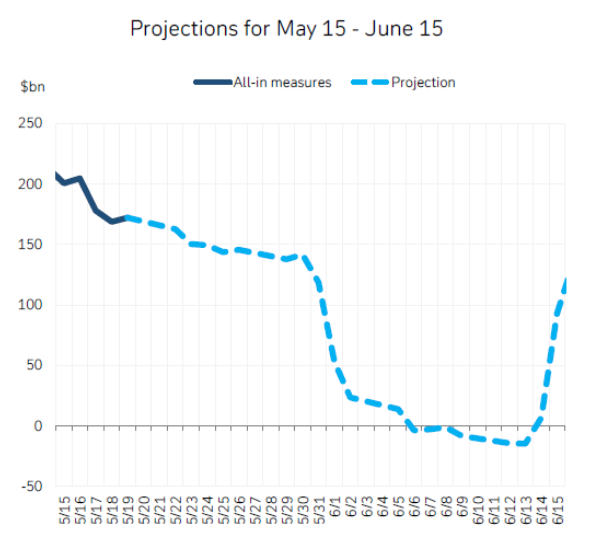

From Zeng and Ryan at DeutscheBank yesterday.

Source: Zeng, Ryan, Debt Ceiling Developments Weekly Tracker, May 22, 2023.

There are no days before June 5 when both House and Senate are in session. Both houses are in session on June 6-8, 12-15, 20-23.

Little sign of pressure in equity markets, but more in bond markets, and in CDS.

Why isn’t Biden, or dumb clueless Copmala Harris [tries to stop the pomegranate juice shooting out of my nose from laughter] getting up on the soapbox to discuss these numbers???

https://www.brookings.edu/blog/fixgov/2023/01/26/cutting-irs-funding-is-a-gift-to-americas-wealthiest-tax-evaders/

If Biden is too decrepit to travel the college circuit, they need to get Harris or someone out there, getting the message out. Again, Democrats sleeping at the steering wheel or just being “Republican Lite”.

‘But the IRS has been left without the resources to hire and support the kind of tax experts who can catch wealthy tax cheats. The lack of staff was highlighted recently when it was revealed that the audit of former president Donald Trump was staffed by exactly one revenue agent. But Trump wasn’t the only one whose taxes were going without thorough examination. Audits of millionaires have dropped 61% in less than a decade. For those making more than $5 million, the audit rate has dropped 87%.’

Multinationals have known for decades that IRS enforcement of transfer pricing is weak at best. Other nations such as Canada and the UK do much better because they try. Now I am hearing the same tax “professionals” who get rich off of all of this that the IRS is now serious. They may be trying but the House Republicans want to shut them down. And we wonder why Hi Tech and Big Pharma pays so little in US taxes.

needing ‘tax experts’ and finding them diverge greatly.

in the case of the irs a ramped up career development program is needed which may yield qualified “tax experts” in 8 to 10 years if they can find the recruits, get them in the laddered development program and keep them once they become valuable to the “tax prep” industry….

in 1984 after a widely publicized scandals about the pentagon paying too much for hammers, high g coffee pots, and spare parts, dod developed an “acquisition logistic” professional field. many new people entered the development process, a few had actually worked on military logistics.

cut to chase: last week gao discovered lockheed is not managing spare parts for the f-35, which is a sustainment nightmare, bc the “acquisition logistic” professionals are not fungible …… or maintained a legacy professionalism, largely bc f-35 and the like ran out of money for developing repair and supply chains. 40 years full circle.

irs will not be any more successful with tax professionals will be!

the pentagon has been training soldiers since von Steuben came over from Europe.

If a tree fall in the woods and nobody hears it did it really happen?

If the Biden administration pushes a story to all the news media and none of them (except an obscure blog) are transmitting the information – did it really happen?

Glasshoppuh, I told you many many times…… get a credentialed arborist to look at tree, then tree don’t fall.

could the fed simply sell off some of their bond holdings and remit the funds to the treasury to cover the gap, especially if the gap is small?

also, can the treasury simply issue a bad check? what happens if the treasury pays a bill without sufficient funds? never really thought about what happens in this situation. for a private person, with insufficient funds in the bank, we get a returned check. what happens in the case of the federal government issuing such a check?

“can the treasury simply issue a bad check?”

I would not want Treas. Sec. Yellen to be put in this position.

Now another thought – can we check on whether the Speaker of the House knows basic arithmetic. After all Kevin refuses to consider any new taxes while exempting Defense spending from any cuts and today ruled out cutting Social Security or Medicare. So what’s let besides growing money on trees?

Ole Bark, bark asks: ” ….Kevin refuses to consider any new taxes while exempting Defense spending from any cuts and today ruled out cutting Social Security or Medicare. So what’s let besides growing money on trees?”

I will repeat average annual total revenue exceeds annual mandatory obligations. Mandatory obligations include: Social Security, Medicare, Medicaid, interest on the debt, etc. This article is a clear description of what is considered mandatory obligations, and how they are funded: https://www.thebalancemoney.com/current-federal-mandatory-spending-3305772

It’s obvious Ole Bark, bark and Baffled are the dumbest of the dumb rocks in this liberal bastion of dumb rocks, but not all mandatory obligations are fully funded from tax revenue. Y’ano some critical obligations like Social Security, Medicare part A and B have their own tax and bond funding streams.

To further confuse the dumb rocks: “….The Treasury always uses whatever cash is on hand — whether from Social Security contributions or other earmarked or non-earmarked sources — to meet its current obligations before engaging in additional borrowing from the public. There is no sensible alternative to this practice. After all, why should the Treasury borrow funds when it has cash in the till?” https://www.cbpp.org/research/social-security/understanding-the-social-security-trust-funds-0

The entirety of your argument is a lie! Mandatory obligations can and will continue be funded out of existing total revenue streams. The prioritization of these obligations funded are not impacted by Amendment 14. They are in fact impacted by the Executive Branch priorities. Please, please continue to rely on Amendment 14 as a solution to change the debt limit.

It’s an amazement how far from reality and dumb is the liberal mind.

@ CoRev 19 disease

Do you think you could just once say something a little more sophisticated than what you heard on Mark Levin the prior night?? Literally stealing 20 year old taglines from the show?? What’s next??~~are you going to end each of your comments “CoRev fair and balanced”?? Grow a damned brain.

covid, you have a misunderstanding of the terminology used in discussing the budget. here is a link so you can become more educated:

https://www.cbo.gov/publication/57660

. . . Discretionary and Mandatory Spending?

The labels discretionary and mandatory identify the process by which the Congress provides funds for federal programs or activities. The distinction is generally made at the time a law creates a program or provides authority to undertake an activity. The Congressional rules and statutory procedures that govern budget enforcement differ for those two types of spending.

Discretionary spending results from budget authority provided in appropriation acts. (A few mandatory programs are also funded through appropriation acts; those programs are discussed below.) Through the appropriation process, the Congress decides on the amount of funding for a program (such as veterans’ health care) or an activity (such as collecting entrance fees at national parks). Administrative costs—to pay salaries, for example—are usually covered through those appropriations.

As a share of all federal outlays, discretionary spending has dropped from 60 percent in the early 1970s to 30 percent in recent years. Almost all defense spending is discretionary, and about 15 percent of pandemic-related spending was classified as discretionary.

Although statutory limits (often referred to as caps) on most types of discretionary budget authority were in place in many years, none are in effect now. The Budget Control Act of 2011 established caps for fiscal years 2012 to 2021; no caps were established for subsequent years.

Mandatory spending (also called direct spending) consists of outlays for certain federal benefit programs and other payments to individuals, businesses, nonprofit institutions, and state and local governments. That spending is generally governed by statutory criteria and, in most cases, is not constrained by the annual appropriation process. Social Security, Medicare, and Medicaid are the three largest mandatory programs.

Funding amounts for a mandatory program can be specified in law or, as is the case with Social Security, determined by complex eligibility rules and benefit formulas. The authorization laws that specify the amount of funding for mandatory programs may use language such as “there is hereby appropriated [a particular amount of money].”

Funding for some mandatory programs—for example, the Supplemental Nutrition Assistance Program, veterans’ disability compensation and pensions, and Medicaid—is appropriated annually. Spending on those programs is called appropriated mandatory spending. Those programs are mandatory because authorization acts legally require the government to provide benefits and services to eligible people or because other laws require that they be treated as mandatory; however, appropriation acts provide the funds to the agencies to fulfill those obligations.

As discretionary spending’s share of total federal spending has declined, mandatory spending’s share has grown, from about 30 percent in the early 1970s to 60 percent in recent years. The remaining 10 percent of total federal outlays consists of net spending on interest (primarily interest payments on the federal debt).

Under the Statutory Pay-As-You-Go Act of 2010 (often called S-PAYGO), the Congress established budgetary reporting and enforcement procedures for legislation that affects mandatory spending or revenues. That act can trigger across-the-board cuts in funding (known as sequestration) for mandatory programs. (For more information, see The Statutory Pay-As-You-Go Act and the Role of the Congress.)

Baffled, why are you confirming what I have said? You are FINALLY NOW understanding mandatory versus discretionary spending? I fully understood and highlighted some things re: SS, Medicare/Medicaid, interest on the debt, etc., as provided in your reference:

“…Mandatory spending (also called direct spending) consists of outlays for certain federal benefit programs and other payments to individuals, businesses, nonprofit institutions, and state and local governments. That spending is generally governed by statutory criteria and, in most cases, is not constrained by the annual appropriation process. Social Security, Medicare, and Medicaid are the three largest mandatory programs.”

and

“As discretionary spending’s share of total federal spending has declined, mandatory spending’s share has grown, from about 30 percent in the early 1970s to 60 percent in recent years. The remaining 10 percent of total federal outlays consists of net spending on interest (primarily interest payments on the federal debt).”

So explain how those above listed exemplary mandatory obligations will NOT be paid by existing revenues. Also explain how Amendment 14 will NOT highlight Biden’s attempts to pay other then those mandatory obligations. Further explain how you can blithely claim these mandatory obligations will not be paid due to reaching the borrowing limit,

Gullibility (believing and repeating obvious lies), ignorance, and failing to understand real world processes is an amazement of the liberal mind.

CoRev

May 25, 2023 at 3:38 am

Followed by a long winded and totally pointless rant. CoRev reminds me of the first version of ChatGPT.

“Gullibility (believing and repeating obvious lies), ignorance, and failing to understand real world processes is” CoRev 24/7. I guess CoRev is a LIBERAL!

Look at the pot calling the porcelain black! People who face real-world issues and look for solutions are dumb?

CoVid has made up a world in which an arbitrary budget category – mandatory obligations – is all that matters. That’s not what the law says. That’s not how the economy works. It’s not what the Constituion allows. But here’s CoVid, calling others dumb, when he’s gotten all the important stuff wrong.

This is the level of thinking you get from people who get all their ideas from John Birch offspring.

Now, now – you forgot to put “mandatory” in bold. To mental retards like CoRev – that makes all of the difference.

McQuack now makes more unsupported assertions.

The failure support erroneous assertions is common, and makes the liberal mind an amazement.

covid has a misunderstanding in what a mandatory and discretionary item is. in other words, he believes that mandatory means it is required by law, and discretionary means it is optional. which of course is an incorrect understanding. I provided him with a lesson from the cbo, but I doubt he read it. both of those obligations are required, by law, because an act of congress has been taken on each item. the only real difference is whether the funding mechanism comes from a yearly appropriation or effectively a recurring appropriation. neither “obligation” is optional. they have both been approved by congress to be executed. covid thinks he can be a deadbeat and not pay for legal obligations. maga republican, the party of deadbeats. bills are now optional for the fiscal conservative, if you have buyers remorse.

Baffled, please show us where I said anything close to your recollection: ” he believes that mandatory means it is required by law, and discretionary means it is optional.”

Moreover, explain how your/liberal claims that SS, SNAP, Medicare/Medicaid, etc will not be paid due to not raising the debt limit. The claim is opposite of what you are now showing us.

You are also confusing the budget with the payments process. I’d go on, but you would be even more confused.

The ignorant, gullible *believing any claim) and confused liberal mind is an amazement.

CoRev We all know how Treasury operates. But please note that in order to fund off-budget spending (i.e., Social Security) with on-budget receipts, Treasury must issue a bond to the Trustees and that bond is scored against the debt ceiling. In fact, you can easily construct a scenario in which Treasury must issue more debt in order to finance a budget surplus. As to the prioritization of payments, there is no clear procedure or guidance. As a practical matter the Treasury has always operated on a “first come, first served” basis. That’s how Treasury computers are programmed to work. There is no way that Treasury could make changes to those programs in such a short amount of time.

Meant to say on-budget spending with off-budget receipts requires a bond being issued to the Trustees. Currently both on-budget and off-budget accounts are running deficits for the entire fiscal year; however, it’s not clear that would be true over the very short time horizons in managing daily cash balances. It’s possible that the off-budget account is in surplus for one day with the on-budget account in deficit, or vice versa. Cash management can be tricky. As to the Fourteenth Amendment, wouldn’t the constitutionally appropriate thing to do would be to abolish the debt ceiling in its entirety? The debt ceiling wasn’t even a thing until long after the Fourteenth Amendment was ratified. The debt ceiling is a bad idea that hasn’t improved with age. It adds no value to our macroeconomy and is ripe for abuse by ignorant politicians. It serves no useful purpose and the debt ceiling law is itself clearly unconstitutional because it implies the possibility of default, which is expressly prohibited by the Fourteenth Amendment.

2slugs I knew you couldn’t remain silent on this issue. You assert: “CoRev We all know how Treasury operates.” Which is obviously not true as hi follows up that assertion with procedural conjecture and questions. And, that follows after Baffled’s comment explaining how I was correct re: mandatory/discretionary obligations.

We have had this discussion for years an you continue to mix budgetary with payment functions. They overlap, but are not the same. You liberals are fighting over ~$30B of the ~$4.6T Covid Relief Spending that still has not been obligated/spent.

“If the money was authorized to fight the pandemic but was not spent during the pandemic, it should not be spent after the pandemic is over,” House Speaker Kevin McCarthy said while introducing the GOP’s debt-limit package last month.” https://www.cbsnews.com/philadelphia/news/how-raising-the-nations-debt-limit-could-reduce-spending-of-some-coronavirus-relief-funds/

Why liberals focus on such little issues ( fighting over ~$30B of the ~$4.6T Covid Relief Spending) versus putting restraints and prioritizing spending is an amazement.

the problem with social security (fica) taxes is for the past few years they have went entirely to pay out to ss beneficiaries with almost all the annual interest cashed to pay as well, in the past couple of years a minute part of the ss trust fund was sold off to meet full obligations, but only a % or so.

each november the bureau of the federal debt is audited (gao) and you can see this!

fica surpluses used to depress/hide the headline deficits…..

to be a bit more in depth the discretionary side is roughly 30% of total outlays and the the pentagon is nearly half of that, the federal debt gets a clean audit but no so for the pentagon.

some of the cash mccarthy is after is “taking back” some of the stimmie the local jurisdictions have not expensed and maybe (omg the horror) cutting some of the pure cost, non-investments in the green new deal!*

*these cuts would help the fed with inflation as well…… if you listen to one fed governor on bbg tv.

I bet you have no clue what discretionary spending even is. Here is an explainer from the CBO:

https://www.cbo.gov/publication/52410

Hey CoRev – defense spending is a huge part of your discretionary spending. Unless you are calling for a massive cut in defense spending, your latest barking is more of your usual stupidity.

Wow! Ole Bark, bark still can not admit that the weeks of FALSE claims that mandatory obligations, SS, Medicaid/Medicare, SNAP, interest, etc. will not paid. You now want to point out that a large part of discretionary spending is for Defense. Your new grasp of the obvious is just another example of your prior ignorance.

The lying, ignorant liberal mind is an amazement.

“CoRev

May 25, 2023 at 11:02 am

Wow! Ole Bark, bark still can not admit that the weeks of FALSE claims that mandatory obligations, SS, Medicaid/Medicare, SNAP, interest, etc. will not paid.”

I have made no such claims. But of course CoRev lies as much as his hero Trump.

But wait – CoRev’s love interest Marjorie Taylor Greene is hoping people will not get paid. Uh CoRev – maybe that is why she is not returning your phone calls.

Republicans had problem with a debt ceiling when they were building a “wall” which from the very start everyone with a brain new wasn’t going to stop any migrant activity at all. And it didn’t. Had holes all along it and as was predicited beforehand would never be completed. But the illiterates thought it was the “magic solution” so they were appeased. Notice the quiet this last couple weeks after we found out there would be no immigrant surge on BIden’s watch. You could have heard a pin drop.

Of course the fact the early surge on trump’s time and very early in Biden’s time was largely caused by donald trump’s refusal to work out diplomatic solutions and at least ATTEMPT to fix the causes of migration in Central and South America is never discussed by Democrats. They have to go home for vacation.

Baffled asks: “could the fed simply sell off some of their bond holdings and remit the funds to the treasury to cover the gap,…” What is it you think they do with the existing Trust Fund holdings? How can you NOT UNDERSTAND the implications of SS being only funded to ~80% after the Trust Fund holdings are exhausted?

The hypocrisy and ignorance of the liberal mind is an amazement.

you make no sense, as usual. just a rant…

CoVid has confused the Federal Reserve with the Social Security Administration and then accused baffled of misunderstanding an issue that baffled didn’t raise.

It’s looking like CoVid’s masters have issued a new set of editorial guidelines, which require raving about ideas which have nothing to do with the issue at hand. Apparently, CoVid’s ideological masters are feeling desparate as a deal approaches.

Got to give poor CoRev a break. He is so far behind JohnH for 2023 Troll of the Year – he really needs to get busy posting stupidity.

@ Macroduck & 2slugbaits (I’ve always wanted to reference you two in the same comment)

Makes you wistful for CoRev’s days as a soybean prices forecaster, doesn’t it?? You remember, yes?? Before CoRev dropped that career to become weekend weathergirl and part-time climatologist. CoRev just keeps branching out to find new avenues of futility.

ss trust fund is credited with special treasuries.

they are not sold off for cash to pay beneficiaries they are retired for face value, congress/treasury sell usa bills and bonds for that cash, but they are not debt obligations of the ss trust!

some day they could sell ‘bonds’ as debt from the trust funds but that would suggest someone find and income stream….

maybe if the ss trust is privatized and it run like an investment bank…….

Yup! “they are retired for face value,…” Retiring them does not add to the Debt Ceiling, as it basically is an accounting change within the Debt subcategories.

So CoRev thinks he is some expert at government accounting. Oh wait – CoRev was the financial auditor for Enron back in the time. OK CoRev – we bow to your expertise at accounting fraud!

Like Lehman, for instance?

Private firms extract a profit from earnings. Socoail Security doesn’t. That profit iwould be lost to beneficiaries. That’s really the whole point of lobbying for privatizing Social Security – turnin public funds into private profit.

We are now past the date that default can assuredly be avoided, even if Biden caves in completely. That is, unless legislative rules are suspended or one of the methods of going around the debt ceiling is employed.

If Biden agrees to missing payments other than interest on the debt, that will become the new standard. Republicans will begin to negotiate with the intention of making Democratic presidents miss payments. The choice of who to stiff becomes a political talking poi t for Republicans and an issue for litigation. Far better to issue a trillion-dollar coin.

Nope. Default is mythical. Just keep borrowing

Mr Bott,

Default isn’t “mythical,” just unConstitutional.

Better: Furlough Congress, and suspend their platinum-plated healthcare

As soon as you know what you’re talking about, let us know.

Bott gets touchy when he’s wrong.

McQuack, Gregory Bott is FAR MORE CORRECT than you. Can/will you define default, and which obligations will fall into this category?

Better still define how the 14th Amendment changes this.

The ignorance of the liberal mind is an amazement.

Le me correct Mquacks comment: “If Biden agrees to missing payments other than interest on the debt, that will become the new Biden/Progressive entitlement and mandatory obligation “standard.”

Payment prioritization is an Executive Branch decision. Who is that?

Why does the liberal mind have to lie? It is an amazement.

CoRev,

Are you really saying that when Congress passes spending legislation it then can wash its hands of the whole matter and refuse to pay the bills?

Is that what you’re really saying?

David you are confusing budgetary and payment processes. Overlapping, but not the same functions. What do you want ot do with the budgeted ~$30B unpaid Covid Relief Funds? This happens at the end of every fiscal year.

CORev,

If the issue were merely funds remaining after the end of a program, the solution would be to draft a bill clawing back those funds. Crashing the economy, driving up funding costs by damaging America’s credit rating, and otherwise acting like a deadbeat dad on a bender for the purpose — and none other — of scoring political points is … deeply illogical and willfully unpatriotic.

Don’t you like the Constitution?

David ignorantly claims: “…the solution would be to draft a bill clawing back those funds. “, which is part of the House Resolution. What other parts of that Resolution do you object?

The ignorance of the liberal mind is an amazement.

CoRev

May 26, 2023 at 4:23 am

David ignorantly claims: “…the solution would be to draft a bill clawing back those funds. “, which is part of the House Resolution. What other parts of that Resolution do you object?

Never mind that stupid House Resolution is defunct. Hey little CoRev boy – how does it feel when the Speaker sold you out completely?

You’ve got the wrong audience in mind, CoVid. Ditto-heads probably don’t visit Econbrowser very often. You might try hewing a little closer to reality while you fume and wave your arms.

McQuack, bor are you wrong: “Ditto-heads probably don’t visit Econbrowser very often.” This is exemplified by your continued claims that SS will not be paid due to the Debt Limits .

The denying liberal mind is an amazement.

Find one instance in which I said that, you lying troll. Just one. Hard as i is to believe, you’ve become more diehonest.

McQuack, how many unsupported assertions does it take to show the depth of your lying?

Lying liberal minds are an amazement.

McQuack asks:”Find one instance in which I said that, you lying troll. Just one. ”

He did so just above by significant omission of SS and other mandatory programs: “If Biden agrees to missing payments other than interest on the debt, that will become the new standard.”

It is the level of misplaced importance that causes liberal confusion over how their government actually works.

This new standard of liberal confusion, hypocrisy and ignorance is an amazement.

And we thought JohnH was the pointless lying moron. No – CoRev is still the king of trolling.

By the way, anyone who is curious about why CoVid is wrong about this “mandatory obligation” nonsense should look into “Clinton v. New York” from 1998, if I recall correctly. The Supreme Court ruled that the president does not have the power to choose which authorized spending items to pay for. Once a spending item has been authorized by Congress and signed into law, it’s as mandatory as any other. CoVid is simply making stuff up, again.

https://www.oyez.org/cases/1997/97-1374

Clinton v. City of New York, 524 U.S. 417 (1998)

Not that a mental midget like CoRev will read this decision. Can you imagine some right wing retard like CoRev telling the Supreme Court Justices to “read the Constitution”.

Sigh! McQuack, you really, really want his issue to go to the Supreme Court? How many more months delay do you want?

The liberal mind is an amazement.

God you are dumb. It did about 25 years ago, which was Macroduck’s point. I provided you a link to the decision. And of course the mental midget known as CoRev did not bother to read the opinions of the Supreme Court justices. No little CoRev is too busy trolling his usual trash.

Sigh (again)! 1st use the 14th Amendment now this thin, thin and finally targeted straw which speaks to another liberal President’s over reach. From the reference: ” …challenges to the constitutionality of two cancellations, made by President William J. Clinton, under the Line Item Veto Act (“Act”).”

You folks really should read Title 31 of US Code to identify the clue bats you are missing.

Another interesting little factoid is: “How much interest is paid on the debt?

This is the fastest-rising portion of the debt. As recently as 2021, it was at a record low — just 1.6%. Now, it is around 6%. Even so, it’s not nearly as high as the mid-1990s, when it reached 15%.” https://www.npr.org/2023/03/23/1163448930/what-is-the-debt-ceiling-explanation

Explain to us again how interest debt was so low before Biden took office, and what was the impact of policy differences

The ignorance and denial of the liberal mind is an amazement.

“How much interest is paid on the debt? This is the fastest-rising portion of the debt.

CoRev mixed up an income flow with an asset/liability stock. Yea – CoRev flunked Accounting 101 too. Income statement v. balance sheet. HELLO?

Insecurity, anger,desperation and lying are Ole Bark, bark’s norm. Didn’t even notice the reference, and certainly never read it.

With such extreme insecurities his liberal mind is an amazement.

The financial press had, until today, been repeating the story that equity investors seem unconcerned about the debt ceiling. The S&P500 shed about 1.25% today, and now the story has changed, in part because the actual story hasn’t changed – no sign of new progress today.

In fact, we don’t have a counterfactual to determine whether stocks investors were or were not concerned. We know that the bill market reflects worry over default and that the credit default swap market reflects worry over default. I don’t see any goodreason to believe that stocks are unaffected. Rather, stocks might have been higher were it not for the threat of default. What has been missing is a dramatic show of fear in equity pricing. That’s more about middle-brow journalism than reality.

‘That’s more about middle-brow journalism than reality.’

There is a reason no one should rely on Jim Cramer for either economic advise or even investment advice. But I digress.

Unless FOX news, conservative a.m. radio/ Youtube fruitcakes succeed conning the functionally illiterate American public (>30%??) into a “prepper” “hoarder” “survivalist” sales job on panic, I’m guessing this stops our commodities/ consumer products inflation problem REAL fast. Inflation has a way of taking an interlude when people see their 401k worth shot to hell.

It “almost” makes you wonder why we’ve been raising interest rates during supply chain and profiteering created inflation. But hey, Larry Summers is, like, a genius, and stuff so if you don’t have an economics degree just STHU about supply-side storylines, ‘cuz it’s not allowed.

in 2011, the market declined after the debt crisis was resolved, the issue today, as then is ‘when you see the pain then react…..”

today’s decline was ‘catastrophizing’ the impact of the deal.

or they “stop worrying the fed rate hikes, and [not] love the debt crisis.”

apologies to stanley kubrick!

I just saw a 4 minute clip of Stephen A. Smith roasting the governor of Florida. I am not providing a link as I get some here are not fans of Mr. Smith. But his point was simple – the governor of Florida apparently could care less about Latinos, blacks, and even women. I’m sorry but how does this MAGA moron think he will ever become President let alone remain the governor of Florida? Yea he gets the Bruce Hall and Princeton Steve vote but DAMN!

@ pgl

If I’m the supposed party-pooper here, I give you my personal word I will say NOTHING about Mr. Smith in this thread, or in future threads relating to this particular roasting.

This is what I have been trying to explain to you, like unless you insult my mother, or only one other person I can think of, who you probably aren’t even aware of…….. I am not going to reveal your ID here, Don’t you think I would have done that by now after the coarse words we had in months long ago??~~if I was gonna do that?? You can come at me with guns blaring and I won’t reveal your ID. I’m not that type of person and I felt that was made clear. I think I stated that in the same comment, where I made it clear to YOU I knew, and no one else could figure it out still.

Part of the fun of blogs is strong disagreements, I would not take that fun part of the blog out of it for you—even if you insulted me. If I seemed “spiteful” to Barkley, it was because he hit two particularly sensitive nerve lines for me. His gargantuan arrogance, and he intentionally hit one personal issue for me I can’t tolerate from anybody. And I might add, not that Menzie ever noticed~~Barkley hit that soft spot for me before I EVER mentioned Barkley’s family relationships here in the threads.

Where are the 5 “moderate” Republicans that the Villagers in the media told me would step up and sign the Dem discharge bill? Gallagher and Steil of WI – you are both fiscally conservative moderate Republicans right? Reach across the aisle to save the U.S. economy? No – The GOP is having a good joke on the U.S. economy and cutting funds for nutrition for newborns/pregnant moms, cancer research, and grants to make sure our drinking water is safe and flaunting their wealth and power. https://www.mediaite.com/weird/mtg-just-paid-100000-for-kevin-mccarthys-used-chapstick/ BTW, much of this SNAP money and grants for rural infrastructure improvements goes to red districts.

It has been a while since we discussed natural prices in Europe but Norway’s Equinor saw an enormous increase in its revenues and profits in 2022:

https://www.argusmedia.com/en//news/2417549-equinor-lifts-fullyear-profit-european-gas-output

Norway’s state-controlled Equinor more than tripled its full year profit in 2022, although it slipped in the final three months of the year as gas and oil prices slid comparatively lower. Equinor posted a profit of $7.90bn for the October-December period, a drop of 16pc on the quarter. It made a profit of $28.74bn for 2022, up from $8.58bn in 2021. Equinor’s output fell year on year in the fourth quarter, with equity production of 2.05mn b/d of oil equivalent (boe/d) down by 5pc from the same period of 2021. Production was affected by “turnarounds in the US offshore, the exit from Russian assets and deferral of gas production from the Norwegian continental shelf to periods with higher demand”, the company said. Equinor’s liquids output declined by 6pc on the year in 2022. Its gas production rose by 2pc, underpinned by an 8pc rise in European output. This led to an overall fall in equity production for 2022 of 1.9pc to 2.04mn boe/d.

Its ownership is 67% government and 33% other shareholders. And even if one owned some of those shares, the effective tax rate for this company is well over 60% as Norway has the good sense to impose a huge excess profits tax.

Now with all the oil and natural gas profits earned by US companies – why are we not doing the same in terms of excess profits taxes?

Inflation Has Peaked—Get Ready for Deflation

By Donald L. Luskin

Any thoughts on this opinion item by Luskin as appearing in the WSJ today?

The opinion seems to be that inflation was caused by the stimulus payments that increased demand, while supply was limited. Now that stimulus payments have ended and money supply is decreasing, deflation is on the horizon. My sense is that it was not the increase in the money supply alone, but the increase that funded stimulus payments when supply was restricted.

Isn’t Luskin the Klown who told us on 9/14/2008 there was no chance of a recession?

Can’t get past the WSJ firewall but someone on Youtube is reading out Luskin’s latest. Luskin is citing data on monetary policy but he is massively contradicting himself. First he says we had massive monetary growth before without inflation. But this inflation was caused by this monetary stimulus. But then Luskin says inflation fell without tight money. Yea – Luskin is all over the map here. But what’s new?

Yeah, mostly. Domestic demand hasn’t recovered its pre-Covid trend, but aggregate labor hours are even further behind trend:

https://fred.stlouisfed.org/graph/?g=15on0

So there is a supply/demand mismatch, relative to the pre-Covid, lower-inflation period. “Scarring” in the labor force (aka hysteresis) is evident.

However, as this post points out, the labor-market contribution to inflation is small relative to profits and non-labor inputs:

https://econbrowser.com/archives/2023/05/why-might-firms-raise-prices-faster-than-input-prices

The Fed has focused on labor market tightness in explaining its policy course, but profits and non-labor costs are also cyclical, so from the Fed’s point of view, the demand/supply mismatch and inflation are what matter, more or less without regard to the contribution of various factors of production to inflation.

That doesn’t mean we should rely on Luskin, who has a long history of being wrong about economics and markets. Deflation? That’s a stretch.

His WSJ rant reminded me of the dumbest version of the Quantity Theory of Money ever. Then again on 9/14/2008 Luskin penned an oped telling us there was no risk of a recession.

there is more ‘unproductive’ federal govt ‘demand in the rescue act, the jobs act and the chip act to keep the fed balance sheet and m2 high longer than luskin thinks.

i do not read wsj.

M2 isn’t legislatively determined. And the bit about “unproductive” is just as nonsensical.

How effing dumb are you. The Treasury and the Federal Reserve are two separate entities. The money supply is mostly the liabilities of the private banking system. And yet you conflate three very different things. DAMN!

My up above comment’s first sentence should read *had no problem with a debt ceiling.

This is what happens in summer heat when my blood pressure rises. I am so sick of the STUPID, rinse, repeat, STUPID rinse repeat, STUPID rinse repeat of this place that is no longer America. It’s a vast ocean of people who cannot read or perform basic logic. That is all America is anymore. And predators on the illiterate. That is all this nation is. Morons and those who prey on them. That is all that exists.

The National Association of Government Employees suit may still end this debt ceilng nonsense, once and for all. The Supreme Court ruled in Clinton versus New York that the presidential line-item veto is unconstitutional, because it grants the president the power to refuse to pay for spending authorized by Congress – a violation of the separation of powers. Under Clinton, if Congress says pay for it, the president has to pay for it. Can’t do tha under the debt ceiling, so the debt ceiling violates separation of powers, and is unconstitutional.

Judge Stearns, we’re waiting…

Jason Furman just suggested Kevin McCarthy’s agenda is not cutting the deficit after all. Furman notes McCarthy wants more defense spending and less in tax on the rich all paid for by cutting Federal spending on domestic programs. If Furman is right – maybe Biden should take the 14th Amendment option and tell McCarthy to eff off.

Judge Stearns suggested in a hearing yesterday that the president has sufficient authority to deal with debt-ceiling blackmail without a finding from his court. Problem is, Stearns doesn’t have a case before him regarding the coin or perpetual bonds or the 14th Amendment.

Meanwhile, the federal government declined the opportunity say “Yeah, NAGE is probably right” at the hearing. So maybe Biden has already decided on a method for telling House Republicans to go soak their heads. I think lowering the odds of having Stearns rule in NAGE’s favor is a mistake, but what do I know?

“So maybe Biden has already decided on a method for telling House Republicans to go soak their heads.”

that is my gut feeling. he has a backup plan in place. and it will irk the gop. and force them to take direct action to cause a default. if there is no agreement, the gop can make the argument Biden chose to allow a default. but if Biden takes some (as of today unknown) step that avoids the default, then the gop would need to actively make a move that forces a default. they will take the entire blame in that case…its hard to blame the dems when you actively take action to cause a default. let them take Biden to court and make a judge force the default…

My guess is they want to make sure to look like Biden has bend over backwards for the sake of US before taking one of the “other” options and solve the problem. No matter what the final deal is, I don’t think the GOP will be able to pass it in the house without Democrats voting for it. So what happens if McCarthy cuts a deal and then it implodes in the house? Biden will be the adult in the room stepping in with a platinum coin or declaring an emergency that require 14’th amendment based action. Alternative would be to make sure the budget deal is much better than would be possible if negotiated separately. That way the problem of getting budgets passed will be solved.

God Made a Fighter? The DeSantis ad as he runs for President:

https://www.youtube.com/watch?v=o8jz7Cwjo3c

I’m sorry but this is an insulting joke. And we thought Trump had an overly inflated ego.

These must be happy days for commenter “ltr”, Xi Jinping’s China becoming more like Nazi Germany as each day passes:

https://www.nytimes.com/2023/05/24/world/asia/china-comedy-music-crackdown.html#:~:text=the%20main%20story-,As%20China%20Ramps%20Up%20Scrutiny%20of%20Culture%2C%20the%20Show%20Does,investigating%20a%20stand%2Dup%20comedian.

Is “LTR” short for “Let Tyranny Reign” ??

Luskin has an oped in the WSJ predicting deflation. I could not get past the firewall but I endured listening to someone read it on youtube. Trust me – not worth watching or even reading but it goes like this. After babbling incoherently a bunch of data, Luskin blamed the rise in M2 for inflation and now that M2 growth has turned negative, we must have deflation. And Luskin actually said M2 has never declined in US history until now. New someone who kept citing Milton Friedman knows M2 fell a few times in the 19th century and of course it fell in the early 1930’s.

https://www.longtermtrends.net/m2-money-supply-vs-inflation/

This link does two nice things. It shows M2 growth from the days of Woodrow Wilson until now and yea M2 fell in the 1930’s. And it shows inflation rates. Now maybe Luskin thinks there is some tight relationship between the two series but that is not what I see in the data.

Hey “H”, your wish is my command, hahahaha!!! I’m not even drinking now I don’t know why that cracks me up.

https://trendmacro.com/system/files/202305223trendmacroluskinwsj.pdf

His writings are always to be found there. I can always get the hardcopy WSJ the next day. I literally do not know how I got it, if I won some internet lottery or someone anonymously gifted it to me (highly improbable). I’m even afraid to talk the details as I’m afraid it will be taken away if I discuss it. But I can snag ANY article the next day, whatever the hardcopy is for that day. I get it slower than the internet but faster than the newsstand if that makes any sense.

“The record increase in the money supply caused by $6 trillion in pandemic relief payments in 2020 and 2021 unleashed the present inflation.”

Luskin must have gotten this garbage from Kudlow who also does not know the difference between fiscal policy and monetary policy.

And I love it when this moron told us that the data on M2 began in 1959. Well that is what FRED reports but Luskin mentioned Milton Friedman who took this data series back to 1868.

I am no Friedman fan, but that’s an excellent point you made about Friedman extending the data back. Which I never would have noted had you not told us (feign like your surprised I wouldn’t have noticed, for thew sake of my sensitive ego, ok??, joke). I presume he did this during the war years or just slightly after?? I strongly dislike Friedman, but he gets a mark in the plus column on that one.

I do not expect Katy Tur to be economist but damn she is a lot smarter than Bob Good (R-Virginia). She kept blaming that stupid 2017 tax cut for the rich while this MAGA supply side liar kept telling us we had 4% growth under Trump and 1% growth under Biden:

https://www.msn.com/en-us/news/politics/it-s-not-inaccurate-katie-tur-spars-with-house-republican-about-trump-s-tax-cuts-exploding-the-deficit/ar-AA1bB69I?ocid=msedgdhp&pc=U531&cvid=4c40e79e5e8647dbbc1af6eb5951cd01&ei=27

“We cannot sustain the one to two percent anemic Biden growth. We gotta get back to three to four percent — the Trump growth patterns that was fueling our economy previously. So it’s growth as well as cuts that’ll get us on a path to fiscal stability,” Good claimed.

Well growth in 2022 may have been 1% but it was 5.7% in 2021. And the idea that real GDP grew by 4% per year under Trump is a JohnH level stupid lie.

Going back to that debate between Katy Tur and some Republican lying jerk, it turns out in the 1st two years of Biden’s awful economy real GDP grew by 6.65% (2020Q4 to 2022Q4).

During the first 4 years of Trump’s incredible economy (2016Q4 to 2020Q4), real GDP grew by a grand total of 6.24%.

Seriously – any wearing a MAGA needs to retake kindergarten arithmetic.

From March 2022 to March 2023, M2 did fall by 4%. So is Luskin right to be worried about DEFLATION? If you said yes – then check out what happened to GDP/M2 (velocity) over the same period:

https://fred.stlouisfed.org/series/M2V

That it rose by almost 10% during the same time period was lost on a monetarist nutcase like Luskin? OK!

Did anyone else read the article from the WSJ referenced below? I thought there were some interesting comments.

The Phony Debt-Ceiling ‘Calamity’

The Treasury made a plan to pay bondholders in 2011. It could do the same with Social Security.

By Conor J. Clarke and Kristin A. Shapiro

May 22, 2023 12:08 pm ET

Hitting the X date won’t cause a default on the national debt. Debt-service payments have a feature that most other government payments lack: When the government pays off maturing debt, the amount of debt subject to the statutory limit declines. This means that the government can “roll over” such obligations—that is, issue new debt to pay off old debt—without violating the debt limit.

For a similar reason, hitting the X date need not stop Social Security and other payments that come from federal trust funds. The payroll taxes that are used to fund such benefits are invested in special Treasury securities that count toward the debt limit. The Treasury has the authority to redeem these securities to pay benefits; when it does so, debt subject to the statutory limit declines. Thus paying Social Security benefits—like paying maturing principal on the public debt—can create headroom under the limit, making rollover strategies possible.

In one respect, hitting the X date could be less disruptive than a government shutdown. The Antideficiency Act requires that many federal functions cease during a shutdown, and most federal employees are prohibited from working. But there is no analogous limit on federal functions after the X date—so many such functions could continue even if payments are delayed.

Mr. Clarke is an incoming associate professor at the Washington University in St. Louis School of Law. Ms. Shapiro practices appellate and constitutional law in Washington and is a senior fellow at the Independent Women’s Forum. Both served as attorney-advisers at the Justice Department’s Office of Legal Counsel during the Trump and Biden administrations.

I’m confused. If Treasury redeems (pays off) a security, it no longer counts as debt – true. However, funds to redeem debt have to come from someplace. If new debt is issued to redeem old debt, it’s a wash under normal circumstances. So I don’t see how the authors’ claim works, under normal circumstances. Where does the money to redeem old debt come from?

However, abnormal circumstances could save the day. If Treasury sells premium debt – debt with above-market Interest rates so that the debt sells at above face value – that could do the trick. Treasury sells $1000 in bonds, but received $2000 for them. Higher than market interest makes up the difference, and the face value o debt is cut in half. That’s also where debt held by the Social Security Trust could come into the picture. Treasury and the Trust could trade debt without any non-standard paper going into circulation. The Trust gets debt which pays higher than market interest but which has lower face value than the debt it gives to Treasury.

But that’s not, however, the argument the authors seem to be making. Only if Treasury has more revenue coming in than it has outlays can it pay down debt. That happens for short periods – and is likely to happen around June 15 – but from now until June 15, outlays are expected to exceed revenues most days, if not all. So how does Treasury reduce the level of debt? Ask yourself – what are the chances the authors have come up with a valid idea nobody else has thought of, which allows debt to be redeemed by paying out benefits? I think they are as confused a I am.

My reeponse was unnecessarily long-winded, so naturally I’m adding to it. Here’s a shorter version:

Try running T-accounts for Treasury and the Social Security Trust on the transactions suggested by Clark and Shapiro. That’s what all those words I used were meant to reflect. A T-account exercise immediately shows that something is wrong.

AS, I just don’t understand why most liberals claiming SS and Medicare/Medicaid, etc will not be paid? It’s like they have not lived through this political theater before. Are they all pubescent teenagers, all emotion and no logic?

The emotional liberal mind is an amazement.

Gee CoRev – I thought you had the hots for Marjorie Taylor Greene. Don’t you realize that this right wing bimbo wants a default? Talk like this and she will never go out with you.

I wanna say something super vulgar here, but I’m pretty certain Menzie (probably in the correct judgement) wouldn’t allow it up. But I think possibly Greene would be the best [ word that starts with an H and ends in a K ] since Kellyanne Conway. NO, I take it back, I just now saw Greene’s lizard skin. Sinema would be better. Nope, I changed my mind again. Lauren Boebert for the win.

You wanna know the word?? hunchback. No, really. It’s hunchback. Would I lie to you people??

When I noted you flunked basic accounting – you accused me of getting emotional. WTF? Do you even know what emotional means? I didn’t think so.

Yea – you are the most worthless little troll God ever created. Now little CoRev – go cry on your momma’s lap.

Just laughing at the weak responses.

The weakness of some liberal minds is an amazement.

OK jacka$$ – here is the appropriate response to this BS:

‘I just don’t understand why most liberals claiming SS and Medicare/Medicaid, etc will not be paid?’

NO ONE here made any such claim. Your incessant repeating of this blatant LIE is stupid, pointless, immature, and downright disgusting. And those are your good qualities.

No CoRev – you are a worthless little troll without an ounce of integrity.

Ole Bark,bark claims: “NO ONE here made any such claim. Your incessant repeating of this blatant LIE is stupid, pointless, immature, and downright disgusting. ”

But we have:

“pgl

May 23, 2023 at 2:28 pm

“can the treasury simply issue a bad check?”

I would not want Treas. Sec. Yellen to be put in this position.

Now another thought – can we check on whether the Speaker of the House knows basic arithmetic. After all Kevin refuses to consider any new taxes while exempting Defense spending from any cuts and today ruled out cutting Social Security or Medicare. So what’s let besides growing money on trees?”

Questioning Kevin McCarthy ruling them out is the same as saying YOU think they are on the table. You are that ignorant of how our Govt’s payment process works.

Some immature, ignorant and insecure liberal minds are an amazement.

Off topic, approval ratings among international rivals –

We have been treated to gleeful blather from the troll choir about the declining stature of the U.S. abroad. There is little doubt that the second Iraq war and U.S. support for Israel’s actions toward Palestinians has done serious hard to U.S. standing. Obama helped, but could not undo all the damage. Time will tell whether Biden can make a permanent dent in the harm done by Trump.

The problem with the view offered by the troll choir – there’s always a problem when dealing with the troll choir- is that the studiously ignore the declining stature of the countries they champion. Russia is in the doghouse:

Qhttps://news.yahoo.com/3-charts-show-russia-declining-111915896.html

China is, too:

https://www.pewresearch.org/global/2022/09/28/how-global-public-opinion-of-china-has-shifted-in-the-xi-era/

Bullying the neighbors is no way to make friends, apparently.

Big wheel keep on turnin’ …… Looks like Tina finally hitched a ride on the riverboat queen.

https://www.nytimes.com/2023/05/24/arts/music/tina-turner-dead.html

She had a rough life, with some domestic abuse involved. I hope her new digs make up for the violence she suffered through.

Something that hasn’t gotten a lot of attention is the fact that Treasury will have to schedule and hold an auction even if Congress acts and raises the debt ceiling. Ust because you have renewed authority to issue new debt doesn’t mean you have actually found buyers for that debt.

Primary dealers will take up the slack. That’s their one of their functions in the auction process. The big auctions that will be held after the debt ceiling is lifted are likely to tail to the moon, though. That’s one of the long-term costs of these debt ceiling battles.

2slugs asserts: “…authority to issue new debt doesn’t mean you have actually found buyers for that debt.” On an economics blog with many articles re: risk and bond prices, he makes such an infantile assertion?

Over the years you have made many crazy comments, but this one is near the top of the list.

The crazy liberal mind is an amazement.

Little CoRev fancies himself to be the Master Debater.

Of course, there are all sorts of high school debate clubs where the joke starts with Master Debater and morphs into Mastur Bater. Which is CoRev to a tee!

Hey CoRev – if high school is too rough for you, doing remedial preK lessons may be more your style.

@ pgl

I’m extremely disappointed in you pgl. Why didn’t you grab that $5 million while you had the chance?? (friendly teasing) You need a do-over pgl.

https://www.politico.com/news/magazine/2023/05/26/my-pillow-mike-lindell-investigation-00097903

: )

Living in this angry dirty head is such a chore. Please get help for your psychoses.

The psychotic liberal mind is an amazement.

Your rudimentary version of ChatGPT keeps writing stupid trash with your name on it.

Find something productive to do – like watching the grass grow.

Even if Congress doesn’t raise the debt ceiling, Treasury still has to run auctions because it has to roll over the bonds that mature each week. I wonder how those auctions will go.

Reluctance to buy Treasuries means liquidity problems, which means the Fed may have to get involved. The liquidity problem wouldn’t be limited to banks or primary dealers, so any liquidity facility should rightly be open to a wide range of borrowers.

RISK, is the word to explain this phenomenon. It goes up and down with each auction. What part of this is so hard to understand?

The liberal mind is an amazement.

RISK – another word little CoRev never got. You are writing dumber and dumber comments by the minutes. Dude – go outside and watch the grass grow.

Whenever government officials start blaming speculators, you know things aren’t going to plan:

https://www.marketplace.org/2023/05/24/saudi-arabia-lashes-out-at-oil-speculators/

Brent is down over 30% from a year ago:

https://www.marketwatch.com/investing/future/brn00?countrycode=uk

Robert Shapiro notes the good news that inflation is low and real disposable income has started to rise again:

https://washingtonmonthly.com/2023/05/23/why-dont-americans-recognize-that-inflation-is-down-and-incomes-are-up/

For example, the latest data from the Bureau of Economic Analysis (BEA) shows that prices for consumer goods and services (technically, the “deflator” for personal consumption spending) increased an average of 0.2 percent per month in February and March of this year. On an annual basis, that comes to 2.6 percent inflation, or less than half the 5.6 percent rate in 2022. The BEA also reports that the inflation-adjusted disposable incomes of Americans per capita jumped 1.8 percent in the first quarter of this year, following two previous quarters of income progress. That is a sharp reversal of the 6.9 percent decline in 2022, driven mainly by that year’s inflation.

Two caveats. As Shapiro notes, real disposable income fell over 2022 more than this partial reversal. And Kevin Drum asks whether this represents lower net taxes more than real wage increases.

McCarthy just send the house members home for the holidays – no urgency on his part.

I was about to say JohnH had already clinched the 2023 contest for Troll of the Year. But damn – CoRev is working extra hard hoping to close the gap.

AS: “Did anyone else read the article from the WSJ referenced below? I thought there were some interesting comments. The Phony Debt-Ceiling ‘Calamity’”

Criminy! That has to be one of the stupidest articles ever published by the Wall Street Journal and that’s saying something. Never get your economic analysis from lawyers!

They actually claim that redeeming Treasury bonds lowers the debt below the ceiling! Where do they think the cash for redemptions comes from — the magical sky fairy? In order to redeem a bond the Treasury has to auction a replacement bond to get the cash for redemption. The same is true for marketable Treasury bonds and for non-marketable bonds redeemed by Social Security.

And here’s the thing, in the event of a default, these new bonds will either have a much higher interest rate, or in the case of T-bills, be auctioned at a much bigger discount to par. That doesn’t lower the debt as the authors claim. It increases the debt.

But I guess that par for the course for a Rupert Murdock rag — the guy who got his start in his media empire selling pictures of naked women.

The lawyer thing bothered me, too.

Joseph,

Were they giving economic advice or legal advice. Something may be legally true, but economically difficult. I assumed it was legal advice. I am not knowledgeable enough to question their legal advice. Maybe others who commented have the legal knowledge.

How worried is the treasury market about continued risk in the treasury market?

As of yesterday, the two-year treasure rate was 4.31% annualized. the one-year rate was 5.12% annualized. Does this not mean that the market expects the one-year rate one year from today to be about 3.5%? 1.0431^2 = 1.088. 1.088/1.0512 = 1.035 or 3.5% annualized.

Similarly using the one-month and two-month treasuries, the two-month rate as of yesterday was 5.22% annualized. The one-month rate was 5.73%. Does this not mean that one month from today, the market expects the one-month rate annualized to be 4.7%? 1.0522^2 =1.10712484; 1.10712484/1.0573 = 1.047 or 4.7% annualized.

“Cave” on SS/Medicare. Just how DUMB are you?!?!?! That was never “on the table” for Republicans either. Because most Democrats in the House and Senate are politically dumb, they buy that crap. GOP put on an exhibitionist B-actor soap opera for their 1% base they’re going to drop SS and Medicare. Then the Republicans act like they gave up bargaining chips and get something in return from the DOPE Democrats for nothing. That’s why Biden is handing Republicans gifts in return for jack squat. Biden sits there in the White House, assumably drooling on himself and asking Jill for his baby bib, while Democrat legislators hand Republicans their last set of underwear. If it wasn’t so pathetic it would be hilarious satire.

If you dont like biden, then find and support somebody else who is electable. Sanders is not electable, so supporting him is akin to voting for trump. Biden was not my first choice, but dems have not offered me a good second choice. I see similar situation with the gop. Most dont want trump, but who can they get as a replacement. Both parties have broken down, unfortunately. But biden is an adult in the room, and better than any alternative.

From a question i asked earlier. The fed remits interest from its bond holdings to the treasury each month. Selling held treasuries each month and returning funds would be a wash, debt limit wise. But the fed holds agency debt (mbs). Does this count against the debt? What if the fed sold those? Does it return those funds to treasury, or do they go elsewhere? Can they coordinate those sales for when treasury has a gap to cover?