Ferrara and De Roux actually pose the question more tactfully, in their paper (Capturing international influences in U.S. monetary policy through a NLP approach) presented at the ISF meetings here in Charlottesville. They look to see if in the FOMC minutes, international economic issues are mentioned in a way that, when converted to an index, shows up as statistically significant in a Taylor equation, and provide the answer “yes”.

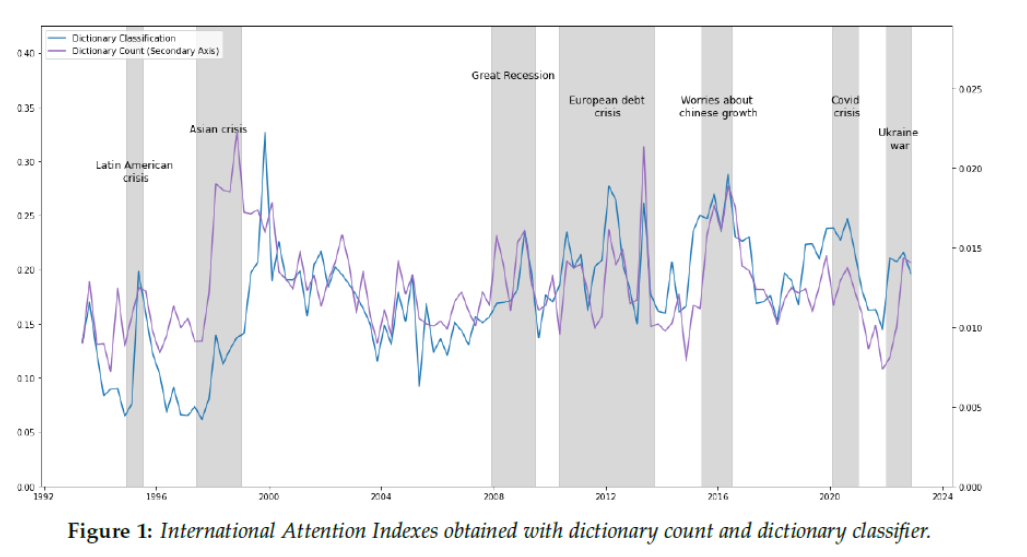

First the “International Attention Index”:

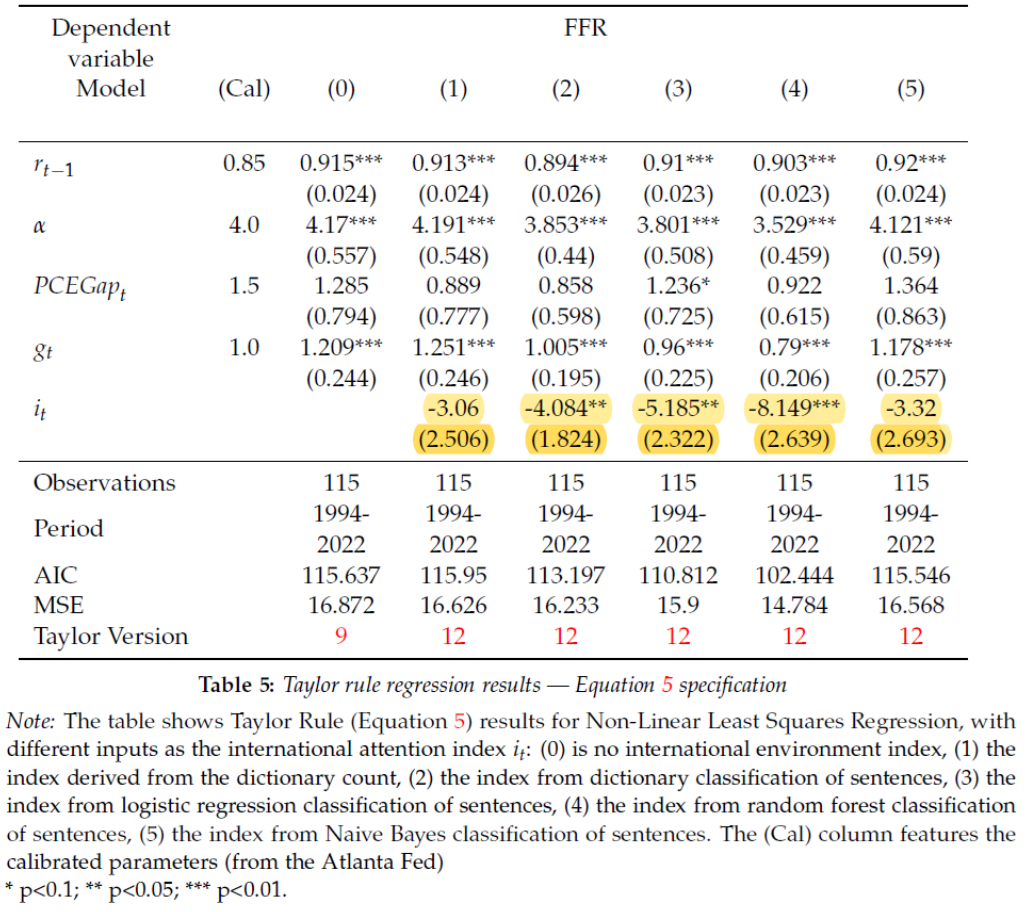

Next, the regression of fed funds rate on lag, nominal interest rate, PCE gap and output gap, augmented with the International Attention Index.

The index is normalized to 0 to 1, so a 0.10 increase in the index results in a 80 bps reduction in fed funds rate relative to what it otherwise would be. For context, the increase in the index during the expansion of the Russian invasion of Ukraine was about 0.10.

From the abstract:

Our results show that when there is a focus on international topics within the FOMC,

the Fed’s monetary policy generally tends to be more accommodative than expected by a standard Taylor rule. This result is robust to various alternatives that includes a time-varying neutral interest rate or a shadow central bank interest rate.

At first glance, I think this proves nothing.

If U.S. domestic accommodative policy is “needed” at the same time global accommodative policy is needed, how are we to know the behavior (accommodative policy) was intended for nations external to America?? It’s like saying you gave a basket of oranges as a Christmas gift to your daughter, she shared an orange with the neighbor kid and “therefor” your intention the entire time was to give an orange to the neighbor. Not convincing.

It’s fascinating to me, BTW, that people (professors, of all people, try not to giggle thinking about it) dissect Fed minutes, as if when Fed members were talking at the time of these little FOMC “get togethers”, they were totally unaware their words would be looked at later. Looking inside a pretentious, and overly-inflated sense of self, FOMC member’s actually simple-headed thoughts.

“Gosh….. we get criticized for how we sometimes murder developing nations’ economies. We DO murder developing nations’ economies with our policies. How to solve…… ?? I know!!!! Let’s flap our jaws and give lip-service to our “deep concern” for foreign nations during our Fed minutes, which are largely an exercise in PR and post airplane crash damage control anyway. Brilliant Jerome, I says to myself. Absolutely brilliant, if I do say so to myself, Jerome.”

Yet, apparently, college profs pour over these Fed minutes like a PhD in Catholic Apologetics trying to explain how in 1950 if Catholics didn’t eat fish on Friday they were going to Hell, but now the Pope says it makes him yawn.

Maybe not “for”, but maybe “because of”. If the rest of the world is a drag on the U.S., the Fed gooses U.S. demand to offset that drag. To heck with the foreigners.

That is certainly what Fed folk would say to Congress.

The missing Groucho Marx punchline:

“How could the Fed care about what’s going on in the rest of the world when they don’t even give a crap about working class America??” [ jars some ashes off my cigar ]

The title of this blog post should be

“A Group of Economists Tried to Create a Model to Quantify What Economists Already Know Regarding the FOMC Caring About the Rest of the World… Did They Succeed?”

We can always count on Econned for utterly worthless chirping.

Yep, because that’s how science works.

Macroduck,

And what about social science?

September 1998.

The US economy is roaring along at nearly 5% p.a.

Asia is in its second year of sliding down the gurgler, and Russia, Latin America, et al, begin to waver.

And, for the first time in my awareness, the Fed took account of global considerations over domestic ones.

Saved the global economy, but at a price and probably against the unwritten rule (“Foreigners Don’t Matter”).

Correction, in south USA they are referred to as “Furners…. and stuff”

Yep, though I think the Fed did not anticipate the influx of funds from abroad and the slide in the price of imported goods experienced at the time. Easing was in response to the rest of the world, and they got away with it even though easing might not have been necessary.

After glancing at the paper – I sort of understand how their “dictionary” was constructed. Still I can’t see if they had added some “catch” words – like “Brexit” to see if that had an impact. Also, I would like to see the same model applied with environmental words – such as “heat wave”, “drought”, “natural disaster”, “extreme weather event”. “climate change” – you know – real world stuff – but I doubt if the current Fed chair has much of a world view beyond the dusty underpinnings found in Larry Summers mind. Thanks – very interesting. (Also in Wisconsin news – FYI – in WI, the Governor can do a partial veto of a bill – Evers is saying he will veto the WIGOP dingbat tax cuts for rich people and the WIGOP insane idea to cut funding for UW because they have a Diversity, Equity and Inclusion program – https://www.wpr.org/republicans-approve-3-5b-income-tax-cut-reduce-state-funds-uw-system)

A reader wrote several times about climate change being too theoretically vague to be worth planning to avert and cope with. However, the climate change mechanism is remarkably well-defined and of immediate concern. The last 8 years, since 2015, each and all, have been the warmest years globally since 1880. This year promises to add to these warmest of years, and will likely be near the very warmest ever recorded. As for investing in climate change limiting and effect averting, the need is immediate and there are no “negative externalities.”

http://pubs.giss.nasa.gov/abs/ha00410c.html

https://gml.noaa.gov/ccgg/trends/

https://data.giss.nasa.gov/gistemp/tabledata_v4/GLB.Ts+dSST.txt

Thanks for this. I have stopped wasting my time responding to CoRev’s lies.

Ole Bark, bark, you’ve stopped because you have no valid arguments to refute the data. https://www.woodfortrees.org/plot/wti/plot/wti/from:2015/trend/plot/gistemp/from:1980/plot/gistemp/from:2015/trend

ltr, just how sweet is that Kool Aid you’re drinking? Please, please show us the calculations for how much of those temperature increases are due to ACO2?

BTW, did you note this in your 2nd cite: “Due to the eruption of the Mauna Loa Volcano, measurements from Mauna Loa Observatory were suspended as of Nov. 29. Observations starting in December 2022 are from a site at the Maunakea Observatories, approximately 21 miles north of the Mauna Loa Observatory.”

Comparing 2 measurements which may BOTH be contaminated by a volcanic eruption is typical for ?Climate Science?.

Also when you say this: “The last 8 years, since 2015, each and all, have been the warmest years globally since 1880. This year promises to add to these warmest of years,…” were you aware that this is the what was happening during your 8 years period? https://www.woodfortrees.org/plot/wti/plot/wti/from:2015/trend/plot/gistemp/from:1980/plot/gistemp/from:2015/trend

Furthermore, are you aware of the NATURAL occurring conditions dominating this and many other periods of the measured temperatures? It is spelled ENSO.

Science is based upon the skepticism of experts, not group think and unquestioning belief of them.

The group thinking, Kool Aid drinking, unquestioning liberal minds are an amazement.