One can talk about a percent increase in a profit margin… but that really only serves to confuse.

Suppose I wanted to look at an after tax profit margin (in this case “Profit per unit of real gross value added of nonfinancial corporate business: Corporate profits after tax with IVA and CCAdj (unit profits from current production)” (A466RD3Q052SBEA)).

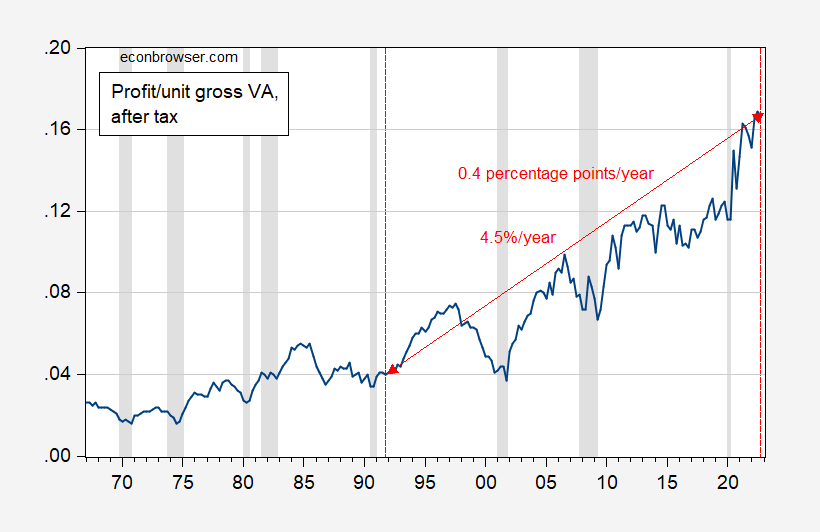

Figure 1: Profit per unit real gross value added in nonfinancial corporate , after tax (blue). NBER defined peak-to-trough recession dates shaded gray. Red dashed lines at 1992Q4-2022Q4; arrows denote percent and percentage point growth between those dates. Source: BEA via FRED, NBER, and author’s calculations.

One could talk about a percentage growth rate of a profit margin (4.5%/yr in Figure 1), but it’s weird to calculate a percentage change on a percent. That’s why typically, when considering changes in ratios, one speaks of percentage point changes (0.4 ppts/yr in Figure 1), thereby avoiding needless confusion. (Those who deliberately want to confuse might want to use “percent change” of ratios, then).

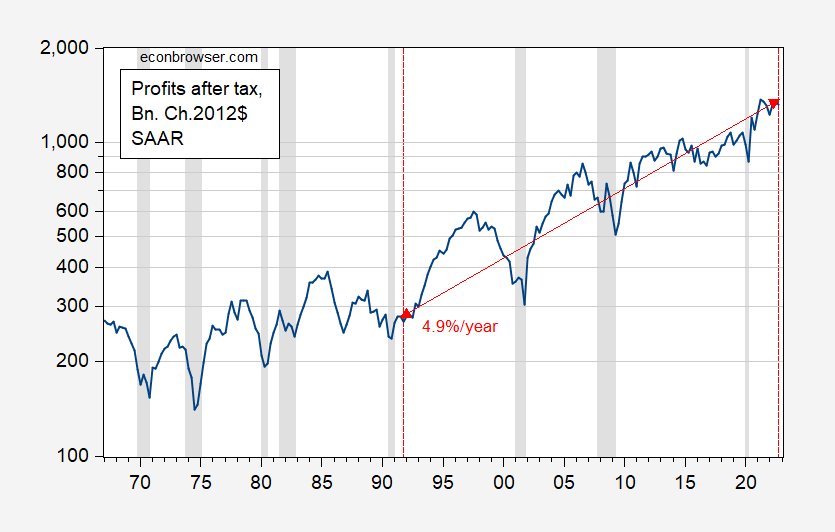

When to use percent change? Well, when discussing something in levels. E.g., Figure 2 below.

Figure 2: Profit for nonfinancial corporate business sector, after tax, in bn.Ch2012$ SAAR, on log scale (blue). Profits deflated by GDP deflator. NBER defined peak-to-trough recession dates shaded gray. Red dashed lines at 1992Q4-2022Q4; arrows denote percentage point growth between those dates. Source: BEA via FRED, NBER, and author’s calculations.

The other point I want to make is that, technically, something growing exponentially doesn’t mean it’s necessarily growing fast. Might be, might not be. For instance something growing at 0.01% per year might be increasing a lot slower than something growing at 0.01 units per year… Exponential just means that if the series is logged, the logged series grows linearly.

Diane Swonk saying Fed Res will pause in June.

Y’all knew this was coming, right?

I’m just always happy when the shotgun blast just barely misses the top of my forehead.

When asked for comment, JohnH replied: “But I ain’t never been to Nacogdoches…… “

That you, Jake?

My favorite John Wayne film by far. 2nd place “The Quiet Man”. A lot of people say “The Searchers” but the kind of subliminal racism came on to strong for me. Which is kind of funny coming from me because I don’t consider myself in the “woke” crowd. I was trying to think of others. When I was super little I liked John Wayne, then as I became an adult the barking commands schtick got a little tedious.

“Exponential just means that if the series is logged, the logged series grows linearly.”

You challenged JohnH to do this. He did not do the real work. But you predicted he would not.

“that really only serves to confuse”

That was JohnH’s intent. It is always his intent.

“One could talk about a percentage growth rate of a profit margin (4.5%/yr in Figure 1), but it’s weird to calculate a percentage change on a percent. That’s why typically, when considering changes in ratios, one speaks of percentage point changes (0.4 ppts/yr in Figure 1), thereby avoiding needless confusion. (Those who deliberately want to confuse might want to use “percent change” of ratios, then).”

The point I was trying to make. Of course JohnH changes the subject (as he often does) telling us that Pepsi’s profit margin in 2022 (which was 13.3%) was higher than its profit margin in 2020 (14.3%). Yea – Jonny does like to mislead mislead about everything.

One of the things I like about Calculated Risk’s economic reporting is that he just points out the facts – which you seldom get from mainstream economic reporting – for the past 20 years – the GOP has been fiscally irresponsible – https://www.calculatedriskblog.com/2023/05/what-happened-to-paying-off-national.html (IMO – the current GOP is a bunch of insurrectionists who want to destroy the U.S. economy.)

Also – I want to point out to my fellow frogs – in case you have been watching Fox News for the last 20 years – the water in the pot is now boiling https://public.wmo.int/en/media/press-release/global-temperatures-set-reach-new-records-next-five-years

At the turn of the millenium, the concern was that the US was paying off the debt too quickly! Here are a few excerpts from a speech by then Fed Chair Alan Greenspan in April 2001:

Bill McBride reminds us of the excuses for those stupid Bush43 tax cut. Thanks for letting his know of this important post!

7) The Trump Tax Cuts: These tax cuts – mostly for the wealthy – were sold with several promises – all failed. See: The Failed Promises of the 2017 Tax Cuts and Jobs Act (TCJA). A couple of quote:

“Not only will this tax plan pay for itself, but it will pay down debt,” Treasury Secretary Steve Mnuchin, Sept 2017

“I think this tax bill is going to reduce the size of our deficits going forward,” Sen. Pat Toomey (R-PA), November 2017

Complete nonsense.

To the point. Bill McBride is a national treasure!

Geneva, 17 May 2023 (WMO) – Global temperatures are likely to surge to record levels in the next five years, fuelled by heat-trapping greenhouse gases and a naturally occurring El Niño event, according to a new update issued by the World Meteorological Organization (WMO). There is a 66% likelihood that the annual average near-surface global temperature between 2023 and 2027 will be more than 1.5°C above pre-industrial levels for at least one year. There is a 98% likelihood that at least one of the next five years, and the five-year period as a whole, will be the warmest on record. “This report does not mean that we will permanently exceed the 1.5°C level specified in the Paris Agreement which refers to long-term warming over many years. However, WMO is sounding the alarm that we will breach the 1.5°C level on a temporary basis with increasing frequency,” said WMO Secretary-General Prof. Petteri Taalas.

Wait for it – CoRev will soon be barking his usual dishonest BS. AHEM!

Ole Bark, bark so what is the difference between today’s average and the “… 1.5°C above pre-industrial levels…”? What catastrophic event(s) will happen? What do you propose to stop it happening? How much will temperature drop from “… 1.5°C above pre-industrial levels…”? What is the cost/benefit of these action(s)?

I’l wait for your studied and erudite response.

The religious beliefs of the liberal mind is an amazement.

“How much will temperature drop from “… 1.5°C above pre-industrial levels…”?”

Drop? You continue to write such gibberish and actually expect people to answer insane tirades of trash?

Hey CoRev – your early version of ChatGPT is just not cutting it. Do you need financial help getting a more modern version?

“What catastrophic event(s) will happen?”

CoRev used to deny global warming but now he is faced with overwhelming evidence to the contrary so little CoRev has changed his tune to a claim that global warming will no serious impacts.

CoRev is certainly one who holds malleable opinions! Then again most worthless trolls do.

Ole Bark, bark, I’ll take your responses as you can not answer any of the questions. Your global warming (Oops- Climate Change) religious views are showing.

You’d think the liberal mind would at least know some of the basics of their beliefs. Nope! It’s an amazement that they know so little, and show us their ignorance over and over.

You can call it what you want, but the fact is that Corporate America’s profit margins have almost quadrupled in the last 30 years. Is the host suggesting that such a development is not significant? Is it not related to rising income inequality? Is that not important?

“almost quadrupled in the last 30 years.”

Well more than 3.75 times. Now had you said that from the beginning no one would have called you out for being deceptive. But then misleading has always been your game. Oh this pathetic game too:

‘Is the host suggesting that such a development is not significant? Is it not related to rising income inequality? Is that not important?’

Everyone who reads this blog and has an ounce of integrity would never ask such disgusting questions. But Jonny boy thinks he has the right to question other people’s morals. Oh no you don’t as you have zero morals, integrity, or even the remotest amount of intelligence.

BTW you have not addressed your lie that Pepsi’s 2022 profit margin (13.3%) was higher than its 2020 profit margin (14.3%).

Then again taking personal responsibility has never been one of Jonny boy’s traits.

Maybe Menzie’s problem isn’t your base argument, or that he wouldn’t even “humor” (be open to) your argument. But his problem is your method, or how you were making your argument. If that’s true, Menzie’s doing you a friendly favor, of sharpening your sword for when you present your argument in the future.

“but the fact is that Corporate America’s profit margins have almost quadrupled in the last 30 years. ”

when you are shown to be wrong, simply double down and commit to your sins. never admit you were wrong. it only shows weakness.

Johnny, Johnny, Johnny…are you that needy? Are you that small minded?

The fact is, you do more damage to your purported cause with your lies and misrepresentations than can be undone by anything else you write.

The fact is that you got all breathless and hyperbolic, misrepresenting the math, AFTER Menzie had already called attention to the role of profits in recent inflation. The fact is, you spent comment after comment throwing dust in the air, and distracting from the issue of Menzie’s post.

By the way, I say “purpoted”, because I don’t think you really care about any of the issues you raise. If you did, you’d be like to understand them better than you do. You simply draw attention to yourself andie about the intentions of others. It is reasonable to conclude that drawing attention to yourself and lying about others is your actual goal.

Johnny, I’m willing to give you the chance to demonstrate that you aren’t, once again, being a lying little idiot. Where do you see Menzie saying anything which suggests the increase in profits as a share of GDP is not significant? Let’s remember, this all got started because of your response to Menzie pointing out that profits as a share of GDP are high. Right?

So you now suggest that because he has pointed out your poor understanding of math, he is minimizing th importance of high profits? That…the same crap you outlined all the time. So, a little copy/paste from you, showing that you actually saw something to justify your Glenn Beck routine.

Seriously, boy, you need to try to act like an adult. You’re getting a late start, so the odds are against you without a lot of effort.

“Exponential just means that if the series is logged, the logged series grows linearly.“

To keep it in terms some readers are familiar with, could we say that exponential means the parameter is compounded? Many readers have heard the term compounded interest, and also should appreciate the past 15 years they have not had much growth in their savings account, even if the growth was exponential.

Thanks prof chinn for the small lesson to help provide clarity. Imprecise or incorrect definitions allow some people to argue in bad faith. We see it often on this blog, and politics in general. Collateral damage from the recent war on truth…

“Imprecise or incorrect definitions allow some people to argue in bad faith.”

That is JohnH’s game to a tee. And when this lying troll is called out – he always reverts to accusing others of not caring about income inequality. On any other blog – his behavior would have had him banned a long time ago.

https://twitter.com/Braves/status/1660821626186002432?s=20&fbclid=IwAR1gm129QM0mYykWqwOUYkg1pfGjCWMKzv4uK5ZCqMSq-dXvlfXrf2u41Wk

Ronald Acuna got his 19th stolen base in a move to behold! OK – the Braves lost as they would not stop Freddie Freeman. But damn – 19 stolen bases on 21 attempts is awesome.

Picked up gasoline today at a station I don’t often go to. Nice pumps, clean inside (didn’t check the toilets) some good junk food, and quick clerk. $3.059 per gallon. I would say the average or median price in my area is $3.19.

One “rule of thumb” (but not concrete, always check) on finding a cheap station (if you don’t use a Wal Mart card or a Costco card). Find the station NEAR to a Wal Mart or Costco affiliated gas station. Often times they will try to compete with the Wal Mart station, and they’ll be at least cheaper to the median price in your area.

Yes, but is gasoline near big box stores exponentially cheaper than elsewhere? That’s all that really matters.

Heh, that word. I mean I have found that word fascinating for many years, since I think I learned it very late in my high school years. Like that magical moment when you figure out what compound interest is and can do (ruin people’s lives for example) and I was like “WOW…….. man…..”. It’s hard to put into words. Like the mirror scene in Citizen Kane:

https://images.app.goo.gl/dPagPVKbSCdNHF8R9

And when I first heard Covid 19 would grow exponentially, I was like “oh shit, this is gonna be big”.

“And when I first heard Covid 19 would grow exponentially, I was like “oh shit, this is gonna be big”.”

this is why there were so many people, including some on this blog site, that wanted to adamantly drown out the concern of the virus spreading exponentially. there was a concerted effort, early on, to significantly downplay how the virus spreads exponentially. they did this so that they could disparage the importance of social distancing and masking. because as we have ALL seen through the pandemic, when you failed to mitigate the virus early on, it spreads like wildfire through a population. but we gave a microphone to too many deniers, and it cost us lives. so we denied the severity of an highly infectious exponentially spreading disease, and then we denied the resulting deaths. all for political points. it was pathetic.

it is about $2.89 in my area. for clean restrooms, go to buccee’s.

5-star comment, just for referencing Buccee’s : )

Americana

“Profit per unit real gross value added in nonfinancial corporate”

Let’s note that gross value added excludes the cost of intermediate goods. So this particular definition of profit margin tends to be higher than profits relative to “sales” if sales includes the cost of intermediate goods. Not that I’m criticizing this measure as it strikes me as very informative.

One other issue – this measure is after-tax which tends to understate operating profits.