CT (pink square), March 8 (sky blue inverted triangle), and February 15 (green triangle). Source: Fed via FRED, CME Fedwatch and author’s calculations.

Implied Fed funds year-end rates now 1.8 ppts lower than they were 11 days ago…

WWGCS – what would Gregory Chow say?

Econned: Well, the Gregory Chow I’ve met probably wouldn’t say much, based on his academic work.

I’m sure someone here is going to “enlighten” me but that seems a strange as hell question to ask out of the blue.

Just curious, are the maga bozos blaming wokeness on the credit suisse failure? Or are we back to the standard “it’s biden’s fault” refrain again? The stooopidity of it is all so confusing these days…

They are over using that term to nonexistence. FYI, it’s a term started by a certain brand of black activism(which many black nationalists hate). Republicans, founder fund via your financier Peter Thiel brought many many deposits to SVB. It’s something your going to be gaslighted on. Like most of the idle rich, crypto were the big thing. It’s why their traditional banking model was replaced by financing crypto startups. Yes, crypto is indeed very “woke”.

ask a conservative to define woke. it is clear these conservatives are full of angst, but not quite sure who to blame. so they blame wokeness.

https://www.cnn.com/videos/politics/2023/03/19/woke-debate-conservative-author-struggles-to-define-ip-sot-vpx.cnn

it has become a term of generalized griping. they don’t even know what it is they are complaining about. but what do you expect from the party of no. it is a vague concept of discomfort, but not quite sure why, in the minds of conservatives. what a joke.

Both are fun! Why choose just one?

This isn’t exactly whataboutism, but it’s analogous. In employing whataboutism, the point is not to mount a coherent argument, but rather to distract from the other guy’s argument. Whataboutism is a pretty reliable indication that the other guy’s argument is a good one. Notice how often Johnny resorts to whataboutism.

Here, the trick is to appeal to low-brow MAGA bros by saying “It’s Biden’s fault” and to middle-brow finance bros by saying “regulation BAD, ’cause Hayek!” and that way the “finance is too dangerous to run around off its leash” argument will be muted. Because it’s a good one.