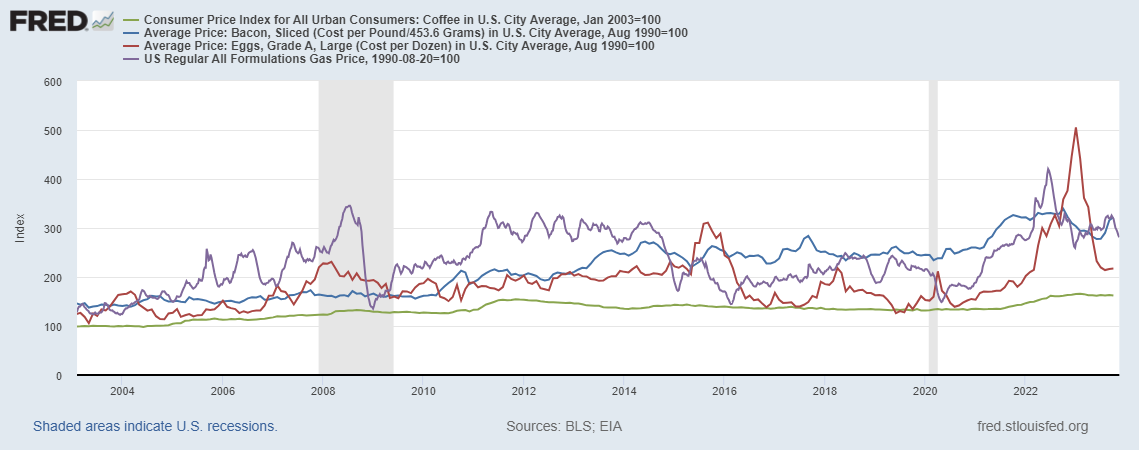

In one picture. Prices of bacon, eggs, coffee lower than a year ago October, and gasoline lower than a year ago week ending November 13 (all normalized to July 1983=100).

Note: All series rescaled to July 1983 = 100.

Every price is lower.

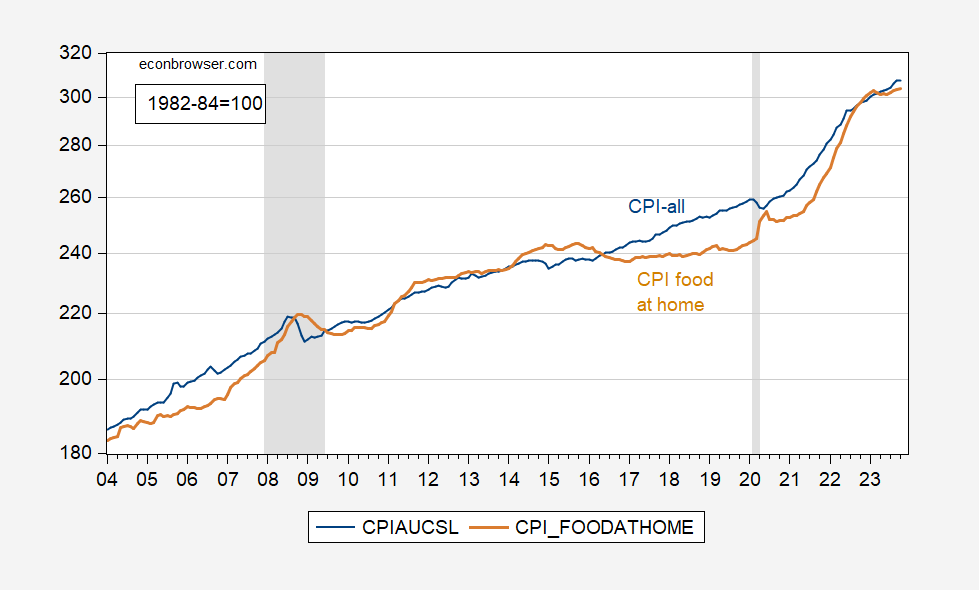

More broadly, CPI for food at home, compared to headline CPI.

Figure 1: CPI all urban (blue), and CPI for food at home (tan), both 1982-84=100. NBER defined peak-to-trough recession dates shaded gray. Source: BLS via FRED, NBER.

Food at home prices have risen at an annualized 2.4% over the last 3 months, compared to overall (headline) CPI inflation of 4.4%.

Off topic, but fascinating – Dollarization?

Milei of the bad hair has won the presidency of Argentina. He has promised to dollarize Argentina’s economy. Ignoring dollarized provinces, protectorates and whatever the po!ite term for former colonies is, here are the actual countries that have dollarized:

Panama, Marshall Islands, Palau, Micronesia, Timor-Leste, Zimbabwe, El Salvador, Ecuador.

Ecuador is the largest, by population at 17.6 million, and GDP at US$98.8 billion. Argentina’s GDP is US$641 billion, population 46 million, so Argentina would be the largest dollarized economy, by far.

Y’all know the deal. Inflation hits a wall, as does independent monetary policy. Less obvious, but only slightly, is that fiscal policy independence is largely lost. If you can’t print money, you have to rely on private demand for debt to allow borrowing, in economies which have been forced to dollarize. So both the tools for demand management are surrendered. If you’re Argentina, maybe that ain’t so bad.

Dollarization is a one-way street, in that no country has ever dollarized and then gone back to printing its own currency. Maybe that means dollarization is great. Or maybe it’s a lobster trap; once you enter, you can’t get out. Beats me. That doesn’t mean adoption of some other country’s currency is irreversable; the aureus, pound sterling and ruble have all been abandoned. Collpse is collapse. It has just never happened with the dollar.

I’m still not convinced that enough dollars can be rounded up to make dollarization work in an economy as large as Argentina. Remains to be seen.

While we’re on the subject of food prices, here are food prices at home and away from home:

https://fred.stlouisfed.org/graph/?g=1bCWT

Prices for food away from home have clearly outpaced those for food at home during the Covid era, but also for some time prior to that. Labor costs are often blamed for rising restaurant prices (and rising prices overall), but profits might figure in here somewhere, as well.

There is, after all, a heck of an appetite for food away from home:

https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=58364

pgl?

And come on, people, you know restaurant food is bad for you:

https://pubmed.ncbi.nlm.nih.gov/33775622/

‘2022 U.S. food-away-from-home spending 16 percent higher than 2021 levels’

This chart notes food away from home spending was quite modest 60 years ago but is now great than food at home spending. Me? Since the pandemic, I make my own meals for the most part.

One question – it seems the reported figures are all nominal figures without distinguishing between real growth v. an increase in the price of a meal. It would be interesting to see these figures in inflation adjusted terms.

“In 2022, food spending by U.S. consumers, businesses, and government entities totaled $2.39 trillion, after a sharp decline in 2020 in which the food market was disrupted by the Coronavirus (COVID-19) pandemic and the recession. U.S. food spending in 2020 totaled $1.81 trillion. Food-at-home spending increased from $954.7 billion in 2021 to $1.05 trillion in 2022 and food-away-from-home spending increased from $1.16 trillion in 2021 to $1.34 trillion in 2022. Food-away-from-home spending accounted for 56 percent of total food expenditures in 2022.”

Interesting at two levels. That 56% of food expenditures was on food away from home is very different from the split 60 years ago.

Also total food consumption in the US was about 9% of GDP. I was looking at the percentage of world GDP spent on agricultural commodities (the raw ingredients in food production) which was near 4%. I know, apples and oranges for several reasons but interesting comparisons nonetheless.

Macroduck: Good assessment. Dollarization would not be necessary in Argentina if Argentinians knew how to play (cooperate) well with each other and could avoid the constant siren call of trying to get something for nothing.

Macroduck: Good assessment.

Dollarization would not be necessary in Argentina if Argentinians knew how to play (cooperate) well with each other and could avoid the constant siren call of trying to get something for nothing.

The country is rich in resources and should have a real per capita income similar to that of Canada. It does not.

https://www.worldstopexports.com/argentinas-top-10-exports/

I was curious what represents Argentina’s main exports which seems to include mineral oils, beef, soybeans, and cereals. I was curious as I have read some reports on how Argentina needs to step up its transfer pricing enforcement so as to protect its tax base from multinational cheats. You mention Canada which has a strong transfer pricing team.

So where are the price indices for those who eat muesli drowned in kefir, topped off with sliced bananas, and those who commute and/or run errands on a mountain bike?

Maybe Dr. Chinn can keep us posted on the pricing for crudites in honor of Dr. Oz’s Senate campaign.

Thanks Menzie for the clarification – unfortunately – the Fox News economic pundits have moved on from “eggs are very expensive!” to Fox News “business reporter” M.B. – again pushing the debunked lab release conspiracy (I’ll link to BMJ debunking https://www.bmj.com/content/382/bmj.p1556 rather than give M.B. another link for her latest “just asking questions!” crap.)

What I find interesting is that food is not more expensive – given extreme weather events due to global warming and Russia’s war on one of the largest wheat exporting countries and disruption in production of fertilizer/inputs.

Also – interesting – that these new appetite suppressing/weight reduction drugs are being cited by food industry CEOs for a decrease in food sales: https://finance.yahoo.com/video/walmart-says-weight-loss-drugs-135235993.html

Although in terms of overall household budget – a month’s worth of Wegovy can set you back around $1,500 –

Again – Thanks for all your informative posts.

On the Russian war on food, there were a number of things that have helped out. First Russia actually don’t have an effective blockade in the Black sea anymore. All of their warships are kept far away from Ukraine for fear of sea drones. Ukraines grain ships have only a short distance in Ukraine territory before they get to NATO country waters. So even the risk of missile strikes on ships is manageable – and insurance subsidies have made it possible to take that risk on at reasonable cost. Russia tried but failed destroying the harbor facilities for loading ships with grain, so they gave that up. Like with the attacks on energy infrastructure the damage is limited and quickly repaired. Russia doesn’t have enough missiles to keep a substantial amount of capacity out of commission for an extended period of time. Alternative export routes to shipping have been developed, and has in part taken pressure off from the shipping. Our competent government (Biden administration) also pushed US producers to pick up the slack on world markets by planting more. Biden also convinced Ukraine to not go after Russian agricultural and fertilizer shipping in the Black sea, to avoid panic on the markets. Ukraine were allowed to do just enough to push Russian ships insurance rates up (to lower Russian profits) but not so much that it deprived the world markets of Russian products (sort of like Biden’s brilliant policies on oil and NG exports from Russia)

‘all normalized to July 1983=100’

Wait – overall CPI normalized to 2003 = 100 while

the individual goods seem to be normalized to 1990 = 100

Doesn’t the mismatch of starting dates overstates the relative price increases of the individual goods?

Sorry but your graph is confusing me.

pgl: Those base years are in the FRED database. I rescaled everything to be 100 in July 1983, in order to make them comparable, as indicated in notes to the figure.

This:

scmp.com/business/china-business/article/3241729/no-end-sight-chinas-property-crisis-new-home-prices-post-sharpest-decline-february-2015

…probably didn’t cause this:

https://www.bloomberg.com/news/articles/2023-11-17/china-puts-money-behind-singapore-model-in-major-housing-shift

…but may have influenced the timing of the announcement.

News of the weakening of China’s housing market in October has been followed immediately by the announcement of new housing investment, based on Singapore’s social housing model. China will spend a trillion yuan on low-income housing and renewal of rundown urban areas.

This is obviously aimed at inceasing the supply and quality of housing at the low end, something China surely needs, and at supporting employment in the construction sector.

China already has an over-supply of housing, though, so this move does raise questions. Why not buy up existing residential units and open them to lower-income households? That doesn’t add to employment or GDP, I guess, but this new plan amounts to “more of the same” when it comes to investment for investments sake; China already has too much of that.

Authoritarian systems do what they know – because new ideas are rebellious and more likely to get punished than rewarded. China has always increased employment by building more infrastructure and housing – it’s what they did, so its what they will do. One of the problems with taking over existing and even half finished housing projects, and renting them out, is that they are already owned by people who invested in them. It may even be more expensive to buy out existing owners than building new – and then you don’t get the new jobs.

More China, not housing-related –

Real short-term rates in China are now roughly equial to those in the U.S., a fairly new development:

https://fred.stlouisfed.org/graph/?g=1bD1g

That is probably why international firms are suddenly doing lots of yuan-denominated trade finance:

https://www.reuters.com/markets/currencies/cheap-yuan-catapults-china-second-biggest-trade-funding-currency-2023-11-17/

Of course, the success of this strategy (assuming less that compelete FX hedging) depends on the exchange rate. Historically, not a bad bet:

https://fred.stlouisfed.org/graph/?g=1bD23

Prominent conservative lawyers band together to fight Trump threat

George Conway, J Michael Luttig and Barbara Comstock create new legal group to ‘speak out against the endless stream of falsehoods’

https://www.theguardian.com/us-news/2023/nov/21/anti-trump-conservative-lawyers

Three prominent US legal thinkers have announced a new organisation to champion conservative legal theory within the rule of law, to fight the threat of a second Donald Trump term. “Our country comes first,” the three wrote in the New York Times, “and our country is in a constitutional emergency, if not a constitutional crisis. We all must act accordingly, especially us lawyers.”

The authors were George Conway, an attorney formerly married to Kellyanne Conway, Trump’s White House counselor; J Michael Luttig, a retired judge and adviser to Trump’s vice-president, Mike Pence, who became a prominent January 6 witness; and Barbara Comstock, a former Republican congresswoman from Virginia. The authors also rebuked prominent rightwing groups including the Federalist Society for not resisting the former president and his authoritarian ambitions.

Their new group, the Society for the Rule of Law Institute, would “work to inspire young legal talent … focus on building a large body of scholarship to counteract the new orthodoxy of anti-constitutional and anti-democratic law … [and] marshal principled voices to speak out against the endless stream of falsehoods and authoritarian legal theories … propagated almost daily,” they said. The Federalist Society and its chair, Leonard Leo, played a key role in Trump’s judicial appointments, installing three hardliners on the supreme court who helped hand down rightwing wins including removing abortion rights and loosening laws on gun control, affirmative action, voting rights and other progressive priorities. Conway, Luttig and Comstock emerged among prominent conservative opponents of Trump, warning of his authoritarian threat before and after January 6, when rioters attacked Congress in an attempt to block Joe Biden’s 2020 election win.

Talk about solidarity in a boycott. Tesla in Sweden can’t even unload their cars or get mail. All because Elon refuses to talk with the Union for 120 workers.

https://www.npr.org/2023/11/17/1213157550/tesla-sweden-union-workers-boycott

We will in all likelihood see Tesla leave the Swedish market because neither side is likely to back down.

“At the Malmo port in southern Sweden, a cargo ship looms over row after row of shiny new cars — Volkswagens, Volvos, Mercedes. Notably missing are Teslas. That’s because dockworkers are refusing to unload them. Goran Larsson, a cargo ship inspector, said he’s informing the crew on each arriving vessel of the labor action and assessing whether any Teslas are on board. “We want there to be good regulation in Sweden — law and order all around the workplaces,” Larsson said. “And this is the first step that we will do.” Tesla has long fended off efforts to unionize its workforce around the world. But in Sweden, the electric vehicle maker is facing its first formal labor action over its anti-union stance, with potential ripple effects for the company globally.

How is Volvo doing these days?

Politico on forced labor (aka “slavery”) in China’s fishing industry:

“How Uyghur Forced Labor Makes Seafood That Ends Up in School Lunches”

https://www.politico.com/news/magazine/2023/11/21/chinese-forced-labor-seafood-00126642

“Uyghurs and North Koreans are forced to work in Chinese seafood processing plants.”

“…we tracked Chinese fishing ships as they moved their catch to refrigeration ships and carried it to ports in China, where the trucks from one vessel were filmed by our investigators and followed to the processing plants. And this is where we discovered that forced labor is as much a problem on land as it is far at sea.”

“We documented the use of Uyghur and North Korean labor to process seafood coming from Chinese ships tied to human trafficking and illegal fishing.”

“The Chinese government has systematically subjected these groups in recent years to forced labor programs at factories across the country monitored by uniformed guards, in dorms surrounded by barbed wire.”

“The Chinese government has instead forcibly relocated tens of thousands of these workers, loading them onto trains, planes and buses, and sending some to seafood processing plants in Shandong province, a fishing hub on the eastern coast.”

“Political analysts Whitley Saumweber and Ty Loft at the Center for Strategic and International Studies in Washington say that China’s overwhelming control of distant-water fishing “imperils the food security of millions of people,” especially in developing countries that rely most on fish for their source of protein.”

“According to a 2021 study by the Global Initiative Against Transnational Organized Crime, a nonprofit that studies the impacts of organized crime, China ranks first and Russia second among 152 nations engaged in illegal fishing.”

“The U.S. Department of Labor said that Chinese squidders are especially apt to use migrant and captive labor.”

“Much of the forced labor, however, appears to be Uyghur.”

https://bloomassociation.org/wp-content/uploads/2023/05/Canned-brutality.pdf

‘The nature of the tuna fishing sector leaves workers at a high risk of human rights abuses. Fishers are often isolated at

sea for long periods of time, which creates an environment where abuse can occur with impunity. As tuna stocks have

been depleted and commercial tuna fishers have been forced to cut costs and travel further out to sea, labour

conditions have only deteriorated.

Human rights abuses are widespread in Indian and Pacific Oceans fisheries: human trafficking, beatings, verbal

abuses, salary retention and inhuman working hours have been documented multiple times by several independent sources.’

It is not just China. This report calls out in particular Bumble Bee.

https://www.in2013dollars.com/Eggs/price-inflation

Price Inflation for Eggs since 1935

Consumer Price Index, U.S. Bureau of Labor Statistics

1973 was a very bad year for those of us who love eggs.

https://www.mediamatters.org/twitter/musk-endorses-antisemitic-conspiracy-theory-x-has-been-placing-ads-apple-bravo-ibm-oracle

As X owner Elon Musk continues his descent into white nationalist and antisemitic conspiracy theories, his social media platform has been placing ads for major brands like Apple, Bravo (NBCUniversal), IBM, Oracle, and Xfinity (Comcast) next to content that touts Adolf Hitler and his Nazi Party. The company’s placements come after CEO Linda Yaccarino claimed that brands are “protected from the risk of being next to” toxic posts on the platform.

Good reporting – right? Well Musk is suing Media Matters for telling the truth. But wait:

Update (11/16/23): IBM released a statement to the Financial Times saying that it has “suspended all advertising on X while we investigate this entirely unacceptable situation.” Media Matters will update if the other major companies in this report take any similar actions.

Update (11/17/23): Axios reported that “Apple is pausing all advertising on X, the Elon Musk-owned social network, sources tell Axios.”

Hey Musk – you deserved this.

China rethink “no limits” alliance with Russia? The idea comes from a former U.S. official among others, so might contain an element of wishful thinking. However, the argument is that global turmoil is bad for China, and “bad for China” is more compelling that “U.S. guy thinks so”. It doesn’t hurt that the U.S. guy did have a pretty good view into China:

scmp.com/news/china/diplomacy/article/3242388/rising-global-tensions-may-have-china-rethinking-russia-alliance-analysts

The basic argument is that Russia is an “agent of chaos”* whereas China has no interest in chaos. This makes good sense; Russia is weak and China, for all its current troubles, remains a global power. The weak tend to want change on a grand scale, while the strong prefer incremental change.

Iran and North Korea are also part of the story, as actors stirring up more uncertainty than China wants.

* Agents of CHAOS. Anybody else remember “Get Smart”?

I always thought Agent 99 was a hottie!

I preferred the reboot with Anne.