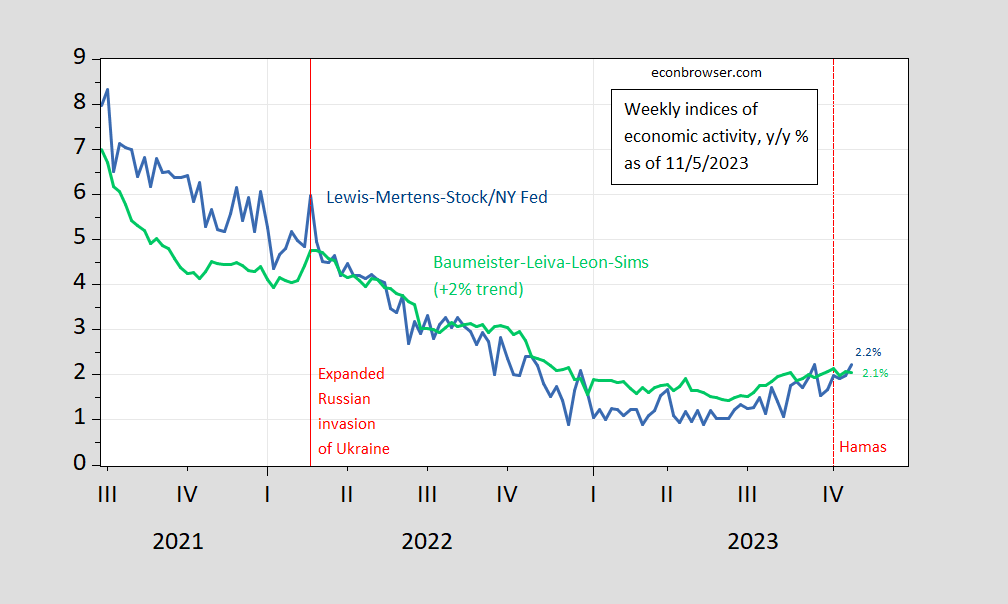

Year-on-Year growth is accelerating modestly, according to the WEI.

Figure 1: Lewis-Mertens-Stock Weekly Economic Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Economic Conditions Index for US plus 2% trend (green), all y/y growth rate in %. Source: NY Fed via FRED, WECI, accessed 11/5, and author’s calculations.

The WECI+2% thru 10/28 is (2.06%), while WEI reading is 2.23%. The latter is interpretable as a y/y quarter growth of 2.23% if the 2.23% reading were to persist for an entire quarter.The Baumeister et al. reading of +0.1% is interpreted as a 0.06% growth rate above the long term trend growth rate. Average growth of US GDP over the 2000-19 period is about 2%, so this implies a 2.06% growth rate for the year ending 10/28.

Recall the WEI relies on correlations in ten series available at the weekly frequency (e.g., unemployment claims, fuel sales, retail sales), while the WECI relies on a mixed frequency dynamic factor model.

I would love to see a graph of political uncertainty against the current U.S. interest rate. Because U.S. rates have been going down very recently at the same time political uncertainty is rising, and I would think that’s a an unusual phenomenon.

I’m hoping this link works as someone who used to work for KPMG is telling Senator Warren was being too hard on Microsoft (if that even is possible):

https://www.taxnotes.com/featured-analysis/lawmakers-should-stay-out-microsoft-transfer-pricing-dispute/2023/11/03/7hhx6

Apparently Senator Warren fired off a stinging letter to the CEO of Microsoft. If anyone has a workable link, it would be an interesting read. BTW the author of this Tax Notes article has had some useful contributions but may we should not be too hard on him.

Synopsis:

https://www.warren.senate.gov/oversight/letters/senator-warren-questions-microsoft-over-deeply-disturbing-reports-company-owes-irs-289-billion-due-to-egregious-tax-evasion-scheme

Actual Warren Letter itself:

https://www.warren.senate.gov/imo/media/doc/2023.10.17%20Letter%20to%20Microsft%20re%20Tax%20Avoidance.pdf

I knew you would come through. Thanks. I loved this:

Reports describe a significant role for accounting firm KPMG in developing and enacting the tax scheme. ProPublica indicated that Microsoft initially chose not to implement the transfer pricing tactic because it was “impractical,” but that the company changed its mind after “KPMG … made a persuasive pitch.”

Here is the funny thing which one might deduce if one checked the bio in Linkedin for Dan Peters. Court filings indicate the low ball valuation that drove this was written by Duff and Phelps who had no transfer pricing presence before 2005. Peters, however, left KPMG for Duff and Phelps taking the Microsoft business with him. So KPMG is getting the well deserved hit to their reputation but Duff and Phelps racked up huge billable hours for their dishonest valuation work.

BTW Microsoft had done its cost sharing BS with respect to Asian and European operations as early as 1999. So Senator Warren is acting being too kind.

Happy to be of service. : )

It’s good to see Warren getting after it on this infested/problem area. Maybe she can get other lawmakers to draw a pulse.

https://www.msn.com/en-us/news/politics/trump-s-word-salad-on-the-witness-stand-stuns-cnn-s-kate-bolduan/ar-AA1jtxNV?ocid=msedgdhp&pc=U531&cvid=31b0db542e0f4b6182b00840e8f04d66&ei=9

As former President Donald Trump took the witness stand on Monday to testify in his civil fraud trial, CNN anchor Kate Bolduan was shocked at how apparently incoherent his testimony was. In particular, at one moment, Trump seemed to suggest his properties were both valued too high and too low. “His take on his — his description of his involvement in these financial statements, and it seems somewhat from the quotes coming out like a word salad on the stand,” said Bolduan. “And some of them … I thought that the apartment was high, and we changed it, and earlier, he said that he thought that the values were off on the financial statements at times both high and low, and ultimately Mar-a-Lago was underestimated as we heard him say outside of the court, and then he said, 40 Wall Street was very underestimated for tremendous value.”

Word salad. Sort of like your stand CoRev comment.

Compare to his usual deposition performance. His aim is to be unresponsive, so unprosecutable. In civil trials, refusal to answer to avoid self-incrimination may be construed as evidence of guilt.

Yes/no questions, with the judge requiring either a yes or a no, might get him closer to jeopardy. We’ll see what happens.

It is obvious that he is guilty of jacking prices up when that is an advantage, and lowering them when that is an advantage. Since he cannot get around these observable facts, he seem to have decided to at least get some political gains from this trial. He is almost begging the Judge to crack down on him so he can start crying that the judge is being unfair and mean to him.