I found this Bloomberg article about the exhaustion of pandemic-benefits related savings of interest and the coming consumption crash of interest.

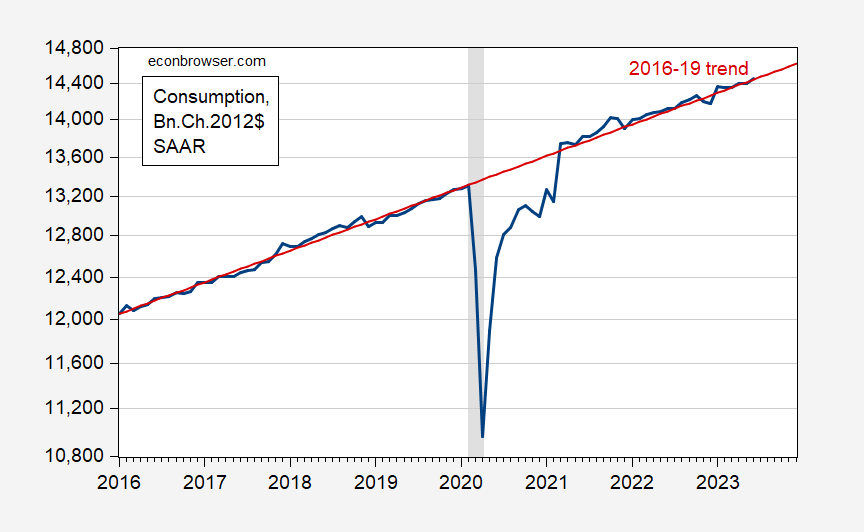

First, it fits into a general commentary regarding American consumer’s behavior. See Jan Groen‘s recent assessment of excess savings. The return of consumption to pre-pandemic trend was enabled by transfers, in this interpretation.

Figure 1: Total consumption, in bn.Ch.2012$ SAAR (blue), and 2016-19 deterministic trend line (red). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

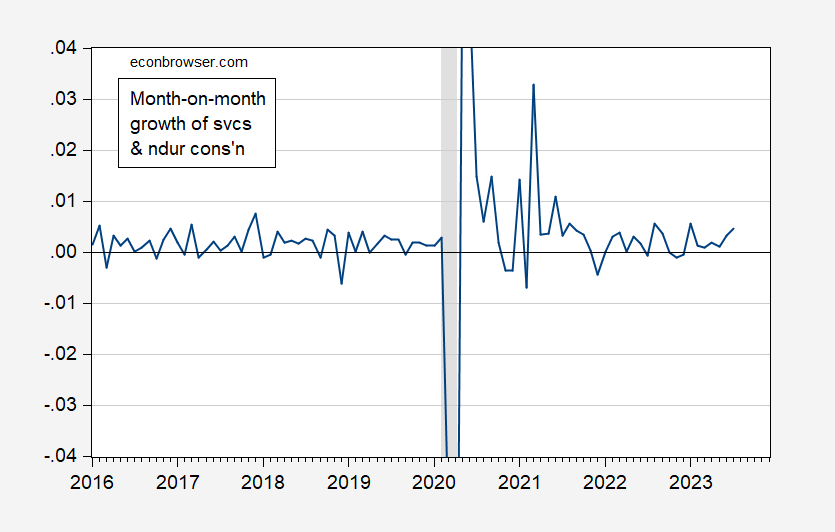

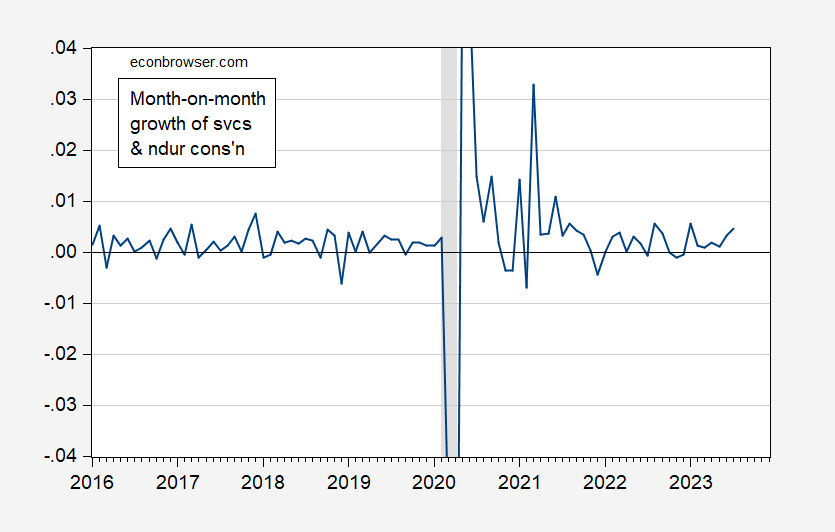

Second, the idea that excess savings would be decumulated within a few years is at variance with the consumption follows a random walk thesis. Remember, risk neutral (or at least certainty equivalence) consumers unencumbered by liquidity constraints should spend only a fraction of a temporary windfall. Consumption flow (different from consumption expenditures) should then follow roughly a random walk. Here’s the first log differences of the sum of services and nondurables consumption expenditure.

Figure 2: First difference of log of sum of services and nondurables consumption, in bn.Ch.2012$ SAAR (blue). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Of course, services consumption was impeded by the pandemic, and the shift to tradables understandable; and changes in interest rates should affect consumption growth too (although usually measured changes are too small).

What is interesting is that consumption doesn’t seem to be a random walk in recent months.

Technically, one can’t reject first differences over the last two years are white noise, although 24 observations means that it’s a pretty low powered test.

In any case, exhaustion of “excess savings” is inconsistent with this simple model.

My preferred explanation is rule-of-thumb consumers (a la Mankiw-Romer). The presence of liquidity constrained consumers is also a possible explanation. However, liquidity constraints do not explain why the excess savings are being spent down (as liquidity constrained agents should be able to save).

In any case, we seem to be away from the Euler equation/consumption follows a random walk model we learned in 1980’s grad school…

As an aside, if we think consumption follows a random walk is true, the recent rise consumption suggests that agents have revised upwards their views of future income…

I’ll get back to this classic debate in a minute for now:

https://tradingeconomics.com/russia/interest-rate

“The Central Bank of Russia raised its key interest rate by 350bps to 12% on August 15, 2023, the highest level since April 2022 and said inflationary pressure is building up. On Monday, the ruble tumbled past the 102 level, with President Putin’s economic adviser Maxim Oreshkin blaming a loose monetary policy for a plunging currency. As of 7 August, the annual rate of inflation rose to 4.4% while current price growth rates continue to increase. Steady growth in domestic demand surpassing the capacity to expand output amplifies the underlying inflationary pressure and has impact on the ruble’s exchange rate dynamics through elevated demand for imports. Consequently, the pass-through of the ruble’s depreciation to prices is gaining momentum and inflation expectations are on the rise. According to the Bank of Russia’s forecast, given the monetary policy stance, annual inflation will return to 4%”

I raise because our resident “expert” Princeton Steve had this comment suggesting that the nominal interest rate was 12.5% and Russian officials forecasted 6.5% inflation. Stevie insisted this was “inconsistent” with his advanced monetary model would required that expected inflation be much higher. After all – his advanced model shows that the real interest rate could never be as high as 6%.

Now we had an interesting episode in the early 1980’s with Reagan’s defense build-up, tax cuts for rich people, and Volcker’s tight money. And those of us that lived through the 1980’s realized real interest rates back then were 6%. Russia’s macroeconomic mix today is similar so I would suggest a 6% real interest rate is quite likely.

But what do I know? I have yet to study Princeton Steve’s advanced monetary model!

https://web.stanford.edu/~rehall/Stochastic-JPE-Dec-1978.pdf

Robert Hall, “Stochastic Implications of the Life Cycle-Permanent Income Hypothesis: Theory and Evidence”. Journal of Political Economy, 1978.

Some good news for everyone except Putin’s pet poodle JohnH

https://www.msn.com/en-us/news/world/ukraine-claims-to-have-retaken-oil-and-gas-platforms-in-the-black-sea/ar-AA1gyU7Q?ocid=msedgntp&cvid=4edcd28cddaf405492bc108923596b05&ei=9

Uraine said on Monday that it had taken control of several oil and gas platforms in the Black Sea, after a series of clashes with Russian aerial and maritime forces in the waters between Odesa and the occupied Crimean Peninsula.

The Ukrainian military intelligence agency released a 13-minute video including combat footage, drone videos and interviews with unidentified special forces soldiers describing what they said was “a unique operation to establish control” over offshore rigs known as the Boyko Towers that Russia seized in 2015.

I personally think that consumption is more affected by current cash in hand than expected cash in the future. The reason that so many people struggle to handle a $400 car repair and have little if any savings even for retirement, is that they never could and never will be able to pass the marshmallow test. They have a lot of things on their “I want/I deserve” list – and when they find a way to get it – they get it. Only items purchased on long-term credit (cars, houses) may have an element of considering long term income streams. This is hard to understand for economists who are exceptionally trained to understand money. For most people the question of “can I afford this” is answered by looking in their wallet.

So you put more stock in borrowing constraints than Ando and Modigliani did in their well respected model. That may be true for households with low income but when thinking about the consumption behavior of the elites – I go with Ando and Modigliani.

I think you arw agreeing with Menzie. This is the liquidity constraints Menzie mentioned. Liquidity constrained consumers will tend to spend windfalls – windfalls are current cash, aka liquidity – to a greater extent than unconstrained consumers.

Thinking of driving an EV? Should one buy or lease?

https://www.businessinsider.com/ev-electric-car-lease-vs-purchase-buying-tips-cost-2023-2

More on Russia’s inflation:

Vladimir Putin says that inflation in Russia is making it ‘practically impossible’ for businesses to plan

https://www.msn.com/en-us/money/markets/vladimir-putin-says-that-inflation-in-russia-is-making-it-practically-impossible-for-businesses-to-plan/ar-AA1gChJ6?ocid=msedgdhp&pc=U531&cvid=c32a9c6a1a4b4be2a80b6b8aeb9890c0&ei=14#image=1

Inflation in Russia makes it nearly impossible for businesses in the country to plan, Vladimir Putin said.

Russian inflation accelerated 5.15% year-per-year in August, well-above the 4% target.

Still, Putin brushed off longer-term concerns for the Russian economy, adding that its problems were not “insurmountable.” Russian president Vladimir Putin acknowledged in a a speech this week that Russia’s inflation problem is bad enough that it has become “practically impossible” for businesses to make any plans in the nation.

The president spoke at Russia’s Eastern Economic Forum on Tuesday, touching on the economic problems that the nation was currently facing. Russian inflation accelerated 5.15% year-over-year in August, well-above the central bank’s 4% inflation target. Prices that high make the economic environment extremely uncertain for businesses in the nation, Putin said, per Reuters.

A few thoughts:

(1) JohnH loves to mock US economists over forecasting inflation but I doubt Putin’s pet poodle has the courage to note the situation in Russia;

(2) Nobel Prize winning economist Princeton Steve doubts inflation can be single digit but I already covered that;

(3) Putin seems to be whining about a problem he created.

As a public service – I will to update the Facts about two measures of oil prices:

Brent just over $92/barrel

Ural less than $74/barrel

The spread exceeds $17/barrel

We need to keep the facts clear as Princeton Steve has been doing a LOT of lying of late trying to tell us our sanctions have collapsed. A $17 spread is not as good as say a $25 spread but it ain’t zero.

Of course Princeton Steve keeps saying the Ural price is headed above $100. No – it is not. In fact, Stevie’s worthless blog has admitted that this price is still less than $75 and the spread is still greater than $16. I guess Stevie does not read his own blog.

Well! This is a comment to note! pgl has declared that the Urals price will not rise above $100…ever! Kind of like when he mocked someone a year ago for suggesting that mortgage rates would barely rise…and then they continued to rise and are now over 7%. Or when two years he mocked anyone who doubted that lumber prices were about to plummet, but then a short six months later they had again risen. Now, a full two years later they’re finally back to where they were five years ago.

Given pgl’s incredibly bad forecasting acumen, it sounds like a good time to bet on Urals…

“pgl has declared that the Urals price will not rise above $100…ever!” Yea – my mentally retarded stalker LIED again. I made no such forecast. I am reporting on current prices. Oh wait – you do not know the difference.

But way to defend your fellow Village Moron Princeton Steve. You two have a nice time on your hot date tonight.

https://www.macrotrends.net/2637/lumber-prices-historical-chart-data#:~:text=Lumber%20Prices%20-%20Historical%20Annual%20Data%20%20,%20%2077.28%25%20%2028%20more%20rows%20

“Or when two years he mocked anyone who doubted that lumber prices were about to plummet, but then a short six months later they had again risen.”

Funny my mentally retarded stalker mentioned lumber prices. Yes I have always noted they are volatile. Now take a look at this chart and you tell me that those sky high prices would continue – which is what little Jonny boy kept telling us. Of course little Jonny boy will likely LIE about even what he said back then.

Poor little Jonny boy – our host’s new post calls out both your latest stupidity and the BS from Princeton Steve in a single yet brutal shot. Not that you would ever understand why. See my comment for clarification.

Link, Johnny? ‘Cause nobody is going to believe you ithout evidence.

Warning to anyone thinking about buying products from Nine Line Apparel:

https://fox17.com/news/local/veteran-owned-company-that-called-out-nike-sued-by-former-employee-for-sex-discrimination

A veteran-owned company which has gained notoriety in recent weeks for their stance on Nike’s decision to remove shoes with an early American flag is also going through its own ordeal due to a lawsuit from a former employee claiming sex discrimination. Nine Line Apparel has been featured numerous times on national media outlets for their pro-veteran stance and products supporting veterans. Most recently, the company has taken such a position calling out former NFL quarterback Colin Kaepernick and Nike for its decision to take shoes with the ‘Betsy Ross flag’ off shelves and pushing back against USA Women’s Soccer star Megan Rapinoe’s comments about President Donald Trump.

The company is also embroiled in a lawsuit filed by Brandy Mai, a former employee and veteran who claims in the suit claims her male bosses created an environment which was “misogynistic, chaotic, and conflicting.” According to the suit, Mai claims the company reduced her salary and changed her job title in 2015, demoting her as a full-time marketing director for Nine Line. Mai claims a disagreement in 2016 led to a written discipline, and discussions between she and the company regarding her request to accommodate her PTSD in the wake of the changes. Mai claims she was replaced by a man with no experience and the company “specifically stated that he was desirable because he was male.”

The suit states Mai was kept from attending events she organized but her male colleagues were allowed to attend. In 2016, she was moved back to Marketing Director but with all-male bosses and that same year, she was allegedly told by consultants she was not wanted to conduct interviews at an event because she “wasn’t a guy.” When she went to a secondary event, the man then allegedly followed her and yelled he wanted to “punch” her in the face and “strangle” her. Mai’s suit states she was discriminated against on the basis of her PTSD and gender when her pay was reduced and when she was ultimately terminated.

There is a massive literature on this windfall stuff. My impression is that there is a great deal of detailed understanding of spending in response to windfalls, but no reliable generalization. Food consumption is less affected than goods consumption. Durables are more affected than non-durables. Luxury items receive a boost beyond that received by durables in general. But each episode of a windfall occurs in a specific context, so the windfall produces different responses in overall consumption. A shift from services to tradables, for instance. As you say, not enough data points.

“Liquidity constraints” strike me as tricky.because they show up differently for different consumption decisions. The monthly payment on a $70,000 auto can be within the family budget with a $30,000 down payment, but not with a $10,000 down-payment. A $10,000 windfall doesn’t make a big difference for Tundras. So choose a less expensive durable good, like a new refrigerator, and the liquidity constraint isn’t binding – and perhaps evidence of liquidity constraints disappears? Receive a windfall, but auto sales don’t respond? Perhaps there’s a chip shortage limiting supplies of autos.

I’m curious as to the foundation for the notion that consumption follows a random walk. It sounds very much as if an equation was sought, found, and assumed to be true in an effort to make calculations tractable. Once empirical confirmation fails to appear, shouldn’t we accept the null hypothesis?