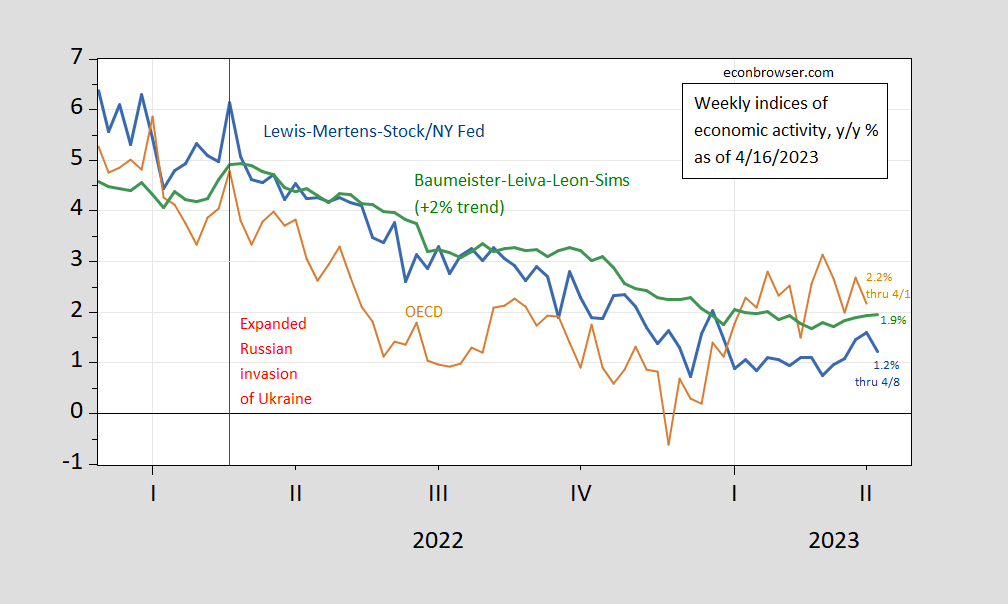

Here’re some macro indices at the weekly frequency for the real economy.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), OECD Weekly Tracker (tan), Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), S&P Market Intelligence monthly GDP (blue bar), all growth rate in %. Source: NY Fed via FRED, OECD, WECI, accessed 4/16, and author’s calculations.

The Weekly Tracker was not updated, so I repeat the growth at 2.2% for the week ending 4/1. The WECI+2% thru 4/8 is (1.9%), while WEI reading is 1.2%. The latter is interpretable as a y/y quarter growth of 1.2% if the 1.2% reading were to persist for an entire quarter.The Baumeister et al. reading of -0.1% is interpreted as a 0.1% growth rate in below the long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 1.9% growth rate for the year ending 4/8.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model. The Weekly Tracker is a “big data” approach that uses Google Trends and machine learning to track GDP. As such, it does not rely on actual economic indices per se.

Off topic but we have seen little Princeton Stevie thinking he has a right to mansplain how to deal with Russia to Janet Yellen. Of course this lady has two things Stevie lacks – intelligence and integrity. Dr. Yellen had some smart things to say about the sanctions this morning. Much smarter than the worthless babble we have to endure from little Stevie:

https://news.yahoo.com/yellen-says-sanctions-may-risk-163713593.html

25

AFP

Sun, April 16, 2023 at 12:37 PM EDT·1 min read

Economic sanctions imposed on Russia and other countries by the United States put the dollar’s dominance at risk as targeted nations seek out an alternative, Treasury Secretary Janet Yellen said Sunday.

“There is a risk when we use financial sanctions that are linked to the role of the dollar that over time it could undermine the hegemony of the dollar,” Yellen said on CNN.

“Of course, it does create a desire on the part of China, of Russia, of Iran to find an alternative,” she told the network’s Fareed Zakaria in an interview. “But the dollar is used as a global currency for reasons that are not easy for other countries to find an alternative with the same properties.”

The robust US capital markets and rule of law “are essential in a currency that is going to be used globally for transactions,” she added. “And we haven’t seen any other country that has the basic… institutional infrastructure that would enable its currency to serve the world like this.”

Funny that these graphs consistently show the start of the Russian invasion, apparently a propos of nothing. Or is the blog host trying to tell us that there was indeed blowback from the sanctions on Russia? Of course, a year ago no one could imagine any possible blowback when I asked about it repeatedly!

In any case, Jaime Galbraith has a different take on the economic impact of the war on Russia: “We conclude that when applied to a large, resource-rich, technically-proficient economy, after a period of shock and adjustments, sanctions are isomorphic to a strict policy of trade protection, industrial policy, and capital controls. Such policies have been applied with success in other countries. They are policies that the Russian government could not plausibly have implemented, even in 2022, on its own initiative. Their success or failure in Russia will be determined over time. However, strong claims for the effectiveness of sanctions in this case, so far, do not appear warranted.”

IOW will the sanctions actually help Russia grow more rapidly over the long term? Hmmm…. The IMF is already predicting that Russia will grow faster than the US in 2024.

Are we indeed witnessing yet another pointless, costly, and futile war, this time an economic one, instigated by the hapless foreign policy establishment?

Babble babble babble! Putin is paying you for this BS?

BTW these graphs were about the US economy. Which is a bit different from what happened to the Russian economy. Yea – we get you don’t know the difference as you know nothing about anything.

Putin may not even exist in 2024.

Odd. Johnny howls about how economics is wrong, corrupt, yack, yack, yack, until he thinks he’s found some economist who agree with his views. Then he quotes freely, hoping to convince…somebody?… that he has made a point.

Also odd. Johnny thinks Galbraith agrees with him. Johnny actually quoted Galbraith writing “Their success or failure in Russia will be determined over time.” In other words, too soon to tell. What a revelation!

Johnny, there’s a huge literature on policy making under uncertainty in economics. Know why? Because all policy making takes place under uncertainty. Galbraith has just repeated that wisdom. The fact that sanctions have been imposed without certain knowledge of their effect is just the way things work.

The alternative is to do nothing. Doing nothing is Johnny’s preference. His job is to justify Putin’s war and Russia’s violent grab for Ukrainian territory. He wants the world to stand aside and let it happen. So Johnny, ever the hypocrite, finds one of those hapless economist pointing out that the future is uncertain.

So impressive.

Funny!!! Ducky can’t abide the thought that US sanctions might actually make Russia stronger…when the hapless U.S. foreign policy borg’s intent was to weaken Russia and perhaps carve it up.

Ducky needs to work on his English as his third language reading skills…

And yet JkhH(?) AKA JackA(?) can’t resist tromping barefoot through the corral and into the barn.

I await your next pithy comment.