Since most of my lecture notes have migrated behind a gate (software called Canvas, used on many campuses), I thought I would share some teaching material that some Econbrowser readers might find of interest.

First, recession vs. output gap (Econ 442 Lecture 9):

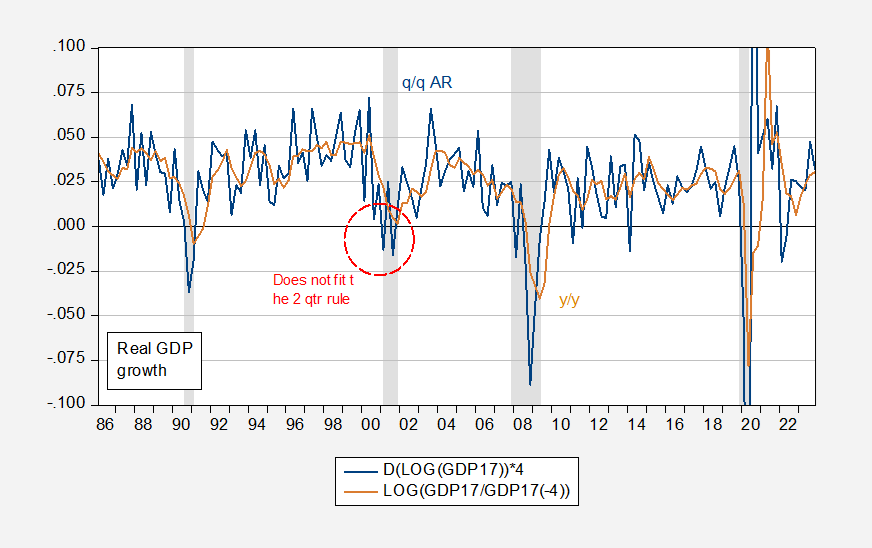

Figure 1: Quarter on Quarter growth rate of real GDP (blue), Year on Year (tan), both calculated as log differences. NBER defined peak-to-trough recession dates shaded gray. Source: BEA, NBER, and author’s calculations.

Note there is no NBER-defined recession in 2022H1, despite two consecutive quarters of negative GDP growth. In contrast, there is a NBER defined recession in 2001, despite the absence of two consecutive quarters of negative growth in the latest vintage of GDP (when was it that there were? See here.). Hamilton’s Markov Switching model of recessions did not indicate a recession then, nor did the real-time Sahm rule.

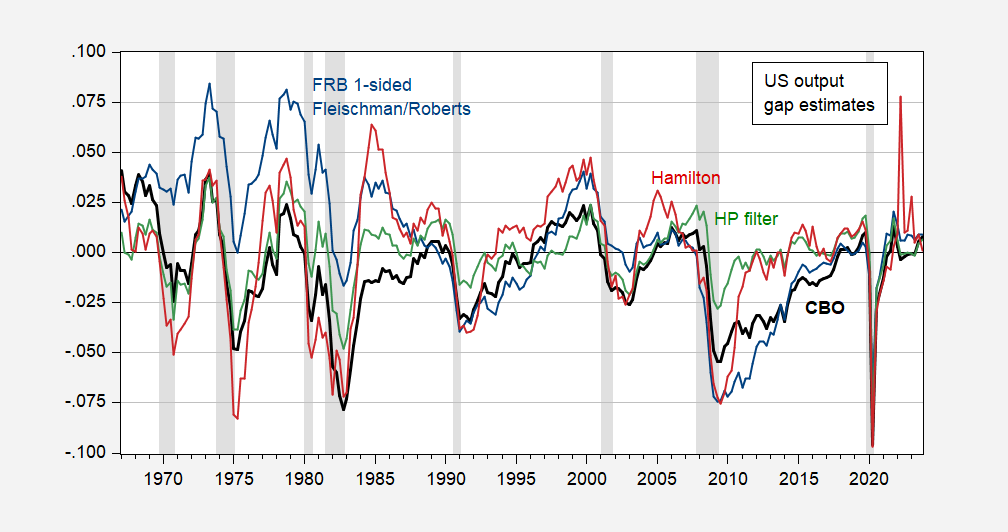

I distinguish between an output gap and recession by referring to this graph:

Figure 2: Output gap, from CBO (bold black), from Fleischman/Roberts-FRB (blue), from HP filter estimated over 1947-2023 (green), and from Hamilton filter estimated over 1967-2023 (red). NBER defined peak-to-trough recession dates shaded gray. Source: BEA, CBO February 2024, Atlanta Fed Taylor rule utility February 2024, NBER, and author’s calculations.

Note that for the Euro area, CEPR’s BCDC noted two consecutive quarters of negative growth in 2023 GDP, but has also not declared a recession, given increases in employment and hours worked.

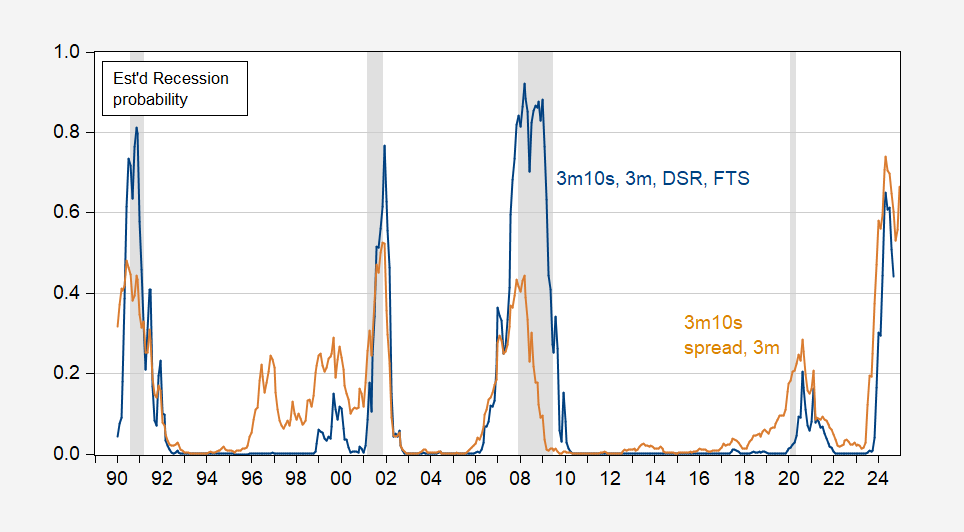

What about recession prediction? That’s discussed in this handout (Recession Early Warning Systems). Given the continued yield curve inversions, it’s not surprising that estimated recession probabilities are high. On the other hand, my research with Ferrara, Ahmed, Kucko and Chatelais and Stalla-Bourdillon suggests other predictors. Those provide alternative estimates of recession probabilities. Below I examine the impact of the foreign term spread as well as the debt service ratio.

Figure 3: Probability of recession from term spread and short rate (tan), and term spread and short rate, debt-service ratio, foreign term spread (blue). NBER defined peak-to-trough recession dates shaded gray. Source: NBER, and author’s calculations.

As I note in the handout:

…the estimated recession probabilities for February 2024 are 56% for the spread plus short rate, and 29.5% for the full specification. This means just because there are no obvious indications of the recession’s onset as of January doesn’t mean that we have necessarily dodged a recession. May 2024 are maximal probabilities.

So, stay on guard for evidence of a downturn.

As an aside, this is an example of how research informs teaching.

I like the conclusions from your lecture notes:

Recessions are declines in economic activity

Output gaps are deviations of output from potential GDP (natural rate of output)

Which one is more important? Latter for our models

Indeed. As your graphs note, we were not below potential GDP at any time during 2022 or 2023. Anyone who wants to scream RECESSION over and over at completely missing the point. Then again the trolls who have been doing so all too often miss the point in almost all economic discussions.

https://www.theweathernetwork.com/en/news/weather/severe/atlantic-hurricane-alley-sees-ominous-mid-july-heat-sea-surface-temperatures-in-february

The heart of the tropical Atlantic Ocean hit summer-like warmth in the middle of February, an ominous sign for this year’s hurricane season

Temperatures in a part of the tropical Atlantic Ocean commonly called ‘hurricane alley’ are as warm right now as they usually are in the middle of July—and it’s only the middle of February. Waters across the northern Atlantic Ocean have been running at historic highs since 2023, but the extent of the warmth down in the tropical Atlantic is cause for concern heading into the summer. Such astounding warmth could provide ample fuel for tropical systems to roar as we approach hurricane season in a couple of months.

The last thing the East Coast needs is another bad hurricane season. But of course the former CoRev and little Bruce Hall will tell us that global warming is not real.

El Nino works to keep the South and Southeast wetter than normal in the winter. A hot Atlantic means more moisture in the air, so more rain, more hurricanes in the late spring through autumn. Though with these temperatures, maybe we won’t have to wait for late spring. Looks like a flood-fest.

https://www.msn.com/en-us/news/world/you-need-to-get-out-more-cnn-s-fareed-zakaria-roasts-tucker-carlson-for-praising-russia-s-cheap-groceries/ar-BB1iuEgq?ocid=msedgntp&pc=U531&cvid=ec3ec450a0d044f5b8d3c09edd080516&ei=37

Fareed Zakaria tears apart the stupid spin from Tucker Carlson on how Moscow has better food than NYC or SF, how their drab buildings are works of art, and of course the claim that Russia’s inflation is lower than inflation in the US.

Wait, wait – is JohnH and Tucker Carlson one and the same.

Jon Stewart’s take is that Carlson is trying to desensitized us to authoritarianism. So yes, absolutely like Johnny.

I’m not a big fan of him, but he sure did the job this time. Excellent link, thanks!

Carlson was impressed with how much he could get for $150 in a grocery store in Moscow and that it would cost twice as much in the US. What he forgot to say was that the average pension in Russia is under $250 per month. The sad thing is that many of his low information viewers may not even recognize that cost should always be evaluated relative to income.

But Jonny boy wants to tell you Russian real wages rose in 2023. Never mind the fact that they fell the year before.

Also never mind that Putin has been forced to pay some serious dough to people in order to get them to go to Ukraine and get killed. Presuming that increase in the parameter “real wages” is always a good thing, sort of presumes that the standard economy is always at work everywhere anytime. I appears that simple minds goes with simply wrong presumptions.

I hope some communications majors take your class so they can distinguish between GOP talking points and evidence-based reality.

In Wisconsin – we now have some least-change maps developed by a bipartisan panel (my problem with it is that the maps are based on mostly 2020 data – and do little to account for what has happened in the past three years) but we should get back closer to a 50-50 legislature rather than a 60% GOP super majority.

I am hopeful that Wisconsin will finally accept that the ACA works and drop the stupid GOP obsession with not taking “Obamacare” because Obama did it. (S. Walker and his WIGOP know-nothings have done millions of $ of damage to the people of Wisconsin during the past decade.) https://www.washingtonpost.com/opinions/2024/02/18/obamacare-affordable-care-act-trump-biden-congress/

Forward! Wisconsin.

“Markets Start to Speculate If the Next Fed Move Is Up, Not Down”

https://www.bloomberg.com/news/articles/2024-02-20/markets-start-to-speculate-if-the-next-fed-move-is-up-not-down?srnd=premium

Isn’t that textbook procedure when an economy starts running hot?

JohnH: If true, hasn’t shown up in futures as of 10:45am CT on 2/20 (unless “up” is “stay the same” as current target range…)

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

Johnny’s problem with selective attention is on display again. In a world full of information, all he seems to notice is headlines which play into his desire to hurt workers by keeping monetary policy too tight. Very Tucker Carlson of you, Johnny.

In a world full of information, all Tricky Ducky seems to notice is headlines which play into his desire to increase the value of his portfolio as a result of an interest rate cut…or headlines which support war not negotiations…and assure that the Zelensky and his Western backers persist in their pointless, futile and wasteful effort…right down the last Ukrainian.

That reply was very teenie weenie

1. When inflation goes down – and it has – interest rates should go down. Why transfer wealth to the moneyed classes by keeping them high? It’s not like first-time home buyers, for example, are typically so heavily invested in the bond market that they prefer high real interest rates to low ones.

2. Since you have evidently adopted the position of “don’t fight back against superior forces because it’s pointless, futile, and wasteful” rather than “invading other countries is bad and should be resisted,” I suppose you would whole-heartedly support the U.S. sending troops into Ukraine to fight the Russians directly, since no one questions the vast superiority of our forces relative to theirs. The ultra-rational Putin would, of course, surrender immediately, ending the war and allowing Ukraine to regain all its lost territory. We could continue, take over Russia, and depose him! We would lose almost no troops because of the rapid surrender, so it would be an entirely successful strategy, right?

Johnny is:

1) Pretending to information he doesn’t have – this time about what assets I own. That’s dshonest

2) Pretending that defense of Ukraine is pointless. Ukrainians have chosen to defend their country against Russia. Johnny’s position is to let Russia win – down to the last Ukrainian.

3) Going with the kitchen sink. He claims my monetary policy views are motivated by greed and that by rooting for Ukraine I’m rooting against Ukraine. I wouldn’t mind tat Johnny has resorted to ad hominem attacks, if he would just be more accurate with those attacks. Johnny goes for cheap and ham-handed. Johnny’s no better at ad hominems than he is at economics.

“Isn’t that textbook procedure when an economy starts running hot?”

And little Jonny boy told us we were in a recession. Yea – little Jonny boy is one confused moron.

Speaking of recession, Israel’s economy is weathering Irael’s war against Palestinians poorly:

“Israel’s economy shrank by far more than expected in the wake of conflict with Hamas in Gaza, according to official figures.

“Gross domestic product (GDP) … fell by 19% on an annualised basis in the fourth quarter of 2023.”

“…private spending dropped by 26.3%, exports fell by 18.3% and there had been a 67.8% slide in investment in fixed assets, especially in residential buildings.”

https://www.bbc.com/news/business-68337731.amp

Military Keynesianism has a hard time supporting growth when labor is in such short supply. Military call-ups and turning Palestinian workers away at the crossings has had a big effect:

https://fred.stlouisfed.org/graph/?g=1h9k8

Israel’s central bank has expressed concern over the budget, and the GDP data probably increase that concern.

Israel’s budget, economy, reputation and future are unlikely to be helped by an expansion of the war into Lebanon. But it keeps Bibi at the center of things, and keeps most of public attention on things other than Bibi’s character, his failures and his crimes.

So they have lost workers to military service, from closing the borders with Palestine and from guest workers (such as from Thailand) going home for fear of the war. You are spot on that the stimulus from war will not work when you have a substantial shrinking of the work force. They are even more desperately in need of US aid than Ukraine.

Yet Mike Johnson and the house GOP is away on vacation (any of them spotted in Cancun yet?). Crisis on the border, crisis in Ukraine and crisis in Israel – but GOPsters got to rest when GOPsters want to rest.

Note that Fig 3 yields what looks like a false negative and a false positive on the far right. If, however, we treat the pandemic as a suppression, rather than a recession, then the analytical framework implied still works.

Why don’t you take a crack at writing a paper on suppressions v recessions, Menzie? There’s a need for a new macro framework wrt to pandemics, lockdowns, supply chain disruptions, stimulus and inflation. Macro is more or less begging for some theory on the topic.

Steven Kopits: Because the term “suppression” is a term of no economic meaning except for an audience of 1 (i.e., you). There are *so* many interesting economic questions out there, why waste (and I use that word advisedly) on your exceptionally stupid term?

In point of fact, several people have developed models related to the pandemic. I cited them on this blog. I taught them in my classes. If only you read something sensible and logical, instead of the latest nonsense and conspiracy theory (viz., BLS made up the employment numbers…).

That’s fine, but then your analytics don’t look all that good. If you wanted some kind of title for a suppression piece, it could be “Exogenous versus Endogenous Business Cycles: How the Pandemic differed from an Ordinary Recession.”

Look, if you think the covid downturn was just like any other recession, then you’re done and need to go no further. But I don’t think it was.

Steven Kopits: They’re not analytics, they’re what other people use to define recessions. If you want analytics (not sure you understand what that word means), then see this (new) post.

https://econbrowser.com/archives/2024/02/not-exogenous-versus-endogenous-business-cycles-how-the-pandemic-differed-from-an-ordinary-recession

That’s the key phrase: “what other people use.” You are looking but not seeing.

I have no skin the in this game. I have other games in which I have considerably more skin. I am personally pretty comfortable with the distinction between a recession, a depression, and a suppression. You are going to wait for someone else to construct the box for you, and then you’ll work inside that framework. Okay, that’s fine, but you’re going to struggle to make certain things fit coherently.

“I am personally pretty comfortable with the distinction between a recession, a depression, and a suppression.”

Stevie did write this even if his past babbling shows he has no idea what depression or even recession even means. Then again – Stevie denied that the FED even existed in 2018.

Maybe you could write a paper. Of course no one would read it as everyone gets you are clueless

Meanwhile, back at the ranch, from the Kyiv Post this morning:

OPINION: US Republicans Lose Avdiivka

https://www.kyivpost.com/opinion/28323

Not all my MAGA readers were happy with this.

East Donbas is a long way from US stocks. Funding to effect support last November would have been committed more than a year ago….

Ukraine problems were broader and deeper than what NATO would do….

I have no idea what that means. US economy is 14x that of Russia. Russia loses if US sticks to its guns. That simple.

I have no idea what that means. US economy is 14x that of Russia. Russia loses if US sticks to its guns. That simple.

As for timing, my schedule puts the end of the war between Sept. 2024 and Oct. 2025, based on historical precedent. But it could go longer. The US revolutionary war took more than eight years, which the US won with French help against a vastly superior British force.

I think the Ukrainians can target 1 million Russians eliminated. The count as of today was 404,000, with a rate of loss around 1,000 / day. So you can get there in another 600 days, just about Oct. 2025. At some point, the casualties will bring down the Russian government.

Russia’s problem is that it can end the war at any time. Pack up the guys, go home, and the war is over. What is Russia fighting for, really? Putin’s ego. At some point that gets old.

For once, I agree with you.

“The transition from an obsession with engineering to an obsession with financial engineering”

https://www.businessinsider.com/boeing-disaster-american-businesses-greedy-broken-stock-market-wall-street-2024-2

That just about sums it up with the problem at Boeing and many other US companies. The C-suite has replaced product experts with spreadsheet junkies. End stage capitalism at its finest.

These things go in cycles, but spreadsheets can be absolutely deadly for sure. Spreadsheets can create theoretical worlds which translate into paid acquisition prices and assumptions regarding revenues, expenses and capital outlays which may be entirely divorced from reality.

For example, If you want to know who was responsible for the BP disaster at Macondo, I would bet you it was a finance guy.

Boeing and Airbus (aka Scare Bus) have been a duopoly for a long time. I seem to recall economic papers on X-efficiency which sort of captures what you are saying. China is developing its own rival – maybe the extra competition will prove useful.

My favorite business book was never intended as a business book. “Whatever Happened to the British Motorcycle Industry” was written by Bert Hopwood. He became an engineer by apprenticing as a drafter, starting in the 1940s, as I recall. The book is a detailed chronicle of how the industry was taken over from engineers by suits, became complacent while milking aging designs and tooling, and was eventually destroyed by competitors who hadn’t been sitting on their thumbs thinking nothing would ever change.