With two quarters of GDP decline in the UK according to the current vintage of data, it’s reasonable to ask if the UK is in recession. ONS discusses the limitations of using the two-quarter rule of thumb here. Figure 2 of this study illustrates the dangers of relying upon the two-quarter rule when the GDP data are subject to revision. See additional discussion using the “technical” definition, AP, CNN, Bloomberg. It’s also of interest to consider whether statistical methods relying on financial indicators would have predicted a recession, variously defined.

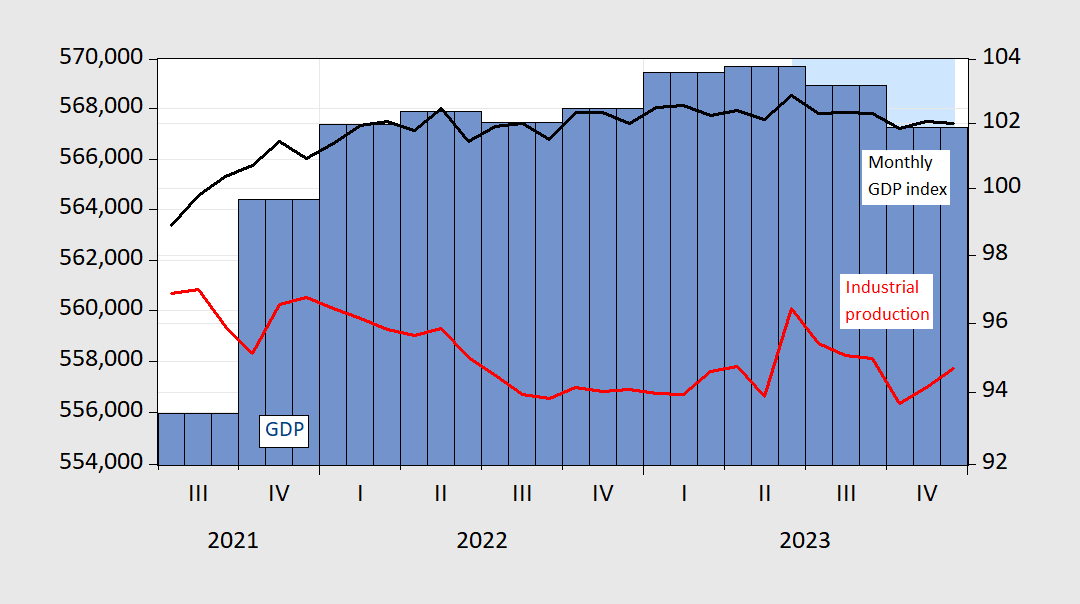

Here’s a picture of GDP, monthly GDP, and industrial production ex-construction:

Figure 1: Real GDP (blue bar, left log scale), monthly real GDP (black line, right log scale), industrial production ex-construction (red, right log scale). Source: ONS. A hypothesized peak-to-trough 2023M06-2023M12 recession shaded light blue.

I mark the end of the recession at 2023M12 since I have no additional data past that time, and BoE Governor Bailey argues the recession might already be over.

As a counterpoint, NIESR observes:

…the state of the UK economy is better described by the fact that GDP fell between the first quarter of 2022 and the final quarter of 2023.

So perhaps the recession is 2022Q2 to 2023Q4, peak-to-trough.

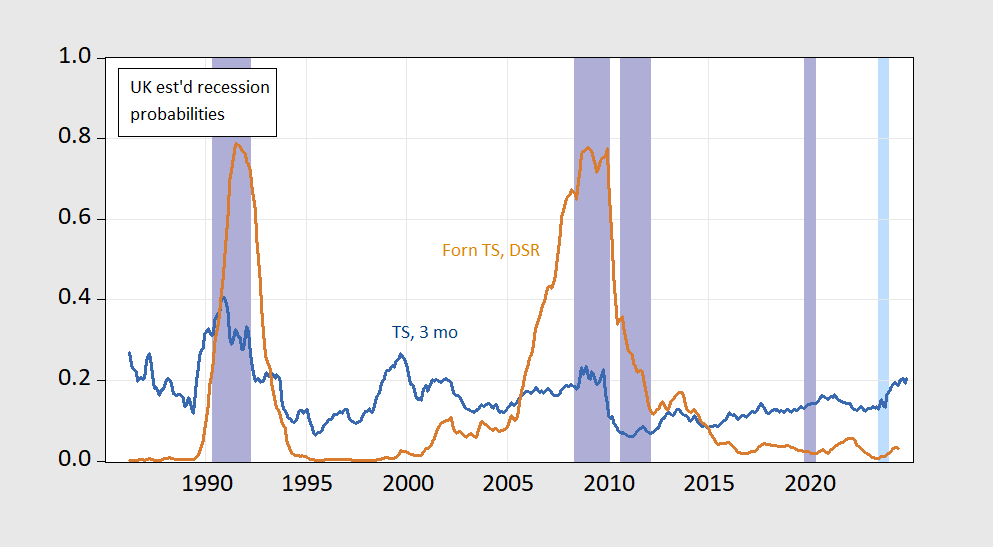

Would we have predicted either of these recessions (if indeed one or the other is a recession)? I compare an estimate from a simple 10yr-3mo spread plus short rate (blue line), against a foreign term spread plus debt service ratio (tan line), the latter suggested by Chinn-Ferrara (2024).

The answer is likely no (for a 1985-2022 sample), unless a very low threshold was used.

FIgure 2: Estimated probabilities from probit model on spread and short rate (blue line), and on foreign spread, debt service ratio (tan line). ECRI defined peak-to-trough recession dates shaded lilac. Hypothesized 2023M06-M12 recession shaded light blue. Source: author’s calculations and ECRI.

While a debt-service model based regression specification has a much higher pseudo-R2 (0.38), the implied recession probabilities are quite low for 2023. Interestingly, the spread plus short rate has a very low pseudo-R2 (0.08), but accords a much higher probability of recession — although well short of 50%. This is in contrast with research which indicates the spread is a good predictor of recessions (Mills, Capehart and Goodhart, 2019), although their sample was much longer than the one I used.

Two years of no increase in real GDP sounds lackluster at best. I was struck by this:

MPs repeatedly pressed Bank officials on why they were not already cutting interest rates. Conservative MP John Baron said the economy was “flashing red”. But the Bank said it was waiting for further evidence in areas such as wage growth and the number of job vacancies to show that inflation – which measures the pace of price rises – had turned decisively.

Mr Bailey pointed to the possibility that inflation is likely to be helped by a fall in energy prices. Ofgem, the energy regulator, is expected on Friday to lower the price cap on UK electricity and gas bills from April. But Mr Bailey said while that is likely to bring overall inflation down to the Bank of England’s 2% target during the spring, over the year it could rise again. “We’re beginning to see things going in the right direction,” said he said. “We need to see more evidence of that… and that’s what will shape my vote going forwards.” Mr Broadbent said interest rate cuts were possible this year. “In my view that is the more likely direction in which Bank rate is likely to move,” he said. “But even if that proves to be the case, the timing of any adjustment can only depend on the actual evolution of the economic data.”

It is if JohnH were running the BoE. Cut interest rates? Never! Even if the UK were indeed below full employment. After all when the UK was below full employment under David Cameron, little Jonny boy cheered as he claimed the weak aggregate demand increased UK real wages. Never mind the fact that real wages fell a lot during Cameron’s fiscal austerity.

Interest Rates: Long-Term Government Bond Yields: 10-Year: Main (Including Benchmark) for United Kingdom

https://fred.stlouisfed.org/series/IRLTLT01GBM156N

UK long-term interest rates rose considerably during 2022.But of course higher interest rates have nothing to do with the weakening of aggregate demand – right? After all Nobel Prize winner JohnH told us so.

The interest rate is the only indicator pgl cares about! The value of retail sales (January, 2024) may be the highest it has been since 2019, real wages may be rising, and unemployment may be at 3.8%, but pgl’s mantra is that “it’s time to cut interest rates!”

https://www.ons.gov.uk/businessindustryandtrade/retailindustry/bulletins/retailsales/latest

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/employmentintheuk/latest#main-points

Is his record stuck in a groove, or what?

Well, may the situation isn’t as dire as pgl makes it out to be…”UK economy puts recession behind it but price pressures rise, PMI survey shows.”

https://www.reuters.com/world/uk/uk-economy-puts-recession-behind-it-inflation-pressures-rise-pmi-2024-02-22/

But one thing is for sure…according to pgl, it’s time to cut interest rates! Gotta boost those asset prices!

“The interest rate is the only indicator pgl cares about!”

You know – I’ve grown used to my mentally retarded stalker lying 24/7 but come on dude – your lies about really dumb. Get a life troll.

“real wages may be rising”

I predicted you would lie about this too so I have a comment that shows the actual data from the ONS. But you have been lying about this issue for over a decade.

“The value of retail sales (January, 2024) may be the highest it has been since 2019”

Of course this is the nominal value of retail sales. The real value is captured by volume which the chart clearly shows has declined considerably.

Come on Jonny boy – no one can be THAT STUPID. Except you of course.

“The interest rate is the only indicator pgl cares about!”

This is a classic Johnny-mumble. He has lied about someone else’s position, rather than making a good argument for his own. Dismissing the other guy’s view means your own view doesn’t have to be very good. Johnny does this all the time.

In case you are wondering what the ONS says about real wages (never trust little Jonny boy as he cherry picks data in a way to mislead but we all knew that):

https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/averageweeklyearningsingreatbritain/latest

Figure 3: Real earnings show a positive annual growth rate for December 2023

Real average weekly earnings single-month annual growth rates in Great Britain, seasonally adjusted, and CPIH annual rate, January 2001 to December 2023

If one looks at the last 3 months, real wages are higher than they were in Oct. 2023. But of course that hides the facts that real wages are lower than they were 3 years ago.

OK – time for a barrage of Jonny boy’s patented lies and insults.

Yadda…yadda…yadda. pgl says that UK “real wages are lower than they were 3 years ago….” but they are moving in the right direction, a fact that pgl willfully overlooks, just like he did back in 2015 when Krugman was whining that deflation would inevitably hurt workers…just as workers were finally starting to see real wage gains that would continue for a couple years more.

I ignored the latest partial recovery? Read again liar

I mentioned it.

You are pathetic

Several developed economies have been struggling lately. Japan’ GDP has fallen for two quarters, but employment continued to increase:

https://fred.stlouisfed.org/graph/?g=1gRbk

Germany shows a similar pattern:

https://fred.stlouisfed.org/graph/?g=1gRjD

In the UK, employment growth had stalled, but the latest data print is from Q3, and employment lags. So while the UK has performed worse than Germany and Japan, the data don’t necessarily argue for continued weakness.

One reason the UK yield curve doesn’t show elevated recession risk is because the UK’s long-end yield now carries a higher risk premium than in the past:

https://fred.stlouisfed.org/graph/?g=1hmqL

Ideology can be expensive. Ideology has also cost the Tories flexibility in dealing with economic weakness. That may not be the only reason Tories are yelling at the “Old Lady”, but it probably accounts for the high pitch.

“As a counterpoint, NIESR observes: …the state of the UK economy is better described by the fact that GDP fell between the first quarter of 2022 and the final quarter of 2023.” So perhaps the recession is 2022Q2 to 2023Q4, peak-to-trough.

Hmmm? By that logic, in the US the 2020 recession started in Q3 of 2017?

joseph: I think there was more up and down motion in US GDP 2017Q3 to 2020Q1, than in the corresponding example from the UK.

Great question!!!! And one the more cowardly students such as myself might have been too afraid to ask and learn from.

Here’s a good summary of the the state of the UK economy in early 2024 that focuses on something other than GDP. Imagine that! In fact, the labor market is discussed first. Heresy! https://www.economicsobservatory.com/what-is-the-state-of-the-uk-economy-in-early-2024

“The Office for National Statistics recently released fresh data on the UK’s labour market, inflation and GDP. While trends in prices and wages have improved conditions for many households, the economy has contracted since early 2022. Prospects for renewed growth are positive but weak.” Notice how they skirt the use of the word “recession” altogether, replacing it with the more descriptive “weak growth.”

“Workers have only started to see their earnings grow in inflation-adjusted terms since the summer, following around two years of wage erosion as a result of inflation.”

Did little Jonny boy once AGAIN fail to read his own link? This accurate statement undermines the incessant dishonesty you have peddled for a decade.

Dude – you are a liar, dumber than a retarded rock, and an utter waste of everyone’s time. We have asked you to stop with this trash but you persist.

“Notice how they skirt the use of the word “recession” altogether, replacing it with the more descriptive “weak growth.””

ponzi johnny, you have been on this site ad nauseam arguing that we should NOT use the term “weak growth” and instead use the term “recession” for such conditions. why are you arguing for the opposite commentary now?

Figure 1: Real average weekly earnings (including bonuses)

I mentioned this chart before which is part of the ONS reporting. Either Jonny has missed this chart even when it is part of his own link or the troll is once again lying (as usual). Yes there has been a very recent and short lived period when real wages have risen by around 1% per annum but that was preceded by a longer period when real wages fell by 3% per year.

Now most of the kiddies in Jonny boy’s nursery class would know this means since the beginning of 2022, UK real wages have fallen. But little Jonny boy is telling us they increased. Is little Jonny boy that stupid or is he doing what he does best – LYING? Either way the other kiddies are laughing at little Jonny boy.

“In fact, the labor market is discussed first. Heresy!”

More Johnny mumble. NBER includes labor-market indicators among its suite of business-cycle monitoring tools and Menzie routinely includes labor market data in his review of economic conditions. Here in comments, New Deal Democrat often notes what going on with jobless claims. And when either pgl or I mention the labor market, Johnny does a Johnhy-mumble, claiming the he knows we don’t actually care about workers. When Johnny was cheering for recession prior to the 2022 mid-term elections, his focus was on GDP, and he claimed others were being ‘selective’ when discussing other indicators.

Massive hypocrisy from Johnny.

Navalny’s body given to his mother, spokesperson says

https://www.msn.com/en-us/news/world/navalny-s-body-given-to-his-mother-spokesperson-says/ar-BB1iOVAa

‘The body of Russian opposition figure Alexey Navalny has been given to his mother more than a week after he died, Navalny’s spokesperson Kira Yarmysh said on Saturday. “Alexey’s body was handed over to his mother. Many thanks to all those who demanded this with us,” Yarmysh posted to social media. Yarmysh added that Navalny’s mother, Lyudmila Navalnaya, is still in Salekhard, the Arctic town where her son’s body was being held. Navalny died on February 16 behind bars in a nearby penal colony. The Russian prison service said he “felt unwell after a walk” and “almost immediately” lost consciousness. Navalny’s family and colleagues have blamed Russian President Vladimir Putin for Navalny’s death, which comes ahead of the country’s presidential election next month. Putin is not running against any meaningful opposition and is expected to sweep to a fifth term in office. Funeral plans have not yet been made, Yarmysh said. “We do not know if the authorities will interfere to carry it out as the family wants and as Alexey deserves. We will inform you as soon as there is news,” she added.

Navalny’s widow, Yulia Navalnaya, accused Putin of ordering that the body be held to hide Navalny’s cause of death and out of fear that his funeral would draw large crowds. The Kremlin has denied the allegations.’

Of course these Kremlin denials are lies. A week delay was likely enough time for the poisons used to disappear from Navalny’s corpse.

Wait – Trump had to read his notes when he told the South Carolina crowd about his wife “Melanie”. Good thing as yesterday he referred to “Mercedes”. Huh – is Trump cheating on Melanie with some hot gold digger named Mercedes?

I wish more people showed real wages over time rather than the rate of change. I wish this excellent graph could be extended to 2023. But please note something I have said for many years to which JohnH are consistently lied about:

https://fullfact.org/economy/how-have-wages-changed/

Before the Great Recession UK real wages were 540 pounds per week. They fell to 500 pounds per week under Cameron but did manage to partially recover to something just over 510 pounds per week in Cameron’s last year.

Only the dumbest liar would say UK real wages rose during this period. But our Jonny boy does so for years as he is a serial liar and the dumbest person I know.

Yes, real wages in the UK dropped in the early 2010s as inflation hurt purchasing power. But the inflation rate dropped in about 2014, and real wages started to recover along with purchasing power…exactly the point at which Krugman started yammering about how bad workers were going to be hurt by deflation. But in fact real wage gains continued for some time after inflation dropped to virtually zero in early 2015.

Of course, pgl, ignoring UK inflation, chooses to frame events in terms of how bad Cameron was, something which Jeffrey Sachs addresses: “Paul Krugman has got it wrong on austerity…Recent trends of falling unemployment and accelerating growth cast doubt on the Nobel laureate’s marcoeconomic diagnosis”

https://www.theguardian.com/business/2015/jan/06/paul-krugman-got-it-wrong-austerity-jeffrey-sachs

Jeffrey Sachs wants to deny standard macroeconomics? Krugman’s point was simple – a depressed economy is bad for real wages. Now if Sachs has some model that says real wages grow when the output gap is high – he has not published his nonsense.

Jonny boy wants to play Nikki Haley the accountant. I mention her because she is two faced and so is Jonny boy. Maybe Jonny boy failed to notice that in 2021 when the UK economy was at full employment nominal wages outpaced inflation. When the economy fell below full employment – they did not. The same can be said about those Cameron years. Dr. Chinn introduced the relationship between GDP and potential. But yea – little Jonny boy did not notice as little Jonny boy is the stupidest troll God ever created.

Dude – you are lying about what Sachs said there. Do you lie about everything? Skip that as we know you do.

My apologies to Menzie for posting a YT link. It’s a short, so it won’t require much time.

Richard Nixon wasn’t a good man, but he wasn’t stupid. Here he makes surprisingly foresighted comments about Russia after the failure of communism:

https://youtube.com/shorts/7Ors4xO2Ef8?si=wKhdnpVGM-p-m7OT

The gist is: A new despotism will rise if freedom fails in Russia. Freedom’s failure in Russia would mean failure in China. Imperialism is a centuries-long feature of Russian foreign policy and will re-assert itself if despotism wins.

Seems like all these predictions have proven true.

By the way, Johnny may mumble against Nixon’s foresight, relying on ad hominem and distraction to obscure the reality of Russia’s and China’s return to despotism. That’s what Johnny does; if your only tool is a cheap rhetorical hammer… But Johnny is just a gnat, trying to distract us from reality.

Much more important is the evidence of the clarity that is possible when one takes the time and makes the effort to understand what history teaches. Nixon could do it. No reason the rest of us shouldn’t try.

Nixon should never have been president – too bloody-minded – but he should be listened to.

It seems little Jonny boy is distracted spreading the lies about how UK real wages have risen (his own link contradicts this lie) and how we allegedly care only about interest rates.

Nixon makes my skin crawl but at least he was not a raging moron like Jonny boy.

Yadda…yadda…yadda. The United States had a golden opportunity to foster democracy in Russia after the fall of the Soviet Union. But instead Clinton chose to let the country be looted by oligarchs and Western business. But as always Ducky chooses to cast blame on others.

Chalmers Johnson: ” “A nation can be one or the other, a democracy or an imperialist, but it can’t be both. If it sticks to imperialism, it will, like the old Roman Republic, on which so much of our system was modeled, lose its democracy to a domestic dictatorship.”

Louis Brandeis: “We can have democracy in this country, or we can have great wealth concentrated in the hands of a few, but we can’t have both.”

The vital signs of American democracy are getting weaker and weaker…great wealth is increasingly concentrated and the urgency to defend America’s threatened hegemony is now paramount. But Ducky prefers to overlook that and hype the problems of US geopolitical rivals–all consistent with an imperialist mindset.

“But as always Ducky chooses to cast blame on others.”

I didn’t cast blame in anyone. Johnny’s claim that I did is just another lie. The U.S. had a role in Russia’s transition away from communism, but there is no evidence that we could have prevented Putin from rising to power.

Note that Johnny has tacitly admitted that Russia isn’t a paragon of democracy but diverts attention to the U.S. Johnny also wants Ukraine to stop defending itself against Russia, even though he has tacitly admitted Russia is non-democratic. Johnny is a Putin puppet.

yes, i am a bit baffled here. according to ponzi johnny, on one hand, the usa is to blame for the demise of democracy in russia, because we did not….do what? intervene? on the other hand, when we have the opportunity to intervene and defend democracy in ukraine against that imperialist russia that ponzi johnny noted, the usa is not supposed to interfere with other nations? we should let democracy fail in ukraine and reward a war mongering russia? ponzi johnny, you are talking out of both sides of your mouth. as usual.

“instead Clinton chose to let the country be looted by oligarchs and Western business. ”

Someone really has no clue what the Yeltsin years were all about. Yea – he was corrupt but Clinton did not encourage Yeltsin. BTW moron – Yukos was not a western business. Then again little Jonny boy has no clue why I brought up Yukos.

Little Jonny boy is at it again – donning his Tory cheerleader miniskirt and telling us UK real wages are “moving in the right direction”. I anticipated that this retarded troll would pull this oldie but moldie so I went ton ONS and pulled UK weekly earnings (nominal) and divided them by their consumer price index (with Dec. 2019 = 1).

At the end of 2021 which was a good year for UK real GDP, this real wage was over 570 pounds per week. A year late it was only 549 pounds per week. And Jonny boy calls that the right direction. Maybe the moron thinks 2023 completely reversed this decline but real wages was still below 560 pounds a week. Even a mental retard would not call this the right direction.

But since Jonny boy is still lying about the Cameron years, let’s review the record. Real wages in late 2010 were 535 pounds. By the end of 2013 they were only 510 pounds. FACTS based on ONS data, which Jonny boy continues to lie about. Yes, real wages at the end of 2014 reached 520 pounds per week. According to little Jonny boy a 15 pound per week reduction in real wages is the right direction.

Yes boys and girls – little Jonny boy is as dumb as he is dishonest.