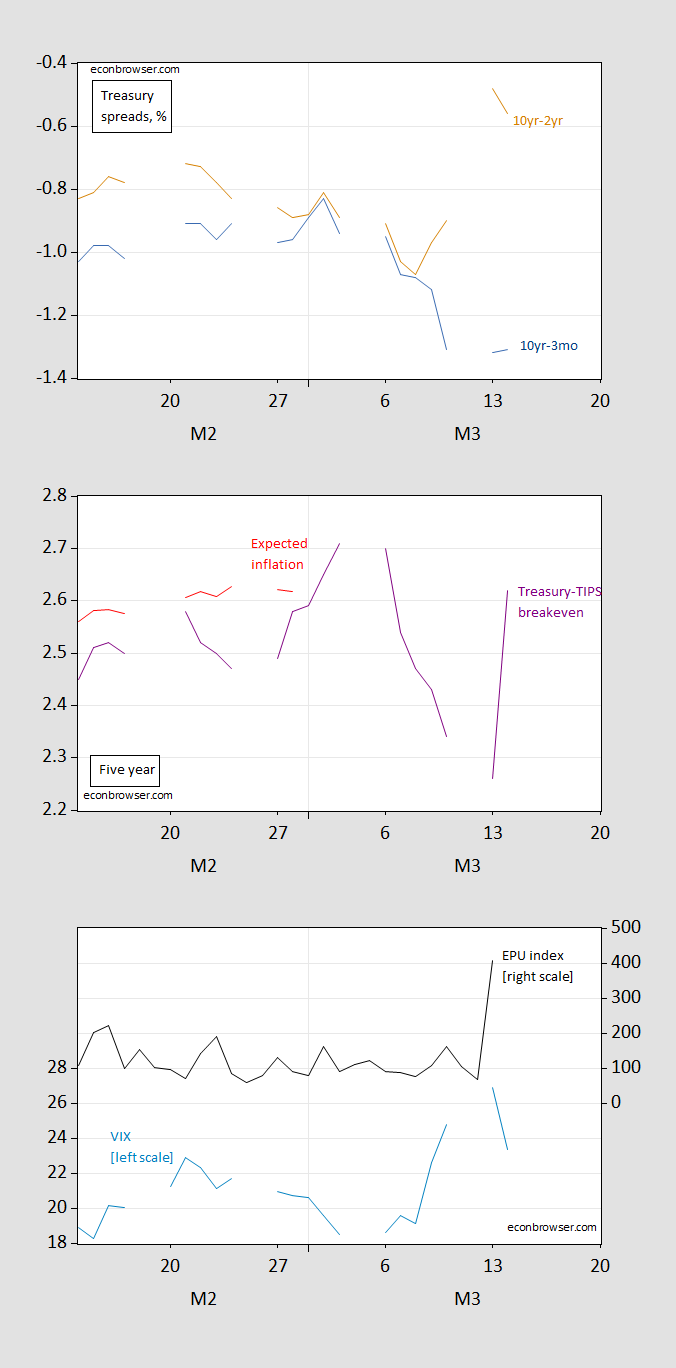

Five year Treasury-TIPS breakeven rises. EPU up on 13th, VIX down (but still elevated) today. 10yr-3mo spread remains very negative.

Figure 1: Top panel: 10yr-3mo Treasury spread (blue), 10yr-2yr spread (tan), both in %; Middle panel: 5 year Treasury-TIPS spread (purple), 5 year spread adjusted for liquidity and risk premia (red); Bottom panel: VIX (sky blue, left scale), EPU (black, right scale). Source: Treasury via FRED, KWW following D’amico, Kim and Wei (DKW), CBOE via FRED, policyuncertainty.com.

Michael Hudson’s explanation of what happened at SVB: “ For Silicon Valley Bank, it turned out that they gambled to make a capital gain by buying long-term Treasury bonds, whose interest rates were being raised sharply by the Fed’s tightening. The bank expected that the Fed couldn’t keep rates high without bringing on a serious recession – and indeed, Fed Chairman Powell said that a recession was indeed what he wanted.

But instead of lowering interest rates, Mr. Powell announced that not enough American workers were unemployed, so he planned to raise interest rates even more than he had expected to. Interest rates rose, and bond prices fell. SVB “was left sitting on an unrealized loss of close to $163bn – more than its equity base. Deposit outflows then started to crystallize this into a realized loss.” (Huw van Steenis, “History can instruct us on the fallout from SVB’s collapse,” Financial Times, March 13, 2023.)

Banks across the country were losing deposits sharply. This was not a “run on the banks” resulting from fears of mismanagement. It was because banks have behaved in so selfish and greedy way that as they have made soaring profits on rising interest rates – the rates they charge borrowers, and the rates yielded by their investments – they have been paying depositors only about 0.2%. Banks were acting as monopolies, together refusing to pay depositors a fair rate – but their monopoly did not extend to control of the U.S. Treasury.The result is a widening gap between what investors can earn by buying risk-free Treasury securities – about 4% — and the pittance that banks pay their depositors. So depositors were taking their money away from the banks to earn a more fair market return elsewhere.”

https://www.unz.com/mhudson/why-the-bank-crisis-is-not-over/

Depositors are now in the same position as workers a year ago—to keep up with inflation, workers had to get a new, higher paying job…and depositors had to find a new bank. Yet even with brokered CDs now yielding around 5%, they are still losing money in real terms, as inflation stands at 6%. Bond investors are doing even worse. But at least banks still holding bonds can hope that they appreciate when interest rates eventually fall…if they can withstand the flight of depositors long enough to avoid having to sell bonds and book the losses. It didn’t work out for SVB.

Is this true for SVB – that those tech companies took their money out to place it into treasuries instead?

I can see that happen for some banks, and they are beginning to respond with raising short CD and high-yield checking account rates to 3-5%. But if they have locked up money in long term treasuries they will be working with a negative spreed – unless they have insurance against rate increases.

Someone pointed out that there are two pots banks can place treasuries into. One is long-term holdings which can be marked to maturity, the other is short term holdings which has to be marked to market. The killer is that if a bank sell just a single bond from the long-term holdings it must move everything from the long term to the short term pot, and mark it all to market. So even as we all complain that they are making a killing with those zero point something rates, some of them may actually be slowly killed or hanging by their nails if they give rates much higher than that. They can either kill their capitalization by beginning to sell long treasuries marked to maturity or kill their balance sheet by giving depositors a fair market rate. By allowing Banks this “mark to maturity” gimmick, they are allowed to pretend solvency and profits that are not real. By forcing them to suddenly mark everything to market we make sure that they will fall off a cliff rather than slide down the mountain.

“Is this true for SVB”.

Let’s make this easy. ANYTHING Ubertroll JohnH writes is never true. Regardless of the topic.

The low rates on deposits while CD rates were at market is simply market segmentation. If depositors aren’t rate-sensitive, why give them good rates? CDs can bring in whatever additional deposits are required. And CDs aren’t as subject to runs.

Banks were also using broker CDs, which were the first to reflect higher market rates. I assumed when this first became a big deal that banks didn’t want to show higher CD rates to their depositors. That only works for a while, though, and you have to pay vig to brokers for their CDs, so banks eventually offered better CD rates, themselves.

Ah yes, screwing bank customers over because many small savers don’t have access to brokered CDs. It’s the American way, something to cheer.

Ivan—does it matter whether depositors from SVB invested in treasuries or in something else? What mattered was that that they fled.

What also matters, per Hudson, is that “ Banks across the country were losing deposits. This was not a “run on the banks” resulting from fears of insolvency. It was because banks were strong enough monopolies to avoid sharing their rising earnings with their depositors. They were making soaring profits on the rates they charge borrowers and the rates yielded by their investments. But they continued to pay depositors only about 0.2%.”

I would even venture to guess that some economists would applaud this—if you make saving unattractive enough, people will prefer to spend their money rather than watch it lose purchasing power sitting in a bank account. Wouldn’t this would boost retail sales and GDP? I mean, what could go wrong?

If you want to understand SVB in order to prevent a repeat it matters a lot WHY/WHERETO depositors fled.

If you want to understand why “Banks across the country are losing deposits” you also want to know where those deposits are going. Whereas the presumption that money will go where it gets the highest return is logic; it is also proven again and again that reality defies logic when it comes to money. If money did indeed flee the banks, then you are wrong that “banks were strong enough monopolies”. The banks that are in trouble are not the ones giving depositors 0.2% and lending out at 5-8%. It is the ones who locked themselves into long treasuries and have to sell at a loss to deal with outflows that they cannot afford to stem by competing for additional deposits.

However, the Fed just bailed them all out by offering banks to use treasuries (and MBS) as collateral at par. So they can weather the storm for the next year by acting as if their depreciated assets have not depreciated at all. I just hope that Banks who do that, are forced to stop stock buybacks and bonuses, until they exit that lending facility.

it seems contradictory to simultaneously say banks have underwater assets but should be paying out more interest to depositors. You might want to think that through from the position of the banks.

Good point but to your sage advice “You might want to think that through from the position of the banks”. Thinking things through has never been anything JohnH ever does.

But having read Hudson’s rantings more carefully that UberIdiot JohnH did – Hudson never said depositors were getting 4%. No – the figure he used was only 0.2%. Yea – little Jonny boy has yet to pass preK reading.

The SVB problem was not they paid too much on their liabilities. The problem it appears to be that it had a lot of uninsured deposits and people freaked when their already thin amount of equity might be sufficient to make up for a fall in the market value of their assets. But of course, we adults are talking about actual financial economics which is WAY OVER Jonny’s little head.

Yes, thinking through the position of banks, which started recording record profits in 2013: “ Banks Making Record Profits Again While Consumers Still Have Losses!” https://www.forbes.com/sites/sharding/2013/06/01/banks-making-record-profits-again-while-consumers-still-have-losses/?sh=72a011446c49

Yes, banksters are such sympathetic parasites, which is probably why pgl hearts them and has even gone so far as to deny that they made record profits back then! And he was the first to defend Obama’s DOJ giving banksters a get out of jail free card. As usual, he will vehemently deny this, though there is ample proof over at EconomistsView.

Yes, “ it seems contradictory to simultaneously say banks have underwater assets but should be paying out more interest to depositors.” Yes, that’s the conundrum, particularly if a bank’d deposit base consists primarily of “hot money,” large depositors who will chase better returns elsewhere. If they have mostly small depositors, they can continue to screw them over with 1% returns, though even that deposit base will dwindle as people taptheir savings to maintain spending even as inflation reduces their purchasing power.

I am going to leave this here for everyone to chew on: a two tier banking system such as the US has now is inherently unstable.

Here’s why. Consider two regulation scenarios:

Scenario 1: All banks are Not too Big to Fail.

Scenario 2: Tier 1 banks are Too Big to Fail.

Tier 2 banks are Not too Big to Fail.

I am a large commercial depositor at a Bank that is Not too Big to Fail. I hear rumors that my bank may be vulnerable to failing.

Under scenario 1, I move my funds to a more conservative bank. Under scenario 2, the solution is easy: move my funds to a Tier 1 bank.

Under scenario 1, contagion is relatively limited to only those banks similar in profile to the original vulnerable bank. Under scenario 2, contagion is immediately endemic to all Tier 2 banks. And that is what was feared could have happened this week had Treasury not intervened: there would have been a massive run on all Tier 2 banks.

Treasury intervention has not solved this problem.

Absolutely right. You can see this effect in deposit flows so far this week.

One perspective on this issue has to do with industry structure. Do you want only banks which are large enough to create systemic risk, and which are put under stringent prudential supervision, or do you want more banks, creating more competition, with the problem of deposit runs at non-TBTF banks?

One solution is universal deposit insurance, which is what has been instituted now, on an emergency basis. Another is increased prudential regulation of any bank which takes large deposits above a small share of total deposits – essentially creating a class of bank which sheds business deposits as soon as a business grows large enough to have deposits above the insured limit.

Pick your risk – more small runs or more systemic risk. Then decide on a structure, in the knowledge that any structure you aim at won’t be the one you get. An proposal with a libertarian sound to it is nuts. Any proposal claiming more banking means a better economy is socialism for the rich. Finance should be a handmaid to the economy, not its master.

We need FDIC to act more like a real insurance company – and lets take the stress tests away from the Fed and give it to FDIC. If FDIC is going to backstop most banks they should also do an extensive stress test of them for all possible stress scenarios. The cost of the backstop should be dependent on the risk the banks have taken. Only the smallest banks (deposits under a few billions) should be insured without stress tests. Sure the Fed should set and enforce minimum standards for banks, but the FDIC is flipping the bill for backstopping the banks so they should know exactly what and how big the risks are at each bank and price their insurance product accordingly.

Some banks are starting to see impacts of their lack of focus on core functions: “The Bank of England plans to cut spending on climate change work and redirect the money to core functions because of rising pressures on its costs.”

https://www.bloomberg.com/news/articles/2023-03-10/bank-of-england-will-cut-spending-for-its-work-on-climate-change#xj4y7vzkg

What is a CORE function troll? Oh yea – kissing CoRev’s lying rear end. I guess you think banks should be obliged to invest in Koch Brothers approved businesses. Do us a favor CoRev – let us know where you are parking your money so we can short sell that company or bank.

Wow! What kind of ignorant denialist would ask this question: “What is a CORE function troll?” What ever could be the core function of a bank? Moreover, how could drifting from such function cause a bank run, which to some estimates was ~40% of assets? Also, how could regulation forestall the bank’s (and its depositors’) loss, even if it had maintained the required amount of asset backup?

Some times shaking one’s head is’lt enough to explain the stupidity of some comments.

“The Bank of England plans to cut spending on climate change work and redirect the money to core functions because of rising pressures on its costs.”

Wait, wait – CoRev does not know that the BoE is the Central Bank for the UK. The equivalent of the Federal Reserve here.

Yea – CoRev is the most clueless troll God ever invented. Some banks? Laughing my rear end off!

The Bank of England isn’t “some bank” for goodness sake. It’s a regulator and lender of last resort.

This is another example of a statement which can only be the result of ignorance or dishonesty. CoVid either doesn’t know what the Bank of England is, or he is conveniently neglecting to mention what it is. Either way, nobody should trust him.

Thanks all for making my point re: core (fiduciary) functions versus the ESG/climate focused functions by the central banks. SVB’s failure exemplifies the need for short term fiduciary focus. These events occur in hours to days versus the years to decades for ESG/climate events.

My usual caveat. Don’t confuse weather with climate.

It is NEVER just one or two banks. Ever.

There will be a lot going on behind the scenes for a while even as all the official “everything is under control” announcements come out.

And I’ll say it again: the Fed cannot continue to undercut the value of all banks holdings – which a rate raise does – and run the risk of breaking more and bigger banks. All banks, everywhere, now have underwater assets on the books (marked to maturity hides that fact) and the tide is going out.

Little Lindsey Graham speaks but no one is listening:

https://www.msn.com/en-us/news/world/lindsey-graham-screed-hits-ron-desantis-you-have-seriously-miscalculated/ar-AA18Fn79?ocid=msedgdhp&pc=U531&cvid=6ab6a829bfa34705883c7cdd73b482fb&ei=9

In a series of tweets coupled with an appearance on Fox News, powerful GOP Senator Lindsey Graham ripped into MAGA politicians playing the America First card to an increasingly isolationist supporter base. Graham’s comments come on the heels of Florida Governor Ron DeSantis‘s controversial assessment of the Russia-Ukraine war, in which the likely presidential candidate characterized the conflict as a “territorial dispute.”

(Note: Even lawmakers who lament the level of financial support the U.S. has provided Ukraine have still largely tended to characterize the conflict as a Russian invasion, not a land “dispute.”) In what’s being seen as a direct rebuke to DeSantis, Graham writes that “if you do not understand that success by Putin in Russia invites aggression by China against Taiwan, then you have seriously miscalculated one of the most obvious nexuses in the world.” Taking more direct aim at DeSantis, yet without naming him, Graham writes: “To those who believe that Russia’s unprovoked and barbaric invasion of Ukraine is not a priority for the United States – you are missing a lot.”

Well DeSantis is missing a lot but Trump is saying the same thing as DeSantis. Trump has in fact gone further by suggesting Ukraine should give up part of its nation to Putin. But has little Lindsey gone out Trump? Of course not as little Lindsey is Trump’s pet poodle.

DEFLATION?

https://www.bls.gov/news.release/ppi.nr0.htm

PRODUCER PRICE INDEXES – FEBRUARY 2023

The Producer Price Index for Final Demand decreased 0.1 percent in February, seasonally adjusted, the U.S. Bureau of Labor Statistics reported today. Final demand prices advanced 0.3 percent in January and declined 0.2 percent in December 2022.

Well over the past 3 months, PPI has been flat.

Hmmm, maybe the Fed overdid it. Who could possibly have predicted that, unless they understood what a supply restricted inflation wave is.

Some talking head on MSNBC just told us higher capital requirements would raise the cost of capital for banks. Only someone who knew nothing about financial economics (as in Modigliani-Miller) would say such a stupid thing. Look – these absurd claims assume the cost of equity is constant even as one raises the equity to asset ratio but that assumption violates basic finance. As the equity to asset ratio is increased, the market lowers the expected return to assets. But I guess knowing finance is not a requirement to be a business reporter.

Oh the humanity – are we really going to demand that bank executives and shareholders give up some of their absurd compensation, just to make the financial system more stable.

The poor talking heads almost turned into exploding heads.