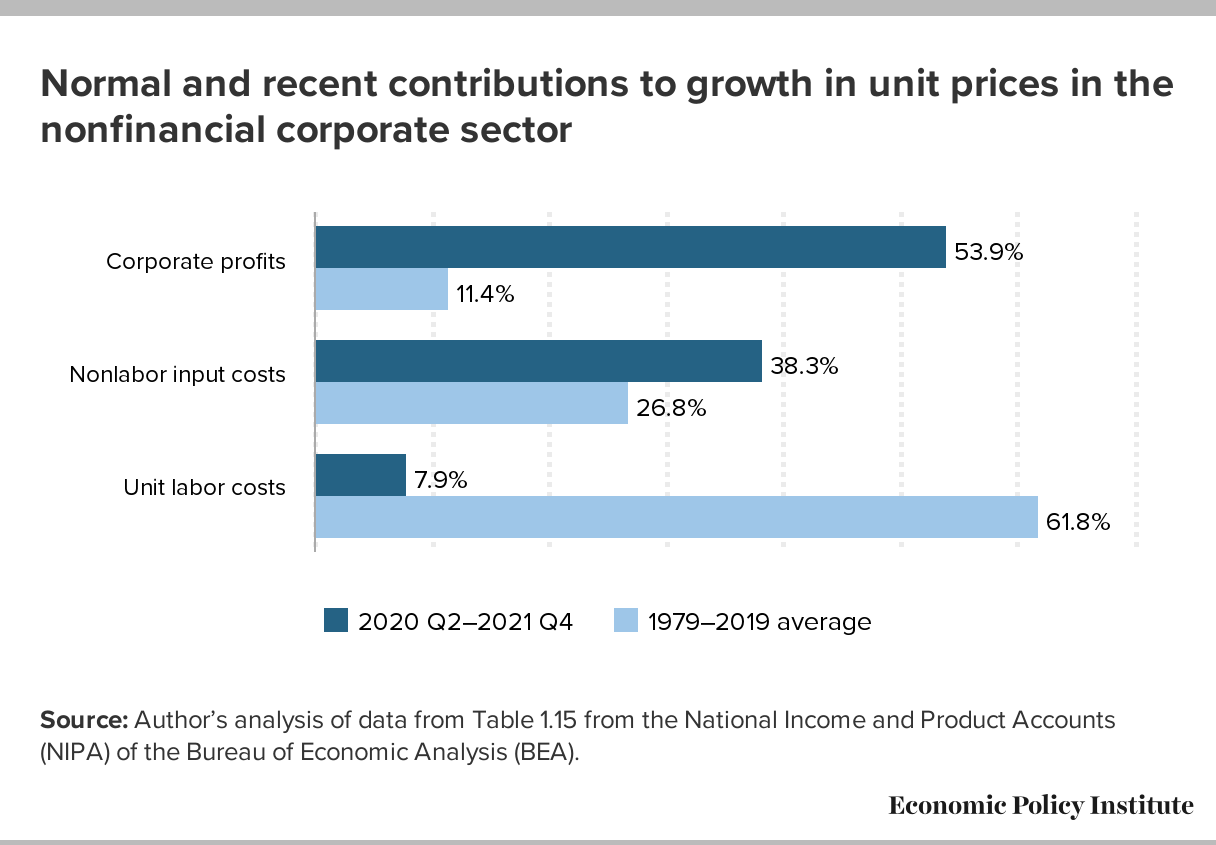

Josh Bivens at EPI has recently presented a decomposition of price changes into those attributable to price-cost margins (i.e., roughly profits), labor and nonlabor input prices, to wit:

Source: EPI, April 2023.

Former Fed Governor Brainard as well as Paul Krugman have commented on this price-price spiral (although I think the latter is a little less definitive on whether he believes this constitutes the majority of the inflationary impulse).

While the decomposition is interesting (it’s a decomposition after all), I’m not sure that the argument that Bivens forwards that it’s not demand pressures (aka overheating). While in very early NK models, the elasticity of demand for the differentiated goods are constant over the business cycle, so the price cost margin is constant, more recent work (e.g., Nakardo and Ramey, JMCB 2020) notes that depending on the type of shock, the profit margin can be procyclical.

It might be useful to think about price changes in the presence of stickiness. When inflation is rapid, then deviations from the optimal price at any given time between price-resetes will be larger, inducing larger profit loss. Assuming more rapid expected inflation in the current episode than occurred in previous periods then implies firms re-set prices faster, and by larger increments. From this perspective, I might expect a bigger mechanically-defined contribution from profits, especially if firms over-estimate inflation.

The preceding argument relies on a Calvo pricing view. If price changes are staggered, an alternative interpretation is that the strategic complementary that slows price adjusment during periods of low inflation would be attenuated when firms reach consensus on a faster rate of inflation.

These aren’t rigorous (i.e., general equilibrium) arguments for an elevated profit margin; they’re just ways of saying we’re not sure the elevated profit margins aren’t due to higher aggregate demand.

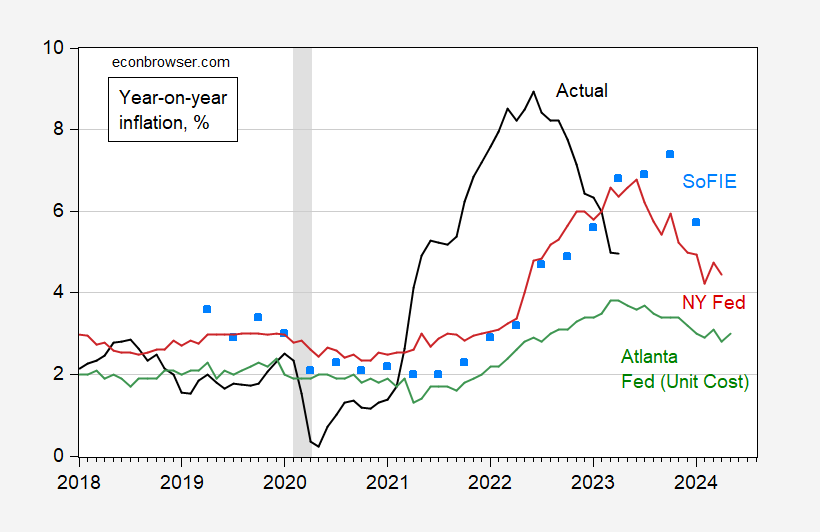

How fast did firm CEOs expect inflation to be? Coibion and Gorodnichenko provide the answer in their Survey of Firm Inflation Expectations.

Figure 2: Actual CPI inflation, y/y (black), NY Fed consumer inflation expectations for year ahead (red), Atlanta Fed unit cost inflation for year ahead (green), and firm expectations for inflation a year ahead (sky blue squares), all in %. NBER defined peak-to-trough recession dates shaded gray. Source: BLS, NY Fed, Atlanta Fed, Coibion-Gorodnichenko, NBER and author’s calculations.

The last observation we have for firm expectations is the January 2023 forecast for January 2024 year-on-year inflation. Interestingly, in the November and January surveys, firm expected inflation outstripped consumer expectations (which in turn outstripped economists’). In other words, firms expected rapid inflation (although not as rapid as actual outcomes, until April’s number). Note the Atlanta Fed measure of expected unit cost inflation is not from the same sample as that for the firm inflation, so a direct comparison is not possible.

None of the foregoing is to say that the profits currently enjoyed by firms is “good”. Rather, I’d just say it’s not clear that one can infer from profit margins whether demand shocks drove the outcome or not.

https://fred.stlouisfed.org/graph/?g=sC7n

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2007-2018

(Indexed to 2007)

Decline in labor share of income:

95.9 – 100 = – 4.1%

Increase in real profits:

152.6 – 100 = 52.6%

Correcting date *

https://fred.stlouisfed.org/graph/?g=sC7n

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2007-2023 *

https://fred.stlouisfed.org/graph/?g=PGTe

January 30, 2020

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2020-2023

(Indexed to 2020)

Decline in labor share of income:

98.7 – 100 = – 1.3%

Increase in real profits:

109.2 – 100 = 9.2%

Price policy was just what Isabella Weber would write about early this year, supported by James Galbraith. Paul Krugman however severely criticized Weber and that criticism evidently made price policy impossible to consider by the Federal Reserve or Treasury, leaving traditional monetary policy as the only real means of lessening inflation. Along with Galbraith, I find this outcome unfortunate.

Correcting:

Price policy was just what Isabella Weber would write about in “December 2021.”

“…and that criticism evidently made price policy impossible to consider by the Federal Reserve or Treasury.”

Nonsense. Krugman is a Nobel winner, but he isn’t the god of economics. He cannot single-handedly make a policy impossible. In addition, the Fed doesn’t have the legal authority to set prices on individual goods or on classes of goods. The Fed is a monetary authority, not a price board.

For that matter, Treasury doesn’t have the legal authority to set price, either. In 1941, the Office of Price Administration was established by Executive Order 8875. Wage and price controls in 1970 were established by Executive Order 11615, and that was only possible because of legislation, the Economic Stabilization Act of 1970. The President and Congress, not the Fed nor Treasury. And certainly not Krugman. Sheesh.

I bet ltr has no clue what Administrations Krugman has worked for. One – Reagan in 1983 as a junior staffer trying to help Martin Feldstein bring some sanity to economic decision making. Krugman would be the first to admit the White House did not listen to the Feldstein CEA. And he has refused to work for any other Administration.

Having listened to Weber’s Bloomberg interview, I am rather underwhelmed with her argument. And yes the younger Galbraith fondly remembers when his father worked on wage and price controls for FDR during WWII. But come on – we are not in a World War scenario (not yet at least). It seems a lot of centrist and right wing publications come to Krugman’s defense (for a change since Krugman is a progressive).

I would venture to guess that most economists have their doubts that wage and price controls are necessary right now – especially since inflation is moderating. But I would rather have a Nixon price control regime than that 1969/70 recession.

Here is a view from Argentina on what Krugman has been saying:

https://awardworld.net/nobel-prize/a-nobel-prize-against-price-controls-paul-krugman-got-involved-in-a-debate-that-resonates-in-argentina/#

https://awardworld.net/nobel-prize/a-nobel-prize-against-price-controls-paul-krugman-got-involved-in-a-debate-that-resonates-in-argentina/#

https://twitter.com/paulkrugman/status/1477247341212184577

Paul Krugman @paulkrugman

Deleting, with extreme apologies, my tweet about Isabella Weber on price controls. No excuses. It’s always wrong to use that tone against anyone arguing in good faith, no matter how much you disagree — especially when there’s so much bad faith out there.

6:56 AM · Jan 1, 2022

You have posted this exact complaint multiple times. Stop. It is rude to keep posting the same thing repeatedly.

Skip ltr’s BS and listen to what Isabella Weber had to say:

https://www.youtube.com/watch?v=Y-sZ2Xv31K8

Isabella Weber on a New Way to Think About Inflation

I went to Youtube because Bloomberg and Spotify want us to pay to listen to her interview.

Skip —– BS…

Skip —– BS…

Skip —– BS…

[ Always but always, the profane bully and would-be intimidator. Never a respite. ]

If you stop being such a propaganda tool, maybe you wouldn’t be treated like a propaganda tool.

I offer what she said and you object. Come on – stop being a cry baby.

instead of whining about being bullied, why not apologize for the repeated post of the same link and complain multiple times. it is rude, so stop doing it and behaving like some innocent hurt person. neither describes you.

When a prominent academic economist makes a point of vilifying an economist who is disagreed with, the result is to arbitrarily limit exploration in the subject. As repeatedly shown, women are especially subject to vilifying:

https://www.nytimes.com/2017/08/18/upshot/evidence-of-a-toxic-environment-for-women-in-economics.html

August 18, 2017

Evidence of a Toxic Environment for Women in Economics

By JUSTIN WOLFERS

Krugman supports women in economics. His wife is an economist. Your tirade against Krugman is laced with all sorts of dishonesty.

When a prominent economist finds it necessary to vilify an economist who is disagreed, there is reason to question not just the vilifying but whether the intemperate economist actually understands the ideas in question. David Card speaks about having been vilified and shunned by colleagues after successfully questioning the assumed effects of an increase in the minimum wage on employment.

https://www.nber.org/papers/w4509

October, 1993

Minimum Wages and Employment: A Case Study of the Fast-Food Industry in New Jersey and Pennsylvania

By David Card and Alan B. Krueger

‘David Card speaks about having been vilified’

Krugman has often praised their research. Come on ltr – do you really want to be seen as one of the dishonest trolls here>?

what happens when a government (ccp) villifies those in their country who speak up against injustices (uighers)? I never hear you defend that group of minorities in china, ltr. crocodile tears.

One easy test of the BS quotient of a writer or speaker is whether their verbal flourishes actually add to meaning, or are just fluff.

Take, for instance, “…finds it necessary to vilify an economist who is disagreed (sic)…” Finds it necessary? No. He did it. Whether he “found it necessary” is not only beside the point, but unlikely. It’s as if ltr had claimed a series was rising at an exponential rate just because it sounds fancy.

But that’s not the worst instance. Check this out:

“…there is reason to question…whether the intemperate economist actually understands the ideas in question.”

We are being told by a China-boosting blog-denizen with limited grasp of economics to question whether a winner of the Nobel Prize in economics understands economic ideas. Our little zhìzhàng is showing her true nature.

https://news.cgtn.com/news/2022-01-22/The-case-for-strategic-price-policies-171AF24WDgk/index.html

January 22, 2022

The case for strategic price policies

By James K. Galbraith

With a single commentary * in The Guardian (and an unintended assist ** from New York Times columnist Paul Krugman), economist Isabella Weber of the University of Massachusetts injected clear thinking into a debate that had been suppressed for 40 years. Specifically, she has advanced the idea that rising prices call for a price policy. Imagine that.

The last vestige of a systematic price policy in America, the White House Council on Wage and Price Stability, was abolished on January 29, 1981, a week after Ronald Reagan took office. That put an end to a run of policies that had begun in April 1941 with the creation of Franklin D. Roosevelt’s Office of Price Administration and Civilian Supply – seven months before the Japanese attack on Pearl Harbor.

U.S. price policies took various forms over the next four decades. During World War II, selective price controls quickly gave way to a “general maximum price regulation” (with exceptions), followed by a full freeze with the “hold the line order” of April 1943.

In 1946, price controls were repealed (over objections from Paul Samuelson and other leading economists), only to be reinstated in 1950 for the Korean War and repealed again in 1953. In the 1960s, the Kennedy and Johnson administrations instituted pricing “guideposts,” which were breached by U.S. Steel, provoking an epic confrontation. In the following decade, Richard Nixon imposed price freezes in 1971 and 1973, with more flexible policies, called “stages,” thereafter.

Federal price policies during this period had a twofold purpose: to handle emergencies such as war (or, in the cynical 1971 case, Nixon’s re-election) and to coordinate key price and wage expectations in peacetime, so that the economy would reach full employment with real (inflation-adjusted) wages matching productivity gains. As America’s postwar record of growth, job creation, and productivity shows, these policies were highly effective, which is why mainstream economists considered them indispensable.

The case for eliminating price policies was advanced largely by business lobbies that opposed controls because they interfered with profits and the exercise of market power. Right-wing economists – chiefly Milton Friedman and Friedrich von Hayek – gave the lobbyists an academic imprimatur, conjuring visions of “perfectly competitive” firms whose prices adjusted freely to keep the economy in perpetual equilibrium at full employment.

Economists with such fantasies held no positions of public power before 1981. But in the 1970s, the practical conditions for maintaining a successful price policy started to erode. Problems multiplied with the breakdown of international exchange-rate management in 1971, the loss of control over oil prices in 1973, and the rise of foreign industrial competitors (first Germany and Japan, then Mexico and South Korea).

Relations with organized labor started to go bad under Jimmy Carter, who also appointed Paul Volcker to run the US. Federal Reserve. But even as late as 1980, Carter imposed credit controls – a move that won public acclaim but also arguably cost him his re-election, because the economy slipped into a brief recession….

* https://www.theguardian.com/business/commentisfree/2021/dec/29/inflation-price-controls-time-we-use-it

** https://twitter.com/paulkrugman/status/1477247341212184577

James K. Galbraith is chair in Government/Business Relations at the Lyndon B. Johnson School of Public Affairs at the University of Texas at Austin.

I guess Brainard, Bivens, and Krugman are not mainstream economists under the JohnH smear economist mantra. But Bivens published that over a year ago. Recent?

Otherwise, an interesting discussion!

Recent?

Isabella Weber – December 29, 2021

James Galbraith – January 22, 2022

Josh Bivens – April 21, 2022

Lael Brainard – January 19, 2023

Paul Krugman – April 28, 2023

Bivens revisited the issue last month, opening the piece with ” The large increase in inflation in 2021 and 2022 in the United States exposed just how little deep thinking had been done about the issue of inflation-control by macroeconomists and policy makers in preceding decades.”

https://www.epi.org/publication/lessons-from-inflation/

Happy now?

Could we at least reproduce the entire abstract?

The large increase in inflation in 2021 and 2022 in the United States exposed just how little deep thinking had been done about the issue of inflation-control by macroeconomists and policy makers in preceding decades. The inflation of that time has often been attributed entirely to an excess of aggregate demand over potential output. But these years saw historically large shocks to the real economy stemming from COVID-19 and the Russian invasion of Ukraine. These shocks imposed extreme distortions on sectoral demand and supply, distortions which seem to have generated inflation globally, not just in the U.S. Further, temporary policies and circumstances (particularly pandemic fiscal relief and the whipsaw of massive layoffs and rapid rehiring efforts in labor-intensive service sectors) gave U.S. workers a pronounced but temporary boost in wage-bargaining with employers. Accordingly, a “shocks and ripples” analysis of inflation explains the data better than analyses based on movements in aggregate demand and supply.

Very much what Dr. Chinn has been saying for the last year or so. And little Jonny boy wants to argue with our host?

russian invasion of ukraine…. are they talking the 2014 invasion of crimea, donetz and lughansk?

iirc there were no sectoral disjunctions in us/eu economies from the attacks on those territories.

interesting, the russian special military operation is no different in terms of impact to the usa and eu, except for sanctions which were supposed to damage russia not the usa and eu.

and releasing 200 million barrels from the strategic petroleum reserves since the start of the smo should have softened motor gas and distillate pricing had usa not reduced crude imports and become a strong (much stronger than with trump) exporter of petroleum products….. supply decisions seem to effect energy pricing.

while the response to corona virus disease was us government stimuli direct to consumers, pouring trillions into m2 and the federal reserve absorbing $3 trillion in treasuries and agency debt! facts that might encourage Milton Friedman followers

NON pay-walled Nekarda Ramey:

https://econweb.ucsd.edu/~vramey/research/markupcyc.pdf

I don’t have any major disagreements with this post, in fact I enjoyed it even more than I usually enjoy Menzie’s posts. But I want to say something (you can label my comment a subjective opinion if you see it as such) regarding the near end part:

“None of the foregoing is to say that the profits currently enjoyed by firms is “good”. Rather, I’d just say it’s not clear that one can infer from profit margins whether demand shocks drove the outcome or not.”

I get, to a degree, and respect, to a degree, the professional economists’ protocol, not to make “value judgements”. Up to a point I “get it”. BUT…… (you knew it was coming, right??) If profit margins are excessive, would that not signal or at least hint that demand shocks had played a less prominent role, or a smaller portion, of the increased inflation of that particular episode/period???

I’ve only read the abstract and the list of references so far but this is an impressive contribution to the literature. On the references, there is a 1968 paper by Edmund Phelps, a 1977 paper by Robert Barro, and an even a 1986 paper co-authored by fellow conservative Glenn Hubbard. There are a lot of other economists who have contributed to this issue.

Which is to say anyone who claims “mainstream” economists do not address this issue seriously needs to catch up with what actual economists are writing. This paper would be a nice start.

I was trying to find the section of the paper that describes the authors’ surveys of firm owners/executives on how they make decisions on increasing prices. I’m still looking. Must be similar to wage increases they make as they complain perennially on labor shortage and skill shortages. Because when they have a shortage of laborers “they want to ‘stay ahead’ of the time” when they would have otherwise found themselves short on labor.

It’s kind of like how bank errors for customers work out?? The customer eats the error because it always magically works out for the banks’ favor?? See I’m slow, I’ll catch on someday on why wages are “sticky” and profit margins are not “sticky”. I just need to immerse myself in more equations.

I think my favorite phrase in the paper (should I do a word count on it??~~as if it’s some kind of cult dogma “the sky is red, the sky is red, the sky is red”) is “cyclical mark-up”:

“In all cases we found that the various measures of markups were either procyclical or acyclical”

Well, that solves that…..

WOW…….. not since I read Rogoff and Reinhart (you know, the economists who got desired results by “errors” made on spreadsheets, “obviously” a research assistant’s sloppiness, not Rogoff and Reinhart’s, nope not them, they only put their names on the front of the book, “innocent parties” to the entire thing) have I seen economists use such absolutist terms such as “ALL” when describing an issue around which there was much debate about.

“ALL”…….. indeed and “indubitably”.

OPEN question (mainly aimed at professional and/or credential academic economists):

When a credential academic economist “surveys” CEOs (generally considered to be a sophisticated group, and aware of their own “opinions” or their own stated opinions on their expectations/thoughts on the direction or level of inflation~~did professional economists expect the CEOs to answer “I think inflation is very high right now, and that’s why we instituted price increases on our customers.” or did professional economists anticipate CEOs saying “I wanted to F— over our own customers to increase profit margins and rationalize my own exorbitant salary”?? Which of those two statements would you make as CEO?? I mean if you were discussing “procyclical” (please gag me now with a giant sized spatula) price markups.

Now…….. (dear genius professional economist)…… please don’t answer this question too quickly……. First provide a 40 page paper packed with equations before answering which of the two answers you expected American CEOs to make. Think REAL hard now. Engage EVERY sensory neuron in that genius brain of yours before answering. I know you can. Be EXTRA CAREFUL when answering DURING “procyclical” (dry vomit) time spans……..

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=223,924,132,134,534,536,158,186,112,111,&s=PCPIPCH,&sy=2007&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Inflation Rate for Brazil, China, France, Germany, India, Indonesia,

Japan, Turkey, United Kingdom and United States, 2007-2022

2021

Brazil ( 8.3)

China ( 0.9)

France ( 2.1)

Germany ( 3.2)

India ( 5.5)

Indonesia ( 1.6)

Japan ( – 0.2)

Turkey ( 19.6)

United Kingdom ( 2.6)

United States ( 4.7)

2022

Brazil ( 9.3)

China ( 1.9)

France ( 5.9)

Germany ( 8.7)

India ( 6.7)

Indonesia ( 4.2)

Japan ( 2.5)

Turkey ( 72.3)

United Kingdom ( 9.1)

United States ( 8.0)

I wonder if anyone has noticed that profit margins have been growing exponentially. Repeat: profit margins, not just absolute profits, have been growing 4.5% per year on average for the past 30 years. The rate is a little lower over a 40 year time frame. https://fred.stlouisfed.org/series/A466RD3Q052SBEA

The chart shows some cyclicality, but, after profits margins fall briefly during recessions, they quickly resume their upward exponential growth.

This rapid margin growth is consistent with Galbraith’s point about the elimination of pricing policies, which were probably exacerbated by Corporate America’s increasing concentration, decreasing anti-trust, shareholder pressure, and a slowly growing realization of how limited the outside constraints were. The pandemic was a real epiphany on how inelastic prices are in many consumer markets.

“I wonder if anyone has noticed that profit margins have been growing exponentially. Repeat: profit margins, not just absolute profits, have been growing 4.5% per year on average for the past 30 years.”

Profit margins are high as many MAINSTREAM economists have noticed but a 4.5% increase per year for 30 years? Dude – your arithmetic is way off. And exponentially does mean what you think it means. We get you are terrible at numbers but could you learn to WRITE? Damn!

pgl obviously ignores Corporate America’s response to the pandemic. Corporate America played an active role in driving inflation, as Lael Brainard stated and Isabella Weber and Josh Biven have demonstrated.

pgl insists on providing cover for Corporate America’s price gouging.

“pgl insists on providing cover for Corporate America’s price gouging.”

Another pointless childish little lie. You are the one ignoring your massive arithmetic error. I would tell little Jonny boy to grow up but it appears he is incapable of doing so.

Johnny has changed the subject because (I get to pretend to know what’s going on in Johnny’s wee brain because Johnny routinely pretends to know what other people are thinking)… because he’s unable to answer pgl’s point about math. Also because pgl’s point is correct. Johnny hasn’t demonstrated exponential growth. He has looked at a chart and guessed.

Here are some simple tests Johnny could have tried. He could have downloaded the data (Oh, No! Download data???) into a spreadsheet sheet and fiddled with the modeling drop down to see if expotential growth is a better fit than any of the other math on offer. Or – apologies to log-phobes – he could convert the series to natural logs and see if a straight line is a reasonable fit.

Why didn’t Johnny do either of these? I offer three possibilities, and they aren’t mutually exclusive:

Johnny doesn’t know how.

Johnny didn’t realize that “exponential” has a specific meaning.

Johnny doesn’t care whether his claims are true.

With my new-found ability to read Johnny’s mind, I can tell you with 100% certainty that all three are correct.

“The fact remains that the average annual growth rate of profit margins over the past 30 years has been 4.5%.”

Jonny boy is doing some National Review word play now. I read – for good reason – that his first attempt to say this, the arithmetic might go like this:

4.4% + 4.5% times 30 years which of course would be a massive increase in the profit margin. And not true.

But clever little Jonny boy is now saying the current profit margin = 4.4% times 3.75 or 4.4% times 1.045)^30.

Clever I guess but very, very misleading. And we know Jonny boy is all about lying Lawrence Kudlow style.

Which as you often point is out is not how adults discuss real issues.

The original claim which is not quite the way dishonest boy is phrasing it now. Such a clever little liar Jonny boy is.

“profit margins, not just absolute profits, have been growing 4.5% per year on average for the past 30 years.”

My apologies for taking a while to figure out Jonny boy’s little dishonest trick.

Why apparently failed at math. He doesn’t know how to calculate 4.5% growth accumulated over 30 years. Hint–it’s the same as 16.7% margin divided by 4.4% margin!

You really are the dumbest troll ever. 1.045^30 = 31.35. If you are too dumb to use Excel, have the other 4 year olds at preK do this for you. Let’s see. If the profit margin started at 3% and grew the way first described they would be 94%.

You did fail at preK arithmetic after all. Now a real man would own up to his stupid error but Jonny boy is a little 2 year old who never grew up.

Damn – arguing with a village idiot like Jonny boy has rotted my brain.

1.045^30 = 3.75 not 31.35. So let’s see. 3%(3.75) = 31.35%. Now that is clearly higher than what Jonny boy’s own graph shows. The rest of my comment stands.

But I’m in a charitable mood. It appears Jonny boy cannot afford an Excel spreadsheet. Let’s take up a collection for the poor boy.

The fact remains that the average annual growth rate of profit margins over the past 30 years has been 4.5%.

pgl is just throwing a bunch of BS up against the wall to see if any of it sticks, his standard operating procedure.

“The fact remains that the average annual growth rate of profit margins over the past 30 years has been 4.5%.”

just to be clear, John, are you now backtracking on your exponential growth claim?

https://fred.stlouisfed.org/graph/?g=nrSP

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 1992-2018

(Indexed to 1992)

Decline in labor share of income:

91.6 – 100 = – 8.4%

Increase in real profits:

330.6 – 100 = 230.6%

https://fred.stlouisfed.org/graph/?g=mQUa

January 30, 2018

Labor Share of Nonfarm Business Income and Real After-Tax Corporate Profits, 2000-2018

(Indexed to 2000)

Decline in labor share of income:

90.3 – 100 = – 9.7%

Increase in real profits:

249.5 – 100 = 149.5%

“profit margins, not just absolute profits, have been growing 4.5% per year on average for the past 30 years.”

It finally happened. I have responded to too much BS from the likes of Bruce Hall, CoRev, and yes the person who wrote the above. One could read this (which is how I did originally) as saying 4.4% + 4.5%*30 = …. which is well over 100%.

But yea another interpretation of this above mish-mush would be 4.4% time (1.045)^30 = …

Let’s give little Jonny boy congratulations as he has learned to write for the National Review where being able to mislead with ambigous English is a requirement.

Quick question: which of these two series is rising at an exponential rate?:

https://fred.stlouisfed.org/graph/?g=15d72

Notice how GDP growth is much smoother than profit growth? So, if profit growth is expnoential, why is it so much more raggedy than GDP? Doesn’t that raggedyness suggest something more comes tha exponential growth? Johnny tries to cover with “resumes exponential growth”, but that’s a nonsense statement. How do you know growth is expoential if it is interrupted? (Hint – a little spreadsheet math would go a long way.)

Now, those familiar with math know that you can find some exponent which can match the endpoints of any series, without “exponential growth” being an appropriate description of the growth rate of the series. What you want is for the exponent to provide a good explanation for the growth of the entire series, not just to match the endpoints.

Want to know another thing? A single exponent doesn’t do a very good job of describing GDP growth, either:

https://fred.stlouisfed.org/graph/?g=15d8W

Notice how the year-over-year growth of GDP slows over time? If the growth rate isn’t constant between time periods, “exponential growth'” is a pretty shabby description for either series.

Shabby, like everything Johnny writes.

Shabby – yea. But this one was also a clever little lie.

One might say nominal sales grow exponentially. One might say nominal profits grow exponentially.

But the profit margin is the ratio of profits to sales. Ratios changing exponentially? No even if the ratio rose over time.

After velocity = GDP/M2. M2 might grow exponentially and some claim GDP grows exponentially. Oh wait GDP has grown by less than M2 so has velocity declined exponentially?

Only a moron speaks this way but that is our Jonny boy!

Hey Jonny boy – new post calling out your latest BS.

Samul Rines discusses Corporate America’s epiphany regarding how inelastic many consumer product markets have become and how Corporate America is taking full advantage.

https://www.seattletimes.com/business/how-excuseflation-is-keeping-prices-and-corporate-profits-high/

The original was posted at Bloomberg and is what Krugman referred to as “quite a discussion [of price-price] inflation over at Bloomberg.”

This long winded discussion had a few pet terms like ExcuseInflation and Pepsi Pricing Power. I had to wonder WTF you were saying about some alleged “how inelastic many consumer product markets have become and how Corporate America is taking full advantage” as the article’s only reference was this:

“Bottlenecks can create temporary monopoly power which can even render it safe to hike prices not only to protect but to increase profits,” Weber says. “This implies that market power is not constant but can change dynamically in a changing supply environment. Publicly reported supply chain bottlenecks and cost shocks can also serve to create legitimacy for price hikes and create acceptance on the part of consumers to pay higher prices, thus rendering demand less elastic.”

Would it be too hard for little Jonny boy to actually note what his own link really said? DAMN!

Jonny boy is citing someone named Samuel Rines. Like WTF is this dude? Does Jonny boy even know. Oh – here is his bio:

”Samuel Rines is chief economist at Avalon Advisors LLC. He was an equity analyst, portfolio manager and economist for Chilton Capital. He is the portfolio manager of Avalon’s Global Macro Strategy”

An analyst for a bunch of hedge fund types. Jonny boy who likes to claim the rest of us are bought and paid for by the banker types turns out to rely on people who are indeed bought and paid for by this crowd. Yes – little Jonny boy is a two faced hypocrite.

BTW – I checked out on Mr. Rines as the stuff he said about Coca Cola and Pepsi was beyond stupid. But par for the course for little Jonny boy.

Remember when you were talking about lumber prices during the recovery from the pandemic:

https://www.macrotrends.net/2637/lumber-prices-historical-chart-data

I bet you claimed they were rising exponentially too. Oh wait – they started falling exponentially. Then they started rising again – exponentially! oh wait – they have been falling exponentially!!!

OK, OK – you have no clue what exponentially even means. Go figure!

And what is pgl’s point? Of course, lumber prices go up and down. But corporate profit margins have on average risen by 4.5% per year over the last 30 years, even with a few dips during recessions.

My point is simple and obvious. You come here to troll. So much stupidity. So many lies. Jonny boy’s only role here is to dumb down the conversation. And you do excel at that.

“The result is a surge in profit margins at both Pepsi and Coca-Cola — and across major companies in general.”

The person who wrote this actually thinks Coca Cola is selling the bottle of his favorite soft drink? No – as someone who actually looked into that infamous transfer pricing battle where the IRS finally won a big case, let me walk you through the break down of a bottle of Coke pre-pandemic. You pay the retailer $1.20 a bottle who pays the wholesale – the bottler – $1.00. Coca Cola does not do the water, the bottle, or anything but the syrup or concentrate which costs only $0.20. Now cost of production, marketing, and distribution was only $0.11 so yea a 45% profit margin for the concentrate company is high even prepandemic. If that profit margin did go up, it might add a penny or two to your bottle of Coke.

The point here is that what really matters is the profit margins for the bottlers. Anyone with a brain knows this. But not the clown who is Jonny boy’s new guru!

““We call it the new PPP,” says Rines, short for “Pepsi Pricing Power.”

Samul Rines has a clever slogan but as I noted – he does not know the cola sector. I just looked at the profit margins for Coca Cola on its concentrate business. They have fell from 2020 to 2021 and fell again from 2021 to 2022. But as I noted, it is the bottlers that have 80% of the value added. I did check on the largest US bottler and their tiny 2020 profit margin has been rising a bit over 2021 and 2022.

Can I suggest your Samul Rines is horrible at economic research. But I’m sure he is better than Jonny boy.

Rines is pretty good about reading what corporations tell their investors.

And BTW…Pepsi margins in 2022 were higher than they were in 2020 and 2021.

pgl is intent on misleading us.

Jonny boy used to dismiss what corporations say in their financials but he thinks someone who does not know the difference between a soft drink and concentrate is a genius. Damn Jonny boy. You are very very dumb after all!

“And BTW…Pepsi margins in 2022 were higher than they were in 2020 and 2021.”

Whoever told you that LIED to you. Its 10-K filings are at http://www.sec.gov. OK you are too dumb to check their financials but I did:

2022 operating margin = 13.3%

2020 operating margin = 14.3%

Oh wait little Jonny boy thinks 13.3 is greater than 14.3.

Yea – you the dumbest troll God ever created.

Great chart! (Exponentially rising profit margins and declining labor share of income.)

Dare we infer the effects? Rising inequality? (Oh, no! Can’t talk about that!)

And let’s not forget that in our monetized “democracy,” money is free speech which translates into corporate domination of the means of communication.

And let’s not forget the Golden Rule: whoever has the gold makes the rules…which strongly suggests that exponentially rising profit margins are a feature, not a bug, of the vaunted “free” market.

But economists can’t bring themselves to talk about the self perpetuating nexus economic and political power, can they?

What is wrong with you, boy? You’ve claimed over and over that mainstream economists – whom you’ve defined as economists who publish in a few major newspapers – don’t write about th contribution of profits to inflation. Menzie writes about profits as a contributing factor to inflation in a useful way – something you’ve never managed to do – and you bitch about it. Grow up, kid.

Moses provided an excellent paper on this where the authors took the time to refer to a host of past papers on this topic from conservative economists, liberal economists, and I guess “mainstream” economists. Has Jonny boy read anyone of them? Of course not because Jonny says this research does not exist.

‘Can’t talk about that’? Real economists talk about inequality a lot. Oh wait – Jonny boy only reads Greg Mankiw and John Cochrane, Never mind.

Real economists talk about inequality a lot? Where have they noticed that Corporate America’s profits have been growing exponentially over the past few decades, helping drive stock prices and the exponential growth of incomes of the 1%.

But pgl doesn’t understand exponential growth, so why am I bothering explaining this to him?

You sniveling little liar! The idea that you know enough math to determine who does and does not understand math is just ridiculous.

I repeat, since you ignored what I wrote before –

“…those familiar with math know that you can find some exponent which can match the endpoints of any series, without “exponential growth” being an appropriate description of the growth rate of the series. What you want is for the exponent to provide a good explanation for the growth of the entire series, not just to match the endpoints.”

Get that, you weasel? You have made a nonsense claim about exponential growth, because a simple exponential growth pattern is poor description of the growth of unit profits. Any and points can be matched using an exponential growth formula, even if the endpoints are identical. No growth at all is exponential growth, if we accept your claim. Two points from a sine wave can be matched with an expoential growth formula, but it’s a sine wave, you moron, not exponential growth.

You’re nothing but a jumped-up little poser.

sniveling little liar!!! You have given the kiddies at Jonny boy’s preschool the perfect little line whenever Jonny boy makes a mockery of their teacher.

“it’s a sine wave”.

James Tobin had a lot of classic lines but my favorite was his take on John Muth’s Rational Expectations. Muth’s favorite example was the behavior of corn prices. Tobin noted that they followed a sine wave pattern until farmers had the information to actually form rationalize expectations. And then they followed a cosine wave pattern.

I wish I had taken better notes as his presentation was a joy to behold.

https://twitter.com/spectatorindex/status/1660213843476332549

The Spectator Index @spectatorindex

United Kingdom Prime Minister Rishi Sunak says that China poses the ‘biggest challenge of our age to global security and prosperity’.

5:20 AM · May 21, 2023

Just as Labour leader Jeremy Corbyn was successfully used as a scapegoat by Conservative and former Labour elite, so now China is to be used by Conservative elite.

No, China is a real threat. Corbin was just the UK’s Hillary.

https://fred.stlouisfed.org/graph/?g=T3lH

August 4, 2014

Real per capita Gross Domestic Product for China and United Kingdom, 1977-2021

(Percent change)

https://fred.stlouisfed.org/graph/?g=T3lJ

August 4, 2014

Real per capita Gross Domestic Product for China and United Kingdom, 1977-2021

(Indexed to 1977)

“Exponentially rising profit margins”

Such abuse of the English language. Like your dishonest claim that profits margins have risen by 4.5% per year for 30 years when you really meant they are 3.75 times higher aka 1.045^30. Yea – Jonny boy is so happy his writing has become as misleading as that garbage Kudlow and Moore used to write for the National Review!

Tell me, oh great pgl, what average margin increase did you arrive at from your calculations? Funny you don’t say! I’ll bet it was 4.5% or very close.

Sigh…and I even have to explain exponential growth to pgl.: “Compounding is the process in which an asset’s earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. This growth, calculated using EXPONENTIAL functions, occurs because the investment will generate earnings from both its initial principal and the accumulated earnings from preceding periods…

By compounding interest, financial balances have the ability to exponential grow faster than straight line interest.” Same for inflation.

https://www.investopedia.com/terms/c/compounding.asp

Average margin growth by Corporate America has been 4.5% per year. Apparently pgl didn’t even know that the ‘^’ in his formula “1.045^30” is an exponent.

Time for pgl’s remedial math lessons to begin…along with his remedial reading and remedial English. (One of the definitions of exponential is “rising or expanding at a steady, rapid rate,) which is exactly what has been happening to Corporate America’s profit margins over the past few decades.

Cut it out, boy. You’ve always lied about the knowledge and views of others, but this is beyond blatant. pgl has math skills far beyond yours. You aren’t fooling anybody.

Yea but I never got a job writing deceptive mush for the National Review. That’s Jonny boy’s forte!

Jonny boy practices advanced fuzzy arithmetic as in this claim:

‘JohnH

May 21, 2023 at 2:03 pm

Rines is pretty good about reading what corporations tell their investors.

And BTW…Pepsi margins in 2022 were higher than they were in 2020 and 2021.

pgl is intent on misleading us.’

Since Jonny boy does not know how to check 10K filings over at http://www.sec.gov I did.

2020 operating margin = 14.3%

2022 operating margin = 13.3%

According to JohnH’s advanced arithmetic 13.3 is greater than 14.3!

Let’s see (16.7% – 4.4%)/30 is not 4.5% per year. But I define ratios properly. Jonny boy defines things National Review style aka intending to deceive. Maybe you did not notice my point is that you are a lying troll but all the other kiddies figured that out.

‘Apparently pgl didn’t even know that the ‘^’ in his formula “1.045^30” is an exponent.’

I did not know what I wrote in Excel? Damn you are an idiot. Just because you can put something in Excel does not make it correct logic. Oh wait – you never put it in Excel. I had to do that for little Jonny boy.

BTW – I did capture your bait and switch sloppy language which was designed to mislead. Congrats Jonny boy – you are as dishonest as Kudlow and Moore. What a guy.

BTW Jonny boy – your claim that Pepsi’s operating margin was higher in 2022 than it was in 2020 and 2021 is refuted by their 10K filings over at http://www.sec.gov. But don’t believe the SEC – try this quarter by quarter chart:

https://www.macrotrends.net/stocks/charts/pep/pepsico/operating-margin#:~:text=Net%20Margin%20Current%20and%20historical%20operating%20margin%20for,PepsiCo%20as%20of%20March%2031%2C%202023%20is%2011.02%25.

Wow – that profit margin is falling as fast as lumber prices. Jonny boy once again says something that is false as Jonny boy flunked basic research!

Quick point in default –

baffling noted that Treasury will eventually make good on any missed payments during a period of default. That’s the widely held assumption and is almost certainly true. That’s a good thing, but mostly in the not-immediate-term.

In the immediate term, if I owe money and intend to use a principle payment from Treasury to make that payment, default by Treasury means I have to either default on my own obligation or come up with some money fast. Default is really bad. Coming up with money quciktime is pretty bad anyone who has had to do it knows.

So let’s think about fire-sale pricing in asset markets. Every time Treasury misses a repayment, anyone who needs that repayment to meet an obligation may sell other assets to avoid default. Equities, MBS, REITs, you name it, they all go on sale. Billions and billions of dollars of assets (thank you, Professor Sagan) will hit the market. Typical falling knife situation – nobody to step in until prices stabilize.

Who sells? Banks which have CDs (not CDS) maturing. Pension funds which have laddered asset maturities to meet pension obligations. Insurance companies which have laddered asset maturities to meet expected payments. Portfolios facing withdrawals – in a fire-sale, this could be a big deal.

One-way markets are illiquid, by definition. Crashetty crash crash crash. Bank assets would fall in value, leading to a pullback in lending. Crash. Spending would slow. Crash.

The Fed hates one-way markets, and would probably buy up under-priced assets to restore liquidity. Big Profits!!!

A crashing real economy might lead the Fed to cut the funds rate. I say “might” because Powell’s Fed intends to keep rates elevated into a recession as it is. So they’d probably ease, but maybe not right away.

One-way asset markets might lead the Fed to suspend asset sales – only reasonable when the Fed is buying assets in another part of its operation to restore liquidity.

All of this despite the fact that Treasury is almost certain to make good on defaulted paper. And all of it when recession risk seems elevated.

And another thing…

Foreign holders of U.S. assets might see Treasury default and the associated plunge in other dollar-denominated assets as a reason to sell. That would put downward pressure on the dollar. These guys face the very same problems as U.S. holders od dollar-denomunated assets.

However, fire-sale prices are a great time to pick up undervalued assets, if you have the cash and the stomach for it. National wealth funds, reserve managers and such might already have decided to grab dollar-denominated assets while the grabbing is good. That would put upward pressure on the dollar. Assuming potential buyers haven’t already arranged private transactions with potential sellers, thereby circumventing the need for foreign exchange transactions, FX volatility could be quite high. Central bank swaps up the wazoo.

What happens when asset prices tumble and all kinds of financial volatility spikes? Emerging market borrowers get trampled. You listening, China? Some debt forgiveness would be nice. Some cooperation with other lenders, too.

Domestic junk will also get trashed. Credit spreads will widen. Bad for mortgages. Bad for borrowers in general.

It seems the semiconductor trade war has heated up:

https://fortune.com/2023/05/21/china-says-us-chipmaker-micron-products-security-risks-semiconductor-battle/

China says U.S. chipmaker Micron’s products pose ‘significant security risks’ in escalating semiconductor battle

China said it found “relatively serious” cybersecurity risks in Micron Technology Inc. products that were sold in the country, and warned operators of key Chinese information infrastructure against buying the company’s goods.

The products caused “significant security risks to our critical information infrastructure supply chain” which would affect national security, according to a statement from China’s Cyberspace Administration on Sunday.

Results of the review came more than a month after China announced an investigation on imports from America’s largest memory-chip maker. That opened a new front in the escalating semiconductor battle between the the US and China.

The world’s biggest economies increasingly see each other’s tech sectors as risks to national security. The US has already blacklisted Chinese tech firms, sought to cut the flow of sophisticated processors and banned its citizens from providing certain help to the country’s chip industry.

Micron said after the review was announced that it was cooperating fully in the inquiry and “committed to conducting all business with uncompromising integrity.” It also said it stood by the security of its products and commitments to customers.

Operators of key information infrastructure should stop purchasing Micron products according to relevant law and regulations, the regulator said Sunday. The checks into Micron products are “necessary measures” to safeguard national security, it said.

China welcomes products and services provided by companies of all countries as long as those goods comply with Chinese laws and regulations, according to the statement.

Micron is the last remaining maker of computer memory based in the US, having survived brutal industry downturns that forced larger companies such as Intel Corp. and Texas Instruments Inc. to bow out. The company has relatively little exposure to China compared with its peers, and it doesn’t use the country as a major manufacturing base.

Breugel on the central bank “trilemma”. No, the other trilemma: stability, growth, unflation –

https://www.bruegel.org/first-glance/central-banks-uncertainty-problem-not-managing-trilemma

the International Monetary Fund in April summarised a recurrent narrative, writing that Europe must strike a balance between “sustaining the recovery, defeating inflation and safeguarding financial stability”

I wanted to note they said financial stability as “stability” has different connotations depending. Another excellent discussion and must read!

https://www.imf.org/en/Blogs/Articles/2023/04/28/europes-knifeedge-path-toward-beating-inflation-without-a-recession

Europe’s Knife-Edge Path Toward Beating Inflation Without a Recession

Success will require tighter macroeconomic policies tailored to changing financial conditions, strong financial supervision and regulation, and bold supply-side reforms

Alfred Kammer

April 28, 2023

So much to catch up on!

Recently, AP published an article reporting on China’s draconian foreign lending practices:

https://apnews.com/article/china-debt-banking-loans-financial-developing-countries-collapse-8df6f9fac3e1e758d0e6d8d5dfbd3ed6

Now Fortune had rehashed AP’s findings in order to then recount some of the bad economic consequences of Chiese lending and lending practices:

https://fortune.com/2023/05/18/china-belt-road-loans-pakistan-sri-lanka-africa-collapse-economic-instability/

We have seen China’s insistence on its own rules and its refusal to cooperate with other lenders justified in comments here in heroic terms – China throwing off the shackles of the established order and blah, blah. In fact, China is the main foreign lender in many Asian and African countries, accounting for half of foreign lending. It is China’s unforgiving lending practices which have fostered default in Sri Lanka and Zambia already, and threaten other nations with default.

China’s demand is to jump ahead of other international lenders, to be paid in full with other lenders’ money, and then walk away when default occurs. China isn’t standing up to the IMF. It’s crushing debtor countries to make a profit.

https://econbrowser.com/archives/2023/05/why-might-firms-raise-prices-faster-than-input-prices

May 21, 2023

And little Jonny boy

I would tell little Jonny boy

Jonny boy is a little 2 year old

Damn – arguing with a village idiot like Jonny boy

Jonny boy cannot afford… Let’s take up a collection for the poor boy.

Let’s give little Jonny boy congratulations

Would it be too hard for little Jonny boy

Yea – Jonny boy is so happy

[ Imagine such maliciousness, such bullying. Over and over and over. ]

Johnny defends China’s comments-section mouthpiece, so China’s comments-section mouthpiece defends Johnny. Birds of a feather…

Can we repeat our host’s key contribution to this discussion?

‘It might be useful to think about price changes in the presence of stickiness. When inflation is rapid, then deviations from the optimal price at any given time between price-resetes will be larger, inducing larger profit loss. Assuming more rapid expected inflation in the current episode than occurred in previous periods then implies firms re-set prices faster, and by larger increments. From this perspective, I might expect a bigger mechanically-defined contribution from profits, especially if firms over-estimate inflation. The preceding argument relies on a Calvo pricing view. If price changes are staggered, an alternative interpretation is that the strategic complementary that slows price adjustment during periods of low inflation would be attenuated when firms reach consensus on a faster rate of inflation.’

Now there are a couple of people here who want to snipe away as if their pet idea is THE ONLY way to think about (even if their sniping shows almost no thought). But did anyone of them address this argument at all. Oh no – just more sniping.

Too bad as this is an important topic and an interesting contribution to it that our little snipers refused to address.

BTW JohnH has once again contradicted himself. After all he has been banging the drum that the recent inflation has been caused by rising profit margins. But wait – now he says profit margins have been rising for 30 years. Oh wait – inflation has been low from 1993 to 2020. HUH!

Look the higher profit margins are a serious microeconomic concern that real economists have been writing about for years.

But little Jonny boy does not know this as he is too busy screaming junk from his soap box.

But little Jonny boy does not know this as he is too busy screaming junk…

[ I happened to watch “Casablanca,” yesterday. I was startled when Ingrid Bergman, Ilsa, called another character in the film “boy.” Sadly, who the “boy” in the film was should be obvious. The demeaning of the character was taken as granted. Here, we find a reader who over and over and over demeans another reader with no sense of shame attached. All that matters here is the demeaning. ]

https://econbrowser.com/archives/2023/05/why-might-firms-raise-prices-faster-than-input-prices

May 21, 2023

And little Jonny boy

I would tell little Jonny boy

Jonny boy is a little 2 year old

Damn – arguing with a village idiot like Jonny boy

Jonny boy cannot afford an Excel spreadsheet. Let’s take up a collection for the poor boy.

Let’s give little Jonny boy congratulations

Would it be too hard for little Jonny boy

Yea – Jonny boy is so happy his writing has become as misleading as that garbage

But little Jonny boy does not know this as he is too busy screaming junk…

China is starting to put on big-boy pants when it comes to dealing with foriegn capital:

https://www.bloomberg.com/news/articles/2023-05-14/china-opens-new-channel-giving-access-to-3-trillion-swap-market

Kind of a big deal.

Just don’t tell any jokes. Nevermind Lenny Bruce~~even Mort Walker would be doomed.

https://www.ft.com/content/f590f4fa-c064-4f5b-a0af-47afbfcdb27e

@ Macroduck

Care to hear an opinion from someone who has affection to much of China’s general population and hates their government??? Any westerner who wagers/invests in the swaps market in China is setting themselves up for a MAJOR fall/failure. You can mark my words on that if you like. They (“they” meaning the Chinese government, not regular mainland citizens) only invite foreigners when they need someone to foot the bill. It’s always centered around self-convenience.

Since ltr has bragged on China’s ability to attract foreign investment, I’m guessing China has a serious need for foreign investment, and is tending to the bells and whistles. Then it’s the usual demands for surrender of intellectual property and the like. You know the story.

I don’t mean to say there aren’t some glimmers of improvement there. You could make a strong argument that since “name brand” western investment banks are involved, willing to stick their toes into the water, that it’s not a total “racket” thing. I just, you see them “fish in” or “reel in” so many companies that should know better, and it’s pretty hard not to be cynical.

Johnny defends China’s comments-section mouthpiece, so China’s comments-section mouthpiece defends Johnny. Birds of a feather…

Johnny defends China’s comments-section mouthpiece, so China’s comments-section mouthpiece defends Johnny. Birds of a feather…

Johnny defends China’s comments-section mouthpiece, so China’s comments-section mouthpiece defends Johnny. Birds of a feather…

[ Ceaseless bullying. ]

If you stop being such a propaganda tool, maybe you wouldn’t be treated like a propaganda tool.

If you stop being such a propaganda tool, maybe you wouldn’t be treated like a propaganda tool.

If you stop being such a propaganda tool, maybe you wouldn’t be treated like a propaganda tool.

[ Ceaseless bullying. ]

You change your behavior, I’ll change mine.

You keep spouting Chinese propaganda, I’ll keep pointing it out.

You keep whining about bullying while justifying Chinese enslavement of Uyghurs, I’ll keep pointing out what a racist you are.

you must understand, ltr does not believe in freedom. ltr believes that the ccp should say and do what it wants, and if there is pushback, they should be jailed. ltr also believes she can make any comment on this site, without pushback when it is false or propaganda. ltr believes in her freedom to call others racist, but considers it bullying if somebody calls her out for racist commentary. ltr likes to call others bully, then uses a bully mentality to try and silence her critics with unrelenting commentary. she has never once apologized for the bullying and racist comments she has made on this site.

MD

Good work!

Arguments should not be confused with propaganda.

Bloomberg’s take:

https://www.bloomberg.com/news/articles/2022-03-30/2021-was-best-year-for-u-s-corporation-profits-since-1950?leadSource=uverify%20wall

The numbers are in: 2021 was the most profitable year for American corporations since 1950.

Profits surged 35% last year, according to data published on Wednesday by the Commerce Department, driven by strong household demand, which was underwritten by government cash transfers during the pandemic. In all four quarters of the year, the overall profit margin stayed above 13%, a level reached in just one other three-month period during the past 70 years.

When money is being tossed around by figurative drunken sailors, who can really blame the bartenders for raising the price of the drinks?

Gee Brucie – it has been a while since we had to endure your BS. Maybe you didn’t notice that the profit margins for beer companies fell in 2021. I guess you spent too many late hours falling on the floor of the bar drunk.

pgl, if you were so interested in beer company profits, could it be because you were worried about your personal supply? But what has that got to do with anything? Cruise lines didn’t do so well in 2020-21 either. Who cares?

I come back occasionally just to real your majestic irrelevance.

Oh, and since the first graph in Menzie’s post is about the 2020-21 period, I think the article I referenced is quite relevant. Bye Gumby.

My personal supply of beer? Brucie thinks he got off a clever little insult. But no Brucie – my local microbrewery makes better beer than that watered down crap you drink because you are cheap. AND the local grocery store has it on sale.

“since the first graph in Menzie’s post is about the 2020-21 period”

Ah Brucie – you must be even more reading challenged than your fellow Village Idiot JohnH who BTW gave us an updated Biven discussion.

Boy little Brucie – too drink to follow a conversation.

If Bruce Hall’s overriding point was, that the American consumer is often their own worst enemy, I cannot really argue with that point. But that has always been the case, since at least the early 1980s and arguably since mass manufacturing or bogus medicines were sold in catalogues in the early 1900s or whatever.

https://www.theatlantic.com/magazine/archive/2019/03/sears-roebuck-bayer-heroin/580441/

https://images.app.goo.gl/xTkSxoYGpRSWeorK9

https://images.app.goo.gl/3VayzAcMdhAzVbHU8

https://images.app.goo.gl/Yjnipc4PDk5LV3ff7

A long time, the American consumer was ill-equipped ok?? We can say a long time this has been true. In other words an uneducated consumer and/or consumers with poor judgement is nothing special to 2021. And for the record, I don’t view “pent-up demand” as even explaining 10% of the story. But I’m guessing most credentialed economists, including Menzie, would disagree with my last sentence, if not all of what I have said related to demand being a lesser factor than supply chain problems and straight-out profiteering in causing inflation.

ByMatthew Boesler

March 30, 2022 at 5:00 PM EDT

The numbers are in: 2021 was the most profitable year for American corporations since 1950.

Brucie boy has just read something that is almost 14 months old? Hey Brucie – the numbers are also in for 2022. I guess you were too drunk to have noticed.

Now had drunken little Brucie been paying attention – 2021 had 5.7% real GDP growth while Trump’s last year in office saw a disaster for real GDP. And had Brucie been paying attention – Biden has reversed that surge in government spending from Trump’s era of drunken fools.

But of course Brucie was Trump’s favorite little drunken fool so hey!

https://fred.stlouisfed.org/series/W019RCQ027SBEA

Federal government total expenditures

I offer this data for when little Brucie boy finally sobers up. Federal spending really soared under Trump but has been substantially reduced since Biden has become President. Not exactly the message Kelly Anne Alternative Facts Conway wanted little Brucie to portray.

In a flow of funds kinda way, taxes should follow funds. When corporations turn the flow their way, we should increase their tax tab.

Bruce Hall So were you one of those “drunken sailors”?

Well, I have a problem. I make widgets which I supply to retailers under a fixed price forward contract (didn’t know that did you). Thing is, inflation is high and unpredictable and I have to offer a fixed price covering the next 6 months. Do I offer a low price based on a conservative estimate of inflation, or a high price covering my worst inflationary fears? The low price option means I sell everything I can make, but risk making a loss on every sale if inflation is higher than expected and my input costs exceed my revenues. The high price means I may not sell to capacity, lowering my efficiency and potentially losing market share. What to do?

Know what, think I’ll go for the highest price. Even if things don’t go well and I lose sales and market share, at least I’ll still be in business. After all, I can always lower input costs (lay off workers, reduce inventories and so on) while still making a profit on each sale. The low price option could send me bankrupt – my business is small and cannot sustain a significant loss on every sale for very long.

And the outcome?

Guess what? Happy days, my competitors mostly made a similar decision! Inflation was higher than I expected but not as high as my worst case. My input costs rose inline with inflation, but the higher price more than covered them. Because so many competitors made the same decision and consumer demand is strong I was able to sell to capacity with the boosted profit margin. I bet those foolish competitors that offered a low price will change their minds in the next round – assuming they are still in business.

Of course, I realize these decisions might create a kind of demand driven price on price spiral. But hey, my profits are up and that’s a problem for economists – not me.

(Sorry Josh, Menzie is right on this one).

@ Flummoxed

You mean Menzie and all these other economists that Menzie shares their papers with us are troubling with equations when all they had to do was make a fictional narrative like you just did in your comment?? Damn…… I bet they feel dumb now that you showed them how it’s done. Oh wait, that’s kinda what “pro-cyclical” is isn’t it?? A BS narrative that means not-uh damned thing. “Prices (and hence profit margins) were increased drastically while the economy was moving well, THEREFOR it was all due to CEO ‘inflation expectations’ “. Thanks Cj Einstein and Valerie Einstein. Your brilliant contributions to the decomposition of inflation scholarly literature will be remembered two centuries forward. Thanks.

No need to thank me, but much appreciated anyway.

Nyaaa nyaaa

PUTTING A PRICE ON CARBON

The state of internal carbon pricing by corporates globally

https://cdn.cdp.net/cdp-production/cms/reports/documents/000/005/651/original/CDP_Global_Carbon_Price_report_2021.pdf?1618938446=&inf_contact_key=720ecd39d93603f4c7bdbc24d0653bcd680f8914173f9191b1c0223e68310bb1

Haven’t read this yet but it strikes me as important.

https://www.statista.com/statistics/269221/operating-profit-margin-of-pepsico-worldwide/

PepsiCo’s operating profit margin worldwide from 2007 to 2022

2020: 14.3%

2021: 14.0%

2022: 13.3%

Consistent with what their 10-K filings say (www.sec.gov)

Now Jonny boy is telling us that the 2022 operating margin is HIGHER than it was in 2020.

Wow – Jonny boy is a GENIUS as he has created the advanced field of fuzzy arithmetic where 13.3 is greater than 14.3.

The rest of us must be morons!

Speaking of profits, here’s a pretty comprehensive one-period data set, by industry:

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/datafile/margin.html

For the curious.

Damodaran’s website has all sorts of Usual Data. Check out the margins for Drugs (Pharmaceutical).

Huh – we had a Senate hearing on this sector last week!

The guy is a treasure. Data. Free classes on YT. Actual understanding.

Kopits did the brown skin test with a color swatch on this Damodaran guy. Apparently Kopits says he “failed” the test. If he dies we’re gonna have to do extra “due diligence” with the brown skin test before making out his death certificate, or Kopits says he won’t count as a dead human.

These are the rules. You can check the Association bylaws yourself:

https://spconsultants.org

BTW, Kopits has done a lot of volunteer work tossing paper towels to “these people”, so don’t come to him if you have any complaints about this association standard:

https://images.app.goo.gl/qzppQUk5ncU2YEzLA

Puerto Ricans were so humbled by Kopits’ volunteer work tossing paper towels into the air with news cameras rolling nearby, locals now call him “Dowager Kopits”

A real economic debate over at Kevin Drum’s place:

Matt Yglesias took to Twitter arguing cutting government spending during a full employment economy might be a good idea. But Kevin counters:

https://jabberwocking.com/austerity-budgeting-really/

This is fair enough but for a few things. First, we’re barrelling headlong into the Fed’s huge rate increases from last year, which are going to strangle the economy starting sometime very soon. I know a lot of people don’t want to believe this because it all seems sort of invisible and theoretical, but it’s neither. Rate increases slowing an economy with a lag time of about a year are about as close to a universal consequence of standard macroeconomics as we have. The tsunami is coming.

Second, high interest rates are already strangling the housing market and will continue to do so. This has obvious ripple effects.

Third, accumulated savings from the pandemic rescue bills is gone outside of the upper middle class—where it does little good anyway. With real income flat/down, this means real spending will drop too. This is already starting to happen.

Finally, there’s China as a wild card. Their economy is stumbling, and this will certainly have no good effect on the rest of the world.

Set against all this is the fact that the labor market remains strong. This is indeed a bit mysterious, but I wouldn’t put too much stock in it. It can turn around on a dime when other factors suddenly surprise people. It’s a thin reed to lean on.

Bottom line: the macroeconomy is stronger right now than it was during the first debt crisis, but it’s in a very tenuous state. It’s on the edge of recession, and the last thing we need is some stupid default brinkmanship to give it a final nudge over the edge.

There is a snake in the bushes of Yglesias’s argument. If we wanted less expansionary fiscal policy, there would still be the question of tax hikes or spending cuts. Yglesias simply begs this question (in the original meaning of the phrase) by specifying spending cuts. Why not tax increases?

Here’s one obvious reason that tax increases are preferable to spending cuts:

https://fred.stlouisfed.org/graph/?g=15jhH

Profits as a share of national income are higher now than any time since the late 1960s, but corporate tax revenue is just off the lowest level since the late 1930s.

The point to Menzie’s post is that corporate profits are extraordinarily high. That qualiies as a distortion, and good public policy aims to correct distortions. Yglesias is aiming at a high level of government spending which is already mostly cured.

Another obvious reason to increase taxes rather than cut discretionary spending is that tax increases reinforce automatic stabilizers, while discretionary spending cuts do not. Drum’s worry about the risk of a downturn is addressed by strengthening automatic stabilizers, but not by cutting discretionary spending. And let’s not forget one of the oldest arguments against fiddling with fiscal policy one a one-time basis to address cyclical imbalances – policy-makers (including armchair policy-makers like Yglesias) have rotten timing. Automatic stabilizers have great timing.

Discretionary spending is also where newly begun efforts to limit CO2 emissions and improve public infrastructure are funded. Yglesias hasn’t bothered to tell us what part of (presumably non-military) discretionary spending he’d cut, and we can’t take seriously any spending cut proposal which doesn’t specify cuts.

Yglesias often strikes me as shallow in his economic thinking. This is a perfect example. I am also suspicious that Yglesias is too far from his “juicebox mafia” days, and has absorbed the Norquist/Peterson miasma that chokes the air of our political thinking. Just not trustworthy.

“since the first graph in Menzie’s post is about the 2020-21 period”

Ah Brucie – you must be even more reading challenged than your fellow Village Idiot JohnH who BTW gave us an updated Biven discussion.

Boy little Brucie – too drink to follow a conversation.

Yglesias often strikes me as shallow in his economic thinking.

Matt’s early blogging was pretty good but then corporate America started paying him for blog posts and since then they have gone down hill.

You Can’t Fake Courage:

https://www.mediaite.com/politics/jon-hamm-attacks-josh-hawley-in-campaign-ad-for-his-senate-opponent-you-cant-fake-courage/

Jon Hamm’s brutal take down of Josh Hawley’s MANHOOD.

Businesses will always increase prices as much as they can get away with. The thing that hold them back (from getting away with murder) is consumers either not buying the product or buying it from someone else. The covered period is from the beginning of Covid so my guess is that the supply chain problems allowed businesses to ignore competition and jack up prices. The consumers had a lot of unspent cash from the closing down of entertainment avenues – so they paid up.

Buying from somewhere else requires that there be too many somewhere elses for non-collusive behavior to produce results similar to collusion. If there are a handful of dominant firms in a sector, price coordination is easy, without collusion. Anti-trust enforcement to lower business concentration is necessary to effectively “buyin it from someone else.” We are seeing a tny increase in anti-trust activity from the Biden administration. Decades of work is needed to set things right.

Yes – market power exists which real economists have noted for all of my life. But we get it – the usual trolls here who have never read any real economics pretends that MAINSTREAM economists have never written about this. I know a few people who work for DoJ and the FTC that would find such claims highly insulting.

Well this is odd:

https://www.ft.com/content/8811c49c-0549-4ce9-9730-6b67ac66a029

Russians fighting Russians in Russia, apparently over Ukraine. More detail needed. Good chance we’ll have to wade through a swamp of lies and misdirection over this one. Like every day.

@ Macroduck

Thanks for this. Quite interesting. I remember when a certain someone in the north part of Virginia said “Russians” in major cities of Ukraine (tending to be in the northeast corner of Ukraine) would be “bored” and in essence pacifist to Russian violence and invasion of Ukraine. Doesn’t seem like your FT story link “jives” with that scenario. I wonder why?? Oh we’d best not debate it. It’s wrong to argue with those claiming “expert” status and “insider” info. Carry on great Academia!!!! You reign supreme!!!! Even in the things you don’t specialize in….. because….. because….. because….. YOU said so. There. Done. All there is to say. NO!!! Quiet plebeians!!!!!! Go back to the diet supplements section of the Wal Mart pharmacy and be banished from dialogue with the special people!!!~~you dirt!!!