The June numbers for Chinese inflation surprised on the downside: 0.0% headline vs. +0.2% y/y Bloomberg consensus, -5.4% PPI vs. -5.0% consensus.

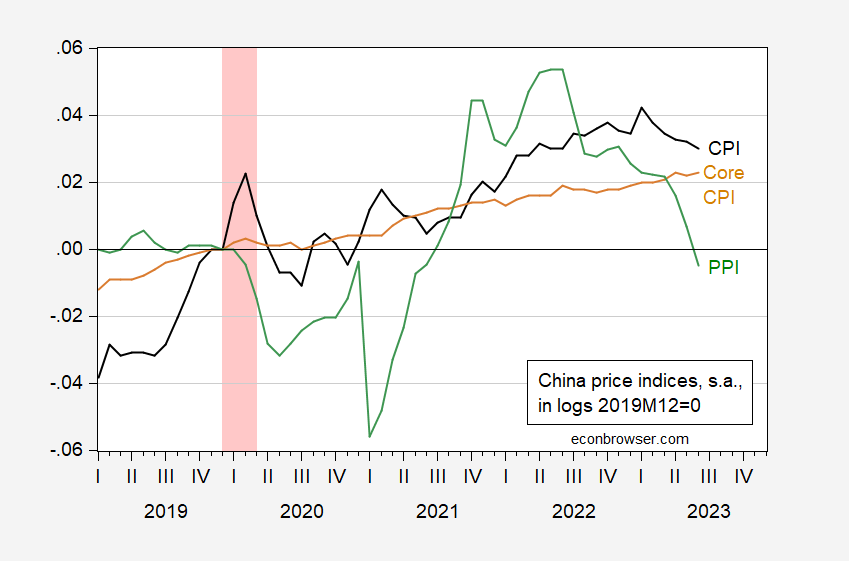

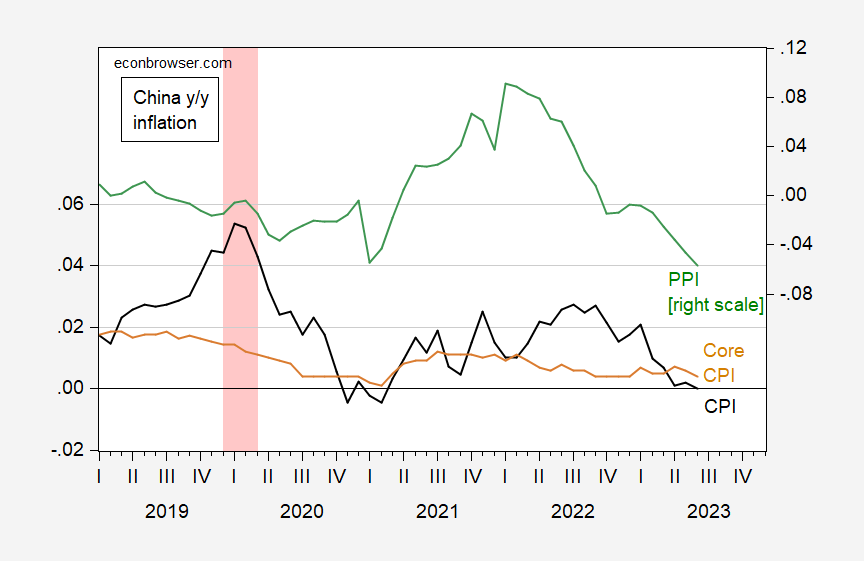

The price level is shown in Figure 1, and year-on-year inflation in Figure 2:

Figure 1: China CPI (black), core CPI (tan), and PPI (green), all in logs, 2019M12=0. ECRI defined peak-to-trough recession dates shaded pink. Source: Kose/Ohnsorge – World Bank and IMF, IFS, both updated using TradingEconomics; and author’s calculations.

Figure 2: China year-on-year inflation rate for CPI (black), for core CPI (tan), and for PPI (green). ECRI defined peak-to-trough recession dates shaded pink. Source: Kose/Ohnsorge – World Bank and IMF, IFS, both updated using TradingEconomics; and author’s calculations.

Why the anxiety about deflation? Bloomberg notes that deflation can be taken as a sign of slowing economic activity, a big worry given the less-than-anticipated rebound from the end of the zero-Covid policy regime. (In some preliminary regressions, I find a 1 ppt output gap defined using a HP filter induces a 0.44 ppt higher inflation rate, after controlling for lagged inflation, over the 1990-2019 period).

There’s also the fact that PPI inflation has continued into negative territory. While it’s tempting to conclude that declining PPI inflation will result in declining CPI inflation, the evidence in support of this view is mixed; Sun et al. (2021; also IJFE 2023). A Granger causality test 2010-2019 indicates one can’t reject null that PPI m/m inflation does not cause CPI inflation, nor can one reject the null that CPI does not cause PPI at conventional levels. On the other hand, one can reject the null hypothesis that the PPI does not cause core CPI inflation at the 10% msl.

FT says veggies in China up 10.8% year-on-year. Pork prices fell 7.2% year-on-year June.

The weakening economic performance comes as Chinese economists are urging the government to shift from its traditional form of stimulus — investing in big-ticket infrastructure projects — to targeting consumers.

Well-known degenerate and former northeast China resident Uncle Moses says chuckling “Stopping the Chinese government from wasting money on useless infrastructure projects?!?!?!?! Good luck wit dat one Biffy”.

“This can more directly correspond to our actual economic blockages and shortcomings,” said Cai Fang, a senior economist from the state-run Chinese Academy of Social Sciences, according to a transcript of a business forum published by Chinese news website Caijing.

https://www.ft.com/content/b684bf72-1aaf-46ac-9cc2-ea765395aa03

https://www.chinadaily.com.cn/a/202307/11/WS64ac568ba31035260b815939.html

July 11, 2023

Flat CPI calls for steps to boost domestic demand

By Ouyang Shijia

China’s consumer inflation remained flat while its factory-gate prices dropped further in June, indicating the still-weak demand and highlighting the necessity for more steps to expand effective demand and boost market confidence, analysts said on Monday.

Despite rising concerns over the weakening momentum of the post-pandemic recovery, analysts believe the country has the capability to achieve its GDP growth target of around 5 percent in 2023, saying the growth will mainly be fueled by the improvement in domestic demand amid stronger policy support in the second half of the year.

China’s consumer price index, or CPI, the main gauge of inflation, remained unchanged from a year earlier in June after a 0.2 percent increase in May, data from the National Bureau of Statistics showed on Monday.

The producer price index, or PPI, which gauges factory-gate prices, was down 5.4 percent in June from a year earlier after a 4.6 percent year-on-year contraction seen in May, the NBS said.

Zhou Maohua, an analyst at China Everbright Bank, said the flat consumer prices are attributable to declining prices of commodities such as energy and raw materials, still-weak demand and abundant market supply.

When it came to the continuous fall in producer prices, Zhou said it was mainly due to declining commodity prices and the high comparison base in the previous year, adding that the PPI may gradually improve with the recovery in demand and stronger policy support to boost domestic demand.

After the CPI increased by 2 percent in 2022, China set an annual consumer inflation target of around 3 percent for 2023.

Warning of challenges from a cloudy global outlook, the scarring effects of the COVID-19 shock and the existing structural issues, Guan Tao, global chief economist of BOC International, said it is advisable for the policymakers to step up macroeconomic policy support, including proactive fiscal policies and structural monetary policy tools, to broaden the economic recovery.

“The ultralow inflation reading lends supports to our view that the People’s Bank of China (the country’s central bank) is likely to implement two more rounds of policy rate cuts of 10 basis points each, and another 25 basis points cut to the reserve requirement ratio over the rest of the year,” said Lu Ting, chief China economist at Nomura.

“Looking ahead, even taking into account a potential rise in service inflation as a result of the summer holiday season, we expect the CPI to dip 0.5 percent year-on-year in July, partly due to a high base,” he said. “On producer prices, we expect the PPI to decline 4.5 percent year-on-year in July, mostly due to a lower base.”

In light of the latest inflation readings, other recent developments regarding China’s broad economy and the lukewarm policy response so far, Lu said his team is further lowering its CPI and PPI forecasts for both 2023 and 2024.

For the full year of 2023, Lu said his team now expects the CPI to grow at 0.3 percent, down from the previous forecast of 0.5 percent. The team revised the PPI forecast from the previous 2.7 percent decline to a 3.2 percent drop in 2023.

Looking ahead, China’s economic growth data for the second quarter is scheduled to be released on July 17. GDP growth is estimated to be higher than that in the first quarter due to the lower-base effect and the continued recovery trend, followed by steady growth in the second half of the year, analysts said.

Guan Tao said his team estimated that the second-quarter GDP growth rate may hit 7.6 percent, followed by an over 5 percent growth rate in the second half of the year.

“With an estimated 5.6 percent full-year growth rate, China will likely meet its preset annual growth target of around 5 percent in 2023,” he said….

One of my friends, a smart guy, once said about emerging economy statistics,

“GDP is like driving a car. You have first gear (0-5%), second gear (6-10%) and illegal. Oh, and don’t bother to measure anything going in reverse.”

Let’s agree that China’s data are not OECD quality, let alone worthy of being calculated to the second decimal place on a month-to-month basis. If we can’t agree on that, there’s no point in going further.

So, the Power of Xi, I mean, “The Powers That Be” have decided that China will not have the problem that occupies other large or important economies, inflation.

Headline news.

“China will not have the problem that occupies other large or important economies, inflation”

Nixon has his wage and price controls. And remember “only Nixon can go to China”. Maybe Nixon taught them his bag of tricks.

Inflation is a problem for lenders (savers). Deflation is a problem for borrowers. So the low-risk picture choice is to aim at policy to protect the class most likely to crash the economy.

Oh, wait…

Richard D. Wolff: “The contradictions of China-bashing in the United States begin with how often it is flat-out untrue. The Wall Street Journal reports that the “Chinese spy” balloon that President Joe Biden shot down with immense patriotic fanfare in February 2023 did not in fact transmit pictures or anything else to China. White House economists have been trying to excuse persistent U.S. inflation saying it is a global problem and inflation is worse elsewhere in the world. China’s inflation rate is 0.7 percent year-on-year. Financial media outlets stress how China’s GDP growth rate is lower than it used to be. China now estimates that its 2023 GDP growth will be 5 to 5.5 percent. Estimates for the U.S. GDP growth rate in 2023, meanwhile, vacillate around 1 to 2 percent.

China-bashing has intensified into denial and self-delusion—it is akin to pretending that the United States did not lose wars in Vietnam, Afghanistan, Iraq, and more. ” https://www.nakedcapitalism.com/2023/07/its-hard-for-americans-to-engage-in-china-bashing-without-tripping-on-contradictions.html

https://fred.stlouisfed.org/graph/?g=16TkI

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2022

(Percent change)

https://fred.stlouisfed.org/graph/?g=16TkM

August 4, 2014

Real per capita Gross Domestic Product for China, United States, India, Japan and Germany, 1977-2022

(Indexed to 1977)

Hey Jonny boy – why have you not replied to Bruno’s comment?

This katheder-sozialistich professor of what he calls “Marxism” writes “Mao Zedong… and Nixon started a period of economic growth, trade, investment, and prosperity for both China and the United States. The success of that period prompted China to seek to continue it.” What is carefully avoided is any consciousness of the climatic catastrophe inevitably forced by such fossil-fueled “prosperity” for China and the United States on the entire planet, they themselves most emphatically included!

katheder-sozialistich? My oh my – Bruno and Jonny boy have a lot in common!

pgl writes: “What is carefully avoided is any consciousness of the climatic catastrophe inevitably forced by such fossil-fueled “prosperity” for China and the United States on the entire planet, they themselves most emphatically included!”

I assume that pgl is engaged in his usual China bashing,,,but maybe he should look in the mirror: “What many Americans don’t realize is that a huge share of our tax dollars are actually funding the most carbon-intensive institution on the planet: the U.S. military.

The U.S. military is the largest institutional oil consumer in the world. In fact, the Pentagon’s ships, jets, bombers, and Humvees — and its global network of over 800 bases, all with buildings to heat, cool, and maintain — produce more carbon emissions each year than entire countries like Sweden, Denmark, and Portugal.

Under President Biden’s Inflation Reduction Act and other new laws, the U.S. is expected to spend about $50 billion per year on climate for next decade. But these welcome investments are dwarfed by much bigger spending on our polluting military.”

https://www.juancole.com/2023/07/heating-military-spending.html

In fact, according to White House data the military budget for 2024 is slated to increase by $91 billion…double what the US spends on climate…and that increase will be carried forward and increased over the next decade.

But naturally pgl is gungho on laying the blame on China!

pgl writes: “What is carefully avoided is any consciousness of the climatic catastrophe inevitably forced by such fossil-fueled “prosperity” for China and the United States on the entire planet, they themselves most emphatically included!”

I did not write that. Damn – your pathetic attempts to go after me has led you to yet another lie. Then again – pathetic lies is your only forte.

pgl wrote,

July 11, 2023 at 9:16 am

“What is carefully avoided is any consciousness of the climatic catastrophe inevitably forced by such fossil-fueled “prosperity” for China and the United States on the entire planet, they themselves most emphatically included!”

Now he denies it!

David O’Rear

July 10, 2023 at 10:39 pm

I was merely replying to David. JohnH – stupidest man alive.

JohnH

July 11, 2023 at 1:38 pm

YEA – Jonny boy cannot follow a conversation. I wonder if his mommy still ties the little boy’s shoes for him.

” according to White House data the military budget for 2024 is slated to increase by $91 billion”

In nominal terms maybe. But come on little Jonny boy – we asked you to do this in inflation adjusted terms about 100 times. What’s the matter – did you skip the preK arithmetic class that taught the other kiddies how to do simple division?

Sure, go ahead pgl…$50 billion spent on the environment, an additional $92 billion spent on the military…both figures adjusted for inflation…and what do you get?

The additional amount spent on environmentally destructive “defense” is still almost twice the additional amount being spent on the environment.

Like I have said before, pgl needs remedial math…

“$50 billion spent on the environment, an additional $92 billion spent on the military…both figures adjusted for inflation…and what do you get?”

Jonny boy does not get the difference between a level v. a nominal increase? Oh that’s right – little Jonny boy cannot add 2 plus 2. Dumbest troll ever!

pgl,

Mao didn’t start the liberalizing, opening Reform Era.

That was Deng Xiaoping, more than two years (12/78) after Mao died (9/76).

History is cool.

I grant that but I’m not the one who opined on this. Do not be confused by the serial lying from JohnH.

Sure, go ahead pgl…$50 billion spent on the environment, an additional $92 billion spent on the military…both figures adjusted for inflation…and what do you get?

The additional amount spent on environmentally destructive “defense” is still almost twice the additional amount being spent on the environment.

Like I have said before, pgl needs remedial math…

Correcting pgl: “O’Rear writes; “Mao didn’t start the liberalizing, opening Reform Era.”

In response pgl claims: “I’m not the one who opined on this,” claiming that I had opined on it.

pgl: Show me where…

I guess Jonny boy forgot to check the link to that WSJ story:

Chinese Balloon Used American Tech to Spy on Americans

Preliminary U.S. findings show the craft collected photos and videos but didn’t appear to transmit them, officials say

It was a spy balloon after all. But hey – that’s OK as little Jonny boy got his ice cream cone!

So those cameras were just up there to enjoy the view ? – traveling around the globe and enjoying the views.

Nobody could have predicted that a spy ballon would retain radio silence while it was over the area it spied on – I mean NOBODY!

Maybe the Chinese relied on JohnH to install the transmission mechanisms. Someone should warn Xi that Jonny is incompetent at everything.

This is just silly. Comparing GDPgrowth while ignoring GDP per person?:

https://fred.stlouisfed.org/graph/?g=16Xu5

Of course China is growing faster.

Comparing inflation rates? Different economic structures, including levels of development, reliance on market forces, consumer share of total demand and the like, make direct comparison of inflation rates an exercise for simpleton. Accusing the U.S. of China bashing without mentioning the steady diet of anti-U.S. propaganda fed to China’s citizens is dishonest.

But then, Little Johhny pulled the same basic stunt when criticizing the U.S. provision of cluster bombs to Ukraine without mentioning that Russia is already using cluster bombs against Ukraine.

To which Noneconomist responded:

YOU’RE calling someone a “faux humanitarian”? The self styled anti war icon who approved the Russian invasion, who never mentioned Russia’s earlier use of similar weapons, or the children and other civilians murdered by those weapons, the guy who SAYS he finds war “unconscionable “ and quickly follows with that declaration with but”…..

You get more clueless with every post, your eternally forked tongue gets even more, uh, forked, and your Putin pimpery continues unabated.

Sadly, you’re beyond embarrassment. And not smart enough to realize how far.

He’s got you there, Johnny.

I tried to get people hear to understand the basic Solow growth model including the Convergence Hypothesis. But it seems a few people here did not pass the first pop quiz in freshman economics.

https://english.news.cn/20230711/9ea8d28c667c432abca1ec70a3d0d121/c.html

July 11, 2023

China’s auto sales up 9.8 pct in H1

BEIJING — China’s auto sales rose 9.8 percent year on year to 13.24 million units in the first half (H1) of 2023, data from the China Association of Automobile Manufacturers (CAAM) showed Tuesday.

In June alone, auto sales reached about 2.62 million units, up 4.8 percent from the same period a year ago.

Sales of passenger vehicles increased 8.8 percent year on year to about 11.27 million units in the January-June period, the data showed.

China’s auto market achieved relatively rapid growth in H1 as market demand gradually recovered, with the second quarter seeing visible improvements, the CAAM said.

The association attributed the expansion to pro-consumption policies, the adoption of a more rigorous set of emissions standards, the roll-out of new models by automakers, and a low comparison base last April and May.

Data also showed that China sold nearly 3.75 million units of new energy vehicles (NEVs) in H1, surging 44.1 percent year on year and bringing the market share of NEVs to 28.3 percent in the country.

In the first six months, China’s car manufacturers exported a total of 2.14 million units of vehicles, soaring 75.7 percent year on year. In June alone, auto exports expanded 53.2 percent from a year ago.

Xu Haidong, deputy chief engineer with the CAAM, expected the consumption potential of China’s automobile market to be further unleashed in the second half of the year.

The sound macroeconomic recovery, strong performance of NEVs, and auto export, coupled with policy effects, will help shore up the country’s auto market, Xu said….

https://english.news.cn/20230711/0a65389394014a85a2cdd527ee957f4e/c.html

July 11, 2023

China’s NEV sales surge 44.1 pct in H1

BEIJING — China’s new energy vehicle (NEV) sales surged 44.1 percent year on year to nearly 3.75 million units in the first half of 2023, data from the China Association of Automobile Manufacturers showed Tuesday.

NEV sales in June stood at 806,000 units, increasing 35.2 percent from a year ago.

The output of NEVs in the country totaled nearly 3.79 million units in the first six months, expanding 42.4 percent year on year, the data revealed.

Data also showed that China exported a total of 534,000 NEVs in the first half, expanding 160 percent year on year….

You do know that 160% of zero is still zero – don’t you?

Let’s agree that China’s data are not OECD quality, let alone worthy of being calculated to the second decimal place on a month-to-month basis. If we can’t agree on that, there’s no point in going further.

So, the Power of Xi, I mean, “The Powers That Be” have decided that China will not have the problem that occupies other large or important economies, inflation.

[ This of course is mere prejudice; meant to be misleading and offensive. ]

It is NOT prejudice to note that China’s national income accounting could be improved. Look – you can have whatever bought and paid for view you wish to have but noting reality is not prejudice.

ltr,

“This is of course mere prejudice…”

Please be specific.

Is anything you don’t like prejudice?

Is everything you don’t like prejudice?

I spent my entire adult life professionally focused on China and its neighbors, and when I post here, I don’t hide my identity.

How about you?

“Stopping the Chinese government from wasting money on useless infrastructure projects?!?!?!?!”

[ This of course is the refrain begun by Congress and the President in 2011, when China was denied working with NASA on space exploration. Now, China has a manned space station, is exploring the Moon and Mars and the Sun, has an advanced Global Positioning System and is launching several satellites weekly and repeatedly making and publishing novel space observations.

Of course, there is also the national green energy network being built, there are the advanced rail lines, there are the green belts being planted, there are water conservancy projects, there are the museums and libraries, there are the schools, there are the hospitals and on and on and on.

A range of prominent Western economists do not care for Chinese infrastructure investments, but these economists would prefer that China be undeveloped. ]

Your last sentence of course is mere prejudice; meant to be misleading and offensive.

Simply because *some* infrastructure projects are useful does not mean *all* or even *most* infrastructure expenditures are on useful projects; the U.S. has certainly seen its share of the latter, and there has been plenty of negative press about them… remember the “Bridge to Nowhere?” Suggesting that the same is true of China, as it is for pretty much everywhere else in the world, is hardly due to “preferring that China be underdeveloped,” quite the reverse if you think about it. The economists would prefer the money to be spent on useful infrastructure projects, which naturally will tend to develop China more rapidly than the money being spent on useless infrastructure projects.

https://news.cgtn.com/news/2023-07-10/China-s-Three-Gorges-dam-generates-1-600-TWh-of-power-in-20-years-1ljSHD9Jore/index.html

July 10, 2023

China’s Three Gorges dam generates 1,600 TWh of power in 20 years

The world’s largest hydropower project, China’s Three Gorges Hydroelectric Power Station on the Yangtze River has generated over 1,600 terawatt-hours (TWh) of clean electricity since 2003 when its first generator unit was put into operation.

This amount of electricity totals the sum of the whole year direct-use electricity by Chinese residents in 2022. It is also equivalent to saving over 480 million tonnes of standard coal and reducing carbon dioxide emissions by about 1.32 billion tonnes.

With 34 hydropower turbo-generators, the power station has a total installed capacity of 22.5 gigawatts and a designed annual power generation capacity of 88.2 TWh.

The project is the backbone of China’s “west-to-east power transmission” and “north-to-south mutual electricity supply” projects. It also provides electricity to other areas and regions including east China, central China and south China’s Guangdong Province.

The construction of the Three Gorges project started in 1994. After passing all acceptance tests, the power station was officially certified as fully completed and functioning in 2020.

Besides electricity generation, the Three Gorges power station has also played a significant role in flood control, shipping and water resource utilization.

https://news.cgtn.com/news/2023-07-10/China-s-Three-Gorges-dam-generates-1-600-TWh-of-power-in-20-years-1ljSHD9Jore/img/598c60bd24bd4897942718845a453e07/598c60bd24bd4897942718845a453e07.gif

The Three Gorges power station along with another five mega hydropower stations on the Yangtze River – Wudongde, Baihetan, Xiluodu, Xiangjiaba, and Gezhouba – make up the world’s largest clean energy corridor.

Spanning 1,800 kilometers with 110 hydropower units, the clean energy corridor boasts a total installed capacity of 71.7 gigawatts and an average annual electricity production of about 300 TWh, which is crucial to building a clean, low-carbon, safe and efficient energy system in China.

I get the fact that JohnH says a lot of dishonest, annoying, and incredibly stupid things on an hourly basis if not more often but when I simply mention that possibility that Yellin’s visit to China might get rid of that 27.5% tariff on Chinese cars, the most annoying lying moron ever had to write:

‘Remember how free trade fundamentalists like Krugman and Frankel used to howl about Trump’s tariffs on washing machines? But where are they know? I guess the political winds have shifted…expediency and politics trump principle for prominent economists?’

WTF? Jonny boy thinks Biden imposed this tariff? Check this story from May 2019:

https://www.wardsauto.com/industry/us-raises-duties-chinese-auto-parts-imports

U.S. Raises Duties on Chinese Auto-Parts Imports

A key goal of the talks would be addressing American concerns about intellectual property protections for U.S. technology exports to China, but the U.S. government says “China has chosen to retreat from specific commitments agreed to in earlier rounds.” The U.S. government on Friday increased its existing 10% additional duties on imports of automotive parts, engines and chassis from China to 25%, citing a lack of progress in ongoing trade talks.

Yes boys and girls – these tariffs were part of Trump’s trade war with China. But little Jonny boy is so incredibly stupid, he did not know this. Of course Jonny does not know a lot of things but that never stopped this pathetic troll from attacking Krugman or Frankel.

“A 27.5% tariff is cheap,” pgl.

July 10, 2023 at 10:53 am

Now he’s trying to deny that he ever said such a thing!

And he still won’t talk about how Krugman and Frankel, those erstwhile “free” trade fundamentalists seem to have gone silent on the issue.

JohnH: I know you are incompetent at locating and understanding data, and you regularly misrepresent articles you link to. However, it is clear you are patently wrong when you assert Frankel has gone silent on the trade issue. See this guest contribution on Econbrowser. This is a longer version of an article circulated widely in international newspapers around the world via Project Syndicate.

I wish you would restrict yourself to writing on things you know something about (I suspect close to the null set).

The null set! On my – something tells me Econned is going to get all riled up over this!

There’s one market where JonnyKnowItAll (NOT) pretended he was the expert – lithium. It started when I simply listed the largest lithium companies in the world – two of which are Chinese. So Jonny boy goes off on how China is investing in lithium but the US was not.

Now as I was praising Chile for trying to avoid China dominating their mines Jonny boy seemed to think transfer pricing manipulation was OK. When I suggested one Chinese company was trying to monopolize the market – Jonny boy suggested this was find and dandy too. OK – Jonny boy is so stupid he cannot even follow the most basics of any conversation but what’s new?

Well I decided to go look at the 10K filing of a North Carolina based company called Albemarle. Why? Because it was the very first company on my original list. And guess what? Its lithium segment generated $5 billion in revenues for 2022. But according to Jonny by – the US is not investing in this market. Yea Jonny boy is too stupid to read even a 10K filing.

Thanks for reminding us of Dr. Frankel’s excellent post which was a joy to re-read. I noticed Jonny boy did not bother to comment on it – likely because its excellent discussion was WAY OVER Jonny’s little brain. But for his benefit – here was a rather relevant line:

‘The Biden administration is reportedly now considering rolling back some of the Trump tariffs, with respect to imports from China in particular, one of the few concrete steps it can take that would immediately help alleviate inflation. The effect on inflation will turn out to be less than the 1.3 % estimate, because the full package will not be adopted. But it would be a step in the right direction.’

Jonny boy for some unknown reason decided to accuse Dr. Frankel of supporting Biden protectionism which of course was yet another one of his blatantly false allegations.

https://econbrowser.com/archives/2022/06/guest-contribution-a-resilience-case-for-international-trade

June 22, 2022

A Resilience Case for International Trade

By Jeffrey Frankel

Some new problems have afflicted the economy in the last year. Two examples come from the US: blockages in supply chain logistics and a critical shortage in infant milk formula. One problem applies to the EU even more than to the US: energy scarcity due to sanctions against Russian fossil fuel exports. And one now applies almost everywhere: inflation.

Some have associated these four problems with what is said to be excessive dependence on international trade, that is, with globalization. Deglobalization, fragmentation, reshoring, friend-shoring, decoupling, and resilience have become familiar buzzwords. The feeling is that individual countries would not have been so exposed to shocks if they had been more self-sufficient.

The argument goes beyond observing that private firms have discovered diminishing returns to ever-lengthening supply chains. Protectionist government policies have gained political support — beginning, notably, with Donald Trump’s trade war in 2018. The impression is that trade barriers could help insulate us all from external shocks.

Each of the four problems listed above can in fact be cited as examples where particular trade barriers erected by governments have reduced resilience and where liberalization could partially help remedy the problem. Let us go through them.

Problem: Bottlenecks in US shipping. Remedy: Repeal the Jones Act, which requires that all shipping between US ports use American carriers and employ crews who are at least 75% American. This legislation was originally passed in 1920, with the intent of enhancing self-sufficiency and national security. But the US maritime industry has not been able to cope with sudden surges like the heightened demand for merchandise imports over the last year, contributing to supply chain delays. Without the Jones Act, American firms could hire foreign-owned vessels to handle the surge (for example, to carry imports from large US hub ports to smaller ports). Logistics would be more resilient.As to bottlenecks in US overland transport, a shortage of truck chassis has been part of the snafu. Imports of chassis from abroad could have helped fill the gap – except that they are impeded by a US tariff (one of the Section 301 tariffs imposed by the Trump Administration, in September 2018). Remedy: roll back the tariff.

Problem: US infant formula shortage. Remedy: Remove tariffs, “Buy America” rules, and unnecessary administrative barriers that impede imports of baby formula.

Abbott Nutrition, one of only four major US producers of baby formula, recalled its product in February, due to the discovery of traces of bacteria in a factory. Recalls are common. But the resulting acute shortage illustrates how international trade could have helped, if it had been allowed to. There was no shortage of infant formula on international markets. If the US had been open to imports, foreign producers could have made up most of the shortfall. But the US (like some other countries), has serious protectionist barriers against importing dairy products. The barriers include tariffs as well as unnecessarily restrictive administrative hurdles and “buy American” policies that constrain the federal Special Supplemental Program for Women, Infants, and Children (WIC), which distributes half of infant formula consumed in the US. Donald Trump even raised barriers on imports of infant formula from Canada when he renegotiated NAFTA.

The FDA responded to the recent crisis by cutting some red tape, such as labeling requirements, to let in imports temporarily. But these barriers should not be in place in the first place….

Jeffrey Frankel’s article is immediately and importantly relevant, as the United States is presently experiencing a serious shortage of cancer drugs and China has been working on production of a range of cancer drugs:

https://www.nytimes.com/2023/05/17/health/drug-shortages-cancer.html

May 17, 2023

Drug Shortages Near an All-Time High, Leading to Rationing

A worrisome scarcity of cancer drugs has heightened concerns about the troubled generic drug industry. Congress and the White House are seeking ways to address widespread supply problems.

By Christina Jewett

https://www.nytimes.com/2023/06/26/health/cancer-drugs-shortage.html

June 26, 2023

How the Shortage of a $15 Cancer Drug Is Upending Treatment

Older generic chemotherapy drugs remain scarce, forcing doctors to put a priority on the patients who have the best chance of survival.

By Christina Jewett

Hey lying little scum. I corrected my spelling error. Now when are you going to admit to the 100 million LIES you have told.

Frankel’s piece is over a year old…

Considering tariffs and sanctions on China alone, there is lots to complain about since then, if you’re serious about free trade:

– https://www.npr.org/2023/06/19/1183040910/tariffs-the-trump-administration-imposed-on-chinese-imports-are-still-in-place

– https://en.wikipedia.org/wiki/United_States_sanctions_against_China#Sanctions_on_Chinese_semiconductor_industry

“Frankel’s piece is over a year old…”

Seriously troll. Either you apologize to Dr. Frankel for your lying accusations or I’ll join the choir to get your pathetic lying BS banned. You are not only worthless – you’re disgusting.

KATHERINE TAI reminds me a lot of Joseph Stiglitz. Now there was someone named JohnH who would praise Stiglitz when he made similar points. But NO – this JohnH has to attack this woman. Go figure.

Sanctions on producers of fentanyl precursors

Jonny boy seems to think this is a mistake? Yea – he is THAT STUPID.

Just before the Trump trade war began – Dr. Chinn posted something on the effective rate of protection. OK we got the tariffs on finished cars from China but Trump was foolish enough to put tariffs on intermediate goods from Mexico:

https://www.theverge.com/2019/6/1/18647215/donald-trump-mexico-tariffs-cars-recession-jobs

The tariffs are on “all goods” coming to the US from Mexico, but they’d likely hit the auto industry hard. If they escalate to the 25 percent cap Trump proposed, and the automakers absorb the entire cost so as not to pass it onto consumers, it could cost General Motors (GM) $6.3 billion, Fiat Chrysler Automobiles (FCA) $4.8 billion, and Ford $3.3 billion, according to a Deutsche Bank estimate. While it’s unlikely that automakers will eat the entire cost, the figures help explain what’s at stake. By the end of Friday, the threat of the tariffs alone had already wiped out about $17 billion of market value from the world’s biggest automakers. Many of those automakers assemble cars in Mexico to be sold in the US, or build cars using a mix of Mexican-made parts. In 2018, Mexico exported $93 billion in vehicles and parts to the US. Major foreign automakers like Audi, Toyota, Nissan, Honda, and Mazda assemble cars in Mexico, many of which are destined for sale in the US. A number of top-tier suppliers like Denso are also located in the country.

Now Trump justified this stupid move by blaming immigration from Mexico. Yea – Trump sucks at economics but those White Nationalists adore him.

Centrica is the major energy supplier for the UK and Ireland with over $42 billion per year in revenues:

https://www.marketwatch.com/story/u-k-gas-giant-reaches-8-billion-deal-to-import-u-s-liquified-natural-gas-66cfe9ed

Centrica on Tuesday said it’s reached an $8 billion deal to import U.S. liquified natural gas, the latest step taken in Europe to diversify supplies after a spike in costs stemming from Russia’s invasion of Ukraine. Centrica CNA, +0.04% said it’s reached a deal to import 1 million metric tons per year of LNG for 15 years from Delfin Midstream, getting the gas from the Delfin Deepwater Port, located 40 nautical miles off the coast of Louisiana. It won’t come soon: operations and first LNG are expected to commence at the Delfin Deepwater Port in 2027.

Centrica said that’s enough gas to heat 5% of U.K. homes for 15 years. It follows a three-year supply agreement with Equinor as well as the reopening of a gas storage facility.

Sounds like pgl is cheering the UK’s decision to use fossil fuels…

You do have a serious emotional problem. I simply note some economic news and you just have to dishonestly attack me? Oh wait – you LIED about Dr. Frankel’s stance on trade and for no reason at all. It is high time you apologized to Dr. Frankel for your rude pointless and dishonest garbage. If not – it is beyond time for Dr. Chinn to ban you for such pointless and disgusting behavior.

I would tell little Jonny boy to GROW UP but it seems your mommy is telling us you are utterly hopeless.

Some good economic news – Mike Lindell has bankrupted his worthless pillow company:

https://www.msn.com/en-us/money/companies/mike-lindell-reveals-mypillow-has-lost-100m-as-he-auctions-off-e

That will make me sleep so much better tonight.

You didn’t buy his Pillow 2.0? Or those ugly slippers he is peddling?

I would rather put my head on a rock and my feet on burning coal than giving any of my hard-earned money to that traitor.

Here is precisely the sort of problem China has been investing in, both through a comprehensive weather satellite program and Artificial Intelligence compilation:

https://www.nytimes.com/2023/07/11/climate/climate-change-floods-preparedness.html

July 11, 2023

Vermont Floods Show Limits of America’s Efforts to Adapt to Climate Change

The lack of a comprehensive national rainfall database and current flood maps hampers the ability to prepare for storms intensified by climate change.

By Christopher Flavelle and Rick Rojas

This week’s flooding in Vermont, in which heavy rainfall caused destruction far from rivers or coastlines, is evidence of an especially dangerous climate threat: Catastrophic flooding can increasingly happen anywhere, with almost no warning.

And the United States, experts warn, is nowhere close to ready for that threat.

The idea that anywhere it can rain, it can flood, is not new. But rising temperatures make the problem worse: They allow the air to hold more moisture, leading to more intense and sudden rainfall, seemingly out of nowhere. And the implications of that shift are enormous.

“It’s getting harder and harder to adapt to these changing conditions,” said Rachel Cleetus, policy director for the climate and energy program at the Union of Concerned Scientists. “It’s just everywhere, all the time.” …

https://www.nature.com/articles/s41586-023-06185-3

July 5, 2023

Accurate medium-range global weather forecasting with 3D neural networks

By Kaifeng Bi, Lingxi Xie, Hengheng Zhang, Xin Chen, Xiaotao Gu & Qi Tian

Abstract

Weather forecasting is important for science and society. At present, the most accurate forecast system is the numerical weather prediction (NWP) method, which represents atmospheric states as discretized grids and numerically solves partial differential equations that describe the transition between those states. However, this procedure is computationally expensive. Recently, artificial-intelligence-based methods have shown potential in accelerating weather forecasting by orders of magnitude, but the forecast accuracy is still significantly lower than that of NWP methods. Here we introduce an artificial-intelligence-based method for accurate, medium-range global weather forecasting. We show that three-dimensional deep networks equipped with Earth-specific priors are effective at dealing with complex patterns in weather data, and that a hierarchical temporal aggregation strategy reduces accumulation errors in medium-range forecasting. Trained on 39 years of global data, our program, Pangu-Weather, obtains stronger deterministic forecast results on reanalysis data in all tested variables when compared with the world’s best NWP system, the operational integrated forecasting system of the European Centre for Medium-Range Weather Forecasts (ECMWF). Our method also works well with extreme weather forecasts and ensemble forecasts. When initialized with reanalysis data, the accuracy of tracking tropical cyclones is also higher than that of ECMWF-HRES.

Let’s hypothesize that China’s current regime is fond of maintaining direct control – of everything, but the case I have in mind is economic. A transition to a larger role for consumer demand would be a transition toward diffuse, private control of economic decisions. So we might expect a transition to a greater share for consumers to be slow in coming.

Take the same desire for direct control and think about the respective roles of public and private enterprise. This story is what you’d expect:

https://www.scmp.com/economy/china-economy/article/3227193/chinas-paltry-support-private-firms-leaves-its-economic-backbone-more-dire-straits-state-firms

China’s policy problem is not a shortage of policy tools. I think is an insistence on relying on only those tools which maintain centralized power.

It will be decadesbefore we will know with any certainty whether China’s relative power has peaked. The fact that the possibility is being discussed is largely the fault of Xi’s nearsighted economic management.

China under the CCP has a long history of shifting from centralization to decentralization and back again.

At first, it was in response to economic pressures, but later political developments led to reallocating power up or down the hierarchy.

It may be too soon to be sure, but I’m beginning to get the sense that this round of centralization may have run its course.

The main obstacle to turning China into a US style consumer economy would be to change the mindset of their people, making them much less focussed on saving and much more on spending. That shift would take generations and China has less than a decade before the low birthrate and high real estate stock have a serious collision. They also have to deal with the fact that you cannot keep salaries low (to retain a competitive export economy) and also build a consumer class – there will be a lot of pain in that transition. Moving from low wage robber baron economies to consumer economies took a lot of unrest and upheaval in the west – I doubt the leadership in China would allow such a thing even if the people decided to become rebellious.

Ivan,

Useful comments.

I subscribe to the belief that China will one day face the music, but that such a day is not close at hand.

Too many observers have opined “this cannot go on,” and yet it does.

On PCE, the key is the perception that 20-40 year olds think they are better off than their parents, and that their children have a bright future. That dream is being challenged, but with a continent-sized economy, there is still plenty of room for modest talent / education to find places where scarcity in such skills provides ample opportunities. That, in turn, means wholly eliminating — in a believable way — the social safety net silos (hukous) so that people can move around the country easily.

But, demographic movements scare the CCP, so they probably will not take this escape route.

https://english.news.cn/20230416/0bc6ee256d004c648cbb2478311a9b4b/c.html

April 16, 2023

New satellite offers high-precision rainfall monitoring

BEIJING — How much rainfall will typhoons bring this year? Chinese scientists will be able to answer such questions more accurately in future thanks to the launch on Sunday of the Fengyun-3G (FY-3G), a satellite dedicated to measuring precipitation on Earth.

With a lifespan of six years, FY-3G is the country’s first satellite allowing scientists to monitor the Earth’s precipitation from space, one of only three such satellites in the world. It was developed by an institute of China Aerospace Science and Technology Corporation, and its ground system will be built and operated by the China Meteorological Administration.

The 20th member of the Fengyun series, the FY-3G will highlight the strength of China’s low-orbit meteorological satellite constellation and significantly improve the early warning capability for global rainstorms, said Chen Zhenlin, head of the central meteorological observatory.

In the past, precipitation data was obtained mainly by ground-based rain gauges and radar. However, equipment shortages and uneven distribution made it difficult to acquire large-scale and high-precision information.

Ground devices have blind spots, but satellites in space can rectify this deficiency, making data available for places where ground-based measurements are sparse, said Zhang Peng, deputy director of the National Satellite Meteorological Center.

To increase the accuracy of precipitation monitoring and early warning, scientists have also mounted dual-frequency precipitation measurement radar on FY-3G, which will enable the satellite to accurately observe drizzle, even at an altitude of 407 km….

more racist and discriminatory propaganda from the ccp.

What has long been little noticed or understood is the extent of autonomy in the Chinese governing system, as well as the increasing extent of autonomy in the Chinese business system. Chinese government leadership is technologically adept and pragmatic, business leadership increasingly is supposed to reflect this:

https://hbr.org/2023/03/how-chinese-companies-are-reinventing-management

March, 2023

How Chinese Companies Are Reinventing Management

They prioritize autonomy at scale, internal digital platforms, and a clear project focus.

By Mark J. Greeven, Katherine Xin and George S. Yip

Summary.

China’s companies have long been acclaimed for their manufacturing prowess and, more recently, for their pragmatic approach to innovation. Now it’s time to recognize how they are reinventing the role of management through an approach the authors call “digitally enhanced directed autonomy,” or DEDA.

These companies use digital platforms to give frontline employees direct access to shared corporate resources and capabilities, making it possible for them to organize themselves around specific business opportunities. Autonomy is not complete, nor is it given to everyone. It is directed exactly where it is needed, and what employees do with their autonomy is carefully tracked. The approach contrasts with the Western model of empowerment, which gives employees broad autonomy through reduced supervision.

This article describes the three core features of the DEDA approach: granting employees autonomy at scale, supporting them with digital platforms, and setting clear, bounded business objectives. It offers examples of how companies are using those features and draws lessons for Western companies. * **

* https://hbr.org/2018/11/the-end-of-bureaucracy

** https://hbr.org/2022/07/how-to-turn-a-supply-chain-platform-into-an-innovation-engine

Mark J. Greeven is a Chinese-speaking Dutch professor of innovation and strategy at IMD Business School.

Katherine Xin is the Bayer Chair in Leadership at the China Europe International Business School (CEIBS), in Shanghai.

George S. Yip is an emeritus professor of marketing and strategy at Imperial College London and a distinguished visiting professor at Northeastern University, in Boston.

ltr,

Does your view of Chinese management evolution include the imposition of party committees on private business?

“What has long been little noticed or understood is the extent of autonomy in the Chinese governing system…”

what a load of ccp propaganda from ltr, once again. what a prejudiced and racist statement filled with misinformation about the wonderful culture of china. and i suppose that autonomy extends to hong kong and taiwan? and the uighyers out west have simply decided it is in their best interest to submit to a cultural genocide and spend years in prison and reeducation camps? sure ltr. it is becoming hard not to laugh each time you post such misinformation.

https://www.imf.org/en/Publications/WEO/weo-database/2023/April/weo-report?c=924,134,534,158,111,&s=PCPIPCH,&sy=2000&ey=2022&ssm=0&scsm=1&scc=0&ssd=1&ssc=0&sic=0&sort=country&ds=.&br=1

April 15, 2023

Inflation Rate for China, Germany, India, Japan and United States, 1980-2022

2017

China ( 1.5)

Germany ( 1.7)

India ( 3.6)

Japan ( 0.5)

United States ( 2.1)

2018

China ( 1.9)

Germany ( 1.9)

India ( 3.4)

Japan ( 1.0)

United States ( 2.4)

2019

China ( 2.9)

Germany ( 1.4)

India ( 4.8)

Japan ( 0.5)

United States ( 1.8)

2020

China ( 2.5)

Germany ( 0.4)

India ( 6.2)

Japan ( – 0.0)

United States ( 1.3)

2021

China ( 0.9)

Germany ( 3.2)

India ( 5.5)

Japan ( – 0.2)

United States ( 4.7)

2022

China ( 1.9)

Germany ( 8.7)

India ( 6.7)

Japan ( 2.5)

United States ( 8.0)