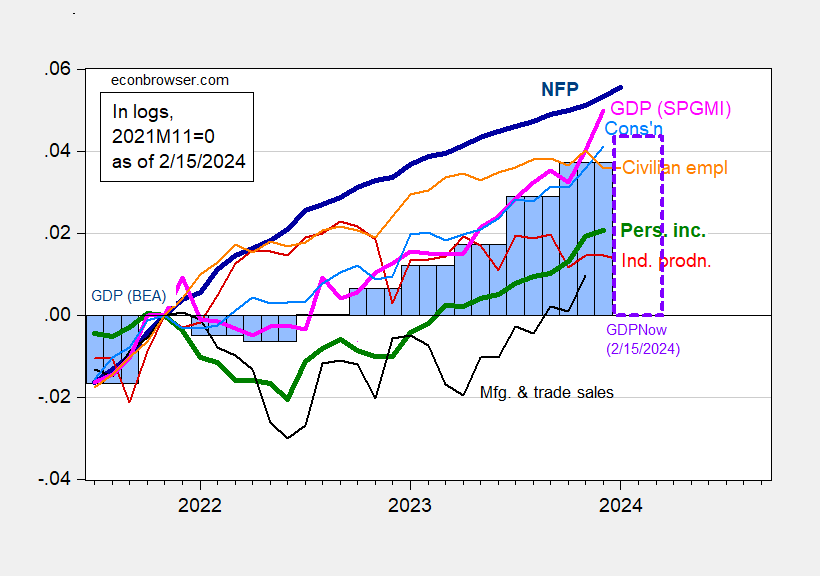

Industrial production comes in under consensus (-0.1% vs +0.2%). Here’s a picture of the key indicators followed by the NBER BCDC.

Figure 1: Nonfarm Payroll employment incorporating benchmark revision (bold dark blue), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 3rd release (blue bars), GDPNow for 2024Q1 as of 2/15 (lilac box), all log normalized to 2021M11=0. Source: BLS via FRED, BLS preliminary benchmark, Federal Reserve, 2023Q4 advance release,, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (2/1/2024 release), and author’s calculations.

there were sharp downward revisions to November and December retail dales, implying downward revisions to PCE goods and hence to GDP….December’s seasonally adjusted sales were revised more than 0.5% lower, from $709.9 billion to $706.2 billion, while November’s sales were revised almost 0.4% lower, from $706.0 billion to $703.336 billion…those downward revisions to November and December sales would suggest that the 4th quarter’s nominal personal consumption expenditures would be revised lower at an annual rate of around $25.5 billion…the Q4 GDP report indicated that a nominal increase of $28.6 billion in PCE goods led to an 85 basis point contribution to GDP growth, so it appears we’ll lose most of that, depending on how the inflation adjustments hit the components revised…

on the other hand, January’s real retail sales aren’t as bad as FRED and some economists would have have it, because despite the 0.3% CPI increase, prices for core goods sold at retail fell 0.4%…..so i get nominal core sales (ex groceries, gasoline, and restaurants) down 1.2%, which goes back to down 0.8% after the deflation adjustment…adjusting food and gasoline sales separately with appropriate prices indices and weighing them back into the total shows that real personal consumption of goods fell by almost 0.5% in January, after rising by a revised 0.7% in December, and by a revised 0.1% in November…note that in estimating November & December’s revised real goods consumption, i’ve incorporated both the revision to nominal sales and last week’s 0.1% upward revision to November’s consumer prices and the 0.1% downward revision to December’s consumer prices, which would precipitate a similar revisions to the the corresponding PCE price index changes, and thus a corresponding change in real PCE for those months..

Q4 GDP still gets a big boost from underestimated construction, so the revisions won’t be all bad…

Good to see you back. Thanks for the serious estimation effort.

Ruh Roh!

https://www.politico.com/news/2024/02/16/trump-fraud-case-verdict-350-million-00141990

Gee it is too bad that Kelly Anne Conway has to cut Bruce Hall off. Will miss those emails she sends Brucie to cut and paste here.

BTW – Trump was ruled not fit to run a NY State business. He is also not fit to be President but the real question – would you trust him to be fit to take out your garbage?

Hi, pgl. Just thought you’d be interested in what two economists from the 100% settle science of economics are saying.

https://finance.yahoo.com/news/no-soft-landing-us-economy-022146984.html

I know that has nothing to do with Menzie’s post, but… oh, wait. Maybe it was Macro and your comments that had nothing to do with Menzie’s post. C’est la vie.

I guess your AI worked overtime to find even more MAGA moronic trash. No little Brucie I could care less about the dumb trash you dig up

pgl… AI? Well, not sure if that’s supposed to be an insult or a compliment. Actually, my 15-year old grandson is already developing his own AI program that you could use. He says it is too human and often answers with snide remarks and profanity.

Are these the two brilliant economists who have called 58 of the last 3 recessions ?

Yep – and when someone presents an intelligent yet different view, these arrogant clowns accuse them of being partisan Democrats. Bruce Hall’s idea of high brow serious discussions.

pgl should be cheering any hypothetical hard landing…then he’s get those low interest rates that he’s been drooling over.

Gee my mentally retarded stalker has started a comedy hour. Only problem – no one wants to watch.

The only one who is drooling is little Jonny boy as he gets to watch Putin’s numerous war crimes.

“Dow tumbles more than 500 points as hot inflation data stokes fears about higher-for-longer rates…CNN’s Fear and Greed Index, which tracks seven indicators of market sentiment in the United States, fell to a “greed” reading from “extreme greed” the prior day.”

https://www.cnn.com/2024/02/13/investing/stocks-tuesday-january-cpi/index.html

This tells you just about all you need to know about what’s behind the pressure on the Fed to lower interest rates. Of course, rate cut boosters will assure you that their sole motivation is to “help workers,” by preventing their becoming unemployed. Benefits to workers are always what gets touted when a policy is under consideration that will amplify the obesity of the fat cats….so transparent…

Oh come on Jonny boy – we were all expecting you to be dancing on the grave of Aleksei A. Navalny.

Dude – Putin takes great pride in killing this man so until his pet poodle celebrates his death – no dog food for little Jonny boy.

And pgl is dancing on the grave of Gonzalo Lira…and maybe soon Julian Assange.

My mentally retarded stalker cannot have an ounce of remorse. Go figure

Killing political prisoners is an abomination whether done by Russia, Ukraine, or the United States.

But they all do it…but pgl only complains when the US bogeyman du jour does it.

I’m sure you did the autopsy on Gonzalo Lira. Oh wait – she was a journalist or a person protesting for the rights of the average citizen. No – she was another Putin pet poodle.

No. They do not all do it. But putin does do it.

Ponzi johnny, russia just threatened nuclear war again. Is russia justified in using nukes to retain land it illegally obtained through its immoral and illegal invasion of Ukraine? And if russia is permitted to obtain land through the threat of nuclear war, I suppose the usa and others can start a similar imperial crusade with their nuclear arsenal. You must be ok with that, right?

“The latest Consumer Price Index revealed that prices rose by 3.1% for the 12 months ended in January, according to Bureau of Labor Statistics data released Tuesday. On a monthly basis, CPI rose by 0.3% last month.”

Hyperinflation! It is as if CNN has become a subsidiary of Faux News. Leave it to little Jonny boy to highlight such an incredibly stupid report.

“‘Our view is that with inflation still on a moderating trend and with economic growth remaining strong, what’s the rush to lower interest rates? Why mess with success?’” wrote Ed Yardeni, president of Yardeni Research, in a Tuesday briefing…

Stocks wouldn’t crater even if cuts were off the table completely in 2024, according to Bank of America, despite what Tuesday’s losses suggest. The bank’s strategists point out that roughly one-third of the S&P 500’s market cap are companies that have cash on hand. As long as the Fed doesn’t hike rates again (there’s no official indication that the central bank is currently considering such a move), stocks could still see a strong performance this year, they say.”

https://www.cnn.com/2024/02/15/investing/premarket-stocks-trading-rate-cuts-delay/index.html

So sad, pgl and Ducky will have to wait a little longer for manna to fall from heaven…and savers will have more opportunities to lock in positive, real interest rates…OMG! positive real interest rates for savers? Perish the thought!!!

Still after those high returns on risk free investments. Ponzi johnny, you cant get money for nothing.

Because real interest rates won’t be positive if the nominal ones fall by 1% or so, enabling more people to afford loans?

This is the same Johnny who cheers for recession and for Russia’s war against Ukraine, and he questions other people’s motives?

Over and over, you’ve asked why the Fed should cut rates. Each time, I’ve shown why, based on evidence. Over and over, you’ve whined about wages. I’ve shown that wage gains tend to be cut short whenever the Fed raises above neutral. Your response? Claim it isn’t true, without a shred of evidence to support your claim. Just “Oooo, the stock market went up. Those other guys must be lying” You getting desperate, Johnny? Not even going to pretend anymore?

Folks, Johnny is claiming that the financial economy works just like the textbook says, but that the real economy doesn’t. Somehow, the real economy is in a world where data must be ignored, because Johnny’s claims don’t fit with the data. “Savers” benefit from higher rates, but “investor”s benefit from lower rates, and that’s all that matters to Johnny. Savers and investors are the same people, you dope.

Meanwhile, borrowers and workers both get hurt when rates are too high, and there are a lot more of them than Johnny will admit. You want real wages to rise? Ieep the expansion going. Want the expansion to continue? Don’t keep rates too high.

Yeah, yeah…more of Ducky trying to rewrite what I said. No, I was emphatically NOT cheering on recession in 1H22…but I was ridiculing the nonsense from folks like Ducky who were trying to obscure the reality of an ambiguous situation–borderline recession/no recession–and reframe it as “definitely not a recession” in the runup to the 2022 election. Unfortunately, ambiguity is not allowed here.

Gee – you lied about what Yardeni said by cherry picking. And you even lie about what YOU said by your infamous deny, deny, deny. I guess you are an equal opportunity liar!

There was no ambiguity. No recession. It wasnt even a close call. You have reached the point where you want to call weak growth a recession. Just silly, ponzi johnny

Wait. First, you claim I’m cheering for stock market gains because I don’t want the Fed to endanger job and wage gains. Then, you’re all “I plead ambiguity when I get caught cheering for recession?”

You’re doubling down on double standards, boy.

People who used to endure the BS from little Jonny boy over at Mark Thoma’s place would remind everyone that little Jonny boy would praise the gold standard despite the massive swings in economic activity created by a chaotic monetary policy. Jonny boy even praised Cameron’s fiscal austerity even as the UK economy stayed well below full employment. Little Jonny boy kept telling Thoma’s readers that this austerity was good for UK real wages because it kept inflation down. Now we know little Jonny boy at first DENIED he make such stupid statements in his incessant lying here but he finally admitted that he made such a contention. Then Jonny boy tried to peddle that his contention was correct only to be called out by one of Dr. Chinn’s blog posts.

Now we must forgive little Jonny boy as Bruce Hall has often called for a reduction in the price level back to where they were 3 years ago. I guess Brucie too has forgotten the wisdom of Lord Keynes who called the return to the gold standard by Britain after WWI an economic disaster.

But wait – this gives me an idea. Trump has in the past praised the likes of Judy Shelton and Stephen Moore who are also big fans of the gold standard. Maybe if Trump gets back in the White House he can once again try to put Shelton and Moore on the FED along with little Brucie boy and little Jonny boy. Then we would likely see the most amazing depression in our life time. Oh joy!

Hannity ran over 80 stories about “the Biden Crime Family” based on the false claims of an FBI informant

https://www.cnn.com/2024/02/16/politics/republicans-biden-impeachment-fbi-informant/index.html

How many stories will Fox run about the revelations of the fake informant? How many stories will the main street press run about this hoax? How many Fox viewers will continue to believe that Biden and his son took bribes?

Me! Me! I know! Call on me!!! Zero, very few, and all of them!

Taylor Swift Calls Travis Kelce’s Serenade the ‘Most Romantic Thing That’s Ever Happened’ to Her

https://www.msn.com/en-us/entertainment/news/taylor-swift-calls-travis-kelce-s-serenade-the-most-romantic-thing-that-s-ever-happened-to-her/ar-BB1ikTCe?ocid=msedgdhp&pc=U531&cvid=adf206932731439bbbaf93519d91749e&ei=7

I was about to say that the trash we have been seeing from the likes of JohnH and Bruce Hall could not be topped in terms of nauseous nonsense but then I read this story. Hey it is basketball season so no way cares about Travis Swift and his damn girl friend.

Awww–is Peppa Pgly jealous of Kelce? Maybe if Peppa Pgly serenaded Swift with a few personal attacks on Kelce, he could succeed in wooing her! LOL!

Are you really this pathetic? Get a damn life dude. Maybe the other two year old children will stop mocking you.

A different topic but of interest.

Revisiting the T-Mobile-Sprint Merger by Alex Tabarrok

https://marginalrevolution.com/marginalrevolution/2024/02/revisiting-the-t-mobile-spring-merger.html

T-Mobile’s takeover of Sprint was controversial among analysts. “If this merger is not anticompetitive,” Eleanor Fox, a trade regulation and antitrust law professor at New York University, told reporters in 2020, “it is hard to know what is.” Yale economist and antitrust scholar Fiona Scott Morton delivered her verdict on the deal in a co-authored 2021 article: “The era of aggressive price competition in wireless is over.” The authors predicted that the wireless industry, whittled down to a big three, would “nestle into a cozy triopoly.” The prediction proved wrong. Average monthly mobile subscription fees dropped sharply. In the three years before the merger, according to government price data, mobile charges declined in real terms by about 8%. In the three years following the merger, the real price decline has been nearly 12%.

But wait – Kevin Drum has an issue with Alex’s cherry picking of the price data:

Here’s what really happened after the T-Mobile/Sprint merger

https://jabberwocking.com/heres-what-really-happened-after-the-t-mobile-sprint-merger/

“Three years” might not sound like anything special, but in fact it’s very carefully cherry picked. The merger took place in April 2020, so three years before that is April 2017. And it turns out that right in the previous month the cost of wireless services dropped a bunch. This means that if you count from April, you miss the big decline. This is very convenient since it produces the worst possible pre-merger baseline you can squeeze out of the data. If, instead, you compare the whole period after April 2020 with the same number of months before April 2020—a much more natural comparison—you get a price decline of 21% before the merger and 16% after … The chart above makes this clear by giving you a long-term look. Wireless phone service costs have been declining for a long time, but they’ve been declining less since the T-Mobile merger with Sprint. The moral of this story is: Never trust anything on the Wall Street Journal editorial page. There’s always jiggery pokerey of some kind. Always. You just have to look.

So, it appears that the Biden Administration is not listening to Kevin Drum.

https://news.bloomberglaw.com/mergers-and-acquisitions/biden-antitrust-enforcers-set-new-record-for-merger-challenges

FTC Chair Lina Khan and Justice Department antitrust chief Jonathan Kanter had both promised more aggressive antitrust enforcement when they took office in 2021, saying increased concentration of corporate power had limited consumer choices and contributed to higher prices.

Drum wants more anti-trust enforcement. So does Biden. Which is a good thing.

But little Brucie apparently never learned to read past preK levels. Dude – we get you are a moron. Maybe you should stop making it so damn obvious.

… and yet:

“Three years” might not sound like anything special, but in fact it’s very carefully cherry picked. The merger took place in April 2020, so three years before that is April 2017. And it turns out that right in the previous month the cost of wireless services dropped a bunch. This means that if you count from April, you miss the big decline. This is very convenient since it produces the worst possible pre-merger baseline you can squeeze out of the data. If, instead, you compare the whole period after April 2020 with the same number of months before April 2020—a much more natural comparison—you get a price decline of 21% before the merger and 16% after … The chart above makes this clear by giving you a long-term look. Wireless phone service costs have been declining for a long time, but they’ve been declining less since the T-Mobile merger with Sprint. The moral of this story is: Never trust anything on the Wall Street Journal editorial page. There’s always jiggery pokerey of some kind. Always. You just have to look.

https://www.fiercewireless.com/wireless/t-mobile-pledges-to-meet-beat-discounts-from-other-carriers

Anti-trust doesn’t automatically mean big or bigger. Internet and cell phone plans’ prices have dropped considerably over the past decades.

https://www.in2013dollars.com/Wireless-telephone-services/price-inflation

And then there is the plethora of businesses that piggyback off the majors:

https://www.whistleout.com/CellPhones/Guides/verizon-mvnos

Anti-business still reigns supreme with pgl.

“The moral of this story is: Never trust anything on the Wall Street Journal editorial page.”

i could not have said it better myself. the editorial page of the wsj is filled with idiots and charlatans. they do a disservice to the quality reporters keeping the business afloat. it is a shame the editorial board is allowed to hang around and drag down the quality of the paper.

I went back and read the excellent comments to Alex Tabarrok’s sloppy endorsement of that WSJ fluff. You should too. Assuming you remotely care about actual economics.

Hey Brucie boy – you did it again. Forgetting to read your own link as in the damn date:

May 23, 2019

They made some pledge before the merger five years ago. And you just ignore the historical data since the merger? OK we get you are a moron but damn!

This is unfortunate. Tabarrok has, in the past, been willing to publish results that are contrary to his anti-regulatory bias. He’s good enough at some economics that what looks like cherry-picking is unlikely to be something other than cherry-picking.

Take a look at the excellent comments to his blog post. Smart readers. Totally the opposite of the sheer stupidity we got from little Bruce Hall.

JohnH is notorious for cherry picked quotes that turn out to be rather dishonest characterizations of what someone really said. Latest case in point – what Ed Yardeni really said:

https://www.cnbctv18.com/market/ed-yardeni-us-fed-rate-cuts-us-indices-market-outlook-india-view-sectors-19028721.htm

It is true that Yardeni does not think the FED will cut interest rates as early as next month. But Yardeni is expecting interest rates cuts later in the year. Of course Jonny boy lies about everything. Maybe Jonny boy is a lawyer. As they say “how can you tell he is lying? His lips are moving”.

BTW – not to be outdone we have little Brucie boy citing someone at Citibank predicting a recession. Memo to Brucie boy – your Citibank dude is no more of an economist that someone working for Mazar’s. So to suggest his is “settled science” or that I give a rat’s rear end is really dumb, which of course is par for the course for little Brucie boy.

Maybe pgly, instead of just saying that I misrepresented what Yardeni said, he could share exactly what was incorrect about what I quoted.

This is classic pgl mendacity…claiming that a quote from a site was a lie…and then having completed his attack, fails to explain exactly what was incorrect about the quote and why it was germaine.

I need to draw it out in crayons with big letters for you? Dude – your reading skills are pathetic. Do watch Berty and Ernie more often.

I was going to tell mentally incompetent Jonny to read the entire link I provided but catch this HEADLINE:

‘Ed Yardeni expects first Fed rate cut in second half of the year’

Jonny boy cannot even read the headline? Yea – he is mentally retarded!

Speaking of Ed Yardeni, his latest webcast is something Bruce Hall should read before this lying MAGA hat moron bores us with another SUNY Albany grad or Citibank tool declaring that all economists reject the notion of a soft landing:

https://us02web.zoom.us/rec/play/ZQXzqaeMmlk5WY5ruBP_sg12VMy1QY55l9MBgGN4flmAakO9f_9lpNwInagI2XhVoOzptsr8JtGDmCme.6kACqhF8egWgxeJM?canPlayFromShare=true&from=share_recording_detail&continueMode=true&componentName=rec-play&originRequestUrl=https%3A%2F%2Fus02web.zoom.us%2Frec%2Fshare%2FI_Sga7HaiALdcPxb_P4AdtavI3hQ-DHVtRHfOaAJ1asX_y6IbyeRLqAXBc3aLIAk.aIHCuCMallS-P85X

Then again – Yardeni speaks in plain English which of course is way over Brucie boy’s little head.

Ritholtz posts a great graphic from Michael McDonough

https://ritholtz.com/2024/02/cpi-shelter-measures-6-12-month-lag/

– and ask an important question: “How much does the FOMC recognize how behind the curve this data is”. My guess is that FOMC fully understand the composition of their most important data point. My guess would be that the inflation panic responses are a lot worse on Wall Street than in the FOMC meeting room.

pgl wants the Fed to conduct monetary policy on the basis of conjecture, speculation, and hypotheticals…using forecasts that haven’t had a great track record over the past five years.

Anything to get those lower rates that he covets so much…

I guess he’ll just have to wait a little longer for those rate cuts and for manna from heaven to be showered on his asset portfolio!

Is there a point to your incessant lying? Dude – everyone knows you are my mentally retarded stalker with zero brains and less integrity. Come on – do you have to make it so damn obvious?

Meanwhile all that credit card debts keeps buckling under those high interest rates. But who is worried about debt? Ponzi johnny is advocating for the average joe, who has mountains of cash sitting in savings accounts and no credit or mortgage debt. So of course high rates are good in his fantasy world.

There was a time over at Thoma’s place where Jonny boy was concerned about high interest expenses borne by credit card holders. But as with everything else – little Jonny boy has very malleable opinions.

Maybe this is why they rely on BEA’s measure more than they rely on BLS’s CPI measure. Then again getting it right is Biden socialism according to our resident Village Idiot JohnH!

OpenAI CEO Sam Altman Eyes Trillions In Funding For Semiconductor And AI Initiative: Report

https://www.msn.com/en-us/money/news/sam-altman-seeks-biden-s-help-for-openai-s-7-trillion-ai-chipmaking-dream-report/ar-BB1ipL38?ocid=msedgdhp&pc=U531&cvid=32e4a8ff7d6b42a4bbb7e24b2985f55c&ei=6

$7 trillion investment is certainly big time even on a global scale!

The Truth about how Putin killed Navalny:

https://www.msn.com/en-us/news/world/journalist-who-helped-expose-the-plot-to-kill-navalny-has-theory-on-how-he-died/vi-BB1ipP8r?ocid=msedgntp&pc=U531&cvid=edf1cb4e73b14cbfab49b23e808d23aa&ei=30

Little Jonny boy does not even try to deny that this brave man was murdered by Putin. Ah but little Jonny boy is elated that a fine defender of decency in Russian was murdered by war criminal Putin. Little Jonny boy is that sick.

Tucker Carlson is amazed at how nice it is in Russia.

https://www.businessinsider.com/tucker-carlson-shopping-cart-russia-2024-2

They even have shopping carts that can be released by a coin. He never saw that sort of advanced technology in the US.

“In one clip, Carlson seems wowed by a shopping cart lock that requires a 10-ruble coin to release.”

I get the fact a ruble is not much but come on. I’m annoyed I have to pay 10 cents for a grocery bag.