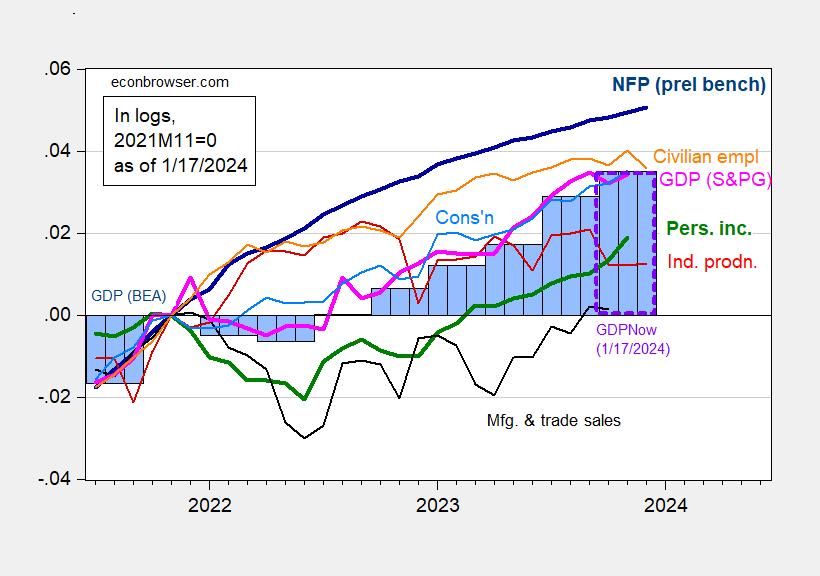

Industrial production and manufacturing production both beat Bloomberg consensus (+0.1% vs 0%). Here’s the picture of some key indicators followed by the NBER Business Cycle Dating Committee, plus monthly GDP and GDPNow (latter up today to 2.4% vs. 2.2% SAAR on 1/10).

Figure 1: Nonfarm Payroll employment incorporating preliminary benchmark (bold dark blue), implied level using Bloomberg consensus as of 1/3 (blue +), civilian employment (orange), industrial production (red), personal income excluding transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 2nd release (blue bars), and GDPNow for 2023Q4 as of 1/17 (lilac box), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, BEA 2023Q3 2nd release incorporating comprehensive revisions, S&P Global/IHS Markit (nee Macroeconomic Advisers, IHS Markit) (1/3/2024 release), Atlanta Fed, and author’s calculations.

The evolution of GDPNow estimates highlights how incoming news has continued to push back any likely date for recession start. While GDPNow was raised by about 0.2 ppts, GS raised its tracking estimate by 0.3 ppts, to 1.8%. Their estimate of final sales growth was also raised to 2.5% (GDPNow’s estimate of final demand is 2.9%).

Source: Atlanta Fed, accessed 1/17/2024.

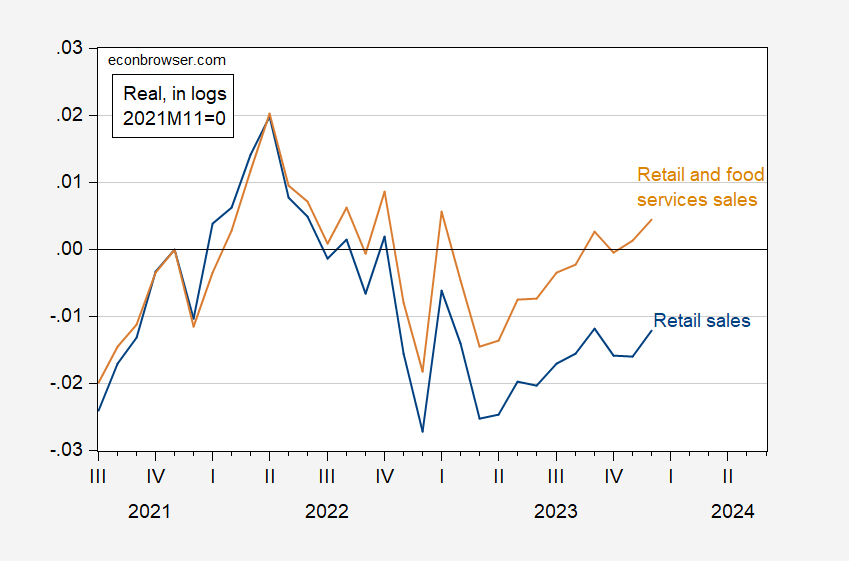

Other data coming in today surprised on the upside, with m/m nominal retail sales at +0.6% vs. +0.4% consensus. Below is a a time series plot of deflated retail sales and retail and food service sales.

Figure 2: Real retail sales (blue), and retail and food services sales (tan), in logs 2021M11=0. Deflated using chained CPI, adjusted by X13 by author. Source: Census and BLS via FRED, and author’s calculations.

by adjusting December’s retail sales with appropriate indices from last week’s CPI report, we can estimate that the income and outlays report for December will show that real personal consumption of goods rose by almost 0.6%…that comes after PCE goods rose by an unrevised 0.5% in November, but after they fell an unrevised 0.2% in October, rose by 0.6% in September, and fell by 0.1% in August…by setting July’s real PCE goods as an index equal to 100, we can then say that August’s real PCE goods would be equal to 99.9, and from that, we’d get index values of 100.5 for September, 100.3 for October, 100.8 for November, and 101.4 for December (yes, there is compounding, but it’s statistically insignificant)….we can then compute the quarter over quarter change in those index values at an annual rate to determine the probable change that would be applied to 4th quarter GDP… (((100.3+ 100.8 + 101.4 )/3) / ((100 + 99.9 + 100.5 )/3)) ^4 = 1.02826, which means that real PCE goods are rising at a 2.8% annual rate over the fourth quarter….since real PCE goods has been running at 24.1% of GDP, that suggests that 4th quarter PCE goods would add roughly 0.68 percentage points to the growth of 4th quarter GDP….

i just got a look at the industrial production report, and should note that there were downward revisions to November; the IP index (2017=100) for November was revised from 102.7 to 102.4, while the November manufacturing index was revised from 99.2 to 99.0…those revisions made is a bit easier for December to beat…

the silver lining to the report was that the utility index fell from 105.0 to 103.9, essentially because December was warmer than normal, reducing demand…the utility index was also 4.9% lower than a year ago, which you may recall was when refineries on the Gulf Coast froze off, with some of them down for a month…i don’t imagine anyone would want to see the utility index rise from that level…

Kudlow alert!

https://www.msn.com/en-us/money/markets/larry-kudlow-unless-the-fed-wants-to-re-elect-biden-central-bank-shouldnt-take-the-foot-off-the-brake/ar-AA1n99Vv

Let’s talk about the economy and Fed monetary policy. Stay awake, please. Hang in there with me. Unless Jay Powell’s Federal Reserve wants to completely politicize monetary policy and slash interest rates in order to juice the economy and re-elect Joe Biden, there is absolutely no reason right now for the central bank to take the foot off the brake and slam down the accelerator. No reason whatsoever!

Come on Larry – get real. You are hoping for a recession so as to help your boy Trump. After all your good buddy Art Laffer even admitted inflation is low and interest rates are too high. Then again Laffer followed you and claimed the recent increase in the price level lowered real income which is just stupid since nominal GDP has increased by the rise in prices and a rather healthy increase in real GDP.

Kudlow the Klown keeps telling his Faux Business devotees that employment growth sucks (yea another lie but run with it). Now if employment growth sucks as you claim – then it is time for us to lower the interest rate on policy grounds. But wait – Kudlow has always been a political hack who could care less about economic policy.

Yes the only logic and consistency you can expect from that clown is that if it hurts democrats and/or help GOP then its the right thing to do for country and economy.