The recession’s start is further delayed as forecasted growth continues. FT article and survey results: q4/q4 growth at 2% [1.3%, 2.5% 90%ile range].

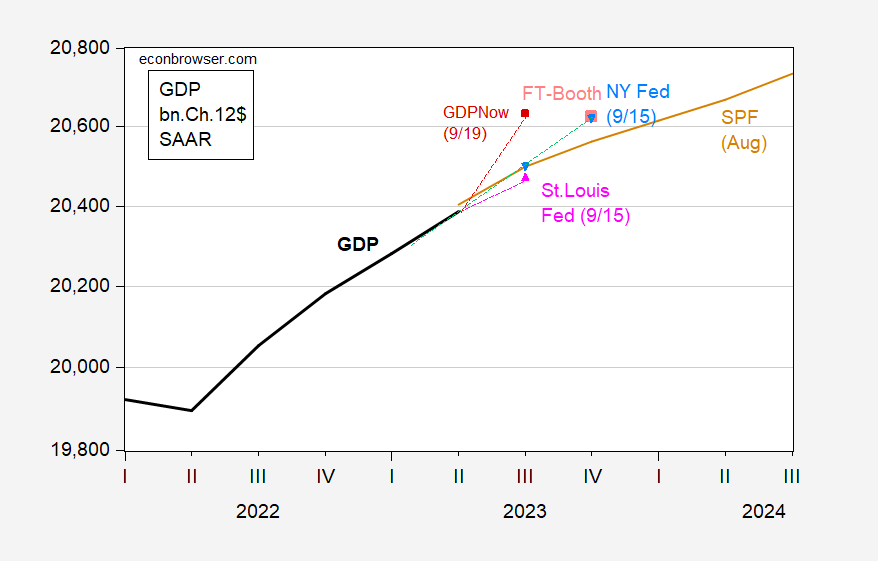

Figure 1: GDP (bold black), Survey of Professional Forecasters median (tan), FT-Booth median survey (light red square), GDPNow 9/15 (red square), St. Louis Fed Economic News Index 9/15 (pink triangle), NY Fed nowcast 9/815(light blue triangle), all in billions Ch.2012$ SAAR. Source: BEA 2023Q2 second release, Philadelphia Fed, Booth/U.Chicago, Atlanta Fed, St. Louis Fed via FRED, NY Fed.

The FT-Booth survey (responses submitted 9/13-9/15) is more optimistic than the August Survey of Professional Forecasters median, through end-2023. (My median forecast was 2.2%.) The increasingly optimistic outlook is in line with the evolution of nowcasts.

While the NY Fed and Atlanta Fed nowcasts remained largely (or completely) unchanged relative to the prior week (9/8), the St. Louis Fed news index has moved from zero growth to 1.71% (SAAR). GDPNow growth for Q3 (4.9%) remains substantially more optimistic than the other nowcasts and tracking forecasts.

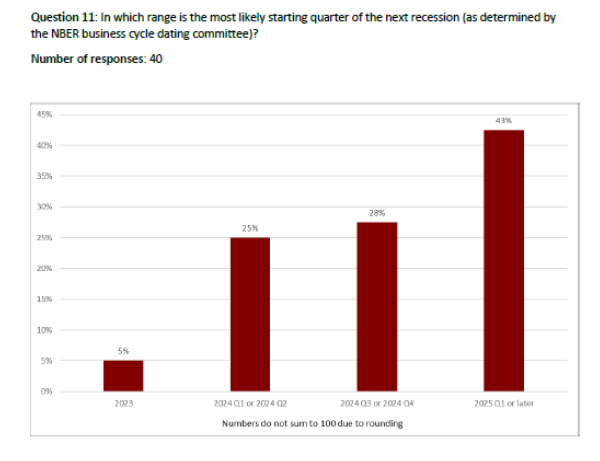

When do economists believe the next recession (as determined by the NBER BCDC) will begin, given the prospective growth path?

Source: Booth School (September 2023).

Once again, the recession start date is pushed back. The modal response (41%) is for 2025Q1 or later (is this the equivalent of “soft landing”?). Only 25% peg the recession start date in 2024H1 (which was my response).

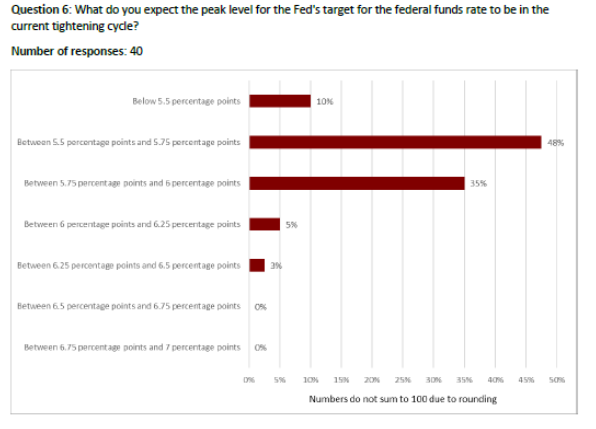

What does the survey indicate about the Fed funds trajectory?

Source: Booth School (September 2023).

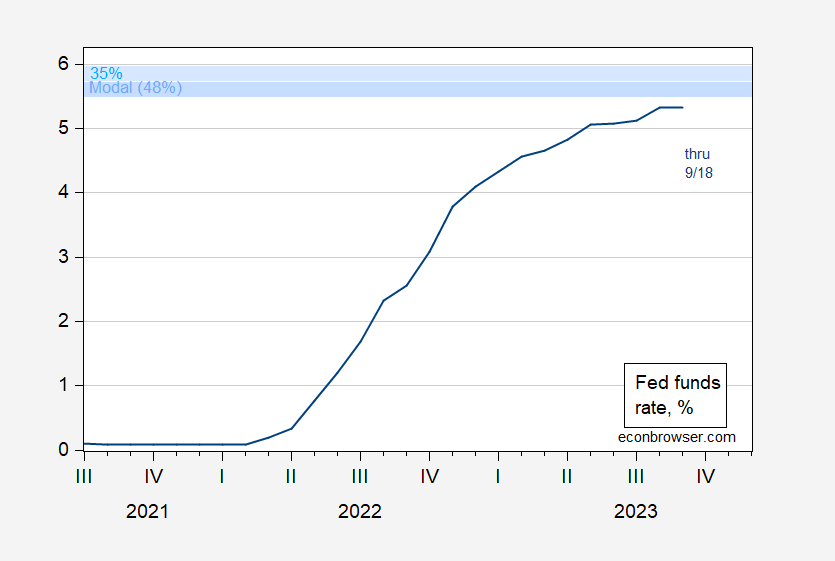

The modal response is for a peak Fed funds rate at 5.5-5.75%. For context, here’s the modal response and 2nd highest response (5.75%-6%) shown with the path of the Fed funds thus far.

Figure 2: Fed funds rate, % (blue). September observation for data through 9/18. Modal response for peak Fed funds shaded light blue, second highest response bin lighter blue. Source: Fed via FRED, Booth School.

OECD interim outlook was released today. U.S. real GDP growth forecast for 2024 was revised up to 1.3% (annual average). For 2023 2.2% real GDP growth is much in line with most banks forecasts at present (Goldman, JPM). The handout is here: https://www.oecd-ilibrary.org/sites/1f628002-en/index.html?itemId=/content/publication/1f628002-en

Wait for it. Head RECESSION CHEERLEADER JohnH will start chirping about GDI again. Yea it is below GDP but little Jonny does not know why. Yea the adults who have checked NIPA table 1.10 know reported profits but little Jonny’s favorite tabloid trash has convinced him that profits are still soaring.

Urals toward $80

https://www.princetonpolicy.com/ppa-blog/2023/9/19/urals-heads-toward-80

It’s so cool that all of your comments on Menzie’s blog are so incredibly crappy, it saves me the time of clicking on your links.

I checked to see how many comments his dumb blog posts get – zero as usual. But little Stevie did admit this:

The Urals discount is largely holding steady, about $17

Seems the sanctions are still having some effect even if little Stevie tries to argue otherwise.

To be fair, the price cap is set at $60. So $20 above the cap seems like a bit of a failure of the cap. I think Steve’s point is that the price cap policy should be changed but not eliminated.

Actually Stevie is claiming that the quotas in general have always been ineffective. The continuing Ural discount is evidence that his claim is wrong.

“The ruble continues to hold up, near 97 rubles / USD. There has been no collapse. Russia’s central bank is doing its share, raising benchmark interest rates to 13%. I would note that there is no such thing as 13% interest rates in the 5-7% inflation environment Russia’s central bank projects for 2023.”

Stevie made this claim before and I responded by noting very good reasons why the ex ante real rate in Russia could be around 6% or even high. After all Russia is running the same toxic mix of Reagan fiscal stimulus and Volcker tight money the US had back in the early 1980’s. Now maybe Stevie is too stupid to know that we had high real interest rates back then. Maybe Stevie is too stupid to get basic macroeconomics. But I explained this to this worthless consultant several times. And he still writes this garbage? Damn!

Russia is not 1970s America. From ’74 to ’80, US inflation averaged 9.3%, and the FFR was below this level the whole time.

In 1981, Volcker slammed on the breaks, with the prior year’s inflation at 13.6% (1980) and the FFR at 16.4% (1981). So if you’re telling me that 5-7% inflation requires a 13% benchmark rate, the answer is ‘no’. It most definitely does not. So either monetary policy is set way too tight in Russia, or the inflation rate is not 5-7%. Inflation could be 10-14%, but I would guess it’s even higher. The Kremlin is not trying to induce a recession to reduce the inflation rate. It is trying to figure out how to fund the war, and that very commonly implies printing money.

https://fred.stlouisfed.org/series/FPCPITOTLZGUSA#0

‘Russia is not 1970s America.’

Are you really this much of a moron. I was talking about 1981/82 not the Nixon years dumbass. Now anyone who remotely understood macroeconomics would have known what I was driving at. But we know your knowledge of economics just sucks so I guess I can just ignore the stupidity of your little reply there.

“Inflation could be 10-14%, but I would guess it’s even higher.”

Is this like your $200 a barrel oil price forecast. It seems you are saying that the real interest rate is zero? For an economy with this much military Keynesianism?

I have to apologize to JohnH. He may be incredibly stupid but no – Princeton Steve has to be the dumbest troll God ever created.

Once again, well out of your depth. So let’s take the US example.

US inflation peaked at 9% in June ’22 and averaged 8.5% from March to September 2022. Notwithstanding, correcting this by the Taylor rule or similar never required an FFR above 4.5% per the various posts here of David Papell and Ruxandra Prodan.

To suggest that Russia needs their FFR equivalent of 13% to combat 5-7% inflation is just pure nonsense, but I am sure that either P&P or Menzie could estimate an implied inflation rate from a 13% benchmark rate.

Here’s one P&P graph from February of this year.

https://econbrowser.com/wp-content/uploads/2023/02/pr2023_panelb.png

https://ycharts.com/indicators/us_inflation_rate#:~:text=Basic%20Info,in%20price%20over%20a%20year.

For the record, I don’t believe I ever forecast $200 oil. Show me the source.

The reason I haven’t forecast $200 is that the global economy can’t take it. The global economy certainly not sustain such a price, even if in theory Brent might peak there for a short time. The projected outcome under such S/D conditions is recession, not $200 oil.

‘Steven Kopits

September 21, 2023 at 6:18 am

Once again, well out of your depth. So let’s take the US example.’

No Stevie – your babble proves you are the “out of your depth”. I was thinking in terms of an actual macroeconomic model that everyone but you get. Your comment was your usual babbling BS. Oh wait – you never mentioned SUPPRESSION! Huh!

“US inflation peaked at 9% in June ’22 and averaged 8.5% from March to September 2022. Notwithstanding, correcting this by the Taylor rule or similar never required an FFR above 4.5% per the various posts here of David Papell and Ruxandra Prodan.”

This is a prime example of why Stevie should never do economics. The Taylor rule applied to the US macroeconomic situation is not a good description of what is happening in Russia right now. Not even close. But yea – little Stevie spelled the names of two economists correctly even if the boy little boy had no effing clue what their paper was about.

Steven Kopits

September 21, 2023 at 11:02 am

For the record, I don’t believe I ever forecast $200 oil.

Stevie pulls a JohnH as in deny, deny, deny. Look if you cannot stand up to previous stupid comments, then stop making so many stupid comments.

“WTI and Brent have been rocketing up, respectively at $93 and $96 at writing. (For those interested in the oil market dynamics, see my presentation from Italy last month. I’ll have a separate post on this). Urals continues to track Brent, with Urals at writing posted at $78.12. Given the surge in Brent, we might expect to see Urals at $80 / barrel in the next week or so, $20 higher than the $60 Price Cap.”

Ah Stevie – Brent yesterday fell below $94 a barrel so your claim of $96 is false. And we know your forecasting record is pathetic. The rest of your blog rant is worthless.

And Russia is curbing sales of refined products:

https://www.cnn.com/2023/09/21/energy/russia-fuel-export-curbs/index.html

It also will collude with Saudi Arabia to try and hold prices up by cutting sales.

So all in all it doesn’t seem like they are going to get a lot of increases in hydrocarbon income, even as the prices move above what is allowed in the part of the world controlled by EU/US. For the war as a whole the issue seem to be more concentrated on the issue of artillery shells. Yesterdays report from ISW mentioned that Russian troops are desperately complaining that they cannot get appropriate coverage from artillery and that a lot of the shells are low quality that fail to explode. Riffles against artillery shells is no way to fight a war.

https://www.understandingwar.org/backgrounder/russian-offensive-campaign-assessment-september-20-2023

“I think Ronald Reagan gave us a great example when federal employees decided they were going to strike. He said, you strike, you’re fired. Simple concept to me. To the extent that we can use that once again, absolutely.”

South Carolina Senator Tim Scott on the UAW call for fairer wages. Your modern Republican Party. But wait – I did not know working for GM and Ford made one a federal employee.

Did you say his name was Tim or Tom??

https://www.harrietbeecherstowecenter.org/harriet-beecher-stowe/uncle-toms-cabin/

Exactly!

Kevin Drum comments on Uncle Tom Scott and includes a clip of the Senator’s remarks:

https://jabberwocking.com/tim-scott-you-strike-youre-fired/

Tim Scott: “You strike, you’re fired”

My father, and somewhat influenced I was by my father, were VERY anti-Reagan, I don’t always like Drum’s posts. But I appreciate this one, and I appreciate you bringing our attention to it.

Really great is Drum’s post. I almost don’t regret ever telling anyone her and Rick Stryker your real name after our semi-vicious battles here on the blog~~~~~ that’s a joke “H”. hoping you take it in the humor, but still a kind of loyalty/promise to you. I would not, nor never

See “pgL”, we had many pretty sharp insults to each other here on the blog before. I wouldn’t throw you to the wolves. Like My Ex-GF’s parents. And My GF, then was so silent when I met her parents at the large table of the restaurant. I keep wondering what she got in “the trade”. I just hope he was so great and enamored. Even in Xi’s current run of events. Or her Father ( A municipal judge) You can build anger over time, great great great anger. But I keep feeling lucky, for things better than I deserved. That’s what saved me, see “H”??

Funny, pgl has no clue as to why GDI is declining…but gladly projects his ignorance onto others!

Seeking Alpha: “There is growing acceptance in the economics community that GDI may be a more robust indicator of the economy’s health in the current environment.” Sad how much it gets overlooked! Because it doesn’t support the right narrative? https://seekingalpha.com/article/4633582-is-recent-gdp-data-overestimating-us-growth

And then pgl chooses to totally ignore extraordinary levels corporate profitability, which I have repeatedly linked to.! So I present the facts yet again–Corporate profit margins in 2Q23 were the fifth highest ever, Corporate America is NOT hurting, however much pgl bleats about how much they are suffering. https://fred.stlouisfed.org/series/A466RD3Q052SBEA

What I suspect is going on here is that some politically motivated folks are invested in a Goldilocks version of the economy, while others want to paint a troubling picture.

Personally, what I would like to see is an accurate picture of the economy, one that shows how average Americans are faring. And from where I sit, it’s not pretty. Since the end of 2019 real wages are stagnating in the midst of extraordinarily tight labor markets that we were assured would result in rising real wages, we were assured.. Meanwhile, GDP, a reasonably good proxy for income growth of the Top 10%, has been growing nicely since 2019, And Corporate America, which helped drive inflation, has reaped extraordinary profit margins.

Instead of regularly discussing this situation, economists here fixate on GDP and the prosperity of the affluent. It that who they really think the economy is supposed to serve? Instead of simply dismissing people who feel they are not better off than they were four years ago, Democrats should seriously consider acknowledging the problem and do something about it. Replaying Hillary’s failed 2016 economic spin may well produce the same result.

“Funny, pgl has no clue as to why GDI is declining”

I know you are dumb but damn! I told you many times that reported profits have declined a lot. Real compensation has risen.

Look I don’t mind having a stalker but why is mine so mentally retarded?

“And then pgl chooses to totally ignore extraordinary levels corporate profitability”

Really? Have you checked NIPA table 1.10? If you had – then you are lying here. If you haven’t then you are indeed the dumbest troll God ever created.

pgl: Johnh and data have long been strangers.

Would you argue with me that figures 22–24 in the Yardeni presentation are interesting??~~and that looking at only the last 5 years of NIPA might not tell the entire story?? Whereas a longer arc of time might tell us something about corporate profits vs wages??

https://www.yardeni.com/pub/ppphb.pdf

They are interesting. Yes profit margins soared for a while but they have started come off their lofty levels.

I found figure 8 interesting (which is confirmed by NIPA table 1.10). Profits in the nonfinancial sector soared for while but profits in the financial sector and net income from abroad did not dramatically rise.

NIPA table 1/10 has a lot of interesting data on GDI by factor of production. Too bad JohnH cannot be bothered to check this data before he spews his serial nonsense.

I should read NIPA more than I do. I am aware of it, just lazy. Which I have no excuse to be lazy because BEA provides some nice explanations. One of these days I will try to get better versed about it. We owe that much to Mr Kuznetz, Aye?? What a awesome dude. Wish I had 1/10th the brains he had.

I need to remind myself to graze in Yardeni’s pasture. It’s easy to learn when the data are presented logically.

Figure 11 addresses an error that was made here by commenters who hadn’t bothered to check the data (guess who) back when banks were falling over. Net income for FDIC-insured banks was fairly stable in the face of Fed rate hikes, while pre-tax profits for the financial sector as a whole fell sharply. The Fed didn’t directly hurt most banks with rate hikes. Indirect harm by destabilizing other financial firms? Quite possible.

For the record I also think Figure 27 of the Yardeni stuff kind of supports the argument I am making. If NIPA are dependable as a barometer on Corp profits, why does the S&P 500 take a larger ratio of the NIPA during certain periods?? (noticeably recent numbers) I am only posing the question and am willing to listen to what factor I am missing here in the reason for increase in the ratio of Figure 27. I’m open to cajoling here, on what I am missing, no sarcasm.

Moses,

S&P’s share of profits appears to be mostly cyclical. Recessions are bad. Dot.com booms are good. Exactly why publicly traded firms’ profits are more sensitive to economic conditions than private firms’ isn’t clear to me – not really an equity guy.

Another question I have. Are the CEO salaries included in the very same numbers of compensation/wages “increases” for minimum wage workers??

https://www.epi.org/publication/ceo-pay-in-2021/

And if so, to use a word some Puh-hud holding “statistical economists” apparently don’t understand (Along with deep concepts such as SAAR) do those executive salaries “skew” the overall compensation/wages data??

Kinda makes you wonder how CEOs and other corp executives got out of bed and tied their shoes previous to the post 1980 “invention” of “incentive”, doesn’t it?? How did they even bother to tie their shoes and read the morning paper previous to 1980s “incentive”?? “Amazing!!!!!!”

In closing to my little diatribe here~~it’s fascinating to me, that OTHERWISE highly intelligent economists take the exit of labor from the fast food service industry because of sub living wage pay, and going to other jobs where labor are barely treated much better, as “a great leap forward for the working class”. And people think I’M jaded in the head?!?!?! “Moving up” a very shitty service industry job to a slightly less shitty service industry job. “Career advancement”…… The great Covid “leap in progress” for humanity.

Why do universities get corporate endowed chairs?? Gosh, that’s a “complex one” to work out the machinations of, isn’t it?? What prizes can I get for putting shoe polish on cow dung??

As always – EPI publications are must reads. My understanding of those NIPA tables, CEO compensation is included in overall compensation of employees by the BEA. Now to the degree that some of this is stock based compensation, I’m not sure. Maybe our host knows.

One would have to go to Census data to get a breakdown of the distribution of the NIPA compensation figure.

@ pgl

‘Preciate the even-tempered answer. It’s interesting. I mean I know Menzie has presented the data pretty well focused on service jobs. I just get worked up and angry about this type topic. I think Menzie knows that or he would have taken me behind the metaphorical woodshed by now with his paddle with the big holes in it. Thank goodness he only mostly uses that for the Stephen Moores and stuff or I’d be in trouble.

https://fred.stlouisfed.org/series/A053RC1Q027SBEA

National income: Corporate profits before tax

I guess Jonny boy is too lazy or stupid to check BEA NIPA table 1.10 so a picture is needed.

Jonny boy keeps chirping that profits are up but real GDI is down. I have told this moron many times that real compensation has risen over the year but profits have fallen a lot. The picture shows the decline in nominal profits and we know the price deflator is up a bit so real profits fell more. And yet this lying moron claims I have no clue?

Yep – Jonny boy is that DAMN DUMB.

From 2021Q2 to 2023Q2, the price level increased by 11.47%.

Over the same period nominal corporate profits FELL by 0.42%.

And somehow JohnH concludes real corporate profits rose over this period? As our host just said

‘Johnh and data have long been strangers.’

But I’m the clueless one? Seriously?

Johnny’s own link notes that:

“GDI growth would have been negative except for a large increase in real wages.”

That was Q2, of course. All this “you think doodie stuff!” argumentation about GDP and GDI ignores that:

– The recent gap between GDP and GDI is large by historic standards

– Both series will be revised repeatedly

– Revisions tend to narrow the gap between the two series

– Because the gap is an anomaly and there have been lots of data anomalies since Covid arrived means we shouldn’t be surprised that the gap exists.

– During the current expansion, real GDI has grown both faster and slower than real GDP, and focusing only on periods when GDI grew slower is dishonest:

https://fred.stlouisfed.org/graph/?g=194lu

So attempts by some annoying lightweight – that’s you, Johnny – to score debating points by pretending he knows which series is superior, why it’s superior and what has caused the gap are silly. Particularly when –

“GDI growth would have been negative except for a LARGE INCREASE IN REAL WAGES.”

There’s Johnny with his “narrative” again.

Here’s Johnny’s “narrative”:

“Instead of regularly discussing this situation, economists here fixate on GDP and the prosperity of the affluent.”

Johnny just can’t help himself. There is a clear interest among commenters here on distribution of income, poverty, labor economics and a bunch of other equity-centered issues that Johnny doesn’t actually understand, but Johnny’s “narrative” is that economists here are all cheering for fat cats – as if Johnny can tell who is an economist. It’s simply a lie.

Always sneering, always distorting. Poor Johnny can’t help himself.

“economists here fixate on GDP and the prosperity of the affluent.”

Huh – he did say that. Jonny is fixated on how real GDI has slipped a bit over the past year but he has no idea how this income behaved by factor of production. Yea – it seems real compensation has continued to rise while real corporate profits (‘the prosperity of the affluent’) have fallen a lot. But that is the opposite of what little Jonny keeps claiming.

Yea – little Jonny and the data are “strangers” as our host noted. Then again as you have pointed out, little Jonny has no clue what any of these terms even mean.

“Personally, what I would like to see is an accurate picture of the economy, one that shows how average Americans are faring.”

Johnny, you claim others are wrong because you cannot define a accurate picture. The problem is you. The economy is exceedingly complex. There is no one single description of the economy that can accurately explain how all participants are performing. Then you blame economists for that failure. But the failure is your desire to have one parameter that fulfills those needs. That parameter does not seem to exist in the way you want it to exist. Accept reality johnny.

But, but, but…if Johnny accepts that reality is comicated, he won’t be able to make sime-minded accusations. He’d just…fade…away…

“GDI growth would have been negative except for a large increase in real wages. Otherwise, we saw an outright contraction in profits from current production, with domestic earnings of financial corporations experiencing a significant decline.”

I just read Jonny boy’s link. This paragraph is what I have been saying for a long time. Jonny boy has been saying just the opposite.

Come on Jonny boy – we have been over this before. If you put up a link, trying READING the DAMN thing. Geesh!

I don’t recall a situation where the start date of the impending recession keeps getting pushed into the future.

I believe the Bank of Canada just made a mistake by pausing rate hikes and the Fed will make a mistake if it pauses this month. It is disappointing and somewhat alarming to see all the Canadian provincial premiers lobbying for a pause and now the federal finance minister not just commenting but praising the pause. Seems to me that Bank of Canada policy has become noticeably more politicized in the last few years.

Oddly enough, I reckon that September rate hikes would have/will benefit incumbent leadership in both Ottawa and Washington, DC. Especially in the context of persistently high energy and food inflation. Higher overnight rates now would/should provide greater scope for NA central banks to start cutting rates earlier in 2024. In time for key elections, late 2024 in the USA and 2025 (at the latest) in Canada. I wonder if Prime Minister Trudeau and President Biden are worried about being turfed by their own parties.

“I don’t recall a situation where the start date of the impending recession keeps getting pushed into the future.”

It’s happened before. Just most economists and market timers would rather we forget. And the American people’s length of memory is quite small (as you have just now exhibited). That’s what guys like Professor Rosser count on when they definitively predict no Russian invasion in Ukraine literally a week before the war starts. But you are evil if you hold them to it.

Erik, you’re right about the oddity of a recession that is predicted but doesn’t materialize. I think that’s because recessions aren’t generally anticipated, so there has been little opportunity in the past to be wrong in this way. We are most often wrong in the other direction, not anticipating a recession until we’re well into it.

The yield curve and the Fed are the most obvious sources of the expectation of recession. Along with the oddity of a recession which doesn’t show up is an inverted curve which doesn’t immediately precede recession – so far.

A big question is what’s going on with the neutral rate right now.

Didn’t Paul Samuelson say something about the stock market predicting 9 of the last 3 recessions?

@ Macroduck

I disagree with you on this one, but I am not willing to get my six-guns out for our high noon gunfight. as I think this thing is particularly hard to quantify “Who said what??” “When did they say it?” “How many said it??” X years ago…… buhduh buhduh buhduh………

There is not a really strong case to be made to continue rate hikes. You are welcome to present that case, but my guess is it will be inaccurate and wrong. But have at it, please. Defend that position with data, not authoritative voice.

Not certain myself about whether pausing or hiking is the right policy here, but I take issue with the idea that central banks will start cutting rates in time for the elections.

In the US at least, I don’t see the central bank cutting rates again until the unemployment rate hits 6%. That’s what Powell’s ‘higher for longer’ is signaling to me.

6%? Well we did have that unemployment rate back in the 1970’s and during the Great Recession but come on.

Just checked the data. The unemployment rate fell from 5% in late 2015 to only 3.5% just before the pandemic. I do not recall any concern about inflation back then.

I would venture to say that if the unemployment rate goes over 4% – there is going to be a very strong case for easing up on monetary policy.

The fed did a minimal quantities tightening around 2018, seen on long term balance sheet chart. They backed off in 2019.

IIRC, Fed thought the economy was getting too “easy”.

You are correct about the FED in 2018 but note that the unemployment rate in early 2018 started off at 4% and went down from there.

I would love to be able to identify a plan from Powell that’s based in fundamentals. For the life of me, I cannot figure out what their view of the economy or their mandate is. I think I understood Bernanke. I think I understood Yellen. I think I understood Greenspan, to the extent he intended to be understood.

Best I can tell, the current Fed learned macro from Potter Stewart. They’ll know policy balance when they see it.

Don’t disagree. But holding rates is quite different from raising them, even a quarter point. Right now, no evidence that rates should increase.

I know we have some wind energy fans here. (Sorry.) There is good news out of The Netherlands:

https://newatlas.com/energy/touchwind-floating-wind-turbine/

Cheaper, sturdier, operates in a wider range of conditions, than the current three-blade behemouth.

Solar and wind continue to improve efficiency, making them more economical each year. Cannot say the same thing about fossil fuels. They are technological dead ends. The future is green electricity…

The Fed’s Summary of Economic Projections may have erased the recession that was built into prior editions. The jobless rate forecasts are only for year-end, so it’s not certain, but the 0.5% rise over a 12-month period may have disappeared.

At the same time, rate cuts for next year have been reduced. Also, suggesting no recession.

@pgl: The expression I recall hearing elsewhere is that the markets predicted 12 out of the last 6 recessions. I always assumed that referred to equity markets. In this case, equity markets are predicting no recession. Perhaps slower growth but no recession.

Fixed income market are clearly predicting a recession and if one does not realize it will be the mother of all false positives. GICs (Canada) and CDs (USA) have looked attractive over the last while. My attention has recently shifted to high dividend paying regulated oligopolies that sold off (telecom, pipelines, etc.).

@Macroduck: I believe you are correct in that forecasters (typically business economists) are more often than not caught offside by a largely unexpected recession. As for the ‘right balance’, I am in the crush the inflation expectations earlier than later camp. Speaking of which….

Has anybody come across a good treatment of the apparent asymmetry in how monetary policy has been conducted in this century, i.e., in the context of a negative economic shock, loosen policy quickly and sharply but in the context of a recovering, growing economy, hesitate to tighten and then do so very slowly in the beginning of the recovery?

Thanks. Maybe 12 out of 6 was an update of what is noted here:

https://www.azquotes.com/author/12933-Paul_Samuelson

A good treatment? Don’t have one handy. But I think I have a handle in the logic behind the pattern you describe. Here goes:

There is asymmetry in business cycles, so there is asymmetry in the policy response across business cycles. If you look at employment, income or output measures, you’ll often see a sudden drop followed by a gradual recovery. For all kinds of reasons, the sudden drop allows and, in fact, requires a sudden easing of monetay policy. Once the recovery begins, calibration of monetary policy to a gradually narrowing output gap means gradual tightening of policy.

Beyond that, the Fed is not much better than anybody else at predicting recessions. They can’t reliably see recession coming. Realization that recession is upon them leads to sudden action. Bernanke’s research into Japan’s “lost decade” led him to conclude that gradualism in response to economic weakness is a mistake, merely the waste of a policy tool. His view is received wisdom among central bankers. The result of these two facts is a sudden, large response to recession.

The thinking around recovery from recession is quite different. The Great Depression is a huge influence on policy thinking, and the conventional view is that a nascent recovery early in the Depression was snuffed out by premature tightening of policy. Same for the double dip of the 1980s. Since premature monetary tightening can end expansions and policy makers, having recently been surprised by recession, are sensitive to their lack of knowledge about the state of the economy, they remove stimulus gradually. With the output gap wide, the balance of risks favors gradalism.

Hope that makes sense.

John Fetterman:

“If those jagoffs in the House stop trying to shut our government down, and fully support Ukraine, then I will save democracy by wearing a suit on the Senate floor next week.”

Speaking of dress codes – is Jim Jordan still taking his coat off every time he goes off on one of his patented rants?

Oil price update in light of the trash from Princeton Steve who keeps saying Brent is at $96 heading to north of $100 while he also claims Urals price is north of $80. That is not what this says:

https://oilprice.com/oil-price-charts/#prices

Brent continues to fall and is not south of $93.75 while Urals price is south of $80.

Yea – never trust the lies from the world’s worst consultant.

538 (now ABC) reports on recent off-cycle elections, noting the Democrats have done much better than Republicans, overall. The article asserts that performance in off-cycle elections is a good predictor of popular vote outcomes in election years, so good news for Democrats.

https://abcnews.go.com/538/democrats-winning-big-special-elections/story?id=103315703

The courts have also been demanding that electoral maps be redrawn in several states, with the result that Democrats will probably pickup a few seats. So there are two factors suggesting Democrats will retake the House in the 2024 election.

Of course, 2024 is a presidential election year, which knocks the whole House-majority-predicting exercise into a cocked hat. 538 doesn’t address the influence of the presidential electri on House elections, but the implication of strong predictive power is that the presidential vote ain’t the whole story.

https://www.msn.com/en-us/news/politics/trump-says-he-always-had-autoworkers-backs-union-leaders-say-his-first-term-record-shows-otherwise/ar-AA1h49z7?ocid=msedgdhp&pc=U531&cvid=eca0563e5bb244cf94ea09d20197fb64&ei=9

This is good reporting. Trump tells union workers such as those in the UAW that Trump has their backs. These unions, however, have not forgotten how many ways Trump stabbed union workers in the back.

Trump’s words mean nothing. He has a Presidential record which is just dreadful.

@Macroduck. Yes. The Great Depression experience in quashing the recovery would still loom large today.

In this particular recovery, from the pandemic-induced recession, central banks including the Fed should have started to tighten in late 2020. If they had done so, some of the inflationary excesses would have been avoided current overnight rates and 10-year yields would not be so high.

Fiscal transfers and the second negative supply shock — the Russian invasion of Ukraine and the NATO sanctions response — would have still driven inflation higher but not as high as experienced.

https://www.msn.com/en-us/news/politics/trump-s-reported-disgust-with-wounded-veteran-sparks-fury-pure-scum/ar-AA1h4jW8?ocid=msedgdhp&pc=U531&cvid=b565330ddb16409eb45fe662af8ac43f&ei=9

Trump never respected people who went to war for us – especially those who ended up wounded. Check out this story to see what a disgusting Commander in Chief Trump was.

What are markets good for? When Liz Trust thought she could substitute right-wing arrogance for traditional parliamentary practices, the bond market fired her. Now that Rishi Sunak thinks he can substitute the arrogance of an opportunistic rich-guy for traditional parliamentary practices, there is no equivalent market to fire him. Arguably, Sunak’s arrogance is more dangerous than Trust’s.

Ahem – Alex Tabarrok opposes any price controls on Big Pharma for reasons his own literature search sort of blows up:

https://marginalrevolution.com/marginalrevolution/2023/09/pharmaceutical-externalities.html

In my view, pharmaceuticals are undervalued and underinvested in because, despite high prices, pharmaceutical innovations earn only a fraction of the value that they create (Nordhaus finds that in general that innovations reap only a small share of the gains that they create).

But did Nordhaus support extreme patent protection?

https://www.nber.org/papers/w10433

The present study examines the importance of Schumpeterian profits in the United States economy. Schumpeterian profits are defined as those profits that arise when firms are able to appropriate the returns from innovative activity. We first show the underlying equations for Schumpeterian profits. We then estimate the value of these profits for the non-farm business economy. We conclude that only a minuscule fraction of the social returns from technological advances over the 1948-2001 period was captured by producers, indicating that most of the benefits of technological change are passed on to consumers rather than captured by producers.

Nordhaus was noting that free entry and competition allowed the gains from innovation to accrues to consumers. This is what Biden is trying to do but Tabarrok objects? I can see why Bruce Hall loves this confused right wing dork!

The idea of consumer surplus is important here. Thinking up a particular definition for profit and slapping a cult-hero name on it is cool and all, but argumentation by definition ain’t new. It’s high school debate stuff.

That’s not to say there is nothing of value in the actual result, but the framing is exactly what trickle-down boosters have been doing forever. Tobarrok is justifying his preferred distribution of shares by slapping a cult-hero label on it.

I wonder if he even realizes what he’s doing.

Look what I found using the Google wayback machine!

Oil could top $200 if Saudi-Iran war breaks out

Steven Kopits, managing director, Princeton Energy Advisors

November 10, 2017

https://finance.yahoo.com/news/saudi-iran-war-create-domino-203431024.html

Little Stevie made Yahoo/Finance by predicting a huge spike in oil prices that never materialized?!

And little Stevie just yesterday declared he never said this? OK!

UAW is going after Senator Tim Scott!

https://www.msn.com/en-us/money/companies/uaw-files-labor-board-complaint-about-tim-scott-s-praise-for-reagan-firing-workers/ar-AA1h4Q2H?ocid=msedgntp&cvid=1c812f85aef04855a6996514e7b3411a&ei=16

UAW files labor board complaint about Tim Scott’s praise for Reagan firing workers

Story by Sareen Habeshian •

United Auto Workers president Shawn Fain filed a complaint Thursday with the National Labor Relations Board against Sen. Tim Scott (R-S.C.) over comments regarding strikers.

Driving the news: Fain claimed that the 2024 GOP hopeful violated federal labor law earlier this week when he praised then-President Reagan’s firing of thousands of striking federal workers in 1981 after being asked about the ongoing UAW strike, per the complaint that was first reported by The Intercept.