A reader, critiquing the argument that the expanded Russian invasion of Ukraine could not explain accelerating inflation before February 2022, observes “The surge of inflation happened well before the war.” I don’t think this characterization is entirely accurate, but in any case, oil prices rose before the so-called “Special Military Operation”, and price pressures showed up concurrently.

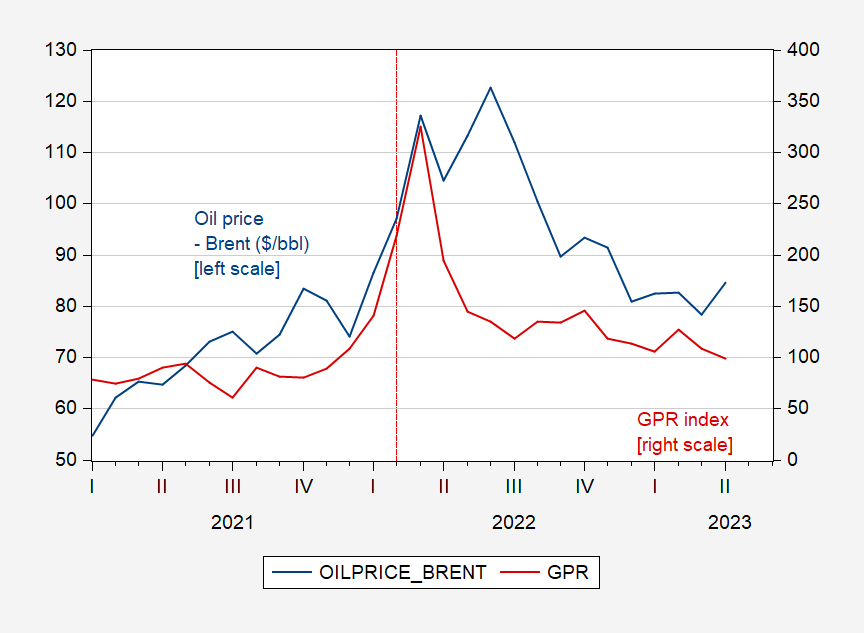

First, consider oil prices (Brent) and Geopolitical Risk as measured by Caldara-Iacoviello GPR index.

Figure 1: Oil price (Brent), $/bbl (blue, left scale), GeoPolitical Risk index (red, right scale). Red dashed line at 2022M02, Russian invasion. Source: EIA via FRED, Caldara-Iacoviello.

Notice that oil prices started rising even before the invasion; anxieties about Russian actions were rife as of November, so this is unsurprising. In other words, cost-push pressures rose before Russian tanks actually moved further into Ukraine.

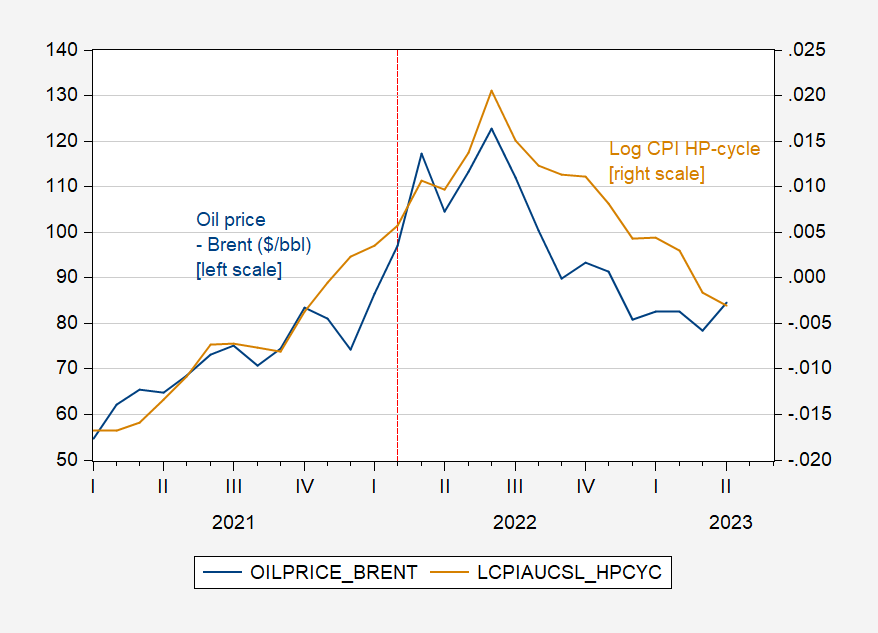

Figure 2: Oil price (Brent), $/bbl (blue, left scale), HP cyclical component of log CPI (tan, right scale). Red dashed line at 2022M02, Russian invasion. Source: EIA via FRED, CPI, and author’s calculations.

The graph indicates that the CPI was 2% above HP trend by June 2022.

A bit off topic to this post, but how come none of the Economics blogs and substacks I read in the wee hours are talking more deeply about default risks? Granted, Menzie touched on this a few days ago, but in a broader sense it feels like the swathe of the internet that can be taken seriously is being a bit too quiet.

Kevin McCarthy is like that crazy B-52 pilot in Dr. Strangelove—he really wants to complete his mission; he’s going to ride that bomb all the way down. And, he’s not alone.

For the record, I am not stocking up on ammo and canned goods, although the liquor cabinet needs a serious replenishment. But there’s a part of me that feels funny, sort of like I felt in 2007. I didn’t know what going on back then and over the next 18 months I was distressed to realize that a lot of people who were supposed to know, didn’t know.

A mild fear, that you are conscious of, is healthy. I would say being “woke” is healthy, but that term has been hijacked and seized by a wild animalistic pack of American children on Coral Island. If you see the head of a pig on top of a sharpened stick planted into the ground with people wearing MAGA hats loafing around nearby…… RUN!!!!!!

Pro tip: Avoid all “prepper” vlogs on Youtube.

“The Caldara and Iacoviello GPR index reflects automated text-search results of the electronic archives of 10 newspapers: Chicago Tribune, the Daily Telegraph, Financial Times, The Globe and Mail, The Guardian, the Los Angeles Times, The New York Times, USA Today, The Wall Street Journal, and The Washington Post. Caldara and Iacoviello calculate the index by counting the number of articles related to adverse geopolitical events in each newspaper for each month (as a share of the total number of news articles). The search is organized in eight categories: War Threats (Category 1), Peace Threats (Category 2), Military Buildups (Category 3), Nuclear Threats (Category 4), Terror Threats (Category 5), Beginning of War (Category 6), Escalation of War (Category 7), Terror Acts (Category 8). Based on the search groups above, Caldara and Iacoviello also constructs two subindexes. The Geopolitical Threats (GPRT) includes words belonging to categories 1 to 5 above. The Geopolitical Acts (GPRA) index includes words belonging to categories 6 to 8.”

An interesting way to measure what market participants were reading. That current market prices depend in part on expectations of the future has been a mainstay of economics for generations even if a few of our readers still do not get it.

It’s unfortunate that the monkey brains of humans is tuned to binary choices, whereas the complex reality of society are multicomponent.

Most non-professionals seek the cause of something, rather than seeking to build multifactorial models that includes all the causes. Yes oil prices were on their way up before anybody predicted the Russian invasion, but they got worse when the risk was realized, and even more after the invasion began. After the reality turned out to be more manageable than feared, prices were reduced. And yes energy is part of inflation – both directly but also indirectly (because raw materials and final products need to be transported).

It is a testament to the US educations failures how many of the non-economists here have a problem dealing with multifactorial parameters.

I am forever amazed by the misdirection/misinformation presented by liberals. A continuous effort to try to hide the BAD impacts from the is breath taking.

If not true a short list of Biden’s liberal demanded/supported/forced policies would be forthcoming.

Hiding the failed ENERGY policies under the trivial umbrella/proxy OIL is just another example of that continuous effort to try to hide the BAD/inflationary energy policy impacts. But, ENERGY is just one class of policies. A list of Biden’s/liberals’ successful policies could include 1) Foreign, 2) Economic (useful for an Economics blog/class), 3) Environmental, 4) Health 5) Pick your own preferred category.

So, where’s that list of successful Biden policies? I’ve waited months now. This not a difficult request, since these are policies you liberals have advocated for decades/generations. Be proud of your successes.

Denial of Biden’s/liberals’ policy impacts is an amazement.

Feeling ignored? Poor baby.

Maybe if you weren’t such a low-life, you’d get a bit more attention. It’s perfectly obvious that you don’t want an answer. If you did, you could find it for yourself. Plenty of information out there.

Dude – please update your remedial version of ChatGPT.

Not knowing how but lamenting his inability to seek answers, the fool rages on, blaming others for his own ineptness.

The trio of responders still will/can not provide the simplest list of “successful Biden policies”. Meanwhile the list of failures is obvious environmental, economic, international, tax, energy, crime, gun, social, etc. The few successes Biden has had is in continuing Trump’s/conservatives’ policies.

Many of Biden’s failures are measurable in dollars (inflation and higher prices above inflation’s rate), increased number of illegal aliens, increased number of deaths due to crime, loss of allies, increased number of environmental diversity (whales, birds, even trees, etc), increased number of electric grid reliability incidents, increased number of crimes, increased number of guns, and increased number of (fill in your favorite impact here).

The failure of liberals to admit these simplest of truths is an amazement. Prove me wrong!?

You are an idiot. You are boring. You are nothing more than the most worthless troll. Get a clue clown – no one here gives a damn about your stupid needling. Take your trash somewhere else.

The fool happily debates himself. As usual, he loses.

What you mean is, we haven’t taken the bait. I repeat: if you were actually interested in the answer, you could easily find it. You’ve put far more time into repeating this question that would be needed to answer it for yourself. We aren’t your research staff and we don’t believe you have any real interest in the answer.

If you weren’t such a low-life, there might be more interest in dealing with you.

For innocent by-standers, here’s CoRev’s deal. He posts right-wing talking points and bad-mouths “liberals”. He insists that others post what he insists are “liberal” views – facts about climate or about Biden’s/Democrats’ record, so that he can respond with more right-wing talking points and more insults to liberals.

Samuel Clemens warned against wrestling with pigs. I heed that warning particularly in dealing with CoRev.

Angry ad hominems still does not provide the simplest answer. Why are you so fearful of a discussion of the successes of the policies you have for years championed? Claiming: ” I repeat: if you were actually interested in the answer, you could easily find it. ” Really? Easily?

Taking your advice i went directly to the administration’s page to provide an answer to my question : https://www.whitehouse.gov/therecord/ If these are considered successes then the inflation resulting form them offsets nearly all the gains. But this is an economics blog and failure to admit negative economic results is the norm for liberals, which results in the self anger, silently disapointedr world in which they/you live.

Prove me wrong or continue in your fear induced psychoses.

Watching the lying, fearful, psychotic, and angry liberal minds in action is an amazement.

The fool—believing in his own superiority—insists he inhabits the minds others, unaware that the narrow channels of what remains of his own mind are clogged with —who else?— Biden!

Every post, every response , nearly every inane utterance centers on, yes, Biden. If Biden was a drug, the fool would be a prime candidate for rehab.

Some might refer to this as BDS—Biden Derangement Syndrome. Not the fool, however, whose need for more Biden seems to grow by the day.

An intervention might be in order. If only there were someone who cared enough to initiate one.’

“If these are considered successes then the inflation resulting form them offsets nearly all the gains.”

actually, inflation is not that bad in the usa. and worldwide, it was 8.8% in 2022 and predicted to be 6.6% in 2023 and 4.3% in 2024, still above pre-pandemic (2017–19) levels of about 3.5%. is biden responsible for those worldwide rates as well?

now go take a lipitor and have a healthy snack before you have another coronary event, which i am sure you will blame biden for.

We now add Baffled to the list of ad hominem throwing, angry, non-responding and in denial of the mountainous failures of their/Biden’s policy failures. The greatest inanity is: “actually, inflation is not that bad in the usa. and worldwide, it was 8.8% in 2022 and predicted to be 6.6% in 2023 and 4.3% in 2024, still above pre-pandemic (2017–19) levels of about 3.5%. is biden responsible for those worldwide rates as well?”

The answer is a simple YES! Especially, since you/Biden follow the same/similar failing policies as the evidenced in much of the remaining world. The spotlight is on the actual failures of those policies, and that is why it is so difficult for your angry (at yourself), denying liberal minds to admit those POLICY failures. Biden’s policies are those you have championed for generations.

The failure to provide a list of Biden’s/progressive policy successes is just another form of denial. Denying the obvious policy failures of the liberal mind is an amazement.

“is biden responsible for those worldwide rates as well?

The answer is a simple YES!”

and this is why you have no credibility covid. you lay blame on Biden for EVERYTHING, and have absolutely no justification other than to claim “failed policy”, which you cannot even detail as to what that policy is and why it caused the failure. you just simply declare it failed, and the inflation is a result of that failure. show me some analysis, rather than think I will simply accept your declarations as true. my guess is you are incapable of doing so.

as for ad homing attacks, covid, you DID have a coronary event that almost cost you your life. it was caused by clogged arteries, which were the result of YOUR poor lifestyle choices over decades. and rather than accept the BLAME yourself, you blame OTHERS. for an old man, you need a lot of GROWING UP to do.

@ CoRev

Hey shit-for-brains, does this rank as a successful policy for you??

https://www.reuters.com/world/us/migrant-crossings-drop-us-mexico-border-after-title-42-expiry-2023-05-14/

Another bright ad hominem throwing liberals asks a question. The answer is NO!

The angry liberal mind is an amazement.

https://twitter.com/FaceTheNation/status/1657166484844453888

Yes I endured Face the Nation interviewing Nikki Haley so Moses did not have to. And Nikki Lightweight was her usual self. She could not take a real stand on the abortion issue and she just lied about immigration. According to Nikki Lightweight the Trump Administration had solved the immigration problem humanely.

Brennan did get in some reality here and there but Nikki Lightweight would just smile and continue with her lies.

Fortunately the other 3 guests were far better on this issue. Face the Nation would have been far better off had they told Nikki Lightweight to just stay at home.

I will say, there were a lot of dumb people, who less than a week before the war started (or was it only two days in Barkley’s case?? I’m kinda tired of back-checking comments) still thought no invasion would occur. One person flat out stated it as assumed fact.

But two things, there were those (hmmmm, I am thinking of one guy now) who were 99% certain war would start. Of course that group is going to start pushing commodity prices up through market bets or market “speculation”. And even those who think there’s “only” a 50% chance of war, will also, “hedge” their market bets (wagers which assume commodity/oil prices will rise) for a war. To think that a large segment of people would wait until actual war is declared and then say “OK!!! ‘GO!!!’ we can place our war bets down in the market now.” is pretty amazingly dumb. MUCH of the inflation pre-February 2022 was caused by anticipation of a war in Ukraine. That’s not rocket science. It’s pretty damned near to common sense.

And…… BTW….. (Uncle Moses toot toots his own trumpet) I was saying war was a near foregone conclusion BEFORE the war started, have multiple back-dated to before the war blog comments to prove it, and an ongoign back-and-forth with a blathering old man desperate to prove how much he was an “expert” on Russia?Ukraine affairs.

I for one was surprised that putin invaded on the scale that he did. the fact that he invaded previously Crimea meant the threat was real. I did not think he would actually try to capture Kiev. on the other hand, the Ukraine defenses have performed much greater than I anticipated. a pleasant surprise. there will be many forgotten heroes from Ukraine when all is said and done. I think the west has done just enough to give Ukraine a chance of success. I would like to see us offer more support, but understand there is a limit before a line is crossed. and the longer the war lasts, the weaker Russia becomes if/when nato needs to take a stronger stand.

Biden has done a brilliant job of balancing on a knifes edge of allowing Putin to think he can win without putting nuclear options on the table, yet giving Ukraine the tools to slowly deplete the Russian military of its weapons and glory. NATO is getting exactly what it wants and needs from this conflict – a defanged Russia without a nuclear war. Competence matter – thank you President Biden.

It seems Paul Krugman heard what Brad Setser said on Thursday!

https://dnyuz.com/2023/05/12/wonking-out-attack-of-the-pharma-phantoms/

Wonking Out: Attack of the Pharma

Share on Facebook

Share on Twitter

On Thursday, Brad Setser of the Council of Foreign Relations — esteemed by cognoscenti for his forensic analyses of balance of payments data — testified to a Senate committee about global tax avoidance by pharmaceutical companies. This issue may not have loomed large on many people’s radar screens, and with everything else going on you may wonder why you should care. But there are at least two reasons you should.

First, at a time when people are once again angsting about budget deficits — much of the angst is insincere, but still — it’s surely relevant that the U.S. government is losing a lot of revenue because multinational corporations are using accounting tricks to avoid paying taxes on profits earned here.

Second, now that it’s looking increasingly likely that Donald Trump will be the Republican presidential nominee, it seems relevant to note that his one major legislative success — the 2017 tax cut, which was supposed to bring corporate investment back to America — was, in practice, an “America last” bill that encouraged corporations to move even more of their reported profits, and to some extent their actual production, overseas.

About pharma: The U.S. health care system, unlike health systems in other countries, isn’t set up to bargain with drug companies for lower prices. In fact, until the Biden administration passed the Inflation Reduction Act, even Medicare was specifically prohibited from negotiating over drug prices. As a result, the U.S. market has long been pharma’s cash cow: On average, prescription drugs cost 2.56 times — 2.56 times — as much here as they do in other countries.

Strange to say, however, pharmaceutical companies report earning hardly any profits on their U.S. sales. Setser offered a striking chart comparing 2022 revenue and profit for six major pharma companies:

As he noted, 2022 was an exceptionally profitable year for these companies, but the pattern — large revenue in the U.S. market, with very low reported profits — has been consistent over time.

How do the pharma giants do that? Mainly by assigning patents and other forms of intellectual property to overseas subsidiaries located in low-tax jurisdictions. Their U.S. operations then pay large fees to these overseas subsidiaries for the use of this intellectual property, magically causing profits to disappear here and reappear someplace else, where they go largely untaxed.

The pharmaceutical industry, where patents rather than manufacturing facilities are companies’ principal assets, is exceptionally well suited to this kind of tax gaming. But it’s not unique. Over time we have increasingly become a knowledge economy, in which a large share of business investment involves spending on intellectual property rather than on plant and equipment:

And whereas factories and office buildings have specific locations, intellectual property pretty much resides wherever a corporation says it resides. If Apple decides to assign a lot of its intellectual property to its Irish subsidiary, causing a huge surge in Ireland’s reported gross domestic product, nobody is currently in a position to say it can’t.

How do we know that big overseas profits mainly reflect tax avoidance rather than economic reality? That’s easy: Look at where the profits are being reported. As Setser also pointed out, following up on the work of Gabriel Zucman (who just won the American Economic Association’s prestigious John Bates Clark medal; congratulations, Gabriel!), the great bulk of U.S. corporations’ reported overseas profits are in tiny economies that can’t possibly be major profit centers but do offer low taxes on reported earnings:

Which brings us to the Trump tax cut. The core of that tax cut was a reduction in profit taxes, based on the premise that America’s relatively high official corporate tax rate was causing large scale movement of capital overseas. But that corporate capital flight, it turns out, wasn’t real; it was a statistical illusion created by tax avoidance.

By the way, this isn’t just a U.S. problem. The International Monetary Fund estimates that about 40 percent of global foreign direct investment — investment that involves control of foreign subsidiaries, as opposed to portfolio investment, like purchases of stocks and bonds — is actually “phantom” investment driven by tax avoidance that doesn’t correspond to anything real.

It’s not surprising, then, that the Trump tax cut never delivered the promised investment boom. As it happens, right now we actually are seeing a boom in manufacturing investment — but that’s being driven by the Biden administration’s green industrial policy rather than across-the-board tax cuts.

But wait, it gets worse. One particularly ill-drafted feature of the 2017 tax law, with the acronym GILTI (I am not making this up), ended up giving corporations an incentive to shift actual production as well as reported profits overseas. As Setser points out, GILTI is probably a major factor in a recent surge in U.S. imports of pharmaceuticals:

Now, there are some very well thought-out proposals to address corporate tax avoidance. Unfortunately, they’re almost surely moot as long as the House is controlled by a party that wants to deny the I.R.S. the resources it needs to go after tax evasion.

But you should still bear in mind that cracking down on tax avoidance could significantly reduce budget deficits. And you should also bear in mind that the Trump administration’s only major domestic policy initiative was a flop.

BTW, in case anyone is confused about false rumors made August of 2023, Elvira Nabiullina still has her job as head of Russia’s Central Bank. It’s strange what people will say when crying out for attention. But Nabiullina is still “happily” employed, and unlikely to lose her job for as long as this war persists.

https://www.reuters.com/markets/rates-bonds/russian-central-bank-keeps-key-interest-rate-75-2023-04-28/

“I shall follow this up with the second English language report (the first I just put up on Econospeak in much greater detail, although crucial details remain unclear) that about last Tuesday, Russian central bank Head Elvira Naibiullina left office. This is all over various substantial Russian language sources, but not reported in English language media until I just did so a few minutes ago on Econospeak.

It is unclear if she resigned or was pushed, but rumors have it she is being set up to be made scapegoat for current Russian economic problems, which do indeed look to be a lot more serious than some had been reporting, especially all the pro-Putin trolls. It may be that declining crude oil prices have really pushed things to the edge. I note the serious irony that reportedly (and this was in western media) Naibiullina had tried to resign in March, but was ordered to stay by Putin. If he now goes after her in any serious way it will be very unfair, although Putin being unfair is hardly the worst thing he has done.”

https://econbrowser.com/archives/2022/08/us-and-euro-area-headline-inflation-compared#comment-282275

For the record, Menzie defended (I think mostly in collegial charity, but also because I think Menzie is just a kind person) what Professor Rosser said, Menzie didn’t think it was “far off the mark” in the sense that Nabiullina had indeed offered to resign months before August. That’s not what I was criticizing Rosser for. It was the “firing” or “terminating” Nabiullina from her job that was an extremely ridiculous statement to make.

*August of 2022. Can I go back to my old standby excuse of summer heat negatively effecting my brain?? Nope?? I fell back on that baloney too many times??

[ discontent sigh…… ]

For what it is worth, extending the graph back 10 years would show the extreme oil price low in early 2020 and it would show that the increases of 2021-2022 were a continuation of the rise that came off that low. However, the rise did continue beyond the loose 2015-2020 range. It’s hard to see how the war did not affect that, but there are a lot of return-from-Covid supply and demand factors intermingled, too.

Williams Burroughs used to call this sort of writing his “comedy routines”. Only the difference here is, Burroughs intended to be satyrical when writing them, such as “Commissioner of Sewers”. Barkley Rosser wrote these, totally unaware of his own ability for ironic hilarity.

http://econospeak.blogspot.com/2022/08/russian-central-bank-head-may-be-out.html

http://econospeak.blogspot.com/2022/07/vladimir-mau-has-been-arrested.html

Another Barkley Rosser comedy gem, responding to Cassandra:

“Sorry, but my connections trump yours by a longshot, like PERSONALLY KNOWING a bunch of the people ware talking about, including mau and Naibullina [ sic ]. I am not sure the meaning of your italicized portion. Is this a quote from somebody over there?” <—notice the pretend confusion Rosser fakes, when presented with obvious quotes from Russian sources. This was another common argumentative ploy of Rosser’s, he assumably thought everyone was too comparatively low to His Royal Highness Rosser to see through. The PhD mathematician has “sudden” “unexplained” Down Syndrome.

The comment from commenter “Cassandra”, which to me, me being a complete outsider to Russian politics, Cassandra’s comment seems highly accurate. NO doubt, since proclaiming Barkley’s comments as incorrect and inaccurate, Barkley must have thought Cassandra was some demon child straight from the depths of hell. As, no doubt, ALL those who call out nonfactual Rosser writings are.

* William Burroughs, excuse me. I’ll have our literary crowd who are fans of the Beatniks in a tizzy of laughter here.

A simple example of what Krugman and Setser had to say about how Big Pharma plays that Trump tax cut and GILTI. Suppose USCO has a patent on some important drug that it sells for $100 a dose even though its production costs are only $20 a dose and its cost of distribution is another $20 a dose. So yea – its profits are an obscene $60 a dose. But one would think the US Treasury would get to tax that $60 at 35% for a tax take = $21 per dose.

Well – welcome to the 2017 tax cut and transfer pricing manipulation. While USCO could have produced this drug here – it decides to produce it in Ireland to get a 2.5% tax rate on any foreign sourced income (something to do with a Double Irish Dutch Sandwich). Now one would think Irish profits would be a mere $5 a dose with U.S. profits for owning the product intangibles being $50 a dose plus $5 a dose for distribution return. Of course, this would be taxed at 21% after the Trump tax cut. Right?

Nope – that is not how Big Pharma plays the game. Under GILTI, which was supposed to tax care of this sort of income shifting, the $5 in production profits are taxed only at the low 2.5% rate and the remaining $50 in profits are taxed at only 10.5%. At the end of the day, the U.S. Treasury gets a mere $6.30 per dose. In other words, the Treasury is ripped off almost as much as the patient.

Menzie, you know that a handful of commenters insist that nobody expected Russia to invade. It’s tough to tell one anonymous from another, but the word salad you’ve responded to suggests this anonymous is one of them.

The GPR index suggests there were a good many nobodies.

I’m Nobody! Who are you?

Are you – Nobody – too?

Then there’s a pair of us!

Don’t tell! they’d advertise – you know!

E. Dickenson

@ Macroduck

You seem to know me pretty well (no sarcasm) considering we never met IRL. OK, you seem to sense my humor, my intelligence (or lack thereof), my lazy side which causes me not to read as much as I should etc……

Picture in your mind what petty statements I would like to make via certain people who expected Russia to invade, and those who with certainty said they would not invade, who are no longer with us. OK, have you got those petty statements you would me saying/typing in a blog comment envisioned in your mind?? See my petty/grudging words??

OK, carry on.

Looks like a run-off in Turkey:

https://www.reuters.com/world/middle-east/turkey-votes-pivotal-elections-that-could-end-erdogans-20-year-rule-2023-05-13/

Erdogan’s count, at 49.86% with 9% not yet counted looks like a potential winner, but I don’t know which districts aren’t yet counted. Al Jazeera reported a run-off 4 hours ahead of Reuters and CNN, and AJ is pretty good at this journlism stuff:

https://www.aljazeera.com/news/liveblog/2023/5/14/turkey-election-results-live-news-vote-count-under-way

May 28 is the date of the run-off.

Oil prices were rising in late 2021 on fundamentals, that is, recovering oil demand as the world was exiting the pandemic.

The underlying inflationary pressures were also manifest. The FFR had been held at all but zero for nearly two years, the S&P was up 50%, and the Case Shiller Index was up by a third. The excesses of stimulus were readily visible, and the probability that this would translate into meaningful inflation was also high.

Latest on the Price Cap is here:

https://www.princetonpolicy.com/ppa-blog/2023/5/11/april-embargo-and-oil-price-cap-more-failure

“We have stated, for more than a year, that the Embargo and Price Cap would be failures, and the incoming data are consistent with our views.”

Who is “we”? Oh yea – you have multiple personalities. Another worthless blog post especially your BS that Russia has not been hurt by the oil embargo. Your own cherry picked data says otherwise but given you think you are the world’s great consultant, you spin otherwise.

Real analysts reach a very different conclusion.

Stevie says “failure” based on output, which official figures show to be down, which Stevie questions. He says failure based on budgets revenues, particularly as a result of a newly raised base price for Urals for tax purposes. But that’s not the conclusion reached by others:

https://www.reuters.com/business/energy/russias-oil-gas-budget-revenue-drops-sharply-april-2023-05-04/

https://www.upstreamonline.com/finance/vladimir-putin-s-oil-tax-plan-backfires-as-russia-s-budget-gap-widens/2-1-1450355?zephr_sso_ott=sWNVnD

So Stevie’s “failure” conclusion is based on Stevie ignoring any data or analysis which disagrees with his own. Or perhaps actually based on Stevie’s refusal to admit that his earlier assessment is wrong.

I should go into consulting. I’m wrong every once in a while, and being wrong is apparently a requirement for being a consultant.

By the way, Russian oil firms have taken to self-insuring, with insurance activity moved offshore. They are also now heavily into ocean shipping, also centered ofshore. Revenues generated from those activities are held offshore and not accessible to Russia’s tax office.

pgl, what practices do you imagine Russian oil firms might adopt in a situation like this? And what might those practices imply for tax revenues?

Shifting oil revenues to tax havens. As old as the Yukos scandal. Then again that was owned by a buddy of Yeltsin until Putin abused Russian transfer pricing rules to make sure he owned this massive oil multinational.

You are making exactly the case against the Price Cap and Embargo. There are many, many ways to circumvent the Cap, transfer pricing being only one of them. Another is fake invoices. And yet another is ‘store credits’, in which the Russians can convert the discount, in part or in whole, into credits to purchase items of value from the benefiting countries, for example, arms and supplies from China; political support from India; sanctions busting from Turkey; and airspace rights from Egypt.

Now the allies are attempting to restrict imports of refined oil products from India distilled from Russian crude. That’s beyond Quixotic and well into idiotic.

I called the Price Cap and Embargo ‘insane’ in these comments for just the reason you mention above, as well as many more.

I would imagine that April oil tax receipts reflected March market conditions, ie, the tax owed for March was paid in April. Brent was weak in March and the Urals discount averaged $26.50 / barrel by my numbers. Not a surprise that April receipts were low.

For April, Urals was about $10 / barrel higher than March, and the discount averaged $20.30. At the same time, Russian oil production appears down about 3-5%, so we might expect oil tax revenues for May (to be published in June) to be about 15-20% higher than the previous month.

…tax revenues for April, received in May, published in June…

There was a clown named Steven Kopits that kept telling us how huge the Russian budget deficit was. Of course that clown overstated the numbers badly.

But this version of Steven Kopits the Klown is telling us Russian has not lost that much.

Yea – little Stevie has very malleable opinions. Funny thing – neither version of your contradictory BS is based in reality.

Hey Stevie – stick to ripping off your clueless clients. ,

Russia setting up a shadow fleet is one expected response to the Price Cap. This would be accompanied by non-European P&I insurance. This is how prohibitions and price caps are evaded, with evasion improving over time. That’s one reason the Urals discount has been closing. It’s also one reason that Russian oil production and exports have remained stubbornly high. All this signals the failure of the embargo and price cap, not its success.

I would add that there appears to be some funny business with the Greeks shippers as well, as it appears that have been accepting fake invoices. Otherwise, it is hard to see how Urals could hold above the Cap level for weeks at a time. But this was the nature of the system the allies established, one which invited this sort of transgression. Again, this represents the failure of the embargo and price cap. But it’s no surprise. This is the expected outcome and the reason I described the policy as ‘insane’ in these comments now many months ago.

Shipping and insurance? Maybe these factors explain (ala Macroduck) how Russian oil economic rents end up in tax havens (which BTW has been happening since Yeltsin) but dude if you think these relatively minor costs under arm’s length pricing are a big deal – then you are the most incompetent consultant ever.

“funny business with the Greeks shippers as well, as it appears that have been accepting fake invoices”

Stevie pooh just discovered transfer pricing manipulation? Odd since Stevie pooh worked for Deloitte Hungary where the job was to rip off places like Russia with these practices.

Hey Stevie – did Deloitte fire you because you were too stupid even to lie for them effectively?

It was and remains the correct call.

Stevie pooh telling Stevie got something right. You are one pompous moron.

Read Macroduck’s rebuttal. No – you were wrong. Then again you are a “consultant”.

The Ukrainians have left $50 bn on the table. Yes, it’s the correct call.

The table? What – you cheat at poker too? Damn your comments are so incomplete for a self styled world class consultant.

I see you don’t understand these sorts of references. I meant that, had the Price Cap and Embargo been structured as theory dictates, that is, as a legalize-and-tax system, the associated vehicle (a bank account, a fund of some sort, etc.) could have collected $50 bn or so by now, with the majority of that transferred to Ukraine to support its economy and war efforts.

Instead, we have an Embargo which has not materially reduced Russian oil production, on the one hand; and on the other, a Price Cap which has nevertheless delivered a discount to Brent which is, in recent weeks, the smallest since the start of the war and smaller than before the implementation of either the Embargo or Price Cap. Both the Cap and Embargo were predictably terrible policy, and we can see that now, as you correctly point out.

Nah. That’s just you being defensive.

Jamie Galbraith opines: “The Debt Ceiling Drama Is All Stagecraft…Remember: The US Treasury is obligated to make payments. The rest is optics…

Long story short: Biden and Yellen are playing up the debt drama not because we face some financial Armageddon, but to make an empty victory at the last minute seem like a big deal. When it happens, everyone involved will heave a big sigh of relief. Debt Disaster!™ will be packed up and put back on the shelf, until the impressionable grandchildren come to visit again.

For the economy, what matters is what they give away to McCarthy, in the budget and appropriations processes, to get their little success. For the election, what matters is how deep the cuts are, who suffers—and how those affected react at the polls. That’s the poisoned apple in another children’s story. Just a few bites now could put the Democrats to sleep for 2024—and erase what remains of the Biden agenda.”

https://www.thenation.com/article/economy/debt-ceiling-yellen-spending-cuts/

Your boy Donald Trump was saying the other day that default would be no big deal. And now Jonny boy dons his MAGA hat and backs the McCarthy blackmail. Atta boy Jonny boy. Here’s your boned.

Why don’t you tell Jamie Galbraith? He’s the one whom I cited.

pgl loves to trash what I say, but I bet he can’t bring himself to criticize a highly respected economist. Same for Ducky.

Awww Jonny boy’s feelings got hurt. Hey troll – go put your trash over at Princeton Steve’s worthless blog. He might should appreciate your stupidity.

pgl is implying that Jamie Galbraith is a Trump supporter! And that his opinion is trash! Wow!!!

And pgl is totally incapable of offering a constructive rebuttal to Galbaith’s well reasoned opinion.

pgl is just a worthless troll.

‘pgl is implying that Jamie Galbraith is a Trump supporter! And that his opinion is trash! Wow!!!’

Jonny boy has to revert to dishonest hyperbole. Dude – the kiddies in the sandbox are laughing at you for good reason. Grow up Klown.

This is the most vacuous stuff in weeks, and you’ve been hitting it pretty hard.

Jonny boy used to cite Dean Baker a lot but he has stopped of late. Dean’s latest email may explain why Jonny boy no longer cites Dean Baker:

‘We now have the greatest economy ever. I’m saying that because President Biden won’t, and everyone knows damn well that if Donald Trump was in the White House and we had the same economic situation, he would be boasting about the greatest economy ever all the time.’

Yea Jonny boy thinks his MAGA hat looks good on him so Jonny boy cannot be brought to cite such things.

Lol, nope. John. Republicans will take blame But 14th amendment will end it anyway. Effectively abolishing the debt ceiling.

Hamilton’s “Why you should never use the Hodrick-Prescott Filter”

https://blog.eviews.com/2017/07/hamiltons-why-you-should-never-use.html

Eric Poole good point. My experience is using the (James) Hamilton filter would only accentuate the CPI uptick.

I am NOT pretending to understand everything in this paper, because I do not, I am only hopeful it will add to the conversation and help anyone who wants to wander down the rabbit hole:

https://www.econstor.eu/bitstream/10419/174891/1/1014338883.pdf

The US CPI was growing at 7.5% per annum in January 2022.

Does that constitute a “surge”?

“Notice that oil prices started rising even before the invasion; anxieties about Russian actions were rife as of November, so this is unsurprising. In other words, cost-push pressures rose before Russian tanks actually moved further into Ukraine.”

That is an interesting version of events. Anxieties about Russian actions were sufficiently widespread to drive up the price of oil and measured headline inflation to 7% prior to the invasion? I would like to see some evidence of that. Anecdotal or otherwise.

From what I recall, many were concerned about the mobilization of the Russian army near Ukraine’s border but few actually expected Russia to invade Ukraine.

This was a full month before invasion, for whatever that’s worth to you,

https://www.nbcnews.com/news/world/blinken-ukraine-russia-attack-short-notice-invasion-fears-mount-rcna12691

I mean, I know that was contra to what Russian “expert” Barkley Rosser was saying at that time, and about 3 weeks into February, but…… Hey, I guess Biden wanted to “live on the edge”…….. er something. He didn’t have Rosser in the State Dept, so I guess Biden just walked ass-backwards into being correct.

Moses Herzog: I think your comments would have more impact if you were debating with someone still alive.

Aaaaawwww, touché mon frère, touché. Your fencing sabre has made a direct hit on my torso.

I’m still sick enough in the head to….. not “enjoy” it…… but get some satisfaction from it. And how do you think it would have gone if the shoes were reversed?? I’m pretty certain I know. Beings….. the man seemed to have a blast critiquing his dead colleagues. Shall I waste more time due to this man looking the comments up?? If you insist I will.

“ I would like to see some evidence of that. Anecdotal or otherwise.” Agreed.

It should be easy enough to confirm or refute… just do a search on oil analysts’ commentary in Oct-Nov 2021. Why not provide citation?

I did this for lumber prices which were skyrocketing at the time but more recently blamed on Russia. I found a WSJ piece from December, 2021 looking at the causes of high lumber prices, and Russia was not mentioned at all!!! It’s not likely that industry analysts would have missed that one!!! (Pal will write that the WSJ was in Putin’s pocket!!!)

I mean, what’s behind this need to rewrite history?

https://fred.stlouisfed.org/graph/?g=KPNp

January 15, 2018

Producer Price Indexes for lumber & wood products and plywood, 2017-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=Yska

January 15, 2020

Producer Price Indexes for lumber & wood products and plywood, 2020-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=14Fvf

January 30, 2020

Case-Shiller Real Home Price Index, 2020-2023

(Indexed to 2020)

“do a search on oil analysts’ commentary”

Like that trash your BFF Princeton Steve writes? No – reading your trash is bad enough.

“I did this for lumber prices which were skyrocketing at the time but more recently blamed on Russia.”

Actually ltr did your homework since Jonny boy does not know how to. Lumber prices starting rising in early 2021 and fell soon after that. Now NO ONE blamed Putin for the US housing boom so once again Jonny boy lies as he is too stupid to follow the conversation.

As I suspected, “6 Oil Price Drivers Fueled A Frenetic 2021 For The Energy Commodity”…and no mention of Russia or Putin.

https://www.investing.com/analysis/6-oil-price-drivers-fueled-a-frenetic-2021-for-the-energy-commodity-200612499

JP Morgan: “ Oil prices are set to rise as high as $150 a barrel as OPEC+ controls supply in the face of Omicron concerns, JPMorgan says”

https://markets.businessinsider.com/news/commodities/oil-price-outlook-brent-crude-150-barrel-opec-jpmorgan-2021-11?op=1

Funny how all those analysts missed what some now claim was the major driver of oil price hikes in late 2021:: “ anxieties about Russian actions were rife as of November” 2021.

Reminds me of Karl Rove who famously said: “ We’re an empire now, and when we act, we create our own reality.”

“A reader, critiquing the argument that the expanded Russian invasion of Ukraine could not explain accelerating inflation before February 2022,…”

“6 Price Drivers Fueled A Frenetic 2021 For The Energy Commodity” Dec 23, 2021

So a review of 2021 is evidence against something that happened “before February 2022”? Johnny, you certainly do have a high tolerance for looking silly.

The point here is that enough market participants were concerned about Russia invading Ukraine that they bid up the price of oil. The fact that some people, at some point before the invasion, were not concerned is not evidence that no one was, or that the risk of invasion wasn’t reflected in oil prices. You’re being childish.

“You’re being childish.”

The other four year olds in Jonny’s sandbox are insulted they are being compared to the Klown they laugh at on a daily basis.

You found TWO stories that did not explicitly mention Putin? NOW that is an incredible job of research. Seriously Jonny boy – you have set the record for lamest troll ever.

https://fred.stlouisfed.org/graph/?g=10MV2

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=10MV4

January 15, 2020

Consumer Price Index for Food and Energy, 2020-2023

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=CgJo

January 15, 2020

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2020-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=10aMb

January 15, 2018

Sticky Consumer Price Index and Sticky Consumer Price Index less Shelter, 2020-2023

(Indexed to 2020)

https://fred.stlouisfed.org/graph/?g=Fn2B

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2023

(Percent change)

https://fred.stlouisfed.org/graph/?g=HKys

January 15, 2020

Consumer Price Index for Rent and Owners’ Equivalent Rent, 2020-2023

(Indexed to 2020)

You may remember how Jim Jordan and other MAGA congressfolks has all sorts of whistleblowers ready to take down Hunter Biden. But there seems to be a small problem:

https://www.msn.com/en-us/news/politics/they-are-missing-marjorie-taylor-greene-confirms-gop-has-lost-several-biden-whistleblowers/ar-AA1bdgFW?ocid=msedgdhp&pc=U531&cvid=4de7dd977377498b992ac6532aac24d7&ei=14

Rep. Marjorie Taylor Greene (R-GA) confirmed on Monday that Republicans were out of contact with all but one “whistleblower” in their investigation of President Joe Biden and his family. Greene spoke to War Room host Steve Bannon after Rep. James Comer (R-KY) revealed on Fox News that at least one informant had been lost. “Now, the truth that I can tell everyone this morning is we have not lost the submarine,” Greene said. “That whistleblower is very safe. But he does fear for his life, and rightfully so.” While Greene claimed she was in contact with one whistleblower, up to nine other witnesses were missing or unavailable.

One of your fake witnesses is missing? Try 9 out of 10. James Comer is a Klown.

My goodness when someone is asked to spew their lying nonsense out under oath to a congressional committee they suddenly evaporate into cyberspace, or refuse to testify (under oat) for fear of their life?

Who could have predicted – except for everybody.

Let’s return to Jeff Frankel’s Guest Contribution: “Restructuring Debt of African Commodity-Exporters”

https://econbrowser.com/archives/2023/04/guest-contribution-restructuring-debt-of-african-commodity-exporters

An estimated 61 countries are currently in debt distress or at risk of it, which is almost one third of the membership of the IMF [32% of 190]. The G20’s Common Framework for Debt Treatment is supposed to facilitate debt restructuring for low-income countries … Admittedly, the idea of commodity bonds won’t help countries where commodity exports are not important. Nor will it help if China intransigently refuses to coordinate with Paris Club creditor countries. But commodity bonds do have the potential to remove from debt restructuring what is perhaps the biggest source of future risk for many countries in Africa, Latin America, and the Middle East.

ltr and JohnH took exception to this. But no never mind them as Brad Setser is back to blogging!

https://www.cfr.org/blog/common-framework-and-its-discontents

Check it out as Setser agrees with Frankel.

https://fred.stlouisfed.org/graph/?g=YcwH

January 30, 2018

Case-Shiller Real Home Price Index, 1988-2023

(Indexed to 1988)

https://fred.stlouisfed.org/graph/?g=YsLU

January 30, 2018

Case-Shiller Real Home Price Index, 2000-2023

(Indexed to 2000)

[ Real home price gains since 2020 are unprecedented, as shown by data extending from 1890 on. ]

https://www.nytimes.com/interactive/2023/05/15/upshot/migrations-college-super-cities.html

May 15, 2023

Coastal Cities Priced Out Low-Wage Workers. Now College Graduates Are Leaving, Too.

By Emily Badger, Robert Gebeloff and Josh Katz

The college graduates who fill white-collar jobs in the San Francisco area began to leave in growing numbers about a decade ago. More and more have moved to other parts of the country — an accelerating outflow of educated workers that, in a poorer part of America, might be thought of as brain drain.

When the pandemic arrived, these departures surged so sharply that the San Francisco area has lately lost more educated workers than have moved in:

Over this same time, a similar pattern has been taking shape on the other side of the country:

And in the New York area, long a net exporter of graduates, swelling losses have reinforced the trend: Educated workers, dating to even before the pandemic, have been migrating away from the most prosperous parts of the country.

This pattern, visible in a New York Times analysis of census microdata, is startling in retrospect. Major coastal metros have been hubs of the kind of educated workers coveted most by high-powered employers and economic development officials….

The Kremlin is sort of reminding me of Faux Business!

https://www.msn.com/en-us/news/world/a-kremlin-propagandist-boasted-of-russia-s-low-unemployment-rate-not-mentioning-it-s-partly-because-it-suffered-so-many-casualties-in-ukraine/ar-AA1bcwwn?ocid=msedgdhp&pc=U531&cvid=a5b9f67369434b5e8ca957183d81bade&ei=9#image=AA1bcNyL|3

Russian TV anchor Dmitry Kiselyov boasted of the health of Russia’s economy.

He said Russia had low unemployment and was doing better than Ukraine.

But he made no mention of how Russia’s invasion of Ukraine impacted those figures.

TV host Dmitry Kiselyov, a bullish ally of Russian President Vladimir Putin, on Sunday boasted about the health of Russia’s economy 15 months after the unprovoked invasion of Ukraine.

In an edition of his show on Russian state broadcaster Rossiya 1, Kiselyov said that it’s “always important to visualise the overall proportions” and specifically “the proportions of the Ukrainian economy and how they’ve changed over the past year,” reported BBC Monitoring ‘s Francis Scarr.

The spin doctor, known as “Putin’s mouthpiece”, went on to point to a number of factors he claimed showed that Russia was economically performing better than Ukraine.

He omitted how Russia’s invasion has decimated the Ukrainian economy, and boasted that in Russia “unemployment is at an historic low.”

Kiselyov didn’t mention key facts that point to a more worrying economic and political reality for the Kremlin.

According to economic data in April, Russia is facing a record labor shortage, and thus low unemployment, largely due to the war in Ukraine.

Hundreds of thousands of Russian men fled the country after the invasion, many of whom were working in high-skilled roles, UK military intelligence said last week.

The labor shortage has been exacerbated by the mass mobilisation of working age men to fight in Ukraine, where the Russian military has suffered steep casualty rates, reports say.

In March, the country was losing an estimated 776 soldiers a day, which dropped to 568 in April, according to UK intelligence.

Around 300,00 men were drafted into the Russian military last September, and a new wave of mobilizations is considered likely amid continued setbacks. Added to that is Russia’s already declining and ageing population.

In an admission of the labor shortages in key sectors of the economy, the Kremlin excluded men working in professions including banking and IT from last year’s draft.

Russia’s GDP declined by 2.1% in 2022, which was better than some analysts had predicted in response to western sanctions, and was mainly fueled by high oil and gas prices, Reuters said. But steep inflation meant that disposable incomes fell by 1% in 2022, and are just beginning to increase again, according to the report. Economic analysts told The Wall Street Journal in March that oil and gas prices would likely fall this year, damaging the Russian economy, which was likely entering a long phase of decline.

The short term effects of war conducted on another country’s territory is supposed to be an increase in GDP. It includes a lot of new spending – and if the destruction is almost exclusively on someone else’s territory then there is not much to be subtracted in the form of destroyed productive capacity. US growth during WW1 and WW2 was huge. The fact that Russia has a decline in GDP is a testament to the success of Biden’s policies and sanctions. The real damage to Russia will not show up until a few years from now. The brain drain and loss of people in their most productive age will have serious long term consequences for both Russia and Ukraine. However, the rebuilding of Ukraine with help from big western countries will do a lot of good for their economy.

Excellent points! At least someone here is talking real economics!

According to ISW “Statistics from Russia’s Federal State Statistic Service (Rosstat) also show that half of the men aged 20 to 24 who died in 2022 died because of the war.” So death within that age group has doubled because of the war. That is a lot of missing people in that vintage. These are people who Russian society have already invested a lot in for raising and educating – and who were supposed to now spend 4 decades being productive and paying taxes.

this comment will be a bit dark, but russia also reduced their prison population over the course of the war. cost savings and improved society as a result?

True but Russia actually don’t spend a lot of money on prisoners. They use them for slave labor and the living conditions (cost) are unbearably minimalist.

“Vice” Media filing for bankruptcy. Kind of interesting. As I recall President Obama was a bit of a Vice Media fan. Apparently it will be “scooped up” as the saying goes and continue under it’s same brand name. Certainly interesting times for media. Just keeps on churning. Many good ones still surviving in one form or another.

The topic of this blog was the anticipation of Putin’s invasion and how that might explain the OIL price increase that started in late 2021.

And what does JohnH say? He reminds us of his stupid chirping about lumber prices? Which of course started rising a lot in early 2021 but fell later (we should thank ltr for providing the data since Jonny boy is too lazy or stupid to do so).

But wait – we do not import lumber from Ukraine or Russia. We grow our own lumber or import it from Canada. So WTF does lumber prices have to do with this discussion? YEA – little Jonny boy continues to chirp about things he never understood or is even remotely relevant to the blog post. Unless Jonny boy thinks Putin’s war crimes caused the US housing boom.

OK JohnH brought up lumber prices which does not have a thing to do with this blog but let’s go with it:

https://fred.stlouisfed.org/series/WPU081

Producer Price Index by Commodity: Lumber and Wood Products: Lumber

From Nov. 2020 to May 2021, lumber prices rose by 75%. Jonny boy’s stupid theory assured us this was a permanent change. Oh wait – we had to remind the Dumbest Troll Ever that these prices fell a lot later in 2021. OK they did go back up and Jonny boy starting chirping how he was so much smarter than the rest of us.

Guess what? Lumber prices now are back to where they were as of Nov. 2020. And little Jonny boy continues chirping unaware that the rest of the kids in the sandbox are laughing at him.

Pgl loves making up what others say…so I say: prove it…chapter and verse. What I said was that drops in lumber prices in commodities markets were not showing up at retail…and I suspected pricing power in the supply chain. pgl then fabricated the ridiculous part about lumber prices never dropping.

Of course, pgl went on and on about how lumber retailers mark to market, take big immediate write-offs on their inventory, and reflect the result in their retail prices. (We already know that pgl is absolutely clueless on how companies actually do business.)

“What I said was that drops in lumber prices in commodities markets were not showing up at retail”

Now if that were true – you could be providing us data on how Lowe’s gross margin on lumber rose. We challenged you to do so many times but little Jonny boy once again failed to deliver. We even found a database on gross margnis by product but that did not show what you claimed.

Poor little Jonny boy – he cannot verify his litany of lies!

“pgl went on and on about how lumber retailers mark to market, take big immediate write-offs on their inventory, and reflect the result in their retail prices.”

I made no such claims. Yea – Jonny boy is the one who lies about what others have said even as he denies his many stupid statements.

Didn’t John Bolton work for Trump:

https://www.msn.com/en-us/news/politics/former-national-security-advisor-john-bolton-says-world-leaders-saw-trump-as-a-laughing-fool-and-disputes-that-the-ex-president-could-have-stopped-russia-s-invasion-of-ukraine/ar-AA1bgCRT?ocid=msedgdhp&pc=U531&cvid=98e9ac51046a4f5aa05aa6b66ffb7672&ei=10

Former National Security Advisor John Bolton on Tuesday said that foreign leaders saw former President Donald Trump as a “laughing fool” and rejected his ex-boss’s claims that he could have stopped Russian President Vladimir Putin’s invasion of Ukraine had he still been in office last year.

During an interview on CNN’s “This Morning,” Bolton — an experienced diplomat and defense hawk who served under Trump from April 2018 to September 2019 — pushed back against assertions that the former president made about Ukraine last week as he participated in the network’s controversial town hall. While speaking with journalist Kaitlan Collins, Trump said that Russia would not have invaded Ukraine had he been in the Oval Office and also said that he could “settle” the conflict in 24 hours if voters send him back to office — both highly questionable claims for a war the US is not a direct participant in. Bolton, while speaking with Collins and journalist Poppy Harlow, quickly rejected such talk.

https://fred.stlouisfed.org/graph/?g=14GnT

January 15, 2018

Life Expectancy at Birth for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2007-2021

https://fred.stlouisfed.org/graph/?g=10Wte

January 30, 2018

Infant Mortality Rate for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2007-2021

https://fred.stlouisfed.org/graph/?g=14GnA

January 15, 2018

Life Expectancy at Birth for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2017-2021

https://fred.stlouisfed.org/graph/?g=11RG7

January 30, 2018

Infant Mortality Rate for United States, Canada, France, Germany, Italy, Japan and United Kingdom, 2017-2021

https://fred.stlouisfed.org/graph/?g=14Gni

January 15, 2018

Life Expectancy at Birth for China, United States, India, Japan and Germany, 2000-2021

https://fred.stlouisfed.org/graph/?g=10WsB

January 30, 2018

Infant Mortality Rate for China, United States, India, Japan and Germany, 2000-2021

https://fred.stlouisfed.org/graph/?g=14Gs4

January 15, 2018

Life Expectancy at Birth for China, United States, India, Japan and Germany, 2007-2021

https://fred.stlouisfed.org/graph/?g=14GrN

January 30, 2018

Infant Mortality Rate for China, United States, India, Japan and Germany, 2007-2021

Why have debt ceiling talks moved from pure name-calling to a mix of name-calling and negotiation? Possibly because Yellen’s warning about default risk in June s being taken seriously. Why is her warning being taken seriously?:

“So far this fiscal year, the IRS has brought in $2.7 trillion in tax receipts, according to the Congressional Budget Office. That’s about $250 billion short of what it predicted just a few months ago.

“And that shortfall is part of what makes this week’s debt limit talks so urgent. Economists were expecting a drop in tax revenue after last year’s boom — but not a 26% drop.”

https://www.marketplace.org/2023/05/15/taxpayers-arent-the-only-ones-disappointed-with-taxes-this-year/

McCarthy is still an extraordinarily weak speaker who may be unable to sell whatever debt-ceiling deal he reaches to his caucus. That means Yellen and Biden may still need to employ some other means of avoiding default.

Mquack, describes even another Biden policy (tax) success. Receipts down by a whopping 26%!

He then goes on to call ?McCarthy? a weak leader?

Still, he can/will not list his policy successes. The convoluted denial of the liberal mind is an amazement.

Well – you are a weak troll. Make that the weakest troll of all time. Congrats CoRev.

Hey CoRev – I bet you did not even read the link. Let’s try this one out:

So, why were the forecasts so far off? “Full disclosure, we don’t really know,” confessed Caroline Bruckner, a tax expert at American University. She said the Congressional Budget Office is probably waiting for more data before it names a culprit. But if she had to guess, “It could be that there were fewer capital gains transactions.”

Huh – the massive price appreciation of the stock market and the housing sector under Biden’s first year did not turn out to continue through the 2nd year. And some genius at American University speculates if this kept tax revenues a bit below expectations.

Oh wait – Biden presided over an incredible booming economy in his first year and little CoRev chirps as if this never happened. I was going to ask you to help Bruckner out but then I remembered you needed to take off your shoes to count past 10.

Ole Bark, bark claims: “Oh wait – Biden presided over an incredible booming economy in his first year and little CoRev chirps as if this never happened.” Where’s the clue bat? Pandemic policy, which was vociferously supported by Ole Bark, bark and most other liberals here DID LOWER THE ECONOMY in 2020, so why is it so astounding that the recovery was large?

Other than coincidence, what was Biden;s policy that made this economic rebound happen? Worldwide? That differed from Trump’s?

Why does Making America Great Again an anathema to these liberal minds? Ole Bark, bark’s mind is an amazement.

‘Receipts down by a whopping 26%!’

CoRev cannot read. That discussion was about revenues relative to expectations. Let’s see what FRED says.

https://fred.stlouisfed.org/series/W006RC1Q027SBEA

Federal government current tax receipts

Massive increase in revenues through 2022Q1 and more modest increases since. Where does CoRev get his notion that revenues fell by 26%? From the fact that he is a moron or is he just lying again?

BTW 0.25 trillion divided by 3 trillion is nowhere close to 26%. But then again CoRev flunked preK arithmetic too.

Ole Bark bark asks where I got the 26% drop from? Here: https://econbrowser.com/archives/2023/05/oil-risk-and-price-pressures-before-putin-ukraine#comment-298988

I actually read the links. Why didn’t you?

What an amazement is Ole Bark, bark’s angry inept mind

Hey CoRev – we know you are too stupid to actually READ the CBO release but here is what it said:

Receipts totaled $2.7 trillion during the first seven months of fiscal year 2023, CBO estimates—

$299 billion (or 10 percent) less than during the same period a year before.

FYI – 10% is not 26%. Now go apologize to your poor preK teacher for ignoring his efforts at teaching the dumbest troll ever,

I feel sorry for little CoRev as it must be hard to be such a Trump cheerleader. Over the 4 years Trump was President, nominal Federal tax revenues rose by a mere 10.5% which is why the deficit ballooned even more than Trump’s waist line. In just 2 years under Biden revenues rose by 42.7% which is why deficits have fallen.

So what does little CoRev do? He claims revenues fell by 26%. They did not but of course little CoRev cannot read, cannot look at actual data, and even has trouble counting to 10. Poor little CoRev.

Bwa ha ha, another comment ignoring pandemic economic perturbations!? Are you that desperately clueless about your own denial?

” In just 2 years under Biden revenues rose by 42.7% which is why deficits have fallen.” There must be a successful Biden/progressive policy behind this 42.7%increase. Please list it.

And yet the Federal Debt: Total Public Debt (GFDEBTN, https://fred.stlouisfed.org/series/GFDEBTN/, continues its annual increases.

Your mind is an amazement. Your comments are not, too often they are just angry and wrong.

CoRev: GFDEBTN (nominal gross Federal debt) continues its annual increases. Yes. And the sun rises each morning.

“There must be a successful Biden/progressive policy behind this 42.7%increase.”

Biden got that weak Trump economy growing again. 5.7% growth in 2021. Or did your Klan buddies not tell you?

Hey CoRev – I get you are blinder than Mr. Magoo but do take a careful look at your link. Massive increase in debt in Trump’s last year in office – not so much since then.

Oh wait – Dr. Chinn has a new post which I bet was motivated by your latest stupidity.

Gee – Trump managed to increase this debt by almost 20% in his last year. And I bet the debt/GDP ratio would look worse since Trump gave us a horrible 2020.

Oh wait – it took Biden two full years to increase this by 13%. And I bet the debt to GDP ratio fell.

I wonder if little CoRev can figure out how a rising debt in absolute terms can fall relative to GDP. Come on CoRev – I bet one of the other 4 year olds can help little CoRev out here!

Menzie, as the Sun rises each morning an annual deficit adds to the the Federal Debt: Total Public Debt (GFDEBTN).

Your grasp of the obvious is another economic amazement. Where’s that list of Biden’s successful policies?

McCarthy will negotiate something that he will take back to the house where it will crash and burn. However, because it was negotiated with Biden and the House GOP were the ones who killed it, the resulting default and delayed social security checks will be unmistakably because of the GOP house members. If you are in the market be ready for a roller coster ride.

biden should tell the treasury to pay the bills under the 14th amendment. then let some foolish conservative take biden to court to stop payment and force a default. then let the conservative supreme court decide to force a default on obligations. you can blame the gop every step along the way. they will be choosing to force a default each time. that will be tough to spin.

Baffled, why the irrational political solution to a fiscal/budgetary problem? The budgetary fallout is intuitively obvious, too many annual budget failures and passage of Continuing Resolutions. Just how high do you want the interest on Federal debt to go?

Power politics exceeds logic?

The liberal mind is an amazement.

Poor little CoRev – he cannot be bothered to say where he would curb Federal spending. Oh wait – Faux News has no clue so why would Tucker Carlson’s #1 fan?

Ole Bark, bark says: ” – he (that’s me) cannot be bothered to say where he would curb Federal spending.” Really!? You finally want a discussion how the Federal Budget, (for the other illiterates here- that’s Biden’s Budget) should be cut?

Having lived and worked several decades within the Federal Government it is an easy answer. Don’t cut! Freeze this monstrosity. That automatically slows runaway growth and focuses, prioritizes any growth within Agencies. Eventually, the budget can be balanced with the revenue. This can not happen in today’s pandering political world. Yes, I know what this actually means. Do you?

The weakness of the illogical liberal mind is an amazement.

covid, is it ok for me to write to visa and tell them I will stop paying off my credit card balance until I have approved of a change in my monthly budget? exactly what kind of response should I expect under those conditions? what will be the ramifications of my decision?

you have bills you already signed off on, covid. you are obligated to pay those debts off, or you face the consequences of failure to pay.

“Baffled, why the irrational political solution to a fiscal/budgetary problem?”

you can call it an irrational solution, but it is in response to an irrational and irresponsible action of refusing to pay off bills you already agreed to. this is a silly argument on your part. as I said, let republicans sue to default. that will be a political stunt. the responsible thing to do is pay off your debt, not act like a deadbeat, which is what you are advocating covid.

Baffled, do what you want with your Visa. Or you could pay cash, instead of deferring payment, paying a 3rd party, and having those Visa seller charges for your convenience added to the prices for all others. Or are you too ignorant to realize that is happening?

So, what part of my comment or the GOP proposal gets you to think I am for not paying out debts? Do you project irrational misunderstanding much!?

The projecting, ignorant liberal mind is an amazement.

If you are not willing to pay your bills, then you are advocating default. You don’t negotiate after you spend the money, unless you are willing to default. The money was already spent and owed. Don’t be a deadbeat, covid.

Baffled, another non-responsive comment to question(s)?

The questions:

1) Baffled, why the irrational political solution to a fiscal/budgetary problem?

2) So, what part of my comment or the GOP proposal gets you to think I am for not paying our debts?

There is adequate revenue to pay our financial obligations. So, your unsubstantiated claim of failing to pay bills is actually what the 14th Amendment solves. It would be the liberal/progressive/Biden administration prioritizing those payments. Not Congress. There is something horrifically wrong with liberals who don;t understand basic finance.

How ignorant are you about basic finance? The projecting, ignorant liberal mind is an amazement.

“There is adequate revenue to pay our financial obligations.”

the entire reason we have to issue debt is because this is false. how stooopid are you, really, covid? this is why a discussion with you is fruitless. you are either actually that stooopid, or you play so stoooopid that it is impossible to have a legitimate discussion, because you pander in falsehoods. based on historical data, I say the former.

Baffled, I realize your brainwashed liberal mind can not understand basic arithmetic, but I even ignored the term “mandatory” in my comment.

So we have:https://www.thebalancemoney.com/u-s-federal-budget-breakdown-3305789

” The U.S. government estimates it will receive $4.174 trillion in revenue through Sept. 30, 2022, creating a $1.837 trillion deficit for Oct. 1, 2022. ”

and

“In the 2022 federal budget, mandatory spending is budgeted at $4.018 trillion.”

Not being a brainwashed liberal I calculate 2022 revenue exceeded “mandatory” obligations still exceed revenue. Also not being a brainwashed liberal I understand that the difference is left over for discretionary spending in Biden’s Executive Branch. Using Amendment 14 will clearly reinforce paying “mandatory” obligations while shining a very bright light on Biden’s discretionary spending. Please, go for it!

It is an amazement that the liberal mind rejects the simplest math while projecting the biggest liberal lies.