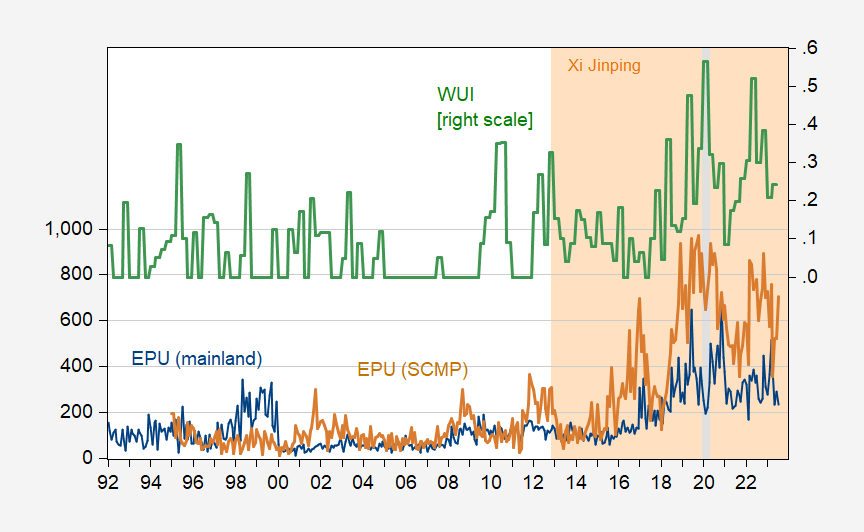

If you were wondering why FDI inflows had sharply decreased, why consumers were wary of spending, part of the reason might be elevated economic and economic policy uncertainty.

Here are three measures of uncertainty; text based policy uncertainty from South China Morning Press, from mainland China newspapers, and the World Uncertainty Index based on Economist Intelligence Unit reports.

Figure 1: EPU-China based on mainland China newspapers (blue, left scale), EPU-China based on SCMP (tan, left scale), and WUI-China (green, right scale). Light orange shading denotes Xi Jinping; gray shading denotes ECRI defined peak-to-trough recession dates. Source: policyuncertainty.com, and worlduncertaintyindex.com, and ECRI.

Jardet, Jude and Chinn (RIE, 2023) (discussed here) shows the negative impact of WUI on FDI inflows.

https://www.nytimes.com/2023/08/11/us/politics/biden-china-criticism-economy.html

August 11, 2023

Biden Describes China as a Time Bomb Over Economic Problems

The sharply worded comments are the latest example of the president’s willingness to criticize China even as he tries to ease tensions.

By Michael D. Shear

President Biden warned on Thursday that China’s struggles with high unemployment and an aging work force make the country a “ticking time bomb” at the heart of the world economy and a potential threat to other nations.

“When bad folks have problems, they do bad things,” the president told a group of donors at a fund-raiser in Park City, Utah.

Mr. Biden’s comments are the latest example of the president’s willingness to criticize China — often during fund-raising events with contributors to his presidential campaign — even as his administration seeks to ease tensions between the world’s two largest economies.

Earlier this summer, at a fund-raiser in California, Mr. Biden called President Xi Jinping of China a “dictator” who had been kept in the dark by his own officials about the spy balloon that flew over much of the United States from late January to early February before being shot down by the U.S. military.

On Thursday night, Mr. Biden said he was trying to make sure the United States has a “rational relationship with China,” but he signaled that he continues to view Beijing as America’s biggest economic competitor.

“I don’t want to hurt China, but I’m watching,” Mr. Biden said in Utah….

This is at least the second time you made the exact same post and link. Redundant. Rude. Please apologize. And stop.

Biden is right on the money with that one. Winnie the Pooh is one bad bear and he will soon get to the point where he needs to start a war to distract his people from the incompetence of his leadership and its disastrous consequences for the young people in his country. Tick-tock-tick-tock……

Except Biden said China’s growth rate has been only 2%. I guess he is entitled to a mistake or two. Compared to the trolls here you get something right about once a year.

Xi could go a few different directions. He could start a war. If he goes after Taiwan, it probably won’t go well. If he goes after part of Siberia, it might go a lot better. He could also turn inward. I’m not sure exactly what he would accomplish by turning inward, since he’s shown little appetite for meaningful reforms. A solution to the glut of younger men would be to start importing Russian mail order brides. What with Putin’s disastrous adventure in Ukraine, and the fact that Russia won’t have a whole lot of young men left when Putin is done, China could import all those young widows and other young women whose prospects were eliminated by the Ukraine war. Any bets on that happening?

https://news.cgtn.com/news/2023-08-10/China-installs-core-module-of-world-s-first-commercial-small-nuclear-reactor-1m9nIsfr77q/index.html

August 10, 2023

China installs core module of world’s first commercial small nuclear reactor

By Zhao Chenchen and Gao Yun

The core module of China’s Linglong One, the world’s first commercial small modular reactor (SMR), was successfully installed on Thursday in south China’s Hainan Province, marking a milestone node of the SMR’s installation.

“This would pave a solid foundation for the installation and testing of the following auxiliary system,” Deng Xiaoliang, deputy general manager of Hainan Nuclear Power Co., Ltd. under the China National Nuclear Corporation (CNNC), told CGTN.

The core module, dubbed the “heart of Linglong One”, is a highly integrated piece of pressure vessel, steam generator, primary pump receiver and other critical equipment.

Its steam generator had been welded into the reactor pressure vessel before lifting, which is similar to integrating the “lung” and “heart” of the nuclear power plant.

The module is a precision piece of machinery that demands precise control of gravitational acceleration, and the installation of it was picked during good weather for that reason.

“Inclement weather conditions, such as strong winds and heavy rain, pose challenges to the safety of the equipment,” Zhao Long, the deputy director of the project engineering department of the institution, told CGTN.

“In order to ensure a safe and successful installation in one go, we require the weather to be ideal,” he added.

Small size, flexible deployment, green contributor

Modular structure is the most prominent feature of Linglong One, which enables short manufacturing cycle with lower cost but higher security.

With a simplified system, the SMR excels in small size, making it easy to be transported and operated. It can also be customized and deployed flexibly based on the client’s requirements, contributing to significant economic benefits….

China is being economically attacked and has been increasingly economically attacked since April 2011 and the passing of the Wolf Amendment designed to undermine the Chinese space program. Even the wonderful Olympic games of 2001 in China were distressingly subject to an economic attack. Imagine attacking the Olympic spirit. Little matter though, for a 5,000 year-old China of 1.4 billion, will be just fine, will thrive and prove a model for the people of developing countries through the world.

Wow! That’s the shallowness, whiniest, most transparently propagandistic bunch of hooey yet.

China has enslaved Uyghurs, denied religious freedom to Buddhists, denied political freedom to Hong Kong Chinese, threatened Taiwan, repeatedly engaged in border condlict with India, claimed large parts of open ocean and other countries’ territorial waters for China, bullied Chinese living abroad, bullied Uyghurs living abroad, rewritten history to support land grabs, sold the organs of prisoners, built more coal-burning power plants than the rest of the world combined – and you want the rest of the world to ignore China’s aggressive behavior?

Cry me a river.

ltr = CNN ..the Chinese News Network.

Could China be producing too many batteries for EVs?

https://www.msn.com/en-us/autos/news/chinese-ev-battery-maker-adds-to-overcapacity-fears-with-plan-for-us-1-39-billion-plant-in-jiangxi/ar-AA1f7jbg?ocid=msedgdhp&pc=U531&cvid=744b1383d081472782146672fa854d5d&ei=8

Jiangxi Judian New Energy Technology has started construction of a plant to produce solid-state lithium batteries that power electric vehicles (EVs), joining a host of suppliers who are threatening to further flood a market that is already facing overcapacity. The company will invest a total 10 billion yuan (US$1.39 billion) to build production facilities with an annual capacity of 10 gigawatt-hours (GWh) of batteries in Ganzhou, in eastern China’s Jiangxi province, its parent Shenzhen Fuxin Industrial Technology said in a statement.

Construction for the first phase of the project, which will manufacture 2 GWh of solid-state batteries and another 2 GWh battery packs annually, began on Tuesday. The company did not say when the first phase will be operational. The total project covers an area of 400,000 square metres, with more than half under the first phase. “A 10GWh capacity is not a small battery production project,” said Davis Zhang, a senior executive at Suzhou Hazardtex, a supplier of specialised vehicle batteries. “Solid-state batteries might represent the future of the industry, but overcapacity woes are looming.”

Now I get this is ltr’s Chinese News Network where everything the PRC does is perfect. So pardon the interruption.

There is no such thing as too many batteries. However, there may be such a thing as too little profit. If China floods the market we will all enjoy lower priced EVs. They may also convert some of it to utility scale or home back up options.

It’s like the shipping industry. Sure having a lot of ships helped us out when there was that supply chain crisis. But the capital intensive shipping sector suffered losses for a decade.

Aside from questions of data quality, there is also a very important question of definitions.

Foreign investment in China is not a straight forward concept. Are we including domestic investment in a joint venture? Capital pledged, but not yet across the border? IPR valuations? It makes a difference.

Those who focus on China consider UTILIZED inward foreign investment to comprise capital that has crossed the border and is employed as per an investment agreement or contract. In joint ventures, this includes materials, labor service, and technology.

According to this consistent measure, FDI in the first half of the year was US$286.9 billion, up 0.4% from the same 2022 period.

Where lazy journalists get caught out is when reporting on APPROVED FDI, including projects that may never see the light of day.

David O’Rear: In Jardet, Jude and Chinn, we use UNCTAD data, which is actual flows as best defined. Because we worry about financial centers and distortions via SPE’s, we cross check using OECD data.

Prof Chinn,

With all due respect, that data is from China’s National Statistics Bureau.

More, if I’m not mistaken, it is a NET figure (maybe I’m wrong; it’s happened before).

Finally, the cross “border” flows into and out of Hong Kong — including many cases of “direct” investment in HK that slides over to other parts of China needs to very explicitly dealt with, for solid credibility.

PS, any thoughts on the pending 40th anniversary of the HK$ peg?

China-Built Car Tariff Loophole Opens Floodgates For U.S. Entry

https://www.msn.com/en-us/autos/news/china-built-car-tariff-loophole-opens-floodgates-for-u-s-entry/ar-AA1faKKD?ocid=msedgntp&cvid=e1ae9613d80f40dfa421b2f2ce52e86f&ei=9

Something to do with the Duty Drawback program. Read the whole thing.

https://www.msn.com/en-us/money/companies/china-s-car-sales-fall-for-2nd-month-in-july-as-price-war-continues/ar-AA1eWN3b?ocid=msedgdhp&pc=U531&cvid=3d2b7dd04e7b4e13821b01b65c6081ef&ei=9

Domestic demand for Chinese cars have been slipping. The good news for Chinese car manufacturers is that they at least exporting more cars.

Chinese debt from real estate developers continues to be under pressure:

https://www.cnn.com/2023/08/14/economy/china-country-garden-onshore-bonds-suspension-intl-hnk/index.html