Instantaneous below y/y:

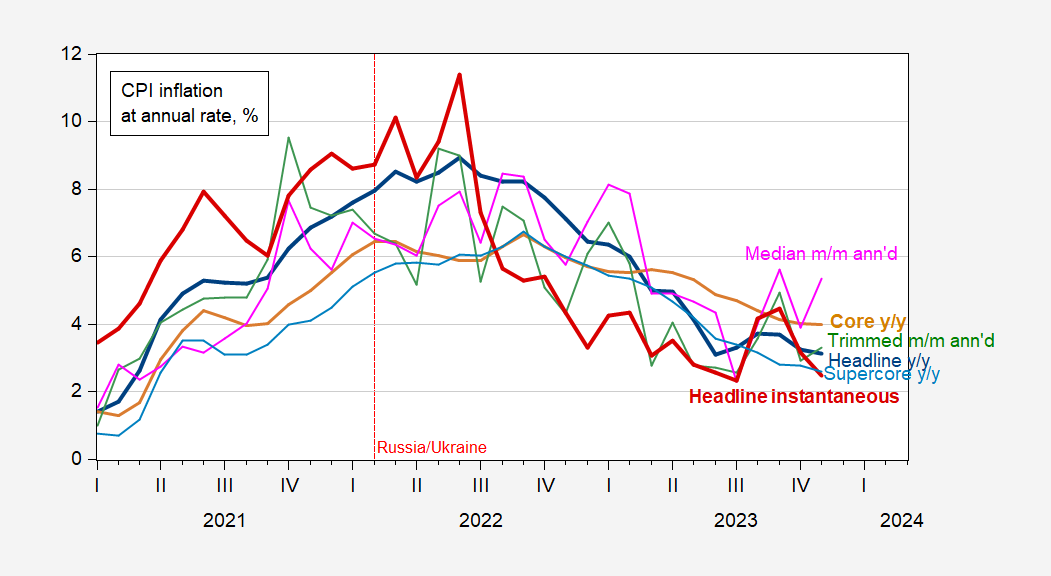

Figure 1: Headline CPI inflation, y/y (bold blue), core CPI inflation y/y (tan), trimmed mean CPI inflation m/m ann’d (tan), median CPI inflation m/m ann’d (pink), headline CPI instantaneous, T=12, a=4 per Eeckhout (bold red), all in %. Source: BLS, Cleveland Fed via FRED, BLS, and author’s calculations.

Using a series of measures that are supposed to track the trend in inflation (core, supercore, median, mean and instantaneous), it certainly appears as if inflation is declining, even if not as fast as one would like.

Instantaneous inflation (T=12, a=4) is now at 2.4%. The implied CPI target conforming to 2% PCE inflation is about 2.45% (0.45 is the difference between CPI and PCE inflation over the 1986-2019 period), so instantaneous inflation is at about implied target.

BLS supercore y/y inflation at 2.6%. Everything you wanted to know about core services ex shelter inflation, see Pawel Skrzypczynski’s website. y/y right now at 4.1%, up from 3.9% in October.

Here’s Headline and Core instantaneous inflation compared.

Figure 2: Headline CPI instantaneous inflation, y/y (bold blue), core CPI instantaneous inflation (tan), both T=12, a=4 per Eeckhout (bold red), all in %. Source: BLS, and author’s calculations.

Note that while m/m core popped up, instantaneous core was flat.

Bruce Hall told us annual inflation was 8%. It seems yr/yr is only half that at best. Yea Brucie is sitll on Kelly Anne’s Alternative Facts campaign.

So far, inflation is falling and the economy doesn’t seem to be showing much sign of recession. Why are people so pessimistic? I don’t get it.

I still think “Supercore” would make a great name for a 1970s superhero action film. Who’s with us?? Sherman Potter informs me we escape at 23 hundred hours tonight.