Plus 3rd release of 2023Q3 GDP.

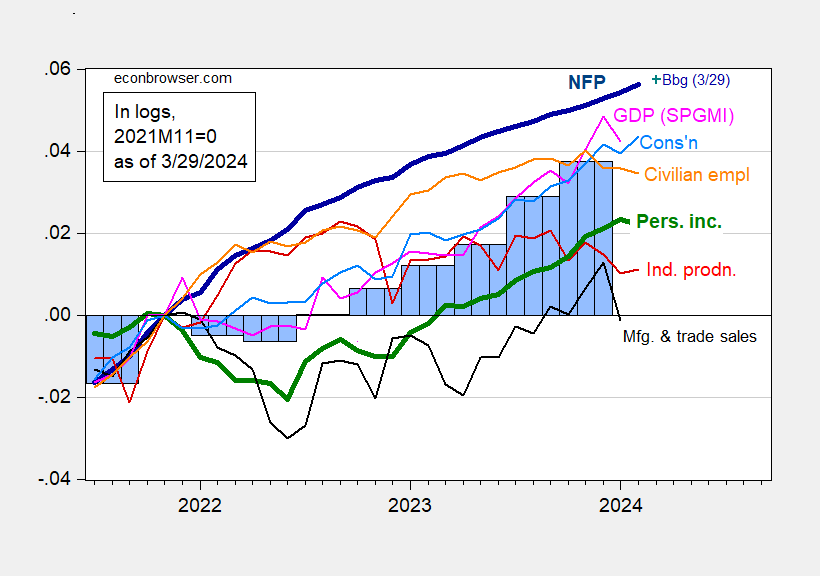

Figure 1: Nonfarm Payroll employment from CES (bold blue), from Philadelphia Fed early benchmark (teal), civilian employment (orange), industrial production (red), personal income excluding current transfers in Ch.2017$ (bold green), manufacturing and trade sales in Ch.2017$ (black), consumption in Ch.2017$ (light blue), and monthly GDP in Ch.2017$ (pink), GDP, 3rd release (blue bars), all log normalized to 2021M11=0. Source: BLS via FRED, Federal Reserve, BEA 2023Q4 2nd release, S&P Global Market Insights (nee Macroeconomic Advisers, IHS Markit) (3/1/2024 release), and author’s calculations.

Consumption showed strength exceeding consensus, while personal income ex-transfers fell. January manufacturing and trade sales fell substantially in January. Combined with lackluster industrial production for February, one could see a slowdown in growth.

That being said, the upward revision in Q4 GDP, along with measures of aggregate demand (final sales, and final sales to private domestic purchasers) suggests a lot of momentum in economic activity.

My FWIW forecast for nonfarm payroll is for an increase of 207K jobs, looking at 17 job categories to make the forecast. This 207K forecast compares to the Bloomberg consensus of 198K. I can rarely get a forecast of total jobs, using FRED series PAYEMS to agree with a detail category forecast. My PAYEMS job forecast shows an increase of 222K. This may be the closest I have ever had the two methods agree with each other. Generally, I find that my forecast using the 17 job categories is much more accurate than trying to forecast an overall change in PAYEMS.

Interesting. Thanks for the share.

Moses,

Thanks.

I notice that the Bloomberg consensus is at 205K as of 3/31/2024.

Don’t like everything I see on ZH, but thought this was a mildly interesting post:

https://www.zerohedge.com/markets/us-economy-inverted-how-flood-illegal-immigration-delaying-official-us-recession

Off topic – commercial real estate tidbit:

The garrish, ego-stroking, mostly-residential needle structure at 9 Dekalb in Brooklyn is in default, due to be auctioned in June cover debts. I find this interesting because it is not an empty-office story. The building is mostly residential, residential units mostly rentals, and has only recently been open for occupancy. Supply-chain troubles delayed completion, and that has meant making debt payments longer than had been budgeted and rolling over debt as interest rates rose.

The default covers less than a billion in debt, and as far as I know, neither bank CRE loans nor CLOs were involved, so this is unlikely to lead to a cascade of financial trouble. The same developer has a similar problem with another property – Billionaire’s Row on West 57th in Manhattan.

That doesn’t mean there is no warning of wider financial risk build into this story. The the combination of slowed completion and rising interest rates is common for lots of developers recently. Other projects of this type are likely to pose greater systemic risk because they do involve bank and bond market exposure.

At its heart, this is another Covid supply-chain story, evidence the lagged effects are still with us.

Ritholtz posted an interesting graph from Liz Hoffman at Semaphor:

https://ritholtz.com/2024/03/weekend-reads-606/

The real high % exposure to commercial RE is with small banks, so when CRE pops, it will not be a particularly big deal. The small ones just get taken over or merged with other banks. The Fed just signaled that they are not in a rush to lower rates, so they must also think that the resetting of rates on commercial loans will be a manageable problem. There is not really any strong argument that they need to lower rates quickly at this point.

The supply chain issues in construction is not just materials but also labor. Nobody in the US want to do the dangerous, hard and dirty work in construction so they have a hard time finding the workers to quickly finish projects. The GOP is blocking the obvious source of that labor, so don’t expect things to get any better anytime soon. They need to keep the sheeple in “crisis” panic to win the election in November.

https://www.cbsnews.com/news/empty-office-buildings-doom-loop-cities-60-minutes/

“doom loop” could be melodrama to get people to tune in Sunday nights or get web clicks. Still an interesting story.