Assume no recession in US through February 2023. What do term and credit spreads, financial conditions index, debt-service ratios predict at the 12 month horizon?

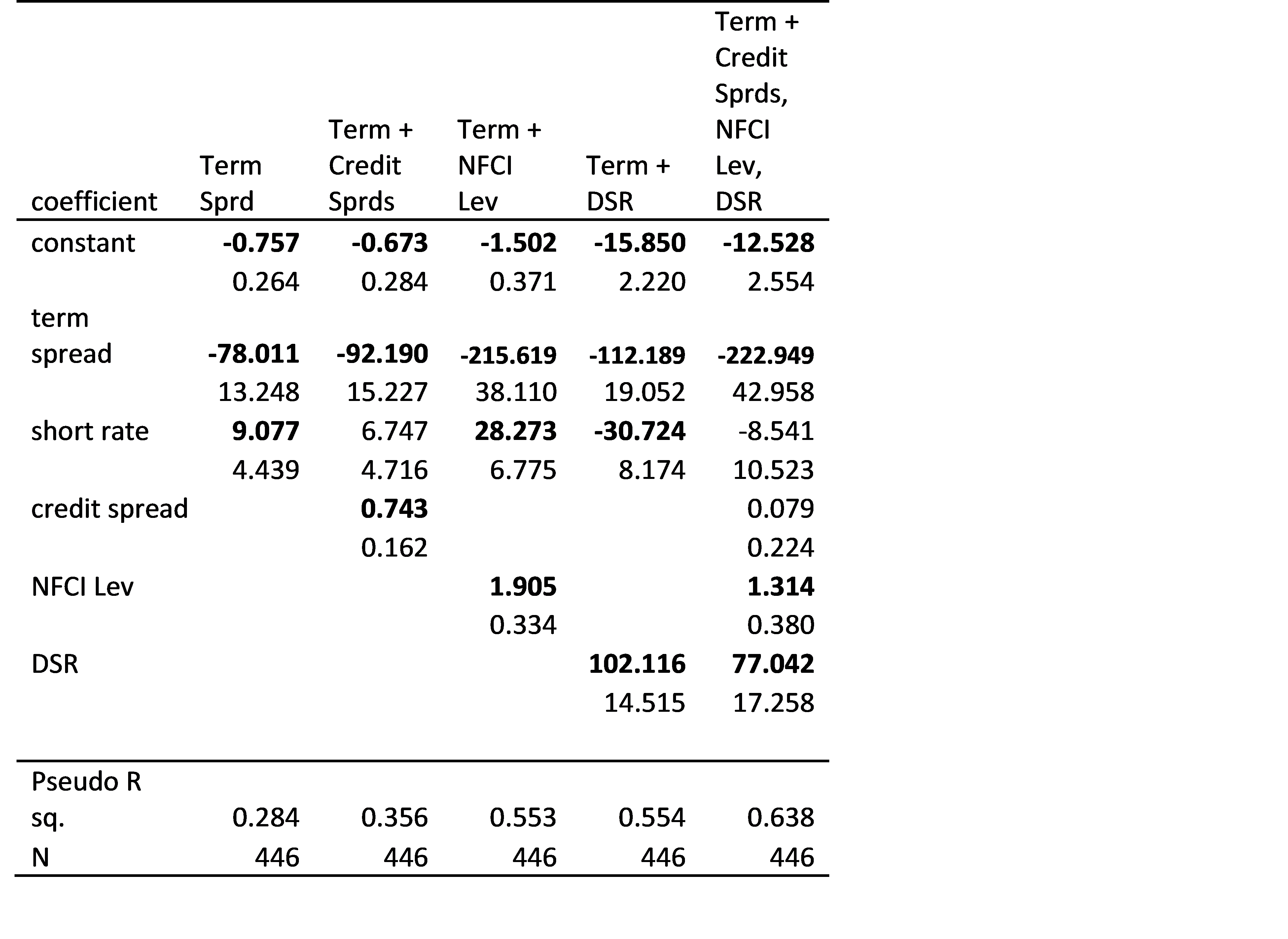

First, probit regression estimates, 1985-2023M02:

Notes: Bold face denotes significance at 10% msl.

Term spread is the 10yr-3mo Treasury spread, short rate is the 3 month Treasury yield, credit spread is the Gilchrist & Zakrajsek (AER, 2012) excess bond premium (EBP), NFCI is the Chicago Fed National Financial Conditions Index, DSR is the debt service ratio.

Note that augmenting the standard term spread and short rate with EBP raises the proportion of variance explained, and EBP enters with expected, and significant, sign. Alternatively financial stress as measured by the NFCI enters in with expected sign, and yet better explains recessions. Finally, as argued by Borio, Drehmann and Xia (J.Macro, 2020), debt service ratio adds measurably to the explanatory power of the term spread.

Interestingly, only the DSR survives as having statistical significance when all three additional financial indicators are added. EBP and NFCI are fairly highly correlated, while DSR is not particularly correlated with EBP and NFCI, so this outcome is not altogether surprising.

While DSR adds substantially to in sample fit, it is interesting to consider what this specification implies for the prediction of recessions.

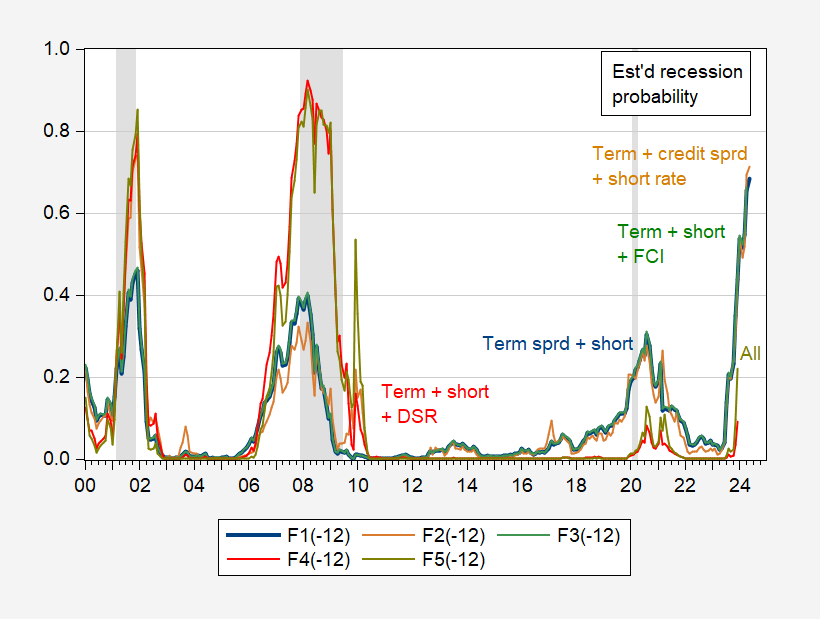

Figure 1: Estimated recession probability from term spread plus short rate (bold blue), from term and credit spreads plus short rate (tan), from term spread plus short rate and NFCI (green), term spread plus short rate and DSR (red), and from term and credit spreads plus short rate, NFCI, and DSR (chartreuse). NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations.

Note that DSR data ends at 2022M12, so forecasts based on the DSR end at 2023M12.

Interestingly, any specification incorporating DSR imputes a substantially lower probability of recession than the corresponding specifications excluding DSR. For instance, at end-2023, a term spread plus short rate model indicates a 44% probabality, while a model incorporating all the measures including DSR stands at 22% probability.

Update, 6/25:

Reader New Deal democrat and Scott Brave suggest using NFCI leverage subindex (Brave points me out to Kelley (2019) as documentation). I repeat Table 2, but replacing NFCI with the NFCI leverage subindex.

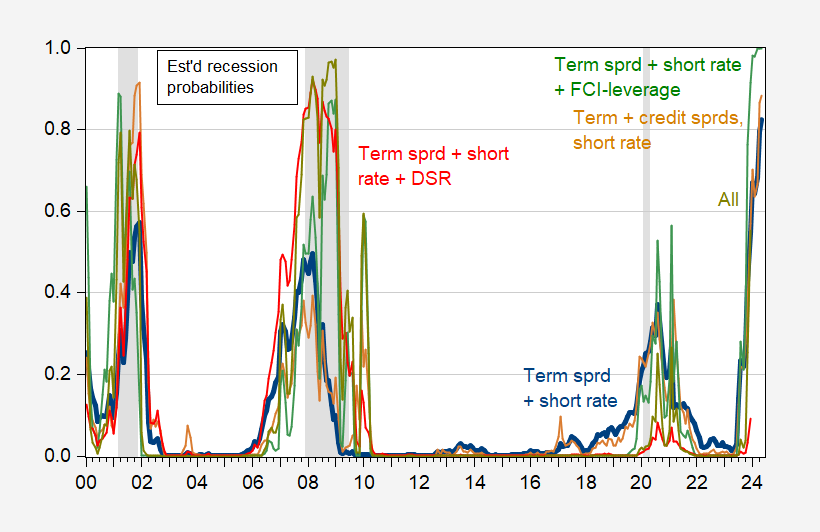

Indeed, the leverage subindex of the NFCI does have more explanatory power than the NFCI. The forecasts now look as follows:

Figure 2: Estimated recession probability from term spread plus short rate (bold blue), from term and credit spreads plus short rate (tan), from term spread plus short rate and leverage subindex of the NFCI (green), term spread plus short rate and DSR (red), and from term and credit spreads plus short rate, NFCI, and DSR (chartreuse). NBER defined peak-to-trough recession dates shaded gray. Source: Author’s calculations.

So, if I read this right, the results presented here are for the U.S. The Borio, Drehmann, Fan results are for countries including the U.S., but not necessarily for the U.S. itself.

Now, to dumb things down (or what am I good for?):

*Term premium amounts to a comparson of current short-term rates with expected future financial conditions, as expressed in long-term rates.

* The financial conditions index is – OK it’s pretty obvious – but the FCI is current, and it’s financial.

* The debt service ratio is, in one sense, a real-economy measure, in that it indicates the amount of current income available for current spending.

* The debt service ratio is the big winner in predictive power for recessions.

If I have this right, then past borrowing and current and past interest rates – factors which determine the debt service ratio – do a better job than any other measure in forecasting recession. Reinhardt and Rogoff may feel vindicated; past borrowing matters. Mian, Sufi and Verner will see the sense in it; past debt-financed consumption matters. However, contrary to R&R, it’s debt service, not debt level, that matters. And perhaps contrary to MSV, pulling consumption forward inhibits future consumption only to the extent it reduces future spending ability; full closets, kitchens and garages don’t necessarily inhibit spending.

And finance has been demoted relative to real economic factors in predicting recession; tell me how much I still have to spend, and I’ll tell you whether we’re likely to have a recession.

Also, if I understand correctly, we now have a clue as to why the inversion of the curve has put out till-now false signals of recession. Here’s a picture of the U.S. private, non-financial debt service ratio:

https://www.ceicdata.com/en/indicator/united-states/debt-service-ratio-private-nonfinancial-sector

Kinda comforting.

“credit spread is the Gilchrist & Zakrajsek (AER, 2012) excess bond premium (EBP)”.

An interesting paper as well as an interesting series. My only nitpick is that their series does not distinguish between EBP rising because of lower credit ratings v. higher spreads for any given rating. But research on credit spreads has always been a challenging area.

I’d be curious what a time series on EBP would show as to what has been happening recently.

FRED provides this measure of credit spreads:

https://fred.stlouisfed.org/series/BAA10Y

Moody’s Seasoned Baa Corporate Bond Yield Relative to Yield on 10-Year Treasury Constant Maturity

Its 6/22 measure = 1.94%. I would argue that this overstates the long-term BB credit spread by the 20-year minus 10-year government bond spread, which was 0.26% on 6.22.

So make this particular spread = 1.68%. A wee bit high but far from what we saw after the collapse of Lehman Brothers.

As sure as summer follows spring, divided government brings talk of government shutdown:

https://talkingpointsmemo.com/news/house-republicans-spending-shutdown-debt-ceiling

The details this time are specific to Kevin McCarthy’s speakership, but the only way those details change the likely economic impact is through the length of a shutdown.

We have a recent example by which to gauge the likely economic impact of a shutdown this year. In December 2018 and January 2019, there was a partial government shutdown lasting 5 weeks. By far the greatest impact on the overall economy was to shift activity from the shutdown period into the period after government re-opened. A 5-week partial shutdown reduces output in the affected quarters by 0.3% of real GDP, nearly all of which was recovered thereafter. Permanent loss of output amounted to about 0.02% of GDP.

Delayed payments are narrowly specific in their impact, so particular individuals and firms can suffer considerable harm from government shutdown.

https://www.cbo.gov/publication/54937

From the point of view of overall economic performance, the rather small effect of a 5-week shutdown is useful in estimatige the effect of a shutdown this year. However,.it’s likely that permanent harm increases not in linear fashion, but rather begins to accelerate with time. A 25-week shutdown would probably cost more than 0.1% of GDP, but that’s the sort of scale we’re talking about. Shutdowns don’t end expansions. Personal harm would also mount with time – miss two paychecks and you can still make the mortgage payment; miss three and default.

Of course, continuing spending resolutions can allow debate to continue without shutting down government – shutting down parts of government is a bullying tactic. It’s not a very wise tactic either, since blame for shutdowns tends to go to the party which refuses to pass a CR. If memory serves, it has always been Republicans who have refused to pass CRs to keep government open, just as it has always been Republicans who have threatened default during debt ceiling debates.

McQuack, would a Government shut down nudge the US into a recession? just asking for a friend.

Little CoRev puts out the bait – but it seems Macroduck ain’t taking. Hey CoRev – give us more Heartland Institute lies!

I’m curious why CoCrevice didn’t ask Kevin McCarthy, he’s the p*ssy who blinked first on default. And now McCarthy can’t pass any Republican legislation. Have fun with that one until 2025 CoCrevice.

I have two questions. Maybe I overlooked something, but here they are:

1. What is the forecast horizon? Now, 6 months, 12 months…?

2. Is there any particular reason that the NFCI was used, and not the Adjusted NFCI, which takes into account background financial conditions, or the Leverage Subindex that theChicago Fed identifies as being more reliably leading (and which is presently giving diametrically opposite signals to the NFCI)?

Thanks

Divergence between the overall Chicago index and the leverage subindex is the largest ever for a non-recessionary period:

https://fred.stlouisfed.org/graph/?g=16qLI

The onset of this divergence also appears to be coincident with the bank run episode. I wonder if the Fed’s most-generous-ever bank stabization effort has undercut the predictive ability of the leverage index.

Or perhaps the leverage index still measures what it has always measured:

https://fred.stlouisfed.org/graph/?g=16qM5

In which case, the FOMC may change its collective mind about additional rate hikes.

It’s Not Too Late for the Republican Party – Michael Luttig

https://dnyuz.com/2023/06/25/its-not-too-late-for-the-republican-party/

Donald Trump this month became the first former or incumbent American president to be charged with crimes against the nation that he once led and wishes to lead again. He cynically calculated that his indictment would ensure that a riled-up Republican Party base would nominate him as its standard-bearer in 2024, and the last few weeks have proved that his political calculation was probably right.

The former president’s behavior may have invited charges, but the Republicans’ spineless support for the past two years convinced Mr. Trump of his political immortality, giving him the assurance that he could purloin some of the nation’s most sensitive national security secrets upon leaving the White House — and preposterously insist that they were his to do with as he wished — all without facing political consequences. Indeed, their fawning support since the Jan. 6 insurrection at the Capitol has given Mr. Trump every reason to believe that he can ride these charges and any others not just to the Republican nomination, but also to the White House in 2024.

In a word, the Republicans are as responsible as Mr. Trump for this month’s indictment — and will be as responsible for any indictment and prosecution of him for Jan. 6. One would think that, for a party that has prided itself for caring about the Constitution and the rule of law, this would stir some measure of self-reflection among party officials and even voters about their abiding support for the former president. Surely before barreling headlong into the 2024 presidential election season, more Republicans would realize it is time to come to the reckoning with Mr. Trump that they have vainly hoped and naïvely believed would never be necessary.

But by all appearances, it certainly hasn’t occurred to them yet that any reckoning is needed. As only the Republicans can do, they are already turning this ignominious moment into an even more ignominious moment — and a self-immolating one at that — by rushing to crown Mr. Trump their nominee before the primary season even begins. Building the Republican campaign around the newly indicted front-runner is a colossal political miscalculation, as comedic as it is tragic for the country. No assemblage of politicians except the Republicans would ever conceive of running for the American presidency by running against the Constitution and the rule of law. But that’s exactly what they’re planning.

The stewards of the Republican Party have become so inured to their putative leader, they have managed to convince themselves that an indicted and perhaps even convicted Donald Trump is their party’s best hope for the future. But rushing to model their campaign on Mr. Trump’s breathtakingly inane template is as absurd as it is ill fated. They will be defending the indefensible.

On cue, the Republicans kicked their self-defeating political apparatus into high gear this month. Almost as soon as the indictment in the documents case was unsealed, Mr. Trump jump-started his up-to-then languishing campaign, predictably declaring himself an “innocent man” victimized in “the greatest witch hunt of all time” by his “totally corrupt” political nemesis, the Biden administration. On Thursday, he added that it was all part of a plot, hatched at the Justice Department and the F.B.I., to “rig” the 2024 election against him.

From his distant second place, Gov. Ron DeSantis of Florida denounced the Biden administration’s “weaponization of federal law enforcement” against Mr. Trump and the Republicans. Mike Pence dutifully pronounced the indictment political. And both Governor DeSantis and Mr. Pence pledged — in a new Republican litmus test — that on their first day in office they would fire the director of the F.B.I., the Trump appointee Christopher Wray, obviously for his turpitude in investigating Mr. Trump. It fell to Kevin McCarthy, the House speaker, to articulate the treacherous overarching Republican strategy: “I, and every American who believes in the rule of law, stand with President Trump against this grave injustice. House Republicans will hold this brazen weaponization of power accountable.”

There’s no stopping Republicans now, until they have succeeded in completely politicizing the rule of law in service to their partisan political ends.

If the indictment of Mr. Trump on Espionage Act charges — not to mention his now almost certain indictment for conspiring to obstruct Congress from certifying Mr. Biden as the president on Jan. 6 — fails to shake the Republican Party from its moribund political senses, then it is beyond saving itself. Nor ought it be saved.

There is no path to the White House for Republicans with Mr. Trump. He would need every single Republican and independent vote, and there are untold numbers of Republicans and independents who will never vote for him, if for no other perfectly legitimate reason than that he has corrupted America’s democracy and is now attempting to corrupt the country’s rule of law. No sane Democrat will vote for Mr. Trump — even over the aging Mr. Biden — when there are so many sane Republicans who will refuse to vote for Mr. Trump. This is all plain to see, which makes it all the more mystifying why more Republicans don’t see it.

When Republicans faced an 11th-hour reckoning with another of their presidents over far less serious offenses almost 50 years ago, the elder statesmen of the party marched into the Oval Office and told Richard Nixon the truth. He had lost his Republican support and he would be impeached if he did not resign. The beleaguered Nixon resigned the next day and left the White House the day following.

Such is what it means to put country over party. History tends to look favorably upon a party that writes its own history, as Winston Churchill might have said.

Republicans have waited in vain for political absolution. It’s finally time for them to put the country before their party and pull back from the brink — for the good of the party, as well as the nation.

If not now, then they must forever hold their peace.

Interesting website. The ‘about’ section leads nowhere. Obviously an illegal scrape and paste site as no authors or bylines are presented.

This looks like a reputable website to me. Do you have any idea how hard it is to find Viagra in chewable mint form?!?!?! It’s hard!!!! It’s very very very hard!!!!

It is the NYTimes without the firewall. Sorry but I’m not paying for the NYTimes but I just wanted to put this NYTImes oped up as it is important.

Ford issued $2 billion in debt on March 15, 2021 and its interest rate was zero?

https://media.ford.com/content/fordmedia/fna/us/en/news/2021/03/16/ford–2-0-billion-convertible-notes.html

Ford Motor Company today announced its intention to offer, subject to market conditions and other factors, $2.0 billion aggregate principal amount of convertible senior notes due 2026 in a private placement to qualified institutional buyers … Conversions of the notes will be settled in cash up to the aggregate principal amount of the notes to be converted and cash, shares of Ford’s common stock or a combination thereof, at Ford’s election, in respect of the remainder, if any, of Ford’s conversion obligation in excess of the aggregate principal amount of the notes being converted. The initial conversion rate and other terms of the notes are to be determined upon pricing of the offering.

One might wonder why anyone would lend to Ford at a zero interest rate especially since the interest rate on 5-year government bonds was 2.4% at the time and Ford’s BB+ credit rating likely meant a 2.4% credit spread had these been traditional corporate bonds. Oh wait the holder has an option to purchase Ford stock. The value of this option is why the interest rate on convertible debt is generally less than the interest rate on traditional debt.

Do we know who the party is?? Buffett is a big fan of convertible debt, is he not?? But I suppose that doesn’t make him special among big players.

Crap car, crap company, so whoever, they should be asking for a hell of a deal.

It would make sense that Buffett likes convertible debt given he really gets option pricing. His defense of FASB 123 (employee stock options are an expense) was classic. But yea – I’d rather be owning Toyota stock.

“Crap car, crap company” but too big to fail…the secret to getting a zero interest rate loan, even when your stock trades for under $10.

Someone does not understand that options have value. Then again 50 year old basic finance is too advanced for little Jonny boy.

“your stock trades for under $10.”

How effing stupid are you? I guess since the last time you looked, Ford’s stock price has gone by 50%:

https://finance.yahoo.com/quote/F/

Given the value of this option lies in upside potential, we have just proved that such options have a lot of value.

But no – all of this is over little Jonny’s little head!

What was the share price when Ford got that sweetheart TBTF loan?

JohnH

June 28, 2023 at 7:18 am

What was the share price when Ford got that sweetheart TBTF loan?

Come on Jonny boy – learn to use Yahoo Finance. It’s easy. Now it is clear you never learned option pricing which explains your incredibly stupid comments and dumb questions.

Yea – you are the dumbest troll ever.

March 16, 2021 – date of that Ford press release clearly marked. But little Jonny could not READ that. Yahoo/Finance reports Ford share price on that date to be near $12 a share.

I mean this is so easy most two your olds get it but not little Jonny boy. I mean can anyone be THAT EFFING STUPID?

Speaking of crap cars and crap companies, JH, how’s the Russian auto industry doing these days? Plenty of reports on the industry being down as much as 67% in 2022. Didn’t have anything to do with sanctions or Ukraine , right?

The love for Ladas and Skodas not what it once was? Well, not everyone is interested in reincarnating the 1992 Toyota Corolla.

How is Jonny boy going to know. He cannot even read the date of the Ford release (March 16, 2021) even though it was clearly marked up front.

And better yet – this moron said the stock price was less than $10 a share when that Yahoo Finance link I provided noted it was closer to $12 a share.

Seriously – why are we bothering with someone THIS DAMN DUMB!

Let’s review a few facts as opposed to the dumb comments and questions from Jonny boy.

I explained why investors would hold Ford debt even though the interest rate is zero by noting convertible debt represents a valuable option.

But Jonny cannot believe that as this moron thinks Ford stock is worth less than $10 a share even though it recently rose above $14 a share.

Next Jonny boy cannot figure out what the share price was on the date the debt was issued as Jonny boy cannot READ the Ford press release which was clearly date 3/16/2021. On that date the share price was near $12 a share.

BEST YET this moron thinks Ford is Too Big to Fail. Of course this moron does not know how to read their financials but I just pulled its 10-K filing.

Operating profits = $6.276 billion for 2022.

Interest expense = $1.259 billion for the year.

Ford is doing OK financially which is why its share price is way over Jonny boy’s $10 a share.

But seriously – why does Jonny boy even bother? He is a moron and everyone knows that. And he reminds us how EFFING dumb he is with every comment.

Putin ‘very afraid’ and ‘probably hiding’ after Wagner rebellion, Zelensky says

https://www.youtube.com/watch?v=FcdrLn5rW3c

The Youtube lasts for only one minute but Zelensky’s mocking of Putin is brutal. Wait for it – Putin’s pet poodle JohnH is about to go off on one of his patented emotional rants.