Answer: No.

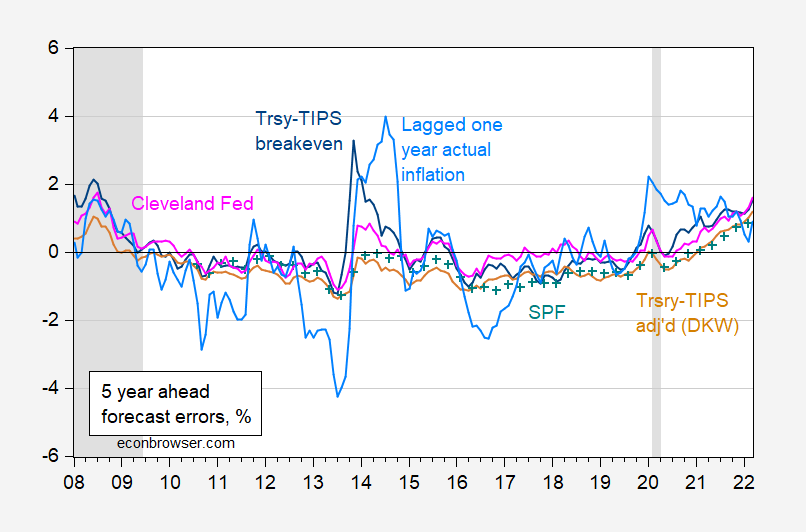

Here’s a picture of CPI inflation expectations errors at the five year horizon.

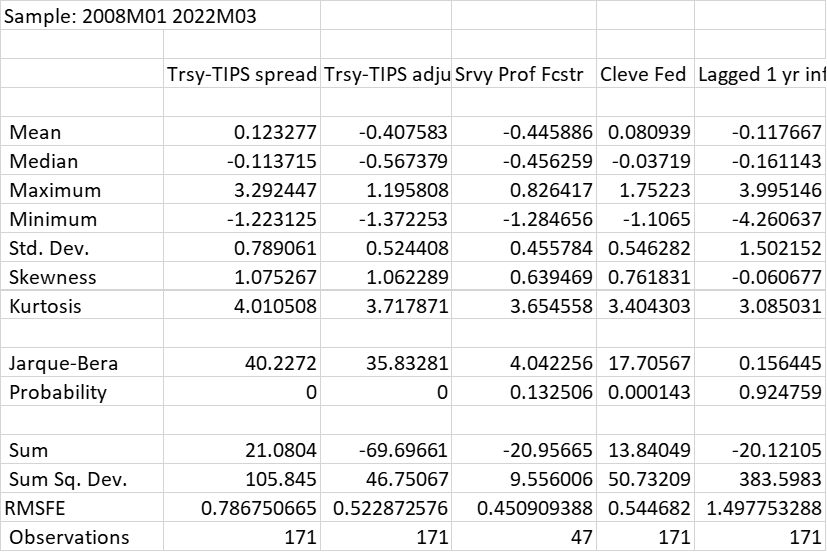

Figure 1: Actual 5 year ex post inflation minus expected from 5 year Treasury-TIPS breakeven (dark blue line), from Treasury-TIPS breakeven adjusted for premia by KWW following DKW (tan), from Survey of Professional Forecasters median (blue +), from Cleveland Fed (pink), from lagged ex post one year inflation (sky blue). NBER defined peak-to-trough recession dates shaded gray. Source: For CPI, BLS via FRED (CPIAUCSL); inflation rates calculated by author using exact formula (not log approximations). Treasury and TIPS from FRED (GS5, FII5), for adjusted breakeven KWW (accessed 4/8), for SPF Philadelphia Fed, Cleveland Fed, and NBER.

I have provided hyperlinks to the specific data sources since reader JohnH has written: “It’s hard to argue with data that does not link to any specific source data!”

Over the 2008M01-2023M02 period, the smallest mean error (in absolute value) is for the Cleveland Fed. The smallest median error (in absolute value) is for the Cleveland Fed. The largest maximum forecast error is for one year lagged inflation. The smallest minimum forecast error is for one year lagged inflation. The largest mean squared forecast error (by far!) is for one year lagged inflation.

I think it reasonable to conclude (if you didn’t already know it) that adaptive expectations using one year lagged inflation is a bad predictor for five year ahead (or 10 year ahead) inflation.

“I think it reasonable to conclude (if you didn’t already know it) that adaptive expectations using one year lagged inflation is a bad predictor for five year ahead (or 10 year ahead) inflation.”

Just in case people do not know what Dr. Chinn noted this, JohnH never bothered to offer his forecasting model beyond his continuing use of the rise in CPI over the PAST 12 months. But Jonny boy is not alone. Edward Pinto of the AER did the same thing when he tried to tell us real mortgage rates turned negative.

Yea if one has a stupid way of forecasting inflation, one can come up with some really bizarre arguments. Which reminds me a lot of Princeton Steve.

JohnH tried to claim that the usual forecasts of inflation have been awful over the past 5 years. 3 of the 4 series you graphed suggest otherwise. Oh yea – there was one measure that did have large forecast errors. That would be JohnH’s preferred approach. Jonny boy – quick to criticize the professionals but never competent at anything especially forecasting inflation.

Let’s do a Bruce Hall had a baby with JohnH. From June 2021 to June 2022, CPI rose by 8.9%. Now I guess one could use this to forecast the increase in CPI from June 2022 to June 2023. But wait – CPI has been rising by less than 4% per annum since June 2022. Now maybe Jonny boy thinks prices will explode over the next 4 months but there is no one who is saying that now.

So if Jonny’s model of expected inflation puts this at 8.9% but actual inflation ends up less than 4%, that would be one huge forecast error.